|

|

|

|

|

| San Francisco Office

Two openings lease pricing division |

Friday, July 29, 2005

Headlines---

Correction: Missouri Court Denies Popular Leasing appeal

Controversy: IFC Credit and the word “Wallop”

Classified Ads----Operations

Leasing Association Fall Conference

Classified Ads – Help Wanted

GATX Corporation Reports 2005 2nd Quarter Results

Carl Zeiss Meditec AG Selects Premier Leasing Partner

CLEARLINKT 1st Quarter Fiscal 2006 $3 Million

Fred Marchini Joins Harborside Capital Group LLC

Relational, LLC Wins ELA Business Technology Solutions Award

Schwarzenegger Signs Recycling Wolk Bill To Solve Problem

Siemens Financial Services to acquire Broadcastle

White Clarke North America completes move to larger facilities

Today's Top Event in History

This Day in American History

Baseball Poem

####### surrounding the article denotes it is a “press release”

Brian Wong/Maria Wong, editors

Correction: Missouri Court Denies Popular Leasing appeal

“Minor clarification. To alleviate potential confusion, I want to point out that the St. Louis County Court's denial of Popular Leasing's motion for reconsideration was not the denial of an "appeal" in the strict legal sense; the matter was still before the same court that issued the original decision. The County Court has set up a very unusual 3-judge panel to decide pre-trial matters.

Usually, only a court of appeals would sit as a 3-judge panel.”

Ronald J. Eisenberg, Esq.

Schultz & Little L.L.P.

640 Cepi Drive, Suite A

Chesterfield, MO 63005

(636) 537-4645

(Thank you for the distinction. Congratulations to you and your law firm for the “win.” The point readers should realize is the “reconsideration request” was denied and the defense may include NorVergence in the case, which brings a new dimension to the leasing industry contracts, according to the opposing counsel in the original article:

http://www.leasingnews.org/#court

----------------------------------------------------------------

Controversy: IFC Credit and the word “Wallop”

by Kit Menkin ( at the airport )

John Estok, Executive Vice President, IFC Credit Corporation, Morton Grove, Illinois ( the signature of his e-mail revealed) objected to the Leasing News headline in the July 28th edition:

" IFC Credit Takes NorVergence Wallop ."

"First, that information in the headline is false, “he claimed. " We did not loose one thin dime. Over a year ago, we released our claim against any lessee or asset in the NorVergence bankruptcy. To link the FTC story to IFC is misleading."

It appears the word “wallop” was a red flag to Mr. Estok's view of the NorVergence leasing portfolio and claims the company originally made with the bankruptcy receiver or any losses the company may sustain from the NorVergence leases they purchased. He is the former President of FIRSTCORP.( First Portland Corporation dba FIRSTCORP, which IFC purchased all outstanding stock in March, 2003.) He told me he was going to call the Leasing News Advisory Board about my false writing and choice of words in the headline to describe the situation. I explained to him I had asked many times for IFC Credit side to the story, even showing them a draft of what Mr. Cundra wrote. I also told Mr. Estok that the Leasing News Advisory Board is not involved in the selection or reporting of any specific news story. Nevertheless, he told me again he was going to call them to let them know that I was writing “false information.” Since he still did not understand that they were not involved in any selection of stories and never reviewed what was written, I bluntly told him I was also the publisher and sole stockholder of Leasing News, Inc. He was talking to the boss. If he wanted to call them, he was welcome to do so. They weren't going to fire me or dock my pay.

When asked about other law suits, or if any of those named in the FTC NorVergence bankruptcy judgment that IFC is legally suing, he had no comment. During the telephone conversation, I requested several times for a written comment or statement to insure that what he was stating was correct, but he did not want to make a written statement. I informed him I was on vacation, but would try to make sure his comments were printed to be fair to all sides, and would be contacting

Steven Cundra, which I did:

“Documents don't lie.” Steve Cundra of Hall, Estill, Hardwick, Gable, Golden & Nelson, P.C., put in an e-mail. “ That is why I sent you the relevant documents, all of which are publicly filed in the NorVergence bankruptcy court, including the letter to Mr. Salan with Exhibits.

“I'll give you a call to discuss. In the meantime, do you want to look at any other documents, including IFC's Lift Stay Motion (an attempt to obtain another 256 NorVergence Equipment Lease Agreements with a face value of approximately $15 Million on which they claimed that they obtained a security assignment from NorVergence and filed their UCC-1 on June 15, 2004), the Affidavit of John Estok in support of IFC's lift stay motion (where he acknowledges that the "matrix" boxes probably have no value without service included - which is why IFC did not seek to foreclose on the collateral "matrix" boxes, only the ERAs) or their court-recorded withdrawal of their motion to lift stay "without prejudice" after we filed our lawsuit (because they stated that they had to first defend our suit before they could pursue their lift stay motion to acquire the additional 256 ERAs).

“ I would be happy to e-mail these and any other documents that you would like to review.

“It is simply untrue for IFC to say that: "Over a year ago we released our claim against any lessee or asset in the NorVergence bankruptcy." The Order I sent you was signed by Judge Gambardella on May 31, 2005, which by my calendar was not "Over a year ago" Further, to link the story to FTC is appropriate, as they supported and joined in our October 15, 2004 Objection of Fraud Victims to IFC's Motion to Lift Stay. ”

“For your further information, I have attached

(1) the Court's May 19, 2005 Notice of Filing of its Pretrial Scheduling Order,

(2) the actual Pretrial Scheduling Order,

(3) the Court's Notice of its Order authorizing my appearance and representation of the NorVergence Fraud Victims Group,

(4) the actual Order authorizing my admission "as counsel for Fraud Victims for all purposes,"

(5) the Transcript of the November 9, 2004, Hearing on IFC's Motion for Lift Stay, showing their withdrawal of their application "without prejudice" at the last minute due to the filing of our Adversary Complaint on November 1, 2004 and the FTC counsel Randy Brook's appearance and support for our Adversary as a basis for denying the relief that IFC had been requesting (see particularly pages 4 and 9-11), and

(6) the Objection filed by the Federal Trade Commission, which endorses our Objection and Adversary Action as a basis for withdrawal of IFC's motion and to litigate the issues in our Fraud Victims Adversary filed on November 1, 2004.

“ Of course, the FTC later filed an Action in the US District Court (but that action was against NorVergence only, and not against IFC Credit Corporation). Our suit named IFC Credit Corporation, Access IT and the Chapter 7 Trustee, Charles Forman as defendants and, unlike the District Court Action. all the defendants appeared by counsel and defended against our lawsuit.

“Please call or e-mail me if you have any urgent questions or concerns.”

http://leasingnews.org/PDF/Notice_of_Filing.pdf

http://leasingnews.org/PDF/Pretrial_Scheduling_Order.pdf

http://leasingnews.org/PDF/Notice_of_Granting.pdf

http://leasingnews.org/PDF/Order_Granting_Cundra_App.pdf

http://leasingnews.org/PDF/Transcript_of_November.pdf

http://leasingnews.org/PDF/Objection_of_FTC.pdf

Leasing News asked both IFC Credit executives Rudy Trebels and Gary Trebels for a comment, and actually held up the story for two days, hoping to get a comment. The draft of the story (sans headline) was sent in five e-mails over the two day period to them. Estok said Rudy Trebels was traveling, but could not speak for Gary Trebels. As Gary's friends, I can guess that he really would like to have never heard of the name NorVergence and wants to have nothing to do with it today, either; that is the task for the corporate attorney.

The story followed the FTC NorVergence judgment story with the names of 1600 lessees affected, and included the information about the release in attachments, along with the latest where IFC then agreed to the "no payment" order entered by the New Jersey Bankruptcy Court on May 31, 2005 ( Mr. Cundra refers to above:)

2.5mb, large download, with letters, e-mails, amended list naming all the other NorVergence lessees involved

http://leasingnews.org/PDF/Salan_Response_with_Exhibits.pdf

An ex-employee of NorVergence, perhaps middle management, told Leasing News the IFC Credit NorVergence leases were mostly a 25% interest yield, a very high one at the time for some very good to excellent credits, and he had brought up the fact that all of them seem to have the same equipment, but many different prices. The good to excellent credits and high yield in the NorVergence portfolio was more important than only one piece of equipment in each lease. When I asked him for more information, he seemed to not want to respond more, but added that he shortly left the company. Perhaps he felt he would be viewed as a “disgruntled employee.”

To add to other comments on Thursday's story, we received this e-mail:

“Our Salon "The Looking Glass Salon" is also with IFC. Why is our name not listed with the others? There were three businesses that had to pay IFC and ours was one of them. Why are we excluded?

“Debra Ranger and Kevin Farley”

Leasing News believes this is a part of the original article not explained by Mr. Estok:

“Hall, Estill, Hardwick, Gable, Golden & Nelson also have another lawsuit with IFC brought on behalf of other ex-NorVergence customers. This was confirmed with Mr. Cundra of Hall, Estill, Hardwick, Gable, Golden & Nelson, P.C.

“'Yes, this is true,' he responded. ‘ This group was added on May 19, 2005 in the same Adversary Action. This group consists of ex-NorVergence customers that were sued by IFC in Illinois. We expect a decision in this part of the action soon. However, IFC presently contends that they are out of the lawsuit, as pertains to all plaintiffs, and do not have to defend. (See letter to Evan Salan, IFC counsel, from the undersigned, dated July 20, 2005).”

The fact is Leasing News gives independent, fair, and unbiased about the leasing industry, even when Gary Trebels is considered a good friend. It was not our intention to malign the company, who is strong financial and in a growth mode. But we will call “a fig a fig.”

We print all sides to a story, and have written mostly positive ones about IFC Credit, such as on June 8, 2005, we wrote:

IFC Credit Corporation, Morton Grove, Illinois has acquired the assets and business operations of Blue Dot Funding LLC, an Irvine, California-based equipment lessor.

Blue Dot Funding Corporation is the fourth company acquired by IFC Credit Corporation in as many years. Earlier, the company acquired Pioneer Capital Corporation, Addison, Texas, First Portland Corporation dba FirstCorp, Portland, Oregon and Spectrum Medical Leasing, Inc., Downers Grove, Illinois.

Rudolph D. Trebels, President and CEO of IFC Credit Corporation, commented: “The acquisition of Blue Dot Funding will help us to accelerate our market growth, and contribute toward achieving our corporate goal of producing $500 million in annual lease originations by 2009.”

IFC now has representatives located in or near key U.S. cities including Dallas, Boston, Portland, New York, Atlanta, Chicago, Los Angeles, Sacramento, Minneapolis and Tampa.

Trebels adds, “The addition of Blue Dot is an important strategic step for us because it provides us with a stronger presence in the Southern California market, adds small-ticket market share and leverages our vendor service capabilities.”

Terms of the acquisition were not disclosed.

Blue Dot Funding LLC was formed in 1999, and provides equipment leasing services to small and mid-size businesses referred to the company by equipment suppliers through formal vendor financing programs.

The group will operate as a regional office of IFC's FirstCorp vendor services division.

“Joining IFC represented an opportunity to expand and profit from increased capabilities,” stated Marcus Davin, President and founder of Blue Dot. “In order to continue our aggressive growth, we needed to join an organization that had a strong marketing and operations platform, and had significant excess funding capacity. IFC Credit provides us with what we need to expand beyond our current level of business.”

Also commenting, IFC's FirstCorp Division President John Estok emphasized the importance of the Blue Dot acquisition for IFC's long-term expansion plans. “Our strategy of cultivating close personal relationships with equipment vendors within targeted vertical and geographic markets will be significantly strengthened by this acquisition.”

IFC expects to continue to consider new acquisition opportunities that add long-term strategic value to the company, despite the reported potential loss of over 500 NorVergence leasing contracts the company purchased before the New Jersey Telecom company filed bankruptcy.

Leasing News welcomes any official comment that IFC Credit Corporation would like to make on this matter, or any other matter.

We are open to presenting all sides to a story and strive to achieve this goal.

-----------------------------------------------------------------

Classified Ads----Operations

Orange County, CA .

Operations/Credit Manager with 15 Years Experience, Middle & Large Ticket, initiated policies for Patriot Act and Sarbanes Oxley, Team Motivator.

E-mail: equiplender@aol.com

Windsor, NJ.

Skilled Manager in credit, collections, training, documentation, policy and procedure, lease and finance operations. Get results and keep the customer coming back.

Email: rgmorrill@comcast.net

Resume

http://216.66.242.252/AL/LeasingNews/Resumes/Richard_Morrill.pdf

New York, NY .

10+ years in equipment leasing/secured lending. Skilled in management & training, documentation, policy and procedure development & implementation, portfolio reporting. Strong work ethic.

Email: dln1031@nyc.rr.com

Wayne, NJ

20+ heavily experienced collection/recovery VP looking to improve someone's bottom line. Proven, verifiable track record. Knowledge of all types of portfolio. Will relocate

Email: cmate@nac.net

For a full listing of all “job wanted” ads, please go to:

http://216.66.242.252/AL/LeasingNews/JobPostings.htm

To place a free “job wanted” ad, please go to:

http://216.66.242.252/AL/LeasingNews/PostingForm.asp

----------------------------------------------------------------

Leasing Association Conferences—Fall, 2005

September 14-16 Vancouver, BC

The Canadian Finance and Leasing Association 2005 Conference "Working smarter for tomorrow ~ Mieux travailler pour demain" & 32nd Annual General Meeting ~ September 14 -16, Westin Bayshore Resort & Marina, Vancouver, BC - Join us in Vancouver for the 2005 Conference and discover how businesses are Working smarter for tomorrow within the asset-based financing/leasing industry.

Registration, plus agenda, please go here.

A list of Conference delegates is available to the Public by Company

www.cfla-acfl.ca/files/public/2005ConferenceRosterbyCOMPANY.pdf

------------------------------------------------------------------

![]()

Eastern Association of Equipment Lessors

September 19th, Teaneck, New Jersey

Information on the key speakers:

http://www.eael.org/keymote-speakers-sept2005.asp

For Agenda and Registration, please go here:

http://www.eael.org/doc/Attendee_Registration_2005.pdf

For Exhibitor Registration

http://www.eael.org/doc/EAEL2005%20brochure.pdf

------------------------------------------

National Assocation of Equiment Leasing Brokers

joins with Eastern Association of Equipment

Lessors for Fall Expo 2005

September 19th, Teaneck, New Jersey

-----------------------------------------

![]()

United Association of Equipment Leasing

September 22-25, Lake Tahoe, California

The event will also feature the exclusive buyout of the M.S. Dixie for the Saturday Sunset Dinner/Dance Cruise.

The complete brochure has been mailed and is also available

at www.uael.org

Make your room reservation as soon as possible at Caesars Tahoe (1-866-89-Tahoe for the UAEL block) as the hotel expects to be sold out.

for more information, please go here:

-----------------------------------------

![]()

Equipment Leasing Association

October 23-24

44th Annual Convention

Boca Raton Resort & Club

Boca Raton, Florida

A non-member who has not attended the conference before is invited

to attend.

Registration and all information about the Annual Convention are now available on-line at http://www.elaonline.com/events/2005/annconv/

---------------------------------------

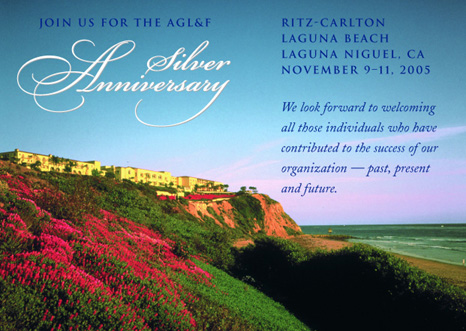

Association of Government Leasing & Finance

November 9, 2005

Dana Point, California

----------------------------------------------------------------

Classified Ads – Help Wanted

Account Executives

|

|

Account Executives to work from our corp. office Aliso Viejo, CA. Exper. only, aggressive, 4 yr college degree required. Lucrative uncapped commission plan/environment conductive to success. To learn more, click here. |

|

Learn more www.providentleasing.com |

Lease Administrator

|

|

|

San Francisco, CA. College Degree plus contract/ lease administration experience required. For a full description, click here. Email resume to |

Lease pricing division economic analysis / analytical support

| San Francisco Office

Two openings lease pricing division |

|

|

|

In business since 1958, DLC is an independent funding source servicing the $10K-250K market in 11 western states. |

Tax Manager

|

|

For complete description and application, click here. |

#### Press Release #####################

GATX Corporation Reports 2005 Second Quarter Results

CHICAGO----GATX Corporation (NYSE:GMT) announced net income from continuing operations for the second quarter of $34.5 million or $.62 per diluted share, compared to $19.7 million or $.38 per diluted share in the second quarter of 2004. Net income from continuing operations for the first six months of 2005 was $62.9 million or $1.14 per diluted share, compared to $39.4 million or $.76 per diluted share in the comparable prior year period. The 2005 second quarter and year-to-date net income includes $.12 per diluted share of after-tax expenses associated with liability management.

Highlights for the quarter included:

North American railcar fleet utilization remained at 98% and lease renewal rates continued to increase, reflecting a very strong market

Aircraft lease rates continued to improve on many aircraft and utilization of GATX's air portfolio increased to 100% Driven by a strong international shipping market, Specialty's marine joint ventures continued to experience high asset utilization and charter rates Specialty also generated a $12.8 million fee from a transaction within one of its managed portfolios, resulting in unusually high remarketing income.

Brian A. Kenney, president and CEO of GATX, stated, "As highlighted by our strong second quarter results, market conditions are increasingly positive. In particular, strength in railcar demand is exceeding our original expectations.

"In Air, our fleet is effectively fully utilized and we are using renewals as an opportunity to improve lease rates. In Specialty, marine income and remarketing income on both owned and managed assets contributed to an outstanding quarter.

"The investment environment, characterized by rising asset prices, is also indicative of the strength of our underlying markets. In rail, new car prices have increased sharply. While this provides us with advantaged new car costs under our Committed Purchase Program, economics on car purchases in the spot market are less appealing at this time. We will remain disciplined in our investment approach."

Mr. Kenney concluded, "We previously announced that we expected GAAP earnings to be in the range of $1.45 - $1.55 for 2005. Based on the improving trend in Rail and Specialty's marine business, coupled with unexpectedly high remarketing income, our 2005 outlook has improved. We now expect 2005 GAAP earnings to be in the range of $1.90 - $2.00 per diluted share."

For the full press release, please go here:

http://www.corporate-ir.net/ireye/ir_site.zhtml?ticker=gmt&script=

410&layout=-6&item_id=736328

### Press Release ######################

Carl Zeiss Meditec AG Selects Key Equipment Finance

as Premier Leasing Partner

Carl Zeiss Meditec AG, a manufacturer of diagnostic and therapeutic devices used by eye care professionals, is now providing financing options to its customers in the United States through a new relationship with Key Equipment Finance. Key Equipment Finance is the nation's third largest bank held equipment leasing company and an affiliate of KeyCorp (NYSE: KEY).

The relationship with Key Equipment Finance enables Carl Zeiss Meditec to provide flexible financing options to ophthalmologists interested in obtaining equipment for use in diagnosing and treating the glaucoma, retina, cataract and refraction disease categories. A lease program will allow Carl Zeiss Meditec to boost sales by offering customers one-stop shopping and financing, tax benefits, equipment upgrade flexibility and better asset management.

“Our company is going through a period of rapid growth, and we were looking for a leasing partner who could help us develop a flexible finance program that would enable us to meet the needs of our growing customer base,” said Joseph Donahoe, executive vice president, Americas at Carl Zeiss Meditec. “Key Equipment Finance is recognized as a leading finance partner for companies around the world and we look forward to working with them to provide a total solution for our customers.”

Carl Zeiss Meditec noted Key Equipment Finance's marketing support and commitment to customer service, as well as its reputation for implementing successful vendor lease programs globally, as the primary reasons for selecting Key Equipment Finance as the company's leasing partner.

“Carl Zeiss Meditec is committed to meeting the needs of its end-user customers and recognizes the importance of providing financing options as part of the sales process,” said Adam Warner, president and chief operating office of Key Equipment Finance's express leasing services unit. “We anticipate that they will experience even greater customer satisfaction and increased sales due to the ease of customer financing through this program.”

About Key Equipment Finance

Key Equipment Finance is an affiliate of KeyCorp (NYSE: KEY) and provides business-to-business equipment financing solutions to businesses of many types and sizes. The company focuses on four distinct markets:

· businesses of all sizes in the U.S. and Canada (from small business to large corporate);

· equipment manufacturers, distributors and value-added resellers worldwide;

· federal, provincial, state and local governments as well as other public sector organizations; and

· lease advisory services for manufacturers' captive leasing and finance companies.

Headquartered outside Boulder, Colorado, Key Equipment Finance manages a $12 billion equipment portfolio with annual originations of approximately $5 billion. The company has major management and operations bases in Toronto, Ontario; Albany, New York; Chicago, Illinois; Houston, Texas; London, England; and Sydney, Australia. The company, which operates in 25 countries and employs 1,100 people worldwide, has been in the equipment financing business for more than 30 years. Additional information regarding Key Equipment Finance, its products and services can be obtained online at KEFonline.com.

Cleveland-based KeyCorp is one of the nation's largest bank-based financial services companies, with assets of approximately $91 billion. Key companies provide investment management, retail and commercial banking, consumer finance, and investment banking products and services to individuals and companies throughout the United States and, for certain businesses, internationally.

About Carl Zeiss Meditec

Built on an unparalleled 150-year heritage of optical innovation, Carl Zeiss Meditec (International Securities Identification Number DE000531370) is one of the world's leading eye care solutions providers. Its product line includes systems for the diagnosis and treatment of the four main diseases of the eye: refraction, cataract, glaucoma and retinal disorders.

The company has incorporated its technologically superior optics into a stream of product innovations throughout the years, from slit lamps and fundus cameras; to the Humphrey® Field Analyzer, recognized as the global standard for glaucoma detection and management; to its newest applications of lasers and light as embodied in its leading-edge MEL-80™ refractive laser and eye-scanning StratusOCT™ optical coherence tomographer.

Carl Zeiss Meditec AG is based in Jena, Germany, with key subsidiaries in the U.S. (Carl Zeiss Meditec Inc.) and Japan (Carl Zeiss Meditec Limited). The rapidly aging global population and other trends are expected to grow the ophthalmic market through 2010, and the company is focused on applying innovative optical technologies to protect and enhance vision now and into the future.

Sites of Reference:

CONTACT:

Cori Keeton Pope

Keeton PR

Phone Number: 303-282-4981

E-mail: cori@keetonpr.com

### Press Release ######################

|

CLEARLINKT 1st Quarter Fiscal 2006 $3 Million

(the Corporation has decided to concentrate on developing the equipment trading division, managing the residual book of business and writing only selected business with existing customers. The Corporation will address its growing excess disposable capital by way of new investments in financial services or shareholder value initiatives.)

Mississauga, Ontario, July 27, 2005 (TSX: CNK): CLEARLINK Capital Corporation today reported results of operations for the first quarter ended June 30, 2005. CLEARLINK's performance reflects stable operations with a resumption of profits in the quarter at a level constrained by technology markets and issues specific to the Corporation.

Net income for the quarter ended June 30, 2005 was $1.5 million or $0.17 per share, the same level of net income and per share earnings as was earned in the corresponding quarter last year. All per share values are fully diluted. The year-over-year reduction in leasing margins was offset by increases in investment income and expense reductions..

Overall, lease margins declined to $3.0 million in the quarter from $3.6 million in the corresponding quarter in Fiscal 2005. On a year-over-year basis, the owned lease portfolio declined on average by approximately 28% to $206 million at June 30, 2005. Portfolio run-off continues to significantly exceed new business volumes. Residual realizations remained strong, generating a realization rate of 151% on $2.7 million of residuals processed. This compares with a 146% realization rate on $3.1 million of residual expiries in the equivalent quarter last year.

Investment income was $1.0 million, an increase from last year's value of $627,000, as cash and marketable securities grew to approximately $64.7million.

Expense levels in the quarter totaled $2.5 million, down from $2.8 million in expenses incurred in the same quarter last year and reflects the impact of historic infrastructure reductions in response to declining activities.

The Corporation's Shareholders Rights Plan has been re-instituted and will be presented for confirmation at the Corporation's annual meeting of shareholders.

The Corporation is also announcing that it will pay a dividend of $0.10 per share, payable October 14, 2005 to the shareholders of record as of September 30, 2005. Issuer bid activity in the quarter was low with 17,400 shares repurchased for cancellation at an average price of $10. Fully diluted net book value per share at June 30, 2005 was $12.60.

The substantial amount of time and focus on litigation matters with resulting negative publicity, together with worsening economics in its technology leasing area has resulted in a substantial erosion of the Corporation's prospects in its traditional core business.

As a result, the Corporation has decided to concentrate on developing the equipment trading division, managing the residual book of business and writing only selected business with existing customers. The Corporation will address its growing excess disposable capital by way of new investments in financial services or shareholder value initiatives.

CLEARLINK Capital Corporation is a provider of innovative financial solutions in technology and equipment leasing, and equipment trading. Based in Mississauga, Ontario, CLEARLINK operates throughout North America and Europe.

CLEARLINKTM is a trademark of CLEARLINK Capital Corporation.

### Press Release ######################

Fred Marchini Joins Harborside Capital Group LLC as

Managing Director of New Business Development

Ridgewood, NJ – Fred Marchini has joined Harborside Capital Group LLC as Managing Director of new business development. In his new position, Fred will be responsible for originating new operating lease transactions for the firm in both the middle market and large ticket marketplace. Fred will focus his marketing efforts calling on other leasing companies, brokers, banks and financial institutions seeking to purchase leased assets.

Marchini comes to Harborside with over 25 years of leasing experience, having previously served as Vice President for Bank of Scotland's Major Assets and Products Group, where he was responsible for new business generation. Prior to the Bank of Scotland, Fred worked at Sumitomo Capital, Pitney Bowes Capital and Barclay's Leasing.

Harborside Capital Group LLC, is a full service independently owned financial services company that provides equipment leasing programs for most types of assets on either a single investor or leveraged basis.

FOR FUTHER INFORMATION CONTACT:

Fred Marchini

Harborside Capital Group LLC

200 Lincoln Avenue

Ridgewood, NJ 07450

Phone Number: 201-670-6005

Fax Number: 201-447-3662

E-mail: fmarchini@harborsidecapitalgroup.com

Sites of Reference:

http://harborsidecapitalgroup.com

CONTACT:

George Fry

Harborside Capital Group LLC

Phone Number: 201-573-0216

Fax Number: 201-573-8037

E-mail: gfry@harborsidecapitalgroup.com

### Press Release ######################

Relational, LLC Wins ELA Business Technology Solutions Award With Submission of Front Office Solution From Cyence International

Posted 07/26/05

Rolling Meadows, Illinois, July 26, 2005-Relational, LLC, a Monitor 100 leasing company, has been honored with the Equipment Leasing Association's 2005 Business Technology Solutions Award. The award recognizes Relational for its innovative use of ExpressCS from Cyence International to improve operations, enter new markets, and build overall ROI.

ExpressCS is a Windows software solution, enhanced with integrated modules built on the Microsoft .NET platform. Compatible with any accounting system, it focuses on "front-end" processes, from e-commerce and sales and marketing to lease pricing, documentation, funding, and reporting.

In partnership with Cyence, Relational designed and implemented an end-of-term module that has streamlined workflow processes, reduced operational costs, and enhanced revenue. The Life-cycle Portfolio Management solution, as it is called, gives customers the flexibility to manage their asset base online while saving time and effort.

"Our solution focused on four key areas," says Christie Peterson, Business Solutions Manager at Relational. "End-of-term quotes, return merchandise authorization, returned asset reconciliation, and suspended billings. Data were made available to customers through our customer web portal and to remote sales through Microsoft Business Solutions CRM."

According to Peterson, the solution has created distinct efficiencies for Relational's customers. "They can do everything from tracking their lease to changing an asset or requesting a remarketing quote," she says. Using Express CS has also boosted sales productivity, she notes. Through the secure Web portal, the Relational sales force has instant online access to portfolios and to the accounting and operations departments.

ELA established the Business Technology Solutions Award as a way to recognize organizations that demonstrate a technologically innovative spirit, along with helping others become aware of unique approaches to market opportunities. Relational won in the large-company division.

"Our ongoing relationship with Relational has been instrumental in our quest to provide value-driven solutions for our clients," says Mike Cumby, Chief Product Architect for Cyence. "Their use of technology in leasing has given them a distinct strategic advantage, and they clearly embody the spirit of this award. We are delighted to see them honored in this way."

About Relational, LLC

Rolling Meadows, Illinois-based Relational, LLC is the premier independent IT portfolio management company in North America. The company helps clients manage the full lifecycle of IT hardware from financing and procurement through asset management and disposition of used equipment. As an independent, Relational provides unbiased third-party advice that reduces the cost and risk of acquiring technology assets in areas such as telecommunications, computing, Internet, Intranet, networking, data storage, and eBusiness. Founded in 1990, the company now manages more than 15,000 individual lease schedules covering $1 billion in equipment, which ranks Relational among the 100 largest privately held firms in Chicago according to Crain's Chicago Business. Clients served by the company's more than 300 financial and technical experts include General Electric, Johnson Controls Inc., and Ford. For more information, contact Relational at: 3701 Algonquin Road, Suite 600, Rolling Meadows, Illinois 60008; Phone 847-818-1700; Fax 847-818-1711; info@relationalllc.com ; www.relationalllc.com <http://www.relationalllc.com/> .

About Cyence International Inc.

Cyence International Inc. is a leading provider of front-office software that integrates financial workflows for the world's banking, manufacturing, and equipment finance markets. Its software solutions, ExpressOST, ExpressCS, and Credit Express for Microsoft® Office 2003T, embed industry best practices and enable real-time, online collaboration in the end-to-end finance process. From Origination to Credit Adjudication, Document Management to Auditing, Funding, and Booking, the Cyence solution has everything needed to streamline financial transactions and achieve operational excellence.

For more information, visit www.cyence.com .

###Press Release#####################

|

Schwarzenegger Signs Wolk Bill To Solve Problem In E-Waste Law

Legislation will streamline payment for proper disposal of electronic equipment

SACRAMENTO- The Governor signed Assembly Bill 575 by Assemblywoman Lois Wolk (D-Davis) to clarify California's electronic recycling law Monday.

"I'm thankful the Governor recognized AB 575 as common sense legislation," said Assemblywoman Wolk. "The bill makes California's recently enacted Electronic Waste Recycling program work better for business and the State. It's a win for everyone, which is why it received such bipartisan support and moved so smoothly through the Legislature."

Under current electronic recycling law, businesses and consumers who purchase computer monitors, televisions and other video display devices must pay an "advanced recovery fee" to offset the cost of properly disposing of the device at the end of its useful life. The amount of the fee ranges from $6 to $10, depending on the size of the screen, and is collected by the retailer at the time of the purchase. If a business wants to lease equipment, however, it often works with a business equipment vendor that helps the business decide what they want to lease and from whom-and also helps the business to choose a financer.

Under current law, it is this financing entity that is obligated to collect the advanced recovery fee from the business leasing the equipment. The vendor cannot pay the State directly-though the financer never handles the equipment and must rely on information provided by the vendor to determine the fee.

"AB 575 solves implementation problems associated with e-waste law," said Wolk. "It does not change the scope of electronic products or purchases to which recovery fees are applied, or the amount of the fees. The bill just streamlines the process by enabling the best suited party, the vendor, to both calculate and directly pay fees in commercial leasing transactions."

"This legislation makes doing business in California more streamlined while bringing more revenue to the State," said Dennis Brown, vice president of state government relations for the Equipment Leasing Association, the bill's sponsor. "The problem with the Electronic Waste Recycling Act was that is was written solely on a consumer retail model, for people who have retail stores, inventories of equipment, and shelves of merchandise. Equipment lease financing companies never see the equipment, and invoices don't always tell us if equipment has a screen, let alone its size... which we need to know to determine fees. It made it difficult, to say the least. This legislation has taken a lot of the mystery out of leasing equipment through vendors."

AB 575 was an urgency bill, and therefore went into effect immediately upon the Governor's signature. The bill's supporters include the American Electronics Association, Bank of America, California Manufacturer and Technology Association, Apple Computer, CIT Technologies Corporation, Hewlett Packard, Landmark Financial, La Salle National Leasing, US Bankcorp Equipment Finance, and Wells Fargo Financial Leasing.

CONTACT:

Dennis Brown

ELA

Phone Number: 703.516.8368

Fax Number: 703.527.2649

E-mail: dbrown@elamail.com

### Press Release ######################

Siemens Financial Services agreed to acquire Broadcastle

Siemens Financial Services agreed to acquire Broadcastle Plc through a tender offer According to FactSet Flashwire, Siemens Financial Services, a subsidiary of Siemens AG agreed to acquire Broadcastle Plc for GBP41.54 million (US$74.47 million) in cash. Under the terms of agreement, Siemens Financial Services agreed to offer GBP1.23 cash (US$2.2 cash) for each Broadcastle Plc share sought.

The acquisition is in line with Siemens Financial Services's strategy to expand its operations in medical equipment financing. Broadcastle Plc operates in the specialized banking and finance services sector. Its principal businesses are the leasing of medical equipment, motor vehicles and industrial and office machinery. In fiscal year ended December 31, 2004, Broadcastle Plc generated pre-tax profit of GBP3.8 million (US$6.8 million).The financial advisors in the deal include: PricewaterhouseCoopers LLP for Siemens Financial Services, Panmure Gordon Investments Ltd for Broadcastle Plc.

###Press Release#########################

White Clarke North America completes move to larger facilities

After 3 years of continued growth, White Clarke North America, a global leader in consulting services and technology solutions for the financial services industry, has expanded into a new location at 150 Ferrand Drive in Toronto, Ontario.

More than twice the size of the original location, White Clarke North America designed and built their new facilities, in centrally located midtown Toronto to accommodate their expanding customer and personnel needs.

"The enterprise-class facilities and their future growth potential are just two of the reasons why WCNA has taken this step to relocate" says Debbie Carroll, CEO, White Clarke North America. The facilities also contribute to an alliance with MCI Worldcom for delivery of an ASP / cost per transaction model of CALMS, due to be launched in September of 2005.

The continued success from their current customers and a growing worldwide customer base, driven primarily by an increased demand for the CALMS (Credit Adjudication and Lending Management System) solution, WCNA felt the timing could not have been better.

About White Clarke North America

White Clarke North America sells consultancy services and component-based products and solutions to the asset finance, auto finance and broader financial services sectors. Their proven track record of business process improvements through appropriate, high quality, practical solutions that deliver quantifiable business benefits has made WCNA an industry leader in financial services process automation.

Sites of Reference:

http://www.whiteclarkenorthamerica.com/index/page/18/cnt_id/51.html

http://www.whiteclarkenorthamerica.com/index/page/18.html

http://www.whiteclarkenorthamerica.com/

CONTACT:

Lisa Campbell

White Clarke North America

Phone Number: (416) 467-4060

Fax Number: (416) 467-4094

E-mail: Lisa.campbell@na.whiteclarkegroup.com

####Press Release######################

|

----------------------------------------------------------------

Today's Top Event in History

1945- After delivering the atomic bomb to Tinian Island, the American cruiser “Indianapolis” was headed for Okinawa to train for the pending invasion of Japan when it was torpedoed by a Japanese submarine. The war was going hot and heavy and there were no indications that Japan would surrender and fight until the end for their Emperor. Of the 1,196 crew members of the Indianapolis, more than 350 were immediately killed in the explosion or went down with the ship. There were no rescue ships nearby, and most of those fortunate enough to survive endured the next 84 hours in ocean waters. By the time they were spotted by air on August 2nd, only 318 sailors remained alive, 528 sailors either drowned or were eaten by the sharks. 878 sailors lost their lives, the US Navy's worst loss at sea.

-------------------------------------------------------------------------------

This Day in American History

1810-The third U.S. Census recorded a population of 7,239,881, an increase of 1,931,398 over 1800. Black population rose by 481,361 to 1,378,110. Of this total, 186,746 were “free citizens,” a group omitted in the 1800 census. The center of population moved to a point 40 mils northwest of

Washington, D.C.

1848-Harris Treaty with Japan, opening commerce while the Japanese objected and wanted to remain “isolationist.”

( lower half of: http://memory.loc.gov/ammem/today/jul29.html )

1864-Both the Democratic and Republican Convention were looming ahead. The presidential election while the Civil War was being fought posed special problems. in the North, there was considerable dissatisfaction with the progress being made in defeating the Confederacy, so President Abraham Lincoln did not think his chances of reelection were good. The Democrats were split between those who supported the war and those who wanted peace at almost any price. The Democratic nominee was General George B. McClellan, commander of the Union Army, who had let several opportunities for victory slip away. The Democratic platform called for peace through reunification of the states, but did not say how this was to be done. Fortunately for Lincoln and the Republicans, several important military victories perhaps influenced the outcome, such as the Battle of Mobile Bay in August, Sherman taking Atlanta, GA in September, and General Sheridans significant victory in October (famous at the time become the poem,” Sheridan's Ride” by Thomas Buchanan, which dramatized the general's return to the field. Lincoln beat McClellan with 212 electoral votes to his 21, popular vote 2,216,067 to McClellan, 18,808, 725, as key states all went to Lincoln. General Sherman in November marched to the sea with 62,000 men, destroying everything useful to the Confederates and raving the countryside. The South was cut in two. In less than six months, General Lee would surrender to General Grant and the ware was virtually ended. Five days later President Lincoln was assassinated. Andrew Johnson became president.

1870- Road pavement of sheet asphalt was laid on William Street, Newark, NJ by Professor Edward Joseph De Smedt of the American Asphalt Pavement Company, New York City. It was known as French asphalt pavement.

1887-Birthday of Timothy James (Tim) Mara, Po Football Hall of Fame executive born at New York, NY. Marra was a successful bookmaker who bought the New York franchise in NFL in 1925 for $500. His team, the Giants became one of the most successful in the league, withstanding challenges from early American Football Leagues; the All-America Football Conference of the late 1940's and the New York Jets of the AFL of the 1960s. Inducted into the Pro Football Hall of Fame as a charter member in 1963. Died at New York, Feb. 16, 1959.

1895-First National Convention of Black Women held in Boston, MA.

1898 - The temperature at Prineville, OR, soared to 119 degrees to establish a state record, which was tied on the 10th of August at Pendleton.

1900-Birthday of arranger/band leader Don Redman, Piedmont, West Virginia.

http://www.redhotjazz.com/redman.html

1909-Birthday of Bernard Mackey ( Ink Spots ),Indianapolis, IN

http://www.inkspots.ca/

http://inkspots.ca/ispress2.htm

1907-Birthday of the “King of Torts,” a friend of mine when I lived in San Francisco-he would always let you buy him a drink, Melvin Belli, born Sonora Calif. Died, July 9,1996 , San Francisco.

http://www.bellilaw.com/company.htm

http://us.imdb.com/Name?Belli,+Melvin

http://www.bwg-law.com/belli.html

http://www.mistersf.com/farewell/fwbelli.htm

http://www.amazon.com/exec/obidos/search-handle-url/index=books&field-author=Belli%2C%20Melvin%20M./103-2358920-6763062

http://smart90.com/melvinbelli#movies

http://www.law.harvard.edu/studorgs/forum/Belli.html

1915- US marines land in Haiti, stay until 1924

http://www.gliah.uh.edu/database/article_display.cfm?HHID=193

1916---Jazz electric guitarist Charlie Christian birthday

http://www.gould68.freeserve.co.uk/charliec.html

1920 -First transcontinental airmail flight from New York.

1926—Birthday of great bowler Don Carter, St. Louis, MO.

http://memory.loc.gov/ammem/today/jul29.html

1928-Walt Disney's "Steamboat Willie" is released

1930 -115ø F (46ø C), Holly Springs, Mississippi (state record)

1932-Birthday of Nancy Landon Kassenbaum, U. S. Senator from Kansas 1979-1996 and daughter of Alf Landon, the 1936 Republican nominee for president. Although a much-admired fiscal conservative, when she became chair of the Senate Labor and Education Committee in 1994, she admitted paying only $5,075 in taxes on an income of $92,000 and refused to show her tax return. She did not seek reelection. Soon after she left office she married a Republican former cabinet member under the Nixon administration Baker. She was appointed head of a committee to study the training of women following the sexual harassment scandals and recommended separate training facilities rather than insisting on men behaving. Predictably she came down on the side of separate training for men and women, a proposal that was ignored.

1936-Birthday of Elizabeth Hanford "Liddy" Dole, now a US Senator from her home state. She married the chairman of the Republican party, U.S. Senator Bob Dole in 1975. She was appointed to head President Reagan's public liaison office, then was appointed U.S. Secretary of Transportation 1983-87, admittedly to answer the gender-gap problem Reagan faced for not appointing women to important positions in his administration. She was moved to head the Department of Labor 1989-90 by President Bush. In 1991 Bush appointed her the president of the American Red Cross. She ran for the presidential nomination but withdrew before the convention.

1945-birthday of guitarist Joe Beck, Philadelphia, PA.

http://www.joebeckmusic.com/meetjb.htm

1945- After delivering the atomic bomb to Tinian Island, the American cruiser “Indianapolis” was headed for Okinawa to train for the pending invasion of Japan when it was torpedoed by a Japanese submarine. The war was going hot and heavy and there were no indications that Japan would surrender and fight until the end for their Emperor. Of the 1,196 crew members of the Indianapolis, more than 350 were immediately killed in the explosion or went down with the ship. There were no rescue ships nearby, and most of those fortunate enough to survive endured the next 84 hours in ocean waters. By the time they were spotted by air on August 2nd, only 318 sailors remained alive, 528 sailors either drowned or were eaten by the sharks. 878 sailors lost their lives, the US Navy's worst loss at sea.

1946---Top Hits

They Say It's Wonderful - Frank Sinatra

The Gypsy - The Ink Spots

Surrender - Perry Como

New Spanish Two Step - Bob Wills

1954-Birthday of 1954, Flo Hyman - U.S. athlete who through her sparkling play single-handedly volleyball from obscurity to international competition. An Afro-American who stood six feet, five inches tall, FH passed on years of her college eligibility to play with the U.S. national team and won the silver runner-up medal in the 1984 Olympics. She turned pro to play in Japan and collapsed and died during a game in 1986, the victim of undiagnosed Marfan's syndrome - a genetic heart disorder that was little understood at the time. Her death advanced the interest in the disease, and early diagnosis and treatment is almost certain today.

1954---Top Hits

Sh-Boom - The Crew Cuts

If You Love Me (Really Love Me) - Kay Starr

The Little Shoemaker - The Gaylords

Even Tho - Webb Pierce

1956-- Bruce Springsteen's wife, E Street Band guitarist and vocalist Patty Scialia celebrates a birthday

1957 - Jack Paar began a successful five-year run as host of the "Tonight" show on NBC-TV, changing its name to "The Jack Paar Show". Jack Paar came to NBC from CBS where he had been a game and talk-show host. Paar's forte was interviewing. He would get so involved with his guests and their stories that he would not only laugh with them, but would sometimes, even cry. Paar's emotional outbursts, whether they involved an interviewee, a personal crusade or a feud with the likes of Ed Sullivan or Dorothy Kilgallen, became the major attraction of the show. Jose Melis and his orchestra stayed with Paar through the years as did his sidekick and announcer, Hugh Downs. The very first show had as guests Alexander King, singer Robert Merrill, and funnyman Buddy Hackett. King and Hackett became regulars over the years just as Jack Paar became a regular in our bedrooms every weekday night until March 30, 1962.

1958- President Eisenhower signed a bill creating the National Aeronautics and Space Administration to direct US space policy.

1973-Birthday of Wanya Morris of BoyzIIMen, Philadlephia, PA.

1959-The first “Jetway” was installed at San Francisco International airport.It was a self-powered telescopic corridor that extended from 44 to 107 feet and swung into place to connect the terminal with aircraft, to protect passengers from wind and weather as they boarded or disembarked. the jetway could be extended from the terminal building to the aircraft door in less than 60 seconds. Work was also going on to expand the airport, which is still going on today.

http://www.geocities.com/boyziimenforever/index.html

1962---Top Hits

Roses are Red - Bobby Vinton

The Wah Watusi - The Orlons

Sealed with a Kiss - Brian Hyland

Wolverton Mountain - Claude King

1967- The Temptations' "You're My Everything" is released.

1970-Six days of race rioting in Hartford, Ct.

http://www.hartford-hwp.com/HBHP/exhibit/04/2.html

1970---Top Hits

(They Long to Be) Close to You - Carpenters

Band of Gold - Freda Payne

Make It with You - Bread

Wonder Could I Live There Anymore - Charley Pride

1974-Second impeachment vote against Nixon by the House Judiciary Committee

1974- St Louis Card Lou Brock steals his 700th base

1974 - Jim Hartz was named to join Barbara Walters as co-host of the "Today" show on NBC. Hartz had been the original host of the popular morning TV show. Others who have hosted the show which has aired since 1952 include Dave Garroway, John Chancellor, Hugh Downs, Frank McGee, Tom Brokaw, Bryant Gumbel, Katie Couric and Matt Lauer.

1978- The first football game in which referees were allowed to check television instant replays was the Hall of Fame game played this day in 1978 at Canton, OH, when the Philadelphia Eagles defeated the Miami Dolphins 17-3. The game was telecast on Channel 7.

1978- Earth, Wind & Fire enter the soul chart with their version of the Beatles "Got to Get You into My Life," from the "Sgt. Pepper" soundtrack. It makes it to number one for a week in September.

1978- Kenny Loggins "Whenever I Call You Friend" is released

1978---Top Hits

Shadow Dancing - Andy Gibb

Baker Street - Gerry Rafferty

Miss You - The Rolling Stones

Only One Love in My Life - Ronnie Milsap

1981 - Millions of people around the world watched on television as England's Prince Charles and Lady Diana Spencer took center stage amidst the pomp and splendor of their royal wedding at St. Paul's Cathedral in London. The ceremony took place in the wee small hours of the morning in America, but was still a ratings success, with coverage on all networks. 2,500 guests were in actual attendance. 1985 - Spring Hill, Tennessee was selected as the new home of the Saturn automobile assembly plant. General Motors announced that it expected to produce up to 500,000 Saturns a year beginning in 1989. Some 14,000 jobs were created to operate the new auto plant.

1981 - Fifty cattle, each weighing 800 pounds, were killed by lightning near Vance, AL. The lightning struck a tree and then spread along the ground killing the cattle

1983- Due to a dislocated thumb caused by a collision at home plate trying to score in the first game of a doubleheader against the Braves, Padre first baseman Steve Garvey's consecutive game streak ends in the nightcap at 1,207.

1986-the United States Football League won its antitrust suit again

1986---Top Hits

Sledgehammer - Peter Gabriel

Danger Zone - Kenny Loggins

Glory of Love - Peter Cetera

1986-- Sparky Anderson, the first skipper to win the World Series in each league, also becomes the first manager to win 600 games in both the National and American Leagues when the Tigers beat the Brewers, 9-5.

1988- Last United States Playboy Club (Lansing Mich) closes, end of era.

http://www.playboy.com/worldofplayboy/faq/clubs.html

1988-- The Orioles trade pitcher Mike Boddicker to the Red Sox in return for Brady Anderson and Curt Schilling. Boddicker will have two successful years with Boston while Anderson will become a productive lead off man for Baltimore and Schilling will became one of baseball's most dominant pitchers of his era

1989-Javier Sotomayor of Cuba became the first man to high jump eight feet. he set the new world record at Caribbean Championship meet in San Juan, Puerto Rico. Sotomayor held the previous record, seven feet 1 ½ inches set in 1988 in Spain.

1990- Boston Red Sox set major league record with 12 double1988 - Afternoon and evening thunderstorms produced severe weather in Minnesota and Wisconsin. Hail three inches in diameter was reported south of Saint Cloud, MN. Hot weather prevailed in the western U.S. Fresno, CA reported a record thirteen straight days of 100 degree heat.

1994—Top Hits

I Swear- All-4-One

Stay (I Missed You) (From "Reality Bites")- Lisa Loeb

Fantastic Voyage- Coolio

Any Time, Any Place/And On And On- Janet Jackson

1996 - Carl Lewis won his ninth Olympic gold medal by winning the long jump competition at the 1996 games. Lewis tied swimmer Mark Spitz for most "golds" by an American athlete. Lewis also was only the second athlete (the other was discus thrower Al Oerter) to win the same track event in four straight Olympics

1999—Top Hits

Genie In A Bottle- Christina Aguilera

Wild Wild West- Will Smith Featuring Dru Hill

Bills, Bills, Bills- Destiny s Child

Last Kiss- Pearl Jam

2002 -The text of the letter signed 40 Hall of Famers and sent to baseball commissioner Bud Selig and union head Donald Fehr urges all sides 'to protect the game we all love and have given so much to, we suggest you agree to a qualified mediator that will allow you to find the common ground necessary to avoid a work stoppage'' is released. The former outstanding players, which includes Reggie Jackson, Willie Mays and Warren Spahn, believe another work stoppage in baseball would be a terrible mistake.

2003---Top Hits

Crazy In Love- Beyonce Featuring Jay-Z

Rock Wit U (Awww Baby)- Ashanti

Right Thurr- Chingy

Magic Stick- Lil' Kim Featuring 50 Cent

----------------------------------------------------------------

![]()

Baseball Poem

A Baseball Game (Free verse)

The ump showed up early.

Sharply dressed

His pants, meticulously creased.

His gold watch glinting in the 4 o'clock

End of March southern California sun.

He held a sour look

It was his first line of defense.

The manager of the Astros

Was what you might call

An easy going type.

A long-time bachelor, and a slob to boot.

He always had a quick sly grin

Popped his gum unceasingly.

His face like an old first-baseman's glove;

Tanned brown with wear,

The stitching undone,

Staggeringly wrinkled from so much daily use.

He strolled over to home,

Tugging at the bottom of his extra-large shirt

Which barely covered the expanse of his girth,

Slapped the ump on the back

and announced that the teams

were a little behind getting the field ready

and could we start the game at a quarter past?

The ump looked at his watch without saying a word

Held up his right hand for a moment,

Then brought it down like an ax,

"Play Ball!" he shouted

2 inches from the Astros manager's leathery face.

|

www.leasingnews.org |