Friday, April 25, 2008 Headlines--- Classified Ad---Syndicator ######## surrounding the article denotes it is a “press release” ------------------------------------------------------------------ Classified Ad---Syndicator

Overland Park, KS Westchester County, NY For a full listing of all “job wanted” ads, please go to: Leasing Recruiters: To place a free “job wanted” ad here, please go to: -------------------------------------------------------------- Brokers not Paid

The story about one of the brokers not being paid may wind up as a legitimate Bulletin Board Complaint or be resolved. It is difficult to believe that the independent leasing company in question wants to be named in a legitimate complaint in Leasing News, especially at this time. Another company, located in Southern California, was brought up as “slow pay” recently by brokers, with several not paid for almost a month. The problem here is none of those who have report their commission is owed want their name to be mentioned as they are afraid of retribution or worse, not getting paid. It seems this cash flow of money owed may be a “sign of the times.” -------------------------------------------------------------- Leasing Up, but Down?

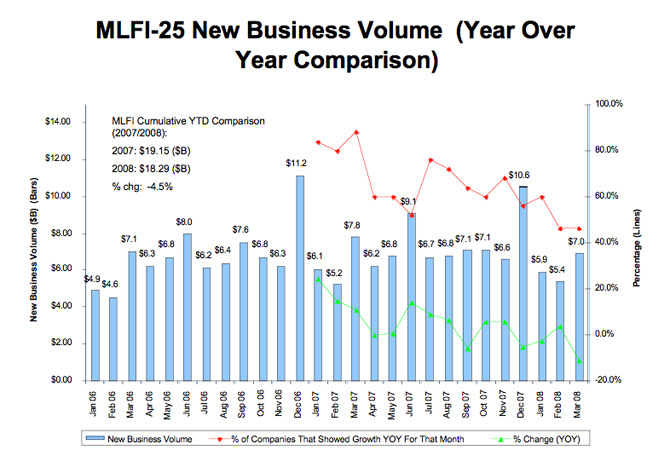

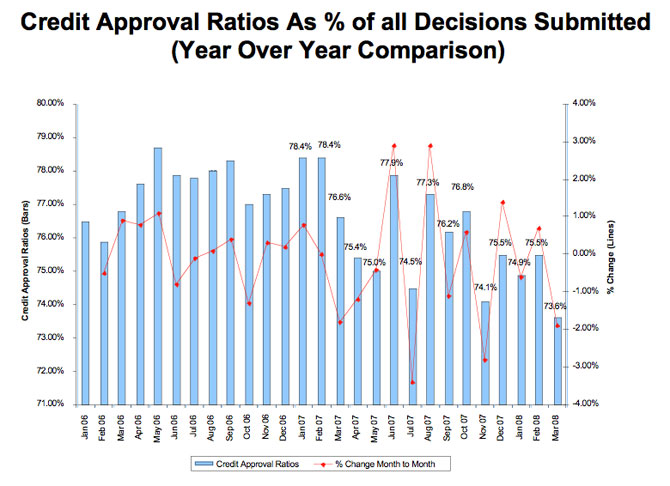

The Equipment Leasing and Finance Association (ELFA) MLFI-25 report showed originations going from $5.4 billion to $7 billion from February to March, but stated in their press release to the media: “the increase was anticipated due to the quarter-ending cyclicality of the equipment finance business.” The ELFA press release appeared to be more concerned with “March decreased 10.3 percent when compared to March 2007. “ The other media picked this up that the subprime mortgage debacle has

The perspective is a matter of opinion, comparing a current month to a previous month or the same month to one the previous year; being positive or being negative. Today is certainly a different market place than a year ago. The situation may be likened to the half full glass or a half empty glass analogy. The glass is half full when viewed as good news that leasing originations were on the plus side compared to the previous month. Half-empty when comparing to the previous year. More important than which view point is more accurate was the MFLI-25 result: current credit approvals for March:  “Overall credit quality over the last two plus years has been extraordinary and some back up should be expected,” the honorable Kenneth E. Bentsen, Jr. President of the ELFA, said. “And it is likely that the commercial finance sector is feeling the effects of the credit crunch putting downward pressure on new originations.

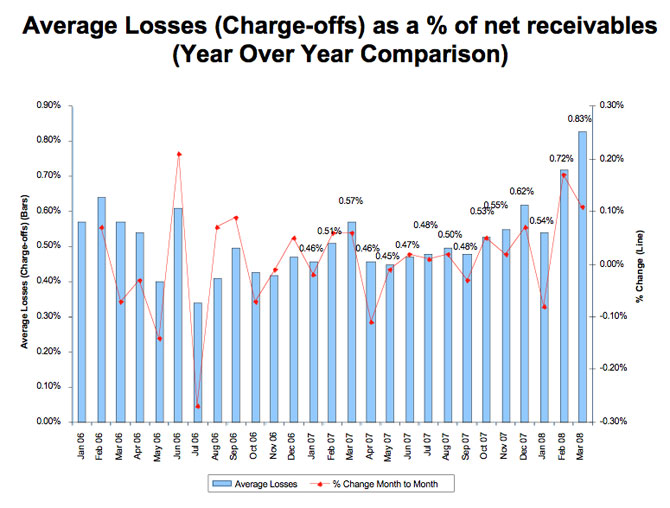

“Clearly the deterioration of the housing sector and credit crisis have had some effect on corporate capital investment appetite and balance sheets,” he added. David Merrill, President, Fifth Third Leasing Company, located in Cincinnati, Ohio, said, “The MLFI-25 indicates credit approval rates are down and delinquencies are up slightly after a period of exemplary performance and we are now seeing slower volume which indicates caution,” said David Merrill, President, Fifth Third Leasing Company, located in Cincinnati, OH.” “The downturn is not widespread, however. Trucking, construction related sectors and rail have been most affected,” said Merrill. Fifth Third Leasing Company is the newest participant in the MLFI-25. Charge-offs were also up:

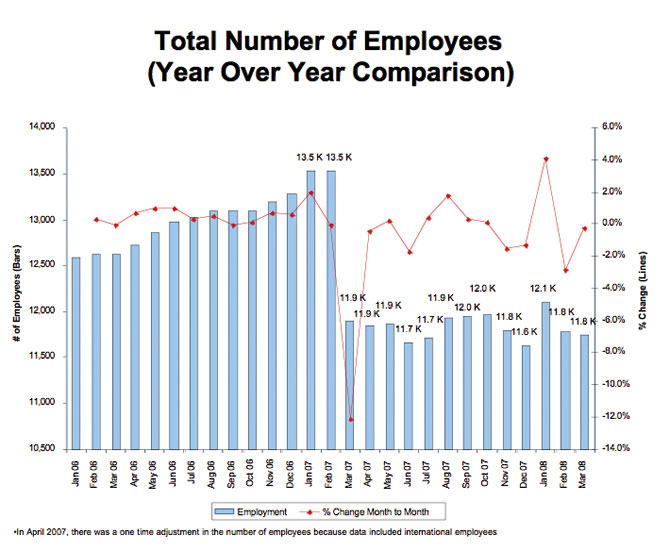

The chart also showed that employment was down, although the numbers that appeared were the same. This could be because LaSalle Equipment Leasing was no longer part of MLFI-25

ELFA MLFI-25 Participants ADP Credit Corporation -------------------------------------------------------------- Judge rules against IFC appeal in Texas by Christopher Menkin

In a major legal blow, IFC, Morton Grove, Illinois lost their appeal regarding the “hold back” issue and NorVergence leases in Texas regarding SOS or Specialty Optical Systems, Inc. This not only costs IFC a lot of money, losing the appeal, but hits right before their bench trial to start next week in Chicago, Illinois brought by the Federal Trade Commission. It appears IFC thinks the FTC is a “paper tiger.” Judge Martin Richter of the Fifth District of Texas at Dallas ruled: Judge Richter also stated: "We conclude the evidence was sufficient to support the trial court's finding that the Lease was unenforceable because Specialty was fraudulently induced to sign it. IFC's third issue is resolved against it. Because of our resolution of this issue, we need not reach IFC's remaining issues concerning the judgment." IFC did win the sanction to not have to inform all NorVergence leases of the motion regarding ‘hold back” as well as costs the judge wanted to add to the decision: "The court awarded $22,078.25 in attorney's fees for the motion when the entire amount of attorney's fees for the trial of the matter were only $45,000. See Footnote 4 The amount of costs incurred, as established by affidavit, were $401.96, and the court gives no explanation or authority for doubling these costs. The record is also silent as to the court's rationale for requiring IFC to contact other lessees in other litigation or for the court's appointment of Specialty's counsel to police the notification process. Without guidance from the court as to the nature of the offensive conduct, we are unable to determine a relationship between the sanction, the conduct, and the abuse sought to be remedied. Accordingly, we conclude the trial court abused its discretion when it awarded sanctions against IFC. We sustain IFC's ninth issue. "Specialty moved for summary judgment prior to trial. IFC filed a response supported by the affidavit of executive vice-president Patrick Witowski. The affidavit stated that IFC took assignment of the Lease by paying the purchase price of $24,723.51, the amount of damages to which IFC claimed it was entitled to recover on its counterclaim for breach of contract. When it was subsequently disclosed that IFC paid only $11,743.67 of the full purchase price for the Lease, Specialty filed a motion for sanctions. The motion requested that IFC be sanctioned because Witowski's affidavit constituted perjury. “ Following the entry of final judgment, the court conducted a hearing on the motion for sanctions. Witowski testified that the $13,000 discrepancy between the contractual purchase price and the amount paid resulted from two holdbacks in the amount of $6, 180.88 and one for $618.09. Witowski explained that the accounting for the holdbacks was complicated, and the court agreed. Although the holdbacks were never paid to NorVergence because it never met the conditions triggering payment, IFC claims the holdbacks were effectively credited to NorVergence because the total amount of NorVergence's recourse obligations to IFC for its breach far exceeded the amount of its holdbacks. Witowski testified that the statement he made in his affidavit was not false. “At the conclusion of the hearing, the trial court entered an order sanctioning IFC. The order requires IFC to send letters to all lessees against which it has made claims under leases or rental agreements acquired from NorVergence. The letter must explain the precise amount of money paid to NorVergence, the basis for and amount of any holdbacks, the basis for the holdback, and the manner in which the holdbacks were applied in IFC's accounting records. Although IFC is in litigation with many of the lessees, none are a party to this case. IFC is also ordered to provide copies of the letters to counsel for Specialty and to pay counsel for Specialty the sum of $13,600 as reimbursement for the fees to be incurred monitoring IFC's compliance. The order also awards $22,078.25 to Specialty for attorney's fees incurred in bringing the motion, and the sum of $803.92, representing two times the actual costs incurred by Specialty. In its ninth issue, IFC argues the imposition of sanctions constitutes an abuse of discretion because: (1) the entry of the award violates IFC's fundamental right of due process because IFC was not given notice that the holdbacks would constitute a basis for sanctions in the absence of a finding that IFC committed perjury; (2) it is Judge Martin Richter ruling: Leasing News to be sued for slander re: IFC/SOS story: -------------------------------------------------------------- Cartoon—Rudy loses control

-------------------------------------------------------------- Fed Weighs Pause After Next Rate Cut

ELFA eNews Daily The Federal Reserve has cut the federal funds rate to 2.25 percent from 5.25 percent, amounting to seven reductions over a span of eight months, and experts anticipate another 0.25 percentage point cut at its April 29-30 meeting. However, experts think the central bank could take a breather after the next rate cut to give officials time to assess the impact of rate reductions, upcoming tax rebates, and other measures on the economy during the latter half of the year. Moreover, there are concerns that further reducing the federal funds rate could increase inflationary pressure and weaken the dollar even more. Despite rising food and oil prices, officials point to some improvements in the financial markets, with the 30-year mortgage rate on the decline; however, they note that stricter lending standards could worsen the downturn. The statement issued by the Fed after its meeting likely will point to ongoing concerns about economic growth and inflation and suggest that additional rate cuts will be made as necessary.

-------------------------------------------------------------- Leasing Industry Help Wanted Collector

Document Processor

Leasing Sales Representative

Special Assets Workout Officer

-------------------------------------------------------------- Sudhir with two ex-Monitor staff starts WLN

Please do not get this confused with Leasing News, as it is not an affiliated publication. The recognized international leasing trainer Sudhir Amembal has joined together with the former editor and advertising director of the Monitor to start World Leasing News. Lead by Sue Lafter, who also is the editor of the United Association of Equipment Leasing “Newsline,” and former editor of the Monitor, as well as Susie Angelucci, the former Monitor advertising director, they promise a bi-weekly internet magazine (up-dated daily) plus a monthly printed magazine to 20,000 subscribers starting in June, 2008. Angelucci, Rafter, Sampaio, Frontario “Cha, Cha, Cha!” Sue Angelucci, Lisa Rafter, The Monitor; Len Sampaio, Security Financial Services; and Frank L. Frontario, Mercantile Lessors, Inc. shakin’ it on the way to Las Fiesta de Los Vientes.” “Our reach of over 20,000 subscribers (15,000 domestic; 5000 international) doubles the reach of other industry publications! And, includes each and every member of ELFA, UAEL, NAELB, EAEL, plus so many more!!! WLN is unique -- as it will offer weekly blogs, audio interviews, webinars, regular columns, plus news and more!” “Currently, we are offering special "pre launch" rates (effective only through 6/15/08). WLN will offer several products including:

Evidently the key promoter will be Sudhir Amembal, who billed himself as "the world renown leasing trainer," when he introduced “2006 Asian Leasing Yearbook” as his 14th book on leasing. The press release also stated, "He is chairman of the recently formed Asian Centre for Lease Education (ACLE). ACLE offers a Certified Professional in Leasing (CPL) programme in the Asian region.” This is his second try at a news web site, having a site constructed when he was involved with Amembal Capital, as Leasing News wrote about. He did not found Amembal Capital, but joined the company in 1996 as a minority investor and was elected Chairman. The company was founded by Loni Lowder in 1979 as PFC Group. In February, 2002, Sudhir sold his interest in Amembal Capital which changed its name to ACC Capital April, 2002, he became a member of the Advisory Board of Odessa Technologies, Inc. has endorsed LeaseWave, Odessa’s Internet based lease accounting and asset management system. His next venture was Leasing Institute of America: In December, 2005, Sudhir Amembal joined Leaseinspection.com as an advisor. He also reportedly even made sales calls. April, 2008: WLN Media Kit: More information on the new software Leasedream:

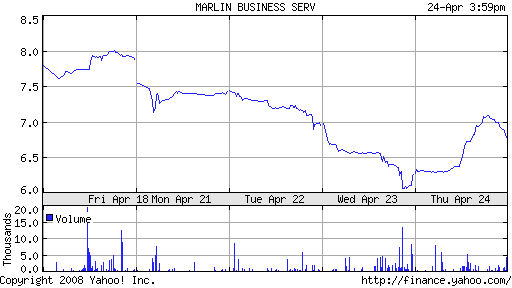

-------------------------------------------------------------- Marlin’s New Director guesses wrong

It was as low as $6.27 yesterday, but finished at $6.79. On April 17, 2008 new Marlin Business Service Director purchased “Matthew J. Sullivan, 50, Partner with Peachtree Equity Partners 2008 He now owns 7,000 shares direct and 2,309,934 indirect. “The 2,309,934 reported shares are owned directly by WCI (Private Equity) LLC, whose sole manager is Peachtree Equity Investment Management, Inc. (the "Manager"). The reporting person is one of the directors of the Manager and could be deemed to be an indirect holder of the reported shares. The reporting person disclaims beneficial ownership of these shares and this report shall not be deemed an admission that he is the beneficial owner of these shares for purposes of Section 16 or for any other purpose, except to the extent of his pecuniary interest therein.” SEC filing:

-------------------------------------------------------------- Business Bankruptcies Rose 43 Percent in 2007 ELFA eNews Daily

An Euler Hermes report estimates that the number of businesses that sought protection from bankruptcy increased 43 percent from 19,695 businesses to 28,322 between 2006 and 2007, as indicated in final figures issued by the U.S. bankruptcy courts. Euler Hermes ACI chief economist Dan North stated, "The escalation in bankruptcies is a direct result of the deterioration in the U.S. economy, which is now in recession. Businesses are now facing a serious combination of factors which will almost certainly continue the trend of increased bankruptcies, including skyrocketing energy and commodities prices, plummeting house prices, job loss, a slowing consumer, record foreclosures and delinquencies, and tightening credit conditions." North said the volume of bankruptcies will probably swell over the next year as the economic recession continues.

-------------------------------------------------------------- **********announcement********************************** ELFA Legal Forum Deadline

The registration list deadline for the Equipment Leasing and Finance Association Legal Forum is today, April 25; after tomorrow you will not be included in the published registration list. Non-members may attend and a second attorney from a law firm may attend at a reduce price. ELFA Legal Forum is considered the Industry Standard on Legal Information and Education In view of the leasing market place, attorneys specializing in leasing will be much busier than last year. This year's program, scheduled for May 4-6, 2008 at the Westin Michigan Avenue in Chicago Illinois, offers up the same great sessions and networking events attendees have come to expect. And the amazing resource materials developed by speakers and presenters are incomparable. Attendees have been known to save the conference notebooks as reference guides which they turn to year after year. Please take a moment to review this years agenda by going here: http://www.elfaonline.org/pub/events/2008/LF/ We are sure you will agree that the ELFA Legal Committee has once again put together an agenda that you won't want to miss. ***** Announcement************************************ --------------------------------------------------------------

“Mediation” Paul Bent, Attorney at Law (Monday’s Leasing #102 by Terry Winders, CLP, discussed arbitration, and did mention mediation. Perhaps one of the best, if not the best authority on leasing mediation is attorney Paul Bent of the Alta Group. Here he brings up points that readers may not know about the process. editor.) Mediation is always non-binding and always completely confidential, so the parties don’t have to worry that their statements or positions during the mediation will be used against them if there is no settlement. However, once they reach a settlement and sign an agreement, that agreement is just as binding as any other contract. In fact, many settlement agreements include very tough sanctions that automatically come into play if a party breaches the settlement agreement itself. (I just mediated and settled a case in which, if the borrower defaults on the settlement agreement itself, the lender can immediately go to court and automatically get a judgment against the borrower, with no trial or other delays. This is called a “stipulated judgment,” and it gives the lender or lessor a lot of comfort that the borrower/lessee can’t just default again like he did on the original loan or lease.) Regarding arbitration, this can be either non-binding (advisory) or binding, as chosen by the parties themselves before the hearing. As Terry says, in binding arbitration the arbitrator’s award can be filed in court and enforced as a judgment. Also note there are other providers of arbitration services besides the AAA, including the National Arbitration Forum (NAF) and JAMS. All have their own rules and all have panels of arbitrators to choose from in various areas of the law. (AAA arbitrators are not required to be lawyers, although many of them are. NAF arbitrators are all lawyers.) Usually, the parties can select the arbitrator from a list provided by the arbitration service – a “strike list,” from which the parties strike the ones they don’t like. There aren’t a lot of arbitrators who are experts specifically in leasing and secured lending, although there are usually enough that the parties can select someone they feel is well qualified. (E.g., I’m on both the AAA and the NAF panels, and all of my cases are in leasing or secured lending.) One other thing to note. The parties have complete control of the process, whether mediation or arbitration. They can pick the mediator or arbitrator, they can select the provider, they can make the rules for the hearing, and they can decide how they want to hearing to be handled. The courts will honor almost anything they agree on as to rules and procedures, as long as they’re spelled out in the agreement. Therefore, it’s very important for lessors to make sure their lawyers or documentation specialists include complete language and rules in the lease agreement itself. Some arbitration provisions go on for several pages and lay out exactly how the process should go. (As just one example, I recently arbitrated a commercial lending dispute in which the loan agreement included, among many other things, detailed provisions for who should pay the arbitration fees and costs, and when and how they should be divided up.) Lessors should not hesitate to include as much detail as possible in the dispute resolution section of the lease agreement. That is almost always better then simply relying on the AAA rules or the Federal Arbitration Act, which don’t address specific financing issues at all. Paul Bent As a principal of the Alta Group, he serves as an industry expert in legal matters involving leasing, complex corporate financings, transaction structuring, and contract interpretation; and he provides services as a neutral mediator and arbitrator in difficult disputes over leasing and corporate finance, with emphasis on maintaining relationships and avoiding litigation. In addition to serving as a principal of The Alta Group, he is the founder, president and general counsel of GoodSmith & Co., Incorporated, a corporate financial services firm specializing in large-ticket leasing and asset-based corporate financing. Paul Bent is an active musician;– now a singer, formerly a violinist and bass player. He is a professional, on the payroll of the Los Angeles Master Chorale, singing at 8 concerts a year at Walt Disney Concert Hall. He also is active in singing in the Los Angeles, California area, “Dispute Resolution” by Mr. Terry Winders, CLP -------------------------------------------------------------- NationaLease Establishes Private Equity Fund truckinginfo.com NationaLease has established a private equity fund to "enable effective ownership transition of existing NationaLease members and provide an opportunity for new ownership to gain viable entry as an independent lessor in the truck leasing and rental industry," said Roger Welling, senior VP, NationaLease.

--------------------------------------------------------------- Leasing News Advisory Board Member Biography Andrew Lea – East meets West

Andrew Lea joined the Leasing News Advisory Board on February 5, 2004. In a lunch at the Vognier, San Mateo, California, with his boss John McCue of McCue Systems, it was recommended that Lea join the advisory board because he was "very creative, up on the latest technology, and could add many good ideas. He would be a great asset." Later McCue Systems would be merged with the international software company NetSol Technologies and McCue Systems then would not only represent the United States, but have the opportunity to expand into other markets. It was Andrew Lea's idea to name his feature "East meets West" because of this event. Andrew was responsible for winning this recognition for McCue Systems, one among many examples. He also gets an award here among Leasing News Advisors for making the most suggestions, coming up with new ideas, pointing out ways for improvement. Most of all, he is not afraid to communicate, even if his observation is not adopted. It should be pointed out – he does have a very high batting average; someone you definitely want on your team.

--------------------------------------------------------------- First Sound Bank Grows Significantly -- First Sound Bank (OTC Bulletin Board: FSWA - News) today reported after-tax earnings of $587 thousand for the quarter ending March 31, 2008, compared to $334 thousand for the first quarter a year ago. First quarter 2008 earnings include a first-time tax provision of $273 thousand and reflect the impact of the acquisition of substantially all of the assets -- as well as a subsequent sale of leases -- of Puget Sound Leasing Company, Inc. Acquisition of the leasing company was completed on March 1, 2008. First Sound Bank's net interest margin showed improvement over year-end 2007, increasing from 4.54 to 4.85 percent. This margin is adversely affected by reductions in the prime rate as more than 55 percent of the bank's loans are made at a variable rate and re-price immediately upon any change in prime. The adverse effects of cuts in the prime rate are offset to some degree by interest rates charged on the lease portfolio, which are priced at a fixed rate. Credit quality continues to be good, with minimal increases in delinquencies. First Sound Bank -- which has no exposure in the subprime real estate market -- recognizes, however, the need to be continually diligent in the oversight of credit in light of the current downturn in the economy. First Sound Bank's efficiency ratio at quarter-end was 58.7 percent -- a 10.9 percent improvement over the ratio at year-end. "The integration of Puget Sound Leasing and First Sound Bank is going very well," said First Sound Bank Chairman and CEO Don Hirtzel. "There is a high regard among staff on both sides, we have very compatible management teams, and Puget Sound Leasing's strong, new equipment leasing generations compare favorably to last year's volumes." "We remain quite confident about the opportunities available in this marketplace for a commercial bank such as First Sound," said First Sound Bank President and COO Steve Shaughnessy. "Our clients continue to recognize and applaud our service, our responsiveness and our flexibility in helping them to achieve their business objectives, and -- most importantly -- they recommend us to their peers." First Sound Bank was founded in July 2004 with initial investor capital of $20 million -- at the time, the most equity ever raised by a de novo bank in the Northwest. In the fall of 2006, the bank raised an additional $11 million in capital. With $255 million in assets, the bank serves clients with a dedicated 89-person staff located in its downtown Seattle office and its leasing company in Bellevue. For a more detailed financial analysis, contact jgould@firstsoundbank.com Certain statements in this press release, including statements regarding the anticipated development and expansion of First Sound Bank's business, and the intent, belief or current expectations of the company, its directors or its officers, are "forward-looking" statements (as such term is defined in the Private Securities Litigation Reform Act of 1995). Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. About First Sound Bank First Sound Bank is a Seattle-based bank offering customized banking for small- to medium-sized businesses, organizations, not-for-profits and professionals in the Puget Sound region. Founded by a team of veteran local banking executives, First Sound Bank is committed to delivering personalized service, convenient access and competitive rates to support the needs of the business community. First Sound Bank offers online banking at http://www.firstsoundbank.com plus an expansive banking network in the western U.S., as well as ATM banking throughout the country and abroad. ### Press Release ########################### Sterling Bancorp Reports 22% Rise in EPS for 2008 First Quarter, NEW YORK, -- Sterling Bancorp (NYSE: STL), a financial holding company and the parent company of Sterling National Bank, today reported its financial results for the first quarter ended March 31, 2008. "Sterling is off to a strong start for 2008. In a period of nearly unprecedented economic turbulence, we delivered a 22% increase in earnings per share, continued loan growth, rising core demand deposits and stable asset quality. Our increased profitability was the result of our continuing focus on growing our business and improving the net interest margin, while controlling funding costs, credit risk and operating expenses," noted Louis J. Cappelli, Chairman and Chief Executive Officer. He added, "At a time when many financial institutions have suspended or reduced their dividends, Sterling has continued its commitment to this important element of shareholder value, most recently with the dividend paid on March 31, 2008." "In the critical area of asset quality, Sterling continued to benefit from our longstanding prudent approach to underwriting and risk management. While no institution is immune to the present disruption in the financial markets, we have a diverse loan portfolio with limited exposure to consumer debt, home equity lending products, credit card receivables, auto loans or other asset classes that have recently generated losses for some institutions." "We are continuing to experience positive momentum in our business, reflected in our robust loan pipeline," Mr. Cappelli continued. "We remain a consistent and reliable source of funding, while some competing institutions have had to withdraw from providing credit due to capital constraints or the dislocation caused by industry consolidation. We continue to believe that, in the current environment, our strong capital and liquidity have positioned Sterling to take advantage of opportunities to serve the unmet credit needs of customers in our market." First Quarter 2008 Financial Results Net income for the 2008 first quarter was $4.0 million or $0.22 per diluted share, an increase of 22% in EPS compared with $3.5 million or $0.18 per diluted share for the same quarter of 2007. The primary source of this earnings increase was higher net interest income, which rose to $20.0 million on a tax equivalent basis for the first quarter of 2008, up 13.1% from $17.6 million in the same period of 2007. The increase in net interest income primarily reflected higher interest income generated by growth in earning assets, coupled with lower funding costs due to the Federal Reserve's actions on interest rates and the Company's strategy to employ wholesale funding rather than rely on higher-priced certificates of deposit. Reflecting the above factors, the net interest margin rose to 4.39% for the 2008 first quarter versus 4.24% for the same period last year. Noninterest income was $8.7 million for the first quarter of 2008, compared with $9.2 million in the same period last year. The decrease principally resulted from lower mortgage banking income due to valuation adjustments on loans held for sale, coupled with lower volume of loans sold and higher losses on sales of other real estate owned. Noninterest expenses for the 2008 first quarter were $20.2 million, compared to $19.6 million for the same quarter last year. Reflecting the Company's cost-control discipline, this was an increase of only 2.7%, primarily due to higher salaries and benefit costs. The provision for income taxes was $2.4 million and $2.2 million for the first quarter of 2008 and 2007, respectively. Asset and Deposit Growth Loans held in portfolio, net of unearned discounts, were $1,155.4 million at March 31, 2008, up 6.9% from March 31, 2007. The year-over-year growth in the loan portfolio reflected robust demand in the Company's marketplace. Investment securities totaled $761.0 million at March 31, 2008, up from $571.3 million a year ago, primarily due to the implementation of asset/liability management strategies designed to capitalize on current market conditions. Demand deposits were $494.3 million at the end of the 2008 first quarter, compared to $461.7 million a year earlier, and represented 33% of total deposits, one of the highest ratios of demand to total deposits in the industry. Asset Quality Highlights The provision for loan losses was $2.0 million for the first quarter of 2008, compared to $1.3 million for the prior year period. The ratio of nonperforming assets to total assets was 0.42% at March 31, 2008, compared to 0.43% at March 31, 2007. The allowance for loan losses as a percentage of total loans held in portfolio was 1.31% at March 31, 2008, compared to 1.46% at March 31, 2007. The adequacy of the provision and the resulting allowance for loan losses is determined based on management's continuing evaluation of the loan portfolio, including an assessment of current and expected future economic conditions, the changing mix of loans in the portfolio, and numerous other factors. Capital Management and Dividends As of March 31, 2008, the Company exceeded the requirements for a well- capitalized institution for regulatory purposes. Its Tier 1 risk-weighted capital ratio was 9.73% and its Tier 1 leverage ratio was 6.76% at that date. Sterling paid a cash dividend of $0.19 per common share on March 31, 2008, to shareholders of record as of March 15, 2008. This extended the Company's record of dividend payments to 249 consecutive quarters, or more than 62 years. Conference Call Sterling Bancorp will host a teleconference call for the financial community on April 24, 2008 at 10:00 a.m. Eastern Time to discuss the 2008 first quarter financial results. The public is invited to listen to this conference call by dialing 800-762-7308 at least 10 minutes prior to the call. A replay of the conference call will be available beginning at approximately 1:00 p.m. Eastern Time on April 24, 2008 until 11:59 p.m. Eastern Time on May 8, 2008. To access the replay by telephone, interested parties may dial 800-475-6701 and enter the access code 920378. About Sterling Bancorp Sterling Bancorp (NYSE: STL) is a New York-based banking and financial services company that serves the needs of businesses, professionals and individuals. With assets exceeding $2.1 billion, Sterling offers a broad array of products and services, combined with a unique high-touch approach to customer service. The Company's principal banking subsidiary, Sterling National Bank, with offices in New York City and Queens, Nassau and Westchester counties, was founded in 1929. Known for its focus on business customers, Sterling offers such services as working capital lines, asset-based financing, factoring and accounts receivable management, payroll funding and processing, equipment leasing and financing, commercial and residential mortgages, international trade financing, cash management, a wide array of deposit products, trust and estate administration, and investment management services. ### Press Release ########################### TCF Stockholders Approve Proposals at Annual Meeting WAYZATA, Minn., -- TCF Financial Corporation ("TCF") (NYSE:TCB) announced today, following its annual meeting, that TCF stockholders elected four directors, voted to eliminate the classified board structure and provide for the annual election of Directors, and voted in favor of the appointment of KPMG LLP as independent registered public accountants for the fiscal year ending December 31, 2008. TCF is a Wayzata, Minnesota-based national financial holding company with $16.4 billion in total assets. The company has 453banking offices in Minnesota, Illinois, Michigan, Colorado, Wisconsin, Indiana and Arizona, providing retail and commercial banking services, and investments and insurance products. TCF also conducts leasing and equipment finance business in all 50 states. ### Press Release ########################### Fitch: Pressure on Global Bank Ratings Intensifies in Q108 Fitch Ratings-London/Paris/NY/HK- Fitch Ratings says the ongoing illiquid and volatile conditions in global financial markets are continuing to put pressure on bank ratings. In Q108, the negative shift in the ratio of Positive to Negative Outlooks continued, while the number of negative rating actions taken during the quarter remained at a comparatively high level. According to the latest Fitch quarterly series of "Global Bank Rating Trends" reports, the operating environment for banks in 2008 is likely to remain challenging and further pockets of negative rating actions are possible. "Some of the major US banks have been hit particularly hard," says Alison Le Bras, Managing Director in Fitch's Financial Institutions Group. "Although measures by the US Federal Reserve have improved short-term funding, several of the major US commercial and investment banks now have Negative Outlooks or Watches." While Q407 saw the highest level of negative rating actions (69) since the series of publications began, Q108 saw a continuation of the gloomy trend with some 52 negative rating actions. At the same time, the number of Positive Outlooks compared to Negative Outlooks continued to decline, standing at 1.7 to 1 at end-Q108 compared with a peak of around 5 to 1 just one year earlier. Although the number of negative rating actions in developed markets fell to 41 in Q108 from 48 in Q407, outright downgrades remained historically high at 18. These downgrades were in the developed Americas and Europe. Banks in emerging markets, on the other hand, have fared better to date, despite some exceptions such as in Kazakhstan. Nevertheless, the ratio of Positive to Negative Outlooks in emerging markets declined further during the quarter, suggesting that the more positive rating trend in these markets may be coming to an end. While globally 78.3% of Fitch's bank ratings still have a Stable Outlook, the number of ratings with a Positive Outlook (10.8%) continues to decrease at the expense of a greater proportion of banks having a Negative Outlook (6.5%). The report, entitled "Global Bank Rating Trends Q108" will be available shortly on Fitch's public website, www.fitchratings.com. ### Press Release ###########################

News Briefs---- Ford Reports Profit up: $100MM Europe sales New home sales plunge to lowest level in 16½ years Rates on 30-year mortgages top 6% this week Microsoft 3Q profit falls 11% from Vista-heavy 2007 quarter AmEx says profit falls 6% as cardholders miss payments Immelt faces room of angry GE shareholders Carly: 'Not that sad' to be eliminated from 'Idol' ---------------------------------------------------------------

You May have Missed--- A Losing Year at Countrywide, but Not for Chief ----------------------------------------------------------------

“Gimme that Wine” Russian River Valley Pinot Noir Gets Its Dew The booming wine market Saving the world from Frankenwines Bolt From the Blue’ on a Tuscan Red Rum's ship comes in Wine Prices by vintage ----------------------------------------------------------------

Calendar Events This Day Anzac Day (Australia) Arbor Day Cuckoo Day National Zucchini Bread Day Penguin Awareness Day and World Penguin Day Saint feast Days

http://www.catholic.org/saints/f_day/apr.php ----------------------------------------------------------------

EARS If your right ear itches, someone is speaking well of you.

----------------------------------------------------------------

Today's Top Event in History 1928 - Buddy, the first seeing eye dog, was presented to Morris S. Frank on this day. Many seeing eye organizations and schools continue to offer specially trained dogs “...to enhance the independence, dignity, and self-confidence of blind people...” (visit http://www.seeingeye.org/). [headlines]

This Day in American History 1507-Little is known about the obscure scholar now called the "godfather of America," the German geographer and mapmaker Martin Waldseemuller, who gave America its name. In a book titled Cosmographiae Introductio, published this day, 1507, Waldseemuller wrote: "Inasmuch as both Europe and Asia received their names from women, I see no reason why any one should justly object to calling this part Amerige, i.e., the land of Amerigo, or America, after Amerigo, its discoverer, a man of great ability." Believing it was the Italian navigator and merchant Amerigo Vespucci who had discovered the new continent, Waldseemuller sought to honor Vespucci by placing his name on his map of the world, published in 1507. First applied only to the South American continent, it soon was used for both the American continents. Waldseemuller did not learn about the voyage of Christopher Columbus until several years later. Of the thousand copies of his map that were printed, only one is known to have survived. Waldseemuller probably was born at Radolfzell, Germany, about 1470. He died at St. Die, France, about 1517-20. NBA Finals Champions This Date -------------------------------------------------------------- Spring Poem Hot Stove by Two Finger Carney Before television Smell the bread baking Pull off your wet boots Against Carl Hubbell If they could be resurrected Was it better when the gloves were small For the '27 Yankees Steer clear of religion and politics Was the best-pitched game The stoves are in junk yards or museums now, forever cool -------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm -------------------------------------------------------------- Daily Puzzle How to play: Refresh for current date: --------------------------------------------------------------

http://www.gasbuddy.com/ -------------------------------------------------------------- Provence, France-Vacation http://le-monastier.site.voila.fr/ -------------------------------------------------------------- News on Line---Internet Newspapers Vero Beach, California -------------------------------- |

||||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

||||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

||||||||||||||||||||||||

Cartoons |

||||||||||||||||||||||||

Editorials (click here) |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|