Friday, July 14, 2006

Headlines--- Classified Ads---Asset Management ######## surrounding the article denotes it is a “press release”

---------------------------------------------------------------- Classified Ads---Asset Management

Native Stone Winery, Jefferson City, Missouri *

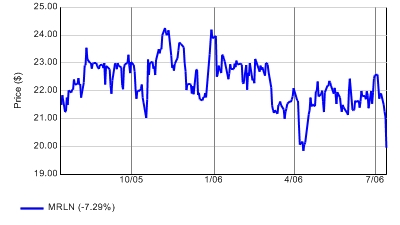

Austin, TX Bloomfield Township, MI Boston, MA Chicago, IL Chicago, IL Princeton, NJ Sausalito, CA Sonoma, CA Wilton, CT For a full listing of all “job wanted” ads, please go to: To place a free “job wanted” ad, please go to: * www.nativestonewinery.com ---------------------------------------------------------------- Open Letter to Marlin Leasing by Christopher Menkin, editor Leasing News attempted several times in the last few days to reach Marlin Business Service corporate officers for a comment on recent Security Exchange Commission filings. E-mails and telephone calls were not returned. Even Michael Bennie didn't want to respond. The main PR man, according to the press releases and records, George Pelose, general counsel and secretary, doesn't even return telephone calls. We don't even try to reach him any more, as it is evident they are afraid to talk to us. I guess the officers think we are just a trade publication for the leasing industry, which we are. However, I should inform them that we turn Marlin NASDAQ stock investors down from subscribing and let them know we have never received a response from about the CFO resigning and the deal made to him, or about the filing dated June 30, 2006 and recorded by the Security Exchange Commission on July 11,2006, JP Morgan Chase & Company is the “beneficial owner of 1,237,110 shares of stock...Percent of class: 10.4%” (roughly $27,055,595 a few days ago.) We really don't want the consumers reading us, as most don't understand the business, plus what we generally write would be very boring to them such as "Lefebre Appointed First Chair Business Council," or John Winchester Chairman of One World, or Bruce Kropschot bringing leasing sales teams to new companies, or FASB. To them, this is “trade news” and would be of very little interest. I tell them this when I inform they we are not giving them an e-mail subscription. It would throw off our web trend account of stories opened. One of the reasons we named our publication Leasing News was I figured readers who wanted information about a company would use that. For instance, if you search Google with “Marlin leasing news” we are number one and two on the list. If you use Yahoo, an ELA press release comes first and we are number two and four. Other browsers put us as number one, and rarely are we not in the top three. After our last story, Marlin Business Service stock went from a high yesterday of $20.80 to a low of $19.93, down $1.10 (5.225) on a volume of 30,258.

http://moneycentral.msn.com/scripts/webquote.dll?Symbol=MRLN Certainly we are not the Wall Street Journal, although some readers have referred to us as the Leasing Wall Street Journal. Others use language we can't print here, but the fact is we are read not only by employees of leasing companies, often their presidents and officers too, but also by investors and consumers. If you want the inside news first, the real thing, not the “spin” press releases, we get the readers. The Alexa/Google listing shows us second in the group, right behind the American Bankers Association web site, much larger and a daily. We usually only publish three times a week, so to get these ratings, above the dailies, means we are read. We don't know about: Money Central reported on 06-30-06 10:27 AM This stock experienced unusually high trading volume of 423,219 shares today; its average daily volume over the previous 30 days was 26,369 shares. And have not reported on: Officers Salaries: I can personally tell you officers of Marlin Business Services, not responding is not going to make us go away. In fact, it is surprising that a successful company appears to have something to hide in to being forthcoming, even on Security Exchange Commission public filings. It makes us want to dig deeper as we think there must be more to the story we don't know about. Why can't you tell us about these SEC filings? Christopher Menkin, editor ---------------------------------------------------------------- Litigious lessor loses a big case FTC, class-action suits have targeted aggressive policies of office equipment lender By Sacha Pfeiffer, Globe Staff Boston.com But that's what happened when she leased equipment from Leasecomm Corp., a subsidiary of MicroFinancial Inc., a Woburn company that finances office products for small businesses. And she wasn't the first Leasecomm customer to find herself in this bind. Last month, a Massachusetts District Court judge ordered Leasecomm to pay Akpaffiong $187,225, ruling that it had deceived her in their business dealings. The amount includes triple damages because Leasecomm willfully violated state law with its ``unconscionable lease," ``false and misleading representations," and ``harsh and heavy-handed collection practices," the court said. The judgment is the latest legal blow for Leasecomm, whose restrictive leases and aggressive debt collection have made it the target of several class-action lawsuits, a federal racketeering complaint, securities fraud allegations, and civil charges by the Federal Trade Commission and an eight-state task force. An attorney for Leasecomm, Richard J. McCarthy, defends its leases as ``perfectly appropriate" and said the company will appeal the Akpaffiong ruling, which he called ``aberrational." Complaints about Leasecomm are similar nationwide, that it manipulated businesses and individuals into signing confusing, complicated leases for an array of business products and online services. Tens of thousands of those people were sued by Leasecomm after they stopped making payments because they had trouble canceling their leases or believed they had been overcharged. From 1985 to 2002, Leasecomm wrote nearly 700,000 leases and filed more than 92,000 lawsuits against people who failed to make payments, McCarthy said. Because its leases often required that disputes be resolved in Middlesex County -- no matter where the lease-signers lived -- Leasecomm won thousands of default judgments when defendants missed court dates in Massachusetts. Leasecomm's lawsuits have been difficult for customers to fight because the debts the company sought were often too small to make hiring a lawyer worthwhile, and because its small-business customers were not protected by some consumer protection laws, according to several attorneys who have represented clients sued by Leasecomm. But last month's ruling is ``very, very important" because it outlines a successful defense for people sued by Leasecomm for outstanding debts, said New York lawyer John C. Klotz , who in 2002 filed a federal civil racketeering lawsuit against the company that is pending. ``What we did differently is put the whole business practice in context and presented that to the court," said Derege B. Demissie , the Cambridge lawyer for Akpaffiong, who lives in Redondo Beach, Calif. ``It's difficult for an individual to win without showing the full picture."Continued... Attorney General Thomas F. Reilly , who helped broker a 2003 FTC civil settlement with Leasecomm, said at the time that the company ``knowingly participated in a scheme that used the `get-rich-quick' allure of selling products on the Internet to take advantage of thousands of consumers who were ultimately forced into debt." Leasecomm, which provides financing for products that cost between $500 and $10,000, often targeted immigrant communities and aggressively pursued outstanding debts through dunning letters and collection agencies, according to attorneys who have sued the company. ``Many people assumed at their peril that Leasecomm would work with them if they ran into problems or made their payments a little late," said Concord lawyer Kenneth D. Quat , who filed several class-action suits against the company, ``but Leasecomm was basically looking to squash everybody." The lease payments often totaled many times the fair market value of the products being financed. In Akpaffiong's case, the credit card machine she leased in 1999 for 24 monthly payments of $100 each could have been bought new for $700 or used for $300, she later learned. But Leasecomm told her the lease, which Judge Santo J. Ruma described in his ruling as ``confusing and beyond the scope of an ordinary person's understanding," could not be canceled. After Akpaffiong finished making payments, Leasecomm continued to assess monthly charges because, it said, she had not returned the equipment or notified the company by certified mail that she wanted to end the lease. Akpaffiong, who had thought she would be able to buy the machine at the end of the lease for $30 to $50, told her bank to stop Leasecomm's automatic deductions from her account. But Leasecomm continued the charges, adding collection fees and late payments. It eventually sued her for $3,029.35 in past-due charges and sent negative reports about her to credit agencies. Akpaffiong was unable to buy a van for her business because of her negative credit rating. ``They're really destroying the lives of people who don't have much money to start with," said Glenn Harrison of Montgomery, Ala., who said he signed up for a $64.95/month Leasecomm service that let him take online credit card payments and, after trying to cancel it, was billed $3,500. ``It's despicable." Leasecomm's chief executive, Richard F. Latour, did not return a call for comment. But McCarthy, Leasecomm's lawyer, said he ``strongly disagrees" with last month's ruling and described Leasecomm's contracts as ``typical finance leases." When customers have payment concerns or problems, Leasecomm is ``flexible and reasonable and practical," McCarthy said, ``and would rather work something out so that some amount of payment is coming in, as opposed to having to resort to litigation." The 2003 FTC settlement canceled $24 million in court judgments that Leasecomm had won by default when small-business defendants couldn't make court dates in Massachusetts. That amount covered between 6,000 and 8,000 leases, according to FTC attorney Randall H. Brook. But Demissie and other lawyers who have sued the company said prosecutors did not go far enough. ``They should have looked at a criminal indictment," said Dorchester lawyer Thomas J. Doherty . Jesse Caplan , chief of the consumer protection and antitrust division for the state attorney general , said the settlement has helped thousands of consumers. ``Are there people out there that may still be litigating with Leasecomm? We're sure there are, and some of them may be frustrated that they did not get immediate relief," Caplan said. ``But I think this is actually an example of a situation where we were able to get very broad relief for a very large number of people, and also change the practices of this company going forward." Sacha Pfeiffer can be reached at pfeiffer@globe.com . Leasing News previous articles on Leasecomm/Microfinancial: ---------------------------------------------------------------- FASB Issues Lease Accounting Guidance A new staff position requires companies to account for the "economic reality" of leveraged leases. Marie Leone, CFO.com July 13, 2006 Come December, companies will be required to recalculate their leverage leases if the timing of tax benefits affect corporate cash flows, says new guidance released Thursday by the Financial Accounting Standards Board. The FASB Staff Position (FSB) revises FASB Statement No. 13, Accounting for Leases. FAS 13 requires that a lease should be recalculated when a change in an important assumption affects net income. One such change would be the timing of cash flows relating to income taxes generated by a leveraged lease. In its guidance, FASB notes that many leveraged leases provide significant tax benefits to the lessor, and leveraged lease accounting is significantly influenced by the cash flows between that lease holder and the taxing authority. So, a change in the timing and amount of those cash flows would be expected to change the economics of the transaction, and therefore should be reflected in the financial statements of the lessor. The FSB "reflects our belief that accounting should fully reflect economics of a transaction," commented FASB Member Edward Trott in a statement announcing the amendment. In other words, explained Trott, any changes in either the timing or amount of the cash flows associated with leveraged lease transactions will be "now be properly reflected in the financial statements." January 23, 2006 At last Wednesday's meeting, the Financial Accounting Standards Board considered proposed changes to Statement No. 13, Accounting for Leases. An existing provision in FAS 13 requires that a lease should be recalculated when a change in an important assumption affects net income. One such change would be to the timing of cash flows relating to income taxes generated by a leveraged lease. In that light, last July's proposed staff position 13-a was potentially significant: It would require that after a leveraged lease is recalculated, if the change in the timing of cash flows modified the characteristics of the lease so it no longer qualified for leveraged lease accounting, then the lease should be reclassified. The debt would then be recorded gross rather than net, and the pattern of income recognition would change as well. Most comment letters disagreed, however, and at last week's meeting the board agreed that a company would not be required to reclassify a lease in such circumstances. "We had valid reasons in the draft for requiring it," board member Leslie Seidman said at the meeting. She added, however, that the requirement seemed to be "inconsistent with the general premise of FAS 13 that you do not reconsider the classification unless there is a change in the terms" of the lease agreement. If FASB pursued the reclassification approach, Seidman also noted, there would be inconsistency and implementation issues to make it operational. Separately, to further clarify FAS 13, the staff recommended and the board agreed that when a leveraged lease is recalculated, all assumptions should be updated to rely on the most current information. The board also decided against its original proposal that interest and penalties should be included in the recalculation. The proposal, which would have accounted for interest and penalties within leveraged lease accounting, would have affected the profitability of individual leases and, possibly, whether the leases would meet the criteria for leveraged-lease accounting treatment. Comment letters also raised the issue of the threshold that should be used for recognizing tax benefits in a leveraged lease transaction — "probable" recognition, or "more likely than not." According to FASB, there is no numerical definition of "probable" in the accounting literature, but as practice has evolved, it has become generally accepted as being between 70 percent and 75 percent. "More likely than not" is generally accepted at 50.1 percent. Respondents expressed concern that when a company evaluated whether the tax position in its financial statements would be sustained upon audit, the probable-recognition threshold would be too high to meet. At last week's meeting, the FASB staff and the board agreed that the threshold should be consistent with FASB's policy on Accounting for Uncertain Tax Positions. In that project — which applies to Statement No. 109, Accounting for Income Taxes, and which is currently in draft form — the board recently lowered the threshold to "more likely than not." ----------------------------------------------------------------

---------------------------------------------------------------- Classified Ads---Help Wanted Account Managers

Sales

Sales Manager

----------------------------------------------------------------

To view Winter/Spring schedule, please go here: ----------------------------------------------------------------

A Manager's Guide to Destroying Trust by Steve Chriest Sales managers who want to build trust in their selling organizations might want to examine the results of a survey about trust conducted with managers and employees in the U.S., France, Singapore and the United Kingdom. Survey respondents revealed what managers do to destroy trust, and what they must do to build trust within their organizations. The truth in their answers appears so self-evident that it's not surprising that trust in managers is at an all time low. Here are some trust-busting behaviors that many managers employ with great success: - Telegraph mixed messages. Your employees will never know where you or they stand on any issue. If sales managers don't want to destroy trust their organizations, it seems obvious that they would be well served by simply avoiding all the above trust-busting behaviors as they work with their sales teams. But building and maintaining trust is perhaps the most difficult challenge facing most managers today. Fortunately, the survey respondents provided the following trust-building behaviors sales managers should employ if they want to build trust: • Always communicate openly and honestly, and don't distort information in any way. - Your employees will soon know you as a straight-shooter who delivers information “as it is,” even when it is painful to deliver or hear. The employees and managers who responded to this survey on trust are really telling all managers that what's at risk for managers, ultimately, is their credibility with their employees. Managers cannot have credibility with their employees if they don't have the trust of those employees. The survey provides excellent stop-doing and start-doing guidelines for sales managers who want to avoid trust busting behaviors and employ those behaviors that build trust among their sales team members. Copyright © 2006 Selling Up TM . All Rights Reserved. About the author: Steve Chriest is the founder of Selling Up TM ( www.selling-up.com ), a sales consulting firm specializing in sales improvement for organizations of all types and sizes in a variety of industries. He is also the author of Selling Up, The Proven System for Reaching and Selling Senior Executives. You can reach Steve at schriest@selling-up.com .

----------------------------------------------------------------

---------------------------------------------------------------- ELA Member Testifies Before Capitol Hill Panel on Sarbanes-Oxley ELTnews On July 11, Dan Pocrnich, Chief Financial Officer of Wells Fargo Equipment Finance, Inc., on behalf of the Equipment Leasing Association testified before a congressionally sponsored panel on the compliance costs associated with the passage of the Sarbanes-Oxley Act (SOX) of 2002. Mr. Pocrnich participated on a panel entitled "Sarbanes-Oxley: Is it the Tip of the Iceberg?" which was sponsored by the American Council of Capital Formation (ACCF) and the Small Business & Entrepreneurship Council. Additional participants included Congressman Tom Feeney (R-FL) of the House Financial Services Committee and prominent financial commentator and columnist for The Wall Street Journal, Alan Murray. Other private sector participants were representatives from the New York Stock Exchange (NYSE), Mercantile Bankshares Corporation and Merrill Lynch. In his presentation before the panel, Mr. Pocrnich stated that Wells Fargo Equipment Finance has found that the internal control requirements under Section 404 of SOX to be very prescriptive, redundant and expensive in terms of process documentation and human capital. In Pocrnich's view, the competitive nature of the leasing industry and the narrow margins of its products mandates that such compliance costs cannot be passed onto consumers since the industry competes with foreign entities and private funding sources that are not subject to the strictures of the Act. This single section alone -of the sixty-six sections of the Act- accounts for most of the recurring and redundant compliance costs for Wells Fargo Equipment Finance and is therefore ripe for change. For further information please contact, David Fenig ELA's Vice President of federal Government Relations at dfenig@elamail.com

### Press Release ########################### Tokyo Leasing (U.S.A.) Inc. Adds Rowland Thomas to Its Sales Force Tokyo Leasing (U.S.A.) Inc. of Purchase, New York is pleased to announce that Rowland Thomas has been promoted to Vice President of Credit and Marketing. In this role Rowland Thomas will be seeking new relationships in two key business segments; portfolio acquisitions and middle market transactions. Rowland is based out of the New York office. He can be reached by phone at 914-696-2216 or email at rthomas@tokyoleasingusa.com Tokyo Leasing (U.S.A.) Inc. is the North American subsidiary of Tokyo Leasing Ltd of Japan. With operations in North America, Asia, Europe and Japan, Tokyo Leasing is one of the largest equipment finance companies in Japan with 2005 revenue in excess of $3.7 billion. ### Press Release ########################### Key Equipment Finance names Richard W. McAuliffe Senior Vice-President SUPERIOR, CO. – – Key Equipment Finance, one of the nation's largest bank-affiliated equipment financing companies and an affiliate of KeyCorp (NYSE: KEY), has named Richard W. McAuliffe as senior vice president and general manager of its Canadian region. Key Equipment Finance Canada Ltd. partners with leading vendors of technology and capital asset equipment providing lease financing to their business customers. They also provide direct financing solutions to corporate and commercial clients for equipment acquisitions. Mr. McAuliffe will lead Key Equipment Finance's development and support of equipment financing programs, products and services across Canada.

Mr. McAuliffe joined Key Equipment Finance Canada in 2003 as vice president, commercial leasing services. Prior to joining Key, he was assistant vice president, Toronto Dominion Commercial Bank and general manager, TD Asset Finance Corp. He has more than 17 years of experience in direct and vendor equipment leasing, having also worked for G.E. Capital Canada Inc. and Chase Manhattan Bank of Canada. He is a member of the Canadian Finance & Leasing Association (CFLA) and serves as chairman of their Education committee. “Richard is a natural choice to lead our Canadian organization,” said H. Clifton Gottwals, executive vice president, North America, within Key's global vendor services business. “His experience in the direct and vendor leasing business in Canada and his strong leadership skills have earned him the respect and recognition of his peers, competitors and team mates. I am very excited to be working with Richard as we focus on increasing our Canadian business.” Key Equipment Finance is an affiliate of KeyCorp (NYSE: KEY) and provides business-to-business equipment financing solutions to businesses of many types and sizes. They focus on four distinct markets: · businesses of all sizes in the U.S. and Canada (from small business to large corporate); Headquartered outside Boulder, Colorado, Key Equipment Finance manages a $12.6 billion equipment portfolio with annual originations of approximately $5.7 billion. The company has major management and operations bases in Toronto, Ontario; Albany, New York; Chicago, Illinois; Houston, Texas; London, England; and Sydney, Australia. The company, which operates in 26 countries and employs 1,100 people worldwide, has been in the equipment financing business for more than 30 years. Additional information regarding Key Equipment Finance, its products and services can be obtained online at KEFonline.com. Cleveland-based KeyCorp is one of the nation's largest bank-based financial services companies, with assets of approximately $93 billion. Key companies provide investment management, retail and commercial banking, consumer finance, and investment banking products and services to individuals and companies throughout the United States and, for certain businesses, internationally. ### Press Release ########################### CIT and Microsoft Announce Global Financing Relationship Agreement Demonstrates CIT's Leadership in Technology Vendor Finance Rollout to Begin in France and Switzerland NEW YORK and REDMOND – – CIT Group Inc. (NYSE: CIT), a leading global provider of consumer and commercial finance solutions, today announced a five-year global relationship to provide vendor financing solutions for Microsoft Corp.'s (NASDAQ: MSFT) products and services. Under the terms of the agreement, CIT will begin as the exclusive financing partner for Microsoft® Financing in France and Switzerland. The relationship is expected to expand to other major markets around the world by the end of 2007. Tom Hallman, CIT's vice chairman for specialty finance, said, “We are excited to add Microsoft to our world-class list of vendor partners. Our newly formed relationship with Microsoft reflects our ability to provide customized financing solutions for customers of leading global technology companies and further solidifies CIT's position as a leading provider of vendor financing around the world. We look forward to working alongside Microsoft as we expand our global alliance.” “This agreement will further enable Microsoft to meet more diverse customer needs for financing their software, services, and hardware,” said Brian Madison, general manager of Microsoft Financing at Microsoft. “We chose CIT because of its global leadership and expertise in technology vendor finance and for its deep understanding of the financing needs of our broad base of customers.” CIT Vendor Finance is a global leader in financing solutions that drive incremental revenues for manufacturers, distributors, and other intermediaries. It provides customized financing solutions to customers in nearly 40 countries, supporting a wide variety of industries, including health care, industrial equipment, and technology. About CIT CIT Group Inc. (NYSE: CIT), a leading commercial and consumer finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has $65 billion in managed assets and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries worldwide. CIT, a Fortune 500 company and a member of the S&P 500 Index, holds leading positions in vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset-based lending. With its global headquarters in New York City, CIT has more than 6,700 employees in locations throughout North America, Europe, Latin America, and the Pacific Rim. www.CIT.com About Microsoft Financing Microsoft Financing is a financing arm of Microsoft Corp. that is dedicated to making it easier to purchase Microsoft products through financing. Microsoft Financing forms partnerships with commercial financing institutions to deliver optimal customer financing solutions. About Microsoft Founded in 1975, Microsoft (Nasdaq “MSFT”) is the worldwide leader in software, services and solutions that help people and businesses realize their full potential. Microsoft is a registered trademark of Microsoft Corp. in the United States and/or other countries. ### Press Release ########################### Siemens Expands Healthcare Finance Offering in the U.S.; ISELIN, N.J.----Siemens Financial Services, Inc. (SFS), the U.S. financial services arm of Siemens AG, today announced the expansion of its financing offering for healthcare providers to include working capital solutions. In addition to medical equipment financing, SFS will now provide revolving lines of credit and term loans to organizations throughout the U.S. who are providing healthcare services. "As healthcare providers in the U.S. continue to struggle to effectively manage financial performance and offer customers the latest technologies, there is an increasing demand for a broader suite of financial solutions," said SFS President and CEO Roland Chalons-Browne. "The addition of working capital financing for healthcare providers allows us to tailor our solutions to address the complex needs of the healthcare market, enabling SFS to have more in-depth, strategic relationships with our customers." This working capital offering is aimed at a range of healthcare providers including, but not limited to, hospitals, physician practices, diagnostic imaging centers, surgery centers, long-term care and skilled nursing facilities. These providers often seek financing when expanding facilities, making acquisitions, or looking to leverage the value of existing assets. SFS is expanding its team within healthcare finance with dedicated senior industry experts including Jim Fuller, Tracy Maziek and Al Smith. Fuller, who has led several healthcare finance teams within SFS, spearheads this new effort within Siemens. Maziek and Smith, based in Southern California and Dallas, respectively, have recently joined the SFS team, bringing extensive knowledge and experience in working capital and structured finance solutions for the healthcare market. About Siemens Financial Services With some 1,700 employees and an international network of financial companies coordinated by Siemens Financial Services GmbH, Munich, the Siemens Financial Services Group offers a broad range of financial services. This covers activities from sales and investment financing to treasury services, fund management and insurance brokerage. The group's key customers are internationally active industrial and services companies, as well as public-sector operators. The group supervises 22 leasing companies worldwide. Further information: www.siemens.com/sfs Siemens Financial Services, Inc. (SFS) is a leading provider of business-to-business financial services and is one of Siemens' operating companies in the United States. SFS helps businesses increase productivity, improve cash flow and acquire the latest technology by providing customized solutions that range from equipment financing to working capital solutions. With U.S. headquarters in Iselin, N.J., SFS employs more than 200 industry experts who specialize in tailoring solutions for thousands of premier businesses. About Siemens Siemens AG (NYSE:SI) is one of the largest global electronics and engineering companies with reported worldwide sales of $96 billion in fiscal 2005. Founded nearly 160 years ago, the company is a leader in the areas of Medical, Power, Automation and Control, Transportation, Information and Communications, Lighting, Building Technologies, Water Technologies and Services and Home Appliances. With its U.S. corporate headquarters in New York City, Siemens in the USA has sales of $18.8 billion and employs approximately 70,000 people throughout all 50 states and Puerto Rico. Eleven of Siemens' worldwide businesses are based in the United States. With its global headquarters in Munich, Siemens AG and its subsidiaries employ 460,000 people in 190 countries. For more information on Siemens in the United States: www.usa.siemens.com . ### Press Release ###########################

News Briefs---- Central Bank Raises Rates in Japan GE 2nd-Qtr Profit May Rise With Engine Sales, Finance Products Oil surges above $78 a barrel as violence in Middle East escalates Intel to cut 1,000 managers Washington Mutual to cut 900 jobs Housing hangover Claims for jobless benefits jumped 19,000 last week Rents could fall as new condos become apartments Big Dig Possible Defect Count Quadrupled in Boston ---------------------------------------------------------------

You May have Missed--- Fed opposes allowing retailers into the club: ilc ----------------------------------------------------------------

“Gimme that Wine” Ark. Wine Case Put On Hold July 27 th The Livermore Valley's Wine & Food Experience Australia's western frontier Wine Prices by vintage US/International Wine Events Winery Atlas Leasing News Wine & Spirits Page ----------------------------------------------------------------

Calendar Events This Day Bastille Day Celebration. Boston, MA France: Bastille Day or Fete National French Fries Day Mission San Antonio de Padua: Founding Anniversary ----------------------------------------------------------------

Today's Top Event in History 1943-The first national monument dedicated to an African-American was the George Washington Carver National Monument, authorized this day, officially established June 14,1951, and dedicated on July 14,1953. It consists of 210 acres about 2.5 miles southwest of Diamond in Newton County, MO. It is administered by the National Park Service. ----------------------------------------------------------------

This Day in American History 1771-Mission San Antonio De Padua founded. From California to the New York island As I was walking that ribbon of highway I roamed and rambled and followed my footsteps When the sun came shining and I was strolling As I went walking, I saw a sign there In the squares of the city, in the shadow of the steeple Nobody living can ever stop me --------------------------------------------------------------

Baseball Poem WHAT DOES HE KEEP IN HIS BAG? The slugger keeps something in his bag, Everyone has seen him unzip The slugger is friendly, even to rookies, Written by Tim Peeler -------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm

|

||||||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

||||||||||||||||||||||||||

Editorials (click here) |

||||||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

||||||||||||||||||||||||||

|

||||||||||||||||||||||||||

|

||||||||||||||||||||||||||