|

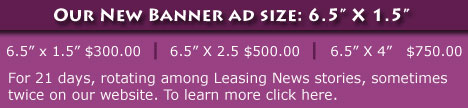

Truck/Trailer Industry

National Account Manager

5+ year proven track record, located in either Texas or upper Mid-West markets,

estab. relationships to produce min. $750k

a month, for more information, click here.

To apply click here.

|

|

Friday, October 7, 2005

Headlines---

Classified Ads

Story Credits

Placard

From Our Archives --- October 7, 2002

Classified Ads --- Help Wanted

The Alta Group Surveys Leasing in Europe

BBB & Equifax to Help Military Families Guard their Credit-

Federated Financial Corporation of America announces expansion

LexisNexis & BBB To Help Verify Validity Of Small Businesses

Main Street National Bank Opens Regional Equipment Leasing Office

Today's Top Event in History

This Day in American History

######## surrounding the article denotes it is a “press release”

-------------------------------------------------------------------------------

Classified Ads --- Documentation Manager, Finance, Legal and Operations

Documentation Manager: New York, NY

10+ years in equipment leasing/secured lending. Skilled in management & training, documentation, policy and procedure development & implementation, portfolio reporting. Strong work ethic.

Email: dln1031@nyc.rr.com

Documentation Manager: Phoenix, AZ

Lease Administrator with exp. in lease administration, doc. & porfolio management for $200M in IT assets. Additional experience financial analysis process improvement/development.

Email: jeg3894@cox.net

Finance: Austin, TX.

20+ years all facets of lease/finance. Collection and credit management. Equipment & rolling stock structuring. $150k credit authority, $100 million portfolio management.

Email: texmartin@juno.com

Finance: Chicago, IL

Finance: Chicago, IL

Experienced in big ticket origination, syndication, valuation and workout. Twenty five years, MBA, CPA, JD, LLM (Tax), structuring specialist. Inbound and outbound transactions.

Email: pal108381@comcast.net

Transaction Summary (http://64.125.68.91/AL/LeasingNews/Resumes/Transaction%20Summary.pdf)

Website: www.tlgattorneycpa.com

Finance: Orange County, CA

25+ years experience large ticket and mid-market commercial finance. Senior manager in operations, documentation, legal, credit, workouts, portfolio management. $2+Billion portfolio. MBA Finance. Juris Doctor.

Email: finance1000@cox.net

Finance: San Jose, CA.

15+ years sourcing debt, managing cash and receivables and other treasury functions. Strong background in credit, contract administration and bankruptcy litigation experience. MBA Finance.

Email: raycis@comcast.net

Finance: Toronto

Long diverse career financial services industry. Executed billions of dollars of leases over 20 years; structuring, executing and pricing US/Canadian transactions. Per Diem or full time.

E-mail: eslavens@eol.ca

Legal: Los Angeles, CA

Experienced in-house corporate and financial services attorney seeks position as managing or transactional counsel. Willing to relocate.

Email: sandidq@msn.com

Operations: Orange County, CA.

Operations/Credit Manager with 15 Years Experience, Middle & Large Ticket, initiated policies for Patriot Act and Sarbanes Oxley, Team Motivator.

E-mail: equiplender@aol.com

Operations: East Windsor, NJ.

Skilled Manager in credit, collections, training, documentation, policy and procedure, lease and finance operations. Get results and keep the customer coming back.

Email: rgmorrill@comcast.net

Resume

(http://64.125.68.91/AL/LeasingNews/Resumes/Richard_Morrill.pdf)

Operations: New York, NY.

10+ years in equipment leasing/secured lending. Skilled in management & training, documentation, policy and procedure development & implementation, portfolio reporting. Strong work ethic.

Email: dln1031@nyc.rr.com

Operations: Wayne, NJ

20+ heavily experienced collection/recovery VP looking to improve someone's bottom line. Proven, verifiable track record. Knowledge of all types of portfolio. Will relocate

For a full listing of all “job wanted” ads, please go to:

http://64.125.68.91/AL/LeasingNews/JobPostings.htm

To place a free “job wanted” ad, please go to:

http://64.125.68.91/AL/LeasingNews/PostingForm.asp

[headlines]

----------------------------------------------------------------

|

Story Credit Lessors

( for other "funders only", who do not specialize in “story credits,” click here

for “super brokers,” who primarily broker leases, click here )

These companies specialize in "C" and "D" credits, often news businesses, or businesses where the principal(s) have Beacon score around 600 or previous difficulties; meaning to become comfortable with the credit and financial situation you need to learn the "story" to make a positive decision, often requiring further security, shorter term, or additional guarantors. Many of these companies may also be a "B," but appear otherwise without the "story" to understand the full financial picture.

(To qualify for this list, the company must be a lessor and not a broker or superbroker, along with an acceptable Better Business Bureau Rating and no history of complaints at Leasing News. We reserve the right to not list a company who does not meet these qualifications.)

We encourage companies who are listed to contact us for any change or addition they would like to make. Adding further information as an "attachment" or clarification of what they have to offer would be helpful to readers is very much encouraged.

Rank |

Name

In Business Since

Contact

Website

Leasing Association |

Employees |

Geo

Area |

Dollar

Amount |

Broker Qualify |

1 |

Financial Pacific Leasing

1975

Terey Jennings CLP,

800-447-7107, tjennings@finpac.com

www.finpac.com

EAEL, ELA, NAELB, UAEL (P) |

115 |

Nationwide |

$5,000-$50,000 |

Please Call or see "Prospective Broker" section on website |

1 |

|

106 |

Nationwide |

$250,000 - $15,000,000+ |

Please Call |

3 |

|

45 |

Nationwide |

$1,000 - $30,000 |

One year time in business |

4 |

|

32 |

Nationwide |

$250,000 - $3,000,000 |

Contact Peter Eaton |

5 |

Sunrise International Leasing Corporation

1975

Carrie Halvorson or Jim Teal,

800-950-3211

www.sunriseleasing.com

ELA (I) |

20 |

U.S., Canada, Latin America |

$1,000

minimum no hard cap in place for maximums |

One year time in business |

6 |

|

12 |

National |

$100,000 to $1,500,00 |

A deal in hand and a full package |

7 |

Creative Capital Leasing Group, LLC

1980

Alister McNeil

1-800-lease'em

(949-650-9880)

www.Creativeclg.com

NAELB, UAEL (M) |

12 |

USA |

$40,000 - $1,000,00 |

Please call Broker Manager, Todd or Jason |

8 |

Summit Leasing, Inc.

1986

James, Klemens, Kevin, Mike, Mark

(800) 736-1530

www.summitleasing.com

UAEL (S) |

12 |

CA, ID, MT, OR, WA |

$20,000 - $400,000 |

Contact us |

9 |

|

10 |

11 Western State |

$10,000.00 - $250,000.00 |

|

10 |

Allegiant Partners Incorporated

1998

415.257.4200

Doug Houlahan ext. 205

Paul Foster ext. 206

www.allegiant-partners.com

ELA, NAELB & UAEL (B) |

9 |

Nationwide, including Alaska & Hawaii |

$70,000 to $250,000 |

|

11 |

|

8 |

Nationwide

(except LA, AR and AK) |

$50,000 to $2,000,000 |

Please Call |

12 |

|

7 |

US Canada (F) |

$50,000 to $3MM

$250,000 average transaction |

Please Call |

13 |

American Leasefund, Inc.

1999

Tom Davis

tom@alclease.com

800.644.1182 - PH

503.244.0845 - FX

www.alclease.com

UAEL (Q) |

6 |

Idaho, Montana, Oregon, Washington |

$3,500 - $50,000 |

Please Call |

14 |

|

6 |

Nartionwide - 50 States |

$25,000.00 + |

Please contact Larry LaChance |

15 |

|

6 |

Nationwide |

$50,000 to $1MM

$250,000 average transaction |

Please call |

17 |

|

5 |

Western U.S. |

$25,000 - $350,000 |

|

18 |

Barrett Capital Corporation

1975

Barry Korn

914-632-4200

Cell: 914.954.1900

Barrett@BarrettCapital.com

www.BarrettCapital.com

NVLA |

4 |

United States |

Vehicles Only

$10,000 minimum |

Please Call |

20 |

|

4 |

Northwestern

(see comments) |

$5,000 - $50,000 |

Please Call |

21 |

|

4 |

Nationwide |

$20,000, average transaction size is $200,000 |

Please Call |

(A) Pawnee Leasing Corporation; Some times we go higher than $30,000, but our marketplace is from $1,000 to $30,000.

(B) Allegiant.pdf

(D) ABCO Leasing, Inc. in Seattle area has been operating since 1974 serving the broker community. We required full financial disclosure on every transaction. We do story transaction, but do not like to refer to them as "C" of "D" credits. We think of therm as "A" type credits that have not been discovered yet. In actuallity, we do not really like to look at what most describes as "D" credits.

(E) Black Rock Capital comment: We book anywhere between $15 to 20 million per year. We do no "app only" business and require a full financial package for each transaction. Our average size transaction is approximately $250k and, although, we concentrate in printing, packaging (steel rule die industry) and road construction equipment we do not rule out anything that makes sense. More information can be found at www.blackrockcapital.com.

(F) Black Rock Capital (Ireland) Limited and Black Rock Capital (UK) Limited provide the same services for small to middle market corporations in the European Economic Community and the United Kingdom.

(G) Cobra Capital, LLC. Comments: Our registered trademark "Making impossible possible" is our central marketing tagline for both strong and weak credits. I have developed a 10 year history, (from Cobra and my prior company GALCO), with specialty, non-conforming transactions (story credits) and have a solid reputation for candidly responding to our originators and lessees and working diligently to mitigate deal risk rather than making excuses to turn deals down. Our originators prefer our underwriting approach to non-conforming transactions since unlike most non-conforming funders, we prefer to mitigate risk versus jacking our return. Both Originators and Lessee's prefer our candid approach as we are also frequently asked to advise lessee's and lessors on the best way to structure their bank loans and raise capital due to our 25+ year banking and accounting backgrounds as my partner and I are both former bankers and CPA's.

| Partners Bio | LaSalle Bank Reference | Cole Taylor Bank Reference |

(H) Pentech is the lessor partner with Manifest Funding Services for their Navigator, Navigator Plus & Navigator Direct. This is through our sister company Pentech Funding Services, located in San Diego and headed up by Ron Wagner.

(I) Sunrise International Leasing Corporation Comment: The broker program is "...an informal program as our primary business is still vendor leasing."

(J) Boston Financial & Equity Corporation, most of our leases are venture capital backed startups and turnarounds. We require full financial disclosures, CPA and internal statements, no tax returns. We do not required additional collateral, no PG's or RE needed. Do not send deals with large tax liens, especially if they are payroll taxes.

(L) IFC Credit Corporation also services on a regular basis "A" and "B" credits, but it also considers "story credits." "As you say, we need to become comfortable with the credit and financial situation and learn the "story" to make a positive decision, often requiring further security, shorter term, or additional guarantors. I would describe the B and C type credits we fund as companies having 'checkered earnings'."

(M) Creative Capital Leasing Group: "We are able to fund tough deals, bad credits, BK's, past tax liens, start ups, used equipment, etc., because we look outside the transaction for real estate, and marketable securities to take as additional collateral."

(N) Blackstone Capital Partners, L.P. lends up to 50% of verified auction value for working capital and/or equipment financing requests (we of course include equipment to be acquired in our valuation). Using this formula, allows Blackstone to approve deals on the assets rather than the credit or cash flow that other lenders desire. Also being an asset lender, we are looking for hard assets i.e. yellow iron, machine tool, manufacturing lines, textile etc... We do not care for soft assets such as computers, furniture, restaurant, or "white elephants" (equipment that is too specific to the clients needs and was specially built for them - there would be no resell available and our liquidity if repossessed would be in jeopardy). If you have any questions, please feel free to call, we will do our best to help or seek the answer for you.

(O) Bankers Capital " We will do ANY Type of Equipment, in ANY industry, in ANY state. We especially like 6-figure transactions with full financial packages no matter how good or bad they look. We look to structure the story C&D credits with any kind of additional collateral that makes sense. It could be with 2nd or 3rd mortgages on residential or commercial Real Estate, additional equipment, cash value life insurance, security deposits, vendor agreements. We look for any way to make the deal work instead of looking for any way to decline the deal."

(P) Financial Pacific Leasing supports a nationwide network of Brokers and Lessors. We specialize in "B" and "C" credits for established companies as well as companies under two years in business.

(Q) American Leasefund, Inc. funds small hard to do transactions under $50,000.00. Most of the transactions are "app only". We look for additional collateral or larger first payments to help the weaker credits. We maintain and service our own portfolio. All of our lessee billings are done via ACH.

(R) Dolsen Leasing has served the 11 Western States since 1958 and specializes in B & C Credits for established and new companies. We require a full financial package and offer both leases and financing for new and used equipment in the range of $10,000.00 to $250,000.00. Specialties include titled vehicles for both existing and new owner operators. Story credits are considered as long as credit has been reestablished and trends are positive. Credit decisions are based on old fashioned common sense, not credit scores, allowing us a very quick turnaround-often the same day. We accept broker business and also have in house salesmen.

(S) We at Summit Leasing consider ourselves to be primarily "B" credit lenders, working almost exclusively through brokers.

(T) TechLease - due to previous experiences, TechLease is vertically focused on three primary sectors: Semiconductor, Media and Aerospace. We fund all deals and hold paper an all equipment under $250,000. Deals over $150,000 we typically want to meet the Lessee face-to-face. We prefer business in California, however we will fund nationwide.

(U) We specialized in start-up business. These are the northern states we do business in AK, AZ, CA, CO, ID, OR, WA. Click here to read our Product overview and Press Realease.

|

| |

[headlines]

----------------------------------------------------------------

[headlines]

----------------------------------------------------------------

From Our Archives --- October 7, 2002

UAEL Elects First Female President

Oren Hall, emeritus member, former president of the United Association of Equipment Leasing (UAEL), made the motion from the floor, and President Bob Fisher, CLP, made the announcement, “ In the first 26 years of our association, we now have a female president, Bette Kerhoulas, CLP. “

2000

Bette Kerhoulas, CLP

Pacifica Capital

(“Winner of Closest to the Pin”)

[headlines]

----------------------------------------------------------------

Classified Ads --- Help Wanted

Lease Representative

|

|

Baltimore - Washington area

Lease Representative

M&T Bank is seeking an in-market lease representative to develop and maintain relationships with broker/lessors, equipment vendors, and direct lessees throughout Maryland and Northern Virginia. Must be knowledgeable small ticket leasing ($75K average ticket) and third-party lease/loan transactions. Please apply on-line at www.mandtbank.com and view posting #4044.

At M&T Bank, we provide and exciting and challenging work environment where performance and innovative thinking is encouraged at every level. With over 700 branches, your career can travel as far as you take it!

|

www.mandtbank.com |

Leasing Sales Manager

|

Leasing Sales Manager

Develop & lead sales force in a fast track

company. Our phenomenal growth provides this great opportunity, 5+ years exper. working w/brokers. Relocate to beautiful

San Antonio, Texas. resumes@swcreditlender.com

|

|

National Account Manager

|

Truck/Trailer Industry

National Account Manager

5+ year proven track record, located in either Texas or upper Mid-West markets,

estab. relationships to produce min. $750k

a month, for more information, click here.

To apply click here.

|

|

[headlines]

###Press Release########################

The Alta Group Surveys Leasing in Europe for Leaseurope Annual Conference

LONDON—

Profitability/volumes and returns on capital. How to increase turnover and the hunt for business. Maintaining good-quality staff. These are the three most concerning issues that keep chief executives of European leasing companies awake at night. How do CEOs view growth prospects? What does the leasing industry think of compliance?

The Alta Group, at the request of Leaseurope, conducted a comprehensive industry survey across Europe of CEOs' views on a variety of topical issues. The results were presented by Alta Principal Derek Soper at Leaseurope's Annual Conference at the beginning of October.

Soper said: “There are some marked differences compared to the 2003 survey that Alta conducted on behalf of Leaseurope as some of the anticipated activity failed to materialise. Our first reaction on analysing the results was that some countries and companies still believe their leasing business is ‘unique' – this is difficult to understand. It is clear that the prevailing areas and subjects of concern are common across Europe. Generally, companies are optimistic about their performance and prospects but not about their country's economy.”

The European leasing industry is mainly bank owned which explains why there was frequent reference to “the parent bank”, “servicing bank customers” and “the bank wants us to do this”. It also confirms that bank parents are very much in the driving seat of their leasing subsidiaries' activities and suggests increasing integration of leasing into the banks - in contrast with the 2003 survey.

In the current climate in Europe of depressed company earnings, pressure on short-term margins and fairly pessimistic GDP forecasts, Soper is surprised that almost all CEOs expect growth year on year for the next three years. He said: “If the business sentiment is correct, where will this growth come from? Looking into my crystal ball, my thoughts are that it could come from: new products and services, investment in more technology, mergers and acquisitions, banks thinking about exiting leasing and therefore selling their leasing businesses, or international expansion in new markets, not least of all places such as China and India.”

Regulation/supervision

Many CEOs believe that regulation or supervision is positive for their business, with supervision affording them protection from the outside world. There is almost universal support for Basel II and the forthcoming changes to the capital adequacy requirements, with improving asset quality anticipated as a positive outcome.

IAS17 - accounting for leases - does not feature as much of a concern, maybe because few CEOs have formed an opinion of the impact it will have on their business. It is surprising that there is little evidence of “new product” activity in the light of operating leasing portfolio implications.

Business prospects

Most CEOs are confident that the leasing market will grow during the next three years and, in an upbeat mood, no one expects a decline for the next three years. But where will growth come from - see table 1.

Table 1: Growth sources

Domestic 87%

Europe 67%

Outside Europe 19%

A change in direction 13%

Other new services 21%

Acquisitions 24%

Margins remain a perennial problem with most CEOs anticipating a reduction in the short to medium term and over two thirds of respondents believing that leasing produces an unsatisfactory return on capital. Looking further ahead, there is some optimism that longer-term margins will improve but no one is advocating better margins from increased services – or perhaps this is secret.

Human resources

A shortage of quality staff over the coming years is exercising CEOs' minds. There is a very strong trend of reducing the size of the back office and increasing the number of sales and customer facing support staff as well as a growing reliance on bringing in staff from the parent bank.

Top of the list of training requirements that are seen as contributing most to the success of the business are: basic leasing skills for new staff, selling and marketing, training the vendor and asset management.

The IT conundrum

There is still little evidence of e-commerce delivery although a quarter of CEOs are planning to do so. The software spend is increasing significantly but there were many negative comments, for example, “no good suppliers”, “the spend is mostly about Basel II” and “takes too much management time”. This suggests that CEOs know that they have to commit resources to IT but do so reluctantly.

Ends

ABOUT THE ALTA GROUP

The Alta Group, established in 1992, provides a broad array of strategic consulting and advisory services, education and training programmes, merger and acquisition and dispute resolution services for companies in the global equipment leasing and asset finance industries. Its clients include manufacturers, banks, independent lessors of various sizes and others in the industry. The Alta team is made up of more than 25 international professionals committed to the asset finance business, including former CEOs, company founders and industry thought leaders who are active in their areas of expertise. They collaborate and share their in-depth knowledge and insights with today's business leaders who face a range of challenges, both old and new. The firm has built a reputation on creative thinking, trust and professionalism. The Alta Group supports clients in North America, Latin America, Europe and the Middle East, as well as Greater China and Asia Pacific. For more information, visit www.thealtagroup.com

MEDIA CONTACTS

Margaret Waldren, MW Links

+44 (0)1372 277772

margaret@mwlinks.com

Derek Soper, The Alta Group

+44 (0)1444 891344

dsoper@thealtagroup.com

[headlines]

###Press Release##########################

BBB & Equifax to Help Military Families Guard their Credit

Equifax Sponsors Better Business Bureau MILITARY LINE Program

ATLANTA, GA and Arlington, VA -- Equifax Inc. (NYSE:EFX) and the Council of Better Business Bureaus (CBBB) have joined forces to equip America's military personnel and their families with resources to help them protect their credit health and guard against identity theft. Through its relationship with the CBBB, Equifax is sponsoring the BBB MILITARY LINE Program and helping military families safeguard their personal information – no matter where duty takes them.

“Equifax has teamed with the Better Business Bureau system as part of its ongoing commitment to educate consumers about the value of credit management,” said Thomas F. Chapman, Equifax Chairman. “By supporting the BBB MILITARY LINE, we are offering America's military personnel and their families promotions on Equifax Personal Solutions credit management products to help them protect their identities.”

The goal of the BBB MILITARY LINE program is to provide consumer education and advocacy for military families, who can be easy targets for scam artists and less-than-ethical business people.

“Through BBB MILITARY LINE, we are marshalling the resources of the Better Business Bureau system and private sector partners to provide valuable consumer tools that will support strong decision-making by service members and their families,” said Steven J. Cole, president and CEO of the Council of Better Business Bureaus. “Teaming with Equifax enables us to put the latest credit education resources in the hands of military families– inspiring them to become champions of their financial well-being and to take control of their credit.”

Military families can easily link from the BBB MILITARY LINE site (http://military.bbb.org) directly to Equifax's credit education Web site (www.mycrediteducation.com), a comprehensive resource designed to give consumers access to credit management tools, tips and advice. The Web site features a wealth of information, including tutorials on topics such as guarding against identity theft, managing your credit and preparing for a major purchase.

Site visitors can purchase Equifax credit monitoring services to alert them to key changes in their credit report. Among these offerings are online credit monitoring services such as Equifax Credit Watch™ Gold and Equifax Credit Watch™ Gold with 3-in-1 Monitoring.

Service members and their families, like other American citizens, are “vulnerable to having their identities stolen and their hard-earned good names compromised,” said Holly Petraeus, a military spouse and vocal advocate for military families who serves as a senior program consultant for BBB MILITARY LINE. She noted that the CBBB's initiative with Equifax “will help to provide expert advice on important steps that military families can take to help keep their personal information out of the hands of identity thieves – giving them one less thing to worry about on the home front.”

About Equifax ( www.equifax.com )

Equifax Inc. is a global leader in turning information into intelligence. For businesses, Equifax provides faster and easier ways to find, approve and market to the appropriate customers. For consumers, Equifax offers easier, instantaneous ways to buy products or services and better insight into and management of their personal credit.

Equifax. Information that Empowers.

About the Better Business Bureau (www.bbb.org)

The Better Business Bureau (BBB) system is dedicated to fostering fair and honest relationships between businesses and consumers, instilling consumer confidence and contributing to an ethical business environment, in both the traditional and online marketplaces. The first BBB was founded in 1912, and the network of BBBs and the Council of Better Business Bureaus have grown to become the most recognized advocate for promoting ethical business and advertising practices, providing more than 60 million instances of service to consumers and businesses in 2004. BBBs in the U.S. and Canada are supported by 375,000 business members throughout North America.

[headlines]

###Press Release##########################

Federated Financial Corporation of America announces

expansion of Commercial Portfolio Servicing Division

Farmington Hills, MI – Federated Financial Corporation of America (FFCoA), a leader in commercial financing, announced the acquisition of $110.0 million in distressed commercial loan and credit card paper.

Commenting on FFCoA's rapid growth and expansion in debt portfolio acquisitions, Joan Flees, vice president of portfolio services, attributes the immediate success “to our financial strength, strong operating systems and experienced staff. We have the flexibility to structure a one-time purchase or enter into a forward flow agreement at competitive rates, since we have no limit when it comes to the type or size of a transaction.”

FFCoA's services division is comprised of a collection and servicing organization that also owns a $150 million commercial vehicle and small ticket lease portfolio.

About Federated Financial Corporation of America

Federated Financial Corporation of America (FFCOA) develops and nurtures companies that are shaping the future of business in the United States. Founded in 1974, FFCOA operates diverse strategic business groups. FFCOA combines a unique mix of financial strength, vision and the ability to expand in new markets with remarkable in-house talent and proven expertise in growing our businesses into marketplace leaders. FFCOA is considered an expert in the areas of transportation finance, investment, outsourced business solutions and technology services, which include deployment solutions. For further information, visit www.federatedcapital.com.

[headlines]

###Press Release##########################

LexisNexis Risk Management Engages With Better Business Bureau

To Help Verify Validity Of Small Businesses

New Product Links Users To Better Business Bureau Reports On Companies

Arlington, VA -- The Better Business Bureau® (BBB) and LexisNexis, a leading provider of legal, news and business information services, announced a strategic relationship with Accurint® Business, an innovative information portal that provides reliable business intelligence on small-to-midsize businesses.

The relationship will enable Accurint Business users to link directly to BBB reports when conducting due diligence on small and medium-sized companies. The technology enables companies to quickly locate, investigate and verify the validity of potential customers, vendors, contractors, partners and competitors. In doing so, users can research whether a particular company is a member of the BBB and obtain a BBB Reliability Report, which includes an analysis of consumer complaint activity or actions that might impact a company's customer relations, on any listed company (member or non-member).

"It is extremely important today to know who you are doing business with," said Jim Swift, chief operating officer of LexisNexis Risk Management. "Accurint Business allows companies to quickly obtain reliable business intelligence that verifies the validity of smaller businesses. And by having access to BBB reports, our customers can trust that they have an extra level of transparency on small companies."

Accurint Business accesses thousands of data sources to verify a company's existence and provides BBB membership and complaint information. Accurint Business also provides information about the company such as corporate filings, tax liens and civil judgments, bankruptcy filings, property ownership and people and other businesses connected to that company.

"The small business community plays a vital role in feeding the nation's economic engine," said Charlie Underhill, senior vice president of the Council of Better Business Bureaus. "Through resources such as Accurint Business, companies will now have quick access to trusted information on our members, as well as access to BBB Reliability Reports on any non-member company for which the BBB has information."

Established in 1912, the BBB is supported by over 375,000 businesses that make up its North American membership. BBB member companies must adhere to strict standards, including supplying information about the company's founding, its principals, location and customer service contact; agreeing to promptly respond in good faith to customer complaints and to adhere to BBB standards of advertising and selling; and, fulfilling all licensing and bonding requirements. Through Accurint Business, companies can quickly verify BBB membership or research the business's complaint history.

About Better Business Bureau

The BBB system is dedicated to fostering fair and honest relationships between businesses and consumers, instilling consumer confidence and contributing to an ethical business environment, in both the traditional and online marketplaces. The first BBB was founded in 1912, and the network of BBBs and the Council of Better Business Bureaus have grown to become the most recognized advocate for promoting ethical business and advertising practices, providing more than 60 million instances of service to consumers and businesses in 2004. The BBBs Internet self-regulation program, BBBOnLine (http://bbbonline.org), helps consumers identify online merchants that meet BBB standards through its Reliability and Privacy "trustmark" programs, and the BBB Code of Online Business Practices. Better Business Bureaus in the U.S. and Canada are supported by 375,000 business members throughout North America.

About LexisNexis

LexisNexis® (www.lexisnexis.com) is a leader in comprehensive and authoritative legal, news and business information and tailored applications. A member of Reed Elsevier Group plc (NYSE:ENL - News; NYSE:RUK - News; www.reedelsevier.com), the company does business in 100 countries with 13,000 employees worldwide. In addition to its flagship Web-based Lexis® and Nexis® research services, the company includes some of the world's most respected legal publishers such as Martindale-Hubbell, Matthew Bender, Butterworths, JurisClasseur, Abeledo-Perrot and Orac.

For more than 30 years, LexisNexis has been a pioneer in secure data sharing, information policy, and personal privacy. Through its risk management flagship products, Accurint®, Banko®, RiskWise®, and PeopleWise®, LexisNexis helps to locate people and assets, authenticate identity, enable commerce, conduct background screening, and support national security initiatives. Customers include almost every Federal Government agency, the top 100 law firms, and Fortune 500 companies in the fields of national security, financial services, collection and recovery, insurance, telecommunications, e-commerce and retail.

LexisNexis and the Knowledge Burst logo are registered trademarks and LexisNexis Risk Management is a trademark of Reed Elsevier Properties Inc., used under license. RiskWise is registered trademark of LexisNexis Public Records Data Services Inc.. Banko is a registered trademark of LexisNexis Public Records Services Inc. Other products or services may be trademarks or registered trademarks of their respective companies.

[headlines]

###Press Release##########################

Main Street National Bank Opens Midwest Regional Equipment Leasing Office

Kingwood, TX— Main Street National Bank, Kingwood, Texas announces the opening of its Midwest Regional Equipment Leasing Office in Oakbrook Terrace, Illinois to serve the equipment leasing industry.

The office will provide small ticket commercial lease and loan financing to vendors, leasing companies and lease brokers in the Chicago metropolitan area and the Midwest.

Staffing the office are Regional Sales Managers, Ron Smith and Ed O'Keeffe, who have over 39 years of experience in the equipment leasing industry. The Chicago office will report to Kevin Kepp, SVP National Sales.

Tom Depping, Chairman of Main Street National Bank stated: “Ron and Ed are seasoned leasing industry veterans and will be a great asset to Main Street. We plan to continue to add sales representatives to the Chicago office with the long-term goal of making Chicago a significant part of our lease originations.”

Main Street National Bank, a federally insured bank established in 1984, maintains banking offices in the Houston, Texas market and equipment lease sales offices in seven locations across the country.

For More Information Contact:

Ron Smith or Ed O'Keeffe

rsmith@msnbank.com

eokeeffe@msnbank.com

Two Mid America Plaza, Suite 800

Oakbrook Terrace, Illinois 60181

Phone 630-873-3570

Fax 281-348-2974

[headlines]

###Press Release##########################

----------------------------------------------------------------

Today's Top Event in History

1864 - Battle of Darbytown Road, Virginia

In the summer of 1864, the campaign between Lee and Union General Ulysses S. Grant ground to a halt at Petersburg, 25 miles south of Richmond. Seeking to halt the march to Richmond, Lee sent two divisions under Generals Charles Field and Robert Hoke to move around the end of the Union line and attacked 1,700 cavalrymen. The assault sent the Yankees into a quick retreat. The Confederates captured eight cannons and drove the Union troopers into the breastworks of General Alfred Terry. Alerted to the advancing Confederates, Terry summoned reinforcements to his position. By the time the Confederates worked their way through the thick foliage, they faced a strong Union force. Lee ordered an attack anyway. Brigades advanced one at a time, and the Yankee artillery tore the lines apart. By the afternoon, the Confederates withdrew to their original position. They lost 700 men while the Yankees lost only 400, and no ground was gained. Lee did not make another attempt to regain the ground and focused instead on setting up defenses closer to Richmond. (there seems to have been several skirmishes around Darbytown Road, but here is from the writing on a solider of the Fourth Oneida Regiment, New York, who was at the scene: “Efforts by the rebel forces to retake Fort Harrison on the 30th were not successful. General Grant decided not to renew the attack on the 30th, ordering the Army of the James to maintain its defensive position in preparation for General Lee's subsequent unsuccessful counterattack,” that followed.

http://www.117nyvi.org/reghist.htm

http://www2.cr.nps.gov/abpp/battles/va077.htm

[headlines]

----------------------------------------------------------------

This Day in American History

1728-Birthday of Rodney Caesar, singer of the Declaration of Independence, most famous for his midnight ride. Rodney's ride ended up at the doorstep of Independence Hall where he cast the decisive Delaware vote for Independence.. Born near Dover, DE, he died June 26, 1794. Rodney is on a quarter issued by the US Mint in 1999, the first in a series of quarters that will commemorate each of the 50 states.

http://www.ushistory.org/march/bio/rodney.htm

http://www.colonialhall.com/rodney/rodney.asp

http://www.state.de.us/facts/history/rodnbio.htm

1777-In the second Battle of Bemis Heights, near Saratoga, NY, the Americans routed a force of some 1500 British. Benedict Arnold was wounded while attempting to force an entrance into the Hessian camp, and British Gen. Simon Fraser was killed.

1780-British and Tory forces were defeated at King's Mountain, South Carolina, by Americans under Col. William Campbell, Col. Isaac Shelby, and Col. Benjamin Cleveland. The British commander, Maj. Patrick Ferguson, and 160 others, were killed. Nearly 800 prisoners were taken.

1821-Birthday of William Still, chronicler of “The Underground Railroad Records,” born near Medford, in Burlington County, N.J

http://www.undergroundrr.com/stillbiofr.html

http://www.undergroundrr.com/firstfamily.html

1832- Birthday of Charles Converse, American lawyer and sacred composer. Converse penned the hymn tune CONVERSE, to which we sing today "What a Friend We Have in Jesus."

http://www.cyberhymnal.org/bio/c/o/converse_cc.htm

1833- Margaret Fox - U.S. spiritualist birthday. Along with her younger sister Catherine (1839) , they are both said to have invented the field of spiritualism. At least they were among the most popular and much sought-after spiritualists of the era of table tapping and sounds from the dead. Later in life Margaret turned to religion and sister Catherine recanted spiritualism and then recanted her recanting. As teen-agers they appeared to have attracted poltergeist-like manifestations. The primary divination method used by the Fox sisters in séances was table tapping - a method in which those in the spiritual (after death) realm used tapping sounds on the table, the walls and the floor to communicate. According to tradition, one of the sisters was able to snap her big toe on the floor to create the tapping sound. Horace Greeley was convinced the sisters were authentic and they got the backing of his New York Tribune. Later in life Margaret Fox revealed it started out as a game and turned into outright charlatan.

http://psychicinvestigator.com/demo/Foxtxt.htm

1849 - Birthday of American Poet James Whitcomb Riley; died July 22, 1916.

http://www.jameswhitcombriley.com/

1864- Naval Engagement at Bahia Harbor Brazil-CSS Florida vs USS Wachusett The Union warship Wachusett captures the famed Confederate raider Florida while the Rebel ship is in port at Bahia, Brazil. After the Yankee crew sailed the Florida out to sea, the Brazilian government protested the invasion of its neutrality. The Union returned the ship and crew to the Confederate government, but the Florida sunk six weeks later off Hampton Roads, Virginia.

http://www.csa-dixie.com/Liverpool_Dixie/exhib.htm

1864 - Battle of Darbytown Road, Virginia

In the summer of 1864, the campaign between Lee and Union General Ulysses S. Grant ground to a halt at Petersburg, 25 miles south of Richmond. Seeking to halt the march to Richmond, Lee sent two divisions under Generals Charles Field and Robert Hoke to move around the end of the Union line and attacked 1,700 cavalrymen. The assault sent the Yankees into a quick retreat. The Confederates captured eight cannons and drove the Union troopers into the breastworks of General Alfred Terry. Alerted to the advancing Confederates, Terry summoned reinforcements to his position. By the time the Confederates worked their way through the thick foliage, they faced a strong Union force. Lee ordered an attack anyway. Brigades advanced one at a time, and the Yankee artillery tore the lines apart. By the afternoon, the Confederates withdrew to their original position. They lost 700 men while the Yankees lost only 400, and no ground was gained. Lee did not make another attempt to regain the ground and focused instead on setting up defenses closer to Richmond. (there seems to have been several skirmishes around Darbytown Road, but here is from the writing on a solider of the Fourth Oneida Regiment, New York, who was at the scene: “Efforts by the rebel forces to retake Fort Harrison on the 30th were not successful. General Grant decided not to renew the attack on the 30th, ordering the Army of the James to maintain its defensive position in preparation for General Lee's subsequent unsuccessful counterattack,” that followed.

http://www.117nyvi.org/reghist.htm

http://www2.cr.nps.gov/abpp/battles/va077.htm

1884-Oct 7

Another point of fact, the first black major league baseball player was Moses Fleetwood Walker, who played for Toledo in the American Association.

http://www.oberlin.edu/external/EOG/OYTT-images/MFWalker.html

http://www.nlbpa.com/walker__moses_fleetwood.html

History

1868-Cornell University welcomes its first student.

(lower half of:

http://memory.loc.gov/ammem/today/oct07.html

1887-Birthday of African-American sculptor Sargent Johnson.

http://www.ijele.com/ijele/vol1.2/montgomery.html

http://www.ijele.com/ijele/vol1.2/images1.2/mont/index.htm

http://www.artcyclopedia.com/artists/johnson_sargent_claude.html

1896---Down Jones began reporting an average of the prices of 13 industrial stocks in the wall Street Journal. In the early years, these were largely railroad stocks. In 1928, Mr. Dow expanded the number of stocks to 30, where it remains today. Today, the large, frequently-traded stocks in the Down Jones Industrial Average represent about a fifth of the market values of all US stocks.

1905 -- Meyer Levin born Chicago, Illinois. His 1956 novel, Compulsion, based on the Leopold and Loeb murder trail, earned him enough money to devote nearly the rest of his life to an epic saga of modern Israel. It took him 15 years and resulted in two big novels, The Settlers and The Harvest.

http://www.geocities.com/meyerdotcom/

http://us.imdb.com/name/nm0505670/

1916-Georgia Tech University defeated Cumberland 222-0, in the most lopsided college football game of all time.

1924-Louis Armstrong's first session with the Fletcher Henderson Orchestra.

1925-Birthday of drummer Alvin Stoller, New York City

1940 - Artie Shaw's orchestra recorded Hoagy Carmichael's standard, "Stardust" -- for Victor Records.

1942 - "TIME" magazine described "Command Performance", which debuted this day, as “...the best wartime program in radio.” The show was originally produced by the U.S. War Department in cooperation with Armed Forces Radio Services specifically for those in the military overseas. It continued until 1949 and was reprised for more than three decades in syndication. "Command Performance" was hosted by Bob Hope, Bing Crosby, Don Wilson and Harry Von Zell and featured just about every major Hollywood and Broadway star.

1947-Top Hits

I Wish I Didn't Love You So - Vaughn Monroe

Feudin' and Fightin' - Dorothy Shay

I Wonder Who's Kissing Her Now - Perry Como

Smoke! Smoke! Smoke! (That Cigarette) - Tex Williams

1950-U.S. forces invaded North Korea across the 38th parallel. The first tank crew to cross was a patrol of the 1st Cavalry Division that crossed into the Kaesong Area, about 85 miles south of the Communist capital of Pyonsang, at 3:14pm. The crew members were Sergeant Homer Lee of Evansville, IN, Private First Class James Emerich of Sutton,WV, Sergeant Walter Hill of Fairmont,ND, Sergeant Charles Gissendanner of Autaughville,AL, and Corporal Clarence Johnson of Taylorsville, NC. the 38th parallel was the line of latitude that had divided North Korea form South Korea since the end of World War II.

1950-“The Frank Sinatra Show” premiered on TV. Singer Frank Sinatra's first series was a musical variety show featuring regulars Erin O'Brien and comic Ben Blue. However, during the last season this show was cut from an hour to 30 minutes at it could not compete with “The Texaco Start Theater” with Milton Bearle, the most popular TV show of the time.

1955- The religious drama 'Crossroads' first aired over ABC television. An anthology which dramatized true experiences of clergymen of all denominations, the program ran for two years.

http://www.tvtome.com/tvtome/servlet/EpisodeGuideSummary/showid-7969/season-all

1955-Top Hits

Love is a Many-Splendored Thing - The Four Aces

Autumn Leaves - Roger Williams

Moments to Remember - The Four Lads

The Cattle Call - Eddy Arnold

1956 - A U.S. House subcommittee began investigations of allegedly rigged TV quiz shows.

1960- "Route 66" premieres. Each week from 1960 through 1964, the “Route 66” television show came into the living rooms and dens of American homes. The series, written by Stirling Silliphant, tracked the adventures of two young men traveling down Route 66. The two drove from town to town along the route in a 1960 Chevrolet Corvette. The series, which lasted four seasons, shot a total of 116 episodes, 36 per year at 36 different locations every year. Before the “route 66” show became history in 1964, the show compiled an incredible 20.1 average rating, making it one of the highest rated shows of that time. Originally starring George Maharis as Buz Murdock and Martin Milner as Tod Stiles. Maharis left the show in midseason to be replaced by Glenn Corbett as Linc Case. The stories centered around their travels on Route 66 in their corvette convertible, working at odd jobs and helping people, searching for adventure. Jazz was played predominately as background music. The theme was written by Bobby Troupe and became a hit song again.

http://www.tvtome.com/Route66/

http://www.route66products.com/home.html

http://www.autobahn.mb.ca/~gardners/BobbyTroup.htm

1963-Top Hits

Blue Velvet - Bobby Vinton

Be My Baby - The Ronettes

Sugar Shack - Jimmy Gilmer & The Fireballs

Abilene - George Hamilton IV

1968-The movie industry adopts a film ratings system for the first time. The initial ratings were G (for general audiences), M (for mature audiences), R (no one under 16 admitted without an adult), and X (no one under 16 admitted). 1990, the Motion Picture Association of America replaced the X rating with NC-17, after its Code and Ratings System Administration gave 10 mainstream films the X rating. NC-17 was designed to indicate a non-pornographic film with sexual content that might be inappropriate for viewers under 17.

1973 - 40,000 football fans failed to use their pro-football tickets, opting instead to watch games on TV since legislation was signed lifting blackout rules of games. It was not soon after that the league re-introduced the “black out” rule if a game did not sell a certain percentage of tickets.

1975-Military service academies' enrollment of women was authored by an act of Congress,” to insure that female individuals shall be eligible for appointment and admission to the service academies beginning with appointments to such academy for class being inning in calendar year 1976.”

1979-The the final day of the fall round up and trail drive for the Ninety-Six Ranch. The Ninety-Six lies along Martin Creek, a tributary of the Little Humboldt River in the upper section of Paradise Valley, Humboldt County, Nevada. Know it very well as my late wife was from this area and we would visit her mother who ran a restaurant near here, and owned land adjacent to Martin Creek in Paradise Valley, where she wanted to retire. (She lives today at 94 in Lamoille, Nevada and still has plans of moving her trailer to Paradise Valley.)

http://memory.loc.gov/ammem/today/oct07.html

1982-Cats opened n Broadway—The longest-running production in Broadway history. Cats was based on a book of poetry by T.S. Eliot and had a score by Andrew Lloyd Webber. More than 10 million theatergoers saw the New York City production, which closed September 10,2000, after 7,485 performances. Cats was also produced in 30 other countries.

1984-Running back Walter Payton of the Chicago Bears broke two records held by Jim Brown in the same game. He passed the mark of 12,312 career rushing yards and rushed for 100 yards or more for the 58th time in his career as the Bears beat the New Orleans Saints, 20-7.

1985-Lynette Woodland, captain of the gold-medal-winning US basketball team of the 1984 Olympics was selected to be the first woman to play for the Harlem Globetrotters.

http://www.harlemglobetrotters.com/history/tl_1985.html

1987-Top Hits

Didn't We Almost Have It All - Whitney Houston

Here I Go Again - Whitesnake

Lost in Emotion - Lisa Lisa & Cult Jam

You Again - The Forester Sisters

1988 -Dallas Green replaces Lou Pinella as NY Yankee manager

1988- Robin Givens files for divorce after 8-month marriage to Mike Tyson

1993 - Toni Morrison was awarded the Nobel Prize in literature. She was the first black woman to received the award and one of America's most significant novelists of the twentieth century. She is the Author of six major Novels, "The Bluest Eye", "Sula", "Song of Solomon", "Tar Baby", "Beloved" and "Jazz". "Song of Solomon" won the National Book Critics Circle Award in 1977 and "Beloved" won the Pulitzer Prize in 1988.

World Series Champions This Date

1933 New York Giants

1935 Detroit Tigers

1950-New York Yankees

1952-New York Yankees

[headlines]

Finance: Chicago, IL

Finance: Chicago, IL