|

Like selling vendor programs and large transactions? CLICK HERE to find out how to have fun again. |

Wednesday, November 19, 2008

| John Francis "Jack" Welch, Jr., born Peabody, Massachusetts, November 19, 1935, former chairman and chief executive officer, General Electric (GE) Company. During his 41 years at GE Welch rose from his position as an entry-level junior engineer to become the company's youngest vice president and later its youngest CEO and chairman from 1981 to 2001. http://en.wikipedia.org/wiki/Jack_Welch |

Headlines---

Classified Ads---Asset Management

Leasing Stocks continue downward Trend

Huntington to discontinue Vendor Finance Group

Synborski no longer at Greystone

No leasing deals in Mexico this Month

Global Funding found Guilty in Clearwater

CMC paper and Officers Back to Litigation

Karl Probst joins Harbor Financial Services

Classified Ads---Help Wanted

Cartoon---AIG Executive

Sudhir Amembal Webinar–Available Now!

Classified Ads--Operations/Remarketing

Sales makes it Happen by Linda P. Kester

“Thanksgiving & Sales”

ELFA takes position on Finance Rescue Package

Federal Reserve Won't Reveal Details on Loans

Bank of America sees record credit card losses

Transit leaders seek help on SILO leases

Big trouble for small casinos, industry head says

Jazeera signs $70mm deal for A320s

G-20 Verdict on Fair Value: Innocent/Not Accounting

China Tops Japan in U.S. Debt Holdings

Home prices down 9% from a year ago

Economy acting out on Broadway attendance

News Briefs---

You May have Missed---

California Nuts Brief---

"Gimme that Wine"

Today's Top Event in History

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

-------------------------------------------------------------------

Classified Ads---Asset Management

| Dallas, TX 17 years experience evaluating/remarketing off lease equipment including IT, telecom, networking among other products. Extensive customer/vendor network in place. leasevalue@gmail.com |

| Massachusetts, MA Started in credit and collections 30 years ago with a private agency. My skills are negotiating with Attorney's, Insurance Companies & Large & small companies. cityofpa@earthlink.net | Resume |

| Seattle,WA--Pacific Northwest Results oriented CLP with 27 year background in all phases of Portfolio Management and underwriting. Contact for resume and references. dcjohnr@comcast.net |

United States |

For a full listing of all “job wanted” ads, please go to:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

To place a free “job wanted” Leasing News ad:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

ELFA Career Center: Job Seekers (free):

http://careers.elfaonline.org/search.cfm

--------------------------------------------------------------

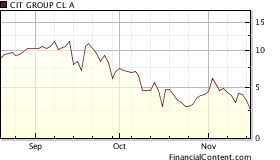

Leasing Stocks continue downward Trend

Employees, current, let go or retired, as well as investors have sold their leasing company stock at prices well below the value of the companies, but worse, they evidently don’t believe in the leasing company’s future.

CIT Group last trade was $2.60, a far cry from their 52 week high of $30.75. With class action suits, assets they cannot sell, their hope is to become a bank and apply for a government loan. Once a commercial finance giant, the lead into consumer finance has cost them dearly. Who’s at fault? The chairman has his friends on the board. “It’s the global economy!!!” they claim.

$16.06 was the close and today's is former CEO Jack Welch's birthday.

He is 73. Happy Birthday!!! From a 52 week high of $38.67--- employees, including the officers, have lost half their assets. They wont' retire as well as Welch did. Again, turning into a bank for a government loan seems to be their answer.

Socialism--no, just taking advantage of a government "investment."

$3.10. Perhaps the industrial bank turning into a Federal Bank was not that bad of an idea, as Marlin then can ask for a loan. Why not? Every other bank seems to be doing it. Why can’t Marlin Leasing take advantage of basically free money.

$4.08, although the previous close was $3.90. And what was the LEAF Financial Corporation Announcement about concerning the Extension of a $205 Million Credit Facility? Was that good news or bad news? It seemed to have come out of left field from previous press releases about raising money and paying off the Net Bank purchase. Didn’t seem to fool the investors.

--------------------------------------------------------------

Huntington to discontinue Vendor Finance Group

Laurie A. Bakke, Vice President, Huntington Equipment Finance, Vendor Finance Group, Bellevue, Washington confirmed that Huntington Bank, Columbus, Ohio, is discontinuing funding for her 12 employee division that specialized in vendor finance and leasing programs.

She says Huntington will continue to accept credit submissions through December 31, 2008 and will honor all backlog.

"Our vendor finance group is one of the strongest teams in the industry, “ Bakke added. “Our sales executives each bring approximately 18 years vendor experience and each member of our operations group brings a minimum 10 years in their respective fields. We are hoping to remain as a team and our vendors have voiced a desire to continue their relationship with the group. We have approximately 60 vendor relationships."

Laurie A. Bakke

Vice President

Huntington Equipment Finance

Vendor Finance Group

411 - 108th Avenue NE, Suite 1920, (NCKRWA) , Bellevue, WA 98004

Phone: 425-637-2050 Mobile: 206-369-3867 Fax: 877-296-5448

Email: laurie.bakke@huntington.com

(November 14, 2008 Huntington Bancshares Incorporated (Nasdaq: HBAN) announced that it has received $1,398,071,000 of equity capital by issuing to the U.S. Department of Treasury 1,398,071 shares of Huntington's Fixed Rate Cumulative Perpetual Preferred Stock, Series B, par value $0.01 per share with a liquidation preference of $1,000 per share and a ten-year warrant to purchase up to 23,562,994 shares of Huntington's common stock, par value $0.01 per share, at an exercise price of $8.90 per share. Both the preferred securities and warrants will be accounted for as additions to Huntington's regulatory Tier 1 and Total capital.)

http://www.investquest.com/iq/h/hban/ne/finnews/hban111408.htm

|

--------------------------------------------------------------

Synborski no longer at Greystone

Donald Synborski, key founder of Greystone Equipment Finance, Massachusetts, is no longer the president. According to rumors a board of directors "disagreement" on the direction of the company saw his "resignation." Leasing News has been trying to contact him and work on the story since October. After receiving a notice for a change of his email address for the news edition, he was contacted for a comment. After he emailed that he had no comment, he was asked if Leasing News could print his new email address for friends who may wish to contact him: dsynbo9556@gmail.com

(He said yes.)

In the Leasing News September 23, 2008 edition: How’s Leasing Business? ---“Heard on the Street,” Don Synborski stated:

“From our perspective we will grow by a substantial amount in 2008, but remain below budget. August was a very slow month, and September looks better, but still below expectations.

“We anticipate the fourth quarter to be month to month equal to or above forecast primarily because the industry shakeout has resulted in the unanticipated addition of several new vendor programs. However, pricing in this environment is extremely challenging as Libor widens out again against Treasuries, and lease rates remain flat. Those who benchmark against Treasuries as a COF measure are at a distinct advantage in the near term.”

When Irwin Financial closed their division in Washington, several sources, including those interviewed, told Leasing News Greystone was interested in the unit of employees, expanding in this area, but what seems to have happened is one salesman was hired and its president not too long afterwards "left" the company.

Synborski started with four employees in 2005.

"Greystone Equipment Finance Corporation ("GEFC") is a small ticket funding source for B and C quality credits. We handle a wide variety of equipment, including titled vehicles with an original cost between $15K and $150K for terms up to 60 months. All business is self funded and held for our portfolio. We originate our business primarily through brokers, and secondarily through vendors and private label programs with community banks. GEFC is an affiliate of Greystone & Co., Inc., a financial services and private investment group that together with its affiliates has 30 offices nationwide and over $10 billion under ownership or management."

Leasing News archives

March 26, 2007 announced achieved “Preferred Funder Status” with OneWorld Leasing, Inc.(“OWL”), now a 26 member leasing co-op.

In the latest Greystone press release:

"Greystone Equipment Finance Corporation (Greystone EFC) is an affiliate of Greystone & Co., Inc, a financial services and private investment group which, together with its affiliated companies, owns or manages more than $12 billion of assets. Greystone EFC provides equipment financing to small, medium and Fortune 1000 companies across the United States, financing a broad range of equipment with purchase prices up to $2 Million and repayment terms from two to seven years. Headquartered in Burlington, MA, Greystone EFC originates its business through vendors and brokers located nationwide."

Greystone Press Release, Leasing News Archives

|

--------------------------------------------------------------

--------------------------------------------------------------

No leasing deals in Mexico this Month

El Camino Resources International Leasing and Financing, Chatsworth, California, with an office in Mexico, is temporarily out of leasing in Mexico due to the credit market, according to its president Dave Harmon.

He expects the market to change and wishes his company were a bank so it could get some "TARP" money.

In the meantime, his suit along with ePlus Group against Huntington Bank, Columbus, Ohio is proceeding to a trial, perhaps by July of next year, he states.

"Case no. 1:07-CV-598) alleges that Huntington Bank aided and abetted Cyberco Holdings Inc. in perpetrating a multi-million dollar financial fraud built around the financing of phantom computer equipment. The Complaint points to Cyberco’s use of the depository and wire-transfer facilities of Huntington Bank to launder monies illicitly obtained from other financial institutions with the bank’s knowledge and cooperation as essential to Cyberco’s scheme. The Plaintiff group alleging this financial malfeasance by Huntington Bank, which includes financial companies based in California, Missouri and Virginia, shows just how wide Cyberco spun its web of financial fraud.

"The Plaintiffs claim Huntington Bank’s improper actions propped up the fraudulent scheme of Cyberco which, without Huntington Bank’s help would have collapsed in early 2004, leaving the bank unpaid but saving others from being victimized. The lawsuit specifically claims that Huntington Bank’s assistance of Cyberco resulted in each of the Plaintiffs being added to the list of Cyberco victims. The Plaintiffs collectively funded $32,000,000.00 in computer equipment advances to Cyberco, from March to November, 2004, while Huntington Bank during that same period was taking its $17,000,000 out of Cyberco."

http://www.leasingnews.org/archives/June%202007/06-27-07.htm#hunt

--------------------------------------------------------------

Global Funding found Guilty in Clearwater

After pleading that his funding sources dried up, Global Funding LLC Managing Member President Jeff Maricle was found guilty of not returning an advance rental in Clearwater, Florida.

His side of the story: the customer came to him in 2005 with a bankruptcy and he told him to come back after it was discharged, which happened in 2006. He then offered collateral of a piece of equipment that it turned out he did not own, and in the course of trying to put it together, the customer went another direction and did not hear from him until recently, where he made an offer to split the deposit. Next step was court, where he lost and the defendant was awarded the advance rental of $4,100 and $10,000 compensatory fee.

Unfortunately, Maricle reports Global Funding has assets less than $2,000 since they closed their office, plus has other debts, including a signed lease agreement for the premises.

The Tampa Tribune Story:

http://www2.tbo.com/content/2008/nov/17/clearwater-finance-company-guilty-fraud-civil-tria/

Global Funding story:

http://www.leasingnews.org/archives/November%202008/11-12-08.htm#town

|

--------------------------------------------------------------

CMC paper and Officers Back to Litigation

by Tom McCurnin, Esq.

Tuesday, November 18, 2008, the California Court of Appeals sent the Commercial Money Case (CMC) case back down to the trial court to be re-litigated under class action procedures. This is a mixed result for both the lessees and financial institutions which owned the CMC paper. In addition, the CMC principals also had bad news today with secret indictment being unsealed this week involving a lawyer who may have to testify against the principals and a former governor who may have ratted out the principals on a $30,000 bribe.

CMC was an unlicensed lender in California which specialized in high interest (40-60%) sub prime leases and securitized them in pools to national lenders in a Ponzi scheme. Although the events occurred in 1999-2001, the sub prime securitization pool scheme and the resulting meltdown was ahead of its time. The principals of CMC were Ron Fisher and Wayne Pirtle. CMC securitized about $500mm of leases over a five year period. Many pools were unfunded.

In a 23 page opinion, the good news for some of the lenders is that they managed to stay away from California's borders sufficiently to avoid being sued in California, e.g., California's long arm statute didn't reach to the Ohio lenders which financed some of the CMC Paper, on the grounds that they never came to California to do the deal and took as collateral only the leases, not the underlying equipment.

The bad news for the rest of the lenders is that due to a change in law, in mid stream in this case, the trial court is required to re-litigate the matter as a class action. The lessees will have 30 days to re-file the action as a class action at the trial court level.

The good news for the lessees is that many of them can still assert the lack of licensing by CMC and the resulting usury claims.

It will be up to the new trial court to actually consider the bulk of the claims asserted by the lessees and the corresponding defenses asserted by the lenders. A copy of the decision is linked below.

The CMC saga has many victims. The bank with the biggest appetite for CMC paper was Net Bank, which purchased almost 70 million dollars of the paper and didn't bother filing a UCC-1 or taking possession of the original leases, which is never a good thing, especially against a bankruptcy trustee. This error contributed to the demise of NetBank last year.

The two principals of CMC, Ron Fisher and Wayne Pirtle, also have bad news this week. A secret indictment was unsealed on November 14 in the USDC for the Southern District of California. In the indictment, Ron Fisher, Wayne Pirtle, and Mark Fisher face fraud, conspiracy and income tax evasion charges in connection with the assignments to the lenders' loan pools.

The criminal case also has a couple twists. CMC's former lawyer, Harold Gewerter has been ordered to be legally capable of testifying against them as to instructions to destroy the CMC computers. In addition, Ron Fisher was also charged with attempting to pay off a former Governor (neither name nor State mentioned) to assist him in defending the charges while out on work release. Inquiring minds want to know who that former Governor was, although given the fact the money was laundered through Colonial Bank, it may be former Alabama Governor Don Siegleman. A copy of the newly unsealed indictment is also linked below.

Of course, the hardest hit victims are the lessees, which paid interest rates of 40-60% with forced evergreen clauses and buy out provisions which were routinely enforced by CMC.

Tom McCurnin

Barton, Klugman & Oetting

350 South Grand Ave.

Suite 2200

Los Angeles, CA 90071

Voice: (213) 621-4000

Direct (213) 617-6129

Fax: (213) 625-1832

www.bkolaw.com

Note: The IRS, FBI, and US Postal Authorities have cases against the former officers of CMC, including a plea bargain with Ronald Fisher’s daughter for turning state and federal evidence:

Kelly Fisher-Buh took a plea agreement in $300 million dollar tax evasion claimed by United States Attorney Carol C. Lam, who brought a twelve-count indictment charging Sterling Wayne Pirtle (president on paper), Ronald Allen Fisher, secretary-treasurer (her father), Mark Edward Fisher (her brother) with income tax evasion, arising from their receipt of unreported and untaxed income from their operation of a now-bankrupt corporation called Commercial Money Center. Inc. ("CMC").

The real head of the group was allegedly her father, Ronald Fisher, who was a chiropractor in Florida, who filed bankruptcy, moved to Nevada, and operated from an office in Las Vegas, and could not be on the corporate papers for that reason (similar to NorVergence's Thomas N. Salzano who had his brother Peter on the corporate documents as president as he also had a bankruptcy in his past.)

For her testimony, Kelly Fisher-Buh was sentenced only to 12 months and a day followed by three years probation. She was also ordered to start her sentence on January 4, 2008 at 12 noon.

According to the indictment brought by the US attorney's office, the defendants used multiple shell corporations to receive substantial, untaxed income from their operation of CMC, and to hold assets and properly for their own use. The indictment also alleges that Pirtle and Kelly Fisher evaded taxes by filing false individual income tax returns. while Ronald and Mark Fisher filed extensions with the IRS which provided false information about the amount of tax that was truly due and owing.

In the plea agreement Kelly Fisher-Buh agreed to testify against her father Ronald Fisher and Wayne Pirtle, plus cooperate in how the scam was done.

Full Story:

http://www.leasingnews.org/archives/November%202007/11-21-07.htm#cmc

November 18, 2008 CMC Decision

http://leasingnews.org/PDF/Decision_Clayton_Fisher.pdf

Fisher Indictment unsealed

http://leasingnews.org/PDF/Fisher_second_indictment.pdf

Copy of the Order where their lawyer was ordered to testify against them about destruction of the CMC computers

http://leasingnews.org/PDF/Order_re_Harold.pdf

Case filed originally as CMC not licensed in California: Usury

http://www.leasingnews.org/Conscious-Top%20Stories/CMC_notlicensed.htm

Commercial Money stories in Leasing News

http://www.leasingnews.org/Conscious-Top%20Stories/CMC_stories.htm

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

--------------------------------------------------------------

Karl Probst joins Harbor Financial Services NW, LLC

Robert D. Monaghan, President of Harbor Financial NW, University Place, Washington told Leasing News that he has hired Karl Probst to open a Portland branch office; to operate and manage it.

"Karl is the right man for the job as he brings to the table over 30 years of lease origination, credit, portfolio management, marketing and proven vast networking skills to the company," Monaghan said. "He has a following in both the broker and vendor community."

In addition to leasing, the Portland office will also generate "equipment finance agreements (EFA)."

Probst said he is looking forward to offering a variety of exceptional commercial financing programs for businesses all across America.

"Through Harbor Financial’s solid network of funding sources, we are able to provide vendors and an end user customer base the most competitive financing terms for new and used equipment," Probst said. "We have the funds and the programs."

HARBOR FINANCIAL SERVICES NW LLC

Portland Branch Office

15405 SW 116th AVE Suite 108

Portland, OR. 97224

TELE: (503) 601-8861 Toll Free: (888) 496-3446

FAX: (503) 601-8862

karl@harborlease.com

www.harborfinance.com

--------------------------------------------------------------

Leasing Industry Help Wanted

|

Burbank , California Credit Analyst Funding Manager Contact :Jason Downs: jdowns@capnetusa.com 877.980.0558 EXT. 125 |

www.capnetusa.com Recently named one of the “5 Best Places to Work” in Los Angeles . |

Sales

|

Like selling vendor programs and large transactions? CLICK HERE to find out how to have fun again. |

Please see our Job Wanted section for possible new employees.

-------------------------------------------------------------

Cartoon---AIG Executive

--------------------------------------------------------------

****Announcement****************************************

Sudhir Amembal Webinar–Available Now!

The international dean of leasing education and training Sudhir Amembal introduces a DVD to help the leasing team generate more transactions.

- to fully understand all the benefits of leasing

- to learn a simple process that facilitates an understanding of why each customer needs to or wants to lease

- to know what the typical objections to leasing are and how best to counter them with logic; and finally, how to put it all together

- to win the deal!

The theme for this extremely relevant and practical webinar has been drawn from Amembal's 30 years of experience as a consultant and his many years as a lessor.

Once purchased, you and your staff can listen/ view the webinar as often as you desire.

SPECIAL LIMITED OFFER UNTIL NOVEMBER 30: $195. (REGULAR COST $225)

To learn more, please go here:

http://www.worldleasingnews.com/webinars.aspx

****Announcement****************************************

--------------------------------------------------------------

Classified Ads--Operations/Remarketing

Leasing Industry Outsourcing

(Providing Services and Products)

| Operations: Houston, TX Silverlake Inspections LLC is an independent contracting company for real estate and equipment verification with pictures. Email: jimh05@sbcglobal.net |

Operations: Portland , OR Portfolio Financial Servicing Company provides state of the art portfolio servicing for portfolios of all sizes. Contact Eric Gross (800 547-4905 X-3226.) egross@pfsc.com |

| Operations: Roseburg, OR Tired of paying a full time documentation person? Try outsourcing. Ideal for anywhere in the USA. E-mail or Call Trina Drury 541-673-4116 or 541-784-7973. email: doc_prep@yahoo.com |

Remarketing: Nassau Asset Management Specializing in: Repossession, remarketing, plant and fleet liquidation, skip tracing and collections. All types of equipment. Over 160 locations nationwide. We will tailor any remarketing program to your specific requirements. www.nasset.com Contact: ECast@nasset.com ELA,NAB T ,EAEL,NAELB,UAEL |

All "Outsourcing" Classified ads:

(advertisers are both requested and responsible to keep their free ads up to date)

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

--------------------------------------------------------------

Sales Make it Happen --- by Linda P. Kester

“Thanksgiving & Sales” Is your favorite part of Thanksgiving feeding your face until you're stuffed like a pig and then "vegging out" in front of a football game? American is a great country, we have a national holiday centered around food. Besides being an excuse to overeat, Thanksgiving is a great time to reflect on all the good in you life and to reach out to your customers. I love to send Thanksgiving cards. Last December I did a sales training at Capital Innovations, a fabulous leasing company, in Warminster Pennsylvania. When I walked in I was happy to see my Thanksgiving card hanging front and center. They put up my card and then started receiving Christmas cards. My card was the first one received in the holiday season and they liked it because of the handwritten thank you note inside. You don't have to send a card to let your customers know that you're grateful for their business. Just pick up the phone and tell them “Thanks for doing business with us this year. Happy Thanksgiving.” If you say it with sincerity, it will make both you and your customer feel good. Frequently we underestimate the power of gratitude. How much time do you actually focus on gratitude, compared to the time you spend thinking about the problems in your life? Many leasing sales people think “I don't have enough applications. I don't have enough volume. I don't have the income I want.” When you focus on the things that you don't want you continue to get those things. Instead focus on the things that you're grateful for like the last big deal you booked, or the lessee who stuck with you even when the funding source backed out at the last minute. It's simple, what you appreciate, appreciates. What you're grateful for you get more of. When you appreciate the customers and volume you have, more customers and volume come to you. I've experienced myself how powerful gratitude is. After selling copiers door to door I was jaded. I brought that negative attitude into leasing sales with me. After struggling for a couple months, I started writing down five things that I was grateful for each day. My gratitude list improved my attitude and my outlook. I started prospecting more and I began to see results. I went from an under performing sales rep to a member of my companies President's Club. After four continuous quarters in President's Club I was promoted. If you count your blessings, then instead of becoming negative at the first sign of difficulty, you take note of all the good around you and you retain your positive energy. This Thanksgiving think of the things you're grateful for and really feel those feelings of gratitude. When your heart swells a little bit, pick up the phone and thank your customers. You will end up expanding your heart and your customers' heart as well. To me that's better than stuffing you face with food. It's stuffing your soul with vitality and optimism. Way more satisfying then pumpkin pie. If the only prayer you said in your whole life was “Thank You,” that would suffice. Linda Kester helps leasing companies obtain more volume. For more information please visit www.lindakester.com Sales Makes it Happen articles:

|

|

--------------------------------------------------------------

ELFA takes position on Finance Rescue Package

The Equipment Leasing and Finance Association (ELFA) submitted the attached recommendations to Treasury Secretary Paulson regarding the financial rescue package specifically as it relates to non-bank financial entities, business credit and asset-backed securitization. ELFA recommended that Treasury consider including the commercial finance market as it reviews potential efforts to support the consumer finance asset-backed securities market.

Referencing Treasury Secretary Paulson’s testimony before the House Financial Services Committee on November 18 and public comments of November 12 regarding the financial rescue package, ELFA president Kenneth E. Bentsen, Jr. said, “Our members, banks and non-bank financial institutions, agree with your comments, with the additional point that the securitization market for business or commercial credit, including equipment loans and leases, has also stalled, as has the bank-supported conduit, commercial paper and syndication market for such instruments. Despite having been more prudent than other classes of credit extension, the equipment finance sector has suffered the effects of the demise of the public securitization market, and more importantly, the private market utilizing private placement securitization, syndication and conduit finance, much of it through the bank channel, resulting in a declining ability to fund transactions,” Bentsen said.

“Our members understand the magnitude of the situation faced by financial policy makers and importantly the need to protect taxpayers’ interests. We appreciate the complex issues related to the extension of the Capital Purchase Program to non-regulated entities and we respect your need to investigate the potential risks related to such action. We believe, however, that there are viable policy options through the regulated bank channel which would provide necessary liquidity to the commercial credit sector similar to your comments regarding support for the consumer finance ABS market through a federally supported liquidity facility. We believe that it is as economically and fiscally prudent to include the commercial credit sector as the consumer finance sector,” Bentsen said.

November 18, 2008

Secretary Henry M. Paulson, Jr.

Department of the Treasury

15th and Pennsylvania Avenue, N.W.

Washington, D.C. 20220

Dear Secretary Paulson:

On behalf of the Equipment Leasing and Finance Association (the “ELFA”)1 , I am writing in reference to your testimony of November 18, 2008 before the House Financial Services Committee as well as your public comments of November 12 regarding the financial rescue package specifically as it relates to non-bank financial entities, business credit and asset-backed securitization. The specific objective of this letter is to recommend that Treasury consider including the commercial finance market as it reviews potential efforts to support the consumer finance asset-backed securities market.

The ELFA’s membership includes a wide variety of entities that are engaged in the extension of credit for commercial capital goods – including commercial banks, investment banks, independent finance companies and finance subsidiaries of manufacturing companies. As you are well aware, investment in plant and equipment is a vital component of capital formation, economic growth and productivity. In 2007, businesses, governments and non-profit entities in the United States invested $1 trillion in plant and equipment (including software).2 Based on models developed for the Equipment Leasing & Finance Foundation, an affiliated research organization, approximately 55% of such investment is financed through leases and loans.3 Furthermore, ELFA survey data indicate that in 2007, 45% of new equipment financed was originated through the bank channel, as compared to 31% through the independent finance company channel and 24% through the captive finance subsidiary channel.4 Throughout 2008, our monthly leasing and finance index of 25 bank-subsidiary, independent, and captive equipment finance companies (the “MLFI-25”) has indicated continued, albeit softening, demand for credit. Our survey showed a decline in new business volume, year over year, for Q1, followed by increased volume for Q2, and flat volume growth for Q3. Overall, through September, new business volume is up 1.9% as compared to the same period in 2007. Further, the MLFI-25 indicates credit quality as showing signs of some deterioration yet far less severe than other financial sectors. Delinquencies, while trending up, remain well below earlier periods of economic stress, as do charge offs. More importantly, however, members increasingly report that capital and liquidity constraints are resulting in fewer transactions being funded.5

In your remarks of November 12, you stated, “we must continue to reinforce the stability of the financial system, so that banks and other institutions critical to the provision of credit are able to support economic recovery and growth.” You went on to state “we will also consider capital needs of non-bank financial institutions not eligible for the current capital program … [n]on-bank financial institutions provide credit that is essential to U.S. businesses and consumers.” And you further noted, “important markets for securitizing credit outside of the banking system also need support. Approximately 40 percent of U.S. consumer credit is provided through securitization of credit card receivables, auto loans and student loans and similar products. This market, which is vital for lending and growth, has for all practical purposes ground to a halt.”

Our members, banks and non-bank financial institutions, agree with your comments, with the additional point that the securitization market for business or commercial credit, including equipment loans and leases, has also stalled, as has the bank-supported conduit, commercial paper and syndication market for such instruments.

Our sector, like other asset-based finance sectors, is highly dependent on availability of credit and liquidity particularly as it relates to the secondary market and the ability to recycle funding into the origination channel. Our credit generally has not experienced problems associated with poor underwriting standards, and we have continued to see demand across most markets outside of housing, home construction and trucking and transportation. Nonetheless, despite having been more prudent than other classes of credit extension, we have suffered the effects of the demise of the public securitization market, and more importantly, the private market utilizing private placement securitization, syndication and conduit finance, much of it through the bank channel, resulting in a declining ability to fund transactions. With continued stress on the financial system, as banks seek to de-leverage and repair balance sheets and institutional investors similarly are unwilling or unable to invest in asset-backed securities, U.S. businesses, large and small, looking to obtain credit for investment in capital plant and equipment are facing contraction in the availability of such credit. In short, the lack of liquidity in our market, and ability of originators to sell transactions in order to fund new transactions, will lead to less credit available for businesses to invest in plant and equipment vital to economic growth and productivity.

Our members understand the magnitude of the situation faced by financial policy makers and importantly the need to protect taxpayers’ interests. We appreciate the complex issues related to the extension of the Capital Purchase Program to non-regulated entities and we respect your need to investigate the potential risks related to such action.

We believe, however, that there are viable policy options through the regulated bank channel which would provide necessary liquidity to the commercial credit sector similar to your comments regarding support for the consumer finance ABS market through a federally supported liquidity facility. We believe that it is as economically and fiscally prudent to include the commercial credit sector as the consumer finance sector.

One option designed to get debt capital to flow back into the equipment finance sector would be through federal assistance for the commercial paper conduits that commercial banks use in connection with their extension of credit to equipment finance companies. CP conduits use A1/P1 rated banks to provide liquidity to the conduits in the event that they are unable to roll over maturing commercial paper. These facilities must conform to standard bank underwriting and risk management practices. The average maturity of most equipment leases and loans, particularly in the small and medium enterprise sector, is 48 to 60 months. If the government were to guarantee a portion of newly created CP conduit facilities, then the banks would feel comfortable in extending these lines for new facilities and the bank should receive preferential regulatory capital treatment for the guaranteed amount.

While this example is a preliminary concept, it lays out a potential remedy to address the liquidity issue for both the bank and non-bank sector, while preserving the nexus with regulated entities. Other options may involve a guarantee of a portion of highly-rated equipment lease and loan ABS that would provide comfort and incentive to traditional investors in this market place. Importantly, we believe that any support provided for the loan securitization market should include a commercial credit component.

The ELFA would welcome the opportunity to provide additional information to you and your staff regarding this matter, including additional industry and market data. We appreciate your consideration of our thoughts and ideas.

With kindest personal regards,

Sincerely,

Kenneth E. Bentsen, Jr.

President

cc: Assistant Secretary Neel Kashkari

Assistant Secretary David Nason

1 The ELFA is the trade association that represents companies in the $650 billion equipment finance sector, which includes financial services companies and manufacturers engaged in financing the utilization and investment of and in capital goods. Our sector provides capital to business, government and non-profit sector for investment in capital plant and equipment. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. The ELFA has over 700 members including independent and captive lease and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers.

2 U.S. Department of Commerce

3 U.S. Equipment Finance Market, Equipment Leasing & Finance Foundation/Global Insight, 2007

4 2008 ELFA Survey of Equipment Finance Activity

5 ELFA Monthly Leasing and Finance Index 2008

### Press Release ###########################

--------------------------------------------------------------

|

![]()

News Briefs----

Bernanke Says Federal Reserve Won't Reveal Details on Loans

http://www.bloomberg.com/apps/news?pid=20601087&sid=aS1eWoJj0sKc&refer=home

Bank of America sees record credit card losses

http://www.reuters.com/article/etfNews/idUSN1828425020081118

Transit leaders seek help from Congress on SILO leases

http://www.usatoday.com/news/washington/2008-11-18-transit-help_N.htm

Big trouble for small casinos, industry head says

http://www.fresnobee.com/384/story/1021009.html

Jazeera signs $70mm deal for A320s

http://www.business24-7.ae/articles/2008/11/pages/11182008_7492b99cbf

95445c80ee697617f618f8.aspx

With an aim of becoming the world's fifth-largest lessor by 2020 and the largest narrow-body lessor by 2012, Sahaab Leasing is due to be physically operational by the end of this year. The leasing unit is being backed by the promoters of Jazeera Airways: NBK Capital and DVB Bank.

G-20 Verdict on Fair Value: Innocent/Not Accounting

http://www.cfo.com/article.cfm/12626458?f=alerts

China Tops Japan in U.S. Debt Holdings

http://www.washingtonpost.com/wp-dyn/content/article/2008/11/18/AR2008111803558.html

Home prices down 9% from a year ago

http://www.usatoday.com/money/economy/housing/2008-11-18-home-prices-q3_N.htm

Economy acting out on Broadway attendance

http://www.usatoday.com/life/theater/news/2008-11-18-broadway-economy_N.htm

Disney's Cody Linley doesn't make 'Dancing' finals

http://www.accessatlanta.com/entertainment/content/shared-gen/ap/TV/

TV_Dancing_with_the_Stars.html

---------------------------------------------------------------

You May have Missed---

Governments Can't Handle Global Run on Gold Coins

http://www.nypost.com/seven/11182008/business/governments_cant_handle_global

_run_on_go_139306.htm

|

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

----------------------------------------------------------------

![]()

California Nuts Briefs---

Schwarzenegger opens climate summit with Obama

http://www.google.com/hostednews/ap/article/ALeqM5iMYGz51DMfI3b3W-

En-7-55su38gD94HPBM80

----------------------------------------------------------------

![]()

“Gimme that Wine”

Wine Spectator Top 100 Wines of 2008

http://top100.winespectator.com/

He Can Bring the Wine and the Music

http://www.nytimes.com/2008/11/19/dining/19pour.html?ref=dining

Liquid Gold in the Santa Cruz Mountains

http://wine.appellationamerica.com/best-of-appellation/Santa-Cruz-Chard.html

A New Glass Wine Producer Enters The North American Market

http://winebusiness.com/news/DailyNewsArticle.cfm?dataid=60267

Tennessee groceries may stock wine in near future

http://www.wbir.com/news/local/story.aspx?storyid=69417&catid=2

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

The London International Vintners Exchange (Liv-ex) is an electronic exchange for fine wine.

http://www.liv-ex.com/

----------------------------------------------------------------

![]()

Today's Top Event in History

1863—Seventeen acres of the battlefield at Gettysburg, PA, were dedicated as a national cemetery. Noted orator Edward Everett spoke for two hours; the address that Lincoln delivered in less than two minutes was later recognized as one of the most eloquent of the English language. Five manuscript copies in Lincoln’s hand survive, including the rough draft begun in ink at the executive Mansion at Washington and concluded in pencil at Gettysburg on the morning of the dedication (kept at the Library of Congress).

http://memory.loc.gov/ammem/today/nov19.html

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

| 1493- Columbus discovered Puerto Rico on his second voyage to the New World. He never set foot on the mainland of what today is the United States. He was a major slave trader of the times, committing genocide, bringing tobacco to addict Europe ( a crop unknown before its discovery in the New World.) Contrary to published reports, the world was known to the general population to be round, there was a easy sail at the time of the year to the Bahama’s, and he died a rich man from all the “commissions” he received from the many voyages to plunder the islands he discovered. (see two books by James W. Loewen, “The Truth about Columbus,” and “ Lies, May Teach Told Me.”) 1620 - The Pilgrims reached Cape Cod. Mariner Bartholomew Gosnold (1572-1607) sailed the New England coast in 1602, naming things as he went.When the Pilgrims first set foot in the New World in November 1620, it was at the site of Provincetown, at the tip of Cape Cod. They rested only long enough to draw up rules of governance (the Mayflower Compact) before setting sail westward in search of a more congenial place for their settlement, which they found at Plymouth. Later settlers stayed on the Cape, founding fishing villages along the coasts. The fishing industry drew boat builders and salt makers. Soon there were farmers working the cranberry bogs as well, and whaling ships bringing home rich cargoes of oil and whalebone. 1752-Birthday of George Rogers Clark, American soldier and frontiersman, born at Albermarie County, VA. Died at Louisville, KY, Feb. 13, 1818. 1831 - birthday of James Garfield, Twentieth president of the US (and the first left-handed president) was born at Orange, OH. Term of office: Mar 4—Sept 19, 1881. While walking into the Washington, DC, railway station on the morning of July 2, 1881, Garfield was shot by disappointed office seeker Charles J. Guiteau. He survived, in very weak condition, until Sept 19, 1881, when he succumbed to blood poisoning at Elberon, NJ (where he had been taken for recuperation). Guiteau was tried, convicted and hanged at the jail at Washington, June 30, 1882. 1847- Mary Anna Hallock Foote illustrated and wrote of life in mining towns and California. http://askart.com/Biography.asp http://members.tripod.com/~ntgen/bw/ha_notable.html#Mary 1862- birthday of evangelist Billy Sunday. A little known fact, Sunday was a major league outfielder in the 1880s before leaving the game to became an evangelist. Died at Chicago, IL, Nov 6, 1935. 1863 - Seventeen acres of the battlefield at Gettysburg, PA, were dedicated as a national cemetery. Noted orator Edward Everett spoke for two hours; the address that Lincoln delivered in less than two minutes was later recognized as one of the most eloquent of the English language. Five manuscript copies in Lincoln’s hand survive, including the rough draft begun in ink at the executive Mansion at Washington and concluded in pencil at Gettysburg on the morning of the dedication (kept at the Library of Congress). http://memory.loc.gov/ammem/today/nov19.html 1868- Testing the wording of the 14th Amendment that says “no State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States,” 172 New Jersey suffragists, including four black women, attempted to vote in the presidential election. Denied, they cast their votes instead into a women’s ballot box overseen by 84-year-old Quaker Margaret Pryer 1874- William Marcy "Boss" Tweed, of Tammany Hall (NYC) convicted of defrauding the city of $12M, sentenced to 12 years' imprisonment: convicted of 204 counts of fraud. Estimates of sum Tweed swindled from City Treasury range up to $200 million. http://7-12educators.about.com/blabosstweed.htm http://www.cmsu.edu/cj/boss.htm 1874-Developed out of the Women’s Temperance Crusade of 1873, the Women’s Christian Temperance Union was organized at Cleveland, OH. The Crusade had swept through 23 states with women going into saloons to sing hymns, pray and ask saloonkeepers to stop selling liquor. Today the temperance group, headquartered at Evanston, IL, includes more than a million members with chapters in 72 countries and continues to be concerned with educating people on the potential dangers of the use of alcohol, narcotics and tobacco. 1883 -- The United States Uniform Time Zone Plan (4 zones of 15 degrees) is put into operation: modern capitalism asserts total control of the social through the development of mass communications and transportation. "Despite all the good scientific and military arguments for world time, it was the railroad companies and not the government that were the first to institute it. Around 1870, if a traveler from Washington to San Francisco set his watch in every town he passed through, he would set it over two hundred times" --- Stephen Kern, The Culture Of Time Space. 1885- Birthday of Haldor Lillenas, American hymn writer. He penned nearly 4,000 Gospel texts and hymn tunes during his lifetime, including "It Is Glory Just to Walk With Him," Wonderful Grace of Jesus" and "Peace, Peace, Wonderful Peace." 1905-Birthday of trombone player/band leader Tommy Dorsey Birthday http://www.redhotjazz.com/tommy.html http://www.tommydorseyorchestra.org/ 1908-birthday of trombone player Keg Johnson, Dallas, TX http://www.artistdirect.com/music/artist/bio/0,, 449858,00.html?artist=Keg+Johnson 1915 -- IWW labor organizer, folk-poet Joe Hill murdered by firing squad in Utah. The subject of numerous songs, plays, & books. Some of his songs have been available continuously in the IWW's "Little Red Song Book," now in its 36th edition. Hill was convicted of killing a grocer & his son, even though the bullets were not from Hill's revolver & no one identified him as the murderer. His last words: "Don't mourn, organize!" Poet Alfred Hays wrote a ballad in Hill's memory: "I dreamed I saw Joe Hill last night, Alive as you and me. Says I, 'But Joe you're ten years dead,' 'I never died,' says he." Labor organizer for the radical Industrial Workers of the World (IWW) & writer of union songs, Hill became a martyr upon his execution. Efforts by President Woodrow Wilson, the government of Sweden, & many prominent Americans to get him a new trial had failed. Utah Phillips has recorded Joe Hill's songs, some downloadable at, http://hillstrom.iww.org/music/Utah_Phillips/ See: Smith, Gibbs M., Labor Martyr: Joe Hill (1972). (Grolier Electronic Publishing, Inc., 1995 Encyclopedia) Only hours before facing the firing squad labor organizer Joe Hill composed his "Last Will": My will is easy to decide, For there is nothing to divide. My kin don't need to fuss & moan Moss does not cling to a rolling stone. My body - Oh! - if I could choose, I would to ashes it reduce, & let the merry breezes blow My dust to where some flowers grow. Perhaps some fading flower then Would come to life & bloom again. This is my Last & Final Will. Good luck to all of you, — Joe Hill http://hillstrom.iww.org/joehill.html http://www.pbs.org/joehill/story/ http://iww.org/ 1919 - The Senate rejected the Treaty of Versailles by a vote of 55 in favor to 39 against, short of the two-thirds majority needed for ratification. 1921- birthday of Roy Campanella, one of the first black major leaguers and a star of one of baseball’s greatest teams, the Brooklyn Dodgers’ “Boys of Summer,” was born at Philadelphia, PA. Campy, as he was often called, was named the National League MVP three times in his 10 years of play, in 1951,1953 and 1955. Campanella had his highest batting average in 1951 (.325) and in 1953 he established three single-season records for a catcher— most putouts (807), most home runs (41) and most runs batted in (142)—as well as having a batting average of .312. His career was cut short on Jan 28, 1958, when an automobile accident left him paralyzed. Campy gained even more fame after his accident as an inspiration and spokesman for the handicapped. He was named to the Baseball Hall of Fame in 1969. Roy Campanella died June 26, 1993, at Woodland Hills, CA. 1934- Chick Webb Band records “Blue Lou,” “ Don’t Be that Way.” 1943- Stan Kenton records his them “Artistry in Rhythm” Capital 159 http://www.artistdirect.com/store/artist/album/0,,113753,00.html http://www.amazon.com/exec/obidos/ASIN/B00004THEJ/inktomi- musicasin-20/ref%3Dnosim/104-3191958-8595946 1944-Looking for ways to fund World War II, President Franklin D. Roosevelt announced the 6th War Loan Drive on this day. The Loan Drive flooded the market with war bonds intended to meet Roosevelt's goals of "immediately" raising $14 billion for the war. 1950---Top Hits Harbor Lights - The Sammy Kaye Orchestra (vocal: Tony Alamo) Goodnight Irene - The Weavers Thinking of You - Don Cherry I’m Moving On - Hank Snow 1954- At the Union Toll Plaza on New Jersey’s Garden State Parkway motorists dropped 25 cents into a wire mesh hopper and a green light would flash. This was the first automatic toll machine. If they didn’t drop the money in, an alarm sounded. A machine that could provide correct change went into operation at the extreme right lane of each direction of traffic. The first modern toll road was the Pennsylvania Turnpike which opened in 1940. On the West Coast, most highways are “free,” thus the word, “freeway.” 1954 - Sammy Davis, Jr. was involved in a serious auto accident in San Bernardino, CA. Three days later, Davis lost the sight in his left eye. He later referred to the accident as the turning point of his career. 1955--Carl Perkins recorded "Blue Suede Shoes" at Sun Studios in Memphis. It became his biggest Pop hit, reaching #2 on the Billboard chart. Elvis Presley's version, which gets more air-play these days, only managed to get to #20. 1958—Top Hits Tom Dooley - The Kingston Trio Topsy II - Cozy Cole Beep Beep - The Playmates City Lights - Ray Price 1959 - The last Edsel rolled off the assembly line. Ford Motor Company stopped production of the big flop after two years and a total of 110,847 cars. 1959-”Rocky and his Friends” premiered on TV.. This popular cartoon featured the adventures of a talking squirrel, Rocky (Rocket J. Squirrel), and his friend Bullwinkle, a flaky moose. The tongue-in-cheek dialogue contrasted with the simple plots in which Rocky and Bull-winkle tangled with Russian bad guys Boris Badenov and Natasha (who worked for Mr. Big). Other popular segments on the show included “Fractured Fairy Tales,” “Bullwinkle’s Corner” and the adventures of Sherman and Mr. Peabody (an intelligent talking dog). In 1961 the show was renamed “The Bullwinkle Show,” but the cast of characters remained the same. http://timvp.com/bullwink.html 1961 - A year after Chubby Checker reached the #1 spot with "The Twist", the singer appeared on "The Ed Sullivan Show" to sing the song again. "The Twist" became the first record to reach #1 a second time around. 1961 — Cleveland running back Jim Brown rushes for an NFL record 242 yards and four touchdowns as the Browns beat the Philadelphia Eagles 45-24. 1962- Jodie Foster, film actor, director, and producer. Multi- Academy Award winner for her acting performances in Cry of the Lambs and Accused. Jodie was the youngest of four children raised by her mother Brandy, an art dealer and publicist. Jodie's father deserted the family before Jodie was born. http://www.jodiefoster.nu/ http://us.imdb.com/name/nm0000149/bio 1964---Gary Lewis and The Playboys record "This Diamond Ring", which will climb to number one in the US the following January. 1965 -- Pop Tarts pastries created. http://www.kelloggs.com/products/poptarts.html http://www.pmichaud.com/toast/ 1966-- in one of the more famous college football match-ups between teams ranked No. 1 and No. 2, top-ranked Notre Dame tied second-ranked Michigan State, 10-10. 1966—Top Hits You Keep Me Hangin’ On - The Supremes Good Vibrations - The Beach Boys Winchester Cathedral - The New Vaudeville Band I Get the Fever - Bill Anderson 1966 - Six weeks before his 31st birthday, LA Dodgers pitcher Sandy Koufax, plagued by arthritis, announced his retirement from baseball. Koufax compiled a 12-season record of 165 wins, 87 losses and 2,396 strikeouts. 1967-For action this date, Chaplain (Major) Charles Watters of the 173rd Airborne Brigade is awarded the Medal of Honor. Chaplain Watters was serving with the 2nd Battalion, 503rd Infantry when it conducted an attack against North Vietnamese forces entrenched on Hill 875 during the Battle of Dak To. The Catholic priest from New Jersey moved among the paratroopers during the intense fighting, giving encouragement and first aid to the wounded. At least six times he left the defensive perimeter with total disregard regard for his own personal safety to retrieve casualties and take them for medical attention. Once he was satisfied that all of the wounded were inside the perimeter, he busied himself helping the medics, applying bandages, and providing spiritual strength and support. According to reports filed by survivors of the battle, Father Watters was on his knees giving last rites to a dying soldier when an American bomber accidentally dropped a 500-pound bomb onto the group of paratroopers. Father Watters was killed instantly. He was awarded a posthumous Medal of Honor on November 4, 1969, in a ceremony at the White House. 1967---*WATTERS, CHARLES JOSEPH Medal of Honor Rank and organization: Chaplain (Maj.), U .S. Army, Company A, 173d Support Battalion, 173d Airborne Brigade. Place and date: Near Dak To Province, Republic of Vietnam, 19 November 1967. Entered service at: Fort Dix, N.J. Born: 17 January 1927, Jersey City, N.J. Citation: For conspicuous gallantry and intrepidity in action at the risk of his life above and beyond the call of duty. Chaplain Watters distinguished himself during an assault in the vicinity of Dak To. Chaplain Watters was moving with one of the companies when it engaged a heavily armed enemy battalion. As the battle raged and the casualties mounted, Chaplain Watters, with complete disregard for his safety, rushed forward to the line of contact. Unarmed and completely exposed, he moved among, as well as in front of the advancing troops, giving aid to the wounded, assisting in their evacuation, giving words of encouragement, and administering the last rites to the dying. When a wounded paratrooper was standing in shock in front of the assaulting forces, Chaplain Watters ran forward, picked the man up on his shoulders and carried him to safety. As the troopers battled to the first enemy entrenchment, Chaplain Watters ran through the intense enemy fire to the front of the entrenchment to aid a fallen comrade. A short time later, the paratroopers pulled back in preparation for a second assault. Chaplain Watters exposed himself to both friendly and enemy fire between the 2 forces in order to recover 2 wounded soldiers. Later, when the battalion was forced to pull back into a perimeter, Chaplain Watters noticed that several wounded soldiers were Lying outside the newly formed perimeter. Without hesitation and ignoring attempts to restrain him, Chaplain Watters left the perimeter three times in the face of small arms, automatic weapons, and mortar fire to carry and to assist the injured troopers to safety. Satisfied that all of the wounded were inside the perimeter, he began aiding the medics--applying field bandages to open wounds, obtaining and serving food and water, giving spiritual and mental strength and comfort. During his ministering, he moved out to the perimeter from position to position redistributing food and water, and tending to the needs of his men. Chaplain Watters was giving aid to the wounded when he himself was mortally wounded. Chaplain Watters' unyielding perseverance and selfless devotion to his comrades was in keeping with the highest traditions of the U.S. Army. 1968--Diana Ross, onstage with the Supremes at the Royal Command Variety Performance in London, interrupts the show with a plea for interracial understanding. The audience, which includes members of the royal family, applauds for two minutes. 1969-Astronauts to retrieve a manmade object from the moon were Commanders Charles Conrad, Jr. ,mission leader and Alan La Vern Bean, lunar landing module pilot, who recovered a piece of the unmanned spacecraft “Surveyor 3,” which had landed on the Ocean of Storms of the Moon on April 19,1967. They were two of the three astronauts on Apollo 12, 2hich was launched by a Saturn 5 rocket from Cape Canaveral, FL, at 11:22am on November 14, 1969. While Commander Richard Francis Gorden, Jr. remained in orbits to pilot the command module, Conrad and Bean descended to the moon’s surface in the lunar module “Intrepid” and remained there for one day, the second time, that human beings landed on the moon. Splashdown took play November 24, 1969, 400 miles from Samoa, after a flight of 244 hours, 36 minutes, 25 seconds. 1974—Top Hits Whatever Gets You Thru the Night - John Lennon with The Plastic Ono Nuclear Band Do It (’Til You’re Satisfied) - B.T. Express My Melody of Love - Bobby Vinton Country Is - Tom T. Hall 1978, Indiana-born, 47-year-old Reverend Jim Jones, leader of the “Peoples Temple,” was reported to have directed the suicides of more than 911 persons at Jonestown, Guyana. US Representative Leo J. Ryan, of California, and four members of his party were killed in ambush at Port Kaituma airstrip on Nov 18, 1978, when they attempted to leave after an investigative visit to the remote jungle location of the religious cult. This day, Jones and his mistress killed themselves after watching the administration of Kool-Aid laced with the deadly poison cyanide to members of the cult. At least 913 persons died in the biggest murder-suicide in history. 1979- pitcher Nolan Ryan became the first baseball free agent to sign a contract for a salary of one million dollars per year. Ryan moved from the California Angels to the Houston Astros. 1980 -CBS TV bans Calvin Klein's jeans ad featuring Brooke Shields 1982---Top Hits Up Where We Belong - Joe Cocker & Jennifer Warnes Truly - Lionel Richie Heart Attack - Olivia Newton-John Heartbroke - Ricky Skaggs 1984 - 20-year-old Dwight Gooden of the New York Mets became the youngest major-league pitcher to be named Rookie of the Year in the National League. The Mets pitcher led the majors with 276 strikeouts. 1986 - Philadelphia’s Mike Schmidt became only the third player in National League history to win the Most Valuable Player award three times. Roy Campanella of the Dodgers and Stan Musial of the Cardinals also won three National League MVP honors. 1990- A summit was held at Paris with the leaders of the Conference on Security and Cooperation in Europe (CSCE). The highlight of the summit was the signing of a treaty to dramatically reduce conventional weapons in Europe, thereby ending the Cold War. 1990—Top Hits Love Takes Time - Mariah Carey Pray - M.C. Hammer More Than Words Can Say - Alias You Really Had Me Going - Holly Dunn 1993- Alan Giarettino proposed marriage to Christy Stubblefield while she rode around the ice rink on the Zamboni during the intermission of an East Coast Hockey League game in Huntington, WV. Stubblefield thought she had earned the ride by winning a contest. In truth, Giarettino had arranged the contest so that he could walk onto the ice during the ride, hand her a bouquet and drop to one knee. She said, “yes.” 1994 - Nirvana’s album, "MTV Unplugged in New York", was number one in the U.S. for the week. The album featured these tracks: "About a Girl", "Come as You Are", "Jesus Doesn’t Want Me for a Sunbeam", "The Man Who Sold the World", "Pennyroyal Tea", "Dumb", "Polly", "On a Plain", "Something in the Way", "Plateau", "Oh, Me", "Lake of Fire", "All Apologies" and "Where Did You Sleep Last Night". 1995--A 60 track album called "Beatles Anthology I" is released in the US and sets a first-day sales record of 450,000 units. 1997 - The world’s first surviving septuplets were born by Cesarean section to Bobbi McCaughey of Carlisle, Iowa. She claimed her place in the record books by giving birth to septuplets: four boys (Kenneth, Brandon, Nathan and Joel) and three girls (Alexis, Natalie and Kelsey). The seven newcomers joined a family that already included one daughter, Mikayla. The infants ranged in weight from 2 pounds, 5 ounces to 3 pounds, 4 ounces and were born over a period of six minutes. The father was Kenny McCaughey, a billing clerk at a car dealership. 1998 - Sammy Sosa is selected as the NL MVP creating an historic Latin American sweep of the MVP awards with Ranger Juan Gonzales winning the award in the AL this season. 2000 -- Florida counts presidential ballots (more or less)... 2001- In a landslide vote (30 of 32 first-place votes) by the BBWAA, Giant left fielder Barry Bonds (.328, 137, 73) wins the Most Valuable Player Award for an unprecedented fourth time (1990, 92- 93 as a Pirate). Three-time MVPs include Yogi Berra, Roy Campanella, Joe DiMaggio, Jimmie Foxx, Mickey Mantle, Stan Musial and Mike Schmidt. 2002 -Twenty-four year veteran Jesse Orosco, who all-time leader in games pitched at 1,187 agrees to a one-year contract with the Padres estimated at $800,000, At age 45, the lefty reliever, who started his major league with the Mets in 1979 (traded by the Twins for Jerry Koosman), is the oldest player in the majors. http://baseball.espn.go.com/mlb/players/profile?statsId=1840 http://www.baseball-reference.com/o/oroscje01.shtml |

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out

with one click, or type in a new route to learn the traffic live.

Bank Beat

Cartoons

Computer Tips

Fernando's Review

Leasing 102

Online Newspapers

Placards

Sales Make it Happen

To Tell the Truth