Wednesday, December 14, 2005

Headlines--- For our Web Site and New Readers ######## surrounding the article denotes it is a “press release”

For our Web Site and New Readers

New readers, welcome aboard. We recommend all readers join our mailing list to get notified when a new edition is “on line,” or to receive “extra's,” such as the notification of the Fed rate increase or “breaking news stories” that concern the industry. Our Web Trend indicates most of our readers “bookmark” our web site, which is a good idea, but if not on the mailing list, they won't get the extras or when we have an edition. We try to have five a week, Monday through Friday, but most often only have three, sometimes four a week. While our goal is to be a daily, we don't print unless there is enough equipment leasing news. We look forward to your comments and try to produce an edition that is worth your time to find an article or two you are interested in reading. For new readers, our best information comes from our “readers” who send us information “on” or “off the record.” Happy Holidays-Merry Christmas Christopher Menkin, Editor -------------------------------------------------------------- Classified Ads-- Documentation Manager / Finance / Legal Documentation Manager / Finance / Legal

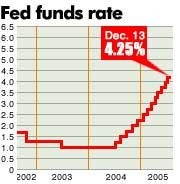

For a full listing of all “job wanted” ads, please go to: http://64.125.68.91/AL/LeasingNews/JobPostings.htm To place a free “job wanted” ad, please go to: http://64.125.68.91/AL/LeasingNews/PostingForm.asp -------------------------------------------------------------- 1 1/2 year Fed Increases one more time?

It is predicted by the experts that the Federal Reserve increases in Fed Fund rate will see the last one for at least six months on January 31, 2006, when Chairman Alan Greenspan officially retires. While all indications by the Feds are that the economy was "solid," they added “... there were still inflationary risks, all statements stressing more rate increases were likely.” Leasing News sent out an "extra" about the announcement yesterday morning: http://www.leasingnews.org/archives/December%202005/12-13-05_Extra.htm -------------------------------------------------------------- Pictures from the Past --- 1991— Rick Wilbur and The Wild Kingdom of SIGs Yes, that is Rick Wilbur as the bear. Kit Menkin has known Mr. Wilbur since 1971, when Mr. Wilbur was part of a group that was a "lessor" for Budget Financial in Los Angeles, California. Leasing News has asked Mr. Wilbur for a more current picture, especially on the golf course that he loves. None received today, so this will have to do. From the 1991 magazine of the Western Association of Equipment Lessors (now known as the United Association of Equipment Leasing.)

“Ring Master” C. Michael Baker, CLP, the April 17-21, WAEL Spring Conference Chairman introduces the “Wild Kingdom of SIGs”—(Special Interest Groups) during the 1991 WAEL Spring Conference. Baker, President of Pacific States Leasing, Fresno, CA, was responsible for keeping three rings going with presentations from the SIGs representing Brokers, Funders, and Lessors during the four day event. SIG chairmen pictured here are (l to 4) Lion---Funders SIG-Mike Wing, President, Fleet Credit/Denrich Leasing Group; Fox—Brokers SIG—George Davis II, President, Fortune Financial; and Bear—Lessors SIG—Rick Wilbur, President, Charter Equipment Leasing Mr.Wilbur reported that his company, now known as Charter Capital, celebrates its 10-Year Anniversary in Scottsdale, Arizona with a ribbon-cutting ceremony for clients, lenders and employees. Charter Capital, a family owned and operated financial intermediary, now with 14 employees, opened its doors in Arizona in 1995 as Media Capital Associates, LLC. In 2004, it changed its name to Charter Capital based on the original name of the company Mr. Wilbur founded in 1977.

--------------------------------------------------------------- CIT Set to Double European Assets ELTnews the Sunday Business Group BYLINE: Ben Marlow Cit group, one of the worldbEos largest commercial lenders, is poised to hit the acquisition trail in Europe. Chief executive Jeff Peek told The Business he plans to double its European assets to $ 20bn (B£11.6bn, E17bn) in the next three years. CIT, which has a market value of $ 10bn, is looking to expand its European operations across all its business units, which include vendor financing, aircraft and railcar leasing, factoring, and funding private equity. Peek, who became one of the top investment bankers in the US while at Merrill Lynch and Credit Suisse First Boston (CSFB), says CIT is on the verge of completing a number of US acquisitions and is also looking for suitable targets in Europe. To fulfill its European ambitions, the 100-year-old firm, which controls nearly $ 60bn in assets globally, will have to take on some of EuropebEos biggest commercial lenders. GE Commercial Finance, which is part of the global conglomerate General Electric, is perhaps the biggest. It will also go head-to-head with AIG, one of the largest US commercial lenders, and the Royal Bank of Scotland (RBS). CIT has already established a vendor-finance business in Dublin, which includes a lucrative deal with Dell, the worldbEos largest maker of personal computers. In August, CIT paid $ 1bn to buy the vendor finance business of US banking giant Citigroup. Peek said he sees more opportunities for acquisitions as investment banks seek to trim their bulging portfolios of assets. Peek sees the potential for developing a significant railcar leasing business in Europe, arguing that high oil prices make the sustainability of road transportation for goods difficult in the long term. CIT owns 85,000 railcars in the US. The group is also keen to increase its presence as a provider of capital to private-equity businesses operating in the European mid-market, which the larger investment banks have tended to avoid. --------------------------------------------------------------- Top Stories--December 5--9

These are the top ten stories most "opened" by readers last week. (1) CMC Bill Hanson Files Bankruptcy (2) Rosanne Wilson, CLP, Number One "Broker/Lessor" (3) Rudy Trebels, President IFC Credit, Issues Statement (4) Lessors Face Persistent Challenges to True Lease Transactions (5) Ernie Reinhardt Gets 70 months + 3 year's probation (6) Bob Quinn Gone-Again! (7) Sudhir Amembal Joins Leaseinspections.com (8) Time to Push "Capital" Lease (9) k Sponsel... Sonia v.M. Stoddard (10) 15,000 Funders---List has “14”

-------------------------------------------------------------- Recomm similar to Royal Links or NorVergence?

Leasing News Emeritus Advisor Charlie Lester sent us this e-mail: “The golf carts sound like Recomm all over again. $125,000,000 in losses when Recomm ran out of money to reimburse the lessees for the monthly lease payments. History does repeat its self and funders never learn. The owners took what money that was left (rumored to be over $25,000,000) and took off to Canada where they cannot be touched by US authorities.” Charlie ((This action evidently happened before Leasing News started this publication and involved 12,000 leases with over 30 leasing companies, including Colonial Pacific Leasing, Lease Partners, Bell Atlantic TriCon, Finova, GreatAmerica Leasing, Textron, among others. It sure sounds like Royal Links, and also may involve NorVergence type leases, too. From this document http://leasingnews.org/PDF/Optical_Tech.pdf “This case involves a scheme to use electronic billboards and kiosk (collectively “kiosks”) for advertising. The promoters of the scheme executed it in the following way. First, they organized Optical Technologies, Inc., and a group of affiliated companies, Recomm International Display Corp. Recomm Operations, Inc, and Recomm Enterprises, Inc (hereafter referred to collectively with Optical Technologies, Inc., as “Recomm”). Recomm, in turn, convinced several advertising agencies of the merits of advertising via kiosks, and convinced pharmacists, veterinarians, optometrists, and others of the profits they would earn by locating the kiosks at their places of business. Having accomplished this, Recomm acquired the necessary kiosks, leased them to the pharmacists and others (the “Lessees”), assigned the leases to finance companies (the “Lessors”), and (4) entered into advertising contracts with the Lessees. These contracts provided that the Lessees would receive a stated percentage of fees Recomm received form the advertising agencies. Recomm, the Lessees, and the Lessors contemplated that the Lessees share of the advertising fees would more than cover the Lessees' lease payments. “The scheme worked for the benefit of all parties for a few years, until mid-1995, when Recomm began to experience cash-flow problems and ceased remitting to the Lessees their portions of the advertising fees. The lessees responded in two ways. First, they quit paying the Lessors the rent due on the kiosk leases; then they sued Recomm. As the law suits multiplied, Recomm turned to the bankruptcy court for relief. In January, 1996, Recomm filed a Chapter 11 petition in the Bankruptcy Court for the Middle District of Florida.” The story best continues in: http://leasingnews.org/PDF/LEAN_NorVergence.pdf Lease Enforcement Analysis News, Summer, 2005, Published by Lease Enforcement Attorney Network—LEAN, titled “NorVergence Related Litigation Paces Standard Lease Enforcement Terms in Jeopardy” by Bryon L. Saintsing and Thomas Grey. “At the same time the lessees entered into the lease with the finance companies (“lessors”), the lessees entered into advertising agreements and rebate agreements with Recomm whereby Recomm agreed to pay license fees to the lessees for the right to place advertisements on the leased equipment. The lessors were not parties to the advertising agreements between Recomm and its customers. Recomm failed to pay the lessees the license fees and rebates and many lessees in turn ceased making payments on their leases to the leasing companies. “In Recomm's bankruptcy the lessees of the Recomm equipment were considered unsecured creditors. Recomm, the Unsecured Creditors Committee, and certain leasing companies filed a plan of reorganization and the Court entered an Order confirming the plan. Among other things, the Bankruptcy Court's Confirmation Order modified the terms of the leases (“modified leases”), declared that the modified leases are valid and binding on the lessees, and released lessors and lesses from various potential claims and defenses against each other form the up through the date of confirmation of the plan. In the aftermath of the confirmed plan, numerous leasing companies have had to resort to filing state court civil actions to enforce the terms of the plan and collect the lease payments provided for under the terms of the confirmed plan.” (Various court documents show "Prior to 1994, Raymond Manklow ("Manklow") and Jean-Francois Vincens ("Vincens") were the sole shareholders..." Records show they "escaped" all claims, and whereabouts are unknown at this time. Editor)) -------------------------------------------------------------- The first in a series that after the follow up article will focus on a new approach to listening for salespeople.

--------------------------------------------------------------

-------------------------------------------------------------- Classified Ads---Help Wanted Documentation Manager

Equipment Finance & Leasing Representative

Senior Funding Manager

-------------------------------------------------------------- Specialty Funding Group joins “Broker/Lessor” List “Broker/Lessor” List Third Column: YES - Year Company Started | YELB - Years in equipment Leasing Business A - City Business License | B- State License | C - Certified Leasing Professional |

To view the full list, please go here: http://leasingnews.org/Brokers/broker.htm -------------------------------------------------------------- Christmas Holiday Parties---Non-members invited Leasing Association Meetings Open to Non-Members

3rd Annual Midwest Regional Holiday Party Cost: $62.00 (spouses and non-members welcome) Location: Reserve your ticket today by emailing Bill Griffith at Bgriffith@PadcoLease.com. All checks should be made payable to UAEL and remitted to Bill Griffith, Padco Lease Corp., 100 W. Monroe Street, Suite 706, Chicago, IL 60603-1901 to insure received no later than November 30, 2005. Menu: Hors d"oeuvres - Fruit & Cheese Platter, Mini Quiche, Poached Salmon with Cucumber Dill Sauce Roasted Roma Tomato with Basil Soup and Grilled Salad w/Vinaigrette Desert - Assorted Brownies and Cookies A special "Thank You" to this year's event sponsors: Law Offices of Swanson, Martin & Bell, LLP This year's event should be a truly memorable one. Ditka's is located on Chestnut just 1 block west of "The Magnificent Mile" shopping district (Michigan Avenue) and 1 block east of Chicago's famous "Rush Street" nightclubs, restaurants and shopping. This year we are also having a United States Marine Corp "Toys for Tots" drive. All attendees (1 per couple) are asked to bring a toy (unwrapped). I look forward to seeing everyone at Ditka's on December 15th. Sincerely,

--------------------------------------------------------------- Federal Judge Rules on LaSalle Bank Motion Federal Judge Rules on LaSalle Bank Motion Judge Bucklo denies LaSalle Bank's motion to dismiss and orders LaSalle to pay plaintiff's legal fees. The trademark lawsuit was filed by Cobra Capital, a small Oak Brook based, finance and equipment leasing company which competes in similar markets as LaSalle and its affiliates. The lawsuit alleges that LaSalle infringed on Cobra Capital's registered trademark, “Making impossible possible” when LaSalle unleashed it's nearly identical new global tagline, “Making more possible” on February 28, 2005. The lawsuit includes emails from ABN LaSalle's CEO Norman Bobins and ABN AMRO's legal counsel Timothy Kaiser sent to Cobra Capital two years prior to the release of LaSalle's new global tagline. The emails state LaSalle's allegations of confusing similarity between the two company's as well as Norman Bobins interest in providing financial services to a DeNovo Community Bank which Cobra Capital was planning on opening in the Chicago land area. Cobra Capital's trademark was awarded to its founder, Dale R. Kluga by the Unites States Patent and Trademark Office, almost two years before LaSalle unleashed its new global tagline. The complaint filed by Cobra Capital references the renowned 7th Circuit Court of Appeals Sands Taylor vs. Gatorade decision which was the largest trademark award in history at the time. The court ruled against Gatorade for its unauthorized use of the term “Gatorade is Thirst Aid”. Kluga and his partner, Dexter Tong, are both former ABN LaSalle employees as Kluga was Senior Vice President and founder of LaSalle Bank's leasing company before leaving to start his first finance company 9 years earlier in 1996. Tong was formerly Senior Vice President and Assistant Treasurer of ABN AMRO, Inc. until 2001 when he received his final equity payout from ABN AMRO's acquisition of The Chicago Corporation. www.cobrallc.com Copy of court judgement: http://leasingnews.org/PDF/Courts_Order_to_Dismiss.pdf ### Press Release ########################### Liquidity Services, Inc. Announces Appointment of James E. Williams Washington, DC - Liquidity Services, Inc., a leading online auction marketplace for wholesale, surplus and salvage assets, is pleased to announce the appointment of James E. Williams to its executive management team as vice president, general counsel and corporate secretary. Mr. Williams brings LSI twelve years of experience in technology-related corporate law and legal planning. In this role, Mr. Williams will be responsible for managing the company's legal, regulatory and corporate compliance activities, including SEC matters, corporate governance, intellectual property, and commercial contract activities. In addition, he will provide legal guidance to LSI's senior management team, the Board of Directors and Board committees, and will supervise and manage the company's relationship with outside counsel. "James has extensive experience in both technology and corporate law and has played an active role in support of public and private financings, acquisitions, human resources administration and legal compliance during his career," said Bill Angrick, Chairman and CEO of LSI. "His background and experience will be a key advantage in helping LSI meet its corporate objectives and comply with government and industry regulations." Prior to joining LSI, Mr. Williams served as general counsel for Acterna in Germantown, Maryland, one of the world's largest providers of telecommunications test solutions, where he directed Acterna's overall legal strategy. He played a key role in the execution of the company's financial reporting preparation and compliance, and directed legal planning around the divestitures of non-core business assets. Mr. Williams also previously served as assistant general counsel for PathNet Telecommunications in Reston, Virginia and as a corporate associate at law firms Kirkland & Ellis in Washington, DC and Wilson Sonsini, Goodrich & Rosati in Palo Alto, California. In addition, he served as a vice president with Hamilton Securities Capital Markets, a private equity firm. Mr. Williams holds a Bachelor of Arts degree in legal history from Brown University, where he graduated with honors. He received his Juris Doctor from the University of Chicago Law School. About Liquidity Services, Inc. Liquidity Services, Inc. and its subsidiaries enable corporations and government agencies to market and sell surplus assets and wholesale goods quickly and conveniently using online auction marketplaces and value-added services. The company is based in Washington, D.C. and employs 285 people. Additional information can be found at: www.liquidityservicesinc.com ### Press Release ########################### CIT Announces Restatement of Financial Results Reflecting a NEW YORK, -- CIT Group Inc. (NYSE: CIT), a leading provider of commercial and consumer finance solutions, is restating its 2005 financial statements due to a technical interpretation of the derivative accounting rules. The Company will file amended statements for the periods ended March 31, 2005, June 30, 2005, and September 30, 2005. Prior period financial reporting was not affected. SFAS 133 Interpretation for Currency Interest Rate Swaps During the fourth quarter of 2005, CIT learned of a different interpretation under SFAS 133, Accounting for Derivative Instruments and Hedging Activities, as amended. After reviewing its hedge accounting treatment for transactions used to protect its business from changes in interest and currency exchange rates related to its debt financing, CIT concluded that its compound derivatives did not qualify for hedge accounting under SFAS 133, even though such swaps were highly effective economic hedges of both the interest rate and currency risks associated with foreign denominated debt. Restatement Impact The change in accounting treatment for the affected swaps had the following impact on quarterly diluted earnings per share: Previously Reported Restated Change Q 1 2005 $0.98 $1.06 $0.08 gain During the fourth quarter, CIT terminated its compound derivatives and replaced each of them with a pair of stand-alone swaps (a cross currency swap and an interest rate swap) that achieve the same economics as the original derivatives and qualify as hedges under SFAS 133. The effect on CIT's diluted earnings per share for Q4 will be a loss of $0.06 per share, reflecting the mark-to-market on the interest rate component of the compound swaps through their dates of termination. In the aggregate for 2005, CIT will show a net gain of $0.11 per share related to these derivative accounting changes. CIT will be filing a Form 8-K with the SEC today covering the topic of this press release. About CIT: CIT Group Inc. (NYSE: CIT), a leading commercial and consumer finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has over $60 billion in assets under management and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries worldwide. CIT, a Fortune 500 company and a component of the S&P 500 Index, holds leading positions in vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset- based lending. With its Global Headquarters in New York City, CIT has approximately 6,000 employees in locations throughout North America, Europe, Latin and South America, and the Pacific Rim. For more information, visit http://www.cit.com . ### Press Release ########################### CIT Quantifies Exposure to Calpine Corporation NEW YORK, -- CIT Group Inc. (NYSE: CIT), a leading provider of commercial and consumer finance solutions, today disclosed its current financing relationship with Calpine Corporation ("Calpine") and related entities. Under existing agreements, CIT holds investments and loans aggregating approximately $260 million in several power projects. All of the projects are current with respect to payment obligations to CIT. Based on its current assessment, management believes that collateral values and cash flows support its carrying value in all but one of the projects. This project, a leveraged lease of approximately $60 million, may not be fully covered by collateral values and cash flows. ### Press Release ########################### Short Line Railroads See Traffic Increases in 2005; RMI's RailConnect Index Highlights Year-to-Date Increases in Rail Traffic ATLANTA---RMI, the largest independent provider of accurate, reliable, comprehensive and secure rail information services to the transportation industry, today reported the RailConnect Index(R) Quarterly Analysis of Traffic Statistics for the first three quarters of 2005. In its Quarterly Analysis, which is designed to provide railroads and rail shippers with insight on short line growth and trends, RMI reports that short line carload traffic increased by 7.1 percent in the first 39 weeks of 2005 over the same period in 2004. The RailConnect Index is the rail industry's first and most reliable source of short line traffic statistics and includes traffic summaries of 14 commodity groups from approximately 225 short line, regional and terminal switching railroads in North America. "A 7.1 percent increase over the same period of 2004 shows consistent and steady growth for the short line, regional and terminal switching railroad industry," said Pete Kleifgen, Chairman of RMI. Increases in Commodity Traffic Commodity carloads increased 1.3 percent and Merchandise traffic grew at a 1.3 percent. Intermodal; Stone, Clay & Aggregates; Petroleum and Coke; Farm and Food (excluding Grain) and Chemicals were the top five performers to date for 2005. Almost 85 percent of carload growth came from Intermodal; Stone, Clay & Aggregates and Chemicals. Three commodity groups lost carloads, including Motor Vehicles, Coal and Other which totaled less than one percent of all carloads. Top Performers: 2005 verses 2004 Rankings Summary: Fastest Growth % Increase % All Carload Carloads Rank -------------------------------------- ---------- ---------- --------- Intermodal 25.6% 17.4% 1 -------------------------------------- ---------- ---------- --------- Short Line Traffic Follows Class I's Patterns In looking at traffic volumes, short lines remain consistent with Class I rail lines. Class I traffic showed similar traffic patterns during the 39 week period, though growth trailed that of short lines in the aggregate. Growth through 39 weeks equaled 3.1 percent versus 2004 traffic. Intermodal was responsible for the increase, growing at six percent for the period. Remaining 2005 Year Predictions For the balance of the year, coal volumes are expected to increase over 2004 as high natural gas prices should push energy producers to coal. Coal stock piles are down and Powder River Basin volumes are increasing following the completion of most major track maintenance projects. Chemicals continue to recover from hurricanes Katrina and Rita and building materials should show improvement as communities rebuild from Texas to Florida. "The first 39 weeks of 2005 started the industry off to a strong year for the short line railroads, with the additional growth expected for the remainder of the year," said Kleifgen. "While grain traffic remains surprisingly slow, railroads are hoping for a better fourth quarter result." RMI Data Collection Process RMI collects and aggregates the data for the RailConnect Index through the company's RailConnect(R) suite of services. The RailConnect applications enable more than 295 railroads and rail shippers in the U.S., Canada, and Mexico to manage rail operations, improve customer service and reduce costs. From its current RailConnect customer base, RMI processes more than seven million carloads annually for railroads, rail shippers and railcar leasing companies. RMI's RailConnect Index Quarterly Analysis is available for distribution and publication to industry analysts and trades journals. The Index is also available to RailConnect customers free of charge. RMI is an independent, privately owned company based in Atlanta. Visit www.railcarmgt.com for more information about RMI. ### Press Release ########################### Global Aircraft Solutions Inc. Announces $12,000,000 Debt Facility TUCSON, Ariz.------Global Aircraft Solutions Inc. (OTCBB:GACF) today announced that it has successfully negotiated an increase of its credit facility from $2,500,000 to $12,000,000 with its existing bank. The bank is an affiliate of a diversified financial services corporation headquartered in Milwaukee, with $43.5 billion in assets. This credit facility bears an interest rate of 3.0% per annum in excess of the applicable LIBOR rate, secured by a first priority lien on the personal property of GACF and their subsidiaries Hamilton Aerospace and World Jet. The term of the Line of Credit expires on Oct. 31, 2007, when the entire unpaid principal balance and accrued and unpaid interest is due and payable. The new $12,000,000 line of credit consists of two components: a $5,000,000 operating line of credit and a $7,000,000 line of credit for use in support of GACF's aircraft trading activities. Also, Global's wholly owned subsidiary, Hamilton Aerospace Technologies, is proud to announce that it has been awarded, for the third consecutive year, the Federal Aviation Administration (FAA) "Diamond Award" for maintenance training. The Diamond Award is the FAA's highest maintenance honor, designed to encourage aviation maintenance technicians and their employers to participate in initial and recurrent training programs. Ian Herman, chairman and CEO of both Global Aircraft Solutions and Hamilton Aerospace, stated, "Although the $5,000,000 operating line of credit will provide working capital to help both of Global's wholly owned subsidiaries, Hamilton Aerospace and World Jet, to achieve our revenue and earning growth goals, we anticipate that the new $7,000,000 aircraft trading line of credit will have an even more significant positive impact on both our top and bottom line results. In past aircraft trading deals we often had to act as an agent utilizing capital provided by our customers. This generally limited our gross margins to 3% to 5% of the value of the transaction. Our new aircraft trading line of credit will allow GACF to act as the principal in our aircraft trading transactions, which will enable Global to garner margins generally closer to the 20% to 30% range on these quick turning transactions." About Global Aircraft Solutions Global Aircraft Solutions provides parts support and maintenance, repair and overhaul (MRO) services for large passenger jet aircraft to scheduled and charter airlines and aviation leasing companies. Hamilton Aerospace and World Jet, both divisions of Global Aircraft Solutions, operate from adjacent facilities comprising about 35 acres located at Tucson International Airport. These facilities include hangars, workshops, warehouses, offices and other buildings. Notable customers include debis AirFinance, BCI Aircraft Leasing, Q Aviation, Falcon Air Express, Jetran International, Goodrich Corp., AAR, National Jet Systems, Pemco, San Antonio Aerospace, Pegasus Aviation, Shaheen Airlines, Iraqi Airways and Aero California. Global's Web site is located at www.globalaircraftsolutions.com. The Hamilton Aerospace Web site is located at www.hamaerotech.com. Global Aircraft Solutions, Tucson Ian Herman, 520-275-6059 ### Press Release ########################### Wheels, Inc. CIO Larry Buettner Honored as 2006 Computerworld Premier 100 IT Leader DES PLAINES, Ill., -- Wheels, Inc., a leader in the multi-billion-dollar fleet-leasing industry, today announced that CIO Larry Buettner has been recognized by IDG's Computerworld, the "Voice of IT Management," as one of the business world's Premier 100 IT Leaders. The Premier 100 IT Leaders Awards Program honors executives who show exemplary technology leadership in resolving pressing business problems. Honorees, including Buettner, will be recognized at Computerworld's Premier 100 IT Leaders Conference March 5-7, 2006 at the JW Marriott Desert Springs Resort in Palm Desert, Calif. Buettner was chosen from 500 nominees, who were measured against Computerworld's IT Leadership Index, a set of characteristics that describes executives who guide the effective use of IT in their organizations, and evaluated by the editors and an external panel of outside judges. "This year's Premier 100 IT Leaders represent a myriad of organizations from universities to Fortune 100 companies," said Don Tennant, editor in chief, Computerworld. "However, each honoree from this year's class has demonstrated how technology can be used effectively, and often times creatively, to positively impact the organization for the long term." Buettner's selection as a Premier 100 IT Leader was based on his leadership of an enterprise-wide initiative that resulted in deploying a new international technology platform called Fleet.net. Created to assist Fleet Logistics, the Wheels European business operation, in servicing global customers with optimal European fleet cost management, the innovative solution manages a unified European currency and the unique business practices of ten target countries. "Larry Buettner and his IT staff delivered the first Pan-European fleet management platform, one that is providing European customers as well as US customers that are global enterprises with the information needed to control and manage their costs at an international level," said Wheels President Jim Frank. "We are extremely gratified by this recognition of Larry's leadership." About Wheels, Inc. Wheels, Inc. (http://www.wheels.com), which pioneered the concept of auto leasing in 1939, provides a full range of specialized services to help corporations manage their vehicle fleets. Wheels has 550 employees and manages more than 240,000 vehicles. Its holding company, Frank Consolidated Enterprises, currently ranks as one of the largest private companies in the United States, with nearly $2 billion in annual sales. For additional information, please contact: info@wheels.com. About Computerworld Computerworld, the "Voice of IT Management," is the most trusted source for the critical information needs of enterprise IT management. Computerworld's integrated offerings form the U.S.-based hub of the world's largest (51-edition) global IT media network through its weekly publication, Computerworld.com Web site, focused conference series and custom research. In the past five years alone, Computerworld has won more than 100 print and online awards for editorial and design excellence, surpassing its direct competition by an order of magnitude. Recognition includes the 2004 Magazine of the Year Award from the American Society of Business Publication Editors and a Jesse H. Neal Award for "Best News Coverage." In print since 1967, Computerworld is the source for information technology management, with a guaranteed rate base of 180,050, a total print audience of 1,293,000 (Intelliquest CIMS 2005 Business Influencer Study) and an online audience of over 1.1 million unique monthly visitors (DoubleClick). Computerworld is a business unit of International Data Group (IDG), the world's leading technology media, research and events company. A privately held company, IDG publishes more than 300 magazines and newspapers, including Bio-IT World, CIO, CSO, Computerworld, GamePro, InfoWorld, Network World and PC World. The company features the largest network of technology-specific Web sites, with more than 400 around the world. IDG is also a leading producer of more than 170 computer-related events worldwide, including LinuxWorld Conference & Expo(R), Macworld Conference & Expo(R), DEMO(R) and IDC Directions. IDC provides global market research and advice through offices in 50 countries. Company information is available at http://www.idg.com. SOURCE Wheels, Inc. ### Press Release ########################### NetBank Introduces Revolving Lines of Credit for Small Businesses; Online Banking Pioneer Works with Wall Financial Services, LLC. to Offer Working Capital Lines of Credit for Small Businesses ATLANTA----NetBank, Inc. (Nasdaq: NTBK), a diversified financial services provider and parent company of NetBank(R) (www.netbank.com), today announced an affiliation between NetBank and Wall Financial Services, LLC (WFS), for WFS to provide secured lines of credit to NetBank's small business customers. "We're working to add the types of products and services our customers have told us they need," said Bert Davis, director of small business banking, NetBank. "Lines of credit are often crucial financing sources for a small business. This new program provides a very cost-effective solution, providing attractive financing for working capital and for business expansion." Additionally, the administration of accounts receivable is frequently a challenging task for the small business. Management often finds it necessary to spend frequent amounts of time in this area instead of focusing on their business. By combining a revolving line of credit with a user-friendly, Web-based receivables management system, the business should be able to significantly reduce accounts receivable administration costs, thereby maximizing profits. Typical candidates for this product include established manufacturers, wholesalers, or other B2B business owners with a need for working capital. NetBank's credit products also include two business credit cards: the no annual-fee MBNA Platinum Plus(R) for Business card and the MBNA Platinum Plus(R) Business Rewards card. In addition to traditional deposit products, NetBank also offers small businesses Internet-based payroll and tax filing services through a partnership with CompuPay; equipment financing services; merchant and payment processing services, and online bill payment (including 10 free payments per month). NetBank's internet banking platform provides superior functionality, including the ability for a business owner to delegate, online, varying levels of authority for access by subordinates to company account information at NetBank. About NetBank, Inc. NetBank, Inc. (Nasdaq: NTBK) operates with a revolutionary business model through a diverse group of complementary financial services businesses that leverage technology for more efficient and cost effective delivery of services. Its primary areas of operation include personal and small business banking, retail and wholesale mortgage lending, and transaction processing. For more information, please visit www.netbankinc.com. CONTACT: NetBank, Inc. Rich Jeffers, 678/942-7596 ### Press Release ########################### Partners Equity Capital Company Names David Gerrard Vice President HORSHAM, Pa.----Partners Equity Capital Company (PECC) announced today that David Gerrard has been promoted to the position of Vice President and General Manager of their Technology Finance Business Unit. In his new role, Gerrard will have overall responsibility for the Technology Financing Group, including the development of new program partnerships and growth of existing manufacturer private label programs through PECC's revenue-generating lease programs and private label support. "David brings considerable knowledge and experience in program development and in the vendor segment," said Don Campbell, CEO of PECC. "His expertise will help PECC reach its objectives for future revenues and growth," continued Campbell. Gerrard has an impressive 20-year career including his prior position of Vice President, Program Management, responsible for the development of two key accounts at PECC. Before joining PECC, he served in several capacities for De Lage Landen, including the position of Vice President, Business Development-Financial Institutions where he was responsible for all new market opportunities and developed partnerships with some of the largest and most prestigious banks and wealth management companies. Before that, he managed the national sales team as Vice President of Sales-Financial Institutions. In DLL's Business Equipment Group, Gerrard was the Director of Sales for the Northeast Region, which became the largest and most successful region for the Business Equipment Group. Earlier in his career, David was District Sales Manager for Lanier Worldwide, Inc. "I'm extremely excited about David leading PECC's Technology Business Unit. His dedication, wide-ranging experience and sales leadership skills will add up to success in his new position and for PECC in the technology market," said Steve A. Grosso, President and COO. Headquartered in Horsham, Pennsylvania, PECC provides private-label, sales-aid finance programs for equipment manufacturers, distributors, and U.S. commercial banks. With vertical markets in Office Technology, Healthcare, and Banks/Financial Institutions, PECC helps its vender partners close more sales through the use of customized financing programs. For more information about PECC can be located at www.partnersequity.com. Contact: Partners Equity Capital Company (PECC) Marc Donahue, 267-960-4043 ### Press Release ###########################

News Briefs---- China to revise size of GDP http://news.ft.com/cms/s/1ed16fae-6b96-11da-bb53-0000779e2340.html Protesters March as WTO Session Opens http://www.washingtonpost.com/wp-dyn/content/article/2005/12/13/AR2005121300642.html Dollar Falls as Year - End Profit Taking Kicks In http://www.nytimes.com/reuters/business/business-markets-forex-report.html?oref=login Google expanding European base in Ireland, hiring 600 more people http://www.signonsandiego.com/news/business/20051213-1432-ireland-google.html Cyber Security Group Flunks Washington http://www.internetnews.com/security/article.php/3570596 A New England brand comes home again in $2.43b deal Banks work to bond with seniors http://www.usatoday.com/money/industries/banking/2005-12-12-bank-clubs-usat_x.htm ---------------------------------------------------------------

You May Have Missed O to a higher power She's been a dominant force for 20 years, but to Oprah Winfrey, the job's just begun. ----------------------------------------------------------------

California News Briefs--- Granting Williams clemency could have cost Schwarzenegger even more GOP support http://sfgate.com/cgi-bin/article.cgi?file=/c/a/2005/12/13/MNG0GG79A41.DTL Williams executed, but controversy remains http://www.usatoday.com/news/nation/2005-12-13-williams-execution_x.htm ----------------------------------------------------------------

“Gimme that Wine” The law permitting direct interstate shipping has proven costly to NY wineries, so now they're ... Wine-ing for changes Château China: $30 million 'hobby If you want to know if you got a value for your wine, or what the wine price is today, go to www.winezap.com Type in the vintage (year) and name of the producer with wine type or geographic area, such as 1995 Chateau Lynch Bages Pauillac. Even 1995 Lynch Bages will work, or 1999 Viader ----------------------------------------------------------------

Restaurant Review Leasing News invites readers recommendations, signed or un-signed. Restaurant Review

Named after the dance, not the ticket theater service. Fandango 223 17th Street http://www.fandangorestaurant.com Map http://www.fandangorestaurant.com/map.html On line reservation: http://www.opentable.com/rest_profile.aspx?rid=4137&restref=4137 Mon - Sat Basque Food/Reasonably priced, specialty fresh seafood http://www.fandangorestaurant.com/recipes.html A charming restaurant with excellent food. Walter Georis, who with his brothers own and operate Galante Winery in near-by Carmel Valley, beautiful roses by the way, built this restaurant in 1983 in a house off the main street. In 1983, among his first patrons were Pierre and Marietta Bain. Pierre was then manager of Club XIX at The Lodge at Pebble Beach. Although Fandango's homey European atmosphere contrasted with the elegance of Club XIX, it struck a chord with him. (His family has operated the Grand Hôtel Bain at Comp-sur-Artuby of France since 1737!) In 1986 Walter sold Fandango to the Bains. With Pedro De La Cruz their head chef, they reopened the restaurant at the end of the year. (Walter and his brother bought the house in Carmel formerly owned by the late Charlie Chaplin's house maid, calling it Casanova. The first thing he did was dig a wine cellar, as the brothers were wine lovers, and today it holds 30,000 bottles ( http://www.casanovarestaurant.com/wine.html) Fandango's is perhaps the best in Pacific Grove, located on the tip of the Monterey Peninsula, not far from cannery Row, and nearby the Monterey Convention facility. A few years ago the Bain's added an up-stairs room to the house, where I have had several dinners with the Chaine des Rotisseurs. I have never been disappointed with any of the food or the excellent service. (for other reviews: please go here: http://two.leasingnews.org/Recommendations/rstrnt.htm 0 ----------------------------------------------------------------

Today's Top Event in History 1774—After Paul Revere warns Portsmith of possible attack, Massachusetts militiamen successfully attacked arsenal of Fort William and Mary and confiscate all arms and gun powder. Actually, here was the first shot of the Revolutionary War, and not in Boston common as history books today report. (Revere did not finish his ride, nor did he communicate about the lantern signals, but he did warns several towns and woke up many farmers to warn other farmers about the possible attack, plus made it to the town of Portsmith.) ----------------------------------------------------------------

This Day in American History 1763 – Fifty-Seven whites enter Conestoga Indian settlement, and in violation of a treaty made between the tribe and William Penn — to last "as long as the sun should shine, or the waters run in the rivers" — shot, stabbed, and hatcheted the three men, two women and one young boy they found there (more on 27 December). ------------------------------------------------------------- American Football Poem

Dear Santa All I want for Christmas is a pair of nice young men, Dear Santa, I promise that I won't hurt them, But Dear Santa, If you can't provide any of the above, Copyright; Robyn Scott |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|