Friday, March 24, 2006

Headlines--- Classified Ads---Operations ######## surrounding the article denotes it is a “press release”

-------------------------------------------------------------- Classified Ads---Operations

o360° Panorama in the Storybook Wine Cave near Calistoga in California's Napa Valley * Orange County, CA. East Windsor, NJ. New York, NY. Wayne, NJ. For a full listing of all “job wanted” ads, please go to: http://64.125.68.91/AL/LeasingNews/JobPostings.htm To place a free “job wanted” ad, please go to: http://64.125.68.91/AL/LeasingNews/PostingForm.asp *Print Pricing 180° Panoramas 360° Panoramas 6" x 20" $34.00 6" x 40" $53.00 http://www.inetours.com/Prints/WCprints/Wcv/Wcaves_Gal5.html -------------------------------------------------------------- Archives, March 24, 2004--- Peter Eaton, CLP, Moves Back to Madison, Wisconsin

Keeping his job at Pentech Financial as Vice-President of Pentech's Intermediary Market Group, the popular Peter Eaton, and his wife Patricia, are moving closer to be with their children and grand-children.

“Conference Chairman Peter Eaton, CLP,(l) and his wife Patricia visit with First National easing Corporation executive Vice-President Casey Kolp and his wife Linda during the Sports Reception.” October, 1990, Western Association of Equipment Lessors Conference, Monterey, California “We've been here twenty years, “ he said. “ I travel a lot now, plus 80% of what I do now comes in over the internet, plus things now are also sent so easily in ‘pdf,” that it doesn't matter where you are. You couldn't say that ten years ago.” Peter would like to also say he is known for his golf game, but those that have played with him say he is a better motorcyclist.

Here is our earliest “Pictures from the Past” on Mr. Eaton, CLP. Pictures from the Past Featured on Leasing News: 3/26/2003 ---1987--- Seven Receive CLP Designation http://two.leasingnews.org/imanges_uael_wael/CLP_designation.jpg The third set of Certified Lease Professionals was granted final approval and received plaques commemorating the designation at the Fall Conference in Hawaii.

New CLPs recognized by Western Association of Equipment Leasing President Joe Woodley(left) were from left: Michael Walsh, Atlantic Financial Savings Bank; Ron Wagner, Heritage Leasing Capital; Brian Pindell, Commercial Equipment Lease Corp.; Ben Millerbis, Pentech Financial Services; Peter Eaton, First National Leasing Corp.; Duane Russell, Atlantic Financial Savings Bank. November, 1987 WAEL NewsLine --------------------------------------------------------------

More on Shieman not at the Matsco Companies by Christopher Menkin As reported in Leasing News yesterday, Matthew D. Shieman is out as president of the Matsco Companies, originally founded by his family, and he is now part of Diversity Capital, working out of Moraga, California, a residential community across the bay from San Francisco.

Mat-S-Co Greater Bay Bancorp President/CEO Byron A. Scordelis returned Leasing News telephone call. He stated Keith Wilton, President of the Specialty Financing Group of Greater Bay Bancorp, was to contact me. This is correct, as Mr. Wilton's secretary called earlier to let me know he was out of town and would be contacting me next week about the Matsco Companies. Wilton is in charge of Matsco, CAPCO and Greater Bay Capital. Scordelis said he could not discuss personnel matters, but the bank "greatly appreciates Matt's past contributions and we wish him well in any future endeavors he might undertake." He said the Matsco Companies continues to do finance leases for dentists, veterinarians, and health care professionals. Much of the story in Leasing News yesterday covered 2001, before Scordelis's watch. The company for five years has been growing each year, he said, and in fact, according to the SEC filings, had a 14% growth rate in 2005 with nearly $900 million in assets. "I would also say the loss record is pristine for a leasing company," he pointed out. "Look at the figures, last year $4.6 million in losses on $885 million, that's roughly a half percent. Pristine! " The 10K Annual Report for Greater Bay Bancorp was filed March 23, 2006: http://leasingnews.org/PDF/GREATERBAYBANCO10K.pdf ------------------------------------------------------------------------------ New NorVergence Settlement Numbers by Christopher Menkin

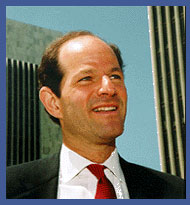

NY Attorney General Elliot Spitzer New York Attorney General Attorney General Eliot Spitzer and his staff were the first to obtain major settlements with funders of NorVergence leases. They lead the way for 28 other attorneys general offices and the District of Columbia to also obtain settlements, originally from the companies Spitzer was about to get from 100% to 85% of the money owed returned, including personal property tax and other fees, plus payments spread over a period of time at not interest, if requested. Leasing News ran two editorials to support the "generous settlement" and was active on blogs and list serves with NorVergence lessees. We got criticism from both sides. We thought it was a wise business decision for all the parties involved. Popular, IFC Credit, Partner's Equity, and Sterling Bank, among others, did not reach a settlement, and several class action suits also were working on the lessees behalf. Leasing News reported that in Illinois, only 48.2% accepted the 85% settlements Illinois Attorney General Lisa Madigan and her staff obtained. Paul Larrabee, New York State Attorney General's Office, reports Attorney General Spitzer and his staff found the percentage to be 67% or 467 accepted from 14 leasing companies, ranging from 85% to 100%, totaling 737 complaints. Excluding the one company who only had one complaint, there were three who received 100%: GE-92; USBancorp- 59, TCF- 43. Wells Fargo had 86, but 15 who declined. CIT had 103 who accepted, but 194 who declined. The figure is surprising as the settlement was 90% of the contract, fees, and terms on the 10% owed at no interest. *Professional Collectors thought it outrageous the settlements of GE, CIT, US Bancorp, and Wells Fargo. Why were the percentages of those who took the settlements not higher? And why four 100%, the rest odds and end, but CIT finding 65% not accepting may be explained as group phenomena. The guess seems to follow those on List Serve who are "hard liners" and expect penalties and fees from the lessors, not forgiveness on the lease contract. Those who are the most vocal are ones who had contracts with CIT, so it appears the followers of this group who also had CIT contracts, were influenced by the alpha vocal critics. In the meantime, other leasing companies, such as Sterling, have offered 50%. as arranged by one class action group, and these clients are annoyed at the figure. Others such at Popular in Missouri, where the defense was unable to change the venue, 400 lessees appear to be going to court. In the IFC Credit case, where there are $14 million in leases, venue is where the lessee is located and there appear to be many individual lawsuits. Not lease to forget is Federal Trade Commission Senior Attorney Randy Brook, who brought Leasecomm down, fined and returning over $24 million to Leasecomm lessees. In the CID filings, particularly with asking leasing companies, for accounting records, was this to learn about "holdbacks," this has not been divulged in a Texas Court case (IFC Credit Vrs. Speciality Optical dba SOS) where IFC paid NorVergence $11,743 for a $28,000 original invoice figure that yielded lease payments of $32,620.20. There was sparing about certain items the IFC Credit attorney said he provided, but in the letter to the editor of the Equipment Leasing Association newsletter, said, "In addition to IFC's two prior responses to requests for production of October, 2004, and January, 2005, (we have written confirmations of delivery), IFC has been cooperating with the FTC on another supplemental request from the FTC for additional information and IFC is in the process of obtaining and assembling such information from third-parties for forwarding to the FTC. "That information and other materials requested by the FTC are expected to be delivered to the FTC very soon which should resolve the requests of the FTC's Civil Investigative Demand. " Brook supposedly is personally familiar with Lease Plus, the software accounting program from LeaseTeam, who advertisers one of their accounts is IFC Credit Corporation. John Estok of IFC Credit admitted in the SOS case that he estimated over $2 million in hold backs from NorVergence. How did they account for these, and was service separated from personal property; were all leases treated the same, meaning insurance and personal property tax based on the stream of payments of the lease and not the equipment cost, as it normally is calculated. In the SOS case, particularly sensitive in the State of Texas, NorVergence was the manufacturer and supplier of the lease contracts to funding sources, actually signing a packet of papers regarding the telephone service. The lease contract was to contain the “equipment” when in fact it also contained the profit, less the cost, of the telephone service itself. These may be important in defining section 2A and rendering the make payments come “hell or high water” subject to further Inspection. According to James M. Johnson, PHD, recognized expert in equipment leasing: “Operating and Capital lease terms, especially the latter, is a creation of the accounting profession. I find no reference to capital leases in the tax code. A capital lease for accounting purposes can be either a true lease or a conditional sale under the IRC. We have long known the reverse to be true as well--operating leases for accounting treatment may be either true leases or conditional sales for tax purposes.” These may change the "substance" of the contracts to more like "conditional sales contracts? Is that what Brook is looking for in the various leasing companies? Does he see similarities between the Leasecomm situation and NorVergence in reference to 2A? Meaning if you define "NorVergence as manufacturer and thus cannot claim to have a "finance lease" as defined by Article 2A. This view would then presumably permit the lessee to reject the lease as provided in Sections 508 and 509." The hell or high water clause states that the lessee, not the lessor, is responsible for selecting the equipment, the vendor, the service provider, and the fitness of the equipment. Furthermore, if the lessee is having trouble with the equipment or related service, its remedies are solely between itself and the vendor and that payments to the lessor are to continue. The residual of the lease, which was booked as having no value, according to testimony. There was no further yield, but in Texas law this may also be viewed as a “capital lease” and not an “operating lease.” The lack of residual value, whether stated or in practice may have legal consequences regarding usury and/or “consumer” law. As a side issue, it seems many local courts are ruling against the venue clause in the NorVergence ERA contracts there also appears to be similarities between Leasecomm and NorVergence in the venue clause of the NorVergence Equipment Rental Agreement. Most local courts have ruled that the venue location was not fairly presented and ruled in favor for the lessee location. There are exceptions for this, such as Popular Leasing in Missouri. This was one of the issues in the Leasecomm suit that the FTC prevailed: “...the contracts contained provisions purporting to waive consumers' defenses and allowing Leasecomm the right to sue consumers in Massachusetts, where it is based, rather than where consumers lived and purchased the business opportunity.” The FTC alleged that most consumers could not afford to travel to Massachusetts to contest Leasecomm's charges and had default judgments entered against them in the Massachusetts court. If they didn't pay, Leasecomm resorted to aggressive collection measures such as wage garnishment and property attachment to collect, even though Leasecomm knew or should have known that their vendors used deceptive practices to sell their business ventures and promote the financing”, according to the FTC's complaint. Is there any intention to make the same arguments as in the Leasecomm situation as with NorVergence? With the Federal Trade Commission investigation off to the side, and possible U.S. Attorney investigations, perhaps those that did not take the settlements from the 28 attorneys generals and District of Columbia, are waiting for the feds to step in. The feds say they want to see the books and tax records before completing their opinion. -------------------------------------------------------------- NorVergence Lessee Wins a Round in Texas

Order issued on 3.17.06 in Dallas, Texas, regarding Lakeview Power Equipment, and Kevin Kerbel vs. Popular Leasing USA. It prohibits Popular Leasing from enforcing an acceleration clause ( Leasing News published a similar order by Paul Cross, the same lawyer on this one, last year.) This order means that at best Popular can hope to only collect the payments monthly, not in a lump sum. http://leasingnews.org/PDF/Popular_Leasing3.pdf -------------------------------------------------------------- Feds Approve National City Acquisition The Federal Reserve Board yesterday announced the approval of the application of National City Corporation, Cleveland, Ohio, to acquire Forbes First Financial Corporation, St. Louis, and its subsidiary bank, Pioneer Bank and Trust Company, Maplewood, both in Missouri. -------------------------------------------------------------- Classified Ads—Help Wanted Account Executive

Business Development Officer

Financial Analyst

Lease Coordinator

Lease Representatives

Portfolio Collection & Customer Service

Sales Manager

--------------------------------------------------------------

LPI Healthcare Services joins “Super Broker” list A -Requires Broker be Licensed | B -Sub-Broker Program | C -Warehouse Line | D -Also a Funder

For view of full “Super Broker” list, please go here: http://www.leasingnews.org/Super_Brokers/Super_Brokers.htm

--------------------------------------------------------------

Burhill Finance Services joins “Broker/Lessor” List Third Column: YES - Year Company Started | YELB - Years in equipment Leasing Business A - City Business License | B- State License | C - Certified Leasing Professional |

D - State(s) sales/use tax license | E - Named as "lessor" on 50% or more of lease contract signed. |

To view the full list, please go here: http://www.leasingnews.org/Brokers/broker_Lessor.htm

--------------------------------------------------------------

LeaseDimensions joins “Back Office” list

To view full list, please go here: http://www.leasingnews.org/elease/backoffice.htm --------------------------------------------------------------

“...for salespeople it's preparation .” by Steve Chriest Having watched baseball spring practice on TV, it shows me even the best athletes get back into shape, exercise their skills, and get ready to get a hit, strike the batter out, or to catch the ball to make an out, plus learn to plan as a team. I think it's the same for salespeople and selling organizations. So, what separates the winners from the also-rans? For athletes it's usually practice , and for salespeople it's preparation . As gifted a golfer as he is, how many tournaments do you suppose Tiger Woods would win if the only golf he played was at tournaments? You can bet that as the other professional golfers spent countless hours practicing their tee shots and their short game, it wouldn't be more than a matter of weeks before Tiger started failing to make the cut at tournaments. While it's true that sometimes luck plays a part in winning, most successful athletes will tell you that they make their own luck. Wayne Gretsky was lucky because during his playing career he spent more time practicing on the ice than he spent on terra firma. Michael Jordan's luck came from his legendary devotion to practice between NBA games. For salespeople, preparation is the equivalent of athletic practice. Just like great tennis players practice baseline shots until making these shots becomes second nature for them, preparing a plan for each sales call and for the management of every customer relationship becomes second nature for the great salesperson. In very much the same way great athletes practice their sport, great salespeople prepare for managing their sales activities. I once heard someone ask a gathering of salespeople these questions: “To be successful, how many books will you read? How many educational seminars will you attend? How much time will you spend with your mentors seeking their advice and counsel?” He was really asking the group how much time and effort they were willing to spend preparing customer account and sales call plans. For salespeople, great success usually springs from good old fashioned preparation , which for the salesperson is the equivalent of athletic practice . Talent is common, and just like dedication to good practice habits distinguish world-class athletes from all others, dedication to good preparation distinguishes great salespeople from merely talented ones. Look around in your own selling organization. It's likely you'll see lots of innately talented people. It's also likely that you'll notice that not all of them perform at the top of their game. Maybe it is because they don't spend enough time preparing to sell. Copyright © 2006 Selling Up TM . All Rights Reserved. About the author: Steve Chriest is the founder of Selling Up TM (www.selling-up.com), a sales consulting firm specializing in sales improvement for organizations of all types and sizes in a variety of industries. He is also the author of Selling Up , The Proven System For Reaching and Selling Senior Executives. You can reach Steve at schriest@selling-up.com . -------------------------------------------------------------- Wal-Mart to Withdraw its Application for a Bank by Christopher Menkin While I am more a Target shopper, I still like Wal-Mart. I mean where else can I go to work part-time after I retire? They even have a wine section. Look for Charlie Lester and I on aisle #12. Leasing News has been writing about the growing trend of state industrial banks, particularly in the State of Utah. When Wal-Mart filed to start an industrial bank, it hit a discord with the new Federal Reserve Chairman Ben Bernanke. The growing campaign resulted in two FDIC hearings, one April 10 and 11 in Arlington, Virginia; the second will take place on April 25 near Kansas City, Kansas. Last week Rep. John Gleason of Michigan proposed a bill Friday that would bar industrial banks like one Wal-Mart is seeking to start. State Delegate Brian Moe in Maryland, also proposed one in his state. In the latest development, Wal-Mart told Reuters it would withdraw its proposed exemption from the Community Reinvestment Act, a U.S. law that places requirements on banks and savings institutions to help meet credit needs of low- and moderate-income neighborhoods. While Wal-Mart said its activities and investments already support surrounding communities, and that it had been advised its bank would be exempt from the law, the retailer has decided to withdraw its proposed CRA exemption Over 45 Congressman have joined the vigilante group to get Wal-Mart. It evidently is safe politics to go after the store that every one supposedly hates. It really cracks me up, supposedly everyone hates Wal-Mart coming to their town, but on the other hand, the shoppers welcome them by buying up everything they have in stock. Wal-Mart is bad for us, and Wal-Mart Bank would even be worse, according to these congressman. Why? They are threatening the U.S. banking system, according to these politicians up for re-election. "Without proper regulatory oversight, an industrial bank owner may put the solvency of both the bank and parent at risk," writes the group in their opposition. The press releases are really flying now. It appears “safe” for Congress to be concerned about commercial owners of industrial banks, who they fear escape a level of federal bank supervision. They finally found a safe platform. The criticism originally came from those opposing the Wal-Mart bid. They began the talk that lack of full federal oversight could allow troubles within the company to bleed into the bank's business and disrupt the payments system. Mean their bank could put the retail side out of business. The same applies to the other industrial bands such as General Electric, Merrill Lynch, and perhaps even Lehman Brothers ( Oh, no, Mr. Bill! No Lehman Brothers!!!) Industrial banks are state-chartered and state-regulated; however, they also are under the supervision of the Federal Deposit Insurance Corp. (FDIC). Commercial companies may own them because federal laws that bar non-financial companies from engaging in banking activities do not classify industrial banks as banks. The question facing regulators is whether Wal-Mart, by far the nation's largest retailer and its biggest private employer, can open a bank in Utah that would process credit and debit card transactions for its 3,500 American stores. Dozens of companies, including Target, Toyota and BMW, operate similar banks. Wal-Mart argues that a bank would save money for itself and its shoppers by avoiding the charges imposed on credit card purchases by other financial institutions, which amount to at least $5 million a year. Opponents argue that the bank, even with its narrow focus, would allow Wal-Mart eventually to open retail banking branches that could wipe out competitors, an ambition Wal-Mart denies harboring. COMMUNITY REINVESTMENT ACT In its application, Wal-Mart said its bank would be a "special purpose bank" and would not be subject to the Community Reinvestment Act, a law enacted in 1977 to encourage banks and savings institutions to help meet the credit needs of low- and moderate-income neighborhoods. The law provides a framework for depository institutions and community organizations to boost the availability of credit and other banking services to underserved communities. According to bank regulators, the law has led banks and thrifts to open new branches, provide expanded services and adopt more flexible underwriting standards. "The CRA exemption was only one of several troubling parts of Wal-Mart's ILC application," said Nu Wexler, a spokesman for a group called Wal-Mart Watch, which is part of The Center for Community & Corporate Ethics and its advocacy arm. "This change does not address our concerns and our allies' concerns about other critical issues -- like the separation of banking and commerce The Congressmen say the fear is coming from their constitutes who are small banks, who fear Wal-Mart could drive community banks out of business, just as the large retailer has driven small retailers out of business in towns where they have opened. No mention of competition from the larger banks, savings and loans, or mergers in the last ten years. Congress now wants to protect small banks. One of the problems to be heard at the two hearings is the barn door has been left open too long. Target, Fry's Electronics and others such as General Electric, Merrill-Lynch, to name a few, have an industrial bank. The Salvation Army, by contrast, plans to speak in support of Wal-Mart, trumpeting the company's steady financial support for the charity's Red Kettle Christmas Campaign and Wal-Mart's rapid response to aid victims of Hurricane Katrina. "We are not bankers and we don't pretend to be," said Maj. George Hood, in charge of national community relations at the Salvation Army. "Our focus is to be a character witness for Wal-Mart and their support for communities." Wal-Mart keeps repeating its purpose is to have better control of their credit card marketing and accounts, telling those who ask they will again explain the functions its proposed bank would perform. In all fairness, it does appear to be an unfair trade restriction to allow a competitor, such as Target, have the ability to process its own credit cards, while denying another. Why the vigilante group? And the screaming, “Let's hang Wal-Mart Bank!” Perhaps the controversy is considered to be a somewhat safe issue, especially compared to huge deficits, the war, Katrina, Homeland security, Medicare, campaign contributions... It looks again like one of those Congressional "friendly lynching" where no one gets actually hanged, but everyone can scream and holler, act like they are getting something done, then go home as if they accomplished something. --------------------------------------------------------------

Fitch Rates CIT Equipment Collateral 2006-VT1 Fitch has assigned ratings to the CIT Equipment Collateral 2006-VT1 (CITEC 2006-VT1) notes as follows: -- $330,000,000 class A-1 notes 'F1+'; -- $179,000,000 class A-2 notes 'AAA'; -- $330,000,000 class A-3 notes 'AAA'; -- $93,790,000 class A-4 notes 'AAA'; -- $22,690,000 class B notes 'AA'; -- $22,690,000 class C notes 'A'; -- $30,252,983 class D notes 'BBB'. The underlying pool of contracts backing the CITEC 2006-VT1 notes consists of equipment lease contracts on new and used technology and other small-ticket equipment originated or acquired by the commercial business units of the Specialty Finance segment of CIT Group Inc (Nachrichten) (CIT). The initial contract principal balance is approximately $1.01 billion. The pool contains 74,262 contracts with major equipment types being computers, telecommunications and office equipment. The CITEC 2006-VT1 ratings are based on the following: -- Historical delinquency and loss performance of the selected portfolios; -- Origination, underwriting and servicing experience and procedures of CIT; -- The role of CIT Financial as servicer; -- Collateral pool characteristics; -- Available credit enhancement for the class A, B, C and D notes; -- Sound legal and cash flow structure of the transaction. The class A ratings reflect credit enhancement provided by the subordination of the class B (2.25%), C (2.25%), and D notes (3.00%) and the initial cash collateral account (6.75%). The class B rating reflects credit enhancement provided by the subordination of the class C and D notes, and the cash collateral account. The class C rating reflects credit enhancement provided by the subordination of the class D notes and the cash collateral account. The class D rating reflects credit enhancement provided by the cash collateral account. The ratings address the payment of interest and principal in accordance with the terms of the legal documents. In determining credit enhancement levels, Fitch took into consideration performance of CIT's past securitizations, as well as its total managed portfolio. Through this analysis, Fitch was able to isolate the historical performance of collateral types relevant to the CITEC 2006-VT1 transaction, while taking into account CIT's low level of annualized losses. In addition, Fitch considered the overall strength of CIT and its relationships with entities such as Dell, Inc. Ultimately, credit enhancement levels were sized to withstand multiples of historical losses at each rating level over the life of the transaction. Under Fitch's 'AAA' scenarios, the class A notes were able to withstand a minimum 4.5 times (x) the expected net loss rate of 2.75%. Meanwhile, the class B, C and D notes sustained more than a 4.0x, 3.0x, and 2.0x stress in each relevant cash flow scenario. Under stress scenarios consistent with the ratings sought, the credit-enhancement structure was sufficient to ensure payment of the class A, B, C and D notes in accordance with the legal documents. CIT Group Inc. is a leading diversified finance company engaging in vendor, equipment, commercial, consumer and structured financing, and leasing activities. CIT is rated 'A' by Fitch's Financial Institutions group. Fitch's rating definitions and the terms of use of such ratings are available on the agency's public site, www.fitchratings.com. Published ratings, criteria and methodologies are available from this site, at all times. Fitch's code of conduct, confidentiality, conflicts of interest, affiliate firewall, compliance and other relevant policies and procedures are also available from the 'Code of Conduct' section of this site. ---------------------------------------------------------------- CIT Ranks as Leading Lender to Women, Veteran, and Minority Entrepreneurs NEW YORK, -- CIT Small Business Lending, the nation's #1 SBA lender for six years and a subsidiary of CIT Group (NYSE: CIT), announced today that the U.S. Small Business Administration credited CIT with over $428 million in SBA 7(a) loan approvals to 821 women, veteran and minority-owned businesses nationwide, making CIT the #1 SBA Lender in these under-served segments. Results were based on activity from all SBA lenders during the SBA fiscal year, which ran from October 1, 2004 through September 30, 2005. SBA 7(a) loans, which are the most frequently used of the agency's business loan programs, offer up to 25-year, fully amortized programs that translate into lower monthly payments for the borrower. Proceeds from the 7(a) program may be used for most business purposes, including the purchase of commercial real estate; construction, renovation or leasehold improvements, acquisition of equipment, purchase of inventory, and working capital. "We're extremely pleased with our lending results," commented John Canning, President, CIT Small Business Lending. "At CIT, we've worked hard to open doors of opportunity for women, veteran, and minority businesses. Whether providing start-up funds to assist an entrepreneur with a new venture or helping more established firms grow and expand, we take pride in helping U.S. small businesses contribute to the vitality, revival, and growth of their communities." CIT is consistently cited as a small business advocate. Last fall, the company secured its position as Top Dollar Volume Lender for the sixth consecutive year. For fiscal year 2005, the SBA credited CIT with over $800 million in SBA 7(a) loan approvals to 1,460 small businesses nationwide. ### Press Release ########################### CIT Announces Retirement of John Canning and Appointment of NEW YORK, -- CIT Group Inc. (NYSE: CIT), a leading provider of commercial and consumer finance solutions, announced the retirement of John Canning as President of CIT Small Business Lending, the nation's #1 Small Business Administration (SBA) lender for six consecutive years. "John has led the most talented and successful small business lending team in the country through a variety of economic cycles and regulatory changes," commented Tom Hallman, CIT's Vice Chairman, Specialty Finance. "We greatly appreciate John's contributions over the past 11 years, and we wish him happiness in his well-earned retirement." Mr. Canning will continue to represent CIT as the company's delegate on the Board of Directors of the National Association of Government Guaranteed Lenders (NAGGL). Succeeding Mr. Canning will be Christine Reilly, effective May 1. Since joining CIT in 1994, Ms. Reilly has served in various leadership roles, most recently as Executive Vice President, Corporate Development. "Chris will inherit one of our strongest businesses. Given her talents and accomplishments at CIT, I look forward to having her lead CIT Small Business Lending to the next level," Mr. Hallman remarked. Ms. Reilly is a Certified Public Accountant and holds an MBA from New York University's Stern School of Business. She will continue to be based in Livingston, NJ. About CIT Small Business Lending CIT Small Business Lending offers Small Business Administration (SBA) loans to finance business acquisitions, owner-occupied real estate purchases, franchises, and medical and professional practice start-ups, through a network of field representatives. The nation's #1 SBA lender for six years, CIT Small Business Lending has been designated a "Preferred Lender" by the SBA and can provide quick credit decisions and loan closings. The company's website and online SBA loan application are located at: http://www.smallbizlending.com. About CIT CIT Group Inc. (NYSE: CIT), a leading commercial and consumer finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has over $60 billion in assets under management and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries worldwide. CIT, a Fortune 500 company and a component of the S&P 500 Index, holds leading positions in vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset-based lending. With its Global Headquarters in New York City, CIT has approximately 6,000 employees in locations throughout North America, Europe, Latin and South America, and the Pacific Rim. For more information, visit http://www.cit.com . ### Press Release ###########################

News Briefs----

Buyout, Sell-Off May Turn GM's Fortunes Existing home sales post unexpected gain in February Build-A-Bear will journey into India with new franchise Microsoft announces management changes in Windows group Microsoft Memo: A marketplace-driven sport makes strides in the US ---------------------------------------------------------------

You May have Missed--- The Container That Changed the World http://www.nytimes.com/2006/03/23/business/23scene.html?_r= ---------------------------------------------------------------

Sports Briefs---- UCLA stuns Gonzaga “What a game!” No. 1 Duke Is Done Panthers land Keyshawn in $14M deal Ex-Cowboy star Allen heading to 49ers Raiders add cornerback Starks Cowboys sign Vanderjagt, NFL's most accurate kicker ----------------------------------------------------------------

California News Briefs--- Money rapidly flows into Gov. Schwarzenegger TV ads http://www.sacbee.com/content/politics/ca/election/story/14233859p-15055600c.html ----------------------------------------------------------------

“Gimme that Wine” Oakville's Screaming Eagle Winery sold Gold Country's rockin' Rhones Decanting Robert Parker by Eric Asimov A Match Made in Australia by Eric Asimov If you want to know if you got a value for your wine, or what the wine price is today, go to www.winezap.com Type in the vintage (year) and name of the producer with wine type or geographic area, such as 1995 Chateau Lynch Bages Pauillac. Even 1995 Lynch Bages will work, or 1999 Viader ----------------------------------------------------------------

Calendar Events This Day Chocolate Covered Raisins Day Saint Gabriel: Feast Day Saint Gabriel the Archangel, patron saint of postal, telephone and telegraph workers. Schmeckfest Freeman, SD. Sausage and sauerkraut, kitchen and pluma moos. These are just a few of the dishes served at the German “festival of tasting” where visitors can also watch cooking and craft demonstrations and an evening musical. ----------------------------------------------------------------

Today's Top Event in History 1837-Canada legally recognizes Black suffrage, thus begins one of the Underground Railroads final destination toward freedom. http://www.duke.edu/~mahealey/black_canada.htm ----------------------------------------------------------------

This Day in American History 1664 - Roger Williams was granted a charter to colonize Rhode Island. NCAA Basketball Champions This Date 1956 San Francisco -------------------------------------------------------------- * Baseball Canto Lawrence Ferlinghetti Watching baseball, sitting in the sun, eating popcorn, |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|