Friday, August 4, 2006

Weather history indicates East Coast heat waves Headlines--- Weather history: East Coast heat waves ######## surrounding the article denotes it is a “press release”

-----------------------------------------------------------------

Weather history indicates East Coast heat waves 1975 - Record heat gripped New England. Highs of 104 degrees at Providence, RI, and 107 degrees at Chester and New Bedford, MA, established state records. The heat along the coast of Maine was unprecedented, with afternoon highs of 101 degrees at Bar Harbor and 104 degrees at Jonesboro. Hot weather continued in the central U.S. Fifteen cities reported record high temperatures for the date, including Concordia KS with a reading of 106 degrees, and Downtown Kansas City, MO, with a high of 105 degrees. Evening thunderstorms produced severe weather in the Ohio Valley and the north central U.S. Thunder- storms in South Dakota produced wind gusts to 70 mph at Philip, and hail two inches in diameter at Faulkton. 1980 - A record forty-two consecutive days of 100 degree heat finally came to an end at the Dallas-Fort Worth Airport. July 1980 proved to be the hottest month of record with a mean temperature of 92 degrees. There was just one day of rain in July, and there was no measurable rain in August. There were 18 more days of 100 degree heat in August, and four in September. Hot weather that summer contributed to the deaths of 1200 people nationally, and losses from the heat across the country were estimated at twenty billion dollars. 1986 - The temperature at Little Rock, AR, soared to 112 degrees to establish an all-time record high for that location. Morrilton, AR, hit 115 degrees, and daily highs for the month at that location averaged 102 degrees. (August 2) 1987-Hot weather continued in the central U.S. Fifteen cities reported record high temperatures for the date, including Concordia KS with a reading of 106 degrees, and Downtown Kansas City, MO, with a high of 105 degrees. Evening thunderstorms produced severe weather in the Ohio Valley and the north central U.S. Thunder- storms in South Dakota produced wind gusts to 70 mph at Philip, and hail two inches in diameter at Faulkton. (July 32) 1987 - Afternoon highs of 106 degrees at Aberdeen, SD, and 102 degrees at Ottumwa, IA, and Rapid City, SD, established records for the date. It marked the seventh straight day of 100 degree heat for Rapid City. Baltimore, MD, reported a record twenty-two days of 90 degree weather in July. Evening thunderstorms produced golf ball size hail at Lemmon, SD, and wind gusts to 80 mph at Beulah, ND. 1988 - Searing heat continued from the Middle and Upper Mississippi Valley to the Middle and Northern Atlantic Coast States. Twenty- six cities reported record high temperatures for the date. Chicago IL reported a record seven days of 100 degree heat for the year 1995-Heat Wave in Chicago, Illinois; 525 deaths attributed. 1999 - The U.S. heat wave -- linked to at least 94 deaths -- continued. As Chicago baked in 100-degree weather, thousands of hot and sweaty residents were forced to endure the heat without air conditioning or fans, due to sporadic power outages and brownouts.

---------------------------------------------------------------- Classified Ads—Asset Management

Brick*House Vineyards, Newberg, Oregon * Austin, TX Bloomfield Township, MI Boston, MA Chicago, IL Chicago, IL Princeton, NJ Sausalito, CA Sonoma, CA Wilton, CT For a full listing of all “job wanted” ads, please go to: To place a free “job wanted” ad, please go to: * ---------------------------------------------------------------- Marlin Leasing Posts Stunning 2nd Quarter

Based on initial equipment cost, the company set records for neworiginations for both the quarter at $97.9 million and a single month (June) at $35.5 million. Net investment in leases was $622.8 million at June 30, 2006. 103 sales representatives produced 8,553 new sales with a total gross volume of $97,871,000 for the first six months of the year with an implicit yield of 12.68%. End-user customer base grew to more than 85,000 at June 30, 2006 compared to 81,000 at June 30, 2005. The number of active leases in the portfolio was approximately 107,000 at June 30, 2006. Stockholder equity went up from $112,609,000 to $126,241,000 while cash and cash equivalents went down from $34,472,000 to $3,168,000 in this six month interim financial statement. Net income of $5.3 million for the second quarter ended June 30, 2006, a 17.8% increase over net income of $4.5 million for the same period in 2005. Diluted earnings per share was $0.44 for the second quarter of 2006, an increase of 15.8% compared to $0.38 for the same period in 2005. The company press release stated, “Due to better than expected collections on leases in areas effected by Hurricane Katrina, net income was positively impacted by an after tax reduction of reserves for expected losses of $545,000 or $.045 per diluted earnings per share. “ Net income for the six-month period ended June 30, 2006 was impacted by the same after tax reduction of reserves for expected losses related to Katrina of $545,000, or $.045 per diluted earnings per share.” Full Press Release:

-------------------------------------------------------------- Kerhoulas settles California tax issue

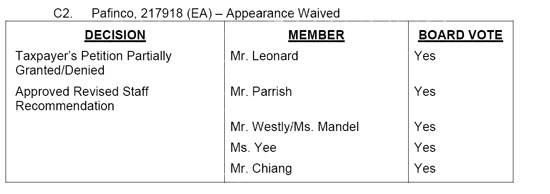

For almost five years Bette Kerhoulas, CLP, has been trying to resolve an issue with the California State Board of Equalization, who after an audit, charged Panfinco dba Pacific-Capital, Irvine, California with not paying "sales/use tax" on documentation and filing fees ( if billed separately rather than on the invoice for first and last they would not be subject to tax, they ruled) plus leases the company assigned they consider "sold," meaning the assets were not only taken as collateral in discounting, but title changed hands, therefore the leases were subject to sales/use tax in the transfer. Several hundred thousand dollars are involved in “double taxation,” and Pacifica-Capital has spent close to $100,000 to date in defending their position. The issue was "settled" before the actual hearing by the California State Board of Equalization. According to the June 6, 2006 edition of ELT News, "The Equipment Leasing Association (ELA) has filed comments with the California Board of Equalization in case #217918 in support of a leasing company contesting application of sales tax to discounted or assigned true leases where the assignment contracts ostensibly transferred title to the property but in reality title was not transferred as the leasing company retained the residual equity interest. The leasing company also argues that for those other transactions in which title was in fact transferred, if the assignment is considered a second sale, then leasing company is entitled to an offset for taxes it originally paid on the equipment. Also in contention is tax on documentation fees in $1 purchase option leases. It is viewed as a case of double taxation since tax was paid up front on the equipment cost providing the State all revenues to which it is entitled.” The United Association of Equipment Leasing also was active in its support.

Leasing News asked Ms. Kerhoulas to give Leasing News readers a recap and the resolution as they may also find themselves in this spot one day: The Case regarding Assignment of Title issues and tax on Documentation Fees was resolved on July 18, 2006 by a unanimous vote of the Board of Directors based on an agreed-upon Third Supplemental Decision and Recommendation made by Senior Tax Counsel of the Appeals Division. The final outcome was the following: The California State Board of Equalization still will not waiver on the assessment of tax on documentation fees, site inspections, etc. - as they consider those items part of gross receipts. We convinced the Board to apply Business Taxes Law Guide Annotation 330.1878 for the proposition that in sales and use tax matters, the language used by the parties to characterize their transactions does not necessarily control. The annotation specifies other evidence such as whether the transferor retained title to the subject property after the payments to the transferee (lessor/assignee), and whether the transferor claimed depreciation and was responsible for the collection of property tax in connection with the property. In other words, even if the form of an assignment document states that title to the property transfers from the Assignor to the Assignee, if the Assignor in substance is only assigning a stream of payments to the Assignee, but retains the residual position, depreciates the equipment and controls the collection of property tax, there is no second sale. Regarding the transactions where Pacifica did indeed sell the residual and execute an Assignment Document in which title to the property transferred to the Assignee, the BOE determined that since there was no intervening use (the leases and assignments were executed contemporaneously), Pacifica should be given an allowance for tax-paid purchases resold. The BOE, however, considered all gross receipts received as part of the transaction, so we were not only taxed on the Present Value of the assignment (our fee), but on the advance rentals that we retained, and all non-taxable items that were on the original invoice, including installation, freight, etc... Kit, this appeals process took over four years and only came about through the tireless efforts of the following team: Pacifica retained the counsel of Cary Boyden, Esq, of Boyden, Cooluris, Livingston & Saxe PC in 2003. He was instrumental in arguing the legal facts of the case. In the final months, once we had exhausted all our appeals and were scheduled for a Hearing in front of the members of the Board of Equalization, Cary suggested that this process had now become a political battle and we should bring in a lobbyist. Based on ELA's recommendation, we hired Jeffrey Leacox, Esq. and Patrick Shannon, Esq. of Greenberg Traurig, LLP. Jeff recommended Patrick as the lead lobbyist. Patrick was amazing. He was familiar with the Board and was able to set up individual meetings with each of the five members so that Patrick and I could outline our arguments and plead our case prior to the actual date of the conference. It was the member's pressure on the Audit Staff that brought about a Second SD&R. More detailed documentation and education of our discounting procedures followed, and then a final meeting with J. Angeja, Senior Tax Counsel and B. Heller, Tax Counsel. The result was a Third SD&R which gave us virtually everything that we were fighting for (except eliminating the tax on doc fees). I would highly recommend Patrick and his firm for future lobbying efforts related to our industry. He's now an expert! ELA - This Association provided an amicus brief in support of our position. It was well received and may have had an impact on the Board members as they were reviewing our arguments. Dennis Brown, Val Pfeiffer and the State Government Relations Committee are to be commended for their efforts. UAEL - This Association also provided an amicus brief in support of our position. Joe Woodley, Victor Harris and the entire Board are to be commended for their efforts. US Bancorp/Manifest Funding Group and Pentech Financial Services, Inc. went so far as to contribute to our lobbying efforts. I can't thank them enough... LeasingNews - Thank you, Kit, for keeping this issue in the forefront and helping to gather information throughout the four-year process. In closing, all I can say is that if I had it to do all over again, I would still make the choice to fight the California State Board of Equalization for the tax assessments that were clearly double taxation and wrong. I spent thousands of hours and many thousands of dollars in attorney and lobbyist fees. Of course our win greatly reduced Pacifica's tax liability (which had been paid in order to reduce further interest), but the fight was primarily to keep a precedent from being set which would negatively affect thousands of leasing companies that do business in California - and with the added knowledge that other states would most likely follow California's lead. Bette Bette Kerhoulas, CLP --------------------------------------------------------------

To view our collection of placards, please go here: -------------------------------------------------------------- Contact Management Survey ---------------------------------------------------------------- Classified Ads---Help Wanted Account Managers

Marketing Specialist

Sales

Sales Manager

-------------------------------------------------------------- Leasing Association Conference 2006

2006 EXPO: Innovative Ideas! Mark your calendars: Monday, September 18 at the Glenpointe Marriott with Keynote Speakers: Christine Todd Whitman and EconomistsL Jonathan and David McMurray. Our Chairman Scott Wheeler promises this year will be the best ever! Agenda and Registration Page: Please call the EAEL office at 212-809-1602 or alison@eael.org for pricing and registration form. ---------------------------------------------------------------------------

EAEL and NAELB Members from both EAEL and NAELB have come together to develop an excellent agenda for this year's EXPO. Every Leasing Professional should plan to attend this exciting event. The theme this year is "INNOVATIVE IDEAS" and the goal of the event is to bring knowledgeable leasing professional together to share and expand their leasing knowledge. The agenda includes but is not exclusive of: Key Note Speakers: Christine Todd Whitman - 50th governor of NJ. and past Environmental Protection Agency Administrator. Jonathan and David Murray- regular guest on The Today Show and CNBC Morning Call where they discuss current economic conditions and investment themes and wealth management strategies. Interactive Forum: "Hiring, Training, and Retaining Superior Sales Professionals in Today's Competitive Market" This discussion will be lead by Steve Chreist of Selling-UP (A regular contributor to Leasing News) and Mike Toglia of Molloy Associates. CLP Introduction Class: The CLP Foundation is offering an "Introduction Class to CLP" on Sunday Sept 17th The Expo is nearly sold out of exhibiting space for Lease Funders and Service Providers. (However there are still a few spots available). I invite all Leasing Professionals to join us on September 18th in Teaneck NJ. This is a MUST attend event for everyone. We are expecting record numbers again this year. For more information and a registration form visit: http://www.eael.org/doc/SeptemberMeetingBrochure.pdf or contact Alison at the EAEL Office at 212 209 1602 or Scott Wheeler- EXPO Chairman at 800 365 6566 ----------------------------------------------------------------------------

UAEL Annual Conference & Exhibition

One of the most popular UAEL events as it is the Grand Opening of the International Balloon Festival, titled: "Out of the Blue." UAEL will provide early morning transportation between the Embassy Suites Hotel and the mass ascension of hundreds of hot air baloons from 7am to 10am.

Review the Larry Mersereau, CTC website The Funding Source and Service Provider Expositon will be held Friday, October 6, after the event. Educational sessions and the Annual Business Meeting will be held on Saturday, October 7. You will become a Balloon Fiesta "VIP" and enjoy the International Balloon Festival from a private reserved area, away form the crowds and with comfortable seating indoors and out. Enjoy this exclusive setting that includes delicious food and a private tent during the Mass Ascension, which is famous for being a top draw of the Festival. UAEL is also providing transportation and admission to the event with paid registration so sign up ASAP to reserve your place at this exciting event . Annual Conference & Exhibiton More information at: www.uael.org Schedule of the International Balloon Festival: You can see the balloons from the Embassy Hotel, where UAEL Exhibitor Layout (The choice of booth location is based in the order of conference registration, so register ASAP to secure your desired spot:) ----------------------------------------------------------------------------

Equipment Leasing Association 45th Annual Convention

LA Convention Registration Available Online! For equipment lessors, the era of "business as usual" has ended. We face a future marked by some hard realities--a mature product, more competitive financing alternatives, greater regulation, greater transparency, less tolerance for certain traditional practices, and fewer opportunities for tax and accounting structures. Those are the realities, but it's what you do with them that matters. Companies willing to ask the tough questions, to discard outmoded ideas, to innovate and to take responsibility for the image and reputation of the industry will create their own place. The future belongs to those willing to create a whole new beginning for their company. The 45th Annual ELA Convention will address these issues. Registration and all information about the Annual Convention are now available on-line at Don't Wait! Register today for this premier industry event!

-------------------------------------------------------------- Surprise Bank of England rate-hike rattles stocks SAN FRANCISCO (MarketWatch) - An interest-rate hike by the Bank of England took U.S. and European markets by surprise Thursday and sent those markets as well as U.S.-listed shares of European companies lower. The Bank of England on Thursday unexpectedly raised its key interest rate by a quarter percentage point to 4.75%, taking back a quarter-point cut it made a year ago. Investors also moved with caution ahead of Friday's U.S. employment report for July, which is seen as having a significant effect on the Federal Reserve's own rate decision at its meeting on Aug. 8. The Bank of New York Europe ADR Index lost 0.7% to 148.53 and the Bank of New York Composite ADR Index fell 0.6% to 147.58. Wall Street had been assessing monthly sales figures from retailers including Wal-Mart Stores Inc. (WMT : Wal-Mart Stores, Inc. The bank cited the quickening pace of economic activity in the past few months as well as higher energy prices as reasons for the increase. See full story. See London Markets. In a move that was widely expected, the European Central Bank also hiked its key interest rate for the fourth time in nine months, to 3% from 2.75%. "This puts a lid on growth outside the U.S.," said Michael Metz, chief investment officer at Oppenheimer & Co. "And we already knew that growth was slowing in the U.S." See Market Snapshot. Most banking shares on the Europe ADR Index were in the red after the BoE rate hike because of fears that higher interest rates will mean more homeowners won't be able to make their mortgages payments. A number of banks have recently reported higher bad debt levels. -------------------------------------------------------------- New Leasing Rules Could Add Assets Accounting changes by FASB and IASB should boost balance sheets, but aren't likely to spawn upgrades in credit ratings, says S&P. Stephen Taub, CFO.com The lease-accounting project recently proposed by the Financial Accounting Standards Board and the International Accounting Standards Board (IASB) could result in hundreds of billions of dollars added to corporate balance sheets, according to a new Standard & Poor's report. The new lease-accounting standards aren't likely to spawn a material change in issuer credit ratings, however, because the previously off-balance sheet amounts are already largely factored into current rating, the rating agency said. "We already attribute additional debt for operating leases, and we therefore do not currently envision that there will be a material impact to our issuer ratings merely as a result of adding these obligations to the balance sheet, unless the nature of the lease arrangements or their monetary significance were not sufficiently disclosed or otherwise available to Standard & Poor's analysts," said Len Grimando, the firm's director for financial reporting analysis. S&P also said that it's too soon to speculate on what new lease-accounting framework would result from the major project by FASB and IASB. That said, the new regime will require some methodology to record assets and liabilities arising from leasing arrangements as well as to bring many such transactions that are currently treated as operating leases onto the lessee's balance sheet, according to the agency. The report does stress that the project could result in some important rating considerations, with the potential for ratings changes. That potential lies in covenant and regulatory compliance matters, adverse market reaction, changes in business practices, and other factors. Much more importantly, the project could spur a big shift in corporate culture. "Perhaps the greatest impact of these proposed rules would be the potential for changes in corporate behavior and business practices that such lease accounting changes may cause," said Neri Bukspan, S&P's chief accountant, in a statement. The report also pointed out that changes in business practices would affect lessee-issuers, lessor-issuers, and issuers that service the lease-structuring industry. The FASB-IASB project could also curb the appeal and change certain structured transactions, according to S&P.

-------------------------------------------------------------- Mortgage demand drops to 2002 Level The Mortgage Bankers Association reports applications hit a new low, reporting its seasonally adjusted index of mortgage application activity for the week ended July 28 decreased 1.2% to 527.6 — its lowest since May 2002 — from the previous week's 533.8. It was the third straight week that overall mortgage activity slumped, despite a decline in interest rates during that period. The average rate on a 30-year fixed- rate mortgage in the U.S. fell to 6.63 percent this week, the second straight decline, according to Freddie Mac. Other rates also slid. The 30-year rate fell from last week's 6.72 percent and compares with 5.82 percent a year earlier. -------------------------------------------------------------- Mark and Rachelle Gordon obituary Mark Gordon (Gordon & Glickson) and his wife both passed away tragically last Saturday in a home fire. Many clients in leasing and finance and a very good guy

Attorney, wife killed in Lincoln Park blaze By Lolly Bowean A Chicago attorney and his wife were killed Saturday morning, on their 34th wedding anniversary, when a fire consumed the inside of their two-story graystone in Lincoln Park, authorities said. -------------------------------------------------------------- AOL to be “Free” Dear AOL Member,

All of this is free , no matter who provides your Internet connection.

--------------------------------------------------------------- Kamradt Promoted at ATEL Capital Group

Dean Cash, CEO and President of the ATEL Capital Group announced the promotion of James A. Kamradt to Executive Vice President and National Sales Manager for ATEL Securities Corporation, effective August 1, 2006.

“Jim has been with ATEL for almost 10 years, holding increasingly responsible positions over this period, most recently SVP-Operations with ATEL Leasing Corporation. He brings a wealth of leasing industry experience to this position, with over 23 years in the business.” Prior to joining ATEL, Jim was employed by Phoenix Leasing and Dana Commercial Credit Corporation, where he was the founding facilitator of a Quality Program that ultimately won the Malcolm Baldridge Award. Jim holds an MBA from the University of California at Berkeley and has been an adjunct professor at Dominican University of California. “I am very confident that Jim will do an outstanding job in this new position. We are looking for continued growth under Jim's leadership.” Mr. Kamradt, who has worked closely with ASC's sales force over the past eight years says, “The sales team that we have assembled is top-shelf and I am proud to be a part of it. Over the past twenty years ATEL has continued to thrive due to our commitment to our Customers, Investors and Broker Dealers. “ I am committed to providing the highest level of communication, primarily through regular personal contact with each and every one of our partners. I am particularly excited about our Growth Capital Funds, which provide a great opportunity for clients to invest in carefully selected, pre-IPO companies funded by leading venture capital firms. “The benefit of having a diversified portfolio of hard assets backing the investment is a key reason that I welcome the opportunity to discuss the superior value that ATEL provides to our broker dealers and investors alike.” ATEL Capital Group is a diversified financial services business with interests in equipment leasing, real estate, growth capital, and property management. ATEL Securities Corporation is a leader in both public and private Direct Participation Programs. Since its founding in 1977, ATEL has priced, structured, owned, managed, and arranged billions of dollars of business with a management team that has over 150 years of combined experience. ATEL is headquartered in San Francisco, with an operations center in Denver and an office in Honolulu. ### Press Release ########################### Beach Business Bank Joins Forces With Baycap For Business Leasing Program

MANHATTAN BEACH, Calif.----Beach Business Bank (OTCBB:BBBC) (the "Bank") today announced that it has finalized details of a new joint marketing effort for equipment leases for businesses and professionals nationwide. Baycap, Inc. ("Baycap") is a nationwide leasing company and has been one of the Bank's most successful clients. The Bank and Baycap have been working together to develop a program for the Bank's clients who would prefer the flexibility of a lease to other forms of financing. "This was a natural fit for us," said Phillip Bond, executive vice president and chief credit officer of Beach Business Bank. "As a business bank, we are frequently asked about leasing. Now we can give our clients exactly what they want. We have been financing Baycap's business for quite some time, so we know the principals and know that their level of high-touch client service is exactly what we want for our clients." "We are in a high growth mode, so expanding our relationship with Beach Business Bank makes perfect sense," said Todd Coordt, the chief executive officer of Baycap, Inc. "The Bank is very pro business and they provide us an extraordinary level of service. Our shared vision of helping businesses succeed will play a critical role in the success of this new equipment leasing program." Beach Business Bank is headquartered at 1230 Rosecrans Avenue, Lobby Level, in Manhattan Beach, and has a second full-service branch at 180 East Ocean Boulevard, Lobby Level, in Long Beach, CA. For more information on the Bank, please visit www.beachbusinessbank.com or call 866-862-3878 or 310-536-2260; and in Long Beach, call 562-435-8600. Baycap is headquartered at 423 S. Pacific Coast Hwy Suite 201 in Redondo Beach, CA. For more information on Baycap, visit www.baycapinc.net or call 877-992-2922 or 310-944-9900. pated events or circumstances after the date of such statements. Contacts Beach Business Bank ### Press Release ########################### Latin America Experiencing Equipment Leasing Boom Report Shows Region's Volume Up 50 Percent in 2005, with Brazil's Nearly Doubling, Argentina's Recovering

FORT LAUDERDALE, FL,– Equipment leasing volume in Latin American countries increased by more than 50 percent on average in 2005, according to a report by The Alta Group Latin American Region (LAR). The Alta LAR 100 report, which includes the firm's second annual ranking of the Top 100 leasing companies in Latin America, has expanded with new information revealing the region's fastest-growing businesses, key multinationals, and growth in each country. “Our most interesting finding is the impressive growth in leasing throughout Latin America in 2005,” said Rafael Castillo-Triana, principal for The Alta Group LAR. The firm provides consulting, legal and research services to manufacturers, banks, leasing companies, associations and organizations working in Latin America. “Brazil, which has the largest leasing industry in the region, experienced tremendous growth and almost doubled in size,” he added. “The report also shows that Argentina's leasing industry is recovering from the downturn following the country's economic crisis of 2002.” Alta believes equipment leasing has grown in Latin America because it has proven to be an effective tool to funnel capital investment into emerging economies, and because the prevailing macroeconomic conditions in Latin America have favored the increasing demand of capital investment, Castillo-Triana noted. “However, the industry still needs to be prepared to be sustainable and continue growing, even in periods of macroeconomic downturns. Alta's sense is that most of the large players are intending to do so, but this requires a lot of adjustments and a willingness to abide by best management practices for the leasing industry,” he said. The report's ranking of the Top 100 leasing operations in Latin America is based on each company's reported portfolio of leased assets in 2005. Alta LAR developed the rankings from data published by the corresponding country leasing associations, Central Banks of regulatory entities, rating agencies and in some cases from data provided by individual companies. The 10 leading companies in the Alta LAR 100 this year are, in order: Cia Itauleasing de Arrendamento Mercantil (Brazil) The complete Alta LAR 100 report is available free of charge, in both English and Spanish. For a copy, please visit www.thealtagroup.com. The Alta Group LAR also plans to offer an in-depth database to accompany the report, for a fee, Castillo-Triana said. About The Alta Group The Alta Group is a global consultancy serving equipment leasing and finance companies, investment professionals, manufacturers, banks and government organizations. Founded in 1992, The Alta Group supports clients in North America; Latin America; Western, Central and Eastern Europe; Australia and China. For more information, visit www.thealtagroup.com. ### Press Release ########################### GATX Leases New Headquarters

CHICAGO--(--GATX Corporation (NYSE:GMT) announced that it executed a new long-term lease agreement for its headquarters in downtown Chicago. In 2008, GATX Corporation will relocate its corporate and rail headquarters to 222 West Adams, having leased approximately 109,000 square feet in Tishman Speyer's Franklin Center complex in Chicago's West Loop district. Brian A. Kenney, chairman and CEO of GATX Corporation stated, "This new lease offers GATX great flexibility, space efficiency, advanced technology and a lower cost platform from which to operate and grow our business. In addition, the location of this exceptional building is highly accessible to our employee base. "Special recognition goes to Melissa Copley, President of Copley Advisors, who led this highly complex process to a successful conclusion, and Mike Thomas, Vice President of Jones Lang LaSalle, who supported Melissa in the transaction. I am pleased that GATX's headquarters will continue to be located in downtown Chicago where we have been since our founding in 1898." COMPANY DESCRIPTION GATX Corporation (NYSE:GMT) provides lease financing and related services to customers operating rail, air, marine and other targeted assets. GATX is a leader in leasing transportation assets and controls one of the largest railcar fleets in the world. Applying over a century of operating experience and strong market and asset expertise, GATX provides quality assets and services to customers worldwide. GATX has been headquartered in Chicago, IL since its founding in 1898 and has traded on the New York Stock Exchange since 1916. For more information, visit the Company's website at www.gatx.com. Investor, corporate, financial, historical financial, photographic and news release information may be found at www.gatx.com. ### Press Release ########################### Trinity Industries, Inc. Reports Strong Earnings and Record Revenues DALLAS, -- Trinity Industries, Inc. TRN today reported earnings from continuing operations of $62.6 million, or $0.79 per common diluted share for the second quarter ended June 30, 2006. These results include a gain of $0.09 per common diluted share from the disposition of property. Earnings from continuing operations for the same quarter of 2005 were $20.5 million, or $0.27 per common diluted share. Total earnings for the second quarter were $85.8 million, or $1.08 per common diluted share, including $0.29 of earnings per common diluted share from the disposition of the fittings business. This compares with total earnings of $21.8 million or $0.29 per common diluted share for the same quarter of 2005. For the six months ended June 30, 2006, the Company reported earnings from continuing operations of $97.6 million, or $1.23 per common diluted share, compared with earnings from continuing operations of $25.7 million or $0.34 per common diluted share for the same period of 2005. For the six months ended June 30, 2006, the Company reported total earnings of $122.8 million, or $1.55 per common diluted share, compared with total earnings of $27.8 million or $0.37 per common diluted share for the same period of 2005. Revenues for the second quarter increased 23 percent to $883.8 million compared to revenues of $718.0 million for the same period in 2005. Quarterly revenues were the highest in the Company's history. Revenues for the six months ended June 30, 2006 increased 20 percent to $1,628.6 million compared to revenues of $1,352.7 million for the same period in 2005. "The driving factors behind our businesses remain strong," said Timothy R. Wallace, Trinity's Chairman, President and CEO. "As a result, our performance continues to improve. Our manufacturing facilities are operating at high levels of utilization and efficiency. Our backlog of orders in both our rail and barge groups continued to grow during the second quarter. This is a positive indicator of continued momentum for Trinity." Trinity received orders for 10,012 railcars in North America during the second quarter, which ended June 30, 2006, and shipped 6,233 railcars. Trinity's North American railcar order backlog rose to 29,320, an increase of over 3,700 from the March 31, 2006 order backlog. The Company added approximately 1,500 new railcars to its railcar lease fleet during the second quarter, bringing the fleet total to more than 27,200 at June 30, 2006. "Investing in our lease fleet continues to be one of our core strategies," Wallace said. Trinity's Inland Barge Group's order backlog grew to $487 million at the end of the second quarter. "Our Inland Barge Group's earnings exceeded our expectations as a result of improved efficiencies," Wallace said. Trinity's Energy Equipment Group also improved its operating profit over the second quarter of 2005. "Our structural wind tower business remains strong and continues to have a nice level of inquiries for additional products." Full press release at: ### Press Release ########################### Netsol Technologies Announces Successful Deployment of End-to-End Company deploys new web-based business originations, fully integrated with back office portfolio management and accounting operations

CALABASAS, CA – – NetSol Technologies, Inc. (NASDAQ:NTWK), a U.S.-based, multinational provider of enterprise software and services for equipment financing, today announced that its wholly owned Burlingame, Calif.-based subsidiary, McCue Systems, has successfully designed and deployed a fully customized portfolio management solution at Sydney, Australia-based Provident Inventory Finance. Provident Inventory Finance provides tailored funding options through brokers, or introducers, enabling them to offer this innovative form of cash flow finance, not offered by traditional lenders, that does not require real estate security or stock presales. “We are very gratified to see our introducer network growing rapidly,” commented Provident Inventory Finance Managing Director Matthew Nolan. “We asked McCue Systems to provide a business origination tool that would inter-operate seamlessly with our customer-facing website. They delivered an effective solution that meets our needs and, most importantly, the needs of our introducers.” Nolan added, “McCue further demonstrated its commitment to our success by minimizing our start-up costs and aligning our ongoing outlays with the growth of the business and our increased usage of the system.” NetSol's McCue Systems development team, working in concert with integration and ASP partner LeaseDimensions, developed and deployed a web-based originations tool designed to streamline deal acquisition and funding decisions for the organization's introducer network throughout Australia. “The success of the Provident Inventory Finance solution is an excellent example of the ability of NetSol Technologies to leverage its asset finance expertise to deliver customized solutions globally, “ stated NetSol Technologies Chairman Najeeb Ghauri. “We look forward to supporting the continued success of Provident Inventory Finance.” About Provident Inventory Finance Provident Inventory Finance Limited is a member of the successful Provident Capital Group of companies. Established in 1990 and wholly Australian owned, the Provident Capital Group manages a portfolio of AUD$250m. Provident Inventory Finance is a specialized lender providing short term loans to Australian businesses, facilitating their acquisition of inventory. Funding is provided on flexible terms to suit our clients and for amounts up to AUD$3m. Provident Inventory Finance's assists growing and profitable businesses that have seasonal buying needs, an opportunity to achieve supplier discounts or a need for additional working capital to expand. For more information, visit www.inventoryfinance.com.au About McCue Systems With over 30 years of experience in developing business solutions for the equipment and vehicle leasing industry, McCue Systems Inc. is the leading provider of lease/loan portfolio management software for banks, leasing companies and manufacturers. Its flagship product, LeasePak, simplifies lease/loan administration and asset management by accurately tracking leases, loans and equipment from origination through end-of-term and disposition. McCue Systems leads the leasing technology industry in the development of Web-enabled and Web-based tools to deliver superior customer service, reduce operating costs, streamline the lease management lifecycle, and support collaboration with origination channel and asset partners. For more information, visit www.mccue.com. About NetSol Technologies, Inc. NetSol Technologies is an end-to-end solution provider for the lease and finance industry. Headquartered in Calabasas, CA, NetSol Technologies, Inc. operates on a global basis with locations in the U.S., Europe, East Asia and Asia Pacific. NetSol helps its clients identify, evaluate and implement technology solutions to meet their most critical business challenges and maximize their bottom line. By utilizing its worldwide resources, NetSol delivers high-quality, cost-effective IT services ranging from consulting and application development to systems integration and outsourcing. NetSol's commitment to quality is demonstrated by its achievement of both ISO 9001 and SEI (Software Engineering Institute) CMM (Capability Maturity Model) Level 4 assessment. For more information, visit NetSol Technologies' web site at www.netsoltek.com . ### Press Release ########################### CapitalStream Appoints Celeste Hauck to Vice President, Professional Services Seattle - SEATTLE -- CapitalStream Inc., a leader in front office automation solutions for commercial lending and finance operations, today announced the appointment of Celeste Hauck to vice president, professional services. Hauck has built and managed large client service teams who have successfully implemented large-scale enterprise systems across a broad range of enterprises including large banks and financial institutions. She will focus on building the processes and personnel skills that ensure CapitalStream's level of service delivery to complement the company's overall growth plans. Hauck spent the last 16 years with Ceridian, a $2 billion enterprise software and services company, in numerous roles including regional vice president of implementation services, general manager and district vice president of client services. Most recently she spearheaded Ceridian's largest Six Sigma project, which defined new implementation methodologies and led to improved implementation cycle time, accelerated revenue recognition, improved customer satisfaction and significant cost savings. "With a healthy pipeline of new business, it is more important than ever that we create a consulting and support organization that can scale, handle multiple large projects simultaneously and exceed customer expectations," said Kevin P. Riegelsberger, president and CEO, CapitalStream. "Hauck's drive and significant leadership experience will contribute greatly to CapitalStream's strategic growth plan." About CapitalStream Established in 1995, CapitalStream provides software and consulting services that enable commercial banks and finance companies to collaborate, integrate and operate more effectively across their front office operations. CapitalStream solutions streamline data gathering, deal structuring, credit analysis, document generation, booking, account monitoring and ongoing risk management to more effectively originate transactions and manage commercial relationships. CapitalStream transforms the paper-based operations of mid-market, small business, equipment leasing and commercial real estate groups by reducing costs, risk and processing times to grow their portfolios without increasing headcount. For more information, visit us at www.capitalstream.com . ### Press Release ###########################

News Briefs---- AOL Plans to Cut 5,000 Jobs Bank of America plans to add 1,300 New England jobs Retailers Report Solid Sales in July More air passengers getting bumped ---------------------------------------------------------------

You May have Missed--- Trillions stashed offshore cost government $40 billion to $70 billion annually ----------------------------------------------------------------

“Gimme that Wine” Worth its weight in gold? California wineries produce crowd-pleasers Americans flock to buy home cellars Wine Prices by vintage US/International Wine Events Winery Atlas Leasing News Wine & Spirits Page ----------------------------------------------------------------

Calendar Events This Day Braham Pie Day Visitors will find homemade pies, craft displays, pie-eating contests, a pie auction, a pie race and performing artists in Braham's main street park. www.braham.com Burkina Faso: Revolution Day. Coast Guard Day Work like a Dog Day ----------------------------------------------------------------

Today's Top Event in History 1964-After disappearing on June 21, three civil rights workers were found murdered and buried in an earthen dam outside Philadelphia, MS. The three young men were workers on the Mississippi Summer Project organized by the Student Nonviolent Coordinating Committee (SNCC) to increase black voter registration. Prior to their disappearance, James Chaney, Andrew Goodman and Michael Schwerner were detained by Neshoba County police on charges of speeding. When their car was found, burned, on June 23, President Johnson ordered an FBI search for the men. ----------------------------------------------------------------

This Day in American History 1693 - It is believed that a monk named Dom Perignon invented champagne at the Benedictine Abbey of Hautvillers in the region of Champagne, northern France. He made the first champagne by re-fermenting a certain wine in the spring and then placing it in strong, sealed bottles so that the wine would become sparkling. Dom Perignon was the Cellar master for 47 years until his death in 1715. The sparkling wine was crude and perhaps the first one to produce what we drink today was Mme. Nicole-Barbe Clicquot, who developed the sur pointe process that clarified the sediment out of sparkling wines. She was also an astute business person, especially in a day that women did not run business. Nicole Barbe Clinquot was the daughter of the mauor of Reims who at 20 was widowed with a daughter after three years of marriage to a vintner. She vowed to carry on her husband's business. She developed the process of remuage (moving) in which the bottles of wine are stored upside down (on their corks or sur pointe) and then the bottles are shaken periodically and then rotated to force the sediments in the wine to settle down on the cork. After a certain period, the cork is quickly removed, the sediment is expelled by the wine gases and then the bottle is quickly re-corked. The widow Clinquot also invented pink champagne. My favorite in Louis Roederer, but a Grand Madame Clinquot, now that is a fine sparkling wine! Here is a secret. You can serve “Champagne” with everything. If you cannot match a wine to a food, serve “Champagne.” Next, a very good beer. Don't laugh, some fine beer goes with everything ( especially if it is “fresh.”) Now what does this have to do with American History? Nothing, but thought you would like to know more about sparkling beverages. --------------------------------------------------------------

Baseball Poem

by Jim "Mudcat" Grant

Life is like a game of baseball

At first base there's religion, Your catcher's name is humor, To make your game complete. Discouragement and falsehood, -------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? |

|||||||||||||||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

|||||||||||||||||||||||||||||||||||

Editorials (click here) |

|||||||||||||||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

|||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||