Wednesday, March 21, 2007

Headlines--- Classified Ads---Credit ######## surrounding the article denotes it is a “press release” Friday---"To Tell the Truth"---Barry S. Marks, Esq. "ELFA"

Classified Ads---Credit

Atlanta, GA Corona, CA Fort Lee, NJ Irvine, CA Los Angeles, CA New Jersey, NJ New York, NY Sausalito, CA Orange, CA These job-wanted ads are free. We also recommend to both those seeking a position and those searching for a new hire to also go to other e-mail posting sites: In addition, those seeking employment should go to the human resource departments on company web sites for funders, captive lessors, and perhaps “broker-lessors.” To place a free “job wanted” ad here, please go to: For a full listing of all “job wanted” ads, please go to: ###Press Release########################################## The Federal Open Market Committee decided today to keep its target for the federal funds rate at 5-1/4 percent.

Recent indicators have been mixed and the adjustment in the housing sector is ongoing. Nevertheless, the economy seems likely to continue to expand at a moderate pace over coming quarters. Recent readings on core inflation have been somewhat elevated. Although inflation pressures seem likely to moderate over time, the high level of resource utilization has the potential to sustain those pressures. In these circumstances, the Committee's predominant policy concern remains the risk that inflation will fail to moderate as expected. Future policy adjustments will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information. More here: -------------------------------------------------------------- Balboa Capital takes on Marlin Leasing by Christopher Menkin Balboa Capital, Irvine, California announced that it has secured up to $15 million of subordinated financing from global investment and advisory firm Babcock & Brown (ASX: BNB). The growth capital will support the company's various expansion initiatives. Bruce Kropschot, of Kropschot Financial Services, served as exclusive financial advisor to Balboa. “Balboa plans to use the capital to expand its middle ticket and small ticket equipment leasing origination activities.” David Chiurazzi, Chief Financial Officer, stated, “We are enthusiastic about our partnership with Babcock & Brown. Their investment provides the company with the flexible long term capital which will fuel the next phase of our growth.” “The commitment by Babcock & Brown to provide up to $15 million of subordinated financing to Balboa Capital Corporation should be an important step in Balboa Capital's growth by expanding the company's capital base,” Bruce Kropschot told Leasing News.* “Subordinated financing is difficult for equipment leasing companies to obtain, and the fact that such a prestigious firm as Babcock & Brown has become a long-term partner of Balboa Capital certainly is a testament to the credibility of the company's business plan and its management team." Balboa makes working capital loans up to $25,000, promoting it to its network of brokers, as well as application only up to $250,000 with $100,000 standard, no bank or trade checks, and it is assumed In its quest to go after middle ticket leases, the smaller leases are approved more quickly, funded more quickly, and brokers rave about the Compass software service, the rates, the approvals, especially the speed in approvals, the liberal equipment criteria, and how easy Balboa Capital is to work with. Many have switched from Marlin Business Services to Balboa Capital, they told Leasing News. Others are waiting in line to get approved as a broker. Coda: Evergreen leases appear to be prevalent in the equipment leasing industry as noted in the Marlin Leasing SEC, as practiced by US Bancorp, and many bank leasing companies.

-------------------------------------------------------------- Funder List up-dated: Sterling Leasing, New York

Leasing News has been getting inquiries regarding Sterling Financial, Kansas, who appears to do “C” and “D” paper. They may qualify for the "Story Credit" list, as our due diligence is almost complete. Sterling Financial, Spokane, Washington, who was a savings bank, has been buying smaller banks in the three neighboring states, recently Northern California, Santa Rosa, to be exact, and is going to move from mortgages to leases ( from press release and a fellow who has interviewed for a top sales position asked me what I knew.) They evidently think they can cut into Exchange Bank’s territory. So it was appropriate to up-date Robert Krause's listing, plus to learn some of their changes, such as the $150,000 application only. He was happy to up-date the listing, but did add, "Too bad we can't copyright the name Sterling." Funder - Update A -Accepts Broker Business | B -Requires Broker be Licensed | C -Sub-Broker Program

(XX) Sterling Bank Leasing a division of Sterling National Bank; please contact us for rates and credit parameters. While we prefer to work with Lessors who will discount with us we will accept experienced brokers. We do not accept broker to broker referrals. To view the complete list please, click here.

-------------------------------------------------------------- Broker/Lessor List up-dated: GCR Capital Equipment Leasing

This is one of the few equipment leasing companies founded and operated by a woman, very successful, too; seems to live on her blackberry, very active in the growth of her company. "Broker/Lessor" List Third Column: YES - Year Company Started | YELB - Years in equipment Leasing Business Business Reports: Companies listed may make any netiquette comment about their company or reports or other information in the footnote section of their listing. Leasing News recommends readers also view the footnote as well as the section itself or searching reports on the business. It also should be noted that if a BBB report listing is found by a reader, as there may not have been one when this was last up-dated, please send the link to maria@leasingnews.org so Leasing News may up-date this section. BBB - Better Business Report | CBB - Leasing News Complaint Bulletin Board A - City Business License | B- State License | C - Certified Leasing Professional |

To view the complete list, please click here.

-------------------------------------------------------------- Bank of the West Expands Back Office Operation

Portland, Oregon --- Bank of the West announces that Eric Gross has joined its Equipment Finance Division as Vice President and Director of Managed Services, where he will head up the commercial 3rd party servicing group. The hiring further emphasizes Bank of the West’s commitment to the managed services business. "I am very pleased that we were able to bring someone of Eric’s caliber and experience in third-party portfolio servicing." said Jerry Newell, executive vice president of Equipment Finance. "Bank of the West has long been a provider of third-party portfolio servicing. We are committed to this segment and under Eric’s leadership we will aggressively pursue this market.”

"Bank of the West entered third party servicing to the equipment leasing and finance industry with its acquisition of Trinity Capital in 2002," according Newell. “We currently have a number of third party servicing customers, but recently we had not been actively developing new customers. As part of Bank of the West’s commitment to grow this business, it makes sense to further expand this business with an additional office in Portland, where there is a wealth of experience and talent in the equipment leasing and finance industry." "I am very pleased that we were able to bring someone of Eric’s caliber and experience in third-party portfolio servicing," he added. "Bank of the West is committed to this segment and under Eric’s leadership we will aggressively pursue this market. ”The commercial third-party servicing industry is quickly maturing,” Gross said, “with the market gravitating towards servicers with substantial financial strength and infrastructure. Many people are unaware that our group has provided 3rd party portfolio servicing since 1989. I very much look forward bringing superior services to the market place.” Founded in 1874, $55.6 billion-asset Bank of the West (www.bankofthewest.com) is the third largest commercial bank by assets based in the Western U.S. Bank of the West offers a full range of business, corporate, personal, trust and international banking services and currently operates more than 700 branch locations and commercial banking offices in 19 Western and Midwestern states. -------------------------------------------------------------- Back Office Companies

(a) Barrett offers proactive lease management/administration of commercial/consumer vehicles and lease/finance portfolios, covering insurance, titles, registrations, sales/property taxes, tickets, collections, repossessions, vehicle transportation and dispositions. Since 1975. (b) Group 88 is a business partner of McCue Systems Inc, maker of LeasePak. With over 20 years supporting major firms in the leasing industry, Group 88 provides data conversions, system implementations, custom software development and outsourced system support. (c) JDR Solutions, LLC., based in Indianapolis, Indiana provides back office lease/loan administration services and hosting of related accounting and portfolio management software. Under a preferred partnership arrangement with International Decision Systems (IDS), JDR Solutions offers its "Managed Service" solutions utilizing the robust capabilities od Infolease and related software applications. JDR will soon offer IDS's next generation software, Profinia, in a hosted environment. For more information about JDR Solutions, visit www.jdrsol.com or call: Paul Henkel, Director of Marketing (d) We also offer specialized programs for banks which want to start their own leasing operations and for vendors who want to find financing or act as lessor for their customers. We also act as a broker for end users looking for commercial equipment financing. Sincerely, (e) ECS Financial Services, Inc. is one of only a few CPA firms in the United States that specializes in providing portfolio management, accounting, tax and management advisory services to the equipment leasing industry. ECS Financial provides lease management services including accounts receivable billing and collections, preparation of monthly lease income and residual schedules, book and tax depreciation tracking, as well as guidance and a variety of useful management reports to assist management in making sound financial decisions. ECS Financial offers accounting and financial statement compilation, review and audit services, as well as multiple state sales tax preparation, federal and state income tax return preparation, and personal property tax preparation and tracking. Our lease management team of accountants and tax specialists are experienced in providing quality professional service in the management of lease portfolios, and their efforts are enhanced by the state of the art, industry-specific software we utilize. ECS Financial serves clients throughout the United States . The name has changed, but the quality service remains the same! (f) PFSC is the largest independent commercial lease and loan-servicing company is the U.S. and is headquartered in Portland , Oregon . PFSC provides primary/master servicing, backup/successor servicing, and consulting for lease and loan portfolios. It currently manages over $14.0 billion in assets. More information can be found at www.pfsc.com. (g) Advanced Property Tax Compliance provides "best in class" personal property tax compliance services at cost effective fees. Our staff has over 60 years of experiance working with leased assets. We do complete compliance process and can tailor our service to each Lessor's unique needs, including invicing. The billing files we create interface with all lease management and accounting software. We offer our clients full disclosure, more accessibility to information, and greater on-line functionality than any other service firm in the industry. Each client has a secure FTP site where they have access to everything we do for them in the compliance of personal property taxes. Our Web Portal allows our client’s customer service departments to get up-to-the-minute tax data for buyouts, terminations, or tax bill copies and detail tax reports to support collections. Major Clients include; LaSalle System Leasing, Evans Leasing, Summit Funding Group, Merrimak Capital, IFC Credit Corp., Greater Bay Capital, Highland Capital, Telerent Leasing, Main Street National Bank, Blackstone Capital, SolarCom World Holdings, Matsco Financial Services, Bayer Healthcare, Altec Capital, Alabama Banker's Bank, Outsource Lease, Vision Financial, VenCore Solutions, Aztec Financial, Evans National Bank For more information about Advanced Property Tax Compliance, visit www.avptc.com or call: Sincerely, (h) U.S. Bank Portfolio Services provides third party solutions and back-up/successor servicing. Third party clients are able to focus on core competencies and avoid the expenses of creating a back office environment by outsourcing their servicing platform. U.S. Bank Portfolio Services adds security and protection as a back-up service provider with the ability to convert any portfolio in seamless manner through advanced preparation. (i) Haws Consulting Group - "We have been in business since 1982 and provide property tax consulting and outsourcing services to a variety of different types of companies. We have a strong leasing background and have provided property tax management services to leasing companies for over 20 years." For more information please see our Brochure and Case Study. (j) Broker Resource Solutions (BRS) offers document processing support services to the equipment lease broker community. Our clients are able to focus on their core business - selling and building their client list - while we handle all of the tedious details associated with putting together a perfect funding package. Broker's who work with us have on-demand access to a highly experienced, qualified staff on an "as-needed" basis. Since we are happy to work either on a single transaction or under contract, our clients are freed from the high overhead associated with finding, hiring and training processing employees. We work on our client’s behalf to coordinate with the lessee, vendor, insurance agent(s), funding source and any other parties necessary in order to develop and submit funding packages that are complete and fund quickly. Our extensive experience on the funding side of the business allows us to identify and resolve potential issues that can delay funding and result in lost deals. We invite you to explore our website at www.brsworks.com and contact us if you have any questions or would like more information on how to get started. Vickie Rocco -------------------------------------------------------------- Leasing Industry Help Wanted Assistant Manager

Credit Analyst

Sales Regional Office

Small Ticket Specialists

--------------------------------------------------------------

Imagine--a tip a day! Great to energize sales and marketing professionals, as well as discuss/brainstorm at sales meetings. Soon to be available at www.leasingpress.com -------------------------------------------------------------- Saratoga Art Show - 6 May 2007

Artist Stan Beckman will be appearing at the Saratoga Art Show, West Valley College, Saratoga, California, Sunday May 6, 2007 from 9am to 5pm. Admission is free. Over 175 artists will be presenting. Prints and originals: More about the Saratoga Art Show: -------------------------------------------------------------- CMC/Netbank: Perfecting Interest in a Lease

David G. Mayer's "Business Leasing and Finance News" March edition is out, with a very interesting story on Commercial Money Center (CMC) and NetBank, regarding the perfection of interest in a lease. Perfecting your interest in a lease is very important to you and your underwriters. In this article by David Mayer, here a case regarding CMC Leasing that is sent back to determine whether the bond issuers held collateral as agent for NetBank and thus was NetBank's interest "perfected." At one time there was over $47 million in receivables, 3. BLFN Case & Comment: Chattel Paper Surprise in Netbank FSB v. Kipperman In a case of first impression, a Ninth Circuit Bankruptcy Appellate Panel ruled on critical issues affecting securitizations and syndications of lease rental payments. In re Commercial Money Center, Inc. (Netbank FSB v. Kipperman), Bk. No. 02-09721 (Amended Opinion, Aug. 25, 2006) (Netbank), the Court focused on the characterization, perfection, sale and financing of lease rental payments stripped from leases (chattel paper) under the Nevada Uniform Commercial Code. See Nev. Rev. Stat. Chapters 104 and 104A (UCC). Deal makers and lawyers can gain clear direction on, among other points, how to identify and prevent identifiable errors in closing and making correct UCC filings in these transactions. BACKGROUND: Commercial Money Center, Inc. (CMC) leased equipment to lessees with sub-prime credit. CMC then assigned to banks, such as Netbank, the rights to receive the rental payments from pools of the leases. In Netbank’s case, the pools amounted to an original asset cost of more than $47 million. To enhance the credit of the lessee and attract purchasers of the rental payment streams, CMC acquired surety bonds and assigned rights to the bonds to banks, including Netbank, as security for the receipt of the lease payments. CMC purported to sell the lease streams and continued to service the underlying lease transactions under an agreement called a “Sale and Servicing Agreement” (SSA). The SSA contained inconsistent and confusing loan and sale language regarding the nature of the assignment of the lease rental streams to Netbank. For example, in Section 2.1(c), the SSA provided that “each assignment and transfer herein contemplated constitute a sale and assignment outright, and not for security” of the leased assets. In Section 2.10 the tax characterization, however, the SSA provided that the amounts payable to Netbank will “qualify [under tax law] as indebtedness [of CMC, as debtor] secured by Leases and other assets… .” Many other sections contained similar contradictory language. Further, the SSA indicated that CMC made the assignment on a non-recourse basis to Netbank. The SSA used terminology like a non-recourse secured loan. Finally, at the end of the period of payments of “principal” and “interest”, Netbank had to reassign whatever interest it had to CMC. “In other words, Netbank (1) [had] none of the potential benefits of ownership and (2) [was] contractually allocated none of the risk of loss,” according to the Court. Under Section 2.1(b) of the SSA, Netbank required CMC to perfect CMC’s interest in the leased equipment, file financing statements under the UCC, assign the financing statements to Netbank under Section 10.2(a) of the SSA (as secured party), and affix a legend to the leases Section 10.2(e) of the SSA indicating Netbank’s interests. CMC also agreed to take other actions to assure the proper issuance of the surety bonds under Section 2.7(g) of the SSA. CMC did not complete these tasks necessary to perfect Netbank’s interests. As a result, Netbank did not have a perfected security interest in the lease rental streams. The Bankruptcy Court initially reviewed the transaction in connection with a challenge by the trustee for CMC’s bankruptcy estate (Trustee) to the perfection of the interests of Netbank in the lease rental streams. The Bankruptcy Court ruled that the payment streams assigned to Netbank constituted “chattel paper.” In the alternative, it found that if the leases did not constitute chattel paper, Netbank did not achieve automatic perfection of its interests in the lease streams as payment intangibles under UCC §9-309(3) because the transactions were loans rather than sales. *Technical Point: Automatic perfection can occur when the assignment constitutes a sale and not just a secured loan pursuant to UCC §104.9309(3). ISSUES: Did the payment streams constitute “chattel paper” within the meaning of UCC Article 9? Were the assignment transactions loans or sales? OUTCOME/DECISION: The Court overturned the Bankruptcy Court finding that the payment streams assigned to Netbank constituted chattel paper. Instead, it held that the payment streams assigned to Netbank were “payment intangibles” under UCC Article 9. The payment of funds by Netbank to CMC did not qualify as a sale, entitling Netbank to automatic perfection in the lease streams as collateral. Rather, the transactions were loans, secured by the lease streams, chattel paper and surety bonds. Perfection of these security interests did not occur by filing based on undisputed facts in the case. LAW OF THE CASE: The perfection rules of Revised UCC Article 9 apply to security interests for loans and to sales of chattel paper and payment intangibles. UCC §104.9109(1)(c) states, with inapplicable exceptions, “this article applies to . . . (c) a sale of accounts, chattel paper, payment intangibles, or promissory notes.” A security interest includes the interest in chattel paper, payment intangibles and accounts under UCC §104.9309(3). *Terms to Know: A “Debtor” means: (1) A person having an interest, other than a security interest or other lien, in the collateral, whether or not he is an obligor; (2) A seller of accounts, chattel paper, payment intangibles or promissory notes. ... UCC §104.102(bb). “Security interest” means an interest in personal property or fixtures which secures payment or performance of an obligation. “Security interest” includes any interest . . . a buyer of accounts, chattel paper, a payment intangible . . . in a transaction that is subject to Article 9. “Security interest” does not include the special property interest of a buyer of goods on identification of those goods to a contract for sale under UCC §104.2401, but a buyer may also acquire a “security interest” by complying with Article 9. . .. “Record” means information that is inscribed on a tangible medium or that is stored in an electronic or other medium and is retrievable in perceivable form. See UCC §104.2401(ee) . (k) “Chattel paper” means a record or records that evidence both a monetary obligation and a security interest in or a lease of specific goods or of specific goods and software used in the goods, or a security interest in or a lease of specific goods and a license of software used in the goods. . ... UCC §104.102(k). A “general intangible” means any personal property other than account, chattel paper, and various payment intangibles. See UCC §104.9102(1)(pp). A “payment intangible” is a general intangible under which the account debtor’s principal obligation is a monetary obligation such as payments of rentals stripped from a lease. See UCC §104.9102(1)(hhh). Few security interests can be perfected automatically. A sale of a payment intangible is one of them under UCC §309(3); it is perfected when the security interest in the payment intangible “attaches.” *Technical Point: Under UCC §104.9203 “(1) A security interest attaches to collateral when it becomes enforceable against the debtor with respect to the collateral, unless an agreement expressly postpones the time of attachment. With exceptions, “(2) a security interest is enforceable against the debtor and third parties with respect to the collateral only if: (a) Value has been given; (b) The debtor has rights in the collateral or the power to transfer rights in the collateral to a secured party; and (c) One of the following condition[s] is met: (1) The debtor has authenticated a security agreement that provides a description of the collateral . . ..” See also UCC §104.9308 and UCC §104.9310(1). For automatic perfection by attachment, CMC, as debtor, had to sell the lease rental streams to Netbank, as secured party. However, the Court and the lower Bankruptcy Court both found that the assignment to Netbank did not result in a sale because the transaction possessed the dominant characteristics of a secured loan, including loan language and rights functionally typical of loans. Therefore, the Court held that Netbank did not perfect its interests in the lease rental stream automatically by attachment. Netbank could also perfect its security interest in the lease receivables upon filing of a UCC financing statement or, in the case of the chattel paper, either by filing or by taking possession of the chattel paper. See UCC §104.9310(1). Netbank relied on CMC to take certain actions to file the UCC financing statements to perfect Netbank’s security interest but, according to the undisputed facts, CMC failed to make the UCC filings. Netbank had only one last method to perfect its security interest in the chattel paper: take or have another authorized person take possession of the leases on its behalf in a manner legally sufficient to be an agent for Netbank for such purpose. In detailed discussion, the Court construed the definition of chattel paper as evidence or a record of monetary obligations. It then concluded that the payment streams once separated by CMC from the leases and assigned to Netbank did not evidence a payment stream or create a record. It concluded: “Payment streams stripped from the underlying leases are not records that evidence monetary obligations – they are monetary obligations.” Opinion at 15. It also classified the rental payment stream: “When stripped from the chattel paper they are payment intangibles.” Opinion at 20. In doing so, it distinguished a transfer of chattel paper which carries the rights and benefits of the underlying transaction. CMC separated the payment stream from the chattel paper in this case. Opinion 19-20. Because of factual issues, the Court remanded the case on the issue of whether Netbank perfected by possession. (The potential for such perfection could occur by the surety bond company holding the chattel paper leases on behalf of Netbank.) The Court clearly stated that CMC, as debtor, could not hold the leases for Netbank as a basis of perfecting Netbank’s security interest. *Comment: The decision of the Court is highly technical, but has important consequences for how parties structure and close securitization and syndication transactions. The secured party or purchaser in Netbank’s position can avoid these issues and fulfill the requirements articulated in the case if the secured party: Files UCC-1s itself or through its counsel to assure filings are done and tracked; Drafts service or similar agreements with consistent language of sales or financing language consistent with the true intent of the parties; Allows no debtor to act as an agent to hold chattel paper (such as the only “original” of a lease); Uses an agent in a three-party agreement to hold originals of leases or other chattel paper if good and valid reasons exist for the purchaser/financier not to hold them; and Handles small transactions (in dollar amount) as important enough to complete the steps for perfection or not do these transactions without the Netbank risk in mind. Lessors must assume that a trustee in bankruptcy will use its strong-arm powers to set aside preferences and to find weaknesses in transactions, including unperfected security interests. Those involved in significant securitizations and syndications generally recognize this risk and understand the importance of complying with UCC rules. The key lesson of this case is that each financial institution that buys or finances lease rental streams should not neglect or agree to allow most lessees/debtors to file UCC financing statements or to comply with other obligations relating to perfecting security interests for the secured party, as apparently occurred in this case, regardless of the size of the lease transaction. As Netbank discovered, small transaction problems can lead to large legal fees, financial losses and unproductive management time. March Edition David G. Mayer is a partner at the law firm of Patton Boggs LLP and Founder of BLN. --------------------------------------------------------------- Key Equipment Finance names Kevin Libert Vice-President, Business Development

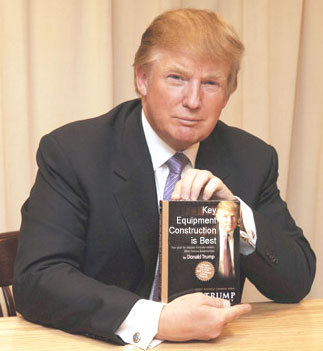

SUPERIOR, CO. – – Key Equipment Finance, one of the nation’s largest bank-affiliated equipment financing companies and an affiliate of KeyCorp (NYSE: KEY), has named Kevin Libert as vice president and business development manager specializing in construction equipment. In this role, Mr. Libert is responsible for identifying new construction equipment clients and developing vendor programs for Key Equipment Finance’s Construction and Industrial operation. His office is based in northern California. “During his 20 years’s experience in the finance field, Kevin has gained a strong command of the construction equipment market,” said Jeff Enoch, sales director, Construction and Industrial segment, for Key Equipment Finance’s global vendor services group. “He is an experienced P&L manager who is adept at identifying and developing new market opportunities that will expand sales volume and ROE.” Prior to joining Key, Mr. Libert was vice president at Peoples Capital & Leasing where he focused on the national construction market as well as regional transportation and printing markets. He was previously director of sales for the west region at Terex Financial Services and had been vice president and business development officer for US Bancorp Equipment Leasing. Mr. Libert earned his bachelors of science degree in business administration from California State University, Hayward. He is a member of the Equipment Leasing and Finance Association (ELFA) and the Association of Equipment Distributors (AED) Key Equipment Finance is an affiliate of KeyCorp (NYSE: KEY) and provides business-to-business equipment financing solutions to businesses of many types and sizes. They focus on four distinct markets: Headquartered outside Boulder, Colorado, Key Equipment Finance manages a $13.1 billion equipment portfolio with annual originations of approximately $6.4 billion. The company has major management and operations bases in Toronto, Ontario; Albany, New York; Chicago, Illinois; Houston, Texas; London, England; and Sydney, Australia. The company, which operates in 26 countries and employs 1,100 people worldwide, has been in the equipment financing business for more than 30 years. Additional information regarding Key Equipment Finance, its products and services can be obtained online at KEFonline.com. Cleveland-based KeyCorp is one of the nation's largest bank-based financial services companies, with assets of approximately $93 billion. Key companies provide investment management, retail and commercial banking, consumer finance, and investment banking products and services to individuals and companies throughout the United States and, for certain businesses, internationally. ### Press Release ########################### MicroBilt Announces Release 3.7 and Debuts New Consolidated Site New MicroBilt.com Site Consolidates Brands into Single Destination for All Products

KENNESAW, GA – – MicroBilt, the single source and industry leader for risk management information, announces the debut of Release 3.7 and the completion of phase 1 of its brand and site consolidation project. Release 3.7 launches the new site that transitions CreditCommander.com, DataFaxInc.com and Integra Info to www.MicroBilt.com and presents all MicroBilt product offerings together, through one site. MicroBilt’s credit data access and its flagship product offered under the CreditCommander name, evolved from land line credit reporting terminals sold in the 70’s and 80’s, to software in the 90’s to a robust web based application with over 150 reports and 40 databases sold to over 90,000 users today. MicroBilt’s significant evolution with credit data and the addition of many new products, services, acquisitions and Internet technologies over the years increased the number of web sites under MicroBilt Corporation. In an effort to minimize the requirements of maintaining multiple sites and user interfaces, the time has come for consolidation. The new site incorporates all of the product offerings under MicroBilt and hosts navigation that provides a more user-centric, intuitive and fluid experience. “Consolidating our brands under the MicroBilt name enables our company to increase our marketing and sales presence and better positions our company for growth,” said Walter Wojciechowski, CEO and President of MicroBilt. “As we approach our 30 year anniversary in 2008, MicroBilt is positioned as a stronger, more powerful brand, continually meeting the needs of our customers.” In addition to the brand consolidation and site redesign, Release 3.7 offers new innovative identity authentication and verification solutions that identify and prevent identity fraud at inception. These products include Fair Isaac’s new Falcon ID products, as well as an ID Authenticate product that prompts ‘out of wallet’ questions known only to the true applicant. Qsent, the leading authority in the use of telephone contact information as an authenticating source of identity, was also added. These latest verification and authentication products offer MicroBilt customers exclusive access to an abundance of identity confirmation data. About MicroBilt MicroBilt also enables credentialed companies to enhance their web site content offerings by delivering a private labeled site to their established online communities. For more information, please contact MicroBilt Corporation, 1640 Airport Road, Suite 115, Kennesaw, GA, 30144 or www.MicroBilt.com. Telephone: 1-800-884-4747. ### Press Release ########################### Maplesoft Strengthens Presence in the Financial Service Industry with Modeling Toolbox Designed specifically for quantitative modeling and analysis

Waterloo, Canada; MaplesoftT, the leading provider of high-performance software tools for engineering, science, and mathematics, announces the launch of the MapleT Financial Modeling Toolbox, a collection of tools for mathematical finance. The toolbox supports a wide range of common tasks such as equity price modeling, cash flow analysis, option pricing, term structure analysis, and simulation. The Maple Financial Modeling Toolbox complements Maple's multi-disciplinary environment with over 100 new commands, designed specifically for quantitative financial modeling and analysis. These can be combined with existing Maple tools - including ODE and PDE solvers, statistical data analysis optimization, and automatic code generation to C, FORTRAN, Visual Basic, and Java - to produce analytical applications and product prototypes in the Maple interactive document interface. "Traders, quantitative and market analysts, as well as risk and portfolio managers can now use the power of symbolics in financial modeling to their competitive advantage," said Jim Cooper, President and CEO, Maplesoft. "The Maple Financial Modeling Toolbox provides an environment for developing solutions, where manual mathematical manipulation is essentially eliminated. Customers can automatically derive models faster and more accurately than with numerical tools alone." Key features of the toolbox include: When applied effectively, a financial model can help prevent major planning errors and provide strategic guidance. Using a computer-based system like Maple enables users to build models from first principles, manage calculations, and simplify documentation of results. Pricing and availability: About Maplesoft Organizations around the world have applied Maple in nearly every technical field including engineering design, operations research, scientific research, and financial analysis. Maplesoft's commercial customer base includes Allied Signal, BMW, Boeing, DaimlerChrysler, DreamWorks, Ford, General Electric, Hewlett Packard, Lucent Technologies, Motorola, Raytheon, Robert Bosch, Sun Microsystems, Toyota, and Tyco. Maplesoft offers powerful and easy-to-use tools that save time and reduce errors. For more information, please contact:

### Press Release ###########################

News Briefs---- Aircraft & engine leasing: Heading skywards More bank buyouts ahead Barclays might be good fit for LaSalle Bank, Chicago Fed aims to steer course through slow growth, high inflation Short-term T-bill rates fall; 1-year yield edges up Parent of sub-prime mortgage lender files for bankruptcy Oracle Says Profit Rose 35% to Exceed Expectations PayPal Announces Nearly 35 Million Accounts in Europe Bank of America CEO gets $92M in stock, options Insurance Insight: Among mortgage guarantors, subprime is in the eye of the beholder Horizon Air’s first flight from Seattle lands in Sonoma County American Idol: 3/20: Who's crying now? First visitors step onto canyon skywalk ---------------------------------------------------------------

You May have Missed--- UC, CSU graduates start at two-year schools, report says ----------------------------------------------------------------

California Nuts Briefs--- 20 Lotto winners claim $72 million prize ----------------------------------------------------------------

“Gimme that Wine” Business Owner Indicted in Vallejo Arson of Wines Central Warehouse Wine Spectator Introduces “Top 100 Wines of 2006” for iPod® on Mogopop.com Chateau Souverain winery upgrades planned Wine Prices by vintage ----------------------------------------------------------------

Calendar Events This Day Aries, The Ram March 21-April 19 California Strawberry Day Children's Poetry Day - Valentine's Day Poetry by Homeschoolers Iranian New Year: Noruz Lesotho: National Tree Planting Day. Memory Day Namibia: Independence Day National Agriculture Day National French Bread Day National Common Courtesy Day Naw-Ruz Single Parent Day Vernal Equinox Day (Europe) Saint Festival Days http://www.catholic.org/saints/f_day/mar.php ----------------------------------------------------------------

Baboons were once trained by Egyptians to wait on tables. (Number 13 incorrect, but this so called fact has really been passed around the internet, as if it could be the "truth." Here

----------------------------------------------------------------

Today's Top Event in History 1955 - No. 1 Billboard hit: ``The Ballad of Davy Crockett,'' Bill Hayes. [headlines]

This Day in American History 1595- Pocahontas, daughter of Powhatan born near Jamestown, VA; leader of the Indian union of Algonquin nations, helped to foster good will between the colonists of the Jamestown settlement and her people. Pocahontas converted to Christianity, was baptized with the name Rebecca and married John Rolfe Apr 5, 1614. In 1616, she accompanied Rolfe on a trip to his native England, where she was regarded as an overseas "ambassador." Pocahontas's stay in England drew so much attention to the Virginia Company's Jamestown settlement that lotteries were held to help support the colony. Shortly before she was scheduled to return to Jamestown, Pocahontas died at Gravesend, Kent, England, of either smallpox or pneumonia. According to the March edition of Atlantic Magazine, the Indians had no immune system to ward off European diseases, including smallpox and pneumonia. NCAA Basketball Champions This Date 1959 California -------------------------------------------------------------- Spring Poem

I am forever walking upon these shores, Kahlil Gibran -------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm -------------------------------------------------------------- Daily Puzzle How to play: Refresh for current date: -------------------------------- |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Editorials (click here) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Cartoons |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|