Wednesday, September 27, 2006

Headlines--- Classified Ads---Operations Please don't miss: Sales Makes it Happen— “Tis the Season” ######## surrounding the article denotes it is a “press release”

----------------------------------------------------------------- Classified Ads---Operations

Poets Leap, part of Long Shadows portfolio, Columbia Valley, WA *

Randy Dunn at Work Orange County, CA East Windsor, NJ New York, NY Wayne, NJ For a full listing of all “job wanted” ads, please go to: To place a free “job wanted” ad, please go to: * One of the best kept secrets comes from Allen Shoup, known as the Robert Mondavi of Washington. He retired from the Stimson Lane Wine Group (Chateau Ste. Michelle, Columbia Crest, to name a few) and opened this boutique group of wine makers' production facility: Feather - Randy Dunn http://www.poetsleap.com/aboutlsv.aspx ---------------------------------------------------------------- Exclusive: UAEL Conference Handbook

An exclusive from Paul Knowlton, CLP, Conference Chairman for the October 5th to 8th United Association of Equipment Leasing Annual Conference and Exhibition being held at the Embassy Suites Hotel, Albuquerque, New Mexico. This is a copy headed for the printers, he told us. The good news: Leasing News Advisory Chairman Bob Teichman, CLP, will be reporting on the event for Leasing News readers. The bad news: Paul states the Embassy Suites Hotel is sold out. “The conference is going very well in terms of registrants, exhibitors and activities, “he said. “ The Embassy Suites, site of the conference is sold out. Staff at the UAEL office ( 760-564-2227 ) can be contacted if assistance is need with rooms at alternative locations. I have attached a copy of the conference handbook which is headed to the printers. You might want to highlight a section, perhaps some of the educational sessions or the exhibitor list??? “Bob will do a great job on the recap I am sure. This has been a lot of work, at a busy time for me, but I am really looking forward to this conference and am confident of its success!” Take Care Paul The conference is usually very well attended, not only for the education and exhibits, but the balloon race and opportunity to float in the air. There are a lot of inside jokes about hot air that it takes to get the balloons up. The last time Sue and I stayed two extra days, visiting Santa Fe primarily, which is only an hour drive from Albuquerque. Great food, shops, art, western collector items such as original sheriff badges, historic sites. Kit Menkin Conference Handbook ---------------------------------------------------------------- Microsoft Explorer 7

If you haven't downloaded the free Microsoft Explorer 7 up-date, you should do so ASAP. It may be long download, even on a fast line, and the installation was very long---but very well worth it. When I went on to check the distance from Santa Fe to Albuquerque via mapquest it brought me up to a road map and when I clicked over my office location, it brought me a live aerial video and I could zoom to where my car was parked in the back office. What I remember on the television series “24” is free now on my computer and “live.” Explorer 7 has other video and audio features. I remember going from “Gopher” to Netscape and thinking it can't get any better than this---but it certainly has beyond my imagination. And for “free.”

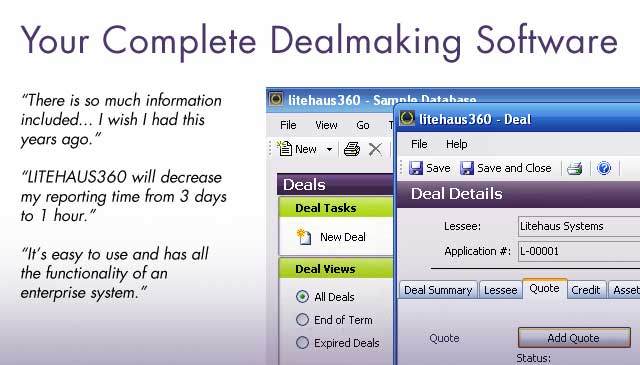

---------------------------------------------------------------- New Lease Broker Software litehaus systems introduces LITEHAUSE360 "... your complete deal making software!" "Our goal has been to create an easy-to-use solution for lease brokers that feature enterprise class functionality without the enterprise class price sticker, Anthony Carrol, President said.”With LITEHAUS360, we believe that we have succeeded."

The company is offering a thirty-day free trial download with the offer if the software is purchased within thirty days, $100 off, making the price: $895 a year. For more: visit www.litehaus360.com ----------------------------------------------------------------

Collection: essential to IFC's financial health by Christopher Menkin

Randy Brook, Senior FTC attorney US Federal Trade Commission Senior Attorney Randy Brook told Leasing News, "The IFC Credit Corporation investigation is still open, and if the Commission determines to close it, typically it will send a letter stating that decision and the letter will be public. Similarly, if the It appears the sole major hold out in settling with NorVergence lessees is IFC Credit, Morton Grove, Illinois. According to a spokesman, the New York Attorney General's office is in "active negotiations" with four remaining leasing companies with the largest number of lessees may be with IFC Credit. Leasing News attempted to obtain a comment or statement on this story, sending an early draft of it to officers of the company, including President and CEO Rudy Trebels. Attorney General Eliot Spitzer was instrumental in getting $20 million from the leasing companies. The exact dollar number is not known of the remaining four as the attorney general's office gets the information via subpoena, according to a spokesman. From information gathered from Municipal and Superior Court records in Illinois, primarily, it appears there may be as many as 200 IFC Credit- NorVergence cases active, with several under appeal, including the SOS matter in Texas where Judge Sally Montgomery ruled IFC Credit was to inform all its NorVergence lessees about possible holdbacks the company held. In recent articles it was noted the court costs, such as SOS with the appeal going up to over $210,000 to chase $11,000. The recent United Business & Industrial Federal Credit Union trial estimate for Askounis & Borst, P.C is $80,000 to over $100,000 in attorney fees and court costs by the prevailing attorney Gregory Adamski, Managing Partner, Adamski & Conti, Chicago, Illinois. Not too bad for these two former employees of well-known attorney Jim Coston. It should be no surprise to readers that this has been a very expensive experience for IFC Credit. And these costs mentioned, do not include the losses from the leases, just the attorney and court costs to date. Collection is essential to IFC's financial health. Originally IFC Credit said there were 550 NorVergence leases, according to a deposition in the SOS Texas trial. In the $13 million outstanding mentioned, 80% were in default, it was stated, and according to one of their bankers, the lease payments on their $11 million line of credit was being made by IFC Credit "as agreed." To readers who do not know the procedure of many funders, it is common for them to pay these leases with a warehouse line of credit, then to bundle them up as a group, and "discount" further to another funder, often at a non-recourse basis. This can be best explained in the example of building a house. You obtain a construction loan, and when the house is completed, you obtain a "take out" or mortgage loan. The "take out" is the bundling of the leases. In personal property leasing, they hold onto the asset or residual, in most cases, with various agreements regarding default. In this regard, the retail cost of the equipment was approximately was a $500 Adtran router that it converted data in a way so there would be no extra long distance charges. The bottom line, most American banks want to be paid within 90 days of a default, if there is a recourse agreement. They have auditors and banking rules they must follow If there is a "representation and warranty" agreement, the NorVergence leases may fall into this category, whether recourse or not, in the sale or borrowing agreement with IFC Credit, for instance. They make other representations such as the collateral itself, to the seller of the equipment, and most of all, that it is also not a fraudulent transaction. In many of the NorVergence matters, NorVergence bundled the leases together and then "discounted" them to banks direct and leasing companies such Preferred or IFC Credit, who in turn also then "discounted" them to someone else. In the case today, the last party can go back but that party can't go back to NorVergence as they are in bankruptcy. In reality, many leasing companies, such as Advanta and others did the same thing in assigning leases (whether an outright sale, a discount, or a recourse or non-recourse loan.) It is also very common in the mortgage industry, and banking industry on a larger scale, to treat these "securitizations" as a portfolio and either "discount" or "sell" them to another who is purchasing it at a lower rate, so the "spread" is or "margin" is the profit. Often these can be private funds or investors or a major bank looking for a better rate than they are receiving elsewhere. Again, in reality, many leasing companies are really "brokers," some going recourse and many not after they sell off the portfolio. During the "construction" phase they have borrowed the money, but once sold, just like Advanta did, their responsibility may just be the "reps and warranty aspect." It is a lot more dangerous than the mortgage business as there the collateral is real property ( hopefully appraised correctly.) In addition, being the owner of the equipment has many more liabilities than being only the creditor, such as in making a loan. In leasing, it can become a house of cards where the original seller is a crook and the collateral costs more to sell in time and procedure than it is worth and you are left to defend your position as lessor rather than lender. There is a lot of European money coming into the United States because they can get a better “margin” here than in their own country. What happens in a default situation is the creditors generally want assurances they will be paid. It could be that they will accept monthly payments, as if they were coming from the lessee, until the default situation is settled in a court of law or "written off" by the original company, such as IFC Credit. IFC said in the SOS case in Texas they were making $300,000 in monthly payments on leases at that time. The creditors don't like to call up loans or assignments. It is not only the cost, but they want to keep receiving new business. Often they believe in their customer and want to demonstrate their loyalty. Often, they do not want to admit they made a poor credit decision. No one likes to admit mistakes. The creditor may be able to “look the other way” because the matter is in litigation. They may footnote their delinquency report as "not settled, pending litigation." Of course, they also may "write it off" and put in another column to appease their regulators, but consider it something that will be settled, perhaps to their borrowers favor and thus their's. One law firm, Fleck Law Office (www.flecklawoffice.com,) has 100 NorVergence-related clients in total, of which approximately 77 are IFC-related.

Michael J. Fleck "My firm is representing close to 100 NorVergence customers, most of who are with IFC," Michael J. Fleck told the "Aberdeen Kid News." I can tell you first hand that IFC has not backed down one bit in spite of the recent events directly involving IFC and regarding the NorVergence debacle generally. In fact, it is to the contrary. To wit: "1. We have just filed our response brief in IFC v. Magnetic Technology in the Illinois First Appellate District appeal regarding the application of res judicata with respect to the FTC and IL AG default judgments. If you recall, we were successful in dismissing this case in the trial court under this theory. IFC appealed, and received two extensions of time to file its initial brief (expecting the Eq Leasing Assoc to file an amicus brief, which it did not do). IFC will be filing its reply brief soon. We do not know when or how this will be ruled upon. "2. The same appellate court has still not ruled on the first round of appeals (which involve 5 of our clients) regarding the dismissal of the cases concerning the forum selection clause. Many of you are aware that IFC did get this issue reversed in the 7th Circuit, and those federal cases (Aliano Brothers and Warner Robins) are still moving forward in the District Court. We have filed affirmative defenses and counter claims in these cases and expect to bring these cases to trial. This is despite IFC's loss in the UBI case before a jury. The Illinois state appellate court is not bound by the 7th Circuit (although that is persuasive authority), so Illinois may rule differently on that. "3. IFC continues to file more cases in Cook County against NorVergence/IFC customers, so they intend to proceed in spite of the wave of settlements by other leasing companies, jury losses and continued pressure from the NorVergence Bankruptcy Trustee and prior FTC action. "4. There have been a number of class action suits filed against IFC in IL alone (state and federal court). It is imperative that you monitor the status and progress of these various suits, as they have slightly different theories and the courts have made certain rulings affecting whether these classes will proceed. "If you are with IFC, speak to your attorney about what is happening. Do not rely on speculation and conjecture. IFC will probably be one of the last LCs to change their position, so you can't just sit back and hope that they do an about face and settle any time soon. "This is not at all intended to cool the firestorm – just to get the facts out." Many believe IFC Credit is playing hard ball because they don't have the ability to pay off the banks involved and for cash flow purposes is fighting each lease to the end. The question is how long can IFC Credit hold off their creditors? It appears a long time, according to their press release of a new line of credit announced last December. "IFC Credit Corporation announced that its wholly-owned subsidiary, FPC Funding II, LLC, has completed the renewal of its $75 million revolving credit facility with Autobahn Funding Company, LLC, an asset-backed commercial paper conduit sponsored by DZ Bank AG Deutsche Zentral-Genossenschaftsbank. The facility has a term of five years.

Rudy Trebels, CEO "IFC President and CEO Rudy Trebels commented, 'The Autobahn facility provides us with low cost funding and flexibility, which optimizes our competitive position in the small-ticket marketplace, and results in an improved customer experience.'” ---------------------------------------------------------------- FTC files injunction against two NorVergence Officers

In a related matter, US Senior FTC Attorney Randall H. Brook and Susan J. Steele, serving a designated local counsel by the United States Attorney, filed a “stipulated permanent injunction and order as to individual defendant Peter Salzano (in addition Thomas N. Salzano and Peter J. Salzano, individually and as officers of NorVergence, Inc.) This matter signed by all parties basically protects the FTC interest in any assets ( which there will be little, if any, but not known as “fact” until findings by the Bankruptcy Court.) The FTC has won several judgments. It also enjoins Salzano and any individual involved with Salzano from entering into future such misrepresentations making those involved personally liable. Here is a copy of the actual filing: ---------------------------------------------------------------- Classified Ads---Help Wanted Office Administrator

Operations Manager

Sales

Sales Representatives

----------------------------------------------------------------

---------------------------------------------------------------- PFCS: iGate Wanted a larger share of stock, VanHellemont claims

The turmoil at Portland, Oregon's back office company Portfolio Financial Servicing (PFSC) continues to grow surrounding its president and CEO Jerry T.Hudspeth resignation, as noted in Leasing News on September 19 th. It seems to center around the offshore service company wanting more stock and “say” in the control of PFSC, according to the current acting CEO Robert VanHellemont. The September 20th Leasing News issue included an interview with Robert VanHellemont, CEO of Varilease, Walled Lake, Michigan who confirmed: “...the acquirer of PFSC, a 150 employee “back office” operation in Portland, Oregon was Walled Lake, Michigan Varilease “owner” Bob VanHellemont, plus “four to five significant investors with a lot of board of director experience." Varilease was also one of the UniCapital companies. PFSC does the servicing for the Varilease small ticket operation.”

Robert VanHellemont “… Mr. VanHellemont says in his letter that a public company, iGate, is one of the shareholders. Because of Mr. Hudspeth's resignation, iGate has notified PFSC Holdings that they are withdrawing from PFSC ownership. This can be verified by contacting iGate in Fremont California. I and other clients are concerned that the new PFSC ownership has a conflict of interest as they are competitors to some PFSC clients.” (name with held) IGate is a company specializing in “... outsourcing with the underlying technology infrastructure to offer an optimized solution and cost savings off shore.” From iGate: “iGATE Global Solutions had made a 5% investment in PFSC with an intention to work together. However, with the changes in management in PFSC, there are material changes in the company causing iGATE to reconsider the investment. iGATE had the option to increase its stake in PFSC on or before June 2006. iGATE did not exercise the option and has asked the other shareholders to buy back the 5% in terms of the agreement with them.” Regards, Salil Ravindran

Robert VanHellemount says Leasing News is not getting the full story from iGate. iGate remains as an investor/director until November 15th , he adds, but they basically have been purchased---after they wanted to increase their share and take business offshore. He and the other investors were not in favor of that, but Hudspeth was, he states. “In May 2006 PFSC sold iGate a 5% interest in the company,” Mr. VanHellemount told Leasing News. “As part of that agreement iGate had an exclusive option to negotiate with PFSC for a larger piece of the company at terms & conditions acceptable to PFSC---all to be accomplished prior to June 20, 2006. PFSC rejected the iGate proposal on or about that date. Pursuant to the terms of the agreement iGate had to sell (& PFSC had to buy) the 5% back in 6 months if the parties did not agree on the terms of iGate's offer to increase its stake. There were and are no elections by either party to do otherwise. “While we appreciate and respect iGate's involvement in partnering with PFSC, our shareholders decided in June that it would not be beneficial to our clients to sell a significant equity interest in the company. “Contrary to Mr. Ravindran's comment, since the recent change in leadership, Mr. Sambasivam Kailasam from iGate called and informed me that iGate's CEO, Mr. Murthy, again wanted to increase iGate's stake in the company. Once again I rejected the proposition. “Another note… We have contacted our clients and informed them of the changes at PFSC. To date we have not received the negative comments or concerns as you have described. “ “PFSC's shareholders have significant resources, experience and expertise. Today more than ever we are excited about the direction in which PFSC is headed and are committed to continuing our leadership position within the servicing industry. “ Robert VanHellemont in his letter to PFSC customers directly confronts any “conflict of interest” charges because his small ticket portfolio is being serviced by PFSC and addresses other matters. “September 21, 2006 “To our Customers: “This letter is to serve as a renewed introduction to Portfolio Financial Servicing Company (“PSFC”), our ownership structure, and financial stability. Additionally, I want to emphasize the commitment of the shareholders to continue to maintain the servicing standards which have become synonymous with PFSC and to improve upon the product we deliver to our customers. “PFSC is wholly owned by PFSC Holdings, LLC (“PFSCH”). PFSCH was formed by the private investment group Partners VX to purchase all of the assets of PFSC from Bank of America, the largest shareholder of PFSC. As part of the purchase arrangement, PFSCH provided all of the equity capital to complete the purchase from Bank of America. Today, PFSCH controls 100% of the outstanding shares of PFSC and the company has been operating for a number of months outside of Bank of America. “PFSCH Stockholders have combined assets in excess of $350,000,000 and manage assets of nearly $1,000,000,000. The PFSCH investment strategy is based on value added investing, with each of the partners providing finance and management expertise contributing to the growth of the company, accompanied by the financial commitment for continued success. We are confident that the PFSCH investment professionals, together with PFSC's management team, bring a unique and formidable set of resources to PFSC. “PFSCH's primary stockholders consist of William Nicholson, IGate Global Solutions (NASDAQ), Ralph Iannelli, and me - Robert VanHellemont. If you would like additional background information on our investment team please contact Eric Gross, PFSC Vice President of Marketing, for a password to the PFSCH website. “It is imperative for me to underscore that while I am President of Varilease Technology Finance Group (“VTFG”) and acting as PFSC's interim CEO, my role at PFSC will in no way disrupt PFSC's obligations to its clients. I am very sensitive to the issue of PFSC's responsibility to its clients to maintain strict confidentiality. As such, VTFG and its employees have no financial interest in PFSC, nor do they have access to PFSC's client customer data. “The motive behind our purchase of PFSC was and continues to be, to further the growth and ensure the continued long-term success of the PFSC organization. PFSC is stronger today than it has ever been with over $16 billion under management through our primary and backup servicing programs. Our shareholders are committed to providing the resources and energy to further PFSC's position as an industry leader. “We are confident that the recent changes within PFSC will allow us a greater opportunity to expand our business and provide more depth and range in terms of the services we are able to provide our clients. One of PFSC's primary goals is to continue to provide you, our client, with exceptional service and professionalism. To that end I welcome your comments, suggestions and questions. Furthermore, please let me know if you have any thoughts on other servicing areas where we may be of assistance. “PFSC is a partnership between our company and yours. We realize that we cannot meet our goals without first meeting your expectations. As we continue to improve our offerings, it is essential that we rely on you, our customer, to validate our performance. Your input and support is paramount to us. Please feel free to contact me directly at 248-366-1212 or rvanhellemont@pfsc.com. “More to follow…… “Sincerely, Robert W. VanHellemont ---------------------------------------------------------------- Sales Makes it Happen—“Tis the Season”

----------------------------------------------------------------

China submits financial leasing law to National People's Congress - official ELTnews From the publication, "AFX International Focus" BEIJING (XFN-ASIA) - Chinese regulators have submitted a financial leasing law to the National People's Congress (NPC), the country's parliament, for review and approval, a government official said at a conference in Beijing. The NPC will consider and approve the law ahead of the full opening of the financial sector to foreign competition at the end of this year, under China's commitment to the World Trade Organization (WTO), said Xu Weigang, deputy director of the policy and law division of the State Administration of Foreign Exchange (SAFE). Xu said it would be China's first-ever financial leasing law. Local media said the new law is expected to lower the threshold for businesses to enter financial leasing by decreasing the registered capital required to 50 mln yuan from 500 mln yuan. The law is expected to be approved by the end of this year. Earlier this week, state media reported that the China Banking Regulatory Commission (CBRC) is considering allowing commercial banks to invest in leasing companies, a form of investment currently forbidden to them ---------------------------------------------------------------- Chinese Banks Set to be allowed to Invest in Financial Leasing ELTnews From the publication, "Asia Pulse": China Banking Regulatory Commission (CBRC), the country's banking industrial watchdog, is making studies on permitting banks to make equity investments in financial leasing companies, Li Jianhua, an official with CBRC's Non-banking Financial Organization Regulatory Department, said in an industrial seminar here recently. Revisions are being made to the existing Administrative Measures for Financial Leasing Companies and a new Law on Financial Leasing is being drafted. China has banned banking capital from investing in the financial leasing business, regarded as a major policy obstacle against the robust growth of the financial leasing industry. The proposed financial leasing law will encourage banking capital to join in the financial lease business, said Guo Shuyan, an expert in charge of the legislation work. Guo disclosed that the law is likely to be submitted to the Standing Committee of National People's Congress, China's top legislature, for deliberation by the end of this year, and the final announcement is expected in 2007. The Ministry of Commerce (MOC) is expected to take responsibility for regulation over the financial leasing business. -------------------------------------------------------------- First Technical Announces Acquisition of United Recovery Services (Kropschot Financial Services initiated this transaction and served as exclusive financial advisor to United Computer Capital Corporation. VERSAILLES, Ky., First Technology Capital, Inc. ("FTC") announced that they had purchased all of the business assets of United Recovery Services ("URS"), a division of United Computer Capital Corporation (UCCC). URS, located in Cherry Hill, New Jersey, is one of the nation's leading providers of Business Continuity Services for both item and remittance processing. URS's New Jersey Recovery Facility contains all of the equipment and infrastructure necessary to allow a financial institution to recreate their production-processing environment at URS's site in the event of a disaster or outage at their production facility. Mr. James Bates, President of FTC, stated, "With hundreds of billions of dollars flowing through the item and remittance processing facilities daily, financial institutions cannot afford to be without the capability to process those transactions in a timely fashion." Mr. Bates went on to say, "There are also government regulations like Check 21 that require financial organizations to take the necessary steps to ensure the continuity of services in the event of some form of outage at the production processing site." The site in New Jersey will provide a logical extension of FTC's current recovery capabilities located both at one of their sites in Phoenix, Arizona and in partnership with a major disaster recovery supplier at a site in Atlanta, Georgia. "The ability to accommodate multiple customers in the event of a multiple disaster or a regional outage has always been of great importance to the financial community when choosing a recovery supplier," said Mr. Bates. "The addition of Cherry Hill to our inventory of facilities only strengthens our ability to accommodate multiple, simultaneous outages within our customer base." About First Technology Capital, Inc. FTC, organized in 1990, is currently the world's largest provider and lessor of secondary market MICR equipment to the financial industry. FTC buys, sells, and leases new, used and refurbished banking equipment manufactured by IBM, Unisys, NCR, BancTec and others. In addition to the MICR services, FTC offers a comprehensive array of Business Continuity Services aimed at the financial services industry. This offering provides financial institutions with comprehensive recovery back up for its check processing operation and it allows total subscriber control over the item processing operation. Corporate offices are located in Versailles, Kentucky with additional sales and service offices in Chicago, Atlanta, New York, Phoenix, and, Florida. ### Press Release ########################### Five Point Capital as San Diego's 9th Fastest Growing Privately Held Companies. The month of September has seen FPC recognized as a 2006 Inc. 500 company (#82); Dan Feder, President received the prestigious business and civic 40 Under 40 Award from the San Diego Metropolitan and the firm was one of San Diego's Top 100 Fastest Growing Privately Held Companies - ranked #9. San Diego-based equipment leasing firm, Five Point Capital (FPC) announced today that the San Diego Business Journal ranked FPC #9 on their List of San Diego's Top 100 Fastest Growing Privately Held companies. The publication hosted an invitational-only event honoring the VIP companies on September 21 at the San Diego Marriott Hotel & Marina. The 100 firms were ranked by percent of verified revenue growth from 2003 to 2005. Five Point Capital ranked #9. In the category of largest employers in the Top 100, Five Point Capital ranked 24 with 120 employees (based on local full-time employees 2005.) This achievement follows on FPC's recent #82 ranking on the 2006 Inc. 500. Sponsor San Diego Business Journal publisher (and Leasing News Advisory Board Director), Armon Mills stated, “It's not easy to qualify as one of the fastest-growing businesses in the region. Determination and drive are key, along with verve and vision.” The Top 100 companies generated $12.1 billion in revenue in 2005 and employed more than 13,620 workers. They grew on average 165%. “At Five Point Capital we help companies nationwide grow through small ticket leasing. This Top 100 honor is a tribute to the commitment of our outstanding team to our own growth. Our professionals are dedicated to one-on-one customer service. It's great to be singled out as a role model for entrepreneurs who seek to turn their ideas into big results,” said president, Dan Feder. About Five Point Capital Five Point Capital http://www.fivepointcapital.com Emerging as one of the nation's leaders in small ticket leasing, Five Point Capital (FPC) was founded by David Gilbert and Dan Feder in 1999 under the principle that “leasing can help any company grow.” The San Diego-based firm employs 120 and occupies 37,000 sq. ft. at 10525 Vista Sorrento Parkway. Five Point Capital currently serves thousands of businesses nationwide, and has doubled revenues annually since its inception. Small businesses benefit with their high performance customer service and personal attention. Each client is assigned an account executive who has specific industry knowledge about the client's business. Five Point Capital leases almost every type of new and used equipment for a wide diversity of businesses including, but not limited to: trucking, restaurants, automotive repair, construction, excavation, multimedia, manufacturing, telecommunications, printing, packaging, waste management, and more. FPC is a member of the Equipment Leasing Association and the United Association of Equipment Leasing. For more information, call (888) 576-4685. ### Press Release ########################### Two Executives To Receive Distinguished Service Awards For Marc L. Hamroff and Rodney W. Hurd Recognized For Their Volunteerism By Equipment Leasing Association -Arlington, Virginia——The Equipment Leasing Association (ELA) will honor two of its members, Marc L. Hamroff, Managing Partner of Moritt Hock Hamroff & Horowitz LLP, and Rodney W. Hurd, Managing Director and a founding member of Montgomery Street Financial, LLC., with Distinguished Service Awards in recognition of their outstanding efforts volunteering on behalf of the equipment leasing and finance industry. Their accomplishments will be formally recognized during a ceremony scheduled as a part of the October 24th general session at the upcoming ELA Annual Convention in Palm Desert, California. “The contributions of Marc Hamroff and Rod Hurd as advocates for the equipment leasing and finance industry have benefited our members and the entire industry,” said Kenneth E. Bentsen, president of ELA. “Their tireless efforts have had a positive, lasting impact and we are pleased to show them our appreciation.”

Marc Hamroff has been active in the ELA for more than 15 years, during which time he has served on both the ELA Credit & Collections and the ELA Legal Forum planning committees. As a member committed to regularly providing educational and strategic seminars to both clients and constituents in the equipment leasing industry, Hamroff has served regularly as a panel speaker at a multitude of ELA conferences, including the Legal Forum, the Credit & Collections Management Conference, the Annual Convention and the Captive & Vendor Finance Conference. He also created the ELA program called Managing the Leasing Relationship. He has also delivered Web seminars. Hamroff's seminars have included topics ranging from legal updates to creditors' rights, bankruptcy, pending legislation, fraud, and Articles 2A & 9 in an effort to promote ELA's commitment to assisting its members stay on the cutting edge of issues affecting the leasing and finance industry. Most recently, he was appointed as Adjunct Professor of Law at Touro Law School, teaching UCC Article 9: Secured Transactions, further demonstrating his commitment to providing education on issues significant to the leasing and finance industry.

Rodney Hurd is currently serving on ELA's Financial Accounting Committee, with which he has been involved for more than 20 years. His has actively participated in drafted comment letters on proposed changes in financial accounting standards, authored articles for Equipment Leasing Today, presented and moderated sessions at leasing industry conferences, and served as a member of Working Groups to the Emerging Issues Task Force on complex leasing issues. Hurd has also served as a volunteer on three leasing projects, which involved providing onsite consulting services to leasing companies in Russia and Morocco. He has a wealth of experience and expertise in the tax, accounting and structuring aspects of the equipment leasing and finance industry, and is also active in the process of working with regulators and rating agencies. Hurd also serves as a Senior Adjunct Professor at his alma mater, Golden Gate University, where he is responsible for the Accounting Department's research & communications courses. “Volunteering for the ELA has been rewarding, affords me the opportunity to network with my peers and industry leaders, and has enabled me to make great friends and colleagues,” said Hamroff. “Preparing for the many topics on which I have presented at various ELA conferences has helped me to remain sharp on the cutting legal issues that impact the leasing and finance communities. I look forward to continuing to give back to an industry that has given so much to me.” “My long-standing service to the ELA reflects my long-standing appreciation and support of leasing in capital formation,” said Hurd. “I intend my continued service to the ELA to contribute to the ongoing success of the leasing industry in the context of our society's broader goals of fair competition, ethical governance and transparency.” About ELA Organized in 1961, the Equipment Leasing Association (ELA) is the premier non-profit association representing companies involved in the dynamic equipment leasing and finance industry to the business community, government and media. As the voice of the leasing industry, ELA promotes the forecasted $220 billion industry as a major source of funds for capital investment in the United States and abroad. For more information on ELA, please visit www.ELAOnline.com. ### Press Release ########################### NetSol Technologies Meets Revenue Guidance of $18.7 Million, Company Posts a 26 Percent Increase in Gross Profits for FYE 2006 as Acquisitions and Global Growth Dominate the Year CALABASAS, CA-- NetSol Technologies, Inc., "NetSol" (NASDAQ:NTWK - News), a multinational provider of enterprise software and services for equipment financing, today announced financial results for its fiscal year end, June 30, 2006. "Fiscal year 2006 was an exciting time in the history of NetSol and significant in our success was the support of our long-term investors and business partners," said NetSol CEO Naeem Ghauri. "In year over year comparables, the company's projected increase in net revenues is a positive indicator that our September 11, 2006 fiscal year 2007 guidance of approximately $30 million, a 60 percent increase in revenue growth, is on target." Full press release at: http://biz.yahoo.com/iw/060925/0166154.html ### Press Release ########################### Promotions at First Business Finance Services

MADISON, Wis., -- First Business Financial Services, Inc. (NASDAQ:FBIZ - News) and First Business Bank - Madison are pleased to announce the following promotions.

Michael Losenegger Michael Losenegger has been named Chief Operating Officer of First Business Financial Services, Inc. He has also been named Chief Executive Officer of First Business Bank - Madison and he will continue to serve on the bank's Board of Directors.

Mark Meloy Mark Meloy has been named President of First Business Bank - Madison. He has also been elected to the First Business Bank - Madison Board of Directors.

Dennis Sampson

Anthony Larson Dennis Sampson and Anthony Larson have been named Senior Vice Presidents of First Business Bank - Madison. These promotions complete the succession plan previously announced whereby Corey Chambas will become Chief Executive Officer of First Business Financial Services, Inc. on or before January 2, 2007. He will continue in his role as President and Director of the First Business Financial Services, Inc. and as a Director of First Business Bank-Milwaukee, First Business Leasing, and First Business Capital Corp. About First Business Financial Services, Inc. First Business Financial Services (NASDAQ:FBIZ - News) is the parent of the First Business family of companies, managing shareholder relations and providing access to capital for our operating entities. Its companies include: First Business Bank - Madison and First Business Bank - Milwaukee (individually chartered banks, not branches), First Business Trust & Investments, First Business Leasing, LLC, and First Business Capital Corp. About First Business Bank - Madison First Business Bank was established by area business owners and investors in 1990 to specialize in quality business banking for the local business community. First Business Bank offers a full line of financial services for businesses and business owners, including: commercial loans, cash management products and remote deposit, Internet banking, retirement plans/investment management services/trustee services, asset based lending, and equipment leasing. For additional information, visit http://www.fbbmadison.com or call 608-238-8008. ### Press Release ###########################

News Briefs---- Granite City Signs Leasing Finance Deal Consumer confidence rises more than expected in September Consumer sector drives ABS market Enron's Fastow Gets 6 Years Ebbers Starts 25-Year Term For Fraud at WorldCom High-tech jobs grow this year/but still lag marketplace ---------------------------------------------------------------

You May have Missed--- 100 best companies for working mothers, according to Working Mother magazine ---------------------------------------------------------------

Sports Briefs---- A's win, Angels lose, magic number zero Owens suffers allergic reaction to medication ----------------------------------------------------------------

California Nuts Briefs--- Polls show governor's lead widens

Angelides camp says there's still time for a turnaround ----------------------------------------------------------------

“Gimme that Wine” A Finicky Grape Finds New Glory- gewürztraminer/Eric Asimov 2006 Wine Industry Salary Report released 360 Global Wine posts $24 million half-year loss; divests of Kirkland Ranch, mining interests Good wines now come with screw caps, pop tops and paper "bottles" The Master of Wine title is the wine professional's grail Wine Prices by vintage US/International Wine Events Winery Atlas Leasing News Wine & Spirits Page The London International Vintners Exchange (Liv-ex) ----------------------------------------------------------------

Calendar Events This Day Ancestor Appreciation Day Ethopia: True Cross Day World Tourism Day ----------------------------------------------------------------

New York City: The term "The Big Apple" was coined by touring jazz

----------------------------------------------------------------

Today's Top Event in History 1912-WC Handy publishes “Memphis Blues.” Although others believe it to be the first Blues song published, it was not. It was the first blues Handy ever wrote. Many consider it to be the first blues song in history, although due to Handy's problems finding a publisher it was preceded in print by Baby Seals Blues by Artie Matthews, in August of 1912 and the Dallas Blues by Hart A. Wand in September of the same year. Handy's song, which had been released as an instrumental in 1910. http://www.jass.com/Others/wchandy.html http://www.satchography.com/sessions5/s540712.html ----------------------------------------------------------------

This Day in American History 1514- The Spanish crown granted explorer Juan Ponce de Leon the title Military Governor of Bimini (an island in the Bahamas) and Florida. With this title and the implied permission it contained to colonize those regions, Ponce de Leon sailed for Florida in 1521. --------------------------------------------------------------

Baseball Poem . That is the Question? 2B or not 2B, Written by Robert L. Harrison -------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? |

||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

||||||||||||||||||||||

Editorials (click here) |

||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

||||||||||||||||||||||

|

||||||||||||||||||||||

|