Friday, April 21, 2006

San Jacinto Day Texas commemorates Battle of San Jacinto in 1836, in which Texas won independence from Mexico. A 570-foot monument, dedicated on the 101 st anniversary of the battle, marks the site of the banks of the San Jacinto River, about 20 miles from present-day Houston, Texas, where General Sam Houston's Texans decisively defeated the Mexican forces led by Santa Anna in the final battle between Texas and Mexico. The Battle of San Jacinto lasted less than twenty minutes, but it sealed the fate of three republics. Mexico would never regain the lost territory, in spite of sporadic incursions during the 1840s. The United States would go on to acquire not only the Republic of Texas in 1845 but Mexican lands to the west after the Treaty of Guadalupe Hidalgo ended the Mexican War in 1848. http://www.tamu.edu/ccbn/dewitt/batsanjacinto.htm http://www.tsl.state.tx.us/treasures/republic/san-jacinto.html (See other calendar events ) Headlines--- Vault.com added to list ######## surrounding the article denotes it is a “press release”

Vault.com added to list

“Twin Sisters" await the coming battle at San Jacinto * Photograph by Stan Wojcik

Find a Job http://www.vault.com/jobs/jobboard/searchform.jsp Add your resume http://www.vault.com/membership/onepagevaultmatch.jsp Employers Post a job for 60 days $125 Research is available on salaries, work conditions, and other information about 4,950 companies with 49,587 surveys http://www.vault.com/companies/searchcompanies.jsp Other e-Mail Posting Sites: www.adams-inc.com For a full listing of all “job wanted” ads, please go to: http://64.125.68.91/AL/LeasingNews/JobPostings.htm To place a free “job wanted” ad, please go to: http://64.125.68.91/AL/LeasingNews/PostingForm.asp * San Jacinto Day 2006 Festival and Battle Re-enactment Saturday, April 22, 2006 San Jacinto Battleground State Historical Park http://www.earlytexashistory.com/SanJacinto/index.html http://www.sanjacinto-museum.org/Monument_and_Museum/Observation_Deck/ ---------------------------------------------------------------- Highline Capital added to “Funder List” A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program

To view full list, please go here: http://www.leasingnews.org/Funders_Only/Funders.htm---------------------------------------------------------------- “SOS v. IFC Credit Corp.” Judge

Judge Sally Montgomery County Court-at-Law 3 Recent Rulings Web-Site 04-04187-C Specialty Optical d/b/a SOS v. IFC Credit Corp. SOS properly cancelled the Lease with NorVergence. IFC takes nothing on it's counterclaim. SOS shall recover court costs and reasonable attorney fees in the amount of $45,000.00 for trial, $30K for appeal, and $15 K for a petition for review to the Supreme Court of Texas, and $15K for responding to any unsuccessful appeal by IFC to the Supreme Court of Texas in the event the petition for discretionary review is granted per the parties stipulation. http://www.judgesallymontgomery.com/recentrulings.htm In Texas, judges run actively for re-election:

Her web site: http://www.sallymontgomery.com/----------------------------------------------------------------

Feds promise to 'go after everyone' involved in CyberNET deception Mlive.com By Ed White The Grand Rapids Press GRAND RAPIDS -- The former president of CyberNET Group is the first to face criminal charges, but authorities are promising to "go after everyone" who participated in a scheme to reap nearly $100 million from banks. James Horton was joined by at least five co-conspirators at CyberNET, according to charges filed Monday in federal court. The co-conspirators, identified only as "principals" one through five, signed loan agreements, stuffed computer boxes with bricks to fool creditors and even rented mail boxes outside Michigan to feed the deception, the government said. "The borrowed money was either used to enrich CyberNET (executives) or to repay earlier loans," according to the charges. Horton, 54, is accused of conspiracy, bank fraud and money laundering. He pleaded not guilty but waived his constitutional right to have a grand jury review the charges, a sign that a plea agreement is likely. Prosecutors began seeking Horton's cooperation in December 2004, just weeks after the fraud was exposed, CyberNET shut its doors and founder Barton Watson committed suicide. "He was near the top of the pecking order," Assistant U.S. Attorney Tim VerHey said of Horton, "but he didn't act alone." Watson's widow, Krista Kotlarz-Watson, also is under scrutiny by the FBI. Horton declined comment after his arraignment. He received a salary, lived in a Watson-owned home and got free use of luxury cars, according to the government. Asked why it took nearly 18 months for criminal charges, VerHey said unraveling alleged fraud is no quick task. "We're talking 90-plus banks and nearly $100 million. ... We're going to go after everyone who was criminally responsible," he said outside court. There is no dispute that lenders were tricked into making loans for equipment that did not exist. Banks were told to send the money to CyberNET's suppliers, but those suppliers, such as Teleservices Group, were shell companies created to commit fraud, authorities said. Besides a role in the broad conspiracy, Horton is accused of providing false financial information to Huntington Bank, which provided a $17 million line of credit, the government said. In November 2004, after federal agents seized records and other property from CyberNET, Horton transferred $700,000 to his bank account to hide it from authorities, according to the charges. Away from the criminal case, the remains of CyberNET, also known as Cyberco, are being picked over in U.S. Bankruptcy Court. The sale of company assets has produced slightly more than $1 million -- just a fraction of the tens of millions in claims filed by creditors. A trustee is considering lawsuits against CyberNET lenders, who recovered much of their money before the fraud was publicly exposed. There may be attempts to collect the money and share it with other jilted creditors. please click to hear sound: http://favewavs.com/wavs/tv/broccoli.wav---------------------------------------------------------------- Feds Step-Up NorVergence Lease Investigation

several technical issues, including accounting of the way "Equipment Rental Agreements" were booked . . In one instance, a Civil Investigative Demand (CID) was issued to IFC Credit Corporation, Morton Grove, Illinois, for such information. According to court filings, this CID was a follow-up to earlier FTC requests to IFC for information, presumably of a much broader nature. http://www.leasingnews.org/Conscious-Top%20Stories/Federal.htm ---------------------------------------------------------------- Cartoon--- Office of IFC Credit President

----------------------------------------------------------------

“From Great to Mediocre (or worse)” by Steve Chriest Last week I wrote about a crisis in sales management that has affected businesses worldwide during at least the last fifteen years. In the opinion of an experienced recruiter of sales managers, the expanding economy of the 1990's required little in the way of selling skills from salespeople, and contributed to the overall decline in sales and sales management skills. While her reasoning sounded plausible to me, I began to think about other potential contributors to today's crisis in sales management. At least two causes came to mind: First is the ill-advised promotion of great salespeople to management positions, and second is the overall lack of management training provided to most sales managers. First, those companies that routinely promote sales superstars to sales management positions often experience these results – they lose a great salesperson, they gain a mediocre or terrible sales manager, and the company's customers suffer in the transition. According to experts in the field of psychological profiling, great salespeople, by definition, do not make great sales managers. Why? Simply because the characteristics needed for sales excellence are diametrically opposed to the characteristics required for great sales management. The great salesperson lives to interact with customers. She is independent, and often shuns help and advice from her superiors. She would much rather interact with customers than fill out call or expense reports. And while she might agree, occasionally, to mentor junior salespeople, she will soon resent this intrusion on her time, and she will itch to get back to interacting with her customers. Expecting a good or great salesperson to also be a good coach, teacher, report writer and internal politician ignores the essential characteristics that make great salespeople great. Another contributor to the crisis in sales management is the observable fact that most sales managers aren't given the education and tools they need to execute the primary responsibilities of management, which include: 1) Setting objectives for their teams If you are a sales manager, how much in-depth management education and training has your company provided to you and your counterparts? If you were lucky enough to receive management training and education, how supportive has senior management been in allowing you the time you need to develop your skills and develop your people? Unfortunately, research shows that the position of salesperson is considered “entry level” at most companies where career development programs are offered to employees. It follows that sales managers are too often viewed as red headed stepchildren by senior managers. Next week I will offer some suggestions to help end the crisis in sales management. Copyright © 2006 Selling Up TM . All Rights Reserved. About the author: Steve Chriest is the founder of Selling Up TM (www.selling-up.com), a sales consulting firm specializing in sales improvement for organizations of all types and sizes in a variety of industries. He is also the author of Selling Up , The Proven System For Reaching and Selling Senior Executives. You can reach Steve at schriest@selling-up.com. -------------------------------------------------------------- Classified Ads—Help Wanted Account Executive

Business Development Officer

Chief Credit Officer

Lease Coordinator

Portfolio Collection & Customer Service

--------------------------------------------------------------- David G. Mayer's Business News---April, 2006

1. IFC Report Questions the Future of Leasing 2. California Decides to Regulate Most Sale-Leasebacks as Loans 3. Lawyers May Report Out Under Sarbanes-Oxley Despite Contrary State Ethics Rules 4. Leasing 101: What Is "Second Lien Loan"? 5. About Patton Boggs LLP; Recent Publications; Upcoming Speech Founder's Note by David G. Mayer This issue of BLN focuses on some of the challenges that the leasing industry faces. Article 1 discusses the 2006 IFC Report, which raises numerous hard questions about the future of the leasing industry and its constituent members. The IFC Report challenges the members to change and adapt and warns them of the downside of failing to do so. Article 2 demonstrates one of the problems for sale-leaseback transactions. California used its regulatory authority to treat certain sale-leaseback transactions as loans subject to lending regulation. Such action may disadvantage the leasing market in California. Note that the entire concept of "true leasing" is under attack in my article available below. Article 3 shows how lawyers practicing before the SEC may encounter a dilemma. On one hand, they must hold client information confidential under state ethics rules. On the other hand, the SEC can force them to "report out" that same information under certain circumstances to the SEC and others. In Article 4, "Leasing 101" describes one of the prominent asset-based loan products called the "second lien loan." This type of loan may displace the need for sale-leasebacks and other lease transactions. In any event, these loans create greater opportunity for lenders and loan financing availability for asset-laden borrowers. Go here for edition:http://www.pattonboggs.com/newsletters/bln/Release/bln_2006_04.htm ---------------------------------------------------------------- ELA Legal Forum

April 30 - May 2, 2006 • Open to Members and Non-Members The Palace Hotel • San Francisco, CA Download Conference Brochure (197kb PDF File) http://www.elaonline.com/events/2006/LF/LF06Brochure.pdf The best place to obtain updates on legal issues that could impact your company, current trends in the industry and information on new products Great networking opportunities with your peers First rate resource materials you'll refer to again and again Highlights from the 2006 Legal Forum: Hot Topics in Structuring and Negotiating Lease Contracts: Focus on Particular Lease Provisions impacted by Recent Case Law Industry Segment Roundtables...Your Opportunity to Share Ideas on Important Industry and Legal Matters Update of Important Business Bankruptcy Cases for the last year including developments under The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 Fraud: The Cost of Leasing Equipment or the Penalty for Not Doing Your Homework! Who Should Attend? Internal and external counsel of all experience levels will benefit from this forum For more information: http://www.elaonline.com/events/2006/LF/LF06Brochure.pdf----------------------------------------------------------------

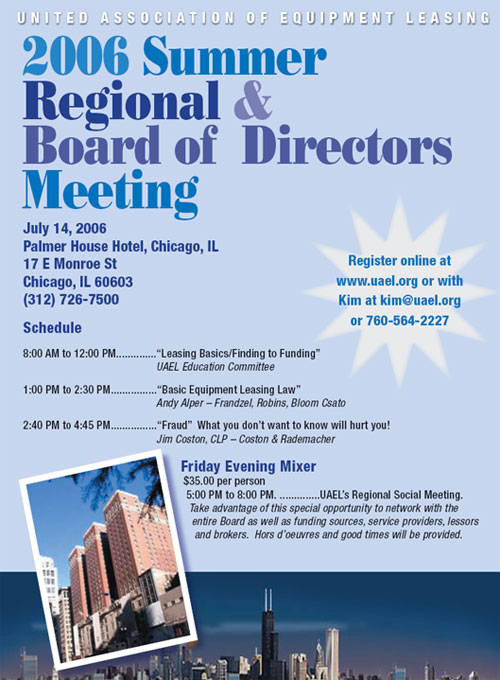

UAEL North Florida Networking Regional 11:30 AM to 1:30 PM UAEL Member and Non-Member cost is $20.00 Meet Brokers, Lessors and Funding Sources at

2755 Ulmerton Road Please contact Kim at kim@uael.org or call at 760-564-2227 Or Register online at www.uael.org --------------------------------------------------------------- UAEL South Florida Networking Regional May 17, 2006 at 12:00 PM Meet Brokers, Lessors and Funding Sources at

TIMPANO 450 East Las Olas Blvd

UAEL Member and Non-Member cost is $24.00 No Host Bar Please contact Kim at kim@uael.org or at 760-564-2227 Or Register online at www.uael.org -----------------------------------------------------------------------------------------

Wednesday May 17, 2006 7:30 AM Tee Time Indian Peaks Golf Course

GREAT NETWORKING, BEAUTIFUL GOLF COURSE AND FUN WITH FRIENDS!! Cost to attend for UAEL Members $89.00 This includes: Register online at www.uael.org or with Kim at kim@uael.org or 760-567-2227 --------------------------------------------------------------------------

EAEL Baltimore Crabfest ---------------------------------------------------------------

June 20th Regional Meeting Lunch To register or learn more, please go here: ---------------------------------------------------------------

------------------------------------------------------------------

August 17th Rock Spring Country Club To register or learn more, please go here: -----------------------------------------------------------------------------

Wyndham Orange County Hotel To learn more, please call: ------------------------------------------------------------------

NAELB Eastern Regional Meeting ---------------------------------------------------------------- Bankruptcy Filings Rebounding Despite Intention of New Law AccountingWEB.com - - The new bankruptcy legislation enacted on October 17, 2005, apparently only had a temporary effect on the number of bankruptcy filings. Some statisticians predict that filings will reach their previous levels in a year or more, according to the Baltimore Sun. “The intent of the new law is to force more filers into Chapter 13 plans. These plans require more filers to make payments to their creditors as opposed to a Chapter 7 filing that completely discharges their debt,” said Jeffery Freedman, senior partner at Jeffery Freedman Attorneys at Law, according to Buffalo Business First. The legislation provisions allowing for six months of pre-bankruptcy credit counseling has made little impact on directing people away from bankruptcy. The Baltimore Sun reports that, at the time, critics of the new law claimed few people were actually abusing the system. This supported their complaints that the law would not significantly reduce bankruptcy filings. On the other side of the issue, banking proponents who pushed hardest for the legislation saw the early numbers as vindication for their efforts. Now they are saying that the rising numbers do not reflect the long-term efficacy of the law and that the levels being seen are lower than those in recent times when personal bankruptcies numbered more than a million annually, according to the Baltimore Sun. Bankruptcies rose 30 percent, to 2 million, before the new law took effect, last year. Fritz Elmendorf, spokesman for the Consumer Bankers Association, told the Baltimore Sun that the decline in filings “does not suggest that there was a lot of discretionary filing, which was the key argument that we put forward. It's often become something of a financial planning tool, and it's not necessarily people at the very end of their ropes.” Still, Senator Charles Grassley (R-IA) told the Des Moines Register that current filing statistics leave him “hard-pressed that we'd be at the 2004 numbers by the end of the year.” Bankruptcy attorney Rory Ellinger told Black Enterprise that although experiencing a reduction in bankruptcies lately, a reduced number of filings should not indicate there is any automatic reduction in the number in creditors starting collection actions on people and families experiencing financial hardship. The critics, including attorneys, respond that rising energy costs, as well as increased credit card minimums and how higher interest rates will impact adjustable–rate and interest-only mortgages, will seriously affect those currently living on the borderline, according to the Baltimore Sun. Brad Botes, executive director of the National Association of Consumer Bankruptcy Attorneys, told the Baltimore Sun, "Congress tried to cure the sickness of too much debt by making it harder to get to the hospital." He finished, “There is no other viable alternative. People have significant money problems.” The Memphis Daily News reported that the reason people and companies, especially, file for bankruptcy protection are the “unknowables.” These are variables, like the arrival of well financed competitors that can dissolve a business' solvency. Bankruptcy attorney Norman Hagemeyer told the Memphis Daily News, “I've been told by the principals that these big box, or whatever you call them, retailers came into town, and that puts a strain on a lot of smaller places that were specialized.”---------------------------------------------------------------- NFFC Issues Bankruptcy Reform report The National Foundation for Credit Counseling has issued a sixteen page report on the bankruptcy reform and its consequences. Their concern is how to make the private and public sectors more aware about credit counseling and education as mandated by the new bankruptcy law. “Financial literacy is at the core of the NFCC's mission...The NFCC is dedicated to helping people learn to manage their money and avoid financial difficulty...” http://leasingnews.org/PDF/NFCC_report_FINAL.pdf The NFCC, founded in 1951, is the nation's largest and longest serving national nonprofit credit counseling organization. The NFCC's mission is to set the national standard for quality credit counseling, debt reduction services and education for financial wellness, through its member agencies. With nearly 1,000 community-based offices nationwide, NFCC members help two million households annually. For free and affordable confidential advice through an NFCC member, call 1-800-388-2227, (en Español 1-800-682-9832) or visit www.nfcc.org. ---------------------------------------------------------------### Press Release ########################### CHP Consulting warns people and business processes must be

CHICAGO, IL.– Technology conversions can quickly go awry when companies focus solely on the new computing platform's capabilities with little regard to the people and business processes involved, significantly damaging employee morale, operational efficiencies and profitability. This warning was made today by Andrew Denton, director of marketing, CHP Consulting, at The Alta Group's Creating IT Solutions in Leasing conference. CHP Consulting has successfully installed its ALFA Systems enterprise software platform at more than 30 asset finance locations worldwide, including major banks, independent leasing companies and equipment vendors. “Some asset finance companies are getting burned in this marketplace by software vendors that fail to take a holistic approach to converting them from a legacy system to new technology,” Denton said. “Often times, they are only worried about the system running correctly. But, you have to take the time to address the effects of the new platform on the staff, processes and overall workflow. This is often the missing link that separates success from disaster in conversions.” CHP Consulting entered North America last year and introduced its first U.S.-based client, Textron Financial, in February. Installation of the ALFA Systems platform at Textron is underway. Denton said ALFA Systems has drawn strong interest from a number of other lessors and asset finance companies in this market during the past several months. During his presentation at The Alta Group event, Denton highlighted a number of important issues that must be addressed during a software conversion: System migration – Has the organization thoroughly planned the timing and logistics of the system migration, including one or more dry runs. What are the benefits of a manual versus automated system migration? Should a lessor execute a full data migration versus a system-by-system or unit-by-unit approach? Cost-benefit concerns – Does the organization have a full understanding of the cost-benefits of the system migration, including deliverables, so everyone's expectations can be realized? In addition, how will the cost benefit be realized – through increased capacity, reorganization, restructuring or decommissioning of the old technology infrastructure? People – Has a change management and communications strategy been developed to help the organization transition to the new technology platform and business processes with minimal angst among employees? Business continuity – What steps have been taken to assure the technology migration creates an absolute minimum of business downtime and impact on customers? Do customers fully understand the benefits of the new technology platform and how it will help their businesses? Is there an escape route in place if the migration goes terribly awry? Training – Is the organization taking ownership of the training process? If so, will training be closely timed with the technology migration? What training approaches will be used? Are there opportunities to use training to create change leaders across the business? System alignment with business processes – What steps have been taken to ensure the business takes full advantage of the new technology system? Will business processes be optimized as a result of the conversion? Volumetrics – Has the organization planned a full-volume test for the new system architecture, so timing is accurate and business continuity assured? “Converting to a new business technology platform takes a significant commitment in time and money,” Denton said. “The bottom line is that implementing a new technology platform is not simply a technology exercise. Optimized business processes, effective staff communication and training, and flawless logistics are equally vital components in successfully switching to a new system. We also must continually keep track of the cost-benefits case and ensure that concrete plans are in place to make sure the promised benefits are indeed delivered to the customer.” About CHP Consulting CHP Consulting has been delivering system solutions to the leasing and asset finance industry since 1990. With more than 150 employees worldwide, CHP has great expertise in the industry and a first-class delivery record. Its flagship product, ALFA Systems, provides dedicated support for equipment finance, consumer finance, asset management, vehicle finance and structured finance. It is used by clients in the United Kingdom, Europe, Australia and North America. These include RBS Lombard, HSBC, Nissan Finance, Lloyds TSB, Royal Bank of Scotland, Société Générale, ING Lease, Investec, Textron Financial and Commonwealth Bank of Australia. For more information, visit www.chpconsulting.com.### Press Release ########################### AIG Commercial Equipment Finance adds Vice President - Credit Randy Allemang AIG Commercial Equipment Finance, Inc. (AIGCEF) is pleased to announce that Randy Allemang has joined the company as Vice President – Credit reporting to Todd Meyer, Senior Vice President and Chief Credit Officer. Mr. Allemang comes to AIGCEF with in excess of twenty-five years experience in the financial services industry. Most recently he was at Wells Fargo Foothill, Inc. Prior experience includes positions at Transamerica Business Credit – Equipment Financial Services. Randy holds a Bachelor of Business Administration in Accounting from Florida State University. Mr. Allemang is responsible for the credit analysis and underwriting of prospective and existing customers of AIGCEF. Randy is based in the Plano, TX headquarters of AIGCEF and can be reached at 972-987-3731 or at randy.allemang@aig.com. AIG Commercial Equipment Finance, Inc. (AIGCEF) is an equipment lease and finance subsidiary company of American International Group, Inc. (AIG). AIGCEF actively seeks middle and upper-middle market transactions and has platforms specializing in the general equipment, tax exempt, franchise, health care and rail markets, building long-term relationships with our business partners. More information on AIGCEF can be found at www.AIGCEF.com American International Group, Inc. (AIG), world leaders in insurance and financial services, is the leading international insurance organization with operations in more than 130 countries and jurisdictions. AIG companies serve commercial, institutional and individual customers through the most extensive worldwide property-casualty and life insurance networks of any insurer. In addition, AIG companies are leading providers of retirement services, financial services and asset management around the world. AIG's common stock is listed in the U.S. on the New York Stock Exchange and ArcaEx, as well as the stock exchanges in London, Paris, Switzerland and Tokyo.### Press Release ########################### AmeriCap Credit, LLC Announces $80.0 Million Equity Oak Brook, IL and New York, NY – – AmeriCap Credit, LLC, a national commercial finance company providing financing products and solutions to the small-ticket commercial vehicle and construction & industrial markets, today announced the execution of a definitive agreement under which investment funds managed by Metalmark Capital LLC will provide up to $80.0 million in equity capital to support AmeriCap Credit's continued growth. Concurrently, AmeriCap Credit will change its name to MeriCap Credit Corporation. The capital provided by Metalmark will enable MeriCap Credit to pursue its mission of being a best-in-class, vendor-centric, full service commercial finance company in a sector that has undergone significant change due to consolidation. Craig Weinewuth, President and Chief Executive Officer of MeriCap Credit, said, “This investment brings significant value to our organization. It represents an endorsement of our business model and industry position, as well as recognition of the attractive market opportunity we have identified. Metalmark is a leading private equity firm with an outstanding track record of supporting management teams to build companies that create enduring value. Metalmark shares our vision for MeriCap Credit and we look forward to beginning the next phase of our growth and development with Metalmark as our partner.” Mr. Weinewuth continued, "This transaction would not have been possible without the hard work of all our employees and the support of our vendors. They should be assured that we now have even greater resources in place to expand our business and are fully committed to maintaining the personal relationships we have established with our customers, which we believe are fundamental to our continued success. Our current management team, which has produced outstanding results in the commercial finance industry over the past two decades, will continue to lead the company through this next stage of growth." According to James Freund, MeriCap Credit's Executive Vice President of Sales and Marketing, "MeriCap Credit targets the small-ticket segment of the commercial vehicle and construction & industrial equipment markets - markets in which we have longstanding relationships with manufacturers, dealers and distributors. Our platform is based on service excellence from the professionals we hire, in the products we offer and in the customer relationships we manage.” Howard Hoffen, Chairman and Chief Executive Officer of Metalmark, said, "We are pleased to be partnering with MeriCap Credit's proven management team and strongly support their plans to develop a world-class, small-ticket equipment finance company in their target segments. We believe that the company is well positioned to grow, while maintaining the highest level of quality in the product and service it delivers to its customers.” Messrs Weinewuth and Freund are joined by the Company's other co-founders Joel Cappon, Chief Financial Officer, and David Pederson, Chief Information Officer. This team worked together at American Express where they steered the direction and growth of American Express's commercial finance business focused on the commercial vehicle and construction & industrial markets. About Metalmark Capital Metalmark Capital is a private equity investment firm managing in excess of $3 billion of assets whose principals have a long and successful track record of investing in a wide range of industries, including its focus sectors of financial services, industrials, healthcare, energy and other natural resources. Founded by former Managing Directors of Morgan Stanley's flagship private equity investment funds, Morgan Stanley Capital Partners, Metalmark Capital manages the Morgan Stanley Capital Partners private equity investment funds on a subadvisory basis and the Metalmark Capital private equity investment funds.### Press Release ########################### GE Commercial Finance Expands Corporate Lending Business; NORWALK, Conn.----GE Commercial Finance announced the expansion of its Corporate Lending business, providing middle market and larger corporate customers a broader suite of financial solutions. As part of today's announcement, the company formally introduced Tom Quindlen as President and CEO and Jim Kelly as General Manager of North America. By combining its long-standing asset-based lending, cash flow lending and structured finance platforms under the Corporate Lending umbrella, GE Commercial Finance is creating a single touchpoint for customers while unlocking deeper value in each engagement. Supported by a research-driven approach to build customized solutions industry-by-industry, Corporate Lending is uniquely positioned to support the entire customer lifecycle, from growth capital and mergers & acquisitions to corporate restructurings, where the company is a leading provider of Debtor-in-Possession (DIP) financing. Tom Quindlen will lead the expanded Corporate Lending business and brings more than 20 years of experience in senior sales and commercial excellence roles across GE. Tom is a GE Officer and previously served as Commercial Leader for GE Capital Solutions and President and CEO of GE Franchise Finance. "Growth for the benefit of our customers is the key here," said Quindlen. "The expanded capabilities will allow us to build more meaningful and longer-term customer relationships. Whether it's today, next year or five years from now, our goal is to be a lender for all seasons, one that helps customers grow in every business cycle." Smarter Capital for Business With $15 billion in served assets and 400+ professionals across 40 locations in North America, Corporate Lending has expanded its offering for companies that are growing, maturing and restructuring. Complimenting its strength in asset-based and cash flow lending, the company now provides structured leasing, tax-advantaged financing, securitization, project financing, junior secured and second lien loans, equity capital and interest rate management. The GE Capital Markets team ranked #9 in volume and #4 in lead arranged transactions, and #2 for second lien transactions in Reuters/LPC's 2005 Leveraged League tables, and includes a dedicated Corporate Lending team led by Jennifer VanBelle, managing director. Corporate Lending's Restructuring Finance team, led by managing directors Frank Galle and Rob McMahon, will continue its focus on financing corporate turnarounds and restructurings. In 2005, this team was again among the leaders in debtor-in-possession financings, and in 1Q 2006 completed $2.3Bn in new DIP and other restructuring transactions. Industry Specialization Launched earlier this year, Corporate Lending is using a research-driven industry approach designed to deliver solutions tailored to the unique capital requirements of customers. The initiative is led by Craig Reynolds, senior managing director, and includes a team of Industry Leaders supported by dedicated research analysts. The Industry Leaders partner closely with Corporate Lending's regional sales force to build customized solutions across nine key industries: Aerospace & Defense; Automotive & Automotive Parts; Chemicals & Plastics; Food, Beverage & Agriculture; Financial & Business Services, General Manufacturing; Paper, Packaging & Forest Products; Steel & Diversified Metals; and Transportation & Construction. The industry team brings more than 175 years of related experience, many former CFOs and operational managers within their target markets. The industry-aligned approach also builds on Corporate Lending's experience as a leading provider of financial solutions for the Retail industry. Jim Hogan, managing director, will continue to lead Corporate Lending's Retail Finance efforts, supported by a dedicated team of retail sales and risk specialists. Enhanced Regional Focus An expanded regional coverage model includes six regions across North America: Northeast, New York City Intermediaries, South, Midwest, West and Canada. Leading the regional teams is Jim Kelly, General Manager for North America. In this role, Kelly will oversee all front-end activities in North America. Reporting to Kelly are six Region Managers responsible for driving growth in their territory: Randy Hicks in Norwalk, Conn.; Al Spada in New York City, Bob Biringer in Atlanta, Paul Feehan in Chicago, Andrew Waterson in Los Angeles and Ellis Gaston in Toronto. Background for Tom Quindlen Quindlen graduated from Villanova and began his professional career with GE through the Financial Management Program in 1985. Upon completion, Quindlen held various financial management roles in GE Aerospace. He moved to GE Capital's Vendor Financial Services in 1992, where he held roles in Marketing, Business Development and Sales. Quindlen joined GE European Equipment Finance in London as Director of Business Development and Marketing in 1996. After serving as Executive Vice President of Sales and Marketing at GE Japan Leasing, he was appointed president and CEO of GE Franchise Finance in 2002. He was most recently Commercial Leader for GE Capital Solutions. About GE Commercial Finance GE Commercial Finance, which offers businesses around the globe an array of financial products and services, has assets of over $190 billion and is headquartered in Stamford, Connecticut. GE (NYSE: GE) is Imagination at Work - a diversified technology, media and financial services company focused on solving some of the world's toughest problems. With products and services ranging from aircraft engines, power generation, water processing and security technology to medical imaging, business and consumer financing, media content and advanced materials, GE serves customers in more than 100 countries and employs more than 300,000 people worldwide. For more information, visit the company's website at ge.com. Contacts GE Commercial Finance, Norwalk Ned Reynolds, 203-229-5717 ned.reynolds@ge.com### Press Release ########################### UnionBanCal Corporation Reports First Quarter 2006 Earnings Per Share of $1.24 SAN FRANCISCO--UnionBanCal Corporation (NYSE:UB) UnionBanCal Corporation (NYSE:UB) reported first quarter 2006 net income of $172.9 million, or $1.18 per diluted common share, and income from continuing operations of $181.5 million, or $1.24 per diluted common share. Excluding a positive tax adjustment of $0.07 per diluted common share last year, first quarter 2006 income from continuing operations per diluted common share increased 9.7 percent. "We are off to a good start in 2006," stated Takashi Morimura, President and Chief Executive Officer. "Our balanced business model is evident in our first quarter results as excellent loan growth and credit quality offset mixed deposit results, reflecting an increasingly competitive deposit market. During the quarter, we returned $139 million to shareholders in the form of dividends and share repurchases, equal to 80 percent of our first quarter net income. Despite this significant return of capital, we finished the quarter with very strong capital levels, including a tangible equity ratio of 8.46 percent." "We generated good loan growth across all categories in first quarter," added Chief Operating Officer Philip Flynn. "Commercial loans increased at a double digit rate, and, though slowing appreciably due to rising rates, residential mortgages still grew at a healthy rate year-over-year. We continue to report very strong credit quality, with net charge-offs of only $5 million in the quarter and nonperforming assets declining further, to just 0.09 percent of total assets at quarter-end. While this trend is unsustainable in the long run, it is evidence of our responsible lending and monitoring practices and the overall quality of our loan portfolio. "Average noninterest bearing deposits declined 9 percent versus the fourth quarter, virtually all due to a decline in wholesale deposits," continued Flynn. "Well over half of the decline in the wholesale deposit base was in title, escrow and other real estate related balances, reflecting slower real estate activity, some of which is seasonal. In addition, demand deposit volumes were affected by disintermediation, which has accelerated due to the cumulative effect of rising short-term interest rates. Despite this more challenging deposit environment, our deposit franchise remains healthy and will continue to afford us a solid advantage in our primary markets. We have built this deposit franchise over the long term, and the inherent strength in this aspect of our business will serve the Company very well going forward. We are confident that we can defend and continue to grow our deposit base, and we took steps to do just that in the quarter by launching several new interest bearing deposit initiatives." Full press release at: http://www.snl.com/irweblinkx/file.aspx?IID=1022285&FID=2217922### Press Release ###########################

News Briefs---- Gas price average tops $3 in Calif. Sky Bank posts 1Q income gain Mortgage rates keep climbing, highest in nearly 4 years Silicon Valley Home prices rise to record: $735,000 median price GM improves earnings but still has sixth straight quarterly loss Google Posts 60% Gain in Earnings Another 'Idol' booted, six remain ---------------------------------------------------------------

You May have Missed--- Increasingly, busy households hiring firms to scour their yards and pick up after dogs http://www.boston.com/business/globe/articles/2006/04/18/when_canine_nature_calls/ ----------------------------------------------------------------

“Gimme that Wine” Wines under $6 still account for most sales Top Portuguese wine producer switches to caps Rising alcohol levels change wines' taste California Wine country blooms with activity in spring Wine Prices by vintage US/International Wine Events Winery Atlas Leasing News Wine & Spirits Page --------------------------------------------------------------

Restaurant Review

Manresa Tuesday through Saturday (Recommend you make a reservation, and the automated response will call you back.) http://www.manresarestaurant.com/contactus/contact.html

Up-Scale/Expensive/a San Francisco restaurant in Los Gatos. —Excellent***** 28 food 24 decor 25 service very few 28 restaurants in SF Bay Area Mansera is hard to find, almost a “secret.” It is a “hidden area,” but perhaps no longer, as this is perhaps the most “up-scale” and “modern” restaurant in Los Gatos, with the best food and very good wine list. The restaurant gets great Zagat reviews and is written up in the San Francisco and Los Angeles newspapers. We are lucky as it is located in our home town ( Los Gatos is a township.) The prix fix menu is the best, as is the “wine flight” menu. Service has been superb on our visits. Food and presentation outstanding. Wine list is okay, but the restaurant is young and the choice of new wine to try from around the world is quite interesting. The customers are also very friendly, and we have found it a fun place. Our trick is to go early before the rush ( and before the “specials” run out. ) The food is served in small portions, and the chef often has items he adds as a gift from the kitchen. They have a waiting list of interns who want to work here as the restaurant has become very well known.) Parking is terrible. There is a strip parking area between University Avenue and Santa Cruz, always full. You can turn down Santa Cruz Blvd by Pedro's Mexican Restaurant (perhaps the oldest in town—I can remember when it first opened and then expanded, with my good friend Louis Funkenstein doing on the equipment leasing, but that is another story), and try and get lucky on this very short street, or try the Bank of the West parking lot at night. Or you can park further away, and walk. The chances of finding a spot here is like winning the lotto. The restaurant is worth any long walk, if you can't find a spot to park. ( My trick: think positive, and you will find a space. ) This site has a map and more information: http://www.manresarestaurant.com/contactus/directions.html (for other reviews: please go here: http://two.leasingnews.org/Recommendations/rstrnt.htm 0 ----------------------------------------------------------------

Today's Top Event in History 1898 -- Using the sinking of battleship Maine as rallying cry, the US declares war on Spain in an attempt (successful) to acquire colonies seeking to win independence from Spain. The US gains Puerto Rico, Guam and the Philippines, with plans to annex the independent nation of Hawai'i later that year. ----------------------------------------------------------------

Calendar Events This Day Brazil: Tiradentes Day National holiday commemorating execution of national hero, dentist Jose da Silva Xavier, nicknamed Tiradentese (tooth-puller), a conspirator in the revolt against the Portuguese in 1789. Festival of Ridvan. April 21-May 2. Annual Baha'I festival commemorating the 12 days (April 21-May2, 1863) when Baha'u'llah, the prophet-founder of Baha'I faith, resided in garden called Ridvan (Paradise) in Baghdad, at which time He publicly proclaimed His mission as God's messenger for this age. The first ninth(April 29) and twelfth days are celebrated as holy days and are three of the nine days of the year when Bahai'i's suspend work. www.bahai.org . Indonesia: Kartini Day Republic of Indonesia Honors the birth in 1879 of Raden Adjeng Kartini, pioneer in the emancipation of the women of Indonesia Italy: Birthday of Rome Celebration of the founding of Rome, traditionally thought to be in 753 BC. Kindergarten Day A day to recognize the importance of play, games, and “creative self-activity” in children's education and to note the history of the kindergarten. Observed on the anniversary of the birth of Frederick Froebel, in 1782, who established the first kindergarten in 1837. German immigrants brought Froebel's ideas to the US in the 1804s. The first kindergarten in a public school in the US was started in 1873 at St. Louis, Mo. San Jacinto Day Texas commemorates Battle of San Jacinto in 1836, in which Texas won independence from Mexico. A 570-foot monument, dedicated on the 101 st anniversary of the battle, marks the site of the banks of the San Jacinto River, about 20 miles from present-day Houston, Texas, where General Sam Houston's Texans decisively defeated the Mexican forces led by Santa Anna in the final battle between Texas and Mexico. The Battle of San Jacinto lasted less than twenty minutes, but it sealed the fate of three republics. Mexico would never regain the lost territory, in spite of sporadic incursions during the 1840s. The United States would go on to acquire not only the Republic of Texas in 1845 but Mexican lands to the west after the Treaty of Guadalupe Hidalgo ended the Mexican War in 1848. http://www.tamu.edu/ccbn/dewitt/batsanjacinto.htm San Jacinto Day 2006 South Carolina Festival of Roses ----------------------------------------------------------------

This Day in American History 1649--- The Toleration Act was passed by the Maryland Assembly. It protected Roman Catholics within the American colony against Protestant harassment, which had been rising as Oliver Cromwell's power in England increased. --------------------------------------------------------------

Spring Poem The Daffodils by William Wordsworth I wandered lonely as a cloud Continuous as the stars that shine The waves beside them danced, but they For oft, when on my couch I lie |

||||||||||||||||||||||||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||

|