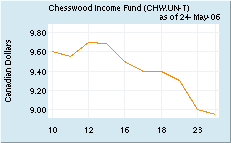

Pawnee Stock down almost a buck! Chesswood Income Fund dba Pawnee Leasing IPO started at $10.00 a share on May 10, 2006, raising $57,781,930 (Canadian) on its first offering. The stock itself has gone up and down since opening and hovers at the end of Thursday at $9.15 (last bid.)

"I'm not worried about the stock price," President Gary Souverein said. "This is a cross border transaction, an investment in our cash flow and proven performance. We are confident in our ability to be a sound and growing investment vehicle.”

Gary H. Souverein (file photograph) After spending a month in the final preparation, and then spending several weeks on the road making presentations to investors for the IPO, he took a week off, and only recently returned back to work. "I was away from my family and owed time with them,” he explained. Asked if anything had changed since the company was now publicly owned, he responded: “It's the same...the same business plan, the same recipe, the same engine that is working, and we continue to polish our service to our broker customers in the start-up and “B” credit markets. He didn't seem concerned about the stock price; although he believes it will improve as the Canadian market sees them perform. "My goal is to exceed our investors' expectations. We won't be changing the systems that have brought Pawnee to where we are today. We have the right employee team, the proven procedures, we know our marketplace, and we perform." The two parties instrumental in the stock offering and procedure told Leasing News they had inquiries of other leasing companies interested in the Canadian public marketplace: “I have followed the success of Pawnee for over 10 years since I first met founder Rob Day when we were in the same golf foursome at a UAEL Convention. Over the years, I have performed several consulting assignments for Pawnee, and it has been gratifying to see the sound growth that the company has achieved under the leadership of Rob, Sam Leeper and Gary Souverein. “I was pleased when Pawnee's shareholders asked me to locate a supportive acquirer to help Pawnee reach the next level of its growth plans. I believe that Chesswood Income Fund, with its access to the public equity markets and having the advantage of being a Canadian income trust, is a perfect match for Pawnee. I have been very impressed with Chesswood CEO Barry Shafran and his vision for the future of the company, and I am confident that Chesswood will provide further opportunities for Pawnee employees and the lease brokers that Pawnee supports.” Bruce Kropschot “My firm (Swandel and Associates) acted for Cars4U (Chesswood). Our role was to find an acquisition and assist with due diligence. It was a pleasure working with Bruce Kropschot who did a superb job for Pawnee. I have had contact with the people at Pawnee through UAEL and NAELB and knew that this deal would be a strong fit for all parties. The people at Chesswood are a brilliant group that made a very complex transaction easy for the public market to understand. “Currently I have Canadian clients seeking to acquire U.S. or Canadian Lessors. With the rapid rise in the Canadian dollar we may see a few more cross border transactions in the near future. Hugh Swandel The original story: http://www.leasingnews.org/archives/May%202006/05-10-06.htm#pawnee

|

|