Tuesday, September 19, 2006

Headlines--- Classified Ads---Asset Management Linda Kester — tomorrow : “Broker Compensation” ######## surrounding the article denotes it is a “press release”

------------------------------------------------------------------ Classified Ads---Asset Management

Leonetti Cellar, Walla Walla, Washington * (Only second to Duckhorn is their merlot. Their “reserve” meritage is number one in my book, always outstanding and very well priced at $100 for the quality. It took me five years of waiting time to get on their wine list. The winery is not open to the public. If you see this wine for sale anywhere, buy it!!!)

Austin, TX Bloomfield Township, MI Boston, MA Chicago, IL Chicago, IL Princeton, NJ Sausalito, CA Sonoma, CA Wilton, CT For a full listing of all “job wanted” ads, please go to: To place a free “job wanted” ad, please go to: * http://www.leonetticellar.com ---------------------------------------------------------------- Jerry Hudspeth resigns from PFSC?

Leasing News has been trying to confirm or deny the many e-mails regarding the resignation of Jerry T.Hudspeth, President and CEO of Portfolio Financial Servicing Company, Portland, Oregon. According to a very reliable source, the acquirer was Varilease and/or its owner Bob VanHellemont. Varilease was also one of the UniCapital companies. It was also reported that PFSC does the servicing for Varilease. There were also rumors about the need for infusion of capital. In addition to the e-mails, Leasing News received the following, allegedly from Mr. Hudspeth: “Dear--- "Please be advised that Portfolio Financial Servicing Company (PFSC) has experienced a change in majority ownership. This new ownership consists of an investment group of high net worth individuals. “Although offered a substantial piece of the PFSC equity, I philosophically disagree with the new ownership structure and direction and have submitted my resignation to the Board of Directors. “I apologize for any problems or issues this change creates and will be available to assist you in any way required." Thank you Best regards, Jerry President & CEO Hudspeth was the president when PFSC was acquired in May 1998 by UniCapital. It became one of the UniCapital companies. It was at that time owned by private equity investors. When UniCapital went into bankruptcy, Bank of America acquired PFSC it is reported because they needed the servicing capability for the 9 figure UniCapital portfolio for which they were the secured creditor. The company, like many of the UniCapital companies, went back into business under their own name. Their web site states: “Portfolio Financial Servicing Company (PFSC) was established in 1992 to manage and service a $160 million securitized equipment and vehicle portfolio beneficially owned by Parrish Equipment Partners. Parrish Equipment Partners ownership consisted of The Travelers Company, The Hillman Company and Parrish Investments. In 1998, PFSC was acquired by UniCapital Corporation and was the catalyst for the UniCapital IPO in May 1998. From 1998 through 2000, PFSC functioned as the operations and information technology group for UniCapital. In December 2000, PFSC became a separate legal entity by purchasing the assets of the UniCapital Operations Group. “Today PFSC is the largest independent portfolio management and servicing company with over $10 billion in assets under management and industry certification as a Master Servicer, Successor Servicer and Backup Servicer.” www/pfsc.com According to the Leasing News list of Back Offices, the company has 150 employees. It also told Leasing News they were serving $14 billion in assets at the time of the listing. Biography from the web site: “Jerry T. Hudspeth - President and Chief Executive Officer Over the last twenty four years Mr. Hudspeth has served as President and CEO for a number of public and private corporations. Mr. Hudspeth has served as President and Chief Executive Officer of Portfolio Financial Servicing Company (PFSC) since 1994 and is the creator of the portfolio management and servicing model currently in use at PFSC. “Mr. Hudspeth has worked closely with the rating agencies, monoline insurers, major lenders and trust groups to establish portfolio management and serving standards, and to evolve requirements and standards for information and data security for portfolio securitizations and lending conduits. “Mr. Hudspeth has published a number of articles on lease and loan servicing, securitization and portfolio management and has been a featured speaker and presenter at over 40 financial services meetings and conferences. “Mr. Hudspeth has degrees in Business, Marketing and Engineering and has been a guest speaker on management at institutions such as MIT, Caltech, Claremont Graduate School and Harvard Business School. “Mr. Hudspeth has served on the Board of Directors of a number of public and private corporations and not for profit organizations and universities.”

---------------------------------------------------------------- Back Office Companies

(a) Barrett offers proactive lease management/administration of commercial/consumer vehicles and lease/finance portfolios, covering insurance, titles, registrations, sales/property taxes, tickets, collections, repossessions, vehicle transportation and dispositions. Since 1975. (b) Group 88 is a business partner of McCue Systems Inc, maker of LeasePak. With over 20 years supporting major firms in the leasing industry, Group 88 provides data conversions, system implementations, custom software development and outsourced system support. (c) JDR Solutions, LLC., based in Indianapolis, Indiana provides back office lease/loan administration services and hosting of related accounting and portfolio management software. Under a preferred partnership arrangement with International Decision Systems (IDS), JDR Solutions offers its "Managed Service" solutions utilizing the robust capabilities od Infolease and related software applications. JDR will soon offer IDS's next generation software, Profinia, in a hosted environment. For more information about JDR Solutions, visit www.jdrsol.com or call: Paul Henkel, Director of Marketing (d) We also offer specialized programs for banks which want to start their own leasing operations and for vendors who want to find financing or act as lessor for their customers. We also act as a broker for end users looking for commercial equipment financing. Sincerely, (e) ECS Financial Services, Inc. is one of only a few CPA firms in the United States that specializes in providing portfolio management, accounting, tax and management advisory services to the equipment leasing industry. ECS Financial provides lease management services including accounts receivable billing and collections, preparation of monthly lease income and residual schedules, book and tax depreciation tracking, as well as guidance and a variety of useful management reports to assist management in making sound financial decisions. ECS Financial offers accounting and financial statement compilation, review and audit services, as well as multiple state sales tax preparation, federal and state income tax return preparation, and personal property tax preparation and tracking. Our lease management team of accountants and tax specialists are experienced in providing quality professional service in the management of lease portfolios, and their efforts are enhanced by the state of the art, industry-specific software we utilize. ECS Financial serves clients throughout the United States . The name has changed, but the quality service remains the same! (f) PFSC is the largest independent commercial lease and loan-servicing company is the U.S. and is headquartered in Portland , Oregon . PFSC provides primary/master servicing, backup/successor servicing, and consulting for lease and loan portfolios. It currently manages over $14.0 billion in assets. More information can be found at www.pfsc.com. (g) Advanced Property Tax Compliance provides "best in class" personal property tax compliance services at cost effective fees. Our staff has over 60 years of experiance working with leased assets. We do complete compliance process and can tailor our service to each Lessor's unique needs, including invicing. The billing files we create interface with all lease management and accounting software. We offer our clients full disclosure, more accessibility to information, and greater on-line functionality than any other service firm in the industry. Each client has a secure FTP site where they have access to everything we do for them in the compliance of personal property taxes. Our Web Portal allows our client’s customer service departments to get up-to-the-minute tax data for buyouts, terminations, or tax bill copies and detail tax reports to support collections. Major Clients include; LaSalle System Leasing, Evans Leasing, Summit Funding Group, Merrimak Capital, IFC Credit Corp., Greater Bay Capital, Highland Capital, Telerent Leasing, Main Street National Bank, Blackstone Capital, SolarCom World Holdings, Matsco Financial Services, Bayer Healthcare, Altec Capital, Alabama Banker's Bank, Outsource Lease, Vision Financial, VenCore Solutions, Aztec Financial, Evans National Bank For more information about Advanced Property Tax Compliance, visit www.avptc.com or call: Sincerely, (h) U.S. Bank Portfolio Services provides third party solutions and back-up/successor servicing. Third party clients are able to focus on core competencies and avoid the expenses of creating a back office environment by outsourcing their servicing platform. U.S. Bank Portfolio Services adds security and protection as a back-up service provider with the ability to convert any portfolio in seamless manner through advanced preparation. (i) Haws Consulting Group - "We have been in business since 1982 and provide property tax consulting and outsourcing services to a variety of different types of companies. We have a strong leasing background and have provided property tax management services to leasing companies for over 20 years." For more information please see our Brochure and Case Study. ---------------------------------------------------------------- Centrix Financial Pushed into Bankruptcy IFC Credit Corp, Suntrust Leasing and Wells Fargo Equipment Finance initiated the Chapter 11 in Denver, Colorado, filing for Centrix Financial. The creditors leased equipment, software and other products to Centrix. IFC Credit Corporation claim is $2.18 million. Suntrust also reports they are each owed over $2.15 million. Wells Fargo reports $345,000. Centrix provides auto loans and leases to subprime borrowers. The company has reportedly been struggling financially over the past year, cutting its workforce from 1,500 to 500. Centrix Financial was the former title sponsor of the Grand Prix of Denver. Copy of filing: http://leasingnews.org/PDF/Centrix.pdf -------------------------------------------------------------- ePlus Announces Jury's Verdict in Banc of America Lawsuit HERNDON, Va.----ePlus inc. (Nasdaq NGM:PLUS), announced the results of a jury trial conducted in the Fairfax County, Virginia Circuit Court from September 11 - 14, 2006. On September 14, 2006, the jury returned a verdict for Banc of America Leasing & Capital, LLC ("BoA") and against ePlus Group, inc. ("ePlus") in the amount of $3,025,000, plus interest at $395.97 per day beginning on December 22, 2004 through the judgment date. As previously disclosed, BoA filed suit against ePlus Group, inc. in May 2005. The suit alleged a breach of warranties made in a Finance Program Agreement relating to a financing transaction between ePlus and BoA, in which BoA financed an installment sale of equipment to Cyberco Holdings, Inc. ("Cyberco") from a third party vendor. After the equipment was financed, the parties discovered that, unknown to ePlus or BoA, Cyberco was committing a sophisticated fraud. The jury appears to have concluded that, by and between ePlus and BoA, ePlus bore the risk of Cyberco's fraud. As of the date of this release, the final judgment has not been entered by the judge, and on October 13, 2006 the court is scheduled to hold a hearing on BoA's possible award of attorneys' fees, at which BoA is expected to seek approximately $1,000,000. In April, 2006, the United States Attorney for the Western District of Michigan asserted that Cyberco defrauded approximately 40 financial institutions of approximately $90 million. In June 2006, one of the principals of Cyberco pled guilty to fraud, money laundering, and conspiracy. Cyberco, related affiliates, and at least one principal are in Chapter 7 bankruptcy, and no future payments are expected from Cyberco. As previously disclosed, ePlus has settled a lawsuit with GMAC Commercial Finance, LLC ("GMAC") in the amount of $6 million. The BoA and GMAC suits are the only two suits regarding Cyberco in which ePlus is the defendant. While ePlus is disappointed with the verdict, it believes that it has strong grounds for appeal, and expects to appeal once there is a final order in the case. The adverse verdict has been recorded in the year ended March 31, 2006. The estimated after-tax loss, calculated using ePlus' 41% tax rate, is approximately $2.5 million. About ePlus: ePlus is a leading provider of Enterprise Cost Management solutions to information technology, finance, procurement, operations, and supply chain professionals who want to reduce the costs of finding, purchasing, managing, and financing information technology goods and services. Our Enterprise Cost Management solutions provide sourcing, procurement, spend analytic, supplier management, document collaboration, asset management, professional services, and leasing to ePlus' 2,000+ customers. Founded in 1990, the company is headquartered in Herndon, VA and has more than 30 locations in the U.S. For more information, visit www.eplus.com, call 888-482-1122 or email info@eplus.com. ePlus® and ePlus Enterprise Cost Management®, and/or other ePlus products referenced herein are either registered trademarks or trademarks of ePlus inc. in the United States and/or other countries. The names of other companies and products mentioned herein may be the trademarks of their respective owners. Statements in this press release, which are not historical facts, may be deemed to be "forward-looking statements". Actual and anticipated future results may vary due to certain risks and uncertainties, including, without limitation, the final determination of the Company's intended appeal of the jury verdict described above; the final determination of the Company's appeal relating to insurance coverage for the payments to GMAC and BoA; the existence of demand for, and acceptance of, our services; our ability to hire and retain sufficient personnel; our ability to protect our intellectual property; the creditworthiness of our customers; our ability to raise capital and obtain non-recourse financing for our transactions; our ability to realize our investment in leased equipment; our ability to reserve adequately for credit losses; fluctuations in our operating results; our reliance on our management team; and other risks or uncertainties detailed in our Securities and Exchange Commission filings. All information set forth in this release and its attachments is as of September 18, 2006. ePlus inc. undertakes no duty to update this information. More information about potential factors that could affect ePlus inc.'s business and financial results is included in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2005, the Quarterly Report on Form 10-Q for the quarter ended December 31, 2005 under the captions "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations," which are on file with the SEC and available at the SEC's website at http://www.sec.gov/. Contact: ePlus inc. ### Press Release ########################### Rare Honor for McCue and Ghauri

John McCue, left, clapping his hands. In the middle, NetSol Technologies Chairman Najeeb Ghauri. Leasing News wrote about the rare honor John McCue, the company's CEO of U.S. operations of Netsol, McCue Systems Inc., and Netsol Technology Chairman, Najeeb U. Ghauri, would have in ringing The NASDAQ Stock Market Closing Bell in New York on September 13, 2006. Leasing News asked Mr. McCue to describe the experience: I've been in this industry for over 3 decades now and I've had many gratifying moments. But I must admit – I never expected to find myself up on the podium of the NASDAQ ! But there I was, on Wednesday, Oct 13, standing with some of major players of Wall Street for the NASDAQ Stock Market closing bell. That was quite an honor for me and will always be a true high point in my career. Association Conference in October. NetSol & LeasePak - A Winning Combination NetSol understands the value of a proven product that enjoys wide acceptance among U.S. manufacturers, banks, and independents. Here is a free demo of LeasePak 6.0 Enterprise Edition http://www.mccue.com/demo/index.html ---------------------------------------------------------------- Sterling Financial Buys Santa Rosa Bank Expanding into Northern California, Sterling Financial out of Spokane, Washington agreed to buy Northern Empire Bancshares for about $335 million to extend its reach into Northern California. They will be in direct competition with many other community banks, such as Exchange Bank, parent of Dumac Leasing. Many believe the area is “over banked.” (Tim Taylor, formerly with Phoenix Leasing is now asst. credit manager at Dumac---no relation to boss Ken Taylor.editor) It is their third acquisition this year. Sterling agreed in February to buy Lynnwood Financial Group, the holding company of Golf Savings Bank and Golf Escrow, for about $64 million, and in June announced the acquisition of 20-branch FirstBank NW for almost $170 million in stock and cash. In the latest deal, investors will receive a 0.805 share of Sterling and $2.71 in cash for each Northern Empire share they own. Based on Sterling's closing price of $33.04 on Sept. 15, the stock portion of the deal's terms is worth $29.31, the company said today in a statement. The $32.02 offer represents a 34 percent premium above Northern Empire's $23.98 share price. Northern Empire, a Santa Rosa, California-based lender with 11 offices, will begin to add to per-share earnings next year, Sterling said in its statement. The combination will create a bank with $11.2 billion in assets and $7.3 billion in deposits. Sterling said it will cut annual expenses by $3.3 million through the acquisition, the bank's fourth this year. Sterling Financial has branches in Washington, Oregon, Idaho and Montana. ---------------------------------------------------------------- Top Stories--September 11-15

Here are the top ten stories most "opened" by readers last week. (1) Sales Makes it Happen-by C. Menkin http://www.leasingnews.org/archives/September%202006/09-13-06.htm#sales (I wrote this at the last minute as no one had written a column for this section. I am surprised it became last week's top read story by readers. ) (2) "Without Precedent, The Inside Story of the 911 Commission" Written by Thomas H. Kean and Lee H. Hamilton (This appeared on our mast head, right below the American Flag up-side down, in distress. We are very pleased so many readers click on to learn more and made this number two in the top ten. Congratulations to our readers. ) (3) Marlin Leasing stock Friday Close (From time to time, we will report on well-known leasing companies stock, particularly if it is newsworthy. I think the poor publicity about fraud and its handling has affected the desirability of leasing company stock, as evidenced by their stock sales. Pawnee is the Canadian exchange, but Marlin's stock should be much higher than it is as it one of, or perhaps number one in its category, the top small ticket leasing performer.) (4) Cartoon---Office of Ira Romoff, One World Leasing (I was going to make this Mike Bennie of Marlin, but then I thought, he doesn't have the sense of humor of Ira Romoff, who would think this funny, and not personal. ) (5) Bryn Mawr Bank enters Leasing Fray (Leasing News has been writing about the many captive lessors entering the marketplace, and community/regional banks.) (6) CIT Small Business Outlook (CIT has their pulse on the economy as they are not only world wide, but diverse, and still have the “old time” let's look at other things besides a credit score.) (7) How Does a Small Firm Attract and Hire In a Competitive Market? (This is actually part II of a three part series for the National Association of Equipment Leasing's “Leasing Log” newsletter. (8) Balboa Capital Releases Compass Version 2.0 (We try to give a balanced and fair report on Balboa Capital, who seems to be cutting the turf with brokers—a surfer phrase: on top of the wave, the cutting edge. The realities will come down the road when the leases are supposed to terminate, as most have an “Evergreen” clause in the contract.) (9) Woody Prothero Joins Main Street Bank (This team is really turning around. Reminds me of the Dallas Cowboys. Bob Fisher is Bill Parcells and the Gazelle is Jerry Jones.) (10 ) Rick Heater joins GE Capital Solutions, Intermediary Funding (Shows press releases do get read in Leasing News.) Kit Menkin, editor

---------------------------------------------------------------- Classified Ads---Help Wanted Office Administrator

Operations Manager

Sales

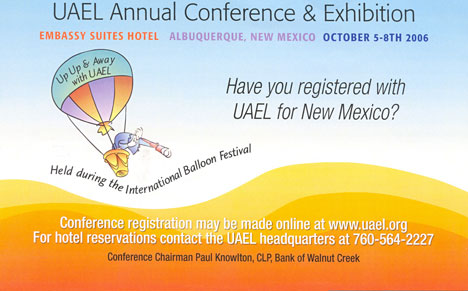

---------------------------------------------------------------- CIT Group in exclusive talks to buy Barclays' leasing and lender finance ops SNL.com By Bree Fortney CIT Group Inc. entered into exclusive talks to buy the leasing and vendor finance operations of Barclays Plc for approximately 1.25 billion British pounds ($2.35 billion), thebusinessonline.com reported Sept. 17. According to the publication, CIT was up against a number of rival bidders, including General Electric Co., Fortis, Siemens and Société Générale. CIT CEO Jeffrey Peek has been aiming to build the company's position in Europe, the publication reported, adding that this year CIT appointed several European executives in attempt to expand its leasing market presence. While the sale will strengthen CIT's presence, it is rumored that it may also lead to Barclays' full withdrawal from the leasing sector, thebusinessonline.com reported. Following the sale of Barclays' operations, Germany's KGAL, one of Europe's biggest leasing firms, will be sold in an auction being run by Goldman Sachs, the publication reported. ---------------------------------------------------------------- Leasing Association Events-Meetings Open to All

Renaissance Concourse Hotel REGISTRATION FEES

Membership: Non-member companies who join NAELB at this meeting will receive a $50 attendee fee credit towards their 2007 membership dues and are entitled to membership privileges for the balance of 2006. ROUND TABLE DISCUSSION TOPICS Round Table Discussions have been added to this year’s agenda in lieu of educational sessions. Below is a list of possible topics for these round tables. Please select 10 discussion topics you would like to have on the agenda for the Western Regional. The top selections will be discussed at the meeting.

Registration form, click here: | ---------------------------------------------------------------

UAEL North Central Regional Event

Chicago Christmas Party Thursday, December 7, 2006 Maggiano's Maggiano's Chicago is a well know Italian Eatery located in Beautiful Downtown Chicago. Come and Join us "Mingle and Jingle" in this years holiday season. There will be a 50/50 raffle to benefit The United States Marine Corp, "Toys For Tots" in honor of all our brave men and women that have and are serving in our armed forces. Ticket will be sold for $1.00 each. This year we will also have "Door Prizes." Each attendee will receive (1) ticket/chance to win upon their arrival compliments of UAEL and our sponsors. This was well received in previous years and all we can say is, "Good Luck!!!!!" Cost to Attend I would like to take this opportunity to extend a Happy Holiday and a great big "Thank You" to all our sponsors on behalf of the "United Association of Equipment Leasing" for all your support over the years. Without your continued support, events such as this would not be possible. I look forward to seeing you all soon at the "4th Annual Midwest Holiday Party" to "Mingle and Jingle... Happy Holidays, Bill Griffith List on Sponsors: Swanson, Martin & Bell, LLP - Joseph P. Kincaid, Esq. ---------------------------------------------------------------- Leasing 102 by Mr. Terry Winders, CLP

A security deposit is defined as “a cash bond taken as security against proper performance by the lessee during the lease term”. If the lessee fails to live up to any of the provisions in the lease agreement, funds from the security deposit can be used under the “right to perform for the lessee” section to pay for it. The funds can be used to pay past due payments, unpaid property tax, insurance premiums, late charges, assessed taxes and the like. These usually are called defaults which are cured by using the security funds. Then the lessee is required to replenish the used funds. When the lease terminates the security deposit is returned to the lessee if no default is left outstanding. Many leasing companies today refer to it as the “last month payment.” In their state or for their accounting records it avoids the “commingling agreement.” Originally the use of a security deposit was to lower the lessees payment if a “commingling agreement” is in the lease agreement. A commingling agreement allows the lessor to use the security deposit funds during the lease without any compensation. If it is used to help the lessor pay for the equipment then the lessor has a lower investment thus a lower payment. However the lease payments plus the residual (if any) must always return the total investment so the security deposit can be returned. The effect is to reduce the payment because the lessor's return is calculated only the funds employed by the lessor. The danger here is that if the funds are required to pay for a default then the lessor does not have full use of the deposit and the yield will suffer. Lower payments help meet the 90% test for operating lease classification for the lessee and are therefore very popular when a conservative residual alone prevents passing the test. On occasion the lessee may feel that they should receive an interest rate on the deposited funds but in effect they are receiving a lower payment which means their funds are reducing the cost on the funds equal the lessor's yield. If a lessor does not reduce the payment when taking a security deposit and has a commingling agreement then the lessor yield will increase sharply. Mr. Terry Winders has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666 October 9th and 10th he is conducting a two day seminar in Louisville, Kentucky. To learn more, please go here: http://leasingnews.org/PDF/Winders_Seminar.pdf ---------------------------------------------------------------- LEARNING CURVE® Less (Spending) Is ABSnet.com Although consumer spending and economic growth may be slowing, reliance on revolving credit is growing. The growth rate for revolving consumer credit was revised to 11.0% from 9.91%, while the preliminary June rate was 9.8%. The personal savings rate continues to be negative. While overall retail sales growth grew by 1.4% in July, several retailers, including Home Depot and Wal-Mart, lowered forecasts for the remainder of the year, due in part to curtailed spending and store visits resulting from high gas prices. The expectations component of consumer confidence, as measured by the University of Michigan's index, decreased in July to 83.8, down 1.1 from June. Unemployment budged up 0.1% to 4.7% and year-to-date hourly earnings and weekly earnings are up 3.8% and 4.1%, respectively. Meanwhile, the Consumer Price Index for All Urban Consumers (CPI-U) increased at a 4.8% seasonally adjusted annual rate during the first seven months of 2006. After 17 consecutive 25-basis-point rate increases, the Federal Reserve did not raise rates at its August meeting, which indicates that economic growth has moderated and that inflation is expected to be contained. Fitch Ratings' full-year projection for real gross domestic product growth is 3.2%, indicating significant slowing from the 5.6% rate actually observed in the first quarter of 2006. Weekly consumer bankruptcy filings equaled about 12,000 for recent weeks, well below historically observed volume of 30,000---35,000 per week. Fitch expects overall consumer charge offs to increase in the second half of the year, toward historically observed levels of 5.5%6.0%, with contractual charge offs likely to increase to the extent bankruptcies remain depressed. Prime Delinquency & Charge offs Late stage delinquencies, representing borrowers 60 or more days past due, and a measure of future charge offs increased two bps to 2.30% in July. Charge offs dipped 14 bps to 3.44%, down 254 bps from 5.98% in July 2005. Loss rates have remained significantly lower than historically observed levels due to the persisting effects of the federal bankruptcy reform act enacted in late 2005. Fitch expects charge offs for U.S. credit card asset-backed securities to eventually reach historical levels as contractual delinquencies begin filling the vacuum created by personal bankruptcy filings. Prime Yield, Payment Rate & Excess Spread In July, Fitch's yield and payment rate indexes decreased. Yield fell 34 bps to 17.63% and is 61 bps above the year-ago level. The monthly payment rate, a measure of the rate at which cardholders make payments on their credit card debt, fell 29 bps to 20.71%, but is 224 bps above the year-ago level. Excess spread, which measures the profitability of credit card securitizations, fell 60 bps to 7.81% and is 187 bps above the year ago level. Excess spread has benefited from subnormal charge off levels for most of 2006 and remains at historical highs as reported by the Fitch Credit Card Prime Index. Subprime Performance Late payments measured by Fitch's 60 days or more delinquency index, rose four bps to 4.94%. Delinquency level for subprime trusts, although marginally higher for July, remains fairly robust and steady, with a positive outlook for future loss rates. Meanwhile, charge offs fell 36 bps to 8.40% -- the lowest level in more than six years and 424 bps below the prior year's level. Improvements in origination policies, credit risk improving performance for subprime issuers. Three-month excess spread for related subprime master trusts fell 22 bps to 10.85%, 313 bps above last year's level. This week's Learning Curve was written by Cynthia Ullrich and Paritosh Merchant, credit card ABS analysts in Fitch Rating's asset-backed securities group in New York. -------------------------------------------------------------- Canadian Finance & Leasing Association

At its 2006 annual conference, the Canadian Finance & Leasing Association (CFLA) was pleased to announce that HUGH SWANDEL, President of Swandel and Associates, had been given the Canadian leasing industry's premier “Member of the Year” Award. HALIFAX, NOVA SCOTIA. At its 2006 annual conference just completed in Halifax, the Canadian Finance & leasing Association (CFLA) was pleased to announce that HUGH SWANDEL, President of Swandel and Associates, had been awarded the Association's “Member of the Year” Award. For CFLA Chairman Joe LaLeggia (Irwin Commercial Finance), “this Award recognizes individuals, volunteers from members, who work quietly for the Association, committed to its goals. Through their generous efforts, CFLA is able to face the challenges confronting the entire asset-based financing and leasing industry.”

Hugh Swandel Hugh Swandel is well respected for his extensive industry experience and broad range of industry know-how. A specialist in corporate finance, merger and acquisition and general management consulting to leasing companies across North America, he has also been a constant advocate for a high standard of knowledge and professionalism in the industry. A strong supporter of CFLA for many years, this year Hugh was instrumental in the Association following through on member calls at last year's conference for an enhanced equipment and vehicle lease training program. He scanned the alternatives available, made the recommendation to partner with the U.S.-based Certified Leasing Professional (CLP) Foundation and the United Association of Equipment Leasing (UAEL) and worked side-by-side with the CFLA President to negotiate the agreement for the exclusive Canadian licence to use the training. In the coming year, he has taken on the most substantial and challenging mandate ever extended by the Association: to adapt the 15 module American training program for Canada. Hugh will lead the development of the curriculum and structure of the program for the Canadian market. The goal is a unique, comprehensive Canadian lease training program delivering a level of knowledge, commitment and professionalism that will take members and their employees on to greater success. Canadian Finance & Leasing Association (CFLA) represents 260 members in the asset-based financing, equipment and vehicle leasing industry in Canada. With over C$92.3 billion of financing in place with Canadian businesses and consumers, the asset-based financing industry is the largest provider of debt financing in this country after the traditional lenders (banks and credit unions). The customers of this industry are Canadian small, medium and large businesses as well as consumers. Website: www.cfla-acfl.ca Swandel and Associates provides corporate finance, merger and acquisition and general management consulting to leasing companies across North America. Website: http://www.swandelandassociates.com/ David Powell President & Chief Executive Officer ### Press Release ########################### Lakeland Bank appoints Kenneth Markman assistant VP of Leasing Division

Oak Ridge, New Jersey —President and Chief Executive Officer Roger Bosma, of Lakeland Bank, recently announced the appointment of Kenneth Markman to assistant vice president of Lakeland Bank's Equipment Leasing Division. Markman, a graduate of Rider University, will be responsible for the review and approval of financial requests for their equipment leasing division. Previous experience includes employment at Interchange Bank, Orix Financial Services and The CIT Group. Markman is a coach for youth basketball and baseball and resides in Waldwick, New Jersey, with his wife and four children. ### Press Release ########################### Leon Branam joins Securus Capital as Vice President Securus Capital LLC, a leading provider of financial solutions to federal agencies and technology vendors, announced today the appointment of Leon Branam, as vice president. Mr. Branam's responsibilities will include originating federal leasing transactions as well as syndication activities. Mr. Branam, a graduate of Rutgers University, joins Securus Capital from Lakeland Bank in New Jersey where he was responsible for federal transactions. Mr. Branam's previous employment includes Hitachi Capital, Citicorp Leasing, and AT&T Capital. Mr. Branam is a member of Equipment Leasing Association and the Association for Government Leasing and Finance. Maeve Rigler, President and CEO of Securus, said “I am delighted to have someone with Leon's credentials and track record join our team. His experience and deep understanding of the federal market will help Securus deliver financial solutions that are second-to-none." Mr. Branam can be reached at work by calling 973-920-2523 or email to LBranam@securuscapital.com. About Securus Capital Securus Capital LLC is a financial solutions company serving the technology industry and federal agencies. Headquartered in Alexandria, Virginia, Securus has a team of finance experts with over 30 years of experience helping vendors recognize more than $1 billion of revenue while helping agencies acquire mission-critical technology. Committed to customer service, Securus has one of the highest Customer Satisfaction Ratings (98 out of 100), according to D&B's Open Ratings Survey. For more information, visit www.securuscapital.com. Sites of Reference: CONTACT: Bob Rigler ### Press Release ###########################

News Briefs---- Intel unveils computing breakthroughs Citigroup names new head for Swiss private bank Sovereign Shareholders to Confront Board on Wednesday Oracle on Deck Holiday Sales Growth Predicted to Decline Microsoft gets candid about video service Wednesday bet is the Reserve will not raise Fed Rate this meeting--- Home builder sentiment sinks again in September Current account trade deficit hits second highest level on record ---------------------------------------------------------------

You May have Missed--- TheMoneyBlogs.com...Nothing But Money ---------------------------------------------------------------

Sports Briefs---- Mets Beat Marlins to Clinch Division Pac-10 sits officials, apologizes to OU ----------------------------------------------------------------

California Nuts Briefs--- Dan Walters: A Schwarzenegger landslide? Angelides is running out of time ----------------------------------------------------------------

“Gimme that Wine” Kendall-Jackson 2006 Harvest Report/Global Warming? Heavy rains plague start of 2006 Bordeaux harvest Top wine bottle executive Harrop starts own firm Winemakers canned during busy season A Sonoma winery that's aging well-Hanzell Winery—Eric Asimov Looks like a vintage year in the Washington State vineyards Wine Prices by vintage US/International Wine Events Winery Atlas Leasing News Wine & Spirits Page The London International Vintners Exchange (Liv-ex) ----------------------------------------------------------------

Calendar Events This Day Saint Christopher (Saint KITTS) and NEVIS ----------------------------------------------------------------

The city of Los Angeles has three times more automobiles than people Distribution of Vehicles and Persons per HouseholdVehicles Per Household1969 = 1.16 Persons Per Household1969 = 3.16 http://www.eia.doe.gov/emeu/rtecs/nhts_survey/2001/index.html

----------------------------------------------------------------

Today's Top Event in History 1873 -Black Friday: Jay Cooke & Co fails, causing a securities panic http://www.buyandhold.com/bh/en/education/history/2000/jay_cooke3.html (It is said that JP Morgan pulled the country out from bankruptcy by guaranteeing loans from European banks, but I am getting ahead of this terrible day in history as perhaps the worst depression the country has ever seen followed this collapse of the stock market. ). ----------------------------------------------------------------

This Day in American History 1676- Bacon's Rebellion, Jamestown, Virginia. Perhaps the first revolt against the British, who formed an alliance with the Indians. Lead by Nathaniel Bacon, a colonist, he was successful, but shortly after winning the town, he caught a disease and died (common in the day, unfortunately).The rebellion then collapsed and his followers were hunted down, some executed and then property confiscated. Virginia Governor Sir William Berkeley was replaced the next year and peace was restored, so says history. ***Bacon's Rebellion: In the Virginia colony every adult male could vote. When Charles II was restored to the English throne, he sought to exploit the colony to the fullest. Virginia Governor Sir William Berkeley, supporting the king, adopted new laws to facilitate these efforts including measures allowing only property holders to vote, raising taxes to build up the town of Jamestown and raising the cost of shipping while lowering the price for tobacco. The resulting discontent exploded when the frontier of the colony was attacked by Indians and the governor refused to defend the settlers. Nathaniel Bacon, a colonist on the governor's council, was made leader by the frontier farmers, and his troops successfully defeated the Indians. Denounced by Berkeley as rebels, Bacon and his men occupied Jamestown, forcing the governor to call an election, the first in 15 years. The Berkeley laws were repealed and election and tax reforms were instituted. While Bacon and his troops were gone on a raiding party against the Indians, Berkeley again denounced them. They returned and attacked Berkeley's forces, defeating them and burning Jamestown on Sept 19, 1676. Berkeley again fled and Bacon became ruler of Virginia. When he died suddenly a short time later, the rebellion collapsed. Berkeley returned to power and Bacon's followers were hunted down, some executed and their property confiscated. Berkeley was replaced the next year and peace was restored. --------------------------------------------------------------

Baseball Poem Ralph Hero without a nickname Heir to Greenberg's Gardens and his wisdom Kiner lit up and filled up Forbes Suddenly he was gone "Traded" — as if anyone Could equal his worth The sounds were long gone Like a trademark hit Written by Gene Carney, “Romancing the Horsehide,” -------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Editorials (click here) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|