|

|

Small ticket leasing company looking for someone to negotiate end lease settlements (renewals, FMV, etc.) and run the department. Report directly to the Director of Operations. Require 2+ yrs. experience minimum. Attractive Compensation $65k to $90k 1 st yr. + benefits. Please email resume to: |

Wednesday, December 17, 2008

| Actor/Author/Singer/Songwriter Thomas William Hicks born 17 December 1936 Bermondsey, London, England. Lead singer for the Frontman, one of England's first Rock'n'Roll bands. He is perhaps known for these songs written in his career such as "Singing the Blues," "Knee Deep in the Blues," "Rock with the Caveman," "Where Have All the Flowers Gone." http://www.imdb.com/name/nm0824687/ |

Headlines---

Corrections---The List (Dec.07 to Date)

Kit’s Salvation Army Kettle

Classified Ads---Sales Manager

Classified Ads---Help Wanted

Prime Rate Lowering Means Little for Leasing

Cartoon---Therapy Session Up

Housing continues to drag down economy

Sales Make it Happen --- by Scott Wheeler

“How to Become a Better Leasing Advisor”

101 Funny Things about Global Warming

Classified ads—Operations/Remarketing

Bank Good Will re-Defined/Intangible Assets

FDIC Doubles Budget, sees real problems in 2009

Increase is $1 Billion, plus Raises other Fees

Employees to go from 5721 to 6269

FDIC raises risk fees 7 cents for every$100

Another indication 2009 will not be very good

CIT Announces $250MM Common Stock Offering

BK wouldn't stop shoppers from buying U.S. cars

Poll Shows 63% Are Already Hurt by Downturn

HUD Chief Calls Aid on Mortgages a Failure

News Briefs---

You May have Missed---

Top Stories---

Sports Briefs---

"Gimme that Wine"

Today's Top Event in History

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

|

------------------------------------------------------------------

Corrections---The List (Dec.07 to Date)

C and J Leasing Corp, Des Moines, Iowa (11/08) in business since 1982 has let go its 18 employees, stopped funding, and is not taking on any new business, according to its president C. Allen Rice. He says he has been in the business for over 26 years and has never seen anything like today's financing marketplace.

Columbia Bank Leasing, Tacoma, WA (12/07) Sr. VP Tom Mahaffey leaves to become, Vice President, Chief Credit Officer, Pinnacle Business Finance (11/08) Bank to exit leasing although excellent portfolio, very low delinquencies, scared of leasing, they say.

Radiance-Capital, Tacoma, WA (12/08)"Currently, Radiance is focused on portfolio management only and not accepting new brokers or credit applications…When things change and we start lending again on more consistent basis and terms, I can update you at that time. Due to the instability in the economy and with those that lend to this industry, I don’t see us lending in 2009. Unfortunately, in my humble opinion, I don’t think we have seen the worst yet."

Meryl L. Newman, Chief Executive Officer."

The three above to be included in this list:

http://www.leasingnews.org/archives/December%202008/12-15-08.htm#list

Curt P. Kovash, US Bank Manifest Funding Services, asked Leasing News "Do you have a current list of leasing companies who have supported the broker/lessor marketplace in the past two years who are no longer doing so?" It was his request that brought the item on my “To Do” list forward.

The last entry in the original "The List" was June, 2007. I did the list back to December, 2007, making it a year. After posting it on Monday, I found the three of the four I was looking for, plus did the rest of 2007 to where left off in June. The web version will be up-dated.

I realized in doing these months that the troubles may have started in 2007, but it is 2008 that turned into a very bad year for many leasing companies, as well as banks and other financial institutions. The government recognized the depression started in December, 2007, and the list certainly follows this fact. From Tuesday’s FDIC meeting, it looks like 2009 may be worse.

By the way, This list originated from Adrian Bulman in 2000 (Adrian sadly passed away at age 53 in January, 2001) that was passed on to him from a memo from then Sierra Cities President Tom Depping to his sales staff telling them with this list of companies no longer in leasing they should have less competition and to go after these accounts no longer being serviced. Depping’s list started Leasing News' "The List."

Ironically Depping's bank Main Street National Bank leasing is expanding its marketing, not only with Studebaker-Worthington, but vendor, franchise, and healthcare units--- perhaps based on the same premise, less competition, more opportunities. His goal was to make the bank a major player in equipment leasing. 2009 should be a very good year for Main Street.

In putting the current Leasing News list together, there are five things observed from talking “off the record” by telephone to presidents and key officers of leasing companies who Leasing News was lead to believe should be on the new list. I would like to pass them on to you “off the record” as to who said what:

#1 They were not going to take on a new broker just because the broker lost their current funding source or was looking around for an additional source. It was not that they were out of money or lines, but had changed their philosophy, also concerned about quality, niche, or as many of them related to me wanted to take care of their existing lessors and brokers first and foremost. They were in control of both demand and supply. Just because they weren’t taking on new brokers did not mean they were having “financial problems.”

#2 Those that cut back brokers told me they were tired, or politely said they wanted more efficiency, but basically didn't want to work with someone who sent them ten deals, had two approved, and only one of the two funded. It wasn't profitable for them to continue in this mode in this economy. They wanted to work with experienced professionals known to them for several years. They were tired

of the amateurs and those that made promises, but did not deliver.

#3 More companies were going "direct" via marketing, telemarketing, and vendor relationships.

#4 Bank relations had changed, meaning credit was tighter and it was taking longer to fund transactions as there was more “due diligence” and questions being asked.

#5 There was growth in the "C" and "D" marketplace from companies with access of money for this niche. At the same time, many were really brokers pretending to be “funders” and had lost their sources. They did not make the list as “brokers” or “super brokers” have not been added to the category.

While many "super brokers" reported they felt like the Maytag repair man, waiting for the telephone to ring, companies such as BSB Leasing were having tremendous growth ( yes, they advertise in Leasing News:)

"PredictiFund through BSB Leasing began accepting broker "turned down" business in March of this year. From zero business to well over $4,000,000 per month in submissions in this short period of time indicates the tremendous demand for funding in this neglected segment of the marketplace. This is what we've done since March:

Over 60% Approval Rate

Over $36,000 Average Deal Size

No Extra Collateral Required

No Big Down Payments

No Credit Card Processing Required"

BSB Leasing,

Kit Menkin, editor

|

Chronological List from November, 2007 to July, 2007

November

NetBank Business Finance (11/07) Name is now LEAF Specialty Finance

Marlin (11/07) Exits factoring business. (08/07) Marlin stocks falls

Direct Capital (11/07) Mike Murray, co-founder with Dave Murray of company retires.

Pawnee (11/07) $7.9 million loss

Dolphin Capital (11/07) Sold to LEAF Corporation

October

NetBank, Alpharetta, Georgia (10/07) FDIC closes bank, approves assumption of by ING Bank, Wilmington, Delaware; CMC Leases and NetBank Business Finance not included.

Provident Bank (10/07) Shares fall 22 percent as the bank reserved several million dollars for a defaulted loan, leasing involved.

CIT Group (10/07) Takes major subprime mortgage hit] (08) CIT stock continues to free fall

PFF Bank, Pomona (10/07) $7.5 million loss, commercial real estate primarily, problems with Creative Capital, too.

Merrill-Lynch, Chicago & NY (10/07) Faces $160 million write-down

September

LaSalle Bank (09/08) Employees fear job losses, leasing division employees to be let go Puget Leasing, Bellevue, WA (09/08) Sold to First Sound Bank. Bank president Don Hirtzel Puget Sound Leasing generates roughly $8 million a month in new leases and has an average delinquency rate of less than 1 percent.

August

IFC Capital, Morton Grove, IL (08/08) FTC files preliminary against IFC, four counts, involving NorVergence leases.

Evans National Bank (08/08) net loss of $(139) thousand, may affect leasing operation.

RW Financial (08/08) Barry Drayer surrenders to federal jail, Barker gets 60 months.

Sovereign Bank (08/08) Sovereign Bancorp Inc. CEO Joseph Campanelli says looks like recession, subprime loans to affect commercial loans and leasing, too.

Dell Computer (08/08) Admits to overinflating sales reports for four years. Sterling Financial, Lancaster, PA (08/08) Request NASDAQ listing despite major fraud loss (07/08) PNC to purchase Sterling

List Chronological:

http://www.leasingnews.org/list_chron_new.htm

--------------------------------------------------------------

Kit’s Salvation Army Kettle

Please click on the Kettle and donate some money. $10. $25.

You can leave your name or do it anonymously. I hope you leave your name as it may attract others who see if you donate, they should too.

--------------------------------------------------------------

Classified Ads---Sales Manager

| Atlanta, GA Strong sales and leadership skills; demonstrated with sales training and sales performance. Lead team in both regional and national operations and developed marketing programs. Email: mll1946@comcast.net [Resume] |

| Chicago, IL Sales Executive or Senior Manager, with responsibility for leasing capital equipment in support of transactions based on current market values, market potential and economic trends. tomvolk53@hotmail.com |

For a full listing of all “job wanted” ads, please go to:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

To place a free “job wanted” Leasing News ad:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

ELFA Career Center: Job Seekers (free):

http://careers.elfaonline.org/search.cfm

--------------------------------------------------------------

Leasing Industry Help Wanted

sales

|

Regional Sales Manager Are you a sales professional with proven track record in the small ticket market? |

|

Like selling vendor programs and large transactions? CLICK HERE to find out how to have fun again. |

Settlement Specialist

|

|

Small ticket leasing company looking for someone to negotiate end lease settlements (renewals, FMV, etc.) and run the department. Report directly to the Director of Operations. Require 2+ yrs. experience minimum. Attractive Compensation $65k to $90k 1 st yr. + benefits. Please email resume to: |

Please see our Job Wanted section for possible new employees.

-------------------------------------------------------------

Prime Rate Lowering Means Little for Leasing

by Kit Menkin

While the prime rate is reaching the lowest, its affect on the financial marketplace is not being felt in the credit lending community. In fact, many banks recently raised their “buy rates” to lessors and other discounters, who pass this along to brokers and other referrers. Many have cut leasing out altogether, or made tougher restrictions and requirements.

Most credit cards do not lower their rate, particularly if you have been late for one day as in most states they are allowed to go to the higher interest rate as per their four or five page eight point

type size letter of explanation (some I swear are six point.) Many have notified their card holders their limit has been lowered. Also look at the cash advance rate. Wells Fargo is 20.99%, one of the reasons the bank is doing so well.

Short term borrowers and those with accounts receivable lines will benefit, if their bank has not already cut back their line by changing ratio’s or making other financial requirements or conditions.

The only good news was stock investors seemed impressed with the Feds action to lower the rate to almost zero. What will happen when they start paying the lender for borrowing money? Or has that already happened with TARP.

The market does not understand the decrease in business is not from high rates, but businesses being scared into taking on new payments or any new obligations. The lack of car sales is not the price of cars or even the credit available, it is the buyer or lessee not wanting to incur any more payments, particularly if they are about to lose their job or if a small business owner, not be able to make payroll because of taking on any new payments. It is not Detroit or gas mileage,

the buyers and lessees are scared.

They are sacred. You should also be scared. The other action taken by the FDIC will scare you even more (stories to follow.) All your skills and experience are about to be tested as never before, but then, that is relative to where life has taken you and how prepared you may be for 2009.

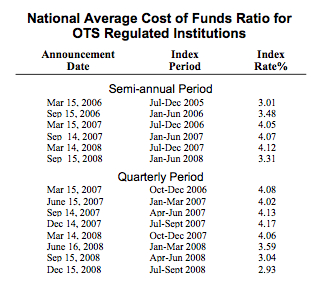

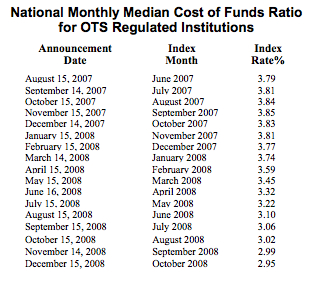

Current Cost of Funds from OTS:

History of Cost of Funds from OTS:

http://leasingnews.org/PDF/Cost_Of_Funds_Dec08.pdf

--------------------------------------------------------------

--------------------------------------------------------------

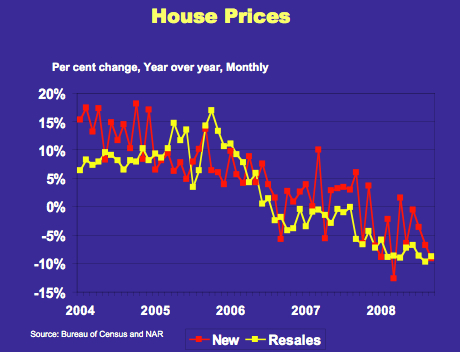

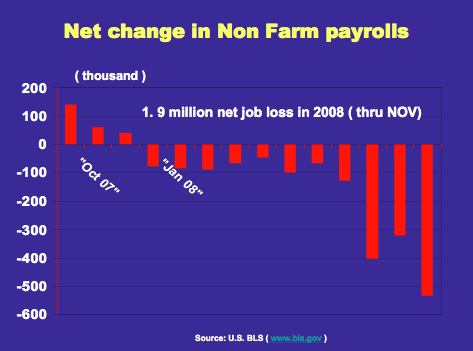

Housing continues to drag down economy

US housing starts tumbled 18.9 percent in November from a month earlier to a new record low, down 47 percent from last year's level, official data showed Tuesday.

The figures showed a steep drop from the October level, which had been the lowest level since the Commerce Department began publishing the data in January 1959.

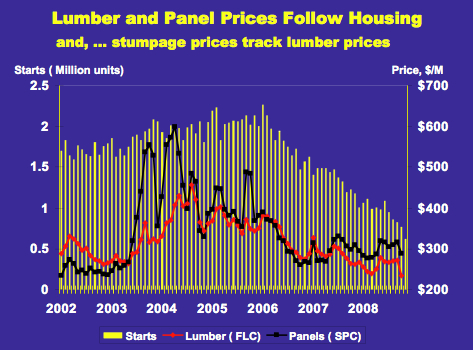

Al Schuler, Analyst, US Department of Agriculture, Timber specialist, reports, “…single family starts were down 17%, and permits were off almost 16%. Starts are now at 625,000, SAAR - the lowest level since WWII. To refresh your memories, starts were 2.1 million in 2005 so the current level is 70% below the 2005 peak. As one could expect, wood product demand is down significantly as are prices, both hardwoods and softwoods - framing lumber, structural panels, engineered wood products, and most of the hardwood grades tied to kitchen cabinets, flooring, molding and millwork.

Schuler notes Lumber and Panel Prices:

The problem in U.S. housing markets is starting to show up in Canada ( albeit not as bad) as the Canadian Real Estate Association ( http://www.crea.ca/ ) reported this week that average prices in November for existing homes, were down almost 10% year over year.

For a good discussion of global home prices, see the Economist magazine (http://www.economist.com/finance/displaystory.cfm?story_id=12725898 ).

We (North America) are certainly not alone.

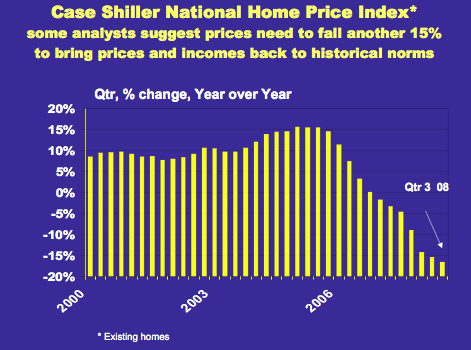

Falling home prices do not seem to be turning the market place around:

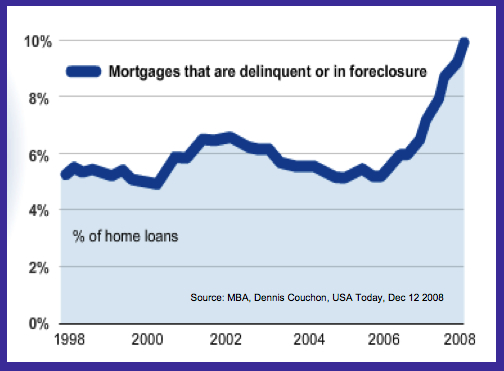

More mortgages are in default, and recent reports state the bottom has not been hit yet, and hopefully will be in 2009.

The housing market contributes heavily to the unemployment figures as all sectors have been effected starting from last year and growing into city, county, and state government layoffs, as well as industrial and retail layoffs:

While Leasing News has used this cartoon before to indicate what is happing in the leasing industry, it certainly also fits here:

--------------------------------------------------------------

Sales Make it Happen --- by Scott Wheeler

With over twenty-six years of leasing experience and an Executive Masters in Business Administration, Scott is an accomplished senior leasing executive with leadership qualities in marketing and operations. His extensive experience will benefit organizations looking to reach a higher level of profitability and corporate development. “How to Become a Better Leasing Advisor” So many leasing professionals represent themselves as a sales representative or perhaps a territory salesperson. What would it take for you to start representing yourself as a Leasing Advisor or a Leasing Specialist; and for the title to really have meaning to you and your clients? A leasing sales representative walks around town or calls into his/her territory with a prepackaged, square (leasing) peg looking for a square (leasing) hole. Most of the time the leasing sales representative becomes frustrated because he/she finds that the world has many round holes and very few square ones. In more challenging times, the round holes seem to multiply and the square ones seem to diminish. In actuality the holes become reshaped and they become oval holes and octagon holes and then eventually a large black hole which swallows the sales representative. However, the Leasing Advisor doesn't sell a prepackaged leasing plan. He doesn't present his product as a commodity product – one size fits all. A Leasing Advisor becomes an investigator first and dissects the needs of his clients. His first step is to investigate the needs of the client and to evaluate whether or not leasing can provide a solution. A Leasing Advisor is willing to reshape his services to meet the needs of his client, but he cannot reshape his product until he thoroughly understands the “real” needs of his clients. Past experiences help us to understand a particular industry or specific equipment; however, we are advising (selling) in a different environment and the past may not be the best barometer of a client's current needs. Therefore, it becomes more important to be an INVESTIGATOR first and an ADVISOR second. Investigation requires questions, probing and digging for the facts. Often times the lessee or vendor is unsure themselves what their real needs are – the Leasing Advisor becomes a facilitator and walks the client through a process to reveal potential leasing opportunities. A Leasing Advisor will lead with information and suggestions which will naturally be followed by answers to important questions. Investigation requires listening, understanding, and learning. What we learn from one lessee or one vendor will assist us in understanding the needs of others. As the new leasing market is being formulated it is our responsibility to integrate information and solutions so that we can provide the very best services to our commercial clients. Statement: “We have seen many current clients using leasing to gain efficiencies in their operation, because in today's economic times, efficiencies and cost savings are front and center for most companies. Does your company have any efficiency initiatives currently being considered?” Statement: Technology is usually a driver behind efficiencies; and technology upgrades usually require equipment purchases; leasing often provides significant cash flow savings when acquiring needed equipment which allow efficiencies to be implemented more quickly. Have you started to explore any new equipment which will help to make your company more efficient and more profitable? A Leasing Advisor engages his clients in conversation and is willing to investigate different leasing structures. A strong Leasing Advisor explores the obvious changes in the market and is comfortable suggesting new options which may be more beneficial; or the Leasing Advisor is able to reinforce the economic benefits of a standard structure as most beneficial even in today's economic market. To be a Leasing Advisor we need to offer more to our clients than a standardized approach or a standardized solution. We need to be inquisitive, interactive, solution based, informative, sincere and above all else we need to be having fun. Our products and services need to be flexible and be able to take on new shapes which will best fit the ever changing needs of our customers. Email me with your suggestions or contact me in reference to upcoming training seminars. Email: scott@wheelerbusinessconsulting.com Sales Makes it Happen articles:

|

|

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Scott Wheeler)

--------------------------------------------------------------

101 Funny Things about Global Warming

Click to Order from Amazon.com

In this outrageous send-up of global warming, Sidney Harris and his cartoonist colleagues comment on today's most inconvenient truths. "101 Funny Things About Global Warming" features never-before-seen work from New Yorker contributors Jack Ziegler, Gahan Wilson and Sam Gross, Tom Hachtman’s 'Gertrude (Stein)' comic strips, leading British cartoonist Ed McLachlan, a 4-page comic strip by MacArthur fellow Ben Katchor, 'Bizarro' creator Dan Piraro, and about fifty pages by Sidney Harris, among others.

The collection points out how far we've come, and how far we have to go in protecting the environment.

--------------------------------------------------------------

Classified ads—Operations/Remarketing

Leasing Industry Outsourcing

(Providing Services and Products)

| Operations: Houston, TX Silverlake Inspections LLC is an independent contracting company for real estate and equipment verification with pictures. Email: jimh05@sbcglobal.net |

Operations: Portland , OR Portfolio Financial Servicing Company is a leading provider of private label primary and backup servicing for lease and loan contracts. 800-547-4905 sales@pfsc.com |

| Operations: Roseburg, OR Tired of paying a full time documentation person? Try outsourcing. Ideal for anywhere in the USA. E-mail or Call Trina Drury 541-673-4116 or 541-784-7973. email: doc_prep@yahoo.com |

Remarketing: Nassau Asset Management Specializing in: Repossession, remarketing, plant and fleet liquidation, skip tracing and collections. All types of equipment. Over 160 locations nationwide. We will tailor any remarketing program to your specific requirements. www.nasset.com Contact: ECast@nasset.com ELA,NAB T ,EAEL,NAELB,UAEL |

All "Outsourcing" Classified ads

(advertisers are both requested and responsible to keep their free ads up to date):

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

--------------------------------------------------------------

Bank Good Will re-Defined/Intangible Assets added

The Federal Reserve Board at its meeting not only changed the prime rate, but passed many other resolutions, such as:

“The federal banking and thrift regulatory agencies approved a final rule that would permit a banking organization to reduce the amount of goodwill it must deduct from tier 1 capital by any associated deferred tax liability.

“Under the final rule, the regulatory capital deduction for goodwill would be equal to the maximum capital reduction that could occur as a result of a complete write-off of the goodwill under generally accepted accounting principles (GAAP). The final rule is in substance the same as the proposal issued in September. The final rule will be effective 30 days after publication in the Federal Register. However, banking organizations may adopt its provisions for purposes of regulatory capital reporting for the period ending December 31, 2008.

“The federal banking agencies are jointly issuing the attached final rule allowing goodwill, which must be deducted from Tier 1 capital, to be reduced by the amount of any associated deferred tax liability. The final rule will take effect 30 days after its publication in the Federal Register. However, a bank may elect to apply this final rule for regulatory capital reporting purposes as of December 31, 2008.”

Highlights

Under the agencies' existing regulatory capital rules, certain assets that must be deducted from Tier 1 capital may be reduced by any deferred tax liability specifically related to the asset.

Under the attached final rule, the agencies are extending this treatment to goodwill acquired in a taxable business combination, thereby allowing a bank, bank holding company or savings association to make the required deduction of goodwill from Tier 1 capital net of any associated deferred tax liability.

The agencies decided not to extend similar treatment to other intangible assets currently required to be deducted fully from Tier 1 capital.

|

Other changes are noted in the following press releases reprinted here:

### Press Release ###########################

(FDIC Doubles Budget, sees real problems in 2009

Increase is $1 Billion, plus Raises other Fees

Employees to go from 5721 to 6269 )

FDIC Approves 2009 Operating Budget, Releases Third Quarter 2008 Results for the Deposit Insurance Fund

The Board of Directors of the Federal Deposit Insurance Corporation (FDIC) at an open board meeting approved a $2.24 billion operating budget for next year. The Board also released financial reports for its Deposit Insurance Fund for the third quarter 2008.

The 2009 budget represents an increase of more than $1 billion from 2008. The cyclical nature of resolution activity requires the allocation of significant resources during heightened periods of activity. The increase in spending is largely attributable to continuing work associated with recent bank failures and the provision of contingency funding for the possible continuation of an elevated number of bank failures in 2009. Thus far, there have been 25 bank failures in 2008, compared to only 3 in 2007, and none from June 2004 through February 2007. This was the longest period in the agency's history without having to resolve a failed bank.

"The budget for 2009 provides the resources that are needed for the FDIC to continue to meet its mission, as it has done for the past 75 years. It is a prudent and measured response given the current banking environment," said FDIC Chairman Sheila C. Bair. "The American people rely on the FDIC to maintain the stability the banking system and to protect their deposits."

The Board also approved an authorized 2009 FDIC staffing level of 6,269, an increase of 1,459 positions from the staffing level authorized at the beginning of 2008. The additional staff, most of which is temporary, will be hired primarily to perform bank examinations and other bank supervisory activities and to address bank failures, including the management and sale of assets retained by the FDIC when a failed bank is sold. The staffing numbers include the recently announced 600 employees that will work out of the west coast consolidated satellite office, located in Irvine, California, and 520 employees in the Division of Supervision and Consumer Protection.

The FDIC also announced that in the third quarter, the Deposit Insurance Fund (DIF) decreased by 23.5 percent ($10.6 billion) to $34.6 billion (unaudited). The reduction in the DIF was primarily due to an $11.9 billion increase in loss provisions for bank failures, which represents the estimated losses for FDIC-insured institutions that are likely to fail over the next 12 months. Accrued assessment income increased the fund by $881 million. Interest earned, combined with realized and unrealized gains (losses) on securities, added $653 million to the insurance fund.

Operating and other expenses, net of other revenue, reduced the fund by $233 million. DIF's cash and investments declined for the year-to-date period by $17.4 billion to $33.4 billion, the decline is mainly attributed to cash outlays of $22.3 billion for the 13 resolutions occurring in the first nine months of 2008, offset by $1.3 billion in assessment collections, $2.1 billion in interest received on U.S. Treasury securities, and a $1.8 billion increase in realized and unrealized gain on available-for-sale (AFS) securities.

For the nine months ending September 30, 2008, Corporate Operating and Investment Budget related expenditures ran below budget by 4 percent ($32 million) and 14 percent ($3 million), respectively. The variance with respect to the Corporate Operating Budget expenditures was primarily the result of lower spending for contractual services in the Ongoing Operations component of the budget through the third quarter.

### Press Release ###########################

(FDIC raises risk fees 7 cents for every$100

Another indication 2009 will not be very good)

FDIC Adopts Assessments for Insured Institutions for 2009

The Board of Directors of the Federal Deposit Insurance Corporation (FDIC) today voted to adopt a final rule increasing risk-based assessment rates uniformly by 7 basis points (7 cents for every $100 of deposits), on an annual basis, for the first quarter of 2009.

"With higher levels of bank failures, the FDIC's resolution costs have increased significantly. This assessment increase creates a path for the fund to return to its statutorily mandated level," said FDIC Chairman Sheila C. Bair. "The banking system is the bedrock of our economy and deposit insurance has played a vital role in providing stability to the system. Maintaining a strong fund positions the FDIC well to handle future challenges."

Currently, banks pay between 5 and 43 basis points of their domestic deposits for FDIC insurance. Under the final rule, risk-based rates would range between 12 and 50 basis points (annualized) for the first quarter 2009 assessment. Most institutions would be charged between 12 and 14 basis points.

In October, the FDIC also proposed changes to take effect beginning in the second quarter of 2009 that would make deposit insurance assessments fairer by requiring riskier institutions to pay a larger share. The comment period for these proposed changes ends on December 17th, and the FDIC will discuss that proposed change early next year.

The first quarter 2009 assessment rate increase adopted by the Board today, together with proposed changes that would take effect in the second quarter, would help ensure that the reserve ratio returns to at least 1.15 percent by the end of 2013. As required by law, the FDIC adopted a Restoration Plan in October that would increase the reserve ratio to the 1.15 percent threshold within five years.

The final rule will be published in the Federal Register and will take effect January 1, 2009.

### Press Release ###########################

CIT Announces $250,000,000 Common Stock Offering

NEW YORK--

-CIT Group Inc. (NYSE: CIT), a leading commercial finance company, announced that it has commenced a $250 million offering of its common stock. CIT also expects to grant the underwriters for the offering an over-allotment option to purchase additional shares of common stock (up to 15% of the total offering). The offering is being conducted as a public offering registered under the Securities Act of 1933, as amended.

The common stock offering is the final element of the regulatory capital plan that CIT presented to the Board of Governors of the Federal Reserve (the “Federal Reserve”) in connection with its application to become a bank holding company under the Bank Holding Company Act of 1956, as amended (the “BHC Act”). This multi-step plan also includes:

The exchange of approximately 19.6 million outstanding equity units of CIT, stated amount $25 per unit, for an aggregate of $81.8 million in cash and 14.0 million shares of CIT common stock pursuant to an exchange offer that expired December 15, 2008 and that is expected to close on December 18, 2008.

The exchange of up to $1,700,000,000 of certain outstanding notes of CIT for either newly issued subordinated notes or a combination of up to $550 million of cash and up to $1.15 billion of subordinated notes at the option of the eligible holders pursuant to an exchange offer which expires at 5:00 PM EST on December 19, 2008 and which, assuming the satisfaction of the applicable conditions of the offer, is expected to close on a customary settlement timetable.

Upon the successful completion of the common stock offering, CIT expects that it will have raised an amount of regulatory capital that the Federal Reserve indicated would be required to gain approval of its application to become a bank holding company under the BHC Act. The Company expects that if the capital plan is successfully completed that its bank holding company application will be timely approved.

However, CIT has no assurances that the Federal Reserve will grant CIT’s application to become a bank holding company. The closing of the common stock offering is conditioned upon approval by the Federal Reserve of CIT’s application to become a bank holding company under the BHC Act.

J.P. Morgan Securities Inc., Morgan Stanley & Co. Incorporated, Banc of America Securities LLC and Citi are serving as joint bookrunning managers of this offering. The offering will be made under CIT’s shelf registration statement filed with the Securities and Exchange Commission.

The issuer has filed a registration statement (including a prospectus) with the Securities and Exchange Commission for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting the SEC Web site at www.sec.gov. Alternatively, the issuer or the underwriters participating in the offering will arrange to send you the prospectus if you request it by calling J.P. Morgan Securities Inc. at (718) 242-8002 or Morgan Stanley & Co. Incorporated toll free at (866) 718-1649.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of, these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About CIT

CIT (NYSE: CIT) is a global commercial finance company that provides financial products and advisory services to more than one million customers in over 50 countries across 30 industries. A leader in middle market financing, CIT has more than $70 billion in managed assets and provides financial solutions for more than half of the Fortune 1000. A member of the S&P 500 and Fortune 500, it maintains leading positions in asset-based, cash flow and Small Business Administration lending, equipment leasing, vendor financing and factoring. The CIT brand platform, Capital Redefined, articulates its value proposition of providing its customers with the relationship, intellectual and financial capital to yield infinite possibilities. Founded in 1908, CIT is celebrating its Centennial throughout 2008.

### Press Release ###########################

--------------------------------------------------------------

|

![]()

News Briefs----

Bankruptcy wouldn't stop shoppers from buying U.S. cars

http://www.usatoday.com/money/autos/2008-12-15-gm-bankruptcy-chrysler_N.htm

New Poll Shows 63% Are Already Hurt by Downturn

http://www.washingtonpost.com/wp-dyn/content/article/2008/12/16/

AR2008121602696.html?hpid=topnews

HUD Chief Calls Aid on Mortgages A Failure

http://www.washingtonpost.com/wp-dyn/content/article/2008/12/16/

AR2008121603177.html?hpid=topnews

GE unit inks power deal worth nearly $3B with Iraq

http://seattletimes.nwsource.com/html/businesstechnology/2008525900_apgeiraq.html

---------------------------------------------------------------

You May have Missed---

After 146 Years, Brooklyn Convent to Close

http://www.nytimes.com/2008/12/17/nyregion/17convent.html?hp

----------------------------------------------------------------

Top Stories

These are the ten top stories chosen by readers as being the most read:

http://www.leasingnews.org/archives/December%202008/12-15-08.htm#top10x`

Top Stories Collection:

http://www.leasingnews.org/Conscious-Top%20Stories/Ten_top_stories.htm

---------------------------------------------------------------

Sports Briefs----

Mannings are first QB brothers to make Pro Bowl

http://www.theredzone.org/absolutenm/templates/template.asp?articleid=985&zoneid=1

----------------------------------------------------------------

![]()

“Gimme that Wine”

Hess Collection invests $30 million to increase vineyards, wine quality

http://www.northbaybusinessjournal.com/article/20081215/BUSINESSJOURNAL/812140242/

1207/BUSINESSJOURNAL02

Researchers Look to Red-Wine Compounds for Alzheimer's Cure

http://www.winespectator.com/Wine/Features/0,1197,4759,00.html

The Spanish Wine Revolution and its Mexico Connections

http://www.mexidata.info/id2096.html

Is Grenache underrated as a wine?

http://sl.farmonline.com.au/news/nationalrural/viticulture/general/is-grenache-under

rated-as-a-wine/1384155.aspx

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

The London International Vintners Exchange (Liv-ex) is an electronic exchange for fine wine.

http://www.liv-ex.com/

----------------------------------------------------------------

![]()

Today's Top Event in History

1976 - The Ted Turner owned WTCG-TV, Atlanta, Georgia, changed its call letters to WTBS, and was unlinked via satellite, making it the first commercial television station to cover the entire United States. WTBS began on only four cable systems, available in 24,000 homes.

He has a book out today called “Call me Ted,” about his life and how he started.

http://www.amazon.com/Call-Me-Ted-Turner/dp/0446581895/ref=sr_1_4?ie=UTF8&s=

books&qid=1229484506&sr=1-4

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

| 1728 -Congregation Shearith Israel of New York purchases a lot on Mill Street in lower Manhattan, to build New York's 1st synagogue. Construction is completed in 1730. http://www.shearith-israel.org/folder/main_frames.html 1734-Birthday of William Floyd, signer of the Declaration of Independence, member of Congress, born at Brookhaven, Long Island. Die at Westernville, NY, Aug 4,1821 1760-Birthday of Deborah Sampson, born at Plympton, MA. She spent her childhood as an indentured servant. In 1782, wishing to participate in the Revolutionary War, she disguised herself as a man and enlisted in the Continental Army's 4th Massachusetts Regiment under the name Robert Shurtleff. She received both musket and sword wounds, but it was an attack of fever that unmasked her identity and led to her dismissal from the army in 1783. In 1802- Sampson became perhaps the first woman to lecture professionally in the US when she began giving public speeches on her experiences. Full military pension was provided for her heirs by an act of Congress in 1838. Deborah Sampson died Apr 29, 1827, at Sharon, MA. 1777 - France recognized American independence. 1777-General George Washington, after losing several battles to superior forces, professional soldiers, well-equipped and fortified, re-groups his farmers and volunteer fighting force by retiring with them to Valley Forge, Pa., for the brutal cold winter. The war was not going well and officers worked their hardest to not only train the troops, but to halt them from deserting. http://www.dcnr.state.pa.us/stateparks/parks/ft-was.htm#history http://www.casayego.com/amrev/vforge/evforge.htm http://www.jimfrizzell.com/valley_forge_washington_headquarters.htm http://www.valleyforge.org/vfpark.asp http://www.soupsong.com/rtripe.html 1788-Poet Robert Burns wrote his version of a old Scottish song to Mrs. Dunlap; the words for “Auld Lang Syne...”( "times gone by.") He sent a copy of his song to his publisher Mr. Johnson, who later published it. http://www.robertburns.org/encyclopedia/AuldLangSyne.5.html 1790-One of the wonders of the western hemisphere—the Aztec Calendar or Solar Stone—was found beneath the ground by workmen repairing Mexico City's Central Plaza. The centuries-old, intricately carved stone lift, 8 inches in diameter and weighing nearly 25 tons, proved to be a highly developed calendar monument to the sun Believed to have been carved in the year 1479, this extraordinary time-counting basalt tablet originally stood in the Great Temple of the Aztecs. Buried along with other Aztec idols, soon after the Spanish conquest in 1521, it remained hidden until 1790. Its 52-year cycle had regulated many Aztec ceremonies, including grisly human sacrifices to save the world from destruction by the gods. 1797- Scientist Joseph Henry was born at Albany, NY. One of his great discoveries was the principle of self-induction; the unit used in the measure of electrical inductance was named the Henry in his honor. In 331 Henry constructed the first model of an electric telegraph with an audible signal. This formed the basis of nearly all later work on commercial wire telegraphy. In 1832 Henry was named professor of natural philosophy at the College of New Jersey, now Princeton University. Henry was involved in the planning of the Smithsonian Institution and became its first secretary in 1846. president Lincoln named Henry as ore of the original 50 scientists to make up the National Academy of Sciences in 1863. He served as that organization's president from 1868 until his death May 13, 1878, at Washington, DC. 1807-Birthday of John Greenleaf Whittier, poet and abolitionist, born at Haverhill, Essex County, MA. Whittier's books of poetry include Legends of New England and Snowbound. Died at Hampton Falls, NH, Sept 7,1892. 1821-Kentucy was the first state to abolish imprisonment for debt. There were no bankruptcy laws, and prior to this. those individuals who got into debt, would be sentenced to prison, no matter the cause of the insolvency. 1846 - Ships under Commodore Matthew Calbraith Perry capture Laguna de Terminos during Mexican War. 1861 - The Stonewall Brigade began to dismantle Dam No. 5 of the C&O Canal near 1862-Union General Ulysses S. Grant lashes out at cotton speculators when he expels all Jews from his department in the west. At the time, Grant was trying to capture Vicksburg, Mississippi, the last major Confederate stronghold on the Mississippi River. Grant's army now effectively controlled much territory in western Tennessee, northern Mississippi, and parts of Kentucky and Arkansas. As in other parts of the South, Grant was dealing with thousands of escaped slaves. John Eaton, a chaplain, devised a program through which the freed slaves picked cotton from abandoned fields and received part of the proceeds when it was sold by the government. Grant also had to deal with numerous speculators who followed his army in search of cotton. Cotton supplies were very short in the North, and these speculators could buy bales in the captured territories and sell it quickly for a good profit. In December, Grant's father arrived for a visit with two friends from Cincinnati. Grant soon realized that the friends, who were Jews, were speculators hoping to gain access to captured cotton. Grant was furious and fired off his notorious Order No. 11: "The Jews, as a class violating every regulation of trade established by the Treasury Department and also department orders, are hereby expelled from the department within twenty-four hours from receipt of this order." The fallout from his action was swift. Among 30 Jewish families expelled from Paducah, Kentucky, was Cesar Kaskel, who rallied support in Congress against the order. Shortly after the uproar, President Lincoln ordered Grant to rescind the order. Grant later admitted to his wife that the criticism of his hasty action was well deserved. As Julia Grant put it, the general had "no right to make an order against any special sect." 1874-Birthday of W.L. MacKenzie, former Canadian prime minister, born at Berlin, Ontario. Served 21 years, the longest term of any prim minister in the English-speaking world. Died at Kingsmere, July 22,1950 1884 - A three week blockade of snow began at Portland, OR. A record December total of 34 inches was received. 1889-Rosemary "Silver Dollar" Tabor, the second daughter of Horace and Elizabeth "Baby Doe" Tabor, is born. The Tabors were one of Colorado's wealthiest families of the time. Silver's mother, Elizabeth Doe, came west from Wisconsin with her husband, Harvey, in 1877; the couple hoped to make a fortune in the booming gold and silver mines of Colorado. Harvey Doe proved to be an inept and lazy miner, though, so Elizabeth divorced him and moved to the mining town of Leadville in 1881, where she performed on the stage and was nicknamed "Baby Doe" by admiring miners. During a chance encounter, Baby Doe won the affections of Horace Tabor, an emigrant from Vermont who made millions in the silver mines. Although Tabor was a married man, he moved Baby Doe into an elegant hotel in Denver and began a not-so-secret affair that scandalized the Colorado gentry. Ignoring the wagging tongues, Tabor divorced his wife and married the beautiful Baby Doe, who was nearly a quarter-century younger than he. For a time, the couple lived a life of extraordinary opulence and pleasure, and Baby Doe had two daughters nicknamed "Lillie" and "Silver Dollar," the latter in recognition of the source of the family's wealth. During the early 1890s, the good times started to slow as some of Tabor's investments went sour and his mines began to decline. The fatal blow came in 1893, when the U.S. Congress repealed the Silver Purchase Act of 1890, which had kept silver prices high through government investment. Without these large purchases of silver by the U.S treasury, prices plummeted and Tabor's once valuable mines were suddenly nearly worthless. In a matter of months, Tabor was bankrupt and the family was reduced to living on the modest income he earned as Denver's postmaster. When Tabor died in 1899 of appendicitis, Baby Doe and her young daughters were left penniless, and moved back to Chicago to live with relatives. Eventually, Baby Doe left Lillie in Chicago and returned to Leadville with Silver Dollar. The decision was disastrous: mired in poverty, Baby Doe and Silver eked out a threadbare existence, living in a small shack near one of the worthless silver mines they inherited from Horace Tabor. As Silver grew older she drank heavily and used drugs. She moved to Chicago, where she was murdered in 1925 at 36 years old. Baby Doe survived for another decade, an impoverished recluse who used old gunny sacks for shoes and doctored herself with turpentine and lard. During a severe blizzard that hit Leadville for several days in February 1935, Baby Doe--who had once been one of the richest people on earth--died cold and alone at 81 years old. 1895- George Loomis, Brownell of Worcester, MA, patented a paper twine machine. It twisted strips or ribbons of paper into cord that was as strong as any known steel. 1903-Birthday of bandleader Ray Noble, Brighton, England http://www.nobello.com/ray.htm 1903 -- American author Erskine Caldwell lives, Coweta County, Georgia. Unadorned novels & stories ( Tobacco Road, God's Little Acre ) about rural poor of the American South mix violence and sex in grotesque tragicomedy -- & he is particularly esteemed in France & the former Soviet Union. He struggled with censorship more than any other writer in his time. He died in Paradise Valley, Arizona on April 11, 1987 http://www.libs.uga.edu/gawriters/caldwell.html http://www.kirjasto.sci.fi/caldwell.htm http://www.newnan.com/ec/ 1903- Orville and Wilbur Wright, brothers, bicycle shop operators, inventors and aviation pioneers, after three years of experimentation with kites and gliders, achieved the first documented successful powered and controlled flights of an airplane. The plane, which weighed 745 pounds and hand a four-cylinder, 12-horsepower engine, was launched from a monorail after a 35-to-40 foot run. It remained aloft for 12 seconds and covered 120 feet. Three subsequent flights took place that day, of which the longest covered 852 feet in 59 seconds. The average speed was 31 miles per hour. Some historians respect the claim of Gustave Whitehead, who is said to have made four flights, one of which covered a distance of 1.5 miles, in his airplane “No. 21” on August 14, 1901, near Bridgeport. The Wright Brothers promoted their launching with press on hand and the event has been celebrated every year at the Wright Brothers National Memorial, Kill Devil Hills, NC, with wreaths, flyover and other observances—regardless of weather. http://memory.loc.gov/ammem/today/dec17.html 1904 – Birthday of artist Paul Cadmus, well respected homosexual paint. His notorious erotic painting The Fleet's In! launched his career as a full-time artist. Died 1999 http://www.artcyclopedia.com/artists/cadmus_paul.html http://www.history.navy.mil/ac/cadmus/cadmus.htm http://www.davidsutherland.com/films_cadmus.html http://www.amazon.com/exec/obidos/ASIN/0915829681/inktomi-bkasin-20/104-3547695-1517507 1908-Birthday of Willard Frank Libby, American educator, chemist, atomic scientist and Nobel Prize winner was born at Grand Valley, CO. He was the inventor of the carbon-14 “atomic clock” method for dating ancient and prehistoric plant and animal remains and minerals. Died at Los Angeles, CA, Sept 8,1980. ( lower half of: http://memory.loc.gov/ammem/today/dec17.html ) 1910 -December 17, Band Leader/Trombone playr Sy Oliver Birthday http://search.eb.com/blackhistory/micro/437/64.html http://www.vh1.com/artists/az/oliver_sy/bio.jhtml http://trumpetjazz.netfirms.com/Artists/Sy_Oliver.html 1920-The first orphanage founded by the Church of God opened in Cleveland, Tennessee. Its establishment was the result of the vision and efforts of Church of God pioneer, A.J. Tomlinson. 1924 - A severe icestorm struck central Illinois. It coated the ground with nearly two inches of glaze at Springfield. The storm caused 21 million dollars damage along with much hardship. Ice was on the trees until the 4th of January, and electricity was not restored until January 10th. 1925-Birthday of drummer Walter Bolden, Hartford, CT Died February 19,2002 http://www.jazztimes.com/JazzNews/XcNewsPlus.asp?cmd=view&articleid=516 http://www.jazzvalley.com/musician/walter.bolden 1925 Colonel William "Billy" Mitchell court-martial for insubordination Served in the U.S. Army during World War I; salesman; member of West Virginia state senate 6th District, 1941-60. Episcopalian . Member, American Legion ; Elks . It was President Coolidge himself who ordered Mitchell's court-martial under charges of insubordination under the 96th Article of War ("conduct of a nature to bring discredit on the military service"). The trial lasted seven weeks, most of which was devoted to a discussion of Mitchell's concept of airpower. The verdict of guilty was a foregone conclusion, and Mitchell was sentenced to be suspended from rank, command, and duty, with a forfeiture of all pay and allowances for five years. President Coolidge, in an uncharacteristic fit of generosity, later reduced this to forfeiture of half his pay and allowances. Billy Mitchell refused the offer and resigned on February 1, 1926. All through the court-martial proceedings, Mitchell had the staunch support of "Hap" Arnold and such officers as Carl Spaatz, Herbert Dargue, Robert Olds, William Gillmore, Horace Hickam, and others. Each put his career on the line for Mitchell even though they knew he would be convicted. After the trial, Arnold was exiled to become commanding officer of the 16th Observation Squadron, Fort Riley, Kan. The assignment was intended to be the end of his career. Mitchell continued to campaign in speeches and articles. "Hap" Arnold, for his part, soldiered on, his leadership qualities inevitably propelling him to the top, regardless of residual resentment about his unflagging support for Mitchell. More important than Arnold's loyalty, however, was his comprehension of Mitchell's fascination with technology. Early in his tour as Army Air Corps Chief, Arnold began soliciting the ideas and the company of the top scientists in the country. Eventually, he enlisted the assistance of such stellar names as Theodore von Kármán, Hugh L. Dryden, Frank Wattendorf, Hsue-shen Tsien, Vladimir K. Zworykin, and many others for the Scientific Advisory Group, later transformed into the Scientific Advisory Board. These men and others created first "Where We Stand" and then "Toward New Horizons," studies that addressed state-of-the-art technology and put forth a blueprint for the development of the postwar Air Force. It is important to note that neither Mitchell nor Arnold had the scientific competence to write such reports; they had, instead, the far more vital ability to see that the reports were needed, recognize who could produce them, and sympathetically enlist their support. The officers Arnold picked to work with the scientists were equally well chosen, among them such men as James H. Doolittle, Donald L. Putt, and Laurence C. Craigie. They knew the importance of science and of scientists. Againin the spirit of Billy Mitchell, Arnold picked promising young officers who understood the requirements of technology and saw that they were given a track to top positions. Doing so cost him friends. Comrades who had served with him, and who were now passed over, resented his choices. But Arnold knew he was not running a popularity contest; he was building an independent Air Force. The constructive culture created by Mitchell and Arnold 1926-- Ben Pollack and His Californians records "He’s the Last Word." In the late 1950's, my friends and I hung out at his Dixieland pizza joint on Sunset Blvd. in Hollywood, where he would play the drums. Sandy Nelson said he got his "boom-chick-a-boom" here, or perhaps it was the burlesque house drummer, which is the real truth. 1932-Birthday of sax player Sonny “Red” Kyner, Detroit, MI http://www.allaboutjazz.com/reviews/r1100_096.htm 1933-Birthday of bass palyer Walter Booker, Jr., Prairie View, TX, died 1982. 1933- the Chicago Bears of the Western Division won the National Football League's first championship game, defeating the New York Giants of the Eastern Division., 23-21. The Bears scored the winning touchdown on a pas-and lateral play begun by Bronko Nagurski. The purse was divided, with 60 percent going to the players, 15 percent to each club, and 10 percent to the league. Shares for individual players were $210 for the Bears and $140 for the Giants. http://www.mapleshaderecords.com/artists/walter_booker.html 1939-Birthday of pianist James Booker, New Orleans, LA http://offbeat.com/booker/discography.html http://www.zultimate1.com/music/blues/j_blues_bands/james_booker.htm http://www.thejukejoint.com/jamesbooker.html 1939-Birthdy of Eddie Kendricks, lead, The Temptations, Union Springs, Al http://www.thetemptations.com/eddiekendricks.htm http://www.alamhof.org/kendrick.htm 1940 - United States President Franklin Roosevelt outlined his plan for "lend-leasing" arms and equipment to Britain during World War II. 1941-Rear Admiral Husband E. Kimmel was relieved of his command of the U.S. Pacific Fleet as part of a shake-up of officers in the wake of the Pearl Harbor disaster. Admiral Kimmel had enjoyed a successful military career, beginning in 1915 as an aide to the Assistant Secretary of the Navy, Franklin Delano Roosevelt. He served admirably on battleships in World War I, winning command of several in the interwar period. At the outbreak of World War II, Kimmel had already attained the rank of rear admiral and was commanding the cruiser forces at Pearl Harbor. In January 1941, he was promoted to commander of the Pacific Fleet, replacing James Richardson, who FDR relieved of duty after Richardson objected to basing the fleet at Pearl Harbor. If Kimmel had a weakness, it was that he was a creature of habit, of routine. He knew only what had been done before, and lacked imagination-and therefore insight-regarding the unprecedented. So, even as word was out that Japan was likely to make a first strike against the United States as the negotiations in Washington floundered, Kimmel took no extraordinary actions at Pearl Harbor. In fact, he believed that a sneak attack was more likely at Wake Island or Midway Island, and requested from Lieutenant General Walter Short, Commander of the Army at Pearl Harbor, extra antiaircraft artillery for support there (none could be spared). Kimmel's predictability was extremely easy to read by Japanese military observers and made his fleet highly vulnerable. As a result, Kimmel was held accountable, to a certain degree, for the absolute devastation wrought on December 7. Although he had no more reason than anyone else to believe Pearl Harbor was a possible Japanese target, a scapegoat had to be found to appease public outrage. He avoided a probable court-martial when he requested early retirement. When Admiral Kimmel's Story, an "as told to" autobiography, was published in 1955, Kimmel made it plain that he believed FDR sacrificed him-and his career-to take suspicion off himself; Kimmel believed Roosevelt knew Pearl Harbor was going to be bombed, although no evidence has ever been adduced to support his allegation. The only intelligence at the time talked about a possible invasion of Indochina. There was speculation that Wake Island in Midway might be a target, but it was thought at the time the Japanese were more interested in the China mainland and its surrounding countries, their century old enemies. 1944--COWAN, RICHARD ELLER Medal of Honor Rank and organization: Private First Class, U.S. Army, Company M, 23d Infantry, 2d Infantry Division. Place and date: Near Krinkelter Wald, Belgium, 17 December 1944. Entered service at: Wichita, Kans. Birth: Lincoln, Nebr. G.O. No.: 48, 23 June 1945. Citation: He was a heavy machinegunner in a section attached to Company I in the vicinity of Krinkelter Wald, Belgium, 17 December 1944, when that company was attacked by a numerically superior force of German infantry and tanks. The first 6 waves of hostile infantrymen were repulsed with heavy casualties, but a seventh drive with tanks killed or wounded all but 3 of his section, leaving Pvt. Cowan to man his gun, supported by only 15 to 20 riflemen of Company I. He maintained his position, holding off the Germans until the rest of the shattered force had set up a new line along a firebreak. Then, unaided, he moved his machinegun and ammunition to the second position. At the approach of a Royal Tiger tank, he held his fire until about 80 enemy infantrymen supporting the tank appeared at a distance of about 150 yards. His first burst killed or wounded about half of these infantrymen. His position was rocked by an 88mm. shell when the tank opened fire, but he continued to man his gun, pouring deadly fire into the Germans when they again advanced. He was barely missed by another shell. Fire from three machineguns and innumerable small arms struck all about him; an enemy rocket shook him badly, but did not drive him from his gun. Infiltration by the enemy had by this time made the position untenable, and the order was given to withdraw. Pvt. Cowan was the last man to leave, voluntarily covering the withdrawal of his remaining comrades. His heroic actions were entirely responsible for allowing the remaining men to retire successfully from the scene of their last-ditch stand. 1944--LOPEZ, JOSE M. Medal of Honor Rank and organization: Sergeant, U.S. Army, 23d Infantry, 2d Infantry Division. Place and date: Near Krinkelt, Belgium, 17 December 1944. Entered service at: Brownsville, Tex. Birth: Mission, Tex. G.O. No.: 47, 18 June 1945. Citation: On his own initiative, he carried his heavy machinegun from Company K's right flank to its left, in order to protect that flank which was in danger of being overrun by advancing enemy infantry supported by tanks. Occupying a shallow hole offering no protection above his waist, he cut down a group of 10 Germans. Ignoring enemy fire from an advancing tank, he held his position and cut down 25 more enemy infantry attempting to turn his flank. Glancing to his right, he saw a large number of infantry swarming in from the front. Although dazed and shaken from enemy artillery fire which had crashed into the ground only a few yards away, he realized that his position soon would be outflanked. Again, alone, he carried his machinegun to a position to the right rear of the sector; enemy tanks and infantry were forcing a withdrawal. Blown over backward by the concussion of enemy fire, he immediately reset his gun and continued his fire. Single-handed he held off the German horde until he was satisfied his company had effected its retirement. Again he loaded his gun on his back and in a hail of small arms fire he ran to a point where a few of his comrades were attempting to set up another defense against the onrushing enemy. He fired from this position until his ammunition was exhausted. Still carrying his gun, he fell back with his small group to Krinkelt. Sgt. Lopez's gallantry and intrepidity, on seemingly suicidal missions in which he killed at least 100 of the enemy, were almost solely responsible for allowing Company K to avoid being enveloped, to withdraw successfully and to give other forces coming up in support time to build a line which repelled the enemy drive. 1944 -- US: Japanese-Americans released from detention camps. US Army announces end of excluding Japanese-Americans from West Coast http://americanhistory.si.edu/perfectunion/non-flash/justice_postwar.html 1946---Top Hits Ole Buttermilk Sky - The Kay Kyser Orchestra (vocal: Mike Douglas & The Campus Kids) White Christmas - Bing Crosby The Whole World is Singing My Song - The Les Brown Orchestra (vocal: Doris Day) Divorce Me C.O.D. - Merle Travis 1946- President Harry S. Truman received the first coin bearing the likeness of an African-American, the 50 cent commemorative honoring Booker T. Washington,, the founder of Tuskegee Institute. It was authorized on August 7, 1946. The obverse showed the head of Washington and the reverse a stylized Hall of Fame, under which were the words “ From Slave Cabin to Hall of Fame.” Centered under this wording was a slave cabin, to the left of which was the inscription, “ In God We Trust,” and to the right, “ Franklin County, VA.” Around the rime was the inscription “ Booker T. Washington Birthplace Memorial---Liberty. The coin was designed by Isaac Scott Hathaway. 1947- New York struck by a blizzard, resulting with 27" of snow. http://manhattan.about.com/library/weekly/aa010101a.htm http://www-nsidc.colorado.edu/snow/shovel.html 1948- vowing this day to not “subvert” his music, Stan Kenton breaks up his band, New York City ( he came back in 1950 with his biggest band yet: http://home.hiwaay.net/~crispen/kenton/biography.html ) 1954---Top Hits Mr. Sandman - The Chordettes Count Your Blessings - Eddie Fisher Let Me Go, Lover! - Teresa Brewer More and More - Webb Pierce 1955 - Carl Perkins wrote "Blue Suede Shoes", which he was recording, less than 48 hours later, at the Sun Studios in Memphis, Tennessee. The song became one of the first records to have simultaneous popularity on rock, country and rhythm & blues charts. 1955--While their hit "Only You" was still at #2, the Platters' "The Great Pretender" enters the Billboard R&B chart at #13. I had all their records at 13 years old. 1955--Tennessee Ernie Ford's "Sixteen Tons" is number one on both the Billboard Pop and Country & Western charts. 1956-The first pilot on a scheduled passenger line who was African-American was Perry H. Young of Orangeburg, SC, he was hired as a flight crewman by New York Airways, New York City. He started regular passenger flights on Fe4bruary 1, 1957, as a copilot in a 12-passenger S-58 helicopter between New York International, La Guardia, and Newark, NJ, airports. 1957-Bobby Helms' "Jingle Bell Rock" enters the Billboard Pop chart for the first time, where it will reach #6. It will make the chart again in December 1958, 1960, 1961 and 1962. 1959 - On the Beach, the gripping post-nuclear war film starring Gregory Peck, Ava Gardner, Fred Astaire, and Tony Perkins, premiered in New York. 1962---Top Hits Big Girls Don't Cry - The 4 Seasons Return to Sender - Elvis Presley Bobby's Girl - Marcie Blane Don't Let Me Cross Over - Carl Butler & Pearl (Dee Jones) 1962-James Carroll at WWDC in Washington, DC, became the first disc jockey to broadcast a Beatles record on American airwaves. Carroll played "I Want To Hold Your Hand", which he had obtained from his stewardess girlfriend, who brought the single back from Britain. Due to listener demand, the song was played daily, every hour. Since it hadn't been released yet in the States, Capitol Records initially considered court action, but instead released the single earlier than planned. 1963- the US Congress passed the “Clean Air Act,” a sweeping set of laws passed to protect the nation from air pollution. This was the first legislation to p1 pollution controls on the automobile industry. It authorized $93 million in matching grants for state-funded air pollution prevention and control programs. The Clean Air Act of 1970, signed into law on December 31, 1970, was the first to set national standards for air polluting emissions for motor vehicles. 1966-The Royal Guardsmen's "Snoopy vs. the Red Baron" enters the Billboard Pop chart, where it will peak at #2 during its eleven week run. 1966-The Four Tops' "Standing in the Shadows of Love" enters the Billboard Hot 100. During a ten week stay, the tune will peak at #6. It also reaches #2 on the R&B chart. 1966 -- Death & Rebirth of the Haight-Ashbury (Hairy Henry & Fyllis busted). Home of the anarchist Bound Together Books Collective . http://www.cnsproductions.com/cocaine.html http://dmoz.org/Society/Politics/Anarchism/Bookstores/ 1969 -- USAF closes Project Blue Book, concluding no evidence of extraterrestrial spaceships behind thousands of UFO sightings. http://www.jagat.com/joel/socks.html http://www.roswell-online.com/clipart/ufoclip1.htm 1969 - The soprano-voiced, ukelele-playing Tiny Tim married the lovely Miss Vickie on Johnny Carson's The Tonight Show on this date before a huge viewing audience. The NBC-TV program earned the second-highest, all-time audience rating; second only to Neil Armstrong's walking on the moon. The unlikely couple later divorced in 1977, but not before Miss Vickie gave birth to daughter Tulip. 1969 - Chicago Transit Authority earned a gold record for the group of the same name, who would later become simply "Chicago". The album's release by Columbia Records marked the first time an artist's debut LP was a double record. 1970---Top Hits The Tears of a Clown - Smokey Robinson & The Miracles One Less Bell to Answer - The 5th Dimension My Sweet Lord/Isn't It a Pity - George Harrison Endlessly - Sonny James 1976 - The Ted Turner owned WTCG-TV, Atlanta, Georgia, changed its call letters to WTBS, and was unlinked via satellite, making it the first commercial television station to cover the entire United States. WTBS began on only four cable systems, available in 24,000 homes. 1977 - Elvis Costello & the Attractions appear on NBC-TV "Saturday Night Live" in place of the Sex Pistols , who can't get a visa to enter the country. Producer Lorne Michaels refuses to allow Costello to perform "Radio, Radio" (because of the song's criticism of the broadcasting industry), but a few measures into "Less than Zero," Costello halts his group & goes into "Radio, Radio." He will never be invited back. 1978---Top Hits You Don't Bring Me Flowers - Barbra Streisand & Neil Diamond Too Much Heaven - Bee Gees My Life - Billy Joel The Gambler - Kenny Rogers 1979- “ House Calls” premiered on TV. This half-hour sitcom set in Kensington General Hospital starred Wayne Rogers as Dr. Charley Michaels and Lynn Redgrave as Ann Anderson, assistant administrator and Michaels's love interest. Also featured was David Wayne as flaky chief of surgery Dr. Amos Wetherby. After a dispute with the producers, Redgrave was dropped in 1982 and replaced by Sharon Gless (as assistant Jane Jeffries 1984- “Run-D.M.C.” went gold, the first Rap album to attract a mass audience, recorded by the rap group of the same name. Run-D.M.C's members were “Jam Master” Jason Mizell, Joseph “ Run” Simmons, and “MC” Darryle “D” McDaniels, all of New York City. The album was released by Profile Records in June,1984, and Rap was the music of this generation. 1986 - A federal jury in Las Vegas ruled on this date that NBC falsely linked entertainer Wayne Newton to organized crime in 1980 and 1981 telecasts. Newton was awarded $19.2 million in defamation damages 1984 - For the first time in 14 matches, John McEnroe and Peter Fleming lost a doubles tennis match in the Davis Cup competition. Anders Jarryd and Stefan Edberg lead the Swedish team to win the title, marking the worst defeat since 1973 for the United States team 1986---Top Hits The Way It Is - Bruce Hornsby & The Range Walk Like an Egyptian - Bangles Everybody Have Fun Tonight - Wang Chung Hell and High Water - T. Graham Brown 1987 - A storm in the southwestern U.S. brought heavy rain and heavy snow to parts of California, Nevada, Arizona, Utah and New Mexico. Charleston NV was blanketed with 12 inches of snow. Lake Havasu City AZ was drenched with 2.26 inches of rain. 1989- “ TV's animated family, “The Simpsons,” premiered as a half-hour weekly sitcom. The originator of Homer, Marge, Bart, Lisa and Maggie is cartoonist Mall Groening. The Simpsons' inaugural episode was "Simpsons Roasting on an Open Fire”. For the full story, go here: http://freespace.virgin.net/lol.marcus/simpsons.htm 1989 - Twenty-one cities from Kentucky to Pennsylvania reported record low temperatures for the date, including Columbus OH with a reading of 12 degrees below zero. Heavy snow continued in the Colorado Rockies. Vail received 65 inches of snow between the 14th and the 18th of December. Steamboat Springs was buried under 74 inches, and reported a total of 108 inches of snow between the 10th and the 18th of the month. 1994-A remixed version of The Four Seasons' "December, 1963 (Oh, What A Night)" re-enters the Billboard Hot 100, where it will stay for another 27 weeks, just as it did when it first charted in 1976. The combined run will establish a record for the longest total chart appearance in history. The song reached #1 the first time out and #14 during its second stay. 2000 — San Francisco wide receiver Terrell Owens sets a new NFL single-game receiving record with 20 catches in the 49ers' 17-0 win over Chicago. Owens totalled 283 yards and a touchdown while topping Tom Fears' mark of 18 receptions which had stood since 1950. |

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out

with one click, or type in a new route to learn the traffic live.

--------------------------------

Bank Beat

Cartoons

Computer Tips

Fernando's Review

Leasing 102

Online Newspapers

Placards

Sales Make it Happen

To Tell the Truth