"Specializing in Equipment Financing" "Specializing in Equipment Financing"

Charlotte * Los Angeles * New York * Phoenix

|

National Account Managers

60% com./30% res. APP only to $150,000. No industry/geo restrictions. Tremendous flexibility/freedom: your home office or our regional offices. bjohnson@alliancecap.com

|

|

|

Wednesday, August 9, 2006

Headlines---

IFC gets Walloped in Jury Trial

Aug. 9, 2000—Archive: Byrne is Out!

Welcome Aboard, New Readers

Classified Ads---Credit

NetBank posts loss, halts dividend

Pacific Capital joins “Funder List”

Classified Ads---Help Wanted

Brady Now GM ABCO Leasing

Probst now GM Willamette Financial

Sales Makes it Happen---by Linda Kester

“Broker Commissions”

Annual Lessor Showcase Attendees

Last Chance: Contact Mnmgt. Survey

Marlin Business Service 10-Q

Marquette Portfolio/Alliance Fin

Popular Leasing/Richlund & Assoc

IDS Rapport Free Web Cast

News Briefs---

You May have Missed---

California Nuts Brief--

"Gimme that Wine"

Calendar Events

Today's Top Event in History

This Day in American History

Baseball Poem

SuDoku Puzzle

In this issue, Linda P. Kester writes about ---

“Broker Commissions”

“I'll take on the role of investigative reporter to provide you with more info on this subject. Please share your knowledge of typical points and deal sizes (I'll keep you anonymous if you like), I'll compile a summary and share the information in a follow-up article to make us all more knowledgeable on current industry trends.”

linda@lindakester.com

######## surrounding the article denotes it is a “press release”

-----------------------------------------------------------------

IFC gets Walloped in Jury Trial

With Cook County Superior Court Justice Matthew F. Kennelly presiding, and in what may be the first IFC Credit Corporation-NorVergence lease jury trial, a precedent may be set in a win by Gregory Adamski, Managing Partner and Samantha R. Engel, Attorney, Adamski & Conti, Chicago, Illinois. The jury heard the case for four days and took only 2 1/2 hours (over the lunch hour) to agree with the presentation that United Business & Industrial Federal Credit Union was "induced by fraud to sign the 5 NorVergence contracts without knowledge of, or reasonable opportunity to learn of, the character or essential terms of the contracts." The legal term for this defense is called "fraud in the factum" or "essential fraud."

This involved approximately $120,000 in five leases with possibly $80-$100,000 in attorney fees from Askounis & Borst, P.C. According to Leasing News records, there were 550 IFC Credit Corporation leases purchased from NorVergence. Most of the cases Leasing News could determine from Pacer records were handled by Askounis & Borst, who at one time threatened to sue Leasing News for printing the news about the SOS case in Texas. Ironically, Leasing News also found one instance where Askounis & Borst also represented directly NorVergence Corporation and defending NorVergence against a fraud counterclaim only one month prior to IFC entering into the Master Program Agreement with NorVergence. The matter was brought up before the jury trial. (In the Northern District of Illinois, Eastern Division: 1:03-cv-05239 NorVergence v. Moo & Oink. Please see motions at the end. Editor)

IFC Credit did not respond to any inquiries regarding this jury trial case.

Managing Partner Gregory Adamski

"In deposition, IFC admitted to writing the NorVergence leasing contract,” Managing Partner Gregory Adamski said. "In the trial, they said it was NorVergence who actually wrote the MPA, but admitted that it was approved by IFC Credit.

“ In fact, the United Business & Industrial Federal Credit Union" contracts were some of IFC Credit's earlier purchases from NorVergence, assigned January 12, 2004. They made claims that the 'equipment' was proprietary, when in fact it was only an Adtran router, and that it converted data in a way so there would be no extra long distance charges.

"On December 12th, they gave the credit union a booklet that this was an application for telecommunications service, when in fact part of the package they presented were leasing equipment rental agreements tied to a master agreement with IFC Credit. NorVergence pitched that its product was in such high demand, that it needed to determine whether the customer was worthy of doing business with it. CIO of the credit union, Mike Knurek, stated that 'it was like trying out to become a member of an exclusive club.'

"When the unit was installed on January 9, 2004, Knurek informed NorVergence that it was not running and complained about it. What he got was a telephone call from NorVergence telling him had to accept this or go back to the waiting list, and even though it was not working, he had to confirm that everything was delivered.

"Next Knurek received a call from IFC asking if the equipment was delivered. He said it was, but it wasn't running. Despite this information, IFC bought the leases from NorVergence and have been litigating over them ever since.”

Attorney Samantha Engel

"I am pleased that the jury looked beyond the four corners of the contracts and saw through NorVergence fraudulent conduct, "Attorney Engel said." I sincerely hope that companies learn that they cannot

hide behind the holder in due course rule, putting their head in the sand and profit off of an obvious scam."

Motion to disqualify Askounis-Borst re: representing NorVergence

http://leasingnews.org/PDF/motion_to-disqualify-attorney.pdf

Askounis-Borst response

http://leasingnews.org/PDF/Askounis-Borst_Response.pdf

Amended Complaint by Adamski & Conti:

http://leasingnews.org/PDF/first_amended_complaint.pdf

http://www.adamskiandconti.com/

http://www.askborst.com/contactus.htm

[headlines]

--------------------------------------------------------------

August 9, 2000—Archive: Byrne is Out!

"Byrne Rumor is True!---Confirmed by two more sources.

"Patrick ‘Evergreen' Byrne, CLP - 50% owner and CEO of Balboa Capital Corporation, Irvine, CA was voted out as CEO by the Board of Directors and no longer "works" for the company.

“‘Founded in 1988 by Patrick ‘Evergreen' Byrne and Shawn Giffin, Balboa Capital has grown into a national company with 150 employees. Balboa is headquartered in Irvine, California, and has offices in Los Angeles, San Francisco, Phoenix, and New York. A two-time member of the Inc. 500 list, and named Orange County's Entrepreneurs of the Year for 1997, Balboa has become a leader in the leasing industry.'

"The above is from their former website (saved in cache, as this has been replaced without any reference to Byrne.)

"Their job application contained this to describe Balboa Capital:

"'Fun Despite the high expectations we have for ourselves, we don't feel that an approach to life that merely emphasizes work accomplishments is healthy or desirable. Let's face it, if all you do is work, you end up being one boring individual. That is why we also stress fun on a daily basis. We promote an atmosphere that makes coming to work enjoyable. Balboans are encouraged to seek excellence both in and out of the office. We sponsor company softball teams, hold company functions (including our infamous annual meeting), encourage employees to exercise daily, promote further education, and try to make every day entertaining. We believe that personal and professional growth are equally important. Well-rounded, happy individuals are the cornerstone of our success."

http://two.leasingnews.org/archives/August/8-09-00.htm

Pictures from the Past—1993---Giffin-Byrne

Balboa Capital Corporation ,VP Finance Shawn Giffin, CLP (left) congratulates President Patrick E. (for “Evergreen”) Byrne, CLP. The Western Association of Equipment Leasing member firm was recently ranked #67 overall on the Inc. 500 list.

Firms: Balboa Capital Corp.

Specialization: High-tech

Lease Range: $10K-$2 million

Number of Employees: 35

------------------------------------------------------------------

Welcome Aboard, New Readers

August 9,2002 Leasing News started its HTML edition on line; our Text Newsletter continued to be sent by e-mail.

One of the advantages of joining our mailing list is to not only receive notice when an edition is posted, you see the headlines of the stories available, plus get from time to time, extra's, such Fed Leaves Rate "As is"

http://www.leasingnews.org/archives/August%202006/08-08-06-extra.htm

You may go to the “add me” feature above or just send an e-mail

to kitmenkin@leasingnews.org .

We don't spam. We don't add anyone unless they ask. We don't share our list with anyone.

There is no cost to subscribe.

Don't miss out on what is really going on in the equipment leasing industry!!!

[headlines]

--------------------------------------------------------------

Classified Ads---Credit

Ponzi Vineyards, Beaverton, Oregon *

Atlanta, GA

10 yrs experience in credit/collections/recovery/documentation in the leasing industry. P&L responsibility, team builder & strong portfolio mgnt skills.

email: mortimerga@adelphia.net

Boston MA

Challenging position where my skills, professional experience, organization, leadership, strategic thinking, creativity, energy, passion, competitive nature will enable me to define opportunities and personal development.

Email: bernd.janet@verizon.net

Corona, CA

VP credit Consumer Credit prime/sub prime Auto lending/leasing/mortgages. 20+yrs exp. If you are looking for someone to affect the bottom line I am that person. Will relocate.

Email: amosca2000@yahoo.com

Fort Lee NJ

3 Years Experience credit/documentation. Looking in NJ/NY.

Email: angitravis@mail.com

Irvine, CA

I have over 16 years of Credit/Collection experience in the finance industry. Prompt results, extremely effective and knowledgeable, professional, excellent manager and team player.

Email: newportresources@sbcglobal.net

Los Angeles, CA

Over 15 years experience in Credit/Operations with Small Ticket and transactions up to $500,000.00. CLP, with excellent relationships with most major lenders.

Email: jonbh123@earthlink.net

New Jersey, NJ

Credit Analyst with 10+ years experience in small-ticket lending up to $500,000. Experience with both vendor-direct and with brokers.

Email: b.leavy@worldnet.att.net

New York, NY

V.P. Credit & Collections w/23 years exp.looking for a situation where I can utilize my varied & extensive knowledge of credit/collections/risk-management & leasing .

Email: rcouzzi@yahoo.com

Sausalito, CA

Sr. Corp. officer, presently serving as consultant, fin. service background, M&A, fund raising, great workout expertise, references

Email: nywb@aol.com

Orange, CA

Credit/Operations-15 years exper., looking for a new home. Have handled both middle/ large ticket transaction, plus muni & international finance.

email: equiplender@aol.com

Senior Credit Officer

experienced in middle-market leasing ; structured, vendor and 3rd party to the fortune 1000. Proactive team builder, originations capable with strong work ethic.

Email: kyletrust@hotmail.com

For a full listing of all “job wanted” ads, please go to:

http://64.125.68.91/AL/LeasingNews/JobPostings.htm

To place a free “job wanted” ad, please go to:

http://64.125.68.91/AL/LeasingNews/PostingForm.asp

* http://www.ponziwines.com/about-us/about-us.asp

-------------------------------------------------------------------------------

Please send to a colleague, as we are trying to build our readership.

[headlines]

--------------------------------------------------------------

NetBank posts loss, halts dividend

By Péralte C. Paul

The Atlanta Journal-Constitution

WWW.AJC.COM

Slowing mortgage activity and a host of other charges led NetBank Inc. to a loss in the second quarter, the company said Tuesday. It also halted dividend payments.

The Alpharetta-based Internet-only bank, which warned last week it would likely post a loss in the quarter ended June 30, said it lost $31.4 million, or 68 cents per share, compared with a profit of $2.3 million, or 5 cents per share, in the year-ago quarter.

For the first half of 2006, the company posted a loss of $42.4 million, or 92 cents per share, vs. a gain of $296,000, or a penny per share, in the first half of 2005.

"Quarterly results remain unacceptable," Douglas K. Freeman, NetBank's chairman and chief executive officer, said in a statement. "The company's performance continues to be adversely impacted by the flat yield curve and relentless pricing and operating pressures we and other institutions are experiencing on the mortgage side of our business."

NetBank shares fell more than 6 percent in early trading.

[headlines]

--------------------------------------------------------------

Pacific Capital joins “Funder List”

In up-dating the “Funder List,” we found several oversights, including the company of the Leasing News Person for the year 2006:

Funder - Update

A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program

| D -"Private label Program" | E - Also "in house" salesmen

Name

In Business Since

Contact

Website

Leasing Association

|

|

|

|

|

|

|

|

|

|

|

25 in division |

US

(no LA or VT) |

$10,000 - $75,000 |

|

Y |

N |

Y |

N |

Y |

The list is getting so large, we have broken it into “A” and “B,” dividing it now by those companies where we have been able to confirm the number of employees. Our process has another 100 to add and it is taking longer than we originally anticipated, as evidently many of the very large leasing companies do not belong to any leasing association, plus it is difficult to reach the department that may provide information on the equipment leasing entity. These companies include: A.T.& T. Capital, Bank of America Leasing, Chase Equipment Leasing, Citicapital, Farm Credit Leasing Service, and other large companies such as International Lease Finance, a major leader in the leasing/remarketing advanced technology commercial jet aircraft to airlines around the world. ILFC portfolio $ 40 billion+, consisting of more than 800 jet aircraft.

The goal is to tie current news stories to their listing, making contact information available to readers, particularly those who are looking for a job: sources they may contact that they have not considered.

There is a new list that we will introduce as soon as we get the next group at least on the Funder "B" list. We hope to continue to up-date and obtain information until the individual listing is fully complete.

Funder List “A”

http://www.leasingnews.org/Funders_Only/Funders.htm.

Funder List “B”

http://www.leasingnews.org/Funders_Only/Funders_B.htm

Editor

[headlines]

----------------------------------------------------------------

Classified Ads---Help Wanted

Account Managers

"Specializing in Equipment Financing" "Specializing in Equipment Financing"

Charlotte * Los Angeles * New York * Phoenix

|

National Account Managers

60% com./30% res. APP only to $150,000. No industry/geo restrictions. Tremendous flexibility/freedom: your home office or our regional offices. bjohnson@alliancecap.com

|

|

|

Marketing Specialist

|

ELD Marketing Specialist

Walnut Creek, CA

Serve as a liaison between the leasing department and several hundred brokers . Requires a BA/BS; 3+ years of leasing and contract experience; Click here for detailed description & resume submission info.

|

|

Sales

|

Highest Commission in Industry

Seeking self-motivated, energetic individuals for California, Florida, Georgia, Illinois,Texas

equipment transportation leasing/financing. Moderate travel & extensive phone work.

Email resume : ekaye@advantagefunding.us or fax to 718-392-5427.

About the Company: Advantage Funding was recently acquired by Marubeni Motor Holdings, a major Japanese trading company and is a leading commercial and consumer vehicle and equipment financing and leasing company based in Long Island City, NY.

|

|

|

|

RETAIL MERCHANT VENDOR SALES

Outstanding opportunity for established vendor sales professional to introduce a cash advance product that vendors can utilize to facilitate the sale of their products. To apply, please send resume to applicant@1rstfunds.com.

|

|

[headlines]

--------------------------------------------------------------

Brady Now GM ABCO Leasing.

“SFBI Professional Recruiting today announces the placement of Jim Brady to the position of General Manager of ABCO Leasing Inc., Bothwell, Washington.

“As General Manager for ABCO Leasing, Jim will be responsible for overall operations, including credit, documentation, portfolio administration, marketing and sales. Jim has over 15 years of experience in the equipment leasing industry, including 7 years as Vice President of Marketing and Sales with Colonial Pacific Leasing and 2 years as Vice President and General Manager of MetLife Business Credit, a division he launched and managed for MetLife Capital Corporation. Jim was also Senior Vice President of Market Development for CapitalStream, Incorporated, a leading provider of software and technology services to the commercial finance industry.

“' Jim's depth and breadth of experience in this industry will be a great fit with our future growth plans for ABCO. I also want to express my appreciation for the integrity and hard work put forth by Fred St Laurent of SFBI in putting this together.' said Bob Bickford, Executive Vice President of ABCO.

“ABCO Leasing was established in 1974 and provides equipment financing to businesses in over 20 states. ABCO delivers this service exclusively through its relationships with independent lease brokers located throughout the U.S.

“For more information please contact ABCO Leasing, Inc., at (800) 995-1897 or Jim Brady

at jimb@abcoleasing.net

“SFBI Professional Recruiting is an executive recruitment firm led by Fred St Laurent who has been recruiting in the Equipment Leasing Industry for more than 12 years. They are members of ELA, UAEL, NAELB and EAEL.

Kind Regards,

Fred St Laurent

CEO and President

SFBI Professional Recruiting

Phone: 678.455.5700 ext 214

Fax: 678.623.8283

Email: Fred@sfbirecruiter.com

"Impacting Companies one person at a time."

“Website: http://www.sfbirecruiter.com/

“Member of ELA

Member of NAELB (Membership Committee)

Member of UAEL

Member of EAEL

Member of the Leasing News Advisory Board

http://www.leasingnews.org/Advisory%20Board/Fred_St_Laurent.htm”

[headlines]

### Press Release ###########################

Karl Probst named General Manager Willamette Financial Funding Service, LLC

Willamette Financial Funding Services, LLC – Portland, Oregon is pleased to announce to the leasing community that Karl Probst has joined the Willamette Financial team as General Manager. Karl has over 30 years experience in commercial bank lending and commercial leasing. Karl's extensive financial experience, energy and management skills bring to Willamette Financial new talent and creativity for future growth.

Willamette Financial has been in business for 21 years, funding deals that range into the hundreds of millions. Willamette Financial specializes in 10K to 500K transactions. Willamette Financial is conveniently located in Eugene, Oregon, Redding, California and Baltimore, Maryland.

Willamette Financial Funding, LLC and Karl welcome all of Karl's broker affiliates to contact him for potential business opportunities, at 1-800-777-5355.

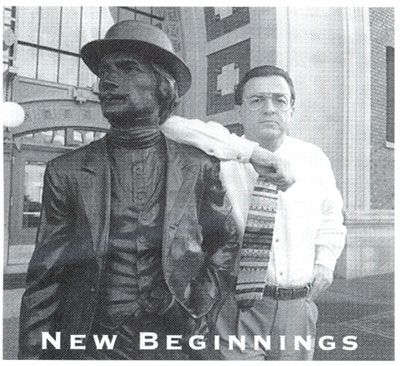

Pictures from the Past—1996—Karl Probst

Karl Probst posed with his favorite statue ‘New Beginnings,' an historical representation of individuals of entrepreneurial spirit, by artist Larry Anderson, located in front of Tacoma Washington's Union Station.

Leasing News wishes Karl the best of luck as he has made many good friends during his time in the equipment leasing business.

[headlines]

--------------------------------------------------------------

Sales Make it Happen

“Broker Commissions”

by Linda P. Kester

After talking to some sources I have found that the general range of points paid is from 3% up to 20%. Balboa and Main Street pay up to 20%.

I'll take on the role of investigative reporter to provide you with more info on this subject. Please share your knowledge of typical points and deal sizes (I'll keep you anonymous if you like), I'll compile a summary and share the information in a follow-up article to make us all more knowledgeable on current industry trends. linda@lindakester.com

Why do funding sources limit the amount of points paid on lease transactions? After all, if it passes their (often arduous) credit test, and if the pricing is right, then what's the problem? Brokers put a lot of time and effort into getting leases through the process, all the way to funding—they should get paid for their efforts.

Often brokers are forced to reduce the points significantly due to rate pressures. When the deal can handle it, they should be able to keep the extra points. So why do funding sources often limit their payouts to sometimes as low as 10 points or less?

And why are those who are trying to attract brokers willing to pay 20% or more?

As someone who has worked for a funding source for many years, I can tell you their logic in limiting the size of the commission. First, they feel that if a deal has excessive points built in, there must be something wrong that the credit process did not uncover. They could feel as if those 20 points you built in is your fee for hiding the fact that the owner of the prospective lessee completed the credit “app” from his jail cell. And even though 20 points may be high, they feel that on average, leases that come with 20 or more points built in are going to perform worse than those with 5 points attached. I think we would all agree there is some logic to that.

Some of the story credit companies limit their fee to 2% or 3% as they know the tough credit will sign anything to get the lease and the lessor thinks that if there is to be a default, paying 10% to 20% in commissions will be too costly for them.

So, the issue really is where the limits should be or if they should be determined on an individual basis.

Many lessors have different equipment cost categories for their policy on points. A common break is transactions over $100,000 and under $100,000, allowing more points on smaller deals. A different standard for deal size makes sense. Usually price sensitivity is less on smaller leases so building in more points should not be as much a red flag to the funding source. Using 20% as an example, certainly paying out $2,000 on a $10,000 deal should not create the kind of worries as paying $20,000 on a $100,000 deal.

On some higher priced transactions the point cap should be determined individually. Many banks limit transactions over $100,000 to 5% to 8%. Some funding sources even make it a 5% security deposit to the lessee, which in reality is the broker's commission.

Today's funding source is typically doing more due diligence, so there is less chance that they would miss some obvious flaw in the deal. Some perfectly viable credits can be very time-consuming and expensive to put together. For example, transactions with letters of credit or a foreign guarantee can be very costly to process... You should be compensated for this accordingly based on the individual circumstances without an arbitrary maximum that applies to all leases.

Using that same logic, it probably makes sense for larger funding sources to set a standard policy for smaller deals. Often, these are put through a pass/fail credit scoring process where a minimal amount of credit information is reviewed. They would not consider it reasonable or in their best interest to determine which deal can handle 20 points and which can only handle five.

So the question comes down to what would be a reasonable cap for smaller deals? It would be easy for a funding source looking for better credits to have a low threshold like 10 or fewer points. This would not be the best strategy, however. There are a lot of solid brokers with great reputations who would shy away from these funding sources because of the caps. Certainly it would be a drawback if they weren't offering some other significant value in exchange.

I think the best strategy for a major funding source is to set a relatively high point cap for brokers and then monitor the mix of credits performance and point totals that they see come from each broker. I would suggest that if a broker is at or near the cap on all their deals than they would warrant further scrutiny, but the broker who has the flexibility to occasionally make a larger profit on a transaction would feel as if their funding source was reasonable.

Please share your knowledge of typical points and deal sizes (I'll keep you anonymous if you like), I'll compile a summary and share the information in a follow-up article to make us all more knowledgeable on current industry trends. Send your input to linda@lindakester.com

Linda Kester helps leasing companies increase volume. For more information visit www.lindakester.com .

|

|

[headlines]

--------------------------------------------------------------

Annual Lessor Resources Showcase Attendees

Atlanta, GA August 30-31 Ritz Carlton, Buckhead

http://www.lessors.com/Events-2006/Fall/attendees.html

Registration: $750

http://www.lessors.com/Events-2006/Fall/register-attendee.html

[headlines]

--------------------------------------------------------------

Last Chance: Contact Management Survey

Results this Friday. What contact management system do you use?

[headlines]

----------------------------------------------------------------

Marlin Business Service 10-Q

70 page Security and Exchange Commission Form 10-Q, for the quarterly period ending June 30, 2006

http://leasingnews.org/PDF/Marlin_form_10-Q.pdf

[headlines]

---------------------------------------------------------------

### Press Release ###########################

Marquette Business Credit, Inc. triples loan portfolio

through $465 million acquisition/Acquires Applied Financial

DALLAS – – Marquette Business Credit, Inc. (MBC), an asset-based lending firm owned by Marquette Financial Companies, has acquired an asset-based lending portfolio with commitments in excess of $465 million from Guaranty Business Credit Corporation (GBCC) of Dallas. Terms were not disclosed.

MBC's acquisition more than triples its loan portfolio from $217 million to $682 million in commitments, doubles the number of clients served throughout the U.S., and adds four additional sales offices, including Seattle, San Francisco, Chicago and a regional office in downtown Los Angeles. With this acquisition, MBC now has 10 offices nationwide, including its headquarters in Dallas.

This marks the second portfolio purchase for MBC, which was established in June 2004 as a de novo company of Marquette Financial Companies by Jim Casper, president, Michael Haddad, executive vice president of marketing, and Jim Johnson, regional vice president-Dallas. In February 2005, MBC acquired a $75.3 million portfolio from Capital Factors, Inc. of Boca Raton, Fla. In December 2005, Itasca Business Credit, a sister MFC asset-based lender, was merged into MBC to give Marquette one national platform.

Since its founding, MBC has combined solid organic growth with select portfolio acquisitions and growth in its existing client base to become one of the largest privately owned asset-based lenders providing credit facilities to middle market companies in the U.S. Offices are located in key geographical markets of California (2), New Jersey, Minnesota, Texas, Georgia, Illinois, North Carolina, Washington and Ohio.

Prior to launching the company in early 2004, MBC's senior management team had more than 90 years of asset-based lending experience. “Our extensive experience will be extremely beneficial in making this transition seamless, both for clients and employees,” said Casper.

Approximately 25 employees from GBCC, primarily in Dallas and Los Angeles, will join MBC, increasing its number of employees to 62. “We were able to recruit all of the employees who service clients, and we are pleased to welcome such a great team to support and grow our business,” Casper said.

“I am very excited for our future,” Casper added. “This acquisition greatly extends our reach, taking us even further toward our goal of becoming the leading relationship- and asset-based lender in our markets.”

MBC provides asset-based working capital and term loans to middle market companies with credit requirements ranging from $1 million to $15 million. The credit facilities are used by companies seeking alternatives to traditional bank lending. Asset-based lending, which relies on a company's collateral, is used to fuel growth situations, restructurings, recapitalizations and for mergers and acquisitions.

Marquette Financial Cos., through its Meridian Bank subsidiary, has acquired Applied Financial, an equipment leasing firm based in Utah.

The company will continue to be based in Salt Lake City, and all of its 75 employees, including its senior management team, have been retained.

Marquette Financial is a privately held financial services company owned by the Pohlad family. The company is based in Minneapolis.

About Marquette Financial Companies

Marquette Business Credit, Inc. is part of Marquette Financial Companies, a privately held financial services company with a portfolio of operating companies focused on providing financial services to businesses and their owners. With assets in excess of $2 billion, the organization has more than 925 employees in 22 states. For more information, visit www.marquette.com.

[headlines]

### Press Release ###########################

Popular Leasing Acquires Certain Assets and Accounts of Richlund & Associates

“The acquisition of certain assets and relationships of Richlund continues our core growth strategy of adding quality assets and companies to Popular Leasing,” said Fred Van Etten, President Popular Leasing. “We are actively seeking more acquisitions which will be accretive to our portfolio and that of our parent Bank.”

Steve Lundergan, former CEO of Richlund & Associates stated: “The ability for Richlund's customers to now work with a one of the country's largest financial institutions allows them to leverage a full line of financing products to their advantage, without sacrificing the personalized service they were accustomed to with Richlund.” Mr. Lundergan will focus all of his efforts and his energies on growing Vision Commerce, a technology solution provider to the leasing and finance industry.

“As part of our Shared Agreements with BPNA we are focusing on significantly growing our assets by utilizing our servicing and origination platforms,” added Van Etten. “That, coupled with leveraging the strength and growth plans of our parent bank, will continue us on the path we have outlined for the future.”

About Popular Leasing

Popular Leasing U.S.A. is ranked the 39th largest bank-owned leasing company in the United States and provides small to mid-ticket commercial and medical equipment financing in 11 states. In October of last year, PLUSA was selected as one of the 2005 winners of the “Greater St. Louis Top 50 Businesses” Shaping Our Future. This award marked a significant milestone in the growth and success of the company. It also recognized PLUSA's contributions to the local community and its place as a leading employer in the region. For more information, visit: www.poplease.com.

About Richlund & Associates

Founded in 1988, Richlund & Associates provides commercial equipment financing for manufacturers, dealers and distributors of Machine Tools, Printing, Direct Mail, and Construction equipment, amongst others.

Sites of Reference:

http://www.poplease.com/

http://www.richlund.com/

http://www.bancopopular.com/us/commercial/others/us-com-oth-home-en.jsp

CONTACT:

Juan Carlos Cruz

Banco Popular North America

Phone Number: 847-994-6442

Fax Number: 847-994-6969

E-mail: jccruz@bpop.com

[headlines]

### Press Release ###########################

“Building and Enhancing Business Partnerships with IDS RapportTM”

Will Be the Focus of a Free Webcast Hosted by International Decision Systems

MINNEAPOLIS, Minn. – On Thursday, August 17, 2006 at 1:00 pm CST, International Decision Systems, Inc. (IDS) will host a free informational webcast titled Building and Enhancing Business Partnerships with IDS Rapport.

This event will be open to company representatives interested in streamlining asset finance origination processes and working more effectively with brokers, dealers, and other partners.

The webcast will feature Paul Marcoe, VP Information Systems for Financial Pacific Leasing, who will discuss his company's ongoing experience extending a large-scale, customized Rapport implementation to a network of hundreds of broker partners. In addition, Steve Caulder, Consulting Manager for IDS, will be on hand to answer questions specific to participating companies' business needs. Joe Lane of IDS will moderate the session slated to cover:

-The positive impact of Rapport on data flow throughout Financial Pacific's origination-through-booking processes.

-An innovative approach to training brokers on Rapport, successful in increasing adoption of the system and freeing valuable resources within Financial Pacific.

-Insight into how Financial Pacific is leveraging Rapport flexibility, evolving its systems to manage change and drive for maximum business efficiency.

-Documentation and management reporting improvements benefiting both Financial Pacific and its broker partners.

To register for this webcast or learn more, contact Robyn Leverton by telephone at 612-851-3287, or email rleverton@idsgrp.com.

About Financial Pacific Equipment Leasing

Financial Pacific Leasing, LLC provides small ticket equipment leasing throughout the United States. The company originates and services a portfolio of equipment leases that range from $5,000 to $75,000. The types of equipment leased are very diverse, including most types of equipment purchased for business uses such as industrial, food service, data processing, vehicles, trailers, construction and maintenance equipment. For additional information about Financial Pacific Leasing visit www.finpac.com or call 1-800-447-7107.

About Rapport from International Decision Systems

IDS Rapport has opened new doors for businesses seeking greater efficiency, flexibility, and competitive advantage in their origination-through-booking operations. This software solution's built-in Rapport Rules engine makes it highly adaptable for organizations focused on business transformation and process enhancements. Designed to link easily with any portfolio management system, including LeaseEnterprise®, InfoLease®, and ProFinia™, IDS Rapport provides real-time communication to all levels of your organization, including controlled visibility for vendors and dealers.

IDS delivers Rapport with a standardized selection of essential screens, workflow, basic rules, and web service connections for credit approval. These preconfigured tools allow you to quickly use and benefit from the system, and they serve as an excellent guide for developing your own fully configured solution.

About International Decision Systems, Inc.

International Decision Systems is the global leader in developing asset finance portfolio management software and services. Headquartered in Minneapolis, Minnesota, International Decision Systems also has offices in London, Sydney, Singapore, and Bangalore, India. International Decision Systems offers the largest and most experienced global consulting, implementation, and technical support teams in the asset finance industry. For additional information, visit www.idsgrp.com or call 1-866-465-9393 to reach global headquarters. To reach the IDS European office, call +44.1256-302000.

[headlines]

### Press Release ###########################

--------------------------------------------------------------

News Briefs---

Fed Keeps Key Rate Steady At 5.25%

http://www.washingtonpost.com/wp-dyn/content/article/2006/08/08/

AR2006080800085.html

For Businesses, the Pinch Moves Beyond the Pump

http://www.washingtonpost.com/wp-dyn/content/article/2006/08/08/

AR2006080801132.html

Fitch Changes HSBC's Outlook to Positive

http://www.fitchratings.com/corporate/events/press_releases_detail.cfm?pr_id=

278631§or_flag=7&marketsector=1&detail=

A Bank for Every Block

http://www.nytimes.com/2006/08/09/business/09banks.html?_r=1&ref=

business&oref=slogin

More weakness seen in credit card sector

http://www.absnet.net/include/showfreearticle.asp?file=/headlines/2.htm

Online Jam Session With Live Performances Newport Festival

http://www.prnewswire.com/cgi-bin/stories.pl?ACCT=104&STORY=/www/story/

08-09-2006/0004412775&EDATE=

[headlines]

---------------------------------------------------------------

You May have Missed---

A Face Is Exposed for AOL Searcher No. 4417749

http://www.nytimes.com/2006/08/09/technology/09aol.html?ei=5094&en=9b5fd9ff3

41e3216&hp=&ex=1155182400&adxnnl=1&partner=homepage&adxnnlx=115510187

4-yymkabGhcpxfIkVWVoLZHw

[headlines]

----------------------------------------------------------------

California Nuts Briefs---

Governor agrees to new casino deal with tribe

http://www.sacbee.com/content/politics/story/14290965p-15124289c.html

[headlines]

----------------------------------------------------------------

“Gimme that Wine”

Survey of Top On-Premise Wines Released

http://www.winebusiness.com/news/DailyNewsArticle.cfm?dataid=44085

Wineries not looking for new grapes as '06 California crush begins

http://westernfarmpress.com/news/08-8-06-wineries-looking-crush/

Alcohol sales zoom 62% in Utah

http://deseretnews.com/dn/view/0,1249,640200361,00.html

The Mail Order Sommelier for Your Home

http://www.coremg.net/newspapers.php?paper=pasadenaindependent&storyid=2875

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

Calendar Events This Day

Raksha Bandhan

Rakhi Festival is celebrated with faith and enthusiasm all over India. Following the tradition, sister tie Rakhi on brother's wrist, perform art of him and pray for his long life. Brothers' present Rakhi Gifts to their sister and promise to protect her always. This simple custom of Rakhi is being carried forward since ancient times.

http://www.raksha-bandhan.com/

Send an eMail Day

Singapore: National Day

Most festivals in Singapore and Chinese, Indian or Malay, but celebration of national day is shared by all to commemorate the withdrawal of Singapore from Malaysia and its becoming an independent state in 1965. Music, parades, dancing.

South Africa: National Women's Day

National holiday. Commemorates the march of women in Pretoria to protest the pass laws in 12956.

[headlines]

----------------------------------------------------------------

Today's Top Event in History

1814-General Andrew Jackson signed the Treaty of Fort Jackson, ending the Creek War. The US received 23 million acres. This vast territory encompassed more than half of present-day Alabama and part of southern Georgia.

http://memory.loc.gov/ammem/today/aug09.html

[headlines]

----------------------------------------------------------------

This Day in American History

1607-History records the first “ Thanksgiving Worship Service” at Phippsburg, Maine, by colonists on “ The Gift of God” and the “Mary and Jahn,” who landed at “ St. Georges Illand” under the leadership of George Popham. Services were held by the Reverend Richard Seymour, “ gyvinge God thanks for our happing metinge & saffe arval into the country.”

1673- The Surrender of New York was demanded by a Dutch force of 23 ships and 1600 men anchored near Sandy Hook. They held possession of the colony until February 9, 1674, when the English regained control.

1814-General Andrew Jackson signed the Treaty of Fort Jackson, ending the Creek War. The US received 23 million acres. This vast territory encompassed more than half of present-day Alabama and part of southern Georgia.

1854 ---Henry David Thoreau publishes "Walden", an American classic and is his most famous work. There is controversy regarding his “lifestyle: about living in “nature, “ but there is no debate he wrote a series of 18 essays, alleged on his two years spent close to nature. The book stresses simplicity and holds that happiness is not be had by pursuit of wealth. Descriptions of plants, bird, and animals are interspersed with reflections on life

http://memory.loc.gov/ammem/today/aug09.html

1842-Before the UC declared its independence, the annexation of Canada appeared to be one of the goals of the colonials at the time. The Webster-Ashburton Treaty signed this day was to end this “conflict.” The treaty delimiting the eastern section of the Canadian-American border was negotiated by the US Secretary of State, Daniel Webster, and Alexander Barin, president of the British Board of Trade. The treaty established the boundaries between the St. Croix and Connecticut rivers, between Lake Superior and the Lake of the Woods, and between Lakes Huron and Superior. The treaty was signed at Washington, DC.

1862- in the Battle of Cedar Mountain, VA., near the Rappahannock R. northwest of Richmond, Confederate troops under Gen. Stonewall Jackson, planning a move northward in advance of Gen. Lee's larger forces, defeated two full brigades of Union forces led by Gen. John Pope and Gen. N.P. Banks. Badly outnumbered, the Union Army suffered 2381 killed or wounded, the Confederates, 1276. Jackson was to continue his victories, seizing the Union arsenal at Harpers Ferry on September 15, and throughout the rest of the year, the Union took many loses, including the Battle of Fredericksburg on December 13 where 12,653 Union soldiers were killed or wounded to the Confederate casualties of 5300.

http://www2.cr.nps.gov/abpp/battles/va022.htm

http://home.adelphia.net/~73rdovi/cedarmountain.html

http://www.aphillcsa.com/index/print/CM.html

http://www.americancivilwar.com/cwstats.html

1878 - The second most deadly tornado in New England history struck Wallingford CT killing 34 persons, injuring 100 others, and completely destroying thirty homes. The tornado started as a waterspout over a dam on the Quinnipiac River. It was 400 to 600 feet wide, and had a short path length of two miles.

1882- The long-simmering tension between the two Appalachian families who lived by Tug Fork on the Kentucky-West Virginia border erupted into full-scale violence on Election Day 1882. Brothers Tolbert, Pharmer and Randolph McCoy knifed and shot Ellison Hatfield. The Hatfield family captured the three McCoys. When Ellison Hatfield died on August 9 th , the Hatfields executed the brothers. The feud continued withmuch loss of life. In 1888, when Kentucky authorities sought to detain feud murder suspects and Ewst Virginia authorities complained, the dispute went all the way to the US Supreme Court, who decided in Kentucky's favor. The feud sputtered out by the end of the century. It was estimated over a 100 family members died.

1892- Thomas Alva Edison of Newark, NJ, filed a patent on the most practical two-way telegraph. It enabled two telegraph operators to send over one were simultaneously. Edison received many patents for many inventions and his biography is fascinating to read.

1916-The first Japanese beetle appeared in Riverton, NJ. Its grubs were believed to have arrived in the roots of imported nursery stock.

1930-Betty Boop debuts in Max Fleischer's animated cartoon Dizzy Dishes.

1936 - Jesse Owens became the first American to win four medals in one Olympics. Owens ran one leg of the winning 400-meter relay team in Berlin. His three other gold medals were won in the 100-meter, 200-meter and the long jump events.

1938-Benny Goodman Orchestra, on a CBS Camel Caravan show from New York City, plays its first Eddie Sauter arrangement, “Bolero.”

1941— Baritone sax player/arranger/producer Willie Henderson birthday

http://allmusic.com/cg/amg.dll?p=amg&sql=Bmve097q7krdt

1942-Birthday of drummer Jack DeJohnette, Chicago, IL.

1944---Top Hits

I'll Be Seeing You - The Tommy Dorsey Orchestra (vocal: Frank Sinatra)

Amor - Bing Crosby

Swinging on a Star - Bing Crosby

Is You is or is You Ain't (Ma' Baby) - Louis Jordan

1945,-Three days after the atomic bombing of Hiroshima, an American B-29 bomber named Bock's Car left its base on Tinian Island carrying a plutonium bomb nicknamed “Fat Man' Its target was the Japanese city of Kokura, but because of clouds and poor visibility the bomber headed for a secondary target, Nagasaki, where at 11:02 AM, local time, it dropped the bomb, killing an estimated 70,000 persons and destroying about half the city. Memorial services are held annually at Nagasaki and also at Kokura, where those who were spared because of the bad weather also grieve for those at Nagasaki who suffered in their stead. August 14 President Harry S. Truman announced the “unconditional” surrender of Japan. V-J Day was August 15. August 30 General MacArthur landed in Japan with occupational forces. September 2 the formal document of surrender was signed about the U.S. Miss our in Tokyo Bay.

1947-Birthday of Barbara Mason, Philadelphia, PA.

1952---Top Hits

Walkin' My Baby Back Home - Johnnie Ray

Auf Wiedersehn, Sweetheart - Vera Lynn

I'm Yours - Don Cornell

Are You Teasing Me - Carl Smith

1959 - Pioneer of the rap genre, Kurtis Blow, is born Curtis Walker in New York.

1960-Race riot in Jacksonville Florida

1960---Top Hits

Itsy Bitsy Teenie Weenie Yellow Polkadot Bikini - Brian Hyland

It's Now or Never - Elvis Presley

Image of a Girl - Safaris

Please Help Me, I'm Falling - Hank Locklin

1961- James B Parsons is the first black appointed to the Federal District Court.

1963-Singer Whitney Houston is born in New Jersey, the daughter of singer Cissy Houston and cousin of Dionne Warwick. Her first seven solo singles go top five on Billboard's Hot 100. (She was featured earlier on a Teddy Pendergrass single that failed to reach the top 40.) Her career is interrupted with a very poor marriage and addiction to drugs.

1965 - No. 1 Billboard Pop Hit: "I Got You Babe," Sonny & Cher. The song, which sells more than 1 million copies, is the duo's only No. 1 hit. A remake of the song by UB40 with Chrissie Hynde hits No. 28 in September 1985.

1968---Top Hits

Hello, I Love You - The Doors

Classical Gas - Mason Williams

Stoned Soul Picnic - The 5th Dimension

Folsom Prison Blues - Johnny Cash

1968-Steppenwolf opened at the San Francisco Avalon Ballroom.

1969 - "Hot Fun in The Summertime", by Sly and the Family Stone, and "Easy to Be Hard", from the Broadway production "Hair", were released on this day. "Hot Fun" made it to number two on the music charts (10/18/69) and "Easy to Be Hard" climbed to number four (9/27/69).

1969 - Cult leader Charles Manson and his disciples committed one of Los Angeles' most heinous crimes. They entered the home of movie director Roman Polanski and brutally murdered Polanski's wife (actress Sharon Tate), movie director Voityck Frykowski, famous hair stylist Jay Sebring, student Steven Parent and coffee heiress Abigail Folger.

1969 - A tornado hit Cincinnati OH killing four persons and causing fifteen million dollars property damage. The tornado moved in a southeasterly direction at 40 to 50 mph.

1971 - LeRoy Satchel Paige, one of baseball's pitching legends, was inducted into the Baseball Hall of Fame in Cooperstown, NY.

1971-the first airport baggage scanning system that converted electronic data to a visible X-ray format was the Pep-720 baggage X-ray system manufactured by Princeton Electronic Products, New Brunswick,NJ. The US. army had it installed at the Army's Picatinny Arsenal

1972-Gilbert O'Sullivan receives a gold record for "Alone Again Naturally." It's Number One for six weeks in the summer.

1974- Richard Milhous Nixon's resigned from the presidency of the US, which he first announced in a speech to the American people Thursday evening, August 8, and it became effective at noon. Nixon, under the threat of impeachment as a result of the Watergate scandal, became the first person to resign the presidency. He was succeeded by Vice-President Gerald Rudolph Ford, the first person to serve as vice-president and president without having been elected to either office. Ford granted Nixon “full, free and absolute pardon” September 8,.1974. Although Nixon was the first US president to resign, two vice presidents had resigned earlier in history: John C. Calhoun, Dec. 8, 1932, and Spiro T. Agnew, October 10,1973. 1989, President George Herbert Walker Bush appointed Colin Luther Powell chairman of the Joint Chiefs of Staff. He became the first African-American appointed to this position. Powell, born in New York City in 1937, served from 1987 to 1989 as national security advisor to President Ronald Wilson Reagan. In 1989, he was promoted to four-star general, thus becoming the highest-ranking African-American officer up to that time. During his service as chairman, he oversaw the 1991 Gulf War military campaign. He resigned in 1993. He was appointed Secretary of State by President George Walker Bush in 2001.

1976---Top Hits

Don't Go Breaking My Heart - Elton John & Kiki Dee

Let 'Em In - Wings

You Should Be Dancing - Bee Gees

Golden Ring - George Jones & Tammy Wynette

1978 - No. 1 Billboard Pop Hit: "Three Times a Lady," Commodores. Band member Lionel Richie was inspired to write the song at a 37th anniversary party for his parents.

1981 - Major-league baseball teams resumed play at the conclusion of the first mid-season players' strike. The first game on the schedule following the bitter strike was the All-Star Game. The National League won the game 5-4. 72,086 diehard baseball fans (a record) came out to see the game at Cleveland's cavernous Municipal Stadium -- and welcome the players back.

1982-Survivor's "Eye of the Tiger," which is the theme song for the hit movie "Rocky III," goes gold.

1984---Top Hits

When Doves Cry - Prince

Ghostbusters - Ray Parker Jr.

State of Shock - Jacksons

Mama He's Crazy - The Judds

1987 - Florida baked in the summer heat. Nine cities reported record high temperatures for the date, including Jacksonville with a reading of 101 degrees. Miami FL reported a record high of 98 degrees.

1987 - No. 1 Billboard Pop Hit: "I Still Haven't Found What I'm Looking For," U2. The album "The Joshua Tree" is U2's first top 10 album in the U.S.

1988 - President Reagan nominated Lauro F. Cavazos to be secretary of education. Cavazos was the first Hispanic in U.S. history to be named to a cabinet position. On Sep 20, 1988, he was unanimously confirmed by the U.S. Senate. President George Bush (I) asked him to continue as Secretary following the Nov 1988 election and he remained in that position until resigning in December 1990.

1988-After a postponement the night before, the first night game in Wrigley Field saw the Chicago Cubs defeat the New York Mets, 6-4.

1989---Top Hits

Right Here Waiting- Richard Marx

On Our Own (From "Ghostbusters II")- Bobby Brown

Batdance (From "Batman")- The Artist

So Alive- Love And Rockets

1990-The US Navy formed a naval blockade and all export of oil from Iraq and Kuwait was cut off. August 10, at a meeting in Cairo, 12 of the 21 member nations of the Arab League voted to support the UN and US Actions. It would not be until November 29, that the UN Security Council voted to authorize the US and allies to use force to expel Iraq from Kuwait, it its troops did not leave by January 15, 1991. by the end of 990, 580,000 Iraqi troops were believed to be in Kuwait or southern Iraq. Facing them were 485,000 troops of 17 allied countries, an armada of ships, carriers, jets based in Italy, Turkey, and many other surrounding countries, and guided missiles with video cameras to not only steer toward the target, but show viewers on home television everything up to impact.

1994---Top Hits

Stay (I Missed You) (From "Reality Bites")- Lisa Loeb

I Swear- All-4-One

Fantastic Voyage- Coolio

Wild Night,-John Mellencamp With Me Shell Ndegeocello

1995- Grateful Dead singer, guitarist and spiritual leader Jerry Garcia dies of a heart attack while undergoing drug rehabilitation at Forrest Farm, Marin County. He was 53.

http://www-2.cs.cmu.edu/~mleone/dead.html

1999---Top Hits

Genie In A Bottle- Christina Aguilera

Tell Me It s Real- K-Ci

Bills, Bills, Bills- Destiny s Child

All Star- Smash Mouth

1999 - “On a grand night for hitters, pitchers got slammed,” as AP sports writer Ronald Blum put it, “for the first time in 129 years of major league baseball, five grand slams were hit in one day.” 1) Fernando Tatis (St. Louis Cardinals), 2) Jose Vidro (Montreal Expos), 3) Mike Lowell (Florida Marlins), 4) Bernie Williams (NY Yankees) ... 5) Jay Buhner of the Seattle Mariners, being the last to hit the slam, actually set the record.

2003---Top Hits

Crazy In Love- Beyonce Featuring Jay-Z

Right Thurr- Chingy

Never Leave You - Uh Ooh, Uh Oooh!, Lumidee

P.I.M.P.- 50 Cent

[headlines]

--------------------------------------------------------------

Baseball Poem

THE MAN WHO GAVE ALL THE DREAMERS IN BASEBALL LAND

BIGGER DREAMS TO DREAM

by Michael J. Farrand

Every dreamer out in Baseball Land dreams the same big dream

He's hurting in the dugout, when he's called to save his team

In the bottom of the ninth, two outs, the count 3-and-2

He'll step in and with one swing, the impossible he will do

'Twas the 1988 World Series, opening night

The L.A. Dodgers had a shot at global bragging rights

They faced America's greatest team, and her most athletic

Canseco and McGwire made their chances seem pathetic

Doubts grew with the great shadows cast by the broad Oakland A's

Those left in the sad Dodgers camp found nothing to do but pray

Down 4-to-3 to Oakland in their last chance with the bats

Eckersley's appearance on the mound surely meant "That's that!"

They scan the dugout for their hero, he who makes it happen

They see instead his teammates' faces, drawn tightly ashen

They know after Scoscia comes a patsy then the pitcher

This pathetic line-up holds not one heroic hitter

Where was the man who saved them oh so many times before?

Vin Scully in the broadcast booth proclaims the hapless score

"The spearhead of the Dodger offense all throughout the year

Will see no action here tonight, because he's just not here!"

Watching the game from the training room, legs encased in ice

He wants so badly to play, but the trainer says "No dice!"

With a torn left hamstring, and a stretched right knee ligament

The Dodgers greatest slugger would be lucky he could limp

But hearing Vin Scully's words, appearing to seal his fate

Kirk Gibson throws off his ice packs, hoping it's not too late

"Set up a batting tee, get Tommy Lasorda in here!"

He shouts with all bravado—heroes like these show no fear

Gibson struggles to his feet as Scoscia pops to shortstop

The left leg goes from under him, he hears the right knee pop

Lasorda waddles up the tunnel, Kirk says "I can hit!"

"You serious?" "Dead serious!" as he teeters a bit

"Making me sit out the game here is a fate worse than death!"

Lasorda mumbles "God Almighty!" under his short breath

"Don't you want me?" the great slugger cries, trusting all to fate

"Damn right I want you", he mutters. "Just make your entrance late!"

By now Hamilton has struck out, leaving them but once chance

The second-worst hitter in the park sets into his stance

Our grievously wounded hero now gingerly takes strides

Down the lonely tunnel, his east-and-west limps hard to hide

In a rare moment of weakness, Eck gives Davis the walk

Down destiny's path our hero must stumble without balk

An impossible dream fills his mind, no bad thought enters in

It's down to him and Eck, and the Dodgers are going to win!

The crowd goes stark raving mad, welcoming their hero in

Stadium dwellers stomp and shout, creating an earthquake din

Here's the man, the only man, to save them from this peril

(Even though he is stumbling in, like some drunken devil)

His practice swings are herky, jerking his numb legs to life

To them it seems that each rotation stabs him like a knife

Their slugger has not faced real pitching in three whole days

But waves and waves of adulation wash his pains away

His teammates celebrate, knowing the power of this man

To fight against impossible odds and make things right again

But after suffering his first two wincing, fouling swings

They lament the 0-2 count, and face the sad state of things

Mike Davis steals second base, as was signaled by his coach

Lasorda's doubts that Gibson can do it prompt such a poach

Clearly he cannot come around on Eck's fast-pitched balls, and

A pained run down the line proves he can't push off or land

"This is just where I want to be!" all baseball dreamers think

But when they consider reality, their vain hopes sink

Wannabe heroes in the stands put childish dreams aside

It's on this broken-down warhorse all Dodger hopes now ride

Mighty Gibson, for his part, goes into survival mode

If he can't hit the fast ones, he will wait for something slow

Battling back with anything to avoid impending rout

With the count 3-and-2, from the batter's box he steps out

Amidst the pandemonium, the huzzahs, and the shouts

He remembers Mel Didier's words, that sage Dodger scout

"In this situation, when Eck's facing a left-hander,

As sure as you're breathing, pardner, it'll be backdoor slider!"

He steps back in on tenterhooks, guessing at the next pitch

Eck winds, curls, and releases the ball, all without a hitch

Gibby's swing is something ugly, an army-wristy stab

His wrenching follow-through suggests he won't survive the jab

Somewhere baseball fans groan, while tossing peanuts in their beer

Somewhere a manager's fired for flubbing a chance so dear

Somewhere red-lighted car-fulls are pleased they left so early

Somewhere else the loyal fans are rewarded with glory

"High fly ball into deep right field—she is GONE!" Scully smiles

Then for a few eternities, the rabid fans go wild

As the Dodgers charge the field in jumping jubilation

Kirk hobbles round the bases, pumping fists in elation

Though the ball flew in the air three hundred and eighty feet

It could be said it rolled forever as the A's it did beat

It paralyzed their big bats and demoralized the team

And all the dreamers in Baseball Land can now dream bigger dreams!

[headlines]

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]