|

|

Baltimore - Washington area

Lease Representative

M&T Bank is seeking an in-market lease representative to develop and maintain relationships with broker/lessors, equipment vendors, and direct lessees throughout Maryland and Northern Virginia. Must be knowledgeable small ticket leasing ($75K average ticket) and third-party lease/loan transactions. Please apply on-line at www.mandtbank.com and view posting #4044.

At M&T Bank, we provide and exciting and challenging work environment where performance and innovative thinking is encouraged at every level. With over 700 branches, your career can travel as far as you take it!

|

|

Wednesday, September 14, 2005

Headlines---

Classified Sales---Senior Management

Archives-September 13, 2001-Dushay/Old Kent

Cartoon---Most Sales Calls

"Sales Makes the Profits"--"Me Too" Players

Classified Ads---Help Wanted

Leasing Conference Latest Up-dates

"Story Credit" Funder List

"Funder Only" List

"Super Broker" List

News Briefs---

You May Have Missed----

"Gimme that Wine"

Today's Top Event in History

This Day in American History

Baseball Poem

######## surrounding the article denotes it is a "press release"

Note: The American Flag is at half-mast as President George W. Bush has ordered the US flag to be flown at half-mast on all government buildings and by the U.S. military until September 20th as a mark of respect for the victims of Hurricane Katrina.

Classified Sales---Senior Management

Some of these are currently employed, but would like their ad remaining. They do consulting, take on private assignments, have "temporary" positions, but are seeking a management position. They may be open for "temporary" or "consulting" positions, and employers may want to consider that.

Baltimore, MD

25 year veteran of commercial and equipment leasing seeking a senior management position with leasing or asset based financing company in the southeast (Florida preferred)

Email: kellogg_md@yahoo.com

Denver, CO.

Fortune 500 GM/SVP wants to team up with aggressive lender looking for Western expansion mid-market equip. finance/leasing. 20+ years experience within Rocky Mountain/Southwest and Ca markets.

Email: legal@csotn.com

Hope, NJ.

25 years in optimizing call center operations, collections, billing, and back end revenue generation. Experienced in $7 + billion dollar portfolios. Verifiable achievements.

E-mail: cmate@nac.net

Irvine, CA.

Credit executive, portfolio manager and syndication facilitator. Extensive business building experience in small and mid-ticket operations. Highly innovative. Fortune 100 audit and technology skills. Bottom-line manager.

Email: lenhubbard@bigfoot.com

Jacksonville, FL.

15+yrs Collections/Customer Service Expert. InfoLease, CARMS,managed staffs excess 100 VERY successfully - will relocate WITHIN Florida for right position ~ SIMPLY THE BEST

Email: rafftink@aol.com

Lawton, OK.

Twenty years, I have been the President of Cash Financial Services. I sold my loan portfolio. Resume.

email: bobmooreok@email.com

Long Island, NY

Degree Banking/Finance. 13 years leasing exp. Now prez young leasing company where promises were not met. Interested in joining established firm with future.

Email: bob33483@yahoo.com

New York, NY, NJ, Ct Tri-State

Top Exec. middle and big ticket, top skills treasury,funding, ops,transaction detail, syndication, ready to max profit, help build quality operation. right now!

E-Mail: leasefinance@optonline.net

Orange County, CA

25+ years experience large ticket equipment finance companies and commercial banking. Operations, documentation, legal, credit, workouts, portfolio management. $2+Billion portfolio. Seeking CFO, COO or similar.

Email: finance1000@cox.net

Philadelphia, PA.

27 yrs. exp. sales, ops., credit, strategy, P&L mngmet. Most recently created & executed the biz plans for 2 highly successful Bank-owned small ticket leasing subsidiaries.

email: mccarthy2020@comcast.net

Portfolio Management Consultant ;

25+years experience in Collections, Customer Satisfaction, Asset Management, Recoveries, Continuous Process Improvement, Back end Revenue Generation, Cost per Collection Analysis. $5+Billion Portfolio expertise.

Email: efgefg@rogers.com

Salt Lake City, UT

GM in Sales, Marketing & Operations for Several technology captives. Seeking new adventure in Western States. Consultant of full time.

Email: stevegbdh@hotmail.com

San Francisco, CA .

25 years experience w/global leasing company, sales,marketing,business dev., P&L responsibility, asset mgmt, brokering and re-marketing. Interested in joining an est. firm with a future.

Email: rcsteyer@yahoo.com

Syracuse, N.Y.

Int. equip. leasing exec. 25 yrs global P&L sr. mngt., including corporate turnarounds, strategic planning, new biz dev., structure finance, contract neg., vendor leasing specialist.

Email: jimh356094@aol.com

Wilmington, DE.

Over 15 years experience managing Credit, Risk Management and Fraud operations for large Financial Institution. Proven Results. Anywhere between NYC and DC for right opportunity.

Email: cklous@comcast.net

For a full listing of all "job wanted" ads, please go to:

http://216.66.242.252/AL/LeasingNews/JobPostings.htm

To place a free "job wanted" ad, please go to:

http://216.66.242.252/AL/LeasingNews/PostingForm.asp

[headlines]

---------------------------------------------------------------

Archives-September 13, 2001-Dushay/Old Kent Communications was being restored in New York City, and we learned some of our leasing friends were okay, such as Phil Dushay of Global Leasing, good news, but there also was bad news in other parts of the country:

"I was recently let go by Old Kent Leasing in Chicago after Old Kent Financial Corporation was acquired by Fifth Third Bank. The leasing division was dissolved and all of us were out of a job.

" I can tell you that nearly all of the employees including myself found their new positions by Networking. I did not find my position through a recruiting firm, internet, or local classifieds. Call your contacts at other leasing companies,brokers and even vendors. I am actually working for a vendor now managing all of their leasing and working with their sales staff. While I am no longer a lessor, I am still in touch with all the lessors because I now need them for funding.

" You would be surprised at just how many people you know in the industry when the word gets out that your business has closed.

Our country is going through a very tough time economically and emotionally in light of the recent tragedy. Realizing that the last thing people need now is to be unemployed on top of all this, don't let it make you feel you need to drop out of society. There are jobs for leasing professionals out there, they just may not be with a leasing company. Hang in there.

"Regards,

"Susan M. Adamatis

"( The classified section is in prototype and hopefully will be on line by as early as the end of next week. editor )"

[headlines]

---------------------------------------------------------------

Cartoon---Most Sales Calls

[headlines]

---------------------------------------------------------------

Legacy of Top Gun

"Me-too" players

"Sales Makes it Happen"

I remember sitting in my office over a period of years when sales representatives from a well known, Midwest funding source visited me at least four times during any given year. They all were young, bright, enthusiastic salespeople who I would love to have invited to a holiday party. They were not, unfortunately, of much value to me in the business. Why? They and their company were "me too" players who suffered from a lack of real identity.

After exchanging obligatory pleasantries, the sales reps would invariably ask the same question: "So, how can we do more business with your company?" My reply would always be the same: "You're the fundor, you should know this business better then me. You're from the " show me state ," so why don't you show me how to increase the business I do with you? The polite, young salespeople would laugh nervously.

I explained that a significant percentage of our business was done with another large, well known funding source, then located in the Pacific Northwest. They were stable, had competitive pricing, though not always the lowest by any means, had predictable credit and funding policies, were responsive and were, above all, highly predictable and dependable. What else could I want?

The nice salespeople from the Midwest fundor did their best to then "pitch" me. "We're stable and our pricing is competitive too, they would say. Our credit and funding policies are competitive too! We're responsive, highly predictable and dependable too! And, we're nice people, too!" Me too, me too, me too! What they may never have realized is that without differentiation, they looked like they were trying their best to look exactly like their major competitor!

Customers aren't likely to switch their allegiance from their current suppliers to your company if you appear to be the mirror image of your competitors. It's always difficult to truly stand out from the competition, but failure to do so sounds the death knell for countless firms. Next week we'll explore a process for creating differentiation by identifying your company's "exclusive strengths."

|

|

|

[headlines]

---------------------------------------------------------------

Classified Ads---Help Wanted Lease Representatives

|

|

Baltimore - Washington area

Lease Representative

M&T Bank is seeking an in-market lease representative to develop and maintain relationships with broker/lessors, equipment vendors, and direct lessees throughout Maryland and Northern Virginia. Must be knowledgeable small ticket leasing ($75K average ticket) and third-party lease/loan transactions. Please apply on-line at www.mandtbank.com and view posting #4044.

At M&T Bank, we provide and exciting and challenging work environment where performance and innovative thinking is encouraged at every level. With over 700 branches, your career can travel as far as you take it!

|

|

National Account Manager

|

National Account Manager

Position located/based anywhere in the U.S.

3-5 years vendor finance/sales experience

For a full description and how to apply,

click here.

|

|

National Program Skills

|

National Program Skills, San Francisco

Daily management national program accounts/support V.P. National Programs Min. 3 yrs leasing exp. understand credit/financial/tax returns w/strong follow-up, great opportunity to grow, to learn more, click here.

|

|

Salesperson

|

"Tired of working for a broker or discounter at inflated buy rates?"

We are a direct nationwide funder.

Decisions are made here on "application only" up to $125,000. We are fast, too, and we will keep your vendors and customers happy with our efficient staff.

Contact Jim Doster sales@abanklease.com

"We want you to make as much money as you can."

|

|

Vendor Relationship

|

Director, Vendor Relationship Development: Office Equipment Group.

Accountable for originating/ maintaining volume from large Office Equipment dealers. Preferred locations - SW and Mid-Atlantic. Full descrip/to Apply, Click here

GreatAmerica is a highly successful entrepreneurial company providing equipment financing to businesses across the United States. |

|

[headlines]

----------------------------------------------------------------

The Leasing Library

All the conferences have been up-dated, with the latest information, including a note from Scott Wheeler on the joint EAEL/NAELB Conference, the UAEL Conference up-date from Chairman Randy Haug, and ELA focus by Lesley Sterling, plus AGLF brochure. editor

Leasing Association Conferences-Fall, 2005

Eastern Association of Equipment Lessors

September 19th, Teaneck, New Jersey

Places* Lights*.. Action

The stage has been set and the Action is about to start

"Fall Expo 2005"

Monday Sept 19th - Marriott Teaneck , NJ.

(Sponsored by EAEL in partnership with NAELB)

Here are The Facts:

- Forty-One (41) Exhibitors

- We have in excess of 280 confirmed registered

participants as of 9/13/05 and more are expected

by the day of the event. 300+ anticipated

- The Action will begin with a Tailgate Gathering

on Sunday afternoon 3:00

- A packed Exhibit Hall all day Monday the 19th

- Nine (9) Excellent Break out Session

- Two (2) Keynote Speakers

- Plenty of new Faces

- Business Opportunities - and new business

relationships will be Forged.

If you need any last minute information or if you still need to register visit www.eael.org or call the EAEL office at 212-809-1650.

WE LOOK FORWARD TO SEEING YOU AT "FALL EXPO 2005"!!!!!!!!!

Scott A Wheeler

Vice President - Sales

800 365 6566

Fax: 410 472 2005

53 Loveton Circle

Sparks Maryland 21152

Information on the key speakers:

http://www.eael.org/keymote-speakers-sept2005.asp

For Agenda and Registration, please go here:

http://www.eael.org/doc/Attendee_Registration_2005.pdf

For Exhibitor Registration

http://www.eael.org/doc/EAEL2005%20brochure.pdf

------------------------------------------

National Assocation of Equiment Leasing Brokers

joins with Eastern Association of Equipment

Lessors for Fall Expo 2005

September 19th, Teaneck, New Jersey

NAELB Registration form:

http://www.naelb.org/associations/2004/files/Attendee_Registration_2005.pdf

-----------------------------------------

"I know that the UAEL is very happy with the number of attendees that have registered. We are expecting a "Full House" for this event next week In beautiful Lake Tahoe.

"I would say that while Ceasers is sold out, there are still limited rooms available at hotels in the near vicinity. Joe Woodley and his staff have been working their tails off trying to accommodate all that want to attend. Even if you have to stay "down the street", this conference is a must attend event for those broker / lessors that are looking to improve their business. The conference theme pretty much sums it up. Peers,Processes, Practices and Profitability. The speakers are excellent (Joe Lane, with the Equipment Lease and Finance Foundation, and Col. Schaefer, Iran hostage ). With everything there is to offer in education and industry roundtables, plus all the great funding sources and providers (over 60 strong) add in all the great networking opportunities and this conference has something that we can all be happy about...great value!

"I strongly believe in this business and see sunny days for those that make an effort to want to improve their business by being members of equipment leasing associations like the UAEL."

Best regards,

Conference Chairman

Randy Haug

Sr. Vice President

LeaseTeam, Inc.

(800)531-5086 x 1014

Our theme for this year is Peak Performance: Peers, Processes, Practices and Profitability. We have a great lineup of sessions, roundtables and panel discussions scheduled on interesting and diverse topics. We also have some good opportunities to network; Thursday night, welcome reception will take place on the deck of the Edgewood Country Club and the other of the events will also feature the exclusive buyout of the M.S. Dixie for the Saturday Sunset Dinner/Dance Cruise.

We are very excited about about two of the speakers we have line up this year. Colonel Tom Schaefer was an Iranian hostage for 444 days in 1979-1980. We also have Mr. Joseph Lane, Chairman of the Equipment Leasing and Finance Fundation, addressing our industry as our keynote speaker.

Col. Tom Schaefer

|

Joseph C. Lane

CEO of GE Technology Finance |

The view the complete brochure, click here.

-----------------------------------------

Equipment Leasing Association

October 23-24

44th Annual Convention

Boca Raton Resort & Club

Boca Raton, Florida

A non-member who has not attended the conference before is invited

to attend.

Registration and all information about the Annual Convention are now available on-line at http://www.elaonline.com/events/2005/annconv/

ELA’s 44th Annual Convention focuses on creating and managing value and performance.

By Lesley Sterling

Value is a subjective word. But it is a critical component of a company’s performance and health. The 2005 Special Edition of The McKinsey Quarterly on Value and Performance suggests that companies with a clear sense of value “...have a robust strategy, well-maintained assets, innovative products and services, a good reputation with customers, regulators, governments and other stakeholders and the ability to attract, retain and develop high-performing employees.” Sound like any of your companies out there? Equipment lessors who are most successful at creating value for customers, investors, parent company and employees strengthen their market presence and increase their opportunities for growth.

Sessions planned for the 44th Annual ELA Convention, scheduled October 23-25, 2005 at the Boca Raton Resort & Club in Boca Raton, Florida, address a wide variety of the dimensions critical to creating and managing value and performance. “Creating Value,” this year’s convention theme, implies that your company is successful because of greater knowledge, convenience or speed.

For the 44th time, everyone who is anyone in equipment leasing and finance will gather at the ELA Annual Convention. What brings them back? As the largest annual gathering of equipment leasing leaders, the ELA Annual Convention is a tremendous opportunity to meet with colleagues, conduct business and update your learning on the latest issues impacting your business. And perhaps most important of all…the ELA Annual Convention is one of the best ways to test your assumptions about your market segment, the economy, and opportunities for business development.

We invite you to review what’s in store for you in Boca Raton this year:

General Sessions

--The United States’ Place in the World Today--

A first-rate group of policy analysts have been invited to discuss America’s role in the world today. This formidable panel is comprised of the following individuals:

Richard Haass--Mr. Haass is president of the Council on Foreign Relations. Until recently, Richard Haass was director of policy planning for the Department of State, where he was a principal advisor to Secretary of State Colin Powell on a broad range of foreign policy concerns. Haass also served as U.S. Coordinator for policy toward the future of Afghanistan and was the lead U.S. Government official in support of the Northern Ireland peace process. For his efforts, he received the State Department’s Distinguished Honor Award. Previously, Ambassador Haass was vice president and director of foreign policy studies at The Brookings Institution.

Dr. Zbigniew Brzezinski--Dr. Brzezinski is a counselor with the Center for Strategic & International Studies, and the Robert E. Osgood Professor of American Foreign Policy at the Paul Nitze School of Advanced International Studies, Johns Hopkins University, Washington, DC. From 1977 to 1981, Brzezinski was National Security Advisor to President Carter. In 1981 he was awarded the Presidential Medal of Freedom for his role in the normalization of U.S.-Chinese relations and for his contributions to the human rights and national security policies of the United States.

General Brent Scowcroft (Ret.)--As president and founder of The Scowcroft Group, and one of the country's leading experts on international policy, Brent Scowcroft provides strategic advice and assistance in dealing in the international arena. Gen. Scowcroft has served as the National Security Advisor to both Presidents Ford and G.H.W. Bush. During his twenty-nine-year military career, West Point-graduate Scowcroft attained the rank of Lieutenant General and served as the Deputy National Security Advisor, Professor of Russian History at West Point; Assistant Air Attaché in Belgrade, Yugoslavia; Head of the Political Science Department at the Air Force Academy; Air Force Long Range Plans; Office of the Secretary of Defense International Security Assistance; Special Assistant to the Director of the Joint Chiefs of Staff; and Military Assistant to President Nixon.

Creating Pockets of Greatness

Jim Collins--Jim Collins is a student of enduring great companies—how they grow, how they attain superior performance, and how good companies can become great companies. Having invested more than a decade of research into the topic, Jim has authored or co-authored four books—including “Built to Last,” a fixture on the Business Week bestseller list for more than six years, and the New York Times bestseller, “GOOD TO GREAT: Why Some Companies Make the Leap…And Others Don’t.” His work has been featured in Fortune, The Economist, Fast Company, USA Today, Industry Week, Business Week, Newsweek, Inc., and Harvard Business Review.

Economic Realities: The World View

David D. Hale--David Hale is the Global Chief Economist for the Zurich Financial Services Group and its investment affiliates, advising the group’s fund management operations on the economic outlook and a wide range of public policy issues. Mr. Hale is a member of the National Association of Business Economists, the New York Society of Security Analysts, the Financial Instruments Steering Committee of the Chicago Mercantile Exchange and the Academic Advisory Board of the Federal Reserve Bank of Chicago. He writes on a broad range of economic subjects for such publications as The Wall Street Journal, The Far Eastern Economic Review, The Financial Times of London, The New York Times, The Nihon Kezai Shimbun, The Financial Analyst Journal, The Harvard Business Review, and Foreign Policy. Since 1990, he also has been a consultant to the United States Department of Defense on how changes in the global economy are affecting United States security relationships.

Breakout Session Sampler

Thirty concurrent breakout sessions have been planned, including the annual meetings of the six ELA Business Councils. Sessions selected for the 44th Annual ELA Convention describe one or more value propositions that are reflected in any of the following:

• Greater value for customers

• New ways of looking at customers

• How products are positioned or priced

• Differentiating your company from competitors

• Higher returns

• Greater market share

• Effective use of resources

• Personnel programs that add value

• Effective management of assets

• Risk management

• Optimizing changes in a new regulatory environment.

For a complete listing of the sessions planned, go to the ELA website: http://www.elaonline.com/events/2005/annconv/

"Business Growth through Customer Satisfaction—How to Make it Happen"

Attendees to this session will get a greater understanding of the role customer satisfaction plays in driving business growth, and will learn specific approaches to pursue better customer satisfaction in a variety of areas. In his more than 20 years working in financial services, Keith Kendall, VP & Managing Director, HP Financial Services, has developed a sense of what works. He maintains that there are three keys to successfully creating and maintaining value for the customer and therefore driving satisfaction: effective partnering, efficient processes, and customer dialogue. Kendall will outline the strategy of HP Financial Services in its pursuit of total customer experience (TCE) and how that has brought the organization squarely into a redesign of customer processes that is spawning new ways of working and driving positive results.

"Developing & Motivating a Sales Force that Creates Value"

This session highlights the value created by a well-trained, highly motivated sales force. Three organizations—a bank, an independent and a captive—will share how they organize, develop, motivate, evaluate and compensate their sales force. Issues discussed include: critical competencies; turning work activities into planned and tracked learning events; using collaborative simulation to improve performance; expanding the role of the sales force into strategic planning and portfolio performance; alignment strategies; processes; performance measurement initiatives; compensation methodologies; sales force structure; activity segmentation; assessment; training methods and performance measurement; importance of aligning captive and vendor sales force training programs with end user go-to-market strategies and financing offerings. Panelists include Paul Frisch, EVP, US Bancorp Equipment Finance, Inc.; Lynda Jackson, Principal, The Alta Group; Todd Karas, Managing Director, Bank of America; Gary Kempinski, VP, Business Development, GE Commercial Finance; and Chuck Thomas, IBM Global Financing.

"Best Practices: How Front-End Systems Can Improve Origination Capacity"

To remain competitive, innovative finance organizations are returning to the point of origination to tap under-leveraged resources and open new portals for business growth. Panelists will share real-world challenges they faced during front-end to back-end processing system integration, the solutions they came up with for implementing a standard process, and the results in improved efficiency, profitability and long term business. Case studies presented by small, mid and large ticket equipment financing companies. Speakers include: Virginia Garcia, (moderator), TowerGroup; Mike Romanowski, CoBank; Elaine Temple, First Continental; and Jim Zook, International Decision Systems.

"Know Your Competition: How to Compete Against Alternative Capital Market Products"

Recent innovations in public debt securities and institutional finance have generated a host of new products that are an alternative to leasing in funding capital equipment acquisitions, especially for below investment grade companies. Mindy Berman, 42 North Structured Finance, Inc., will help attendees identify the capital markets products that compete against leasing products. These products are not always a direct replacement for leasing but provide an alternative source of funds that frequently pre-empts a company’s need to finance capital equipment spending on a dedicated basis. She will also identify the size and characteristics of each product market and the target borrowers for each. Berman will discuss how these capital market alternatives compare to equipment financing and the pros and cons of each, including terms, pricing and corporate restrictions. How to sell against these products will also be reviewed.

"Getting the Leads-Managing the Relationship-Closing the Loop"

This panel of experts from leasing, business process and technology service providers will review the latest tools, techniques and methodologies in sales and marketing automation. Presenters will address key topics such as list/campaign management techniques, leading sales automation technologies, tying together marketing, sales, pricing, credit and operations, application to small versus mid ticket businesses, marketing vendor programs, accelerating source/program approval. Panelists, which include: Michael Pennell, CapitalStream; John Hurt, LaSalle National Leasing Corp.; and Steve LeBarron, Blackwell Consulting Services, will provide real world examples of techniques and technologies that have, and have not, worked.

"Data Security: The Rules Have Changed and the Risks are Higher"

The flood of news items disclosing one data security breach after another continues to rise. These data security breaches are embarrassing and costly: the average reported loss of a data theft incident is $2.7 million (Wall Street Journal). Jeffrey Zeigler, Newmarket Trading Group Ltd, will help attendees understand how the changing regulatory environment is effecting data security requirements for owners and lessees of information technology equipment. Areas covered include Sarbanes-Oxley, Health Insurance Portability and Assurance Act (HIPAA) and Graham Leach Bliley ( GLB). Attendees will also learn how the rise of identity theft and the technology used to combat its spread is impacting the equipment leasing industry. The security and documentation procedures needed to demonstrate compliance is also discussed. The session will address the key issues related to ELA members for data security requirements in 2005 and beyond.

"Building Small Ticket Business by Creating Value for Manufacturers and Distributors: Take the Mystery out of Leasing with Technology"

Manufacturers and distributors of equipment need robust funding sources and programs that will enable them to differentiate their products from the competition by way of financing they provide their customers. Financing must be price competitive, easy to access and able to support multiple levels of credit-worthiness. Dwight Jackson and Stuart Koplowitz of Terra Vista Software, Inc., will discuss: how automating the process of online rate sheet pricing and applications reduces response time back to customers resulting in increases in the sales hit rate for manufacturers and distributors; how automating rate sheet pricing substantially reduces the risk to the funder by improving the accuracy by which the process is applied, improving efficiencies and reducing costly mistakes. This translates into higher profit and overall customer satisfaction and better customer retention.

We hope to see in you Boca Raton, Florida. For a complete review of the activities and sessions planned for the 44th Annual Convention, please visit the ELA website here:

http://www.elaonline.com/events/2005/annconv/

Lesley Sterling is ELA vice president, professional development.

---------------------------------------

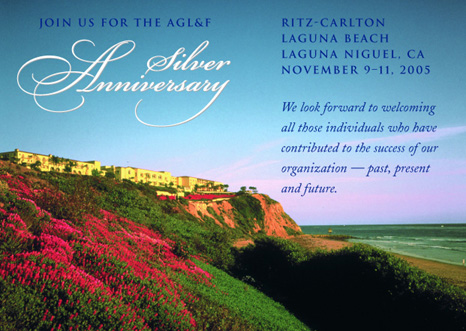

Association of Government Leasing & Finance

November 9, 2005

Dana Point, California

Conference Brochure and Registration:

http://www.aglf.org/pdf/25AM05RegPgm.pdf

AGL&F FALL CONFERENCE SPONSORS

Chairman's Club

AIG Commercial Equipment Finance

Banc of America Leasing and Capital Group

DeLage Landen Public Finance, LLC

Standard & Poor's Corp.

President's Club

Fifth Third Leasing Company

LaSalle National Leasing Corporation

Moody's Investors Service

National City Commercial Capital

Oppenheimer & Co., Inc.

SunTrust Leasing Corporation

Silver Anniversary Club

All Points Capital Corp.

Ambac Assurance Corp.

Becker Stowe & Bieber, LLC

Chapman & Cutler, LLP

Doyle & Bachman

Financial Security Assurance

GE Capital Public Finance

Gilmore & Bell, P.C.

Government Leasing Company

Marquette Bank

Peck Shaffer & Willams, LLP

Popular Leasing

Tatonka Capital Corp.

Wachovia Bank, N.A.

Windels Marx Lane & Mittendorf, LLP [headlines]

----------------------------------------------------------------

Listings are free. Companies must qualify and Leasing News has turned down three who were not funders, but brokers. Nothing wrong with that, but they should be on the "Super Broker" list. editor

Story Credit Lessors

( for other "funders only", who do not specialize in "story credits," click here

for "super brokers," who primarily broker leases, click here )

These companies specialize in "C" and "D" credits, often news businesses, or businesses where the principal(s) have Beacon score around 600 or previous difficulties; meaning to become comfortable with the credit and financial situation you need to learn the "story" to make a positive decision, often requiring further security, shorter term, or additional guarantors. Many of these companies may also be a "B," but appear otherwise without the "story" to understand the full financial picture.

(To qualify for this list, the company must be a lessor and not a broker or superbroker, along with an acceptable Better Business Bureau Rating and no history of complaints at Leasing News. We reserve the right to not list a company who does not meet these qualifications.)

Rank |

Name

In Business Since

Contact

Website

Leasing Association |

Employees |

Geo

Area |

Dollar

Amount |

Broker Qualify |

1 |

Financial Pacific Leasing

1975

Terey Jennings CLP,

800-447-7107, tjennings@finpac.com

www.finpac.com

EAEL, ELA, NAELB, UAEL (P) |

115 |

Nationwide |

$5,000-$50,000 |

Please Call or see "Prospective Broker" section on website |

1 |

|

106 |

Nationwide |

$250,000 - $15,000,000+ |

Please Call |

3 |

|

45 |

Nationwide |

$1,000 - $30,000 |

One year time in business |

4 |

|

32 |

Nationwide |

$250,000 - $3,000,000 |

Contact Peter Eaton |

5 |

Sunrise International Leasing Corporation

1975

Carrie Halvorson or Jim Teal,

800-950-3211

www.sunriseleasing.com

ELA (I) |

20 |

U.S., Canada, Latin America |

$1,000

minimum no hard cap in place for maximums |

One year time in business |

6 |

|

12 |

National |

$100,000 to $1,500,00 |

A deal in hand and a full package |

7 |

Creative Capital Leasing Group, LLC

1980

Alister McNeil

1-800-lease'em

(949-650-9880)

www.Creativeclg.com

NAELB, UAEL (M) |

12 |

USA |

$40,000 - $1,000,00 |

Please call Broker Manager, Todd or Jason |

8 |

Summit Leasing, Inc.

1986

James, Klemens, Kevin, Mike, Mark

(800) 736-1530

www.summitleasing.com

UAEL (S) |

12 |

CA, ID, MT, OR, WA |

$20,000 - $400,000 |

Contact us |

9 |

|

10 |

11 Western State |

$10,000.00 - $250,000.00 |

|

10 |

Allegiant Partners Incorporated

1998

415.257.4200

Doug Houlahan ext. 205

Paul Foster ext. 206

www.allegiant-partners.com

ELA, NAELB & UAEL (B) |

9 |

Nationwide, including Alaska & Hawaii |

$70,000 to $250,000 |

|

11 |

|

8 |

Nationwide

(except LA, AR and AK) |

$50,000 to $2,000,000 |

Please Call |

12 |

|

7 |

US Canada (F) |

$50,000 to $3MM

$250,000 average transaction |

Please Call |

13 |

American Leasefund, Inc.

1999

Tom Davis

tom@alclease.com

800.644.1182 - PH

503.244.0845 - FX

www.alclease.com

UAEL (Q) |

6 |

Idaho, Montana, Oregon, Washington |

$3,500 - $50,000 |

Please Call |

14 |

|

6 |

Nartionwide - 50 States |

$25,000.00 + |

Please contact Larry LaChance |

15 |

|

6 |

Nationwide |

$50,000 to $1MM

$250,000 average transaction |

Please call |

16 |

|

6 |

California Only |

$10,000 to $200,000 |

NAELB Members preferred but not required |

17 |

|

5 |

Western U.S. |

$25,000 - $350,000 |

|

18 |

Barrett Capital Corporation

1975

Barry Korn

914-632-4200

Cell: 914.954.1900

Barrett@BarrettCapital.com

www.BarrettCapital.com

NVLA |

4 |

United States |

Vehicles Only

$10,000 minimum |

Please Call |

20 |

|

4 |

Nationwide |

$20,000, average transaction size is $200,000 |

Please Call |

(A) Pawnee Leasing Corporation; Some times we go higher than $30,000, but our marketplace is from $1,000 to $30,000.

(B) Allegiant.pdf

(C) Mesa Leasing, Inc., Industries served: Titled vehicles (Trucks, trailers, OTR, etc.), Construction, Restaurants, and all the other "hard to get approved" industries.

(D) ABCO Leasing, Inc. in Seattle area has been operating since 1974 serving the broker community. We required full financial disclosure on every transaction. We do story transaction, but do not like to refer to them as "C" of "D" credits. We think of therm as "A" type credits that have not been discovered yet. In actuallity, we do not really like to look at what most describes as "D" credits.

(E) Black Rock Capital comment: We book anywhere between $15 to 20 million per year. We do no "app only" business and require a full financial package for each transaction. Our average size transaction is approximately $250k and, although, we concentrate in printing, packaging (steel rule die industry) and road construction equipment we do not rule out anything that makes sense. More information can be found at www.blackrockcapital.com.

(F) Black Rock Capital (Ireland) Limited and Black Rock Capital (UK) Limited provide the same services for small to middle market corporations in the European Economic Community and the United Kingdom.

(G) Cobra Capital, LLC. Comments: Our registered trademark "Making impossible possible" is our central marketing tagline for both strong and weak credits. I have developed a 10 year history, (from Cobra and my prior company GALCO), with specialty, non-conforming transactions (story credits) and have a solid reputation for candidly responding to our originators and lessees and working diligently to mitigate deal risk rather than making excuses to turn deals down. Our originators prefer our underwriting approach to non-conforming transactions since unlike most non-conforming funders, we prefer to mitigate risk versus jacking our return. Both Originators and Lessee's prefer our candid approach as we are also frequently asked to advise lessee's and lessors on the best way to structure their bank loans and raise capital due to our 25+ year banking and accounting backgrounds as my partner and I are both former bankers and CPA's.

| Partners Bio | LaSalle Bank Reference | Cole Taylor Bank Reference |

(H) Pentech is the lessor partner with Manifest Funding Services for their Navigator, Navigator Plus & Navigator Direct. This is through our sister company Pentech Funding Services, located in San Diego and headed up by Ron Wagner.

(I) Sunrise International Leasing Corporation Comment: The broker program is "...an informal program as our primary business is still vendor leasing."

(J) Boston Financial & Equity Corporation, most of our leases are venture capital backed startups and turnarounds. We require full financial disclosures, CPA and internal statements, no tax returns. We do not required additional collateral, no PG's or RE needed. Do not send deals with large tax liens, especially if they are payroll taxes.

(L) IFC Credit Corporation also services on a regular basis "A" and "B" credits, but it also considers "story credits." "As you say, we need to become comfortable with the credit and financial situation and learn the "story" to make a positive decision, often requiring further security, shorter term, or additional guarantors. I would describe the B and C type credits we fund as companies having 'checkered earnings'."

(M) Creative Capital Leasing Group: "We are able to fund tough deals, bad credits, BK's, past tax liens, start ups, used equipment, etc., because we look outside the transaction for real estate, and marketable securities to take as additional collateral."

(N) Blackstone Capital Partners, L.P. lends up to 50% of verified auction value for working capital and/or equipment financing requests (we of course include equipment to be acquired in our valuation). Using this formula, allows Blackstone to approve deals on the assets rather than the credit or cash flow that other lenders desire. Also being an asset lender, we are looking for hard assets i.e. yellow iron, machine tool, manufacturing lines, textile etc... We do not care for soft assets such as computers, furniture, restaurant, or "white elephants" (equipment that is too specific to the clients needs and was specially built for them - there would be no resell available and our liquidity if repossessed would be in jeopardy). If you have any questions, please feel free to call, we will do our best to help or seek the answer for you.

(O) Bankers Capital " We will do ANY Type of Equipment, in ANY industry, in ANY state. We especially like 6-figure transactions with full financial packages no matter how good or bad they look. We look to structure the story C&D credits with any kind of additional collateral that makes sense. It could be with 2nd or 3rd mortgages on residential or commercial Real Estate, additional equipment, cash value life insurance, security deposits, vendor agreements. We look for any way to make the deal work instead of looking for any way to decline the deal."

(P) Financial Pacific Leasing supports a nationwide network of Brokers and Lessors. We specialize in "B" and "C" credits for established companies as well as companies under two years in business.

(Q) American Leasefund, Inc. funds small hard to do transactions under $50,000.00. Most of the transactions are "app only". We look for additional collateral or larger first payments to help the weaker credits. We maintain and service our own portfolio. All of our lessee billings are done via ACH.

(R) Dolsen Leasing has served the 11 Western States since 1958 and specializes in B & C Credits for established and new companies. We require a full financial package and offer both leases and financing for new and used equipment in the range of $10,000.00 to $250,000.00. Specialties include titled vehicles for both existing and new owner operators. Story credits are considered as long as credit has been reestablished and trends are positive. Credit decisions are based on old fashioned common sense, not credit scores, allowing us a very quick turnaround-often the same day. We accept broker business and also have in house salesmen.

(S) We at Summit Leasing consider ourselves to be primarily "B" credit lenders, working almost exclusively through brokers.

(T) TechLease - due to previous experiences, TechLease is vertically focused on three primary sectors: Semiconductor, Media and Aerospace. We fund all deals and hold paper an all equipment under $250,000. Deals over $150,000 we typically want to meet the Lessee face-to-face. We prefer business in California, however we will fund nationwide.

[headlines]

----------------------------------------------------------------

Listings are free. Companies must qualify to be "funders" and not "super brokers" or brokers pretending to be "funders" of leasing transactions.

Funder's Only

( for funders specializing in "Story Credits, " please click here

for "super brokers," who primarily broker leases, click here )

A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program

| D -"Private label Program" | E - Also "in house" salesmen

Rank |

Name

In Business Since

Contact

Website

Leasing Association |

Employees |

Geo

Area |

Dollar

Amount |

Equipment Restrictions |

A |

B |

C |

D |

E |

1 |

TCF Equipment Finance

11100 Wayzata Blvd., Ste 800

Minnetonka, MN 55305

800-247-4011

800-247-4018 - Fax

1999

Kathie Shuman, ext 22

kshuman@tcfef.com

Patty Weaver, ext 24

pweaver@tcfef.com

ELA, NAELB (D) |

190 |

Nationwide |

$10,000 + |

Please Contact Rep. |

Y |

Y

in

CA |

N |

Y |

Y |

2 |

NetBank Business Finance

1988

Rich Viola

800-669-0222 ext. 8225

Fax 800-669-8102

rviola@netbankbusinessfinance.com

www.netbankbusinessfinance.com

EAEL, ELA, NAELB, UAEL (E)

|

70 |

the contiguous US minus VT |

$5,000 to $1,000,000 |

Please visit out website for this information. |

Y |

Y

in

CA & NC |

Y/N |

Y |

N |

3 |

Madison Capital

1997 (formed by merger of Harbor Leasing, started 1983, & Fox Valley Leasing, started 1974)

Nancy Pistorio, VP 410-653-6269 ext. 125

npistorio@madisoncapital.com or Allen Levine, COO 410-653-6269 ext. 117 alevine@madisoncapital.com

www.madisoncapital.com

EAEL ,ELA, NAELB, NVLA (F)

|

27 |

U.S., Canada, Puerto Rico |

$5,000 to $450,000, Vehicles: Unlimited |

Tanning beds, owner operators, HVAC, restaurant hoods, boats |

Y |

N |

N |

Y |

Y |

4

|

Pioneer Capital Corporation

(A wholly-owned subsidiary of IFC Credit Corporation)

1983

John Boettingheimer VP/General Manager

800.521.1308

www.PioneerFunding.com

NAELB, UAEL (A) |

20 |

50 U.S. States |

$5,000 minimum (no maximum) |

ATM , aircraft, energy management, livestock, tanning, copiers, vending, website development.

For more visit our website. |

Y |

N |

N |

Y |

N |

5 |

ICB Leasing Corp.,

2004 (Our parent, Independence Community Bank, was established

in 1850.)

Ira Romoff at 212-209-9177,

e-mail: iromoff@icbny.com or

Jean Cutting at 212-209-9178

e-mail: jcutting@icbny.com

EAEL, ELA (G) |

17 |

Nationwide |

$75,000 to $5 million |

No aircarft or marine vessels |

Y |

Y |

N |

Y |

Y |

6 |

|

10 |

11 Western State |

$10,000.00 - $250,000.00 |

None. We fund in case by case basis. |

Y |

Y |

N |

N |

Y |

7 |

|

5 |

Northern California |

$5K - $500K |

Standard |

Y |

N |

Y |

N |

Y |

(A) Pioneer Capital originates all it's paper from brokers - 100%. Pioneer is a full service funding company that holds 100% of its transactions internally. We have over $150 million in small ticket leasing lines. We offer "A", "B" and in some circumstances "C+" credit coverage. We also offer franchise, medical, and new business leasing programs. Accepts Broker Business - to apply for to http://www.pioneerfunding.com/becomebroker.html. Private Label Program - Pioneer offers private label documents and discounting programs to eligible brokers.

(B) BWC Equipment Leasing only funds deals in Northern California. Sub-broker accepted only is disclosed up-front. Broker must sign "Representation and Warranty" broker agreement.

(C) Dolsen Leasing, see our Broker Application at www.dolsenleasing.com . While we do not require brokers to be licensed, we do a background check on all prospective brokers. While we have both inside and outside sales people, we are always open to expanding our broker network.

(D) TFC Equipment Finance is a wholly owned subsidiary of TCF National Bank (TCF). TCF is a subsidiary of TCF Financial Corporation.

TCF Financial Corporation (TCF) is a $12 billion national financial services holding company. TCF trades on the NYSE under the symbol TCB.

(E) NetBank Business Finance accepts sub-brokered transactions only from a select, pre-approved group of broker/lessors. NBF is a wholly owned subsidiary of NetBank, Inc. and will occasionally accept lease and loan referrals from other NetBank companies.

(F) Madison Capital - Broker should be in business at least 2 years. Private Label program requires six months positive experience working with them; and only after the 6 month term we offer the brokers or discounter a contract that allows them to put their name on it, primarily for marketing purposes. We originate business through both direct sales and indirect sales. However, we offer broker protection and are extremely vigilant about it. One clarification. We do offer financing to restaurants, but not for their exhaust hoods, an item we are frequently asked about.

(G) ICB Leasing - Business is conducted only with approved brokers. In addition, Brokers must not only be approved by ICB but licensed where appropriate. We will permit use of ICB Leasing Corp. lease docs in approved originators name and purchase/take assignment of lease. The only company that has qualified to be on this list has been BSB Leasing. Again, the listing is free, but Better Business Bureau report or complaints to Leasing News are a major consideration.

[headlines]

----------------------------------------------------------------

Super Brokers' List

( for "funders only," please click here

for funders specializing in "Story Credits, " please click here )

A -Requires Broker be Licensed | B -Sub-Broker Program | C -Warehouse Line | D -Also a Lessor

Rank |

Name

In Business Since

Contact

Website

Leasing Association |

Employees |

Geo

Area |

Dollar

Amount |

Broker Qualify |

A |

B |

C |

D |

1 |

|

15 |

National |

Application Only $5,000 - $100,000, Commercial $50,000 - $500,000 |

|

N |

N |

Y |

Y |

(A) BSB Leasing, Inc has been providing syndication services for brokers nationwide since 1982 and have been funding business directly since 2002 through BSB Direct Finance, LLC. We offer Brokers a complete internet solution for credit submission and tracking and document preparation.

---------------------------------------------

These companies basically function as a "broker," meaning most of their transactions are sent to other leasing companies or funders.They are not “lessors” or “funders.” An additional description: the majority of their business comes from others, who are acting as a broker. These “deals” may come from an independent, a “company,” or even a “lessor” or “funder.”

Brokers come to them because they may not have the "volume" for the source the "super broker" may have; they may be "too new" in business to qualify for many sources: they may be looking for a better rate than their regular sources, or the transaction was originated by another broker and they need to acknowledge that the transaction comes from another broker, called "sub broker," in the trade (most funders will not accept business from that has been “re-brokered.” .” As important, the sender may not have a regular source for the specific transaction they want to place, such as a young privately held company wanted the lease as “corporate only.”

The transactions may come from a lessor that wants to satisfy their client, and they have a "minimum" that the transaction does not meet; or perhaps their client is to the maximum amount of exposure for them.

For whatever reason, they come to a "super broker" to place the deal on their behalf.

In the question of sub-broker business, we take for granted that the “super broker” not only has a written agreement with the sub-broker but informs the lessor when submitting an application it has come from a sub-broker. A violation of this will have the company removed from the list.

This list is not does not include leasing companies who "fund" the majority of the transactions they receive.

In addition to the above qualifications, the "Super Broker" must have a "clean" Better Business Bureau rating, no Leasing News Bulletin Board complaints or a poor record, and must belong to a national leasing association, as we view this that they are professional and abide by their association standards and code of ethics.

We also will be verifying warehouse lines or "lessor" lines with their bankers (as done with those on the Story Credit List.)

Leasing News reserves the right not to list any company it believes does not meet the qualifications as stated above.

[headlines]

---------------------------------------------------------------

News Briefs---- Wholesale prices up 0.6% in August, pre-Katrina

http://www.usatoday.com/money/economy/inflation/2005-09-13-ppi_x.htm

Trade deficit improves a bit in July

http://www.usatoday.com/money/economy/trade/2005-09-13-trade-deficit-july_x.htm

Bill Gates Shows Next Windows

http://www.nytimes.com/2005/09/14/technology/14soft.html?pagewanted=all

[headlines]

----------------------------------------------------------------

You May Have Missed Gartner warns of offshore ID theft risk

http://www.computing.co.uk/vnunet/news/2142204/gartner-warns-indian-call

[headlines]

----------------------------------------------------------------

"Gimme that Wine" California Grape harvest slows to a crawl

http://www1.pressdemocrat.com/apps/pbcs.dll/article?AID=/20050913/NEWS/

509130344/1033/NEWS01

Fine French wines going for a song

http://www.decanter.com/news/68483.html

Wine Expert Makes a Bold Choice

http://www.nytimes.com/2005/09/14/dining/14pour.html

10 tough matches

Our Pairings expert plays matchmaker for foods that don't get along with most wines

PLUS ten Classic Matches ( best I have seen. editor)

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2005/09/08/WIGCEEHLHD1.DTL

[headlines]

---------------------------------------------------------------

Today's Top Event in History 1814 - An attorney in Washington, DC, Frances Scott Key, was aboard a warship that was bombarding Fort McHenry, the outpost guarding the city of Baltimore, Maryland. Key wrote what would become famous words to express his emotions. Those words would become "The Star-Spangled Banner", which officially became the national anthem of the United States by an act of Congress in 1931.

[headlines]

----------------------------------------------------------------

This Day in American History 1716--- First lighthouse in US lit (Boston Harbor)

1752-- England and colonies adopt Gregorian calendar, 11 days disappear.

1847- Gen. Winfield Scott entered Mexico City. A Battalion of U.S. Marines made its presence felt at the "halls of Montezeuma." The United States was later able to claim a large Mexican territory, including what was to become the state of California In 1850 (following the gold rush fever of 1849).

1814 - An attorney in Washington, DC, Frances Scott Key, was aboard a warship that was bombarding Fort McHenry, the outpost guarding the city of Baltimore, Maryland. Key wrote what would become famous words to express his emotions. Those words would become "The Star-Spangled Banner", which officially became the national anthem of the United States by an act of Congress in 1931.

1847 - Mexico City was occupied by US troops after the defeated forces of General Santa Anna were forced to abandon the city. The day before, young Mexican cadets had tried unsuccessfully to defend the fortified hill of Chapultepec. With the occupation of Mexico City, the United States-Mexico conflict virtually came to an end. While some call the 1846-48 period the "Mexican War," others call it the "US Invasion".

1850--Big earthquake felt in San Francisco. Fourth Great Fire destroyed 150 buildings in the area bounded by Dupont, Montgomery, Washington and Pacific streets. Loss set at $500,000. The fire broke out in the Philadelphia House on the north side of Jackson between Grant and Kearny. The San Francisco, Empire and Protection fire companies fought the blaze but had no water. The most damage in the 1906 Earthquake came from the fires, not the earthquake itself.

1861- The first Civil War Naval Battle took place at Pensacola, FL. Lieutenant John Henry Russell descended upon the Confederate navy yard at Pensacola at 2 a.m. He had sailed the frigate Colorado past shore batteries in the dark, and with a force of 100 sailors and Marines, went for the southern privateer five gun Judah in the shipyard. After hand-to-hand fighting, the contingent burned the vessel to the waterline and left. They burned the five-gun steamer Judah, lying at anchor, and spike the only gun in the yard. There were no Confederate casualties. three of the Union troops were killed and four wounded President Lincoln thanked Russell personally and the Navy Department honored him.

1882- Birthday of Winnifred Sprague Mason Huck, U.S. Congressional Representative from Illinois, serving out the term of her late father 1922-23. She broke the rules about freshmen being still and introduced a number of bills including the call for independence for the Philippine Islands. She was an investigative reporter who even went to jail for four months under an assumed name to bring to light the abuses in prison as well as the difficulties in "going straight" afterwards.

1868 - The first recorded hole-in-one at golf was scored by Tom Morris at Prestwick in Scotland.

1874 -- The White Leagues, paramilitary organizations dedicated to the restoration of lily-white rule in Louisiana, temporarily seize control of the state government in a bloody coup d'etat. 38 killed. 79 wounded.

http://www.jimcrowhistory.org/scripts/jimcrow/map.cgi?city=new%20orleans&state=louisiana

http://civilwar.bluegrass.net/AftermathAndReconstruction/raceriots.html

1886- George K. Anderson of Memphis, TN, received a patent on typewriter ribbon.

1886-Birthday of "'Round 'Bout Midnight": Stanley "Midnight Assassin" Ketchel, heavyweight boxing champ, considered the middleweight champion of all time.

http://www.ibhof.com/ketchel.htm

1889- Hull House in Chicago opened its doors. Formed by Jane Addams and Ellen Starr, it was the first major settlement house in the United States. In its first year of operation, it hosted more than 50,000 people. In all, there would be more than 600 residents at various times ranging from some of the most influential social reformers of the day to a future prime minister of Canada - and just about everyone in between. Hull House under Addams, in addition to social work and reform, served as the "mother house" for the meeting and networking of reformers who then went out to change the world.

1897-Birthday of Margaret Fogarty Rudkin, American businesswoman. who started making a healthy bread for one of her sons in 1937 and parlayed those few loaves of bread it into a major commercial company, Pepperidge Farms. The company had sales of $32 million a year when she and husband sold out to Campbell Soup. She stayed as president - supervising the day to day operations personally as she had from the beginning - until a year before her death in 1967 of breast cancer, a disease from which she had since 1956. Her noted collection of cookbooks was donated to the Pequot Library in Southport, Connecticut.

1900 ---Jazz Trumpet player Kid Rena born.

http://www.redhotjazz.com/kidrena.html

1916 - Pitcher Christy Mathewson won the last pitching assignment of his major- league career. He had a total of 373 wins, 188 losses, 83 shutouts in 636 games, and he struck out 2,511 batters.

1921- Constance Baker Motley , U.S. District judge who framed many of the early civil rights cases. CBM influenced legal desegregation interpretations in nine victories before the U.S. Supreme Court. She was the first Afro-American woman to become a federal judge (1966) and only woman borough president of Manhattan (1965).

http://www.jtbf.org/five_firsts/Motley_C.htm

http://www.toptags.com/aama/bio/women/cmotley.htm

1926- seventeen-year-old Benny Goodman's first recording session ( with Ben Pollack and his Californians), Chicago, IL.

1927 - Gene Austin recorded one of the first million sellers; his composition, "My Blue Heaven", for Victor Records.

1929 -- Ella May Wiggins and other workers are riding in the back of an old pick-up truck to a union meeting, when local vigilantes, thugs, and a sheriff's deputy force the truck off the road and begin shooting at it. Ella May is killed. Labor union organizers appear in Gastonia, Carolina. The textile mill workers there eagerly flock to the union, but when the mill owners refuse to recognize the union, a strike breaks out in June of this year. Prominent on the union picket lines is Ella May Wiggins, a 29-year-old mother of nine children who had been working the night shift at one of the mills. When some of her children come down with whooping cough, Ella May asks the mill foreman to put her on the day shift so she can care for her sick babies. The foreman refuses and Ella May is forced to quit her job. With no money for medicine, four of her children die. From this point on, she becomes a militant in the strike movement. Her songs, with the older melancholy of mountain ballads, help cheer on fellow picketers.

(See middle of this: http://www.beachonline.com/textile.htm )

http://www.charleston.net/stories/022904/sta_29slain.shtml

http://www.ibiblio.org/uncpress/chapters/smith_ncwomen.html

1948 -- Milton Berle starts his TV career on Texaco Star Theater.

http://us.imdb.com/name/nm0000926/

http://www.cnn.com/2002/SHOWBIZ/News/03/27/milton.berle.obit/

1937 - The mercury soared to 92 degrees at Seattle, WA, a record for September.

1938-Birthday of Niara Sudarkasa, Black-Afro-American anthropologist and president of Lincoln University in Pennsylvania. She is an authority on African and Black Afro-American women and families. NS is one of the leading scholars of the U.S. and has served on more than 20 boards and task forces in the furtherance of race relations.

http://www.malaspina.com/site/person_1090.asp

1944 -the Great Atlantic Hurricane passed near Cape Hatteras, NC. A few days before it was a category 5 hurricane with winds near 160 mph. At Cape Henry, VA sustained winds of 134 mph with gusts to 150 occurred. The storm raced into New England. 46 were killed on land and over 300 were lost at sea. Total damage was $122 million The hurricane destroyed the Atlantic City NJ boardwalk

1951- In a 9-6 loss to the Red Sox at Fenway Park, rookie Bob Nieman hits consecutive dingers off Mickey McDermott becoming the first player to hit home runs in his first two career at bats in the majors. In his third trip to the plate, the St. Louis Browns freshman beats out a bunt for a base hit.

1956---Top Hits

Hound Dog/Don't Be Cruel - Elvis Presley

Whatever Will Be Will Be (Que Sera Sera) - Doris Day

The Flying Saucer (Parts 1 & 2) - Buchanan & Goodman

I Walk the Line - Johnny Cash

1957- "Have Gun, Will Travel," so read the business card of Paladin (Richard Boone), a loner whose professional services were available for a price. This western also featured Kam Tong as his servant, Hey Boy. The show was extremely popular and ranked in the top five for most of its run. My father Lawrence Menkin wrote many of the episodes.

http://www.museum.tv/archives/etv/H/htmlH/havengunwil/havegunwil.htm

http://www.hgwt.com/

1963-The Beach Boys' "Surfer Girl" peaks at #7 on the pop singles chart.

1964---Top Hits

The House of the Rising Sun - The Animals

Because - The Dave Clark Five

Bread and Butter - The Newbeats

I Guess I'm Crazy - Jim Reeves

1965--- The Television show "F-Troop" premiers

1967- "Ironsides." This crime series starred Raymond Burr as Robert T. Iron side, Chief of Detectives for the San Francisco Police Department (he was in a wheelchair, paralyzed from an assassination attempt).Also featured were Don Galloway as his assistant, Detective Sergeant Ed Brown, Barbara Anderson as Officer Eve Whitfield, Don Mitchell as Mark Sanger, Ironside's personal assistant, Gene Lyons as Commissioner Dennis Randall, Elizabeth Baur as Officer Fran Balding and Joan Pringle as Diana, Mark's wife.

http://us.imdb.com/title/tt0107951/

http://www.museum.tv/archives/etv/B/htmlB/burrraymond/burrraymond.htm

1968-Big Brother and the Holding Company's LP, "Cheap Thrills" enters the LP chart -- where it will stay for 29 weeks, including 8 at #1.

1970 - The temperature at Fremont, OR, dipped to 2 above zero to equal the state record for September set on the 24th in 1926.

1972- "The Walton's." This epitome of the family drama spawned nearly a dozen knock-~offs during its nine-year run on CBS. The drama was based on creator/writer Earl Hamner Jr's experiences growing up during the Depression in rural Virginia. It began as the TV movie "The Homecoming," which was so well-received that it was turned into a weekly series covering the years 1933-43. The cast went through numerous changes through the years; the principals were: Michael Learned as Olivia Walton, mother of the clan, Ralph Waite as John Walton, father, Richard Thomas as John-Boy, eldest son, Jon Walmsley as son Jason, Judy Norton Taylor as daughter Mary Ellen, Eric Scott as son Ben, Mary Beth McDonough as daughter Erin, David W. Harper as son Jim-Bob and Kami Cotler as daughter Elizabeth. The Walton grandparents were played by Ellen Corby (Esther) and Will Geer (Zeb). The last telecast aired Aug 20, 1981

http://www.geocities.com/TelevisionCity/2792/walton1.htm

1972---Top Hits

Alone Again (Naturally) - Gilbert O'Sullivan

Long Cool Woman (In a Black Dress) - The Hollies

Baby Don't Get Hooked on Me - Mac Davis

Woman (Sensuous Woman) - Don Gibson

1973 - For his hit single "The Twelfth of Never," Donny Osmond received a gold record. Released in March of 1973, the son was one of five that went gold for the young Osmond. His other solo successes were: "Sweet & Innocent", "Go Away Little Girl", "Hey Girl" and "Puppy Love".

1974---"I Shot the Sheriff" by Eric Clapton topped the charts and stayed there for a week.

1975- the first Catholic saint who was born in America was Elizabeth Ann Bayley Seton, who was born into a Episcopalian family in New York City on August 28, 1774, was canonized this day. The mother of five children, she founded the Society for the Relief of Poor Widows with Small Children in 1797. She converted to Roman Catholicism in New York City in 1805 and founded an order of nuns, the Sisters of Charity of St. Joseph. She died on January 4, 1821, in Emmetsburg, MD, was beatified on March 17, 1963, at the Vatican, Rome, by Pope John XXIII, and was canonized this day in 1975.

1978 - The first episode of the television series "Mork & Mindy", starring Robin Williams as Mork and Pam Dawber as Mindy, debuted on ABC-TV. Mork made an earlier appearance in February, 1978, during an episode of "Happy Days".

http://www.timstvshowcase.com/mork.html

http://us.imdb.com/title/tt0077053/

http://www.tvtome.com/tvtome/servlet/ShowMainServlet/showid-1520

1980---Top Hits

Upside Down - Diana Ross

All Out of Love - Air Supply

Fame - Irene Cara

Lookin' for Love - Johnny Lee

1985- "Golden Girls" premiere on TV.. This comedy starred Bea Arthur, Betty White, Rue McClanahan and Estelle Getty as four divorced/widowed women sharing a house in Florida during their golden years. The last episode aired Sept 14, 1992 but the show remains popular in syndication.

http://timvp.com/goldgirl.html

1985 - At Radio City Music Hall in New York City, the first "MTV Video Music Awards" were presented. The Cars won "Best Video" for "You Might Think" while Michael Jackson won "Best Overall Performance" and "Choreography" for his "Thriller" video.

1985 - The Reverend Benjamin Weir, an American missionary, was released after being held captive for 16 months by Shiite Muslim kidnappers in Lebanon.

1987 - A record for the skateboard high jump was set when Tony Magnuson went 9.5 feet above the top of the U-ramp.

1987 - Thunderstorms developing along a cold front produced severe weather from Minnesota to Texas. Thunderstorms in Iowa produced baseball size hail at Laporte City, and 80 mph winds at Laurens. Hail caused more than ten million dollars damage to crops in Iowa. Thunderstorms in Missouri produced wind gusts to 75 mph at Missouri City and Kansas City. A thunderstorm in Texas deluged the town of Fairlie with two inches of rain in just two hours

1988---Top Hits

Sweet Child o' Mine - Guns N' Roses

Simply Irresistible - Robert Palmer

Perfect World - Huey Lewis & The News

(Do You Love Me) Just Say Yes - Highway 101

1988 - Thunderstorms produced severe weather over the Texas panhandle during the evening hours. One thunderstorm spawned a strong (F-2) tornado in the southwest part of Amarillo, and deluged the area with five inches of rain. The heavy rain left roads under as much as five feet of water, and left Lawrence Lake a mile out of its banks. Hurricane Gilbert lost some of its punch crossing the Yucatan Peninsula of Mexico. Its maximum winds diminished to 120 mph.

1990- Ken Griffey, Sr. , and Ken Griffey, Jr., father and son, hit unprecedented back-to-back home runs for the Seattle Mariners in a game against the California Angeles. Kirk McCaskill was the pitcher. The Mariners lost, 7-5.

1991-- "I Adore Mi Amor" by Color Me Badd topped the charts and stayed there for 2 weeks.

1994---Top Hits

I' ll Make Love To You- Boyz II Men

Stay (I Missed You) (From "Reality Bites")- Lisa Loeb

Stroke You Up- Changing Faces

When Can I See You- Babyface

1996- Mark McGwire hits his 50th home run off Cleveland hurler Chad Ogea becoming the 13th player in major league history to reach that plateau. The Cardinal first baseman gives the milestone ball to his eight-year-old son, Matthew.

1998 - A new talk show, The Roseanne Show, debuted in syndication in more than 150 stations in the country. It was Roseanne's first major television project since her hit ABC sitcom Roseanne ended its 9-year run in May 1997.

http://us.imdb.com/name/nm0001683/

http://abc.go.com/primetime/realroseanne/index.html

1999- The free "Sheryl Crow and Friends" concert is held in New York's Central Park. She is joined on stage at different times by Keith Richards, Stevie Nicks, The Dixie Chicks, Eric Clapton, Chrissie Hynde and Sarah McLachlan. The second hour of the concert is broadcast live on Fox.

1999---Top Hits

Unpretty- TLC

Bailamos- Enrique Iglesias

Summer Girls- LFO

She s All I Ever Had- Ricky Martin

2002- Barry Bonds ties Hank Aaron for the most 100-RBI seasons by a National League player as he drives in his 100th run of the season for the 11th time in his career. The major league record is13 shared by Jimmie Foxx, Lou Gehrig, and Babe Ruth. Saying his heart has always been in San Francisco, Barry Bonds avoids arbitration by agreeing to a five-year, $90 million deal with the Giants. The contract also calls for 10-year personal services commitment at the end of the 37-year left fielder's playing days.

2002 Chin-Feng Chen becomes the first Taiwan-born player to appear in the major leagues as he walks and scores as a pinch-hitter for the Dodgers against the Rockies. The 24-year-old first baseman-outfielder played for the 1990 Taiwan team which won the Little League World Series.

2003---Top Hits

Shake Ya Tailfeather- Nelly, P. Diddy & Murphy Lee

Baby Boy- Beyonce Featuring Sean Paul

Right Thurr- Chingy

Into You- Fabolous Featuring Tamia Or Ashanti

[headlines]

----------------------------------------------------------------

Baseball Poem

Baseball Poem

THERE WAS A BALL GAME SOMEWHERE

by Tim Peeler

Before video parlors, PCs and

Nintendo, on our ragged bicycles

We scrambled to one house or the other-

Hefners, Peelers, then the Swansons who moved

In the neighborhood, sometimes the Coffeys

From church, or the Swansons' friends from their church -

For the really big affairs with full teams,

Baseball games with football scores. Out in the heat

Most of the day, just breaking for lunchtime-

Easy pitches and little guys taking

Big cuts, ghost runners and no catcher, weird

Rules like ground rule doubles for balls driven

Into the short cow pasture fence in left

Or how to play a pop fly that rolled off

The eight-sided parsonage roof or smacked

The huge oak trees in center field or the

Maple in right-center.

Barefoot sometimes, always in shorts only,

Crew cuts and popsicle stains on our mouths-

Before Play Station and VCRs there

Was a baseball game somewhere in dust and

Sweltering heat, a game to be played by

Our rules only.

--- with the permission of the author, from his

book of baseball poetry:

[headlines] |