Wednesday, October 25, 2006

Headlines--- Classified Ads---Senior Management This issue: This Friday: Bob Teichman, CLP, on “ Dancing with ELFa.” ######## surrounding the article denotes it is a “press release”

------------------------------------------------------------------------------- Classified Ads---Senior Management

Va Piano Vineyards, Walla Walla, Washington *

These job-wanted ads are free. We also recommend to both those seeking a position and those searching for a new hire to also go to other e-mail posting sites: In addition, those seeking employment should go to the human resource departments on company web sites for funders, captive lessors, and perhaps “broker-lessors.” To place a free “job wanted” ad here, please go to: Atlanta, GA Atlanta, GA Baltimore, MD Chicago, IL Denver, CO Hope, NJ Irvine, CA Jacksonville, FL Lawton, OK. Long Island, NY New York, NY, NJ, Ct Tri-State Orange County, CA Philadelphia, PA Portfolio Management Consultant ; Salt Lake City, UT San Francisco, CA Sausalito, CA Syracuse, NY Tampa, FL Wilmington, DE For a full listing of all “job wanted” ads, please go to: *http://www.vapianovineyards.com [headlines]

Convention Report: Cracks in Small Ticket Portfolio Quality? 1. Larkins: "The Precipice of Change" ELTnews (From the Equipment Leasing and Finance Association, formerly Equipment Leasing Association, conference in Palm Desert, California. While not signed, probably written by Matt Philbin, Director-Editorial Services. Monday's Small Ticket Business Council Meeting used technology to get at some of the core issues facing small ticket lesssors. Sponsored by De Lage Landen, the packed session featured a panel of experts prepared to lead discussions on a variety of issues, but those issues were chosen by attendees. Selecting from a list of topics, attendees decided which were of the most concern to them, answering via hand-held keypads. The results were tabulated in realtime and displayed on the screen at the front of the room. The technology allowed the moderators to ask questions of the audience and receive the answers within seconds. For example: 2. Portfolio Quality— 46% of attendees said portfolio quality is showing signs of weakness, compared to 37% who said they're seeing no change, and 18% who said it is improving. Asked to elaborate, one attendee admitted the signs of weakness are "nothing earth-shattering, but we just can't maintain the stellar performance of the last few years." Another agreed that quality is "just too good." Transportation lessors said that high fuel costs have impacted their portfolios. Panelist Tom Ware of Paynet said his company's data shows delinquencies up from their level a year ago. Asked which small ticket segment is most likely to have trouble in 2007, the top three selected by attendees were retail (34%), office imaging (20%), and manufacturing (20%). Attendees' prognosis for retail was driven by an acknowledgement of the slowdown in consumer spending. However, when asked if they were increasing their provisioning, attendees from this market mainly said no, although a couple said their companies use dynamic provisioning. In his Monday address to attendees at the ELFA Annual Convention in Palm Desert, California, Chairman Paul A. Larkins said that, "Our Industry is on the precipice of change." Certainly, he said, it's been a good time for equipment leasing and finance. Companies are growing and portfolios are healthy, according to ELFA's 2006 Survey of Industry Activity. "Overall we have healthy numbers," Larkins said, "but there is a red arrow in there...our pretax spreads." It's a complaint you'll hear over and over at the Convention--margins are thin and getting thinner. Said one attendee, "We're doing more business than we did four or five years ago, and we're making less money." "At the current rate of margin erosion," Larkins joked, "I figure that by 2020, we'll be paying our clients to do business with us." Even some of the healthier aspects of lessors' business may be harming margins. "Charge offs are very low right now. But is it sustainable? Or desireable? A riskless horizon can convince us that pricing doesn't matter." Lessors are standing at another precipice: regulation. "Regulation touches our business at some point," he said, Some people don't believe the Basel II Accords are coming here, and think they're just a European problem. But they are coming, and they'll affect more than just banks." Lease accounting also will change, he said, noting that FASB and IABC have finally put FAS 13 on their agenda. Finally, Larkins addressed the "human capital" issue. Equipment leasing and finance, he said, is a "graying industry." There is a lack of young talent coming in. "We are trading gray in this industry," he said, "trading bodies back and forth between the companies in this room." In Tuesday morning's general session , ELFA President Kenneth E. Bentsen, Jr. delivered his first report to the membership. Since joining the association in April, he said, he's been on a "listening tour," making 15 trips to meet with more than three dozen member companies to learn about their businesses and their relationship with the association. Simultaneously, ELFA "undertook a very high level qualitative survey of our membership to try and really understand what members of all shapes and sizes were thinking as it relates to the market place, their role in it, and the association, and its necessary role and function." 3. The key conclusions: --Our membership is engaged in a dynamic sector of finance, which is highly efficient and critical to the financial, and manufacturing supply chain. --This sector is more broad and wide than it was even just a few years ago, and may well be larger than we think. --This sector is not well understood by the outside world including even customers, and too often subject to scrutiny without sufficient allies. --The association needs to be flexible, fluid and focused on external constituencies. --The relationship and functions of the association need to be more closely aligned with member companies and the direction they are headed. A further meeting with association staff produced a new core mission: "We are a forum for industry development; a platform to advocate on behalf of the industry; and the principal source of industry information." Based on this and other information, the Executive Committee adopted a new strategic plan. "If the plan is predicated on one theme that theme is change," Bentsen said. Accordingly, the plan stresses: --Establishing the industry's identity and worth. "If we do anything," Bentsen said, "we must establish our brand to the outside world. It is the sine qua non of our strategy." ELFA will therefore take a number of steps "to enhance our efforts to better define ourselves on Capitol Hill, in the states, among regulators, the media, and the public," he said. --Further improving, broadening and disseminating ELFA's research. "We have good research," Bentsen said, but "we need to make sure it truly captures our economic footprint, which is why we are undertaking efforts to better define the equipment finance marketplace and its true size and breadth." --Re-establishing communications as a key function in the association. This includes selling the industry's brand to Wall Street analysts and the media. --Changing ELFA's business and professional development function "to achieve our goal of timely and relevant programming," Bentsen said. Business development and professional development will be separated and each will have task forces to review its programming to make sure it is meeting the members' needs. --Enhancing member relationships and improving internal communications to broaden ELFA's reach and relevance. "In addition we seek to enhance member involvement in association direction. Going forward I think it is important that our leadership is more directly involved in day to day affairs, in the office, and as our emissaries. We work for you, and we need to have your involvement and direction," Bentsen said. --Positioning ELFA as the "standard bearer of the highest business and professional standards." To that end the Code of Fair Business Practices was updated, and the Principles of Fair Business Practices introduced.

[headlines] Another Alignment at Key, this time: Larkin

Larkins to Head New Key National Finance Group October 9th , KeyCorp announced several alignments: Adam Warner became president and COO of Key Equipment Finance's commercial leasing services business, Karen Larson to remain the president and COO of Key Equipment Finance's global vendor services unit, Steve Dixon to oversee the company's syndication and leveraged leasing services and then on October 18th, J. Georgelas senior vice president and director of Capital Markets within Key Equipment Finance. Yesterday KeyCorp announced that Paul A. Larkins, president and chief executive officer of Key Equipment Finance, has been selected to lead the company's new Key National Finance group.

Key National Finance is comprised of Key's businesses with a national, and in the case of equipment finance global, scope which includes Key Equipment Finance, Key Education Resources, Key Business Services and Key Recreation Lending and Auto Finance. "By bringing these businesses together, we will be able to more effectively deliver products and services that meet our consumer and commercial clients' needs," said Thomas W. Bunn, vice chair, KeyCorp National Banking. "Paul Larkins was the natural choice to head this group. He has a proven track record of growing national businesses, while delivering impressive results year after year." It also may be that the bank is position Key National Finance in a a position to sell or have investors spin into a new entity. Only history will tell us the motivation, as today all are denying this is one of the intentions. Here is the official realignment: Key National Finance's executive team will be comprised of Steve Dixon, managing director for Key Equipment Finance's lease advisory and distribution services; Karen Larson, president of Key Equipment Finance's global leasing services; Adam Warner, president of Key Equipment Finance's commercial leasing services; Grant Skeens, president of Key Recreation Lending and Auto Finance; Richard Vonk, president of Key Education Resources; and Robert McCambridge, president of Key Business Services. "I am excited about the opportunity to bring together four extremely successful, top-performing businesses within Key, and I'm confident that the synergies we'll see from this alignment will benefit each business, as well as our clients," said Larkins. "I am impressed by the expertise and success of each member of the leadership team. This truly is an all-star executive team and I am looking forward to working with all of them." Combined, Key National Finance represents four business units with more than $28 billion in managed assets and nearly 1,400 employees. Keycorp stock has been up and down and thus joins the Leasing News list of stock to watch: http://www.leasingnews.org/#friday

[headlines]

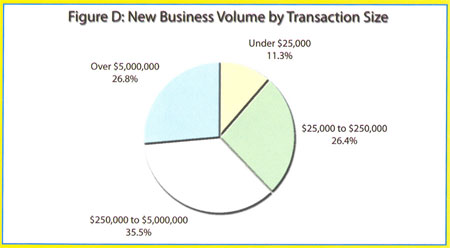

[headlines] Annual State of the Industry Report not clear by Christopher Menkin The annual State of the Industry (SOI) taken by the new Equipment Leasing and Finance Association appears lop-sided in favor of the very large leasing companies and thus appears off center. It does not follow the associations own MLI Index, taken from now 25 members. This report allegedly was from the responses of 126 member companies, and managed by PricewaterhouseCoopers, LLP. Let's look at the employment figures, which indicate a discrepancy, and certainly do not reflect the total number of employed in the industry as compared to Leasing News lists (albeit not complete, but with the information to date, there is a lot more than 19,000 employed in this industry world wide (this report has world wide information from members.) “The total number of full-time equivalent employees (FTEs) is 19,818, a decline of 7.3% from last year's employee total of 21,390. Middle market lessors contracted their workforce by 22.1%, whereas small ticket lessors slightly increased their workforce by 1.9%” Perhaps this information is misleading when viewing where the statistics are coming from. This appears evident from the “New Business Volume by Category:”

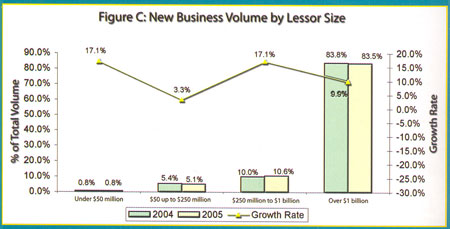

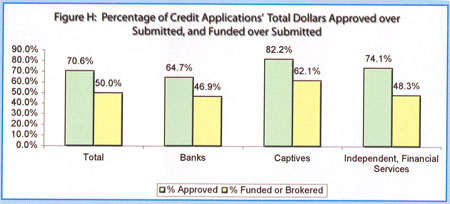

These two graphs taken from the report speak loudly to the issue that basically it is the “few” from the report who are doing the “most” in dollar amounts, which influences the results of the report.

“Large ticket lessors manage $14.7 million per FTE (full-time equivalent employers) while micro ticket only handles $.07 million. Moderate sized lessors with between $250 million and $1 billion in new business volume improved productivity to$12.9 million, outperforming lessors with over $1 billion in new business volume who manage just $8.6 million.” “Total numbers of small ticket applications submitted was 623,851 and total dollars submitted was $21.3 billion. On average, 61.2% of those dollars were approved and 43.8% of them were funded or brokered.”

“Income before taxes as a percentage of revenues was 27.5%, an average of all respondent's pre-tax income weighted by their total dollar new business volume.” “The average charge-off is 1% of the average net lease receivables balance, a healthy decrease from last year's 1.5%. Charge-offs are at their lowest levels since 2001.” The State of the Industry Report, published by the Equipment Leasing & Finance Foundation will debut at ELA's Annual Convention. Foundation donors will receive a pre-release copy; all others may purchase the study for $200, after its release, through the Foundation library at [headlines] Classified Ads---Help Wanted Operations Manager

Sales

[headlines]

[headlines] Nigerian eMail Conference For years Leasing News was passing on the “Nigerian type” leasing e-mails and stories of those in the industry who have fallen for it. If you ever wonder about why you get so many, even today:

Previous stories: http://www.leasingnews.org/Conscious-Top%20Stories/Nigeria_lawFirm.htm [headlines] The Leasing Sourcebook A reader asked where they could obtain a current book on all leasing companies in the United States, remembering there was a publication called "The Leasing Sourcebook," published by BIBLIO.TECH. Barbara Low started this publication in 1983. The last edition was 2001. She has since retired. She was a regular reader of Leasing News, until this year, when she said most of her time now was spent with her grand kids. The Equipment Leasing Association published a "Who's Who in Equipment Leasing." The last edition appears to have been in 1997 (we have a library of association magazines, many from D. Paul Nibarger, CLP collection.) The various associations also have lists, but they are usually their members or from advertisers who pay to be listed. Leasing News has various lists, but the best source today for the United States and other countries is "The World Yearbook." http://leasingnews.org/Ads/Current Ads/WLY.htm

[headlines] Leasing Association Events-Meetings Open to All

October 31,2006 The National Funding Association-Charlotte will host a networking luncheon at The Palm on October 31, 2006; doors open at 11:30 am. Our speaker will be John Silvia, Chief Economist, Wachovia Corp. Details and Registration Form will be posted on the Calendar Page. National Funding Association, Inc. ------------------------------------------------------------------

Renaissance Concourse Hotel This year's meeting boasts 40 exhibitors that you can meet with face to face in addition to the networking opportunities and education being offered!For those members who have not yet redeemed their $50 Member Benefit Voucher, this would be a great time to redeem it with your registration before it expires on December 31, 2006. If you haven't registered yet – Send It In Today! Don't miss out on your chance to meet with all of these exhibitors! 2006 Eastern Regional ExhibitorsACC Capital Corporation

And...NEW MEMBERS who join the NAELB and attend the regional, get the rest of this year's membership free plus a $50 credit towards their 2007 dues. REGISTRATION FEES

ROUND TABLE DISCUSSION TOPICS Round Table Discussions have been added to this year’s agenda in lieu of educational sessions. Below is a list of possible topics for these round tables. Please select 10 discussion topics you would like to have on the agenda for the Western Regional. The top selections will be discussed at the meeting.

Registration form, click here: | ---------------------------------------------------------------

November 8, 2006 Join Us For Meet Your Funders: Each Funder Will Have The Floor For

WHEN: Wednesday November 8, 2006 Includes: Meeting, 3 games, Shoe Rental, Pizza, To RSVP your spot and for additional information, click here. ---------------------------------------------------------------

UAEL Nort Atlantic Regional Event

A GREAT Opportunity to Network with Industry Peers - Join us for lunch! REGISTER NOW: This is a no host lunch Register Online at the UAEL website Please contact Gina Iacono, Westover Financial, Inc. To opt out of UAEL promotional emails please reply back to this email address info@uael.org UAEL ---------------------------------------------------------------

UAEL North Central Regional Event

Chicago Christmas Party Thursday, December 7, 2006 Maggiano's Maggiano's Chicago is a well know Italian Eatery located in Beautiful Downtown Chicago. Come and Join us "Mingle and Jingle" in this years holiday season. There will be a 50/50 raffle to benefit The United States Marine Corp, "Toys For Tots" in honor of all our brave men and women that have and are serving in our armed forces. Ticket will be sold for $1.00 each. This year we will also have "Door Prizes." Each attendee will receive (1) ticket/chance to win upon their arrival compliments of UAEL and our sponsors. This was well received in previous years and all we can say is, "Good Luck!!!!!" Cost to Attend Menu I would like to take this opportunity to extend a Happy Holiday and a great big "Thank You" to all our sponsors on behalf of the "United Association of Equipment Leasing" for all your support over the years. Without your continued support, events such as this would not be possible. I look forward to seeing you all soon at the "4th Annual Midwest Holiday Party" to "Mingle and Jingle... Happy Holidays, Bill Griffith List on Sponsors: Swanson, Martin & Bell, LLP - Joseph P. Kincaid, Esq. [headlines] Dresdner Kleinwort and Equilease Close $100 Million ABCP Facility

(Leasing News is attempting to follow-up with Mr. Silverhardt, president, on the significance of this announcement as it brings Equilease in the positionof being a major player again.editor) Equilease Financial Services, Inc. (“Equilease”) announced that a Dresdner Kleinwort sponsored ABCP conduit has committed $100 million of funding to Equilease. This transaction is earmarked for Equilease's small-ticket financing programs and complements the company's middle-ticket and portfolio acquisition business segments. Gary Silverhardt, President of Equilease, stated, “This new facility makes us more competitive in the small-ticket marketplace on a national basis, and gives us the opportunity to offer greater flexibility to our vendor and dealer partners throughout the country.” Equilease, founded in 1957 ( www.eqfsdirect.com ) and headquartered in Norwalk, Connecticut, provides small- and middle-ticket equipment lease and finance solutions to businesses nationwide, indirectly through equipment vendors/dealers and other specialty finance companies, and directly to end users. The company finances business-essential income producing equipment. Equilease currently serves customers in the construction, transportation, machine tool, printing and other capital intensive industries. [headlines] Fitch: Interest Rates, Economy Cloud U.S. Equipment Lease ABS Outlook

(Follows Monday's report from USA Today poll: http://www.leasingnews.org/archives/October%202006/10-23-06.htm#usa ) Fitch Ratings-Chicago- A slowing U.S. economy and rising interest rates are likely to temper an otherwise favorable outlook for the U.S. equipment lease ABS sector going into 2007, according to Fitch Ratings in the latest edition of its 'ABS Equipment Expo'. Positive business investment trends have buoyed both small/mid-ticket equipment ABS, and securitizations involving construction (CE), agricultural (AG) and truck and transportation (TR) equipment. Additionally, Senior Director Joe Tuczak says that delinquency rates on equipment lease ABS continued their steady decline even in the face of a dramatic increase in gas prices, which could have had an particularly adverse effect on truck/transportation equipment-backed securitizations. 'Agricultural equipment demand benefited from robust crop yields, while a booming economy was an asset to construction equipment,' said Tuczak. 'Collateral and ratings performance has also remained steady due to solid/reliable underwriting and servicing of portfolios.' Nonetheless, Fitch's optimism for continued stable performance for equipment lease ABS remains cautious as the economy shows signs of slowing down, housing markets are beginning to show some strain, and questions remain on how far interest rates will rise. In order to develop a performance benchmark for issuance in the two major segments of equipment lease ABS, Fitch has enhanced its original Index (originally launched in April 2002) by separately tracking small/mid ticket equipment ABS delinquency performance, as well as AG/CE/TR equipment ABS delinquency performance in their own separate indices. Fitch's coverage of the space now includes the delinquency performance of another 42 transactions representing an additional $24 billion of issuance between both of these two new indices. 'The ABS Equipment Expo - October 2006' is available on the Fitch Ratings web site at 'www.fitchratings.com'. Contact: Joseph S. Tuczak +1-312-368-2083, Ravi Gupta +1-312-368-2058, Chicago or John H. Bella, Jr. +1-212-908-0243, New York. Media Relations: Sandro Scenga, New York, Tel: +1 212-908-0278. ### Press Release ############################ NEW STUDY RELEASED ON U.S. INFORMATION TECHNOLOGY EQUIPMENT ACQUISITION AND FINANCING TRENDS Research by Equipment Leasing and Financing Association of America and The Alta Group shows market growing, but challenges lie ahead. Palm Desert, Calif., Oct. 24, 2006 – How do U.S. businesses and other organizations acquire critical information technology (IT) equipment? What drives their decision-making processes? These questions and others are answered in a new, comprehensive study commissioned by the Equipment Leasing and Financing Association of America (ELFA) and produced by The Alta Group, the leading industry consultancy. The study is being released today at the 45th Annual ELA Convention in Palm Desert, Calif. According to the report, IT equipment financing has grown to $40 billion per year. This is a 67 percent increase from just three years ago, when compared to findings in a similar 2003 IT equipment-financing study commissioned by the ELFA. What's more, IT equipment financing as a percent of total U.S. equipment financing activity nearly doubled from approximately 12 percent in 2002 to 22 percent last year, according to the new ELFA-Alta Group study. A variety of trends affecting IT equipment leasing and finance are explored in the study. As part of the research, Alta completed interviews of senior-level executives at bank, independent and captive equipment leasing organizations this summer. “While we're encouraged by the growth in IT equipment financing, this study sheds light on a number of developments that are reshaping our industry,” said John C. Deane, managing principal, The Alta Group. “Customer needs are changing and equipment vendors and their financing partners must adapt accordingly to assure their success. They need to anticipate their next moves now to stay ahead of the game.” Based on the interviews, modest growth in IT financing is expected over the next three years. Insights from the executives interviewed indicate lessors should evaluate their competitive positions now to capitalize on trends identified in the study, which include: · CFOs are paying more attention to IT equipment acquisitions. So much money is spent on IT equipment, many organizations now consider IT spending an integral part of the capital budgeting process. · Technology changes are actually leading to longer lease terms. PC performance continues to evolve and lease terms have actually increased. Leases for advanced servers are lengthening, as well. · Customers are demanding total-solution financing. The bundling of hardware, software and services is now the norm, rather than the exception, in the business. · Captive leasing organizations are flexing their muscles. Captive leasing companies are growing their asset bases by significantly expanding and enhancing their sales organizations and employing other aggressive strategies. · Independent leasing companies are being squeezed like never before. Between the aggressive pricing of captives and banks' low cost of funds, the survival of independent lessors is at a crossroads. · More new business is coming from the reseller channel. Lease finance companies will be relying more on the channel and less on direct sales over the next several years for a variety of reasons. · It's harder than ever to establish and recover residual values. Distinguishing the differences between IT products is harder than ever, prompting the rapid commoditization of equipment – and making it increasingly difficult for equipment leasing companies to establish and recover residual values. “ELFA members are financing an evolving world and the ELFA-Alta study will help our membership identify niches and other aspects of the IT industry that are rapidly changing,” said Kenneth E. Bentsen, Jr., ELFA President and COO. “The association is committed to bringing research and intelligence that helps its members' business development needs. This study helps equipment financiers serve their customers better.” The Information Technology Equipment Leasing and Financing Study can be ordered online at www.elaonline.com. About The Alta Group: The Alta Group is a global consultancy serving equipment leasing and finance companies, investment professionals, manufacturers, banks and government organizations. Founded in 1992, The Alta Group supports clients in North America; Latin America; Western, Central and Eastern Europe; Australia and China. For more information, please visit www.thealtagroup.com. About the ELFA: Organized in 1961, the Equipment Leasing and Financing Association (ELFA) is the premier non-profit association representing companies involved in the dynamic equipment leasing and finance industry to the business community, government and media. As the voice of the collateralized finance industry, ELFA promotes the forecasted $220 billion industry as a major source of funds for capital investment in the United States and abroad. For more information on ELFA, please visit www.ELAOnline.com. #### Press Release ########################### Sterling Financial Third Quarter Good News

Sterling's net income for the third quarter ended September 30, 2006, was $5.6 million or $0.19 per diluted share, compared to $10.1 million or $0.34 per diluted share for the same period last year. Included in Sterling's third quarter 2006 net income was a non-cash impairment charge totaling $5.2 million ($8.0 million pre-tax) or $0.18 per diluted share. The impairment charge was related to Sterling's affiliate, Corporate Healthcare Strategies, LLC's (CHS), goodwill and intangible assets and reflects management's current estimate of the expected impairment (see non-interest expense section for a more detailed explanation). Historically, this affiliate has not been a material contributor to Sterling's earnings or earnings per share. Excluding this charge, Sterling's third quarter 2006 net income would have been $10.8 million, an increase of 6.8 percent from the same period last year, while diluted earnings per share would have been $0.37, an increase of 8.8 percent from the same quarter in the prior year. Full press release at: ------------------------------------------------------------------------------- IMAP appoints new President at Mannheim meeting

Karl Fesenmeyer has been appointed as the new President of IMAP, the exclusive global organisation of independent merger and acquisition advisory firms in 33 countries. He was appointed during last week's bi-annual IMAP conference in Mannheim. Mr Fesenmeyer is also President of M&A Consultants AG, a member of IMAP in Germany. During the meeting, it was announced that IMAP had completed 180 deals with a total value of US$ 5.7 billion for the nine months to the end of September. An awards ceremony was also held during the closing dinner at Heidelberg Castle where it was announced that in the last 12 months, IMAP members completed deals with a record value of US$ 6.5 billion. This was the largest meeting ever held by IMAP, not only in terms of the number of IMAP members, but also the number of external speakers from leading companies looking to communicate their acquisition strategies to IMAP members. The conference attracted 150 M&A professionals from Asia, Australia, Europe and North and South America. They heard presentations from major groups such as Ranbaxy, a major Indian based pharmaceutical group, and Netherlands based Scheuten Group, about their acquisition strategies. IMAP member and Leasing News Advisory Board member Bruce Kropschot, Financial Services, Inc. of Vero Beach, FL, was in attendance at the meeting. “Through my membership with IMAP I am able to bring quality global connections to my clients,” said Bruce Kropschot. “IMAP brings together the power of strong local boutiques from around the world, which is becoming ever more important to our clients.” Discussions were also held with IMAP members and their clients in relation to the outlook for India and China. With the Indian economy growing at over eight per cent per annum, the conference heard that conditions were ripe for continuing growth in the M&A market. IMAP members are currently working on over 20 transactions with Indian companies. Also during the meeting, Mark Esbeck of Business Capital Corporation in the USA was appointed Chairman. Other additions to the IMAP board included Andy Moore of Clearwater Corporate Finance in the UK, Dimitri Abudi of IGC Partners in Brazil and Gordon Gregory of Mosaic Capital in Los Angeles. Karl Fesenmeyer commented: “IMAP is going from strength to strength and I am looking forward to developing it further from an already well established base. With over 300 M&A professionals across four continents, we can offer a truly global service to our clients. He added: "My key priority as the new President of IMAP is to promote the IMAP brand name on a global basis. IMAP's Member Firms are well established in their local markets with excellent brands. But the time has come to spread the word about IMAP and its members, to ensure that it becomes well recognised as a leading player in cross-border M&A”. #### Press Release #############################

News Briefs---- Paccar stays in the fast lane, but slowdown around bend Fitch: Newspapers, TV Network Affiliates most threatened by Online Advertising Home sales, prices drop in September Lack of liquor license dries up sales at restaurants Local group may bid for Boston Globe Newspaper J.P. Morgan Chase: Building The Global Bank Wilson's Bakery bows out---an icon in Silicon Valley -------------------------------------------------------------------------------

You May have Missed--- When Jobs Are Bountiful and Pay Isn't

Sports Briefs---- Snap decision can't save Cowboys in 36-22 loss Cowboys are prepared to hand over the huddle to Romo

“Gimme that Wine” Oregon Vineyards enjoy year to toast Copia cuts back, shifts focus to wine education Construction starts today on Amapola Creek winery/Arrowhead Wine Prices by vintage US/International Wine Events Winery Atlas Leasing News Wine & Spirits Page The London International Vintners Exchange (Liv-ex) is an electronic exchange for fine wine. --------------------------------------------------------------------

Cartoonists against Crime Day Kazakhstan: Independence Day Saint Crispins Day A passage in Shakespeare's Henry V notes this. By the way, one of the earliest hoaxes being sent around on the internet was : The 'middle finger salute' is derived from the defiant gestures of English archers whose fingers had been severed by the French at the Battle of Agincourt because the archers stuck it up and yelled, “Pluck You.” It was false: The Shakespeare Poem is printed again here, but the synopsis again is the turn of the battle was due to the French getting cut in deep mud. Say "Hey" Day Sourest Day Taiwan: Retrocession Day ------------------------------------------------------------------------------

Strawberries contain more Vitamin C then oranges

-----------------------------------------------------------------------------

Today's Top Event in History 1864-Confederate President Jefferson Davis meets with General John Bell Hood at Hood's Palmetto, Georgia, headquarters to discuss the recent misfortunes of the Army of Tennessee. Since Hood had assumed command of the army in July, he had launched an unsuccessful series of attacks on Union General William T. Sherman's forces, endured a month-long siege in Atlanta, and was finally forced to abandon the city. Now, Davis journeyed to Georgia to shore up the sagging morale of his leader and troops. The most pressing problem was dissent within the Confederate command. Leading generals began feuding and pointing fingers to assign blame for the disastrous Atlanta campaign. Hood blamed General William Hardee, commander of one of Hood's three corps, for the loss of Atlanta, and Hardee demanded removal from Hood's authority. After conferring with Hood, Davis reassigned Hardee to the Department of South Carolina, Georgia, and Florida. Even though Hardee was the most able corps commander, Davis personally selected Hood to command the Army of Tennessee in July, and refused to admit his mistake. Unfortunately for the Confederates, Hood invaded Tennessee in the late fall, and by Christmas he saw his once-grand army virtually destroyed. On his return trip to Richmond, Davis gave a speech at Columbia, South Carolina, in which he gushed about Hood's prospects. In doing so, he let slip important information, saying that Hood's eye was set "upon a point far beyond that where he was assailed by the enemy." Sherman read the quote in a newspaper a few days later and guessed, correctly, that Hood intended to move back into Tennessee to cut Sherman's supply lines. Sherman planned his fall strategy accordingly, sending part of his army to deal with Hood while he took the rest across Georgia. -----------------------------------------------------------------

This Day in American History 1741-Georg Wilhelm Steller discovers the Kiska Island in the Aleutian Island chain of present day Alaska. http://memory.loc.gov/ammem/today/oct25.html ---------------------------------------------------------

Baseball Poem God Protects Fools with Curveballs by Tim Peeler Going after her Touching All Bases Tim Peeler ---------------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm -------------------------------------------------- |

|||||||||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

|||||||||||||||||||||||||||||

Editorials (click here) |

|||||||||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|