|

Financial Analyst – Irvine, CA

Calfirst Leasing Corporation is looking for experienced individual with a commercial credit analysis background. This opportunity affords a competitive salary plus great medical and 401k benefits. If you have a minimum of 2 years commercial credit analysis background, please send us your resume to learn more about this exciting opportunity. Send resumes to bbumblis@cfnbc.com.

|

|

Wednesday, February 22, 2006

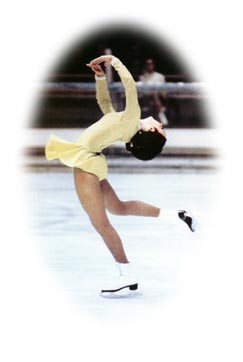

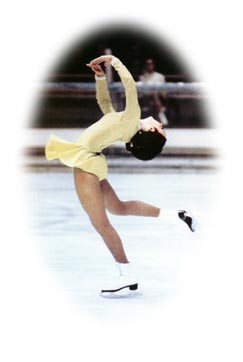

Peggy Fleming

ABC televised the 1968 Winter Games live and in color for the first time ever, and the enduring image from that coverage will always be of Peggy's free-skating program. It was a program that won her the Gold Medal by 88.2 points over her closest competitor, and it would be the only Gold Medal the United States brought home from Grenoble.

Headlines---

Classified Ads---Asset Management

Wal-Mart not backing off Bank & Leasing

Sales Make it Happen--by Linda Kester

--—“Objections We all See”

Placard—“Ladder of Achievement”

Leasing Assoc, Meetings Open “Non-Members”

Continental Bank added to “Funder” list

Bach Biz Credit: “Broker/Lessor” list

Classified Ads---Help Wanted

“Risky Business” Is Back

Sarbanes-Oxley Under Fire

Saveriano Joins Alter Moneta

Truck Repossessions High Again in Q4

NACM New Scholarship Foundation

Pratt Exec. VP/Chief Sales CIT Constr

Parlier Joins Commerce Commercial

Republic Financial Airbus A340 Aircraft

News Briefs---

You May have Missed---

Sports Briefs---

"Gimme that Wine"

Restaurant Review--Roy's Restaurants

Calendar Events Today

Today's Two Top Event in History

This Day in American History

George Washington Poem

######## surrounding the article denotes it is a “press release”

----------------------------------------------------------------

Classified Ads---Asset Management

Peggy Fleming

1968 Olympic gold medalist, sixth in the 1964 Olympics

Three-time consecutive World Championship champion from 1966-68

Five-time consecutive U.S. National champion from 1964-68

Inducted into the U.S. & World Figure Skating Halls of Fame in 1976; and the U.S. Olympic Hall of Fame in 1983.

Fleming was the first U.S. skater in any discipline to win a medal in the World Championships and Olympic Winter Games following the 1961 plane crash that killed the entire U.S. World Team in 1961 including Fleming's coach.*

Austin, TX.

20+ years exper. lease/finance. P & L responsibility, strong credit & collection management, re-marketing& accounting. Computers, construction, auto & transportation. Both commercial/ consumer portfolios.

Email: kmalone@austin.rr.com

Bloomfield Township, MI.

15+ yrs experience asset management and credit analyst. Leadership and training skills. Audited returns, max residual, lease end and resale negotiator.

E-mail: cmcozzolino@msn.com

Boston, MA

10yrs exp structuring/modeling sophisticated lease/ loan products. Expert programmer: customized portfolio mgmt, securitization, economic capital & pricing applications. Available for contract work.

E-mail: lease_structuring@yahoo.com

Chicago, IL.

MBA, 15+ years exp. Long history of success in maximizing residual position through outstanding negotiation skills & lease contract management. Third party re-marketing, forecasting etc...

email: jgambla@aol.com

Chicago, IL

2+ Years Exp. Asset Remarketing Transportation/ Medical/Cosmetic Equipment; Superior End Of Lease Negotiation Skills; Comprehensive Buyer Contacts; Available Immediately For Assignment

Email: Lonnie0168@comcast.net

Princeton, NJ.

Asset management/credit/collection

20+ years experience in equipment financing. Last five years in Asset Management including remarketing, end of lease negotiations, equipment and market evaluations

E-mail: bgaffrey@earthlink.net

Sausalito, Ca

Sr. Corp. officer, presently serving as consultant, fin. service background, M&A, fund raising, great workout expertise, references

Email: nywb@aol.com

Sonoma, CA

20+ years managing/ maximizing residual values, exp. computers/ hi-tech mfg. Excellent negotiation skills. Outstanding 3rd party contacts/buyers. Created deal winning structures-established residual values.

Email: dfeltman@yahoo.com

Wilton, CT.

18 years exp. in IT and High Tech leasing industry. Residual forecasting, workouts, off-lease sales, mid-term restructures, auctions, all aspects of remarketing and equipment management.

Email: charrer@hotmail.com

For a full listing of all “job wanted” ads, please go to:

http://64.125.68.91/AL/LeasingNews/JobPostings.htm

To place a free “job wanted” ad, please go to:

http://64.125.68.91/AL/LeasingNews/PostingForm.asp

* Born in San Jose, California, she is Peggy Fleming is very active in the community. In 1970 she married dermatologist, Dr. Greg Jenkins. They live in Los Gatos, California, and have two sons, Andy and Todd. Peggy is also a proud grandmother to two grandsons. They have their own vineyards, which she and her husband work, and produce wine, labeled "Victories": http://www.flemingjenkins.com/victories/default.htm

[headlines]

----------------------------------------------------------------

Wal-Mart not backing off Utah industrial Bank and Leasing

The controversy over Wal-Mart, the world's largest retailer, to open a small state-chartered bank in Utah continues to grow, and may affect other industrial banks.

Wal-Mart says it wants to use its Utah bank to cut credit and debit card processing costs and is not seeking permission for an interstate branch network. They also have in the works a “rental” and “lease-to-own” plans.

Other Industrial Banks in the equipment finance and leasing business include CapitalSource with commercial loans. Daimler Chrysler automobile loans and

LCA Bank Corporation: equipment leasing.

Lehman Bros. Bank was set up to provide commercial real estate loans and warehouse lines of credit. "We'll have no retail presence," Julie Boyle, the bank's president, told the Salt Lake Tribune. "Our smallest loan will be in the $5 million range."

SLM Corp., better known as Sallie Mae, plans to offer student and education loans through its bank. "The industrial bank will allow us to fund and originate, in our own name, private credit education loans that we offer nationwide to students and families," said a statement from Sallie Mae executive vice president Marianne Keler.

The status over the state-chartered industrial loan companies (ILCs), described by Alan Greenspan, former head of the Federal Reserve, as a “loophole” in US bank regulation, and now opposed by his succcessor, Ben Bernanke, is causing quite a bit of fury in Washington, DC.

Utah currently licenses more than 35 such industrial banks, run by investment banks, carmakers and finance companies, as well as by Fry's Electronics and Wal-Mart's discount store rival, Target.

Target uses its Utah bank to issue its business credit card. Volvo, BMW and General Motors use the banks to operate car financing. Volkswagen's bank also operates online and offers interest bearing certificates of deposit and mortgage lending. Merrill and others are also interested in leasing opportunities.

The bold fact is The Federal Reserve has never liked the state industrial banks, which by the way, exists in other states. These industrial banks are exempt from the federal legislation prohibiting commercial companies from engaging in banking activities. The leading credit card companies oppose the creation of industrial credit cards, formerly having to "partner" relationships and control the profits made via charges to the cards from both users, the buyer and seller.

Senator Hillary Clinton has joined the bandwagon that has demanded the Federal Deposit Insurance Corporation (FDIC) hold an unprecedented public hearing on the application.

Spencer Bachus, a Republican who heads the House's banking sub-committee, has also said he intends to hold a hearing on the wider issue of industrial loan and leasing companies.

Wal-Mart is pressing ahead with its application and has said it is looking forward to a public hearing at the FDIC. The company yesterday announced fourth earnings rising 13.4 percent with Net income at $3.6 billion. For the full year ended January 31, Wal-Mart said net sales were up 9.5 percent to $312.4 billion and net income rose 9.4 percent to a record $11.2 billion, or $2.68 per share.

Wal-Mart has previously announced it will remodel 1,800 of its nearly 3,200 U.S. stores in the next 18 months to give them a more open, inviting look and improve the shopping experience.

Ironically, the debate to allow Wal-Mart to issue its own credit cards has also forged an unlikely alliance of interest between Wal-Mart and the Securities Industry Association, which is lobbying to head off attempts to control the industrial banks. The issue also borders on the rights of states versus federal government regulations.

Utah benefits from the added income and fees, plus employment, with industrial banks.

Utah is one of the few states that allows industrial loan corporations. It was created in 1987 by congress that allows brokers and retailers to own a federally insured, deposit-taking financial institution. In California, many banks are located in large grocery stores and drug stores. Many retailers have also gone direct to forming their own banks out of state to be able to issue credit cards direct, plus use their cash flow, cutting out the "middle-man."

[headlines]

--------------------------------------------------------------

Sales Make it Happen

OBJECTIONS WE ALL SEE

By: Linda P. Kester

In 1988 I would drive my Saab to a vendor's location and ask them “Do you have any apps for me?” Inevitably they said “No, we don't have any leasing deals for you right now, but you can stop back in a couple of weeks.” A couple of weeks would go by, I'd stop by again and they would tell me “No leasing deals now, but feel free to stop by again.”

Was I prospecting? I thought I was. What I was really doing was wasting everyone's time! Wasting my own time by prospecting with no clear objective, not uncovering the vendors needs with good questions and not moving the sales process forward.

I was wasting the prospect's time because I didn't give them any value in doing business with me. They saw nothing to gain, and they didn't want to come right out and tell me NO.

In the leasing industry there are many types of objections. I shared my experience above because I didn't uncover any specific objections. I just kept getting a stall, and a stall is an objection that can happen at any point in the sales cycle. The stall I experienced happened very early in the process. You may experience this as a “brush off”. The typical brush off objections that come early in the sales call are:

- We're happy with who we are using

- Just send me some literature

- We don't use leasing

If a vendor tells me in the first 25 seconds of the call that they are happy with their present leasing company, I know that my opening statement was not very effective, and then I'll say “some of my best customers said the same thing the first time I called them. Who are you using?” I brush off their brush off and ask a question.

If the prospect says “Just send me some literature on that.” Reply with “There are questions people have that simply aren't addressed in the literature. That's why I'd like to ask you a few questions…”

Other objections/resistance come further in the sales process:

- Your rates are too high

- All our customers pay cash

- We've been disappointed in the past with turn-around time or speed of payment

The worst thing we can do when faced with an objection is tell the other person that they are wrong. Unfortunately, that's what most objection rebuttals do. The best route is to show empathy and ask questions and help someone to:

- Doubt their own beliefs

- Change their mind on their own

For example, I was in the market for a Jaguar automobile. I questioned the salesman about the reliability of the car. Everyone knows that Jaguars have a reputation for frequent breakdowns. The salesman did not show any empathy when I voiced my objection. He gave a heavy sigh and announced that Jaguar was bought by Ford and now they have an excellent service record. He didn't show any empathy, in fact he demonstrated annoyance. He then tried to have me change my mind with some lame service record report. If he followed my model he would say something like… “I understand, Jags used to have that kind of reputation. Have you heard this about any models made after 2004? Do you know we have an all inclusive maintenance program?” These comments would have made me feel better. And that is a big point…don't underestimate how big of a role emotions can play in decisions. They can certainly cause someone to throw logic out the window.

Sometimes the prospect doesn't even know his true objection. He may not be confident offering leasing or he doesn't understand how leasing works and so he's embarrassed to admit it. He feels uneducated and his ego demands that he say that he won't offer it. The prospect thinks if they get a leasing company involved they may lose control of their transaction. They say to you…“We let the customer get their own financing”, or “We don't offer leasing.” So, all of your logic backed facts won't change their mind. You have to go back and ask more questions. You have to focus on the vendor or the lessee and what is important to them. What we want or think doesn't matter. The customer in this case is similar to a credit analyst. A credit analyst is not (in most cases) just going to change his mind and approve your deal. He will, however, make a new decision based on additional information. A prospect is not going to change his mind and suddenly start using your leasing company. He may make a new decision based on additional information. That is why it's so important to have an arsenal of value based programs to offer the prospect.

If a vendor says “All my customers pay cash”, a good response is “I understand. In your situation customers have a lot of different ways of acquiring your equipment. Why do you think that they pay cash? Are you getting your cash they day you deliver your equipment? Are you waiting 30 days or more for your money? Do you have to handle payment and collection issues? What happens if the customer asks about financing options? Suppose I handled all the leasing details then would you feel comfortable using it?”

Early in my sales career I rarely got to the objection part of the sales cycle. What I've learned is that a sales pro will bring out all the objections as early possible so each objection can be dealt with effectively. If the objection is: “ Your rates are too high” Your response could be “Competitive rates are an important ingredient in our services. Can you tell me what you are comparing my rates against? Besides rate, is there any other reason why you wouldn't use my leasing company? Tell me about your current rates, how many payments are required in advance and what type of residual options you quote.

If you can identify the true objection, then you can take steps to resolve it or move on to the next prospect instead of wasting time trying to close a sale that will never be closed.

Linda Kester motivates, educates and empowers leasing sales reps to obtain top performance and increase volume. She provides enthusiastic and practical ideas for success. For more tips visit www.lindakester.com

|

|

|

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Leasing Association Meetings Open to “Non-Members”

2006 UAEL Networking Happy Hour

Thursday, February 23, 2006

Who: All UAEL Members and Non-Members who would like to network with other members of the leasing community.

What: Networking session along with kicking off the New Year!

Where: Dave and Busters:

1-25 at Colorado Blvd (Midway Room)

Denver , CO 80222

Phone: 303-759-1515

Time: 4:30 PM until 7:00 PM

Cost: $25.00 for Members, $30.00 for Non-Members

Includes: One drink ticket, Munchies, Separate Networking Room, Fun, and Business Opportunities!

All Payments must be made out to UAEL:

78120 Calle Esatado, Ste 201, La Quinta, Ca 92253; #760-564-2227 Or Kim@uael.org You can also pay online at www.uael.org

For any questions please contact:

Scott Woodring – Pawnee Leasing Corporation #800-864-4266

scott@pawneeleasing.com

or

Skip Wehner – 5280 Financial # 303-309-6888 skipw@5280financial.net

--------------------------------------------------------------------------

Roundtable Event

UAEL So-Cal Region would like to invite you to our

Annual Roundtable Event

Thursday, March 30th, 2006

1:00 PM – 4:30 PM

Experian Building , Orange County

Roundtable Discussions:

Mohammed Ahsan, Quail Capital

“How to put together a winning submission package”

Ken Goodman, Goodman & Associates

“ Advanced Leasing Sales Skills”

Sell more, build stronger vendor relationships and understand your lessee

Bob Robichaud, PFF Bank & Trust

“How to sell a deal by understanding their financials”

Paul Foster, Allegiant Partners

“Selling structured transactions to your credit challenged customer; working with start-ups and how to get them financed”

Experian

“ How to read credit reports and business credit reports”

Chris Pisacane, PFF Bank & Trust

“ How to make your deals fund fast, eg: doc issues, delivery, vendor invoice”

**This discussion will help with back office issues.

No cost to UAEL Members, $10 for Non-Members

Please register via email with Gina Iacono at

giacono@westoverfinancial.com or telephone (714) 834-0127, ext. 102

Event Hosted by the UAEL Southern California Region

[headlines]

--------------------------------------------------------------

Continental Bank added to “Funder” list

A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program

| D -"Private label Program" | E - Also "in house" salesmen

|

Name

In Business Since

Contact

Website

Leasing Association

|

|

|

|

|

|

|

|

|

|

36. |

|

10 |

United States |

$75,000 Min. $175,000 average transaction |

Depends on credit |

Y |

Y |

N |

Y |

N |

(EE) Continental Bank is FDIC insured bank, primary focus is equipment leasing.

To view the complete list, please go here:

http://www.leasingnews.org/Funders_Only/Funders.htm

[headlines]

--------------------------------------------------------------

Bach Business Credit added to “Broker/Lessor” list:

Third Column: YES - Year Company Started | YELB - Years in equipment Leasing Business

A - City Business License | B- State License | C - Certified Leasing Professional |

D - State(s) sales/use tax license |

E - Named as "lessor" on 50% or more of lease contract signed. |

Rank |

Name

City, State

Contact

Website

Leasing Association |

YCS

YELB

(see above for meaning) |

# of Empl. |

Geographic Area |

Minimum

Dollar

Amount |

Service Organization |

|

|

|

D |

|

48. |

|

2001

18 |

8 |

Nationwide |

$1,000.00 - $10 MM |

BBB & Sartell Chamber of Commerce |

* |

* |

* |

* |

* |

To view full list, please go here:

http://www.leasingnews.org/Brokers/broker_Lessor.htm

[headlines]

--------------------------------------------------------------

Classified Ads—Help Wanted

Account Executive

|

Account Executive

Seeking an assertive, goal-oriented, profit-motivated Account Executive with sales experience in the equipment finance industry for Irvine , California headquarters. Unlimited earning potential - competitive salary with bonus and commission. Send resumes to llewis@calfirstlease.com or log on to www.calfirstjobs.com/apply_now.htm to apply for position.

|

|

Financial Analyst

|

Financial Analyst – Irvine, CA

Calfirst Leasing Corporation is looking for experienced individual with a commercial credit analysis background. This opportunity affords a competitive salary plus great medical and 401k benefits. If you have a minimum of 2 years commercial credit analysis background, please send us your resume to learn more about this exciting opportunity. Send resumes to bbumblis@cfnbc.com.

|

|

Funding Manager

|

|

FUNDING MANAGER: Seeking a very organized, detail oriented Funding Manager with experience in discounting consumer

and commercial auto loans and leases.

Top salary. Send resume via email to ekaye@advantagefunding.us

or fax to 718 392 5427.

About the Company: Advantage Funding is the leader in automotive and equipment lease financing, Long Island City, NY.

|

|

Independent Regional Sales Manager

|

Independent

Reg. Sales Managers:

Philadelphia, Baltimore, Washington, D.C., Florida, Georgia. Other positions available nationally. Vehicle & Equipment Funder.

Earnings potential is unlimited. Two years outside leasing/finance sales, proven track closing deals. Est. customer base/vendors a plus. Click here for more info.

|

|

|

Lease Representatives

|

Seeking Lease Representatives

in Baltimore, Atlanta,

Charlotte or Raleigh.

In these positions, you will develop and maintain relationships with lease brokers, leasing companies, equipment vendors and direct lessees throughout the Region. Must be knowledgeable in indirect/third party transactions ranging from $15K and up and have the necessary in-market experience. Please apply on-line at www.mandtbank.com.

At M&T Bank, we provide an exciting and challenging work environment where performance and innovative thinking are encouraged and rewarded at every level. With over 700 branches, your career can travel as far as you want to take it!

|

|

Sales Manager

|

Sales Manager – Irvine, CA

We're looking for a detail oriented, profit driven Sales Manager with 10 years experience in sales and/or management in the middle ticket equipment finance/leasing industry. Great opportunity for huge earnings potential as we offer a competitive salary with bonus and commission. Send resumes to llewis@calfirstlease.com .

|

|

[headlines]

--------------------------------------------------------------

“Risky Business” Is Back

Businessfinancemag.com

A troubling side effect of the wave of corporate accounting scandals was that the remedies (Sarbanes-Oxley, a more vigilant SEC) might also stifle corporate risk appetites. That problem seems to be fading:

"Corporate America's largest companies are taking more risks," according to Protiviti's latest U.S. Risk Barometer report. "Without question, the overall level of risk is increasing for many companies," the report proclaims. "

More than four in 10 top executives surveyed at Fortune 1000 companies say their organizations take a moderate number of risks, while an additional 30 percent indicate their organization takes many risks.

Nearly five in 10 senior executives believe their organization's risk profile has become more risky, attributing the change most often to strategic decisions, such as the introduction of new products." The results cover changes in risk profiles, risk management capabilities and, perhaps most interesting, rankings of top risks:

http://leasingnews.org/PDF/USRiskBarometer.pdf

[headlines]

--------------------------------------------------------------

Sarbanes-Oxley Under Fire

In another development, PCAOB & Sarbanes-Oxley Under Fire

as the Public Company Accounting Oversight Board (PCAOB) is being challenged, constitutionally, according to accountingweb.com:

http://www.leasingnews.org/Pages/PCAOB.htm

[headlines]

### Press Release ###########################

Saveriano Joins Alter Moneta Corporation

Alter Moneta Corporation announces the addition of Neil Saveriano as our new sales representative in New England.

Neil Saveriano has joined Alter Moneta Corporation as District Sales Manager for the New England area. Prior to accepting this position, Neil was employed by the Equipment Finance Group of Eastern Bank for seven years and possesses over 18 years experience in the equipment finance industry. Neil will be covering Massachusetts, Connecticut, Rhode Island, Vermont, New Hampshire and Maine in a direct calling capacity on behalf of Alter Moneta. He will report to Tom Greco, Vice President , US Direct Sales.

[headlines]

### Press Release ###########################

Truck Repossessions High Again in Q4,

Reports Nassau Asset Management

Company believes 2005 fuel prices a major contributing factor

WESTBURY, NY,—Repossessions and liquidations of tractor-trailer trucks nationwide increased again in fourth quarter, according to Nassau Asset Management. Nassau's NasTrac Quarterly Index (NQI) reveals trends in equipment repossessions and orderly liquidations based upon the company's own internal activity in a given quarter compared to the same quarter the previous year.

Nassau provides asset recovery, appraisal, collections, liquidation and remarketing services for equipment leasing and finance companies across the nation. In November, the company reported that overall equipment repossessions and liquidations during the first three quarters of 2005 increased significantly for the first time since 2002.

The upward trend continued in fourth quarter (Q4) 2005 for tractor-trailer trucks (+145%) and construction equipment (+44%).

“We believe fuel costs in 2005 have contributed directly to the rise in truck repossessions, and may have had some impact on construction repossessions,” says Nassau President Edward Castagna. “But it is important to note that more positive factors are also at play.

“Reports indicate that equipment leasing industry volume has been increasing. That means there was more leased equipment in the marketplace in 2005 than in 2004. Naturally, there will be a rise in repossessions and liquidations when the pool of equipment in the marketplace has increased,” Castagna explains.

Fourth quarter traditionally is the slowest for repossessions and liquidations. Nassau's NQI indicates repossessions and liquidations in Q4 2005 compared with Q4 2004 were down in three of five major categories: printing (-32%); machine tools (-22%); and medical devices (-72%).

Castagna says it is too early to determine if the drop indicates a broader trend since all three equipment categories fluctuated during the previous three quarters. With its Q4 data now in, Nassau plans a Year 2005 analysis of the top five equipment categories by March.

About NQI

NQI reports on Nassau's internal repossession and orderly liquidation activity in a given quarter compared to the same quarter the previous year. Readers should keep in mind that results must be viewed over several quarters to establish trends.

Finance companies and industry analysts can also contract with Nassau to dig deeper into the numbers, determining the root causes for trends and researching specific equipment types. Companies can use their private reports created by Nassau to help mitigate risk in portfolios and/or provide useful economic indicators to their own clients.

About Nassau

Nassau Asset Management of Westbury, NY, has been providing nationwide full-service asset management, including equipment remarketing, fleet and plant liquidations, collections, and appraisals for more than 25 years to the equipment finance industry. For more information, please visit www.nasset.com or call 1-800-4.NASSAU.

[headlines]

### Press Release ###########################

National Association of Credit Management Announces New Scholarship Foundation

Columbia, Maryland:—The National Association of Credit Management (NACM) is pleased to announce that it has established a new Scholarship Foundation to benefit members who work in the field of credit management. Funds have been raised from generous donations throughout the NACM community, as well as from the association's annual Silent Auction, held each year at its annual conference, “Credit Congress”. This year's conference is being held in Nashville, Tennessee, May 21-24.

Kevin Burke, CCE, Chairman of NACM's newly formed Scholarship Committee, which assisted in creating the Foundation and selects recipients for the scholarships, said “It was an honor to be selected to serve as the first Chairman of this committee, and to have such a talented group of committee members to assist in creating a Scholarship Foundation as a way to provide aid towards supporting the future educational needs of fellow NACM members.”

“We hope that every NACM member will take advantage of this new opportunity by submitting an application for scholarship funds,” he added.

NACM membership is made up of those people at companies large and small, in all industries, who are responsible for business credit and accounts receivable. Business Credit is the single largest source of U.S. business financing by volume—even exceeding bank loans. Accounts receivable is typically the largest asset on a company's balance sheet—it's cash flow; and the ability to manage cash flow is directly linked to the ability to manage risk. In the wake of widely-reported corporate accounting scandals and wrong-doing, ever-more scrutiny and pressure is put on those working in corporate finance departments to ensure financial reporting and risk management are handled correctly. To this end, NACM educates its members to manage these functions at their companies.

NACM extends an invitation to individuals and companies wishing to support the Foundation with contributions towards this year's Silent Auction at Credit Congress. Contributions are tax deductible. For more information, go to www.nacm.org.

The National Association of Credit Management (NACM), headquartered in Columbia, Maryland, supports more than 25,000 business credit and financial professionals worldwide with premier industry services, tools and information. NACM and its network of Affiliated Associations are the leading resource for credit and financial management information and education, delivering products and services, which improve the management of business credit and accounts receivable. NACM's collective voice has influenced legislative results concerning commercial business and trade credit to our nation's policy makers for more than 100 years, and continues to play an active part in legislative issues pertaining to business credit and corporate bankruptcy.

Contact: Norma Heim, NACM

410-740-5560

[headlines]

### Press Release ###########################

CIT Names Pratt Executive VP and Chief Sales Officer, Construction

Tempe, – CIT Group Inc. (NYSE: CIT) today announced the appointment of Tim Pratt to Executive Vice President and Chief Sales Officer, CIT Construction. Mr. Pratt will be based in Tempe, AZ and will concentrate on generating new business opportunities and managing the sales force.

“Tim's vast experience in niche industries within the equipment finance sector, specifically vocational trucks and construction, will help us to manage and grow our business,” said Ron Riecks, President of CIT Construction. “He is a welcome addition to our team and his 23 years of experience will be a valuable asset to CIT.”

Mr. Pratt joins CIT from Wells Fargo Equipment Finance where he was a Senior Vice President and Sales Manager of the Commercial Vehicle Group since 2002, responsible for all originations and day-to-day sales management. Prior, he was employed at TCF Equipment Finance, Missoula Freightliner, Norwest Equipment Finance, First Bank System Leasing and Wallwork Lease and Rental.

Mr. Pratt has a B.A. from Mayville State University in North Dakota. He currently resides in Orono, MN with his wife Karen and their three children, and will be relocating to the Phoenix area.

About CIT Construction

CIT Construction creates total financial solutions for the national and regional construction industry, providing a wide range of financial products and services to end users, contractors, equipment dealers, equipment-rental companies and other construction-related clients. The vertical also specializes in creating custom financial solutions including manufacturer-supported retail and inventory financing programs, total money facilities, dealer revolving lines of credit, contractor revolvers and working capital loans.

About CIT

CIT Group Inc., a leading commercial and consumer finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has over $60 billion in assets under management and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries worldwide. CIT, a Fortune 500 company and a component of the S&P 500 Index, holds leading positions in vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset-based lending. With its Global Headquarters in New York City, CIT has approximately 6,000 employees in locations throughout North America, Europe, Latin and South America, and the Pacific Rim.

For more information, visit http://www.cit.com.

[headlines]

### Press Release ###########################

Parlier Joins Commerce Commercial

Matthew W. Parlier has joined Commerce Commercial Leasing LLC, the equipment finance and leasing unit of Commerce Bank, based in Cherry Hill, NJ. Parlier joins Commerce as an Aircraft Finance Specialist having spent most of his leasing career specializing in this asset class. Parlier was most recently with Valley National Bank and previously Summit Bank engaged in aviation finance.

According to John F. Unchester, Sales & Syndication's Manager for Commerce Commercial Leasing, business aircraft financing is a new market focus for Commerce. As the Mid Atlantic region represents a heavy concentration of both private and business operators, Commerce will access this market through Bank referrals and through the dealer network offering a full menu of leasing and finance products.

Unchester also announced plans for Commerce to expand it's current Express Lease product to include coverage and origination's from commercial equipment distributors located in the nine (9) state market footprint of Commerce Bank. The Express Lease unit originates new business with small to medium size companies through the Bank's branch network, which now exceeds 370 locations. Recognizing that distributors also value a convenient, fast and simple source of customer lease financing, Commerce will extend it's Express Lease product to this channel. Robert Lubeck, a Commerce Leasing Officer, will expand his responsibilities to include coverage of the dealer network.

Aircraft finance and Vendor leasing are two new initiatives designed to complement Commerce's core business of Commercial and Healthcare lease financing. Combined, the Leasing business is expected to maintain an annual growth rate exceeding 20% per year in order to keep pace with the expansion of parent company Commerce Bank, according to Anthony Sasso, President of Commerce Leasing.

[headlines]

### Press Release ###########################

Republic Financial Corporation Facilitates Airbus A340 Aircraft Sale with Long-term Lease

Aurora, Colorado – — Republic Financial Corporation (Republic) announced today the acquisition of six Airbus A340 – 200 aircraft from Airbus Financial Services (“AFS”), a wholly owned subsidiary of Airbus. The aircraft are currently subject to five-year operating leases with South African Airways (Proprietary) Limited. Republic recognized the complexities of the transaction and successfully addressed them by combining their asset evaluative expertise with the aviation asset finance specialization of the London-based aviation team of DVB Bank AG (“DVB”). Republic's ability to leverage its relationships and its in-depth knowledge of the product enabled the company to arrange funding and close a complex and sophisticated international transaction.

David Goring-Thomas, global head of aviation of DVB noted, “Because Republic presented a well-structured transaction with attractive characteristics of mitigated risk and healthy collateralization, this was a competitively bid and awarded financial opportunity. Not only does it provide liquidity for the seller, but it also is a compelling investment opportunity for us as the lender.”

With extensive global aviation industry experience, Republic invests in aircraft, aviation-related assets and businesses, as well as equipment-lease portfolios. Since 2003, the company has invested in a portfolio of 41 aircraft and aircraft engines. Not only does this latest acquisition expand Republic's role in the aircraft lease market, it also demonstrates the 2005 resale value of the A340 in the market. Republic will maintain the aircraft leases through the year 2010; at which point in time, Republic will pursue a number of asset disposition options including lease extension.

“We were able to recognize the strong value in the assets and leases to create a unique investment opportunity for Republic to the satisfaction of all parties involved,” stated Paul Mason, president of Republic's Aviation & Portfolio Group. “This is our second transaction with DVB in less than one year and our first with Airbus. I look forward to bringing these parties together again in future acquisitions with Republic as the originator.”

“We were delighted to assist AFS and consider this an excellent opportunity for AFS to relinquish their long-term lease arrangement while entrusting our customer relationship with confidence to a valued partner,” acknowledged Philippe Archaud, vice president of Airbus' Asset Management Division. “Republic's demonstrated ability to generate value through creative financial structuring and comprehensive in-depth analysis provided a platform which drove this transaction to completion. Republic with their ability to construct transactions of this nature is a great fit for Airbus and brings great value to us in our asset trading business. We look forward to the next deal.”

[headlines]

### Press Release ###########################

--------------------------------------------------------------

News Briefs----

Fed Leaves Door Open to Interest Rate Hike

http://www.newsday.com/business/ats-ap_business11feb21,0,5674133.story?coll=

ny-business-leadheadlines

Leading economic indicators rise dramatically in January

http://www.signonsandiego.com/news/business/20060221-1409-economy.html

Wal-Mart Tries to Find Its Customer

http://www.nytimes.com/2006/02/22/business/22place.html?_r=1&oref=slogin

Wal-Mart's fourth-quarter profit rises 13 percent

http://www.signonsandiego.com/news/business/20060221-1352-earns-wal-mart.html

Home Depot reports jump in fourth-quarter profit

http://www.ajc.com/business/content/business/stories/0221homedepotearns.html

Health spending rises at blistering pace

http://www.usatoday.com/money/industries/health/2006-02-21-health-costs-usat_x.htm

San Francisco examines power of dog droppings

http://www.usatoday.com/tech/science/2006-02-21-poop-power_x.htm

IRS has $2 billion for taxpayers who never asked for refund

http://www.usatoday.com/money/perfi/taxes/2006-02-21-irs-back-refunds_x.htm

Ranking American Idol Ladies

http://www.accessatlanta.com/blogs/content/shared-blogs/accessatlanta/idol/entries/

2006/02/21/221_its_showtim.html/

[headlines]

---------------------------------------------------------------

You May Have Missed

A Book for People Who Love Numbers

http://www.nytimes.com/2006/02/22/books/22stats.html

[headlines]

---------------------------------------------------------------

Sports Briefs----

Skating Sprites Come Up Big

http://www.washingtonpost.com/wp-dyn/content/article/2006/02/21/

AR2006022101943.html

Culpepper shopped to Baltimore

http://www.startribune.com/510/story/259636.html

[headlines]

----------------------------------------------------------------

“Gimme that Wine”

Column: Is now the right time for California wine grape commission

http://westernfarmpress.com/news/2-20-06-Column-wine-grape-commission/

Tin Barn Vineyards is one of Sonoma's best-kept secrets

http://www.sonomasun.com/2006/February/16/Epicure-Gray-021606.html

Editorial notebook: Let she who is without zin...

http://www.sacbee.com/content/opinion/editorials/story/14214339p-15040399c.html

www.winezap.com

http://www.wine-searcher.com/

If you want to know if you got a value for your wine, or what the wine price is today, go to www.winezap.com Type in the vintage (year) and name of the producer with wine type or geographic area, such as 1995 Chateau Lynch Bages Pauillac. Even 1995 Lynch Bages will work, or 1999 Viader

[headlines]

----------------------------------------------------------------

Restaurant Review

Roy's Restaurant

There are two located in the San Francisco Bay Area ; San Francisco and in

Carmel, at the Spanish Bay Inn . Also one in Newport Beach, in Southern California.

Roy Yamaguchi opened his first "Euro-Asian" restaurant in Hollywood, California, had some financial difficulties in making it work, moved to Hawaii, where he made some changes, and incorporated more fish, more Hawaiian food, if you will, into his menu and before you know it, he had three restaurants here. The first one I ate at was in Maui, and the most recent, was in Waikoloa and Kauai. He likes the coinage: Euro-Asian, Roy started out in the islands in "shopping centers;” certainly the Spanish Bay Inn in Carmel is far from that. The food and presentation are outstanding. The service has always been very friendly, best ever, and the wine list may be limited, meaning not large enough to impress the Wine Spectator, but it is outstanding. Great choices; even has my favorite, Viader. Extremely knowledgeable choices. I must admit Sue and I like the "house wines" best.

These are private labels, not from Gallo but from smaller wineries from all over. One of my favorites is: Roy's, Oregon Pinot Noir 1998 (by Rex Hill, Willamette Valley, Oregon) He is opening up more restaurants, some of them franchises, and there may one closer to you. For a location, please go here: http://roys.know-where.com/roys/

(for other reviews: please go here:

http://two.leasingnews.org/Recommendations/rstrnt.htm 0

[headlines]

----------------------------------------------------------------

Calendar Events This Day

Teddy Bear Day

World Thinking Day

[headlines]

----------------------------------------------------------------

Today's Two Top Events in History

1819- The Florida Purchase treaty was signed by Spain and the U.S. After having lost several decisive sea battles with the British, and the French, Spain was ready to abandon its several centuries of settlements in the new world. In a triumph of diplomacy by Secretary of State John Quincy Adams, Spain ceded the remainder of its old province of Florida at no cost beyond that of U.S. assumption of up to $5,000,0000 of the claims of U.S. citizens against Spain. Adams also obtained for the U.S., a transcontinental southern boundary that legitimized U.S. interests on the northern side of the line to the Pacific. Florida became a state in 1845.

1847- At the Battle of Buena Vista, U.S. forces under Gen. Zachary Taylor defeated the Mexicans under Gen. Antonio Lopez de Santa Anna. ( later in the year a battalion of U.S. Marines made its presence felt in Mexico at “the halls of Montezuma.). The war would end in 1948, by its terms Mexico recognized Texas a part of the US and ceded to the use 500,000 square miles of territory, including all of the future states of California, Nevada, and Utah, almost all of New Mexico and Arizona, and parts of Colorado and Wyoming. In return, the U.S. agreed to pay Mexico $15,000,000 . The war resulted in 1721 dead and 4102 wounded. In addition, some 11,115 Americans died of disease as a result of the war. The total cost of the war was estimated at $97,5000,000. The U.S. became an enormous continental republic, but the acquisition of the new territory aggravated the dispute between slavery and antislavery forces.

[headlines]

----------------------------------------------------------------

This Day in American History

1616-A smallpox epidemic among Indians relieved future New England colonies of the threat of major hostilities with the Indians. The tribes from the Penobscot River in Maine to Narragansett Bay in Rhode Island were virtually destroyed. It was not the white man that defeated the American natives but the diseases they brought with them from the old world.

1618-In a move to compel church attendance, Governor Samuel Argall of Virginia decreed that all who failed to attend church service would be imprisoned in the guardhouse, “lying neck and heels in the Corps of Gard ye night following and be a slave ye week following.” Sunday dancing, fiddling, card playing, hunting, and fishing were also forbidden.

http://www.famousamericans.net/sirsamuelargall/

1630 - Popcorn was introduced to English colonists by Quadequine, brother of Massasoit, who brought a bag of it to dinner.

http://ks.essortment.com/whatisthehist_rsdt.htm

http://www.factmonster.com/spot/popcorn1.html

1631-The first public thanksgiving, a fast day, was celebrated in Massachusetts Bay Colony, though many private celebrations had been recorded before this.

1656- Congregation Shearith Israel, the first Jewish congregation in America, consecrated the first Jewish cemetery in New York City. The plot occupied a piece of ground in the section now known as Chatham Square.

1732 –Birthday of the United States first president, George Washington, ( "in war and peace"); however, the Julian ( Old Style) calendar was still in use in the colonies when he was born and the year began in March, so the date on the calendar when George Washington was born would be actually February 11, 1731. To reduce the amount of holidays, whereas for over a century Washington was revered as president and general, we now have President's day for both George Washington and Abraham Lincoln.

http://memory.loc.gov/ammem/today/feb22.html

1773 - The memorable "Cold Sabbath" in New England history. Many persons froze extremities while going to church, according to weather historian David Ludlum

1778- birthday of Rembrandt Peale, American portrait and historical painter, son of artist Charles Willson Peale, born at Bucks County, PA. Died at Philadelphia, PA, Oct 3, 1860.

1784 - The Empress of China, first trading ship sent to China from the United States, set sail from New York on this day, arriving in China on August 28.

1819- The Florida Purchase treaty was signed by Spain and the U.S. After having lost several decisive sea battles with the British, and the French, Spain was ready to abandon its several centuries of settlements in the new world. In a triumph of diplomacy by Secretary of State John Quincy Adams, Spain ceded the remainder of its old province of Florida at no cost beyond that of U.S. assumption of up to $5,000,0000 of the claims of U.S. citizens against Spain. Adams also obtained for the U.S., a transcontinental southern boundary that legitimized U.S. interests on the northern side of the line to the Pacific. Florida became a state in 1845.

1819 -- James Russell Lowell, poet/essayist/diplomat, born Cambridge, Massachusetts.

http://www.lib.rochester.edu/camelot/auth/lowell.htm

http://www.selfknowledge.com/267au.htm

1847- At the Battle of Buena Vista, U.S. forces under Gen. Zachary Taylor defeated the Mexicans under Gen. Antonio Lopez de Santa Anna. ( later in the year a battalion of U.S. Marines made its presence felt in Mexico at “the halls of Montezuma.). The war would end in 1948, by its terms Mexico recognized Texas a part of the US and ceded to the use 500,000 square miles of territory, including all of the future states of California, Nevada, and Utah, almost all of New Mexico and Arizona, and parts of Colorado and Wyoming. In return, the U.S. agreed to pay Mexico $15,000,000 . The war resulted in 1721 dead and 4102 wounded. In addition, some 11,115 Americans died of disease as a result of the war. The total cost of the war was estimated at $97,5000,000. The U.S. became an enormous continental republic, but the acquisition of the new territory aggravated the dispute between slavery and antislavery forces.

1847- As one of his last official acts, Alcalde Bartlett certified the accuracy of the new town plan for San Francisco before the County Recorder.

1864 –The second day/last day of Battle of Okolona, MS

http://www.cr.nps.gov/hps/abpp/battles/ms013.htm

1864-- Battle at Dalton, Georgia. From Vicksburg, Mississippi, Sherman launched a campaign to take the important railroad center at Meridian and, if the situation was favorable, to push on to Selma and threaten Mobile, in order to prevent the shipment of Confederate men and supplies. To counter the threat, Confederate President Jefferson Davis ordered troops into the area. While these operations unfolded, Thomas determined to probe Gen. Johnston's army in the hope that Johnston's loss of two divisions, sent to reinforce Lt. Gen. Leonidas Polk as he withdrew from Meridian to Demopolis, Alabama, would make him vulnerable. Skirmishing and intense fighting occurred throughout the demonstration. At Crow Valley on the 25th, Union troops almost turned the Rebel right flank, but ultimately it held. On the 27th, Thomas's army withdrew, realizing that Johnston was ready and able to counter any assault.

1865-- Battle of Wilmington NC (Fort Anderson) occupied by Federals ends with Confederate Gen. Braxton Bragg ordered the evacuation of Wilmington, burning cotton, tobacco, and government stores. A similar event happened in the burning of Atlanta, where union troops were blamed for the destruction, but in reality it was the fleeing confederate army not wanting to leave supplies, buildings or any aid to the occupying union army. The Union army captures Fort Fisher with the great help of the “colored infantry division.” Today the fort is an national historical site, also housing the famous North Carolina Aquarium, receiving over 1 million visitors each year.

http://www.cr.nps.gov/hps/abpp/battles/nc016.htm

http://www.powells.com/cgi-bin/biblio?inkey=1-1882810244-1

http://www.ah.dcr.state.nc.us/sections/hs/fisher/fisher.htm

http://www.ncaquariums.com/newsite/ff/ffindex.htm

1876-Johns Hopkins University opens, the first research university in the United States.

http://webapps.jhu.edu/jhuniverse/information_about_hopkins/about_jhu/

a_brief_history_of_jhu/index.cfm

http://www.jhu.edu/

1879- Frank Woolworth opened his first store at Utica, New York. The store was a great disappointment as it s sales after a few weeks were as low as $2.50 a day. Woolworth moved his store in June 1879 to Lancaster, PA, where it proved a success. He came up with the idea for a five-cent store on September 24,1878, in Watertown, NY, when he originated a “five-cent table” in the store of Moore and Smith during the week of the county fair. The first joint venture of the Woolworth brothers in Harrisburg, PA, was called the “Great 5 Cent Store.” In 1997, the closing of the chain was announced. Macy's, Montgomery Ward, K-Mart, the White House, among others have filed bankruptcy as Wal-Mart and Costco's have changed the "department store" business.

1884- birthday of Abe Attell, boxer born Albert Knoehr at San Francisco, CA. Attell held the featherweight championship for 11 years in the early part of this century when boxing was not quite as organized as it could have been. A heavy gambler, he got involved in baseball's Black Sox scandal, actually delivering $10,000 to the player-conspirators. but he avoided prosecution, first by fleeing to Canada and then by convincing authorities that there were two Abe Attells and the other one was the guilty party. Dieted at Livingstone Manor, NY. Feb 6, 1970.

1888- General A.M. Winn leads a parade in San Francisco, celebrating the passage of California's 8-hour word day law.

http://www.sfmuseum.org/hist8/earlylabor.html

1889- President Cleveland signs the Omnibus Admissions Act to admit Dakotas, Montana and Washington state. One final amendment to the Omnibus Bill was particularly significant for Washington state. Representative Springer of Illinois, chairman of the House Committee on Territories, wanted to rename Washington as the state of Tacoma. The move sparked considerable controversy in Washington, including a letter by ex-governor Watson Squire charging that the Northern Pacific had chosen the name for the city of Tacoma, had wanted to change the name of Mt. Rainier to Tacoma, and now wanted to rename the state. Watson argued the importance of keeping the name as a "trademark" and in honor of George Washington: And is not this commonwealth one of the monuments erected to the father of the republic? Why impiously seek to tear it down? Is the monument unworthy of the name? Only an ignoramus could harbor the thought! The Omnibus Bill would have renamed the state Tacoma until the final vote on February 20, at which time the name of Washington was restored. It was signed by President Cleveland on the 22 nd to honor the first president of the United States.

http://www.appeal-law.com/constitution/voorhees.shtml

1892- birthday of Edna St. Vincent Millay, American poet ("My candle burns at both ends . . ."), born at Rockland, ME. She died Oct 19, 1950, at Austerlitz, NY

1906-- Black evangelist William J. Seymour first arrived in Los Angeles and began holding revival meetings. The "Azusa Street Revival" later broke out under Seymour's leadership, in the Apostolic Faith Mission located at 312 Azusa Street in Los Angeles. It was one of the pioneering events in the history of 20th century American Pentecostalism.

1907- birthday of trumpeter Rex Stewart, Philadelphia, PA

1915 –Tenor Saxophone player Buddy Tate birthday, born George Holmes Tate in Sherman, Texas, died February 3,2002

http://elvispelvis.com/buddytate.htm

1918- birthday of Robert Wadlow, tallest man in recorded history, born at Alton, IL. Though only 9 lbs at birth, by age 10 Wadlow already stood over 6 feet tall and weighed 210 lbs. When Wadlow died at age 22, he was a remarkable 8 feet 11.1 inches tall, 490 lbs. His gentle, friendly manner in the face of constant public attention earned him the name "Gentle Giant." Wadlow died July 15, 1940, at Manistee, MI, of complications resulting from a foot infection.

1920- honky-tonk piano player Del Wood, whose real name was Adelaide Hendricks, was born in Nashville, Tennessee. She recorded a ragtime version of a fiddle tune called "Down Yonder" in 1951 and came up with a million- seller. Jerry Lee Lewis has cited Del Wood as one of the artists he listened to in his early years. Wood died on October 3rd, 1989 of a stroke.

1922-- Trumpeter Joe Wilder birthday, Colwyn, PA.

1936 - Although heat and dust prevailed in the spring and summer, early 1936 brought record cold to parts of the U.S. Sioux Center IA reported 42 inches of snow on the ground, a state record.

1937- Bobby Hendricks, one of the several lead singers of the original Drifters following the departure of Clyde McPhatter in 1955, was born in Columbus, Ohio. Hendricks was with the Drifters for eight months. He had earlier sung with the Swallows and the Five Crowns. In 1958, Bobby Hendricks had a hit on his own with "Itchy Twitchy Feeling."

1945—Birthday of '60s folk-rock singer Oliver, whose full name is William Oliver Swofford.

1946- Dizzy Gillespie first records “ Night in Tunisia,” NYC ( Vi 40-0130 )

1956--- Eighty well-known boycotters, including Rosa Parks, Martin Luther King, Jr., and Edward. Nixon marched to the sheriffs office in the Montgomery County, Alabama courthouse, where they gave themselves up for arrest. On Feb 20, 1956, white city leaders of Montgomery, Alabama, issued an ultimatum to black organizers of the three-month-old Montgomery bus boycott. They said if the boycott ended immediately there would be "no retaliation whatsoever." If it did not end, it was made clear they would begin arresting black leaders. Two days later, they were booked, finger printed and photographed. The next day the story was carried by newspapers all over the world.

1956 - For the first time, Elvis Presley hit the music charts as "Heartbreak Hotel" began to climb to number one on pop charts. It reached the top on April 11, 1956, and stayed there for eight weeks.

1956-Billboard reviews James Brown's debut record "Please, Please, Please": "A dynamic, religious fervor runs through the pleading solo here. Brown and the Famous Flames group let off plenty of steam.

1957---Top Hits

Too Much - Elvis Presley

Young Love - Tab Hunter

Love is Strange - Mickey & Sylvia

Young Love - Sonny James

1957- In a small club in Blytheville, Arkansas, Jerry Lee Lewis plays "Whole Lotta Shakin' Goin' On." Although Lewis did not write the tune, it was a favorite of his since he first heard it a year earlier. This is the first time Lewis adds his own words to replace those he has forgotten.

1958 - Roy Hamilton's record, "Don't Let Go", hit #13 for its first week on record charts, making it the first stereo record to make the pop music charts. The year 1958 saw several stereo recordings, including: "Hang Up My Rock and Roll Shoes" by Chuck Willis, "Yakety Yak" by the Coasters, "Born Too Late", by The Poni-Tails, "It's All in the Game" by Tommy Edwards and "What Am I Living For" by Chuck Willis.

1959 --the first running of the Daytona 500, the race that has become the most important event on the NASCAR calendar took place at the newly-opened Daytona International Speedway in Florida. Drivers lee Petty and Johnny Beauchamp crossed the finished line in what appeared to be a dead heat, but photographs and film, examined later, showed Petty to be the winner.

1965---Top Hits

This Diamond Ring - Gary Lewis & The Playboys

My Girl - The Temptations

The Jolly Green Giant - The Kingsmen

I've Got a Tiger by the Tail - Buck Owens

1965 - In the Bahamas, filming got underway for the Beatles' second movie, "HELP!" Other scenes were shot in England and Austria. The film opened in North America in August.

1965 - The Rodgers and Hammerstein musical Cinderella, starring newcomer Lesley Ann Warren, debuted on CBS. It received a Nielsen rating of 42.3 and was among the highest-rating single programs in the history of television.

1968-Genesis, a group formed as a songwriters' cooperative by three English schoolboys, Peter Gabriel, Tony Banks and Mike Rutherford, release its first single, "The Silent Sun."

1969- The Foundations' "Build Me Up Buttercup" peaks at #3 on the pop chart

1969- Barbara Jo Rubin became the first woman jockey to win a thoroughbred horse race in the United States. She rode Cohesion to victory by a neck over Reely Beeg in the ninth race at Charles Town Race Track in W3est Virginia.

1973-Roberta Flack receives a gold record for "Killing Me Softly With His Song" which was Number One for five weeks. It is rumored the quietly murdering artist in question is folkie Don McLean.

1973---Top Hits

Crocodile Rock - Elton John

Oh, Babe, What Would You Say? - Hurricane Smith

Dueling Banjos - Eric Weissberg & Steve Mandell

I Wonder if They Ever Think of Me - Merle Haggard

1980- the Miracle on Ice...The US Olympic hockey team upset the team form the Soviet Union, 4-3 on the Lake Placid Winter Games to earn a victory often called the “Miracle on Ice.” the Americans went on to defeat Finland two days later and win the gold medal. The lit the fire at this year's winter games in Salt Lake City, Utah.

1981- the Duke Ellington musical "Sophisticated Ladies," starring Phyllis Hyman, opened on Broadway. The Grammy's are awarded: Tracy Chapman wins Best New Artist; Bobby McFerrin's "Don't Worry Be Happy" wins Best Song and Record and Jethro Tull wins the first Hard Rock/Metal Grammy.

1981---Top Hits

9 to 5 - Dolly Parton

I Love a Rainy Night - Eddie Rabbitt

Woman - John Lennon

Southern Rains - Mel Tillis

1986 - A twelve siege of heavy rain and snow, which produced widespread flooding and mudslides across northern and central California, finally came to an end. The storm caused more than 400 million dollars property damage. Bucks Lake, located in the Sierra Nevada Range, received 49.6 inches of rain during the twelve day period.

1989---Top Hits

Straight Up - Paula Abdul

Wild Thing - Tone Loc

Born to Be My Baby - Bon Jovi

Big Wheels in the Moonlight - Dan Seals

1989-The Grammys are awarded: Tracy Chapman wins Best New Artist; Bobby McFerrin's "Don't Worry Be Happy" wins Best Song and Record and Jethro Tull wins the first Hard Rock/Metal Grammy

1989 - Strong northwesterly winds ushering cold arctic air into the north central U.S. produced snow squalls in the Great Lakes Region, with heavy snow near Lake Michigan. Totals in northwest Indiana ranged up to 24 inches at Gary, and up to 16 inches buried northeastern Illinois.

1992 - Kristi Yamaguchi of the United States won the gold medal in women's figure skating at the Albertville Olympics. Although she fell while performing a triple loop, she committed far fewer errors than her rivals, thus getting the gold medal. Midori Ito of Japan won the silver, Nancy Kerrigan of the United States the bronze. “Yamaguchi crafted her title on a feathery vision of artistic precision and elegance, with near total disdain for the latest trends in acrobatic jumping,” wrote Michael Janofsky in the New York Times.

1995---Top Hits

Take A Bow- Madonna

Creep- TLC

On Bended Knee- Boyz II Men

Another Night- Real McCoy

[headlines]

----------------------------------------------------------------

Winter Poem

George Washington

a poem by

James Russell Lowell

Soldier and statesman, rarest unison;

High-poised example of great duties done

Simply as breathing, a world's honors worn

As life's indifferent gifts to all men born;

Dumb for himself, unless it were to God,

But for his barefoot soldiers eloquent,

Tramping the snow to coral where they trod,

Held by his awe in hollow-eyed content;

Modest, yet firm as Nature's self; unblamed

Save by the men his nobler temper shamed;

Never seduced through show of present good

By other than unsetting lights to steer

New-trimmed in Heaven, nor than his steadfast mood

More steadfast, far from rashness as from fear,

Rigid, but with himself first, grasping still

In swerveless poise the wave-beat helm of will;

Not honored then or now because he wooed

The popular voice, but that he still withstood;

Broad-minded, higher-souled, there is but one

Who was all this and ours, and all men's - Washington

[headlines]