|

"Tired of working for a broker or discounter at inflated buy rates?"

We are a direct nationwide funder.

Decisions are made here on "application only" up to $125,000. We are fast, too, and we will keep your vendors and customers happy with our efficient staff.

Contact Jim Doster sales@abanklease.com

"We want you to make as much money as you can."

|

|

Wednesday, September 21, 2005

Headlines---

Two Corrections: Greene Agreement/BSB Leasing

Classified Ads---Collector-Controller-Contract Admin.

Fed Raises Rate 25 basis points

ELA Healthcare Finance Summit

Cartoon---

Legacy of Top Gun: "Fast Turn Around Time"

Butler Capital Joins "Funder Only" List

Classified Ads---Help Wanted

Leasing Conferences Up-Date

Barrett Capital Group Moves to NYC

Purcell Leaves USbancorp for COO Job Aequitas Capital

David Tunnicliffe Appointed HSBC West Coast Reg. Prez.

CIT Names J. Daryl MacLellan President, CIT Canada

News Briefs---

You May Have Missed---

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

Today's Top Event in History-1 ST American Flag

This Day in American History

Baseball Poem

Track Rita's Path (see tracking map for latest location

www.usatoday.com/weather/graphics/hurricane/2005_storms/flash_leader.htm?

####### surrounding the article denotes it is a "press release"

Two Corrections: Greene Agreement/BSB Leasing

Ken Winkle, EVP of Yale Capital Group, Inc. and Administrator of MicroFour Healthcare Solutions Financing was the first to report not being able to open the "Greene Agreement."

This form was designed to allow costs and other expenses to be kept if a lease does not fund.

http://www.leasingnews.org/Conscious-Top%20Stories/Greene_Lease_agreement.htm

Full list of agreements at:

http://www.leasingnews.org/#lease

BSB Leasing---from Don Myerson

"FYI; The copy of the ad that you printed - I hadn't had a chance to proof yet. A broker called this morning and pointed out that the number for BSB was incorrect. It should have been 800-945-3372.

"I am reworking the ad with the new contact information and most likely we'll start it next week. I'll get back to you.

"It's also amazing the reach you and Leasing News have. You would have thought I had placed an ad for a new Broker Services Manager from the amount of phone calls and e-mails that I've received that were a direct result of your article."

Thanks

Don

Don Myerson,

President

Office: 303-376-4662

dmyerson@bsbleasing.com

(Don is correct, the ad was never proofed, nor approved, but was a working draft. editor)

[headlines]

------------------------------------------------------------

Classified Ads---Collector-Controller-Contract Administrator

Collector

Boston, MA.

Challenging position where my skills, professional experience, organization, leadership, strategic thinking, creativity, energy, passion, competitive nature will enable me to define opportunities and personal development.

Email: bernd.janet@verizon.net

Beaverton, Oregon

20 year experience in equipment leasing in the Portland, OR metro area as an Asset & Collection Manager.

Email: pbost2004@yahoo.com

RESUME

http://216.66.242.252/AL/LeasingNews/Resumes/Patty.pdf

Jacksonville, East Brunswick, FL.

13 years experience with collection, recovery,re-marketing and legal on commercial loans and leases. Expertise with distressed portfolios, Six Sigma trained. Willing to relocate.

Email: RichardB12364@aol.com

Controller

Seattle, WA

CPA w/ Sarbanes Oxley/ 15 years management exp. as CFO/ Controller/5 yrs w/ PWC Extensive exp providing accounting/ tax guidance for the equipment lease industry. Willing to relocate.

Email: bltushin@hotmail.com

RESUME

http://216.66.242.252/AL/LeasingNews/Resumes/CFO-Controller-CPA-Leasing-Sarbanes%20Oxley.pdf

Southeastern, MI.

Controller & Management experience w/ equip lessors &broker. MBA, CPA w/ extensive accounting, management, securitization experience with public and private companies. Willing to relocate.

Email: Leasebusiness@aol.com

Uniondale, NY

I have a strong multifaceted background in all areas of lease accounting combining my years as a Controller of leasing companies and as Vice-President of Leasing for a NY Bank.

Email: awinitt@hotmail.com

Contract Administrator

New York, NY.

10+ years in equipment leasing/secured lending. Skilled in management & training, documentation, policy and procedure development & implementation, portfolio reporting. Strong work ethic.

Email: dln1031@nyc.rr.com

Portland, OR.

6+ years small ticket leasing/financing. Documentation/funding

Policy development &implementation, management &training, process mapping, customer service, broker, vendor, portfolio experience.

Email: susanc777@hotmail.com

For a full listing of all "job wanted" ads, please go to:

http://216.66.242.252/AL/LeasingNews/JobPostings.htm

To place a free "job wanted" ad, please go to:

http://216.66.242.252/AL/LeasingNews/PostingForm.asp

[headlines]

------------------------------------------------------------

Fed Raises Rate 25 basis points

(Here is the Federal Reserve Official Statement:)

The Federal Open Market Committee decided today to raise its target for the federal funds rate by 25 basis points to 3-3/4 percent.

Output appeared poised to continue growing at a good pace before the tragic toll of Hurricane Katrina. The widespread devastation in the Gulf region, the associated dislocation of economic activity, and the boost to energy prices imply that spending, production, and employment will be set back in the near term. In addition to elevating premiums for some energy products, the disruption to the production and refining infrastructure may add to energy price volatility.

While these unfortunate developments have increased uncertainty about near-term economic performance, it is the Committee's view that they do not pose a more persistent threat. Rather, monetary policy accommodation, coupled with robust underlying growth in productivity, is providing ongoing support to economic activity. Higher energy and other costs have the potential to add to inflation pressures. However, core inflation has been relatively low in recent months and longer-term inflation expectations remain contained.

The Committee perceives that, with appropriate monetary policy action, the upside and downside risks to the attainment of both sustainable growth and price stability should be kept roughly equal. With underlying inflation expected to be contained, the Committee believes that policy accommodation can be removed at a pace that is likely to be measured. Nonetheless, the Committee will respond to changes in economic prospects as needed to fulfill its obligation to maintain price stability.

Voting for the FOMC monetary policy action were: Alan Greenspan, Chairman; Timothy F. Geithner, Vice Chairman; Susan S. Bies; Roger W. Ferguson, Jr.; Richard W. Fisher; Donald L. Kohn; Michael H. Moskow; Anthony M. Santomero; and Gary H. Stern. Voting against was Mark W. Olson, who preferred no change in the federal funds rate target at this meeting.

In a related action, the Board of Governors unanimously approved a 25-basis-point increase in the discount rate to 4-3/4 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, Philadelphia, Richmond, Chicago, Minneapolis, and Kansas City.

[headlines]

------------------------------------------------------------

ELA Healthcare Finance Summit Provides Well-Balanced Picture of Risks and Opportunities

ELTnews

Last week's Equipment Leasing Association Healthcare Finance Summit offered a comprehensive, cutting-edge view of the state of healthcare delivery, regulation and financing during the day and a half conference. Many attendees cited the realistic depiction of the healthcare finance market as a welcome surprise, as speakers discussed the potential risks as well as the opportunities.

Alan Frankel, a member of the Planning Committee and a conference presenter, said that one of his concerns prior to the summit was not to present healthcare leasing as the holy grail of equipment leasing, with participants taking profits and no losses. Frankel said, however, "Companies looking at another healthcare segment or entering a segment received a substantial amount of warnings and opportunities."

Healthcare lease financing is unlike other leasing market segments, in terms of government regulation, reimbursements and dynamic growth. Presentations covered the economic landscape, the influence of the federal government and Medicare, information technology systems, patient privacy, risk management and liability, as well as breakout sessions with lessors on specific healthcare markets.

Presenter and attendee Bruce Trachtenberg, De Lage Landen Financial Services, said the summit provided great perspectives on the macro issues going on in healthcare, which lessors don't often have a chance to talk and learn about. He also thought that each presentation had some resonance with attendees, which doesn't always happen in a wider themed conference. Trachtenberg said, "The ability to focus on a single sector with its challenges and goals was a tremendous benefit."

Attendees at the summit also received a copy of the new Equipment Leasing & Finance Foundation report, "Long-Term Trends In Healthcare: Implications for the Leasing Industry." The report, available at http://www.leasefoundation.org/store, provides an industry overview as well as well as future trends for specific healthcare markets.

[headlines]

------------------------------------------------------------

[headlines]

------------------------------------------------------------

Legacy of Top Gun

“Fast Turn around Time”

If you want to avoid the label of a “me-too” player in your industry, you will want to identify your company's Exclusive Strengths.

Because some customers use your services, you have, at least in their eyes, Exclusive Strengths. These are strengths that are exclusive to your company, are recognized as exclusive by your customers, and for which you have earned bragging rights. Exclusive Strengths can only be claimed by you - they cannot also be claimed by any of your competitors.

In the equipment finance business, the claim of “fast credit turnaround time” can be claimed by so many competitors that the claim isn't even a strength today, it's a requirement for staying in business! The same is true for a claim that your company's people truly care about their customers. You can bet that your competitors are making the same claim to their customers.

So, how do you go about identifying Exclusive Strengths? The process is relatively simple, and deceptively powerful. First, conduct a brainstorming session with everyone involved in the company's revenue generating process. You can do this in an office setting or at a retreat. Ask the participants to answer these questions: What do we have that our competitors cannot offer, or what do we do that our competitors don't do? Once answers to these questions are developed into a list, the qualification process begins.

To qualify as an Exclusive Strength, what you have or what you do must be something your customers care about. For example, if you truly have a system of credit and collection activities that allow you to approve and fund more “D” credits than any industry competitor in a geographical area, and your customers care about this ability, it begins to qualify as an Exclusive Strength. If you can prove your claim to your customers, it will then pass the final test and will qualify as an Exclusive Strength for your company. It's important to note that your claim is an Exclusive Strength only for those customers who are “D” credits or those who provide goods or services to “D” credit customers. “A” credit customers, or those who sell exclusively to “A” credit customers, may have no interest in your sub-prime funding capabilities. In these cases your ability is not seen as an Exclusive Strength because they don't care!

Another, almost failsafe approach to zeroing in on your Exclusive Strengths is to ask your customers! Instead of sending out surveys which ask your customers how you can improve your services, ask them, in person, the following, simple questions: “Why do you do business with us? What do we have or do that distinguishes us, in your eyes, from our competitors?” They will tell you how they see you as different from your competitors, and they'll let you know what else they want from you to remain loyal customers. |

|

|

[headlines]

------------------------------------------------------------

Butler Capital Joins "Funder Only" List

Funders Only - Update

A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program

| D -"Private label Program" | E - Also "in house" salesmen

Rank |

Name

In Business Since

Contact

Website

Leasing Association |

Employees |

Geo

Area |

Dollar

Amount |

Equipment Restrictions |

A |

B |

C |

D |

E |

4 |

|

45 |

National (U.S.) lender |

$25,000 - $1Million

(typically $100,000 - $350,000) |

post-production, mining, aircraft, vessels, gaming, ATMs, tanning |

Y |

Y |

N |

Y |

Y |

(I) BUTLER CAPITAL - For nearly three decades, Butler has purchased loans and leases - individually or in portfolios - from lessors and brokers nationally. Butler 's inclusion in the 2005 edition of the "Monitor 100" underscores the firm's commitment to funding deals quickly, structuring deals professionally, and avoiding the limitations of app-only credit scoring. As a direct lender with wholesale lines of credit ready to be tapped for our broker/lessor clients, we pride ourselves on common-sense, individualized credit decisions on a wide variety of equipment. We invite no-obligation calls! In those states in which brokers must be licensed, Butler , too, requires such licensing. We welcome both opportunities to fund brokers' transactions under our name or create private-label programs to enable brokers to market their own services more broadly. Although Butler has in-house sales personnel, we do not solicit the customers of our broker/lessor clients; rather, we work to preserve and enhance a broker's relationship with his/her customer.

To view the complete list, please click here.

[headlines]

------------------------------------------------------------

Classified Ads---Help Wanted

National Program Skills

|

National Program Skills, San Francisco

Daily management national program accounts/support V.P. National Programs Min. 3 yrs leasing exp. understand credit/financial/tax returns w/strong follow-up, great opportunity to grow, to learn more, click here.

|

|

Salesperson

|

"Tired of working for a broker or discounter at inflated buy rates?"

We are a direct nationwide funder.

Decisions are made here on "application only" up to $125,000. We are fast, too, and we will keep your vendors and customers happy with our efficient staff.

Contact Jim Doster sales@abanklease.com

"We want you to make as much money as you can."

|

|

Vendor Relationship

|

Director, Vendor Relationship Development: Office Equipment Group.

Accountable for originating/ maintaining volume from large Office Equipment dealers. Preferred locations - SW and Mid-Atlantic. Full descrip/to Apply, Click here

GreatAmerica is a highly successful entrepreneurial company providing equipment financing to businesses across the United States. |

|

[headlines]

------------------------------------------------------------

Leasing Conferences Up-Date

Leasing Association Conferences-Fall, 2005

For all attendees for the Fall Conference at Caesars Lake Tahoe we wish to

inform you that the average temperature is in the mid 60's as the high and

the mid 30's as the low. Please plan to dress comfortably and accordingly.

For those of you needing transportation from Reno to South Lake Tahoe please

contact South Tahoe Express at 775-325-8944. You can also see the arrival

and departure times at www.southtahoeexpress.com

We Look forward to seeing you at Caesars!!

"I would say that while Ceasers is sold out, there are still limited rooms available at hotels in the near vicinity. Joe Woodley and his staff have been working their tails off trying to accommodate all that want to attend. Even if you have to stay "down the street", this conference is a must attend event for those broker / lessors that are looking to improve their business. The conference theme pretty much sums it up. Peers,Processes, Practices and Profitability. The speakers are excellent (Joe Lane, with the Equipment Lease and Finance Foundation, and Col. Schaefer, Iran hostage ). With everything there is to offer in education and industry roundtables, plus all the great funding sources and providers (over 60 strong) add in all the great networking opportunities and this conference has something that we can all be happy about...great value!

"I strongly believe in this business and see sunny days for those that make an effort to want to improve their business by being members of equipment leasing associations like the UAEL."

Best regards,

Conference Chairman

Randy Haug

Sr. Vice President

LeaseTeam, Inc.

(800)531-5086 x 1014

Our theme for this year is Peak Performance: Peers, Processes, Practices and Profitability. We have a great lineup of sessions, roundtables and panel discussions scheduled on interesting and diverse topics. We also have some good opportunities to network; Thursday night, welcome reception will take place on the deck of the Edgewood Country Club and the other of the events will also feature the exclusive buyout of the M.S. Dixie for the Saturday Sunset Dinner/Dance Cruise.

We are very excited about about two of the speakers we have line up this year. Colonel Tom Schaefer was an Iranian hostage for 444 days in 1979-1980. We also have Mr. Joseph Lane, Chairman of the Equipment Leasing and Finance Fundation, addressing our industry as our keynote speaker.

Col. Tom Schaefer

|

Joseph C. Lane

CEO of GE Technology Finance |

The view the complete brochure, click here.

-----------------------------------------

Equipment Leasing Association

October 23-24

44th Annual Convention

Boca Raton Resort & Club

Boca Raton, Florida

A non-member who has not attended the conference before is invited

to attend.

Registration and all information about the Annual Convention are now available on-line at http://www.elaonline.com/events/2005/annconv/

ELA’s 44th Annual Convention focuses on creating and managing value and performance.

By Lesley Sterling

Value is a subjective word. But it is a critical component of a company’s performance and health. The 2005 Special Edition of The McKinsey Quarterly on Value and Performance suggests that companies with a clear sense of value “...have a robust strategy, well-maintained assets, innovative products and services, a good reputation with customers, regulators, governments and other stakeholders and the ability to attract, retain and develop high-performing employees.” Sound like any of your companies out there? Equipment lessors who are most successful at creating value for customers, investors, parent company and employees strengthen their market presence and increase their opportunities for growth.

Sessions planned for the 44th Annual ELA Convention, scheduled October 23-25, 2005 at the Boca Raton Resort & Club in Boca Raton, Florida, address a wide variety of the dimensions critical to creating and managing value and performance. “Creating Value,” this year’s convention theme, implies that your company is successful because of greater knowledge, convenience or speed.

For the 44th time, everyone who is anyone in equipment leasing and finance will gather at the ELA Annual Convention. What brings them back? As the largest annual gathering of equipment leasing leaders, the ELA Annual Convention is a tremendous opportunity to meet with colleagues, conduct business and update your learning on the latest issues impacting your business. And perhaps most important of all…the ELA Annual Convention is one of the best ways to test your assumptions about your market segment, the economy, and opportunities for business development.

We invite you to review what’s in store for you in Boca Raton this year:

General Sessions

--The United States’ Place in the World Today--

A first-rate group of policy analysts have been invited to discuss America’s role in the world today. This formidable panel is comprised of the following individuals:

Richard Haass--Mr. Haass is president of the Council on Foreign Relations. Until recently, Richard Haass was director of policy planning for the Department of State, where he was a principal advisor to Secretary of State Colin Powell on a broad range of foreign policy concerns. Haass also served as U.S. Coordinator for policy toward the future of Afghanistan and was the lead U.S. Government official in support of the Northern Ireland peace process. For his efforts, he received the State Department’s Distinguished Honor Award. Previously, Ambassador Haass was vice president and director of foreign policy studies at The Brookings Institution.

Dr. Zbigniew Brzezinski--Dr. Brzezinski is a counselor with the Center for Strategic & International Studies, and the Robert E. Osgood Professor of American Foreign Policy at the Paul Nitze School of Advanced International Studies, Johns Hopkins University, Washington, DC. From 1977 to 1981, Brzezinski was National Security Advisor to President Carter. In 1981 he was awarded the Presidential Medal of Freedom for his role in the normalization of U.S.-Chinese relations and for his contributions to the human rights and national security policies of the United States.

General Brent Scowcroft (Ret.)--As president and founder of The Scowcroft Group, and one of the country's leading experts on international policy, Brent Scowcroft provides strategic advice and assistance in dealing in the international arena. Gen. Scowcroft has served as the National Security Advisor to both Presidents Ford and G.H.W. Bush. During his twenty-nine-year military career, West Point-graduate Scowcroft attained the rank of Lieutenant General and served as the Deputy National Security Advisor, Professor of Russian History at West Point; Assistant Air Attaché in Belgrade, Yugoslavia; Head of the Political Science Department at the Air Force Academy; Air Force Long Range Plans; Office of the Secretary of Defense International Security Assistance; Special Assistant to the Director of the Joint Chiefs of Staff; and Military Assistant to President Nixon.

Creating Pockets of Greatness

Jim Collins--Jim Collins is a student of enduring great companies—how they grow, how they attain superior performance, and how good companies can become great companies. Having invested more than a decade of research into the topic, Jim has authored or co-authored four books—including “Built to Last,” a fixture on the Business Week bestseller list for more than six years, and the New York Times bestseller, “GOOD TO GREAT: Why Some Companies Make the Leap…And Others Don’t.” His work has been featured in Fortune, The Economist, Fast Company, USA Today, Industry Week, Business Week, Newsweek, Inc., and Harvard Business Review.

Economic Realities: The World View

David D. Hale--David Hale is the Global Chief Economist for the Zurich Financial Services Group and its investment affiliates, advising the group’s fund management operations on the economic outlook and a wide range of public policy issues. Mr. Hale is a member of the National Association of Business Economists, the New York Society of Security Analysts, the Financial Instruments Steering Committee of the Chicago Mercantile Exchange and the Academic Advisory Board of the Federal Reserve Bank of Chicago. He writes on a broad range of economic subjects for such publications as The Wall Street Journal, The Far Eastern Economic Review, The Financial Times of London, The New York Times, The Nihon Kezai Shimbun, The Financial Analyst Journal, The Harvard Business Review, and Foreign Policy. Since 1990, he also has been a consultant to the United States Department of Defense on how changes in the global economy are affecting United States security relationships.

Breakout Session Sampler

Thirty concurrent breakout sessions have been planned, including the annual meetings of the six ELA Business Councils. Sessions selected for the 44th Annual ELA Convention describe one or more value propositions that are reflected in any of the following:

• Greater value for customers

• New ways of looking at customers

• How products are positioned or priced

• Differentiating your company from competitors

• Higher returns

• Greater market share

• Effective use of resources

• Personnel programs that add value

• Effective management of assets

• Risk management

• Optimizing changes in a new regulatory environment.

For a complete listing of the sessions planned, go to the ELA website: http://www.elaonline.com/events/2005/annconv/

"Business Growth through Customer Satisfaction—How to Make it Happen"

Attendees to this session will get a greater understanding of the role customer satisfaction plays in driving business growth, and will learn specific approaches to pursue better customer satisfaction in a variety of areas. In his more than 20 years working in financial services, Keith Kendall, VP & Managing Director, HP Financial Services, has developed a sense of what works. He maintains that there are three keys to successfully creating and maintaining value for the customer and therefore driving satisfaction: effective partnering, efficient processes, and customer dialogue. Kendall will outline the strategy of HP Financial Services in its pursuit of total customer experience (TCE) and how that has brought the organization squarely into a redesign of customer processes that is spawning new ways of working and driving positive results.

"Developing & Motivating a Sales Force that Creates Value"

This session highlights the value created by a well-trained, highly motivated sales force. Three organizations—a bank, an independent and a captive—will share how they organize, develop, motivate, evaluate and compensate their sales force. Issues discussed include: critical competencies; turning work activities into planned and tracked learning events; using collaborative simulation to improve performance; expanding the role of the sales force into strategic planning and portfolio performance; alignment strategies; processes; performance measurement initiatives; compensation methodologies; sales force structure; activity segmentation; assessment; training methods and performance measurement; importance of aligning captive and vendor sales force training programs with end user go-to-market strategies and financing offerings. Panelists include Paul Frisch, EVP, US Bancorp Equipment Finance, Inc.; Lynda Jackson, Principal, The Alta Group; Todd Karas, Managing Director, Bank of America; Gary Kempinski, VP, Business Development, GE Commercial Finance; and Chuck Thomas, IBM Global Financing.

"Best Practices: How Front-End Systems Can Improve Origination Capacity"

To remain competitive, innovative finance organizations are returning to the point of origination to tap under-leveraged resources and open new portals for business growth. Panelists will share real-world challenges they faced during front-end to back-end processing system integration, the solutions they came up with for implementing a standard process, and the results in improved efficiency, profitability and long term business. Case studies presented by small, mid and large ticket equipment financing companies. Speakers include: Virginia Garcia, (moderator), TowerGroup; Mike Romanowski, CoBank; Elaine Temple, First Continental; and Jim Zook, International Decision Systems.

"Know Your Competition: How to Compete Against Alternative Capital Market Products"

Recent innovations in public debt securities and institutional finance have generated a host of new products that are an alternative to leasing in funding capital equipment acquisitions, especially for below investment grade companies. Mindy Berman, 42 North Structured Finance, Inc., will help attendees identify the capital markets products that compete against leasing products. These products are not always a direct replacement for leasing but provide an alternative source of funds that frequently pre-empts a company’s need to finance capital equipment spending on a dedicated basis. She will also identify the size and characteristics of each product market and the target borrowers for each. Berman will discuss how these capital market alternatives compare to equipment financing and the pros and cons of each, including terms, pricing and corporate restrictions. How to sell against these products will also be reviewed.

"Getting the Leads-Managing the Relationship-Closing the Loop"

This panel of experts from leasing, business process and technology service providers will review the latest tools, techniques and methodologies in sales and marketing automation. Presenters will address key topics such as list/campaign management techniques, leading sales automation technologies, tying together marketing, sales, pricing, credit and operations, application to small versus mid ticket businesses, marketing vendor programs, accelerating source/program approval. Panelists, which include: Michael Pennell, CapitalStream; John Hurt, LaSalle National Leasing Corp.; and Steve LeBarron, Blackwell Consulting Services, will provide real world examples of techniques and technologies that have, and have not, worked.

"Data Security: The Rules Have Changed and the Risks are Higher"

The flood of news items disclosing one data security breach after another continues to rise. These data security breaches are embarrassing and costly: the average reported loss of a data theft incident is $2.7 million (Wall Street Journal). Jeffrey Zeigler, Newmarket Trading Group Ltd, will help attendees understand how the changing regulatory environment is effecting data security requirements for owners and lessees of information technology equipment. Areas covered include Sarbanes-Oxley, Health Insurance Portability and Assurance Act (HIPAA) and Graham Leach Bliley ( GLB). Attendees will also learn how the rise of identity theft and the technology used to combat its spread is impacting the equipment leasing industry. The security and documentation procedures needed to demonstrate compliance is also discussed. The session will address the key issues related to ELA members for data security requirements in 2005 and beyond.

"Building Small Ticket Business by Creating Value for Manufacturers and Distributors: Take the Mystery out of Leasing with Technology"

Manufacturers and distributors of equipment need robust funding sources and programs that will enable them to differentiate their products from the competition by way of financing they provide their customers. Financing must be price competitive, easy to access and able to support multiple levels of credit-worthiness. Dwight Jackson and Stuart Koplowitz of Terra Vista Software, Inc., will discuss: how automating the process of online rate sheet pricing and applications reduces response time back to customers resulting in increases in the sales hit rate for manufacturers and distributors; how automating rate sheet pricing substantially reduces the risk to the funder by improving the accuracy by which the process is applied, improving efficiencies and reducing costly mistakes. This translates into higher profit and overall customer satisfaction and better customer retention.

We hope to see in you Boca Raton, Florida. For a complete review of the activities and sessions planned for the 44th Annual Convention, please visit the ELA website here:

http://www.elaonline.com/events/2005/annconv/

Lesley Sterling is ELA vice president, professional development.

---------------------------------------

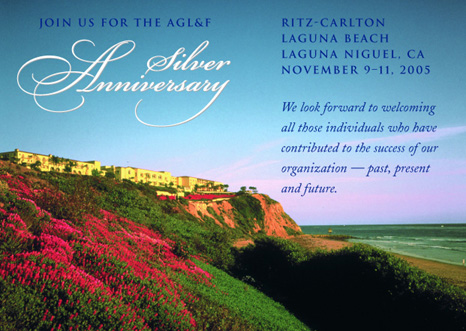

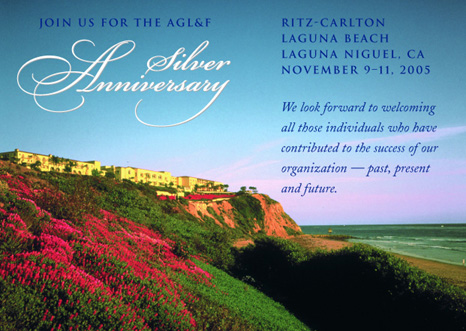

Association of Government Leasing & Finance

November 9, 2005

Dana Point, California

Conference Brochure and Registration:

http://www.aglf.org/pdf/25AM05RegPgm.pdf

AGL&F FALL CONFERENCE SPONSORS

Chairman's Club

AIG Commercial Equipment Finance

Banc of America Leasing and Capital Group

DeLage Landen Public Finance, LLC

Standard & Poor's Corp.

President's Club

Fifth Third Leasing Company

LaSalle National Leasing Corporation

Moody's Investors Service

National City Commercial Capital

Oppenheimer & Co., Inc.

SunTrust Leasing Corporation

Silver Anniversary Club

All Points Capital Corp.

Ambac Assurance Corp.

Becker Stowe & Bieber, LLC

Chapman & Cutler, LLP

Doyle & Bachman

Financial Security Assurance

GE Capital Public Finance

Gilmore & Bell, P.C.

Government Leasing Company

Marquette Bank

Peck Shaffer & Willams, LLP

Popular Leasing

Tatonka Capital Corp.

Wachovia Bank, N.A.

Windels Marx Lane & Mittendorf, LLP

|

[headlines]

------------------------------------------------------------

### Press Release ###########################

"Thanks for including us in your story credit list. It's testimony to you and Leasing News that we have received a number of phone calls."

Best regards,

Barry

Barry P. Korn, CFA

President

Barrett Capital Group

Barrett Capital Group Moves to NYC

Financial institution that serves the commercial vehicle market relocates to the world's financial hub.

New York, N.Y. - Barrett Capital Group (www.barrettcapital.com), a company that has been providing leasing and financing services for more than 30 years, moved its base of operations to New York City on September 1, 2005.

Barrett serves the national market for commercial ground transportation vehicles and work trucks - including limousines, shuttles, specialty vans, Black Cars (executive sedans), buses, tow trucks (rollbacks and wreckers), sweepers, dump trucks, and funeral and medical transportation vehicles. A "direct" finance source, Barrett has financed and managed vehicles and equipment costing in excess of $100 million.

The company also specializes in diplomatic leasing. In support of its financing and leasing programs, Barrett buys, sells and auctions new and used vehicles.

"When you call us, you are dealing directly with your lender, not a broker, so you can receive fast credit approval, your questions are answered more quickly and you can count on the best customer service anywhere," says Barrett's principal, Barry P. Korn, CFA, who has served the finance and leasing industries for more than 30 years. "We moved to New York City because it puts us in the heart of the world's financial district."

According to Korn, Barrett also handles "C" and "D" credit financing, successfully applying its expertise to individuals and corporations with prior credit problems. Barrett delivers on its motto, "When you need a second chance."

The company works with every major automobile, bus and truck manufacturer, coachbuilder, dealer and distributor, and offers pre-approved credit lines, so users can move quickly once a desired vehicle is located.

Prior to its September 1 move, Barrett was located in New Rochelle, New York. The company is now located at 51 East 42nd Street, Suite 408, New York, N.Y. 10017.

For more information, visit

www.barrettcapital.com,

call (212) 682-8500,

fax the company at (212) 682-9235 or

email Barrett@BarrettCapital.com.

[headlines]

### Press Release ###########################

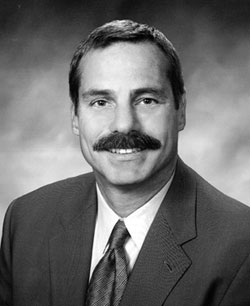

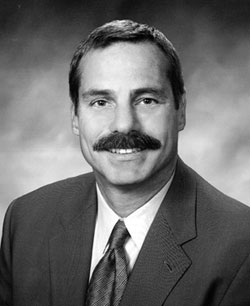

Aequitas Capital Management Appoints William Purcell as

Chief Operating Officer Portland, Ore.

William Purcell

Aequitas Capital Management has added William Purcell as Chief Operating Officer. Mr. Purcell most recently served as President and Chief Executive Officer of U.S. Bancorp Equipment Finance, Inc., one of the largest bank-affiliated equipment finance companies in the nation and a major funding source for companies in nearly every industry sector nationwide. In this position, he directed all operations of the stand-alone leasing company with five divisions, 30,000 contracts and 375 employees, incorporating more than $4 billion in assets and $1 billion in annual new business volume.

Prior to joining U.S. Bancorp Equipment Finance, Mr. Purcell was Executive Vice President for Machine Tool Finance Corporation, a company that financed metal cutting, fabrication and plastics equipment. U.S. Bancorp acquired the business in 1990. Mr. Purcell was promoted to Group President in 1993 and the company relocated to Portland, where he led the division through 2001.

"Bill's extensive background in commercial finance and his experience in managing dynamic businesses will prove invaluable as we continue growing our investment management business. I believe our lending in healthcare and middle markets will benefit significantly from his leadership," said Robert J. Jesenik, President and Chief Executive Officer of Aequitas. "I'm pleased he has chosen to join us and look forward to the contributions he will make."

Aequitas Capital Management, a diversified financial services firm, acquires and deploys capital in high potential and socially responsible markets. Since 1993, Aequitas has structured and invested more than $1.5 billion in customized financial transactions. Aequitas provides broad capabilities and focused execution in the sectors of health care, energy, manufacturing, distribution and professional services.

For more information, visit Aequitas Capital Management's Web site at

www.aequitascapital.com .

For More Information, Contact: David Dugan, (503) 221-0100

[headlines]

### Press Release ###########################

David Tunnicliffe Appointed HSBC West Coast Regional President

NEW YORK - HSBC Bank USA, N.A., the U.S. banking unit of one of the world's largest financial services companies, today announced it has named David Tunnicliffe president of its U.S. West Coast region. He is based in San Francisco and reports to Brendan McDonagh, the bank's chief operating officer.

Prior to taking on the West Coast role, Tunnicliffe was senior vice president and manager of the Vancouver main office for HSBC Bank Canada. In that role, he managed the bank's Vancouver main branch. In his new position, Tunnicliffe is responsible for HSBC's retail and commercial banking operations on the U.S. West Coast. HSBC has an expanding network of branches in the San Francisco Bay Area and the Los Angeles area in addition to commercial banking, private banking and commercial real estate capabilities. The bank also has commercial banking offices in Portland and Seattle, which Tunnicliffe now oversees.

"Under David's leadership, HSBC will continue to expand all aspects of its West Coast business," McDonagh, the bank's chief operating officer, said. "Throughout his career, David has held a wide range of roles that will help him guide our West Coast growth plan."

Tunnicliffe began his banking career in 1968 when he began working at the Bank of Nova Scotia. In 1971, he joined the Bank of British Columbia. That bank was acquired in 1986 by the Hong Kong Bank and eventually became part of HSBC Bank Canada. He also served as head of HSBC's Personal Financial Services business in Australia.

About HSBC Bank USA, National Association:

HSBC Bank USA, N.A. has nearly 400 branches in New York State, a network of branches in Florida. California and Pennsylvania and one branch each in New Jersey, Delaware, Washington State, Oregon and Washington, D.C. It is the principal subsidiary of HSBC USA Inc, an indirectly-held, wholly-owned subsidiary of HSBC North America Holdings Inc., one of the nation's 10 largest bank holding companies by assets.

For more information about HSBC Bank USA and its products and services visit us.hsbc.com.

[headlines]

### Press Release ###########################

CIT Names J. Daryl MacLellan President, CIT Canada

NEW YORK, / -- CIT Group Inc. (NYSE: CIT), a

leading provider of commercial and consumer finance solutions, today announced the appointment of J. Daryl MacLellan to the position of President, CIT Canada. He will be responsible for directing the continued expansion of CIT's financial offerings across multiple business lines as the company extends the full scope of its lending power, relationships and financial expertise in the growing Canadian market. Mr. MacLellan will report jointly to Rick Wolfert, Vice Chairman, Commercial Finance, and Tom Hallman, Vice Chairman, Specialty Finance. In addition to this newly-created position, he will also continue in his current role as President of CIT Group Securities (Canada) Inc.

Mr. MacLellan has been with CIT for 15 years, and has held a number of senior executive positions. Most recently, he served as Executive Vice President and Chief Operating Officer of CIT Capital Finance and President of CIT Group Securities (Canada) Inc. He is a graduate of the University of Waterloo, a Chartered Accountant and serves on the Board of Directors of the CFLA (Canadian Finance & Leasing Association).

Jeffrey M. Peek, Chairman and CEO commented: "Canada is an important part of CIT's broadening global strategy. With above average investment and growth in key lending areas, such as technology, natural resource development and healthcare, Canada represents an important area of growth for CIT's overall business strategy. We are excited to recognize the contribution Daryl has made to the growth of CIT Canada as we position the organization to further capitalize on key sectors under his leadership."

With more than 600 employees, CIT Canada provides clients in many leading industries, including the transportation, construction, energy and consumer products markets, with products and services ranging from corporate finance, equipment financing and vendor financing, among others.

About CIT:

CIT Group Inc. (NYSE: CIT), a leading commercial and consumer finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has nearly $60 billion in assets under management and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries. CIT, a Fortune 500 company and a component of the S&P 500 Index, holds leading positions in vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset-based lending. CIT, headquartered in New York, has approximately 6,000 employees in locations throughout North America, Europe, Latin and South America, and the Pacific Rim. For more information, visit http://www.cit.com.

SOURCE CIT Group Inc.

[headlines]

### Press Release ###########################

---------------------------------------------------------------

News Briefs----

ABS researchers chop up autos, cards and student loans

http://www.absnet.net/include/showfreearticle.asp?file=/headlines/2.htm

Housing construction falls in August for second straight month

http://www.signonsandiego.com/news/business/20050920-1406-economy.html

Federated plans to cut about 6,200 jobs

http://www.usatoday.com/money/industries/retail/2005-09-20-federated_x.htm?csp=26

N.Y. Times cutting 500 jobs, 4 percent of work force

http://www.signonsandiego.com/news/business/20050920-1404-nytimes-jobcuts.html

[headlines]

----------------------------------------------------------------

You May Have Missed

Gold is Back in Higher Value/Forecast of the Economy

http://leasingnews.org/PDF/ROBsept17-2005.pdf

[headlines]

----------------------------------------------------------------

Sports Briefs----

Bonds Greeted By Boos, Silence

http://www.washingtonpost.com/wp-dyn/content/article/2005/09/20/AR2005092002094.html

There's no looking back for Tyrone Willingham

http://www.mercurynews.com/mld/mercurynews/sports/colleges/12692674.htm

[headlines]

----------------------------------------------------------------

California News Briefs---

Schwarzenegger admits mistakes, says he'll prevail

http://www.signonsandiego.com/news/state/20050920-2016-ca-schwarzeneggerinterview.html

[headlines]

----------------------------------------------------------------

"Gimme that Wine"

California's Napa Valley Expects Best `Crush' in Four Years

http://www.bloomberg.com/apps/news?pid=10000103&sid=awYaqxi32v3M&refer=us

Wine-And-Grape Business Feeds $3.3B to N.Y.

http://www.sfgate.com/cgi-bin/article.cgi?f=/n/a/2005/09/20/financial/

f024333D44.DTL&hw=wine&sn=001&sc=325

Little bug could mean big trouble for Arizona wine industry

http://kvoa.com/Global/story.asp?S=3871999&nav=HMO6HMaY

California winemakers cheer agreement with European Union

http://www.sfgate.com/cgi-bin/article.cgi?file=/news/archive/

2005/09/15/state/n153551D56.DTL

[headlines]

----------------------------------------------------------------

This Day in American History

1737 -Birthday of Francis Hopkinson, American statesman, signer of the Declaration of Independence, first native-born American composer and writer. He also designed the first American flag with stars and stripes. The design of the first Stars and Stripes by Hopkinson had the thirteen stars arranged in a "staggered" pattern technically known as quincuncial because it is based on the repetition of a motif of five units. This arrangement inevitably results in a strongly diagonal effect. In a flag of thirteen stars, this placement produced the unmistakable outline of the crosses of St. George and of St. Andrew, as used together on the British flag. Whether this similarity was intentional or accidental, it may explain why the plainer fashion of placing the stars in three parallel rows was preferred by many Americans over the quincuncial style

http://www.ushistory.org/declaration/signers/hopkinson.htm

http://www.colonialhall.com/hopkinson/hopkinson.php

[headlines]

----------------------------------------------------------------

This Day in American History

1596-Spain named Juan de Oñate governor of the colony of New Mexico.

http://memory.loc.gov/ammem/today/sep21.html

1737 -Birthday of Francis Hopkinson, American statesman, signer of the Declaration of Independence, first native-born American composer and writer. He also designed the first American flag with stars and stripes. The design of the first Stars and Stripes by Hopkinson had the thirteen stars arranged in a "staggered" pattern technically known as quincuncial because it is based on the repetition of a motif of five units. This arrangement inevitably results in a strongly diagonal effect. In a flag of thirteen stars, this placement produced the unmistakable outline of the crosses of St. George and of St. Andrew, as used together on the British flag. Whether this similarity was intentional or accidental, it may explain why the plainer fashion of placing the stars in three parallel rows was preferred by many Americans over the quincuncial style. Francis Hopkinson was the only individual to actually claim the credit for the design of the U.S. flag at the time. He billed Congress for "a quarter cask of the public wine" for his efforts. Congress did not outright deny his claim but sat on it for years. Only after Hopkinson rebilled his claim in cash, *along with other claims for other emblems*, did Congress act on it, denying it on the grounds that Hopkinson was not the only person who had a hand in designing the flag *and other emblems.

http://ww http://fotw.vexillum.com/images/u/us-hopk1.gifw.ushistory.org/declaration/

signers/hopkinson.htm

http://www.colonialhall.com/hopkinson/hopkinson.php

1782- Congress authorized the printing of the complete Bible in English, only available in Green and Latin to that time. It was entitled "the Holy Bible, containing the Old and New Testaments-newly translated out of the original tongues; and with the former translations diligently compared and revised." The frontispiece noted that it was "printed and sold by R. Aitken, at Pope's Head, Three doors above the Coffee House in Market Street, Philadelphia, PA, 1782." It was a duodecimo of 353 pages without pagination. Philadelphia, PA, in 1782

1784-The first daily newspaper begins in Pennsylvania.

( lower half of: http://memory.loc.gov/ammem/today/sep21.html )

1814 -- Black troops cited for bravery in Battle of New Orleans.

On each page of history

America sees my face

On each page of history

We leave a shining trace

On each page of history, My race! My race! My race!

---Langston Hughes

http://lsm.crt.state.la.us/cabildo/cab6.htm

1884-Birthdy of Hugh I. "Shorty" Ray, Pro football Hall of Fame official born at Highland Park, IL. Ray was the NFL Supervisor of Officials from 1938 through 1952. He wrote the high school rule book that became the basis for all football rule books. He raised the quality of officiating games conducting seminars and requiring officials to take written exams,. Inducted into the Hall of Fame in 1966. Died Sept 16,1956

1894 - A heavy chicken house, sixteen by sixteen feet in area, was picked up by a tornado and wedged between two trees. The hens were found the next day sitting on their eggs in the chicken house, with no windows broken, as though nothing had happened.

1912-Birthday of cartoonist Chuck Jones, born at Spokane, WA. Chuck Jones worked as a child extra in Hollywood in the 1920s. After attending art school, he landed a job washing animation cels for famed Disney animator Ub Iwerks. He learned the craft, and by 1962 he headed his own unit at Warner Bros. Animation. He created the characters Road Runner and Wile E. Coyote, Marvin the Martian and Pepe le Peu. He worked on the development of Bugs Bunny, Elmer Fudd, Daffy Duck and Porky Pig, and also produced, directed and wrote the screenplay for the animated 1966 television classic "Dr. Seuss How the Grinch Stole Christmas." He won several Academy awards for his work and his cartoon " What's Opera, Doc"" is in the National Film Registry. He died on Feb. 22, 2002, at Corona Del Mar, CA.

1914- bassist Slam Stewart born, Englewood, NJ

1918- Bassist Tommy Potter born, Philly.

1921-Birthday of drummer Chico Hamilton

http://www.drummerworld.com/drummers/Chico%20Hamilton.html

http://music.barnesandnoble.com/search/artistbio.asp?userId=&mscssid=&pCount=

&sRefer=&sourceid=&ctr=70348

1924-two tornadoes, one an F4 and the other an F5 tore paths of devastation through Eau Claire, Clarke and Taylor counties in Wisconsin. Death toll was 18 and 50 people were injured

1934 - Singer/composer/musician/poet Leonard Cohen born Montreal, Canada.

http://www.leonardcohen.com/

www.leonardcohenfiles.com/

http://members.aol.com/megan2c2b/

http://www.webheights.net/dearheather/songs.html

1938 - A great hurricane smashed into Long Island and bisected New England causing a massive forest blow down and widespread flooding. Winds gusted to 186 mph at Blue Hill MA, and a storm surge of nearly thirty feet caused extensive flooding along the coast of Rhode Island. The hurricane killed 600 persons and caused 500 million dollars damage. The hurricane, which lasted twelve days, destroyed 275 million trees. Hardest hit were Massachusetts, Connecticut, Rhode Island and Long Island NY. The "Long Island Express" produced gargantuan waves with its 150 mph winds, waves which smashed against the New England shore with such force that earthquake-recording machines on the Pacific coast clearly showed the shock of each wave.

1941-Birthday of country songwriter, singer~ Dickey Lee (Lipscomb), born Memphis, Tennessee.

http://www.cmt.com/artists/az/lee_dickey/bio.jhtml

1947---Top Hits

Peg o' My Heart - The Harmonicats

That's My Desire - The Sammy Kaye Orchestra (vocal: Don Cornell)

I Wonder Who's Kissing Her Now - Perry Como

Smoke! Smoke! Smoke! (That Cigarette) - Tex Williams

1947-Birthday of author Stephen King, born Portland, ME.

1948- " Texaco Star Theater" premiered. I remember around six years old watching this, and laughing at Milton Berle in women's clothing, the group of us sitting around the television on the block, marveling at this invention.

1949-Wesley Anthony Brown of Washington, DC, became the first Naval Academy Graduate who was African-American when he received his commission as ensign.

1950-Comedian/Actor Bill Murray born Evanston, IL.

1955---Top Hits

The Yellow Rose of Texas - Mitch Miller

Maybellene - Chuck Berry

Love is a Many-Splendored Thing - The Four Aces

I Don't Care - Webb Pierce

1955-The Platters' first million seller, "Only You," enters the pop charts at #24. The song hits Number One on the R&B chart. It becomes the first record to sell more than a million copies in France.

1955 - Boxing fans all over the world held their collective breaths as Archie Moore, the light heavyweight champion, knocked the heavyweight champion, Rocky Marciano, to the floor on this night. But the champ got up ... just as he had done in every fight before this ... and went on to defeat Moore. Rocky Marciano was the only world champion at any weight to have won every fight of his professional career (1947 to 1956). 43 of his 49 fights were won either by KO's or because the fight had to be stopped.

1957- "Perry Mason" premiered on television. Raymond Burr will forever be associated with the character of Perry Mason, a highly skilled criminal lawyer who won the great majority of his cases. Episodes followed a similar format: the action took place in the first half, with the killers identity unknown, and the courtroom drama took place in the latter half. My father Lawrence Menkin was the story editor for several years, and also wrote several of the episodes. Mason was particularly adept at eliciting confessions from the guilty parties. Regulars and semi-regulars included Barbara Hale, William Hopper, William Talman and Ray Collins ( who when he got old, moved slowly, so Talman and Burr liked to pitch his butt, even on camera, to get him moving, and the crew sometimes would laugh too much and they would have to shoot the scene over, I remember my father telling me ).. Following the series' end, with the last telecast on Jan 27,1974, a number of successful "Perry Mason" TV movies aired and the show remains popular in reruns. Raymond Burr owned and operated a winery in Sonoma County, which still exists today.

1959- "Sleep Walk" by Santo & Johnny topped the charts and stayed there for 2 weeks.

1963-- "Blue Velvet" by Bobby Vinton topped the charts and stayed there for 3 weeks.

1963---Top Hits

Blue Velvet - Bobby Vinton

Heat Wave - Martha & The Vandellas

Sally, Go 'Round the Roses - The Jaynetts

Abilene - George Hamilton IV

1963-"Sugar Shack" by Jimmy Gilmer & the Fireballs enters the Hot 100. It says there for 15 weeks and climbs to Number One for five weeks starting on October 12. It receives a gold record on November 29.

1965 -- The Jefferson Airplane opens for Lightnin' Hopkins at the Matrix on Fillmore St. Norm Mayell backed Hopkins on drums.

He patted him on the back no sooner Mr. Charlie had stooped over

He said, mi'mi mi'mi Mr. Charlie

Mr. Charlie straightened up and looked at him & say

Boy you tryin to tell me somethin

He say, Now if you can't talk it then sing it

& he say

oooooooohhhh mister charlie

your rollin mill is burnin down

- Lightnin Hopkins, Once in the Country

1968-Jimi Hendrix' "All Along the Watchtower" is released.

1968- "Harper Valley P.T.A." by Jeannie C. Riley topped the charts and stayed there for a week.

1970- the first "Monday Night Football" premiered. Following the complete merger of the American Football League and the National Football League, ABC joined CBS and NBC in television weekly games w. The show originally began as an experiment but soon became an institution. Announcers Howard Cosell, Keith Jackson and Don Meredith called the first game, a 31-21 victory by the Cleveland Browns over the New York Jets.

http://espn.go.com/abcsports/mnf/s/alltimehistory.html

1971---Top Hits

Go Away Little Girl - Donny Osmond

Spanish Harlem - Aretha Franklin

Ain't No Sunshine - Bill Withers

The Year That Clayton Delaney Died - Tom T. Hall

1974-The Rolling Stones' "It's Only Rock & Roll (But I Like It)" peaks at #16 on the chart.

1974- "Can't Get Enough of Your Love, Babe" by Barry White topped the charts and stayed there for a week.

1976-The Bee Gees' 20th album, "Children of the World," goes gold. It contains two of their latest hits "You Should Be Dancing" (Number One two weeks ago) and "Love So Right" (which will make it to #3 in two months.)

1979---Top Hits

My Sharona - The Knack

After the Love Has Gone - Earth, Wind & Fire

The Devil Went Down to Georgia - The Charlie Daniels Band

You're My Jamaica - Charley Pride

1981 - Sandra Day O'Connor was confirmed by the United States Senate in a 99-0 vote, and she became the first female Justice of the United States Supreme Court.

1983-Billy Joel's "Tell Her About It" hits #1 on the singles chart.

1985-Michael Spinks won the heavyweight championship by taking a unanimous 15-round decision over Larry Holmes in Las Vegas. Sppnks held the title until June 27,1988,when he was knocked out by Mike Tyson in the first round.

1985-- "Money forNothing" by Dire Straits topped the charts and stayed there for 3 weeks.

1986-The New York Jets and Miami Dolphins combined for a record 884 passing yards and scored 96 between them, including 13 touchdowns and a pair of field goals. Quarterback Ken O'Brien completed four touchdown passes to wide receiver Wesley Walker, including the game-winner in overtime. The final score: New York 51, Miami 45.

1987 - Tropical Storm Emily, which formed in the Caribbean the previous afternoon, caused considerable damage to the banana industry of Saint Vincent in the Windward Islands. Unseasonably hot weather continued in Florida and the western U.S. Redding CA and Red Bluff CA, with record highs of 108 degrees, tied for honors as the hot spot in the nation.

1987---Top Hits

I Just Can't Stop Loving You - Michael Jackson with Siedah Garrett

Didn't We Almost Have It All - Whitney Houston

Here I Go Again - Whitesnake

This Crazy Love - The Oak Ridge Boys

1989 - Hurricane Hugo slammed into the South Carolina coast about 11 PM, making landfall near Sullivans Island. Hurricane Hugo was directly responsible for thirteen deaths, and indirectly responsible for twenty-two others. A total of 420 persons were injured in the hurricane, and damage was estimated at eight billion dollars, including two billion dollars damage to crops. Sustained winds reached 85 mph at Folly Beach SC, with wind gusts as high was 138 mph. Wind gusts reached 98 mph at Charleston, and 109 mph at Shaw AFB. The biggest storm surge occurred in the McClellanville and Bulls Bay area of Charleston County, with a storm surge of 20.2 feet reported at Seewee Bay. Shrimp boats were found one half mile inland at McClellanville

1991-Stevie Nicks' greatest hits LP, "Timespace" enters the chart and Rush's "Roll the Bones" enters the LP chart.

1993-"NYPD Blue" Premiers on TV. This gritty New York City police drama has had a large and changing cast. The star of today's CSI Miami David Caruso was the first to leave to begin a movie career that did not happen. The central characters were partners Detective Bobby Simone ( who later died,) played by Jimmy Smits, and Detective Any Sipowicz, played by Dennis Franz. Other cast members have included Kim Delaney as Detective Diane Russell, James McDaniel as Lieutenant Arthur Francy, Gordon Clapp as Detective Gregory Medavoy, Rich Schorder as Detective Danny Sorenson, Nicholas Turturro as Detective James Martinez, Mark Paul Gosselaar as Detective John Clark and Esai Morales as Lieutenant Tony Rodriquez.

http://www.tvtome.com/NYPDBlue/

http://rotteneggs.com/r/show/se/2047332.html

http://www.imdb.com/title/tt0106079/

2001- The Mets donate their day's pay, which totals approximately $500,000, from tonight's game with the Braves at Shea to a rescue fund for the families of the firefighters and policemen killed in the World trade Center terrorist attacks. The contest is the first professional baseball game played in New York since the tragedy. Uplifting ceremonies before and during the game, which include singers Diana Ross, Marc Anthony Lisa Minnelli as well as bagpipers, pay tribute to victims of the tragedy. Mike Piazza's eighth inning home run gives the Mets a 3-2 dramatic victory over the Braves.

[headlines]

----------------------------------------------------------------

Baseball Poem

National Pastime

anonymous

Somewhere in the summer city...

someone's stoop... mid 50's,

when gods wore pinstripes,

and kids crammed their mouths

full of cloyingly sticky gum.

Got it... need it... want it.

Could have been anywhere, really.

Babe's House, Duke's Domain,

The Polo Grounds... Fenway Park.

The voices... Red Barber, Mel Allen,

statically beautiful.

Going... going.... gone!

Stark, white powder... highlighting

base lines, connecting the bags.

Irish-green outfields...

their warning tracks beckoning

that high, fly ball...

Holy cow... Oh, Momma, Touch 'em all!

Thurman and Roberto... gone too soon.

Mickey's left the reminiscing to Yogi.

Oh... for a ten-cent Coke, a shoe box,

crammed with flip-worn icons,

and somebody's mother...

calling him in to dinner.

[headlines]