|

National Machine Tool Financial Corporation |

National Tel-Med Capital | National Business Finance |

Sales Reps

Machine tools, construction, medical equip. Top competitive comp. package Fax resume: 847-871-4209 e-mail: chris@netlease.com

|

www.netlease.com

National has operated as an indirect lessor for over 25 years. They are expanding three of their divisions. |

Wednesday, October 18, 2006

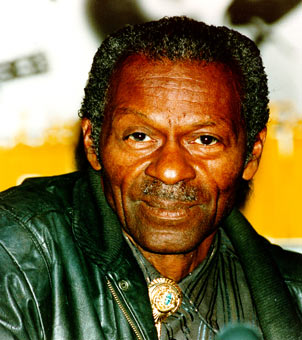

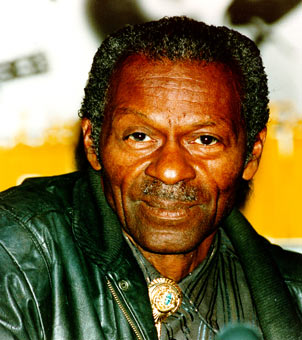

Chuck Berry doing his famous “duck walk.”

He is 80 years old today. Happy Birthday,

“Roll over, Beethoven” and make some room

for “Johnny B. Goode.”

Headlines---

Welcome to Leasing News and Mea Culpa

Classified Ads—Sales

“Broker-Vendor” Commission Chart

Sales Makes it Happen—Linda P. Kester

“Questions and Answers”

Linda P. Kester Questionnaire

Alexa Leasing Association Web Report

Classified Ads---Help Wanted

Cartoon---Here comes little Miss Perky

The Best, and Worst, State Tax Climates

Cash/Choksi go Kalakane!!!

Landmark Study/SOX Compliance Issues

Travelers CEO Jim Case named

Ernst & Young Entrepreneur

Resource America $60mm Leaf II

CIT Declares Dividends 3rd Quarter

CHP Consulting/ALFA Systems 4.5

Alta Latin American Leasing Conf

Bank of America Biz Cap/Ashtead Group

Key Names Pete J. Georgelas Sr.VP+

CIT Rail/Bombardier's Rail Car

Bank Quarterly reports

News Briefs---

You May have Missed---

"Gimme that Wine"

Calendar Events

Snapple Real Facts

Today's Top Event in History

This Day in American History

Baseball Poem

######## surrounding the article denotes it is a “press release”

-------------------------------------------------------------------------------

Welcome to Leasing News and Mea Culpa

While I would like to welcome each reader personally, the task of managing the mailing list is now done automatically. I am informed who has joined, and who has left. Some directly e-mail to me to let me know why they are leaving. They don't like one story, so it is "good bye!" Others are leaving the leasing industry entirely and no longer need to be "in touch," they say. Sometimes it is like losing an old friend.

The fact is most read Leasing News go to the web site first and do not subscribe to the e-mail edition. They are not informed that the edition has been posted, nor do they receive an "extra" during the day. We post most of them, so perhaps they are not missing it.

I am surprised how many people read the edition at night, not in the morning, as we issue usually around 5am, EST.

We strive to be controversial. Leasing News likes to print what others will not.

We try to be thought provoking, tell the truth, be accurate and give all sides to a story. We are also the first to forgive, to make a compromise, and yes, you will hear me admit when we “step over the line” or make a mistake. I have made it a point to admit errors, and most often, you will find them at the beginning of the edition, not hidden near the bottom. My dog Bode thinks I am perfect, but readers know I make errors, especially late at night.

So please hang in there. Ask a colleague to subscribe. Tell your employer they should take out a banner ad or an employment ad. And to the individual in Arizona who sent us $150, just to show us his support, wow!!! He didn't want me to acknowledge it or use his name. He just wanted us to continue what we are doing.

Kit Menkin, editor

[headlines]

----------------------------------------------------------------

Classified Ads—Sales

Red Sky Winery owners Carol and Jim Parsons, Woodinville , WA *

These job-wanted ads are free. We also recommend to both those seeking a position and those searching for a new hire to also go to other e-mail posting sites:

http://64.125.68.91/AL/LeasingNews/Classified.htm

In addition, those seeking employment should go to the human resource departments on company web sites for funders, captive lessors, and perhaps “broker-lessors.”

To place a free “job wanted” ad here, please go to:

http://64.125.68.91/AL/LeasingNews/PostingForm.asp

Sales

Sales: Bakersfield, CA

I have an extensive sales and management background in equipment leasing. My work history exhibits my major strength in small ticket equipment leasing.

Email: pangress@msn.com

|

Sales: Boston, MA

Middle market originator, construction/Trucks / Trailers w/ 8 years in territory, looking for company / bank with competitive products

Email: mrichlease@comcast.net |

|

Sales: Cedar Rapids, IA

Formally trained in Credit, Collections, & Sales with regional bank. Seeking sales or sales management.

Over ten years |

in SM, vendor and end user.

E mail: mjrprime@yahoo.com

|

Sales: Compenhagen, Denmark

10 years of experience as VP Europe, Middle East and Africa for a US based Equipment Leasing Company. $500,000 plus w/ excellent connections European shipping lines/ maritime financing. Click here . |

Sales: Dallas, TX

17 years of experience in vendor sales. Solid book of business. Can hit the sales ground running in Dallas/Ft. Worth. Can Start ASAP

E-mail: whomadewho12@yahoo.com |

Sales: Denver CO

Experienced Equipment Leasing Broker looking for a in house leasing company. Can bring a book of business with me or develop new territory where needed.

Email: Steven@eagle2.net |

Sales: Detroit MI

Motivated self-starter w/5 yrs sales exp. IT leasing. Excellent communicator w/strong negotiation/biz dev. skills. Six-sigma certified w/ Fortune 50 company/book of business.

Email: playmakers1@sbcglobal.net |

Sales: East Central FL

20+ years experience in all areas of leasing; sales, credit, operations, syndication. Currently independent seeking position with direct middle market lender in regional capacity

email: southernleasing@bellsouth.net |

Sales: Fresno CA

Account Exec/Manager. 7+ years Leasing Sales: underwriting/contract, complex transactions, hi-tech, government, direct & vendor leasing. Captive & syndicator environments. Expert deal closer. Will send resume.

Email: dsp559@pacbell.net

Resume |

Sales: Greensboro, NC

Seeking direct & broker sales w/major finance companies in NC or southeast market. Small to mid-ticket range. Stable &family oriented. Will have series 6,63,65 license shortly.

Email: kc1492@aol.com |

Sales: Kansas City, MO

20 years Senior Sales/Management experience in small ticket/government leasing. Program Management experience, managing 12

Reps. Credit Auth to $50K. Success in soliciting and maintaining accounts.

Email: dhundley1@kc.rr.com |

Sales: Los Angeles CA

5 years experience structuring off-balance sheet finance solutions on computer and medical equipment. Perform detailed competitive analysis and market research. I uncover leads and sell.

email: barretthawk@hotmail.com |

Sales: Midsouth, TX

Lease Veteran-25+ years, heavy Vendor experience looking for new

opportunity in MidSouth/SE. Experience in leasing to major accounts in high-tech/computers/Golf/transportation.

Email: LeaseVeteran@sbcglobal.net |

Sales: Mission Viejo, CA

Account Sales Executive with 10 years of leasing experience looking for company to bring existing customer base.

Email: makelly21@hotmail.com |

Sales: Montgomery, AL

Individual with 10 years advertising sales exp. & 7 years insurance sales exp. Wants independent contractor situation in Alabama.

Work with leasing company or broker.334-281-5200 E-mail: billmcneal2003@yahoo.com |

Sales: Nashua, NH

10+ years sales experience small & mid-ticket hi-tech & telecom in a captive and vendor environment. Seeking new sales opportunity in New England.

E-mail: RPepa@aol.com |

Sales: Newport Beach, CA

Direct sales rep. in the middle market w/22 years experience various types of equipment. Leasing/ financing from medical equip. to

mfg. equip.. Strong closer.

E-mail: pauldriscoll1@lycos.com

|

Sales: North Carolina, Central

7 yrs.equip leasing &finance; specialist in heavy construction equip for 2-top-5-specialty finance/lease companies, NC &VA territories. $10-15MM annual funding. Downsized in 2002, now independent broker with varied customer base. Email: sunriseleasing@aol.com |

| Sales: Philadelphia , PA Seeking an open opportunity to advance in the automotive, commercial leasing & finance industry......... Email: alexe362002@yahoo.com |

Sales: Philadelphia, PA

25 years in Healthcare and seeking an opportunity to represent a lender for dental/medical funding in the Northeast to

Mid-Atlantic states.

email: mitutz@msn.com |

Sales: Portland, OR.

"Exp. In direct sales and sales mgmt.

I love Portland, but decent here jobs are few. Willing to be re-located, would like to work for you.

Email: pthygeson@netscape.net |

Sales: Prairie Village, KS Have substantial deal flow and database of broker referral sources. Generated and closed over $22M LY. Seeking exclusive relationship w/direct founder.

Email: fiergl@aol.com |

Sales: Saint Louis, MO

25+ years in sales + sale management. Top producer. Will relocate for right opportunity.

email: wwa2@htc.net |

Sales: San Francisco Bay Area, CA

10+ yrs in middle market leasing. Seek direct lessor only. Transaction size from $500M to $10.0MM. Client base: printing, food, retail, manufacturing. Email: edm173@sbcglobal.net |

Sales: Currently employed Vendor Program “Hunter”, with complex program development experience. Also skilled at program management. Technology to yellow iron assets. Extensive national rolodex.

Email: VdrPgmBizDev@aol.com |

Sales: San Francisco Bay Area, CA

15+ yrs--mid mkt. $500M to $10.0MM. Seeking role w/ captive or global leasing firm. large book to bring with me! Debt, tax, 1st amendment, etc. Email: lac4002@yahoo.com |

Sales: San Francisco Bay Area, CA

20 plus years experience in small ticket and middle market, mostly vendor driven business; specialist in manufacturing, hi-tech & medical. Excellent analytical and marketing skills.

Email: deals_2_do@yahoo.com |

Sales: Southern California

Equipment Financing Professional with strong background in Sales, Management, Marketing & Operations. Will consider relocation for Senior Sales or Management position offering dynamic growth opportunity.

Email: natsif@hotmail.com |

South Central US

TX, OK, KS & AR Territory.

Equipment finance and leasing professional, 20 years experience. Top producer in middle to upper middle markets. Extensive customer base.

Email: usleasingrep@yahoo.com

|

|

For a full listing of all “job wanted” ads, please go to:

http://64.125.68.91/AL/LeasingNews/JobPostings.htm

* http://www.redskywinery.com/

[headlines]

----------------------------------------------------------------

Click on image to view a larger copy

Click on image to view a larger copy |

Please use this form to submit any other companies and/or points to our list. |

[headlines]

----------------------------------------------------------------

Sales Make it Happen

Questions and Answers

By: Linda P. Kester

Linda Kester helps leasing companies increase volume. For more information visit www.lindakester.com . Questions, contact: Linda@lindakester.com

The latest list of "broker/vendor" commissions is above. Note: you may click on it to enlarge. In the size above, it is easier to see who is in the categories. It is no secret that "discounters" and "lessors" make more money than an independent salesmen; however, there are several "funders" who are promising what appear to be like commissions.

I also should take that back about “independent salesmen.” Sierra Cities, then American Express Business Finance, had one salesman in Florida who was earning $2 million plus a year in commissions. From my experience, I have seen several who make $300,000 to $400,000 a year. When Tom Depping had his company going, many says were making $250,000 and above their first year. In fact, a broker or leasing sales person who is not grossing $150,000 a year, needs my help.

At this point, the information I have received was at my request. If you have a company you would like to investigate the points policy of specific funding sources, fill out the questionnaire form and hopefully they can take advantage of the free publicity.

I look forward to those requests, and here are some “on line” responses from questions I have received from Leasing News readers:

Q: I am curious as to the “broker” policies of other funders out there when it comes to lease default – say, within the first year of the lease. Typically, would a broker take some responsibility for the default? Would he/she be asked to “pay back” part of the commission that was paid out on the transaction?

A: Typically a broker would have to buy back a default if he violated the reps and warranties of the broker agreement. The most common agreements call for this if the broker knowingly misrepresents the deal or withholds pertinent information. This would include pay back of the commission.

Q: I work for a funding source. We understand that commission amounts paid to brokers can be quite high. This is fine with us, but it seems to raise issues around usury in $1 option leases. Do you have any thoughts on how funding sources avoid that issue?

A: Different states have different usury laws and also different interpretations of them i.e. if commercial leases are subject to them and if $1 out leases is also subject to them. One way some get around it is to have an assignment of residual back to the broker. The broker can still make it a $1 out lease to the customer but the funding source considers it a lease with a residual. The broker takes the usury risk.

I know that some funding sources only worry about the usury in the state they are located. They feel that if they have a lenders license in a certain state it protects them from usury issues. Also, most leases state that they are subject to the laws of a certain state, usually the lessor's home state.

That said, some funders limit commissions or disclose the rate in the lease documentation in certain states to keep the rate from becoming a usury issue (Texas, Arkansas, and Louisiana, for example). This generally is a result of prior litigation in those states.

Q: Has the role of the salesperson changed such that they can obtain a higher commission and part of the residual?

A: The role of the salesperson varies by leasing company. Some are just expected to “spray & pray” and then there are the true leasing sales professionals who can structure and work a deal.

Good quality reps should be well compensated. A rep should get a higher commission for selling FMV. If they are still employed by the leasing company at the end of the term, they should receive additional income from the residual.

Q: I thought giving a vendor a commission was against the law.

A: I have heard of “conflicts of interest” and potential problems with such a policy, but it appears to be like the speeding law. If you are traveling at the speed of regular traffic, meaning if you are all going over ten miles above the speed limit, it appears that is the acceptable, meaning you won't get a ticket.

Q: How long does it take the average leasing sales person to start to earn a decent commission.

A: It depends on the individual and circumstance. The average time recruiters' state is between three and six months. Generally, if you are not seeing a good living after six months, you should choose another profession or go to another company. Usually your employer will make that decision for you if you are not producing well after six months.

|

[headlines]

----------------------------------------------------------------

[headlines]

----------------------------------------------------------------

For the second month in a row, Leasing News is #1.

As important, Leasing News has now broken 100,000.

For a trade publication, this is quite a fete. Google and Alexa also treat the web site differently, giving more reporting information, more feed back for us, and move us forward in searching as the top 100,000 is a benchmark for the search engines.

Alexa Ranks Leasing Media Web Sites

|

Rank |

|

|

|

WEBSITE NAME |

| 1. |

97,986 |

100,075 |

|

www.leasingnews.org Leasing News |

|

2. |

124,966 |

112,998 |

|

www.aba.com American Bankers Association |

| 3. |

201,274 |

207,032 |

|

www.elaonline.com Equipment Leasing Association |

|

4. |

281,383 |

273,346 |

|

www.monitordaily.com Monitor Daily |

|

5. |

577,681 |

649,860 |

|

www.ibaa.org Ind Community Bankers of America |

| 6. |

650,637 |

643,282 |

|

www.naelb.org* National Assoc. of Equip Leasing Brokers |

|

7. |

903,814 |

990,463 |

|

www.iicl.org Institute of International Container Lessors |

|

8. |

1,080,571 |

1,187,882 |

|

www.cfa.com Commercial Finance Association |

|

9. |

1,088,460 |

1,118,967 |

|

www.lessors.com eLessors Networking Association |

| 10. |

1,201,430 |

1,197,767 |

|

www.leasingnotes.com Leasing Notes |

|

11. |

1,314,457 |

1,311,260 |

|

www.leasecollect.org Lean -Lease Enforcement Att Net |

| 12. |

1,364,386 |

1,033,450 |

|

www.us-banker.com U.S.Banker |

|

13. |

1,806,631 |

1,832,393 |

|

www.executivecaliber.ws Exec Caliber-Jeffrey Taylor |

|

14. |

1,864,044 |

1,375,480 |

|

www.uael.org United Association of Equipment Leasing |

|

15. |

1,878,444 |

2,331,288 |

|

www.leasefoundation.org Equip. Leasing & Fin Fndn |

|

16. |

3,543,284 |

3,546,785 |

|

www.clpfoundation.org CLP Foundation |

|

17. |

4,323,376 |

No Data |

|

www.aglf.org Assoc of Government Leasing Financing |

|

18. |

No Data |

5,496,965 |

|

www.leaseassistant.org Lease Assistant |

|

19. |

No Data |

No Data |

|

www.nationalfunding.org The National Funding Assoc |

|

20. |

No Data |

No Data |

|

www.eael.org*Eastern Association of Equipment Leasing |

| 21. |

No Data |

3,534,068 |

|

www.Leasingpress.com Leasing Press |

|

22. |

No Data |

No Data |

|

www.efj.com Equipment Financial Journal |

David G. Mayer's Business Leasing News is not included in the Alexa report list as it does not have its own individual site and Alexa finds Patton Boggs, LLP Attorneys at Law. The rating is not valid as it includes all those who visit and communicate with the law firm. When Business Leasing News has its own individual web site, it will be included in the Alexa survey.

*It should also be noted that two web sites have their "list serve" posted via their site, meaning their e-mails are counted as a visit to the site, whereas they are "list serve" communication. These are technically visits to the web site, but primarily to use "list serve."

These comparisons are compiled by Leasing News using Alexa and should be viewed as a "sampling," rather than an actual count from the website itself. Other than as noted above, we believe the ratings are reflective as most have stayed in the same position, basically, for over a year.

The Alexa tool bar works on most browsers.

They are partnered with Google.

You may download their free tool bar A graph and analysis of the last three months are available.

( Note: the lower the number, the higher you are on the list. It is based on all web sites. Leasing is only a very small part of the various sites such as Yahoo, MSN, Google, etc. )

[headlines]

----------------------------------------------------------------

Classified Ads---Help Wanted

Operations Manager

|

Operations Manager

Minneapolis,MN

Coordinates lease process from inception through pay off. 3+ years proven leasing account management exper.

For more info, click here

|

|

Sales Representatives

|

National Machine Tool Financial Corporation |

National Tel-Med Capital | National Business Finance |

Sales Reps

Machine tools, construction, medical equip. Top competitive comp. package Fax resume: 847-871-4209 e-mail: chris@netlease.com

|

www.netlease.com

National has operated as an indirect lessor for over 25 years. They are expanding three of their divisions. |

[headlines]

----------------------------------------------------------------

[headlines]

--------------------------------------------------------------

The Best, and Worst, State Tax Climates for Business

AccountingWEB.com

When it comes to gaining or losing jobs, the Department of Labor (DoL) reports the most mass job relocations occur between U.S. states, rather than jobs moving out of the country entirely. As a result, it is vital that businesses, lawmakers and even citizens understand how their state's business climate and environment compare with others, both regionally and nationally.

A state's business climate is built on taxes. Taxes build the infrastructure, the roads, schools and public services businesses and their employees depend on. Understanding a state's business climate, however, means more than just knowing how much the state collects in taxes. It also means knowing how those taxes are collected. Every state tax law enacted or amended will, in some way, impact that state's ability to compete with other states in the same region and across the country. In this age of global markets, it may even affect a state's international competitiveness as a place to live and do business.

The 2007 edition of the State Business Tax Climate Index (SBTCI), released by the Tax Foundation on Wednesday, is designed to measure the competitiveness of each state's tax system. The SBTCI places more than 100 variables into five component indexes measuring different sectors of the state's tax climate and calculates the state's total score based on the scores of the component indices. The component indexes are: Corporate Tax, Individual Income Tax, Sales Tax, Unemployment Insurance Tax, and Property Tax. The use of component indices allows the tax climates of states with widely varying tax structures to be compared on a level playing field by rewarding strong aspects of the state tax system, such as no individual income tax, and penalizing them on their weaker aspects, such as high sales tax levels.

Based upon these calculations, the ten states having the best tax climate are:

Wyoming

South Dakota

Alaska

Nevada

Florida

Texas

New Hampshire

Montana

Delaware

Oregon

According to the Tax Foundation's 2007 State Business Tax Climate Index, the ten states having the worst tax climate are:

50. Rhode Island

49. Ohio

48. New Jersey

47. New York

46. Vermont

45. California

44. Nebraska

43. Iowa

42. Maine

41. Minnesota

In the global marketplace, American companies are often at a disadvantage. Not only are they subject to a federal corporate income tax with a top rate of 35 percent, states levy an additional tax burden on companies.

According to the SBTCI, the ideal tax system, regardless of level (local, state or federal), is “simple, transparent, stable, neutral to business activity and pro-growth." Further, good state tax systems levy low, flat rates on the broadest possible bases and treat all taxpayers equally.

The 64 page report is available at:

http://www.leasingnews.org/PDF/Tax_fundation.pdf

[headlines]

--------------------------------------------------------------

Cash/Choksi go Kalakane!!!

On the eve of the Loma Prieta California earthquake, ATEL Capital Group Chief Financial Officer Paritosh K. Choksi announces the commencement of Kalakane Capital LLC in Denver , Colorado .

Dean Cash, ATEL's CEO, will provide additional lease financing expertise and capital resources to assure Kalakane is a successful enterprise.

"This is our earthquake emergency disaster facility," Pari Choksi said. "Basically 4,000 square feet ready if we have an earthquake here in San Francisco and cannot operate. We were getting so many requests from Fortune 100 companies, and others, for minority based

lessor transactions, that along with Eliza Cash, we formed this platform to allow themselves as minority owners to qualify for these transactions."

Kalakane Capital LLC is a minority business enterprise for the purpose of allowing ATEL to work with lessees seeking to business with minority business for meeting their federal quota requirements as required in their Federal contracts. Typically they are over $2 million and qualify as true, tax advantaged operating leases.

Choksi said he and Eliza Cash chose Becky Hanley to run the operation in Denver as Vice President, Director of Syndications.

They stole her away from Key Equipment Finance where she was Vice-President of Capital Markets. Prior to that she was a Syndication Sales Representative for CitiCapital Commercial Corporation. She has over ten years in both syndication and indirect originations.

Pari Choksi, President and CEO states of Kalakane, “Becky brings to Kalakane a tremendous amount of leasing experience from both the syndications and originations side of the business. I am confident that she will provide an immediate and consistent impact to growing our business and I look forward to her being an integral part of Kalakane for a long time to come.”

He told Leasing News they also expect business from Atel Capital Group where they have sought bidding from other companies in this field and see a growing demand in this leasing segment.

Kalakane is affiliated with ATEL Capital Group (“ATEL”), an equipment leasing holding company, founded in 1977. ATEL is the ultimate parent of the general manager of a number of public and private equity funds, which currently manage approximately $1 billion in equipment leasing assets.

Kalakane will specialize in leasing a wide variety of essential-use equipment such as manufacturing, transportation, shipping, rail, and mining to primarily investment grade corporations. The primary focus is on transactions over $2MM that qualifies as true, tax advantaged operating leases. Through relationships with bankers, brokers, leasing companies, third party intermediaries and packaging, Kalakane will act as a funding partner by acquiring new or seasoned leases and portfolios.

Atel Capital Group recently on September 11th announced a lease established a lease receivable securitization facility with Bayerische Hypo- und Vereinsbank AG, New York Branch (HVB) for ATEL Capital Equipment Fund X, LLC (Fund) in its capacity as the Fund's Manager. The facility will provide up to $100MM in funding from a commercial paper conduit administered by HVB.

Liquidity provided by the facility is expected to be used to acquire additional leases and equipment. The facility termination date is July 31, 2008.

Mr. Paritosh K. Choksi, ATEL's Chief Financial Officer, stated, “The securitization facility provides an additional source of liquidity for the Fund at a competitive cost. This transaction represents our fourth securitization since 1998. It is also the second $100M transaction we've done with HVB. I am appreciative of the efforts they made in putting together this transaction.”

ATEL Capital Group is one of the largest privately held owned equipment leasing and financial services companies in the United States . Since its founding in 1977, ATEL has priced, structured and arranged over $30 billion of equipment leases. ATEL specializes in leasing low-technology equipment such as manufacturing, shipping, rail, and mining to investment-grade companies. In addition, ATEL provides financing to venture-backed companies through its ATEL Venture, Inc. subsidiary.

For further information, visit www.kalakane.com or www.atel.com

(Hawaiian word Kala means Cash and Kane means money.

The photograph is contemporary of Chuck Berry, who

is 80 years old today. Paritosh K. Choksi did not have

a photograph available, so thought it appropriate to

salute the octogenarian. editor)

From This Day in American History, October 17, 1989:

1989--We experienced an earthquake of 7.1 in my hometown of Los Gatos at 2:04PM I was in my Chevrolet Suburban, not far from the office, near the University of Santa Clara , and a student on a bicycle in front of me suddenly fell down. At first I thought I hit him, and as he got up, I glanced over and saw two other bicyclists trying to stand, and my car was violently rocking sideways as if the car had been silently blind sided. KCBS was on and announced they felt an earthquake, which later turned out in the Loma Prieta section of Los Gatos . The quake caused damage estimated at $10 billion and killed 67 people, many of who were caught in the collapse of the double-decked Interstate 80 in Oakland , California . We were without electricity and water for several days and sales for the month were the lowest they ever have been in our history as it took business many weeks to recover.

As a sports note, the event is also known as the “World Series Earthquake. Minutes before the start of Game 3 of the World Series billed as the “Battle of the Bay, “ between the Oakland A's and the San Francisco Giants, Candlestick Park was rocked by the Loma Prieta earthquake. the game was postponed and the Series delayed for 11 days. The Oakland Athletics won games three and four for the first Series sweep in 13 years.

[headlines]

--------------------------------------------------------------

Landmark Study Reveals SOX Compliance Issues

AccountingWEB.com -

COSO 1992 Control Framework and Management Reporting on Internal Control: Survey and Analysis of Implementation Practices, a landmark research study by the Institute of Management Accountants (IMA), reveals two key cost drivers for public companies complying with Sarbanes Oxley (SOX)

Section 404.

“IMA's study is the first comprehensive study of its kind that goes beyond estimating the cost of compliance. This study helps to identify the real drivers of cost and provides actionable insights for policy makers, regulators and professionals associations,” Paul Sharman, president and chief executive officer (CEO) of the IMA, said in a prepared statement announcing the results. “We have hypothesized for some time that current controls frameworks are inadequate, as they do not allow management practitioners to conduct cost-effective, risk-based assessments covering internal controls over financial reporting, fraud risk, general IT controls, and other areas.”

The study, conducted by professor Parveen P. Gupta of Lehigh University , assessed the views of nearly 400 experienced chief financial officers (CFOs), controllers, internal auditors, and SOX compliance specialists at publicly traded companies. The two key factors identified were a lack of practical management implementation guidance and the incomplete nature of the Committee of Sponsoring Organizations (COSO) 1992 framework in assessing the effectiveness of internal controls over financial reporting (ICoFR). Other key findings include:

Approximately two-thirds of those responding attributed the two key factors as major cost drivers.

More than half of respondents acknowledged that they did not use COSO 1992 to assess IT control effectiveness, in spite of indicating their control assessment was done in accordance with COSO 1992. Almost 52 percent of respondents used COBIT for the critical aspect of their ICoFR assessment.

More smaller companies, 45 percent compared to 35 percent of larger companies, are using a “bottom-up” approach to internal controls rather than a “risk-based” point-of-view, suggesting a skills gap in applying robust risk assessment methods.

Only 38 percent of respondents did not believe that the COSO 1992 controls framework was guiding their internal control assessments, while 62 percent primarily rely on Accounting Standard 2 (AS2), which has become the de facto assessment standard for company management.

Fifty-seven percent of respondents did not believe that the COSO 1992 framework alone was sufficient guidance for determining the effectiveness of internal controls, strongly suggesting that practical assessment methodologies linked to the framework are necessary to assert to the Securities and Exchange Commission (SEC) that an organization has an effective system of internal controls.

“These results suggest that our hypotheses have been proven to a reasonable degree. Now it is time to develop the long awaited assessment guidance so desperately needed by American businesses to cost-effectively comply with SOX while protecting shareholder interests,” Sharman added.

The study was designed to determine the extent to which companies are using COSO's 1992 internal controls framework and identify the factors which inhibit a successful and cost-effective SOX compliance outcome, including high-cost compliance activities, definition and use of “risk based” models, application of risk assessments (fraud, plausible, and inherent risk), integrated audits, IT controls assessments, skills gap issues and other practical areas. The study, COSO 1992 Control Framework and Management Reporting on Internal control: Survey and Analysis of Implementation Practices, includes an Executive Summary that is available free of charge. The full study is available for purchase from IMA at www.imanet.org.

[headlines]

### Press Release ###########################

Travelers CEO Jim Case named

Ernst & Young Entrepreneur Of The Year® 2006 Pacific

BURNABY , BC , Jim Case, CEO of The Travelers Financial Group, is the recipient of the Pacific region B2B Ernst & Young Entrepreneur Of The Year® 2006 award. Mr. Case received his award at the gala banquet held at the Vancouver Convention and Exhibition Centre.

Mr. Case was chosen based on his leadership role as CEO of Travelers Leasing Corporation, a member of the Travelers Financial Group of Companies. The company has, since its formation in 1995, achieved outstanding success and phenomenal growth with increase in employees twenty fold from 8 to over 160, annual origination growth from $8 million over $200 million and geographic expansion from British Columbia only to all ten provinces.

“I am honoured and humbled by the award,” said Case following the presentation. “To be chosen among so many outstanding nominees is cause for celebration and circumspection. This recognition is directly attributable to my talented management team and to the ongoing commitment of our employees in going the extra mile to deliver best in class service to our dealer partners and their customers. It is inspiring and rewarding to work with such a motivated and service-driven team who together make Travelers such a phenomenally successful and gratifying company to lead”.

Jim Case serves is CEO for the Travelers Group of companies including Travelers Financial Corporation (Equipment Leasing & Finance), Travelers Automotive Finance (Vehicle Finance) and Travelers Acceptance Corporation (Consumer Finance). Each of the Travelers member companies has developed a sophisticated and meaningful range of financial products and services offered through dealer partners and structured to meet the most demanding requirements – all provided within an independent, flexible, non-bank environment. For more information about Travelers visit www.travelersfinancial.com.

The Ernst & Young Entrepreneur Of The Year® is the first and only truly global award of its kind. It celebrates entrepreneurs who are building and leading successful, growing and dynamic businesses, recognizing them through regional, national, and global programs in more than 125 cities, in over 35 countries, and on six continents. Established in Canada in 1994, the program acknowledges Canadian entrepreneurs who have invested their time, energy and resources in a good idea, grown with it, and inspired others to believe in it. The international recognition of the award positions recipients as world-class entrepreneurs, and provides a benchmark for entrepreneurial excellence. Winners are much-admired leaders in their industries and important role models. The Ernst & Young Entrepreneur Of The Year® was established in Canada in 1994. The program acknowledges Canadian entrepreneurs who have invested their time, energy and resources in a good idea, grown with it, and inspired others to believe in it.

[headlines]

### Press Release ###########################

Resource America, Inc. Announces Completion of $60 Million Funding of LEAF II

PHILADELPHIA, PA -- -- Resource America, Inc. (NASDAQ: REXI) announces that the public offering of Lease Equity Appreciation Fund II, L.P. ("LEAF II"), which was sponsored by Resource America's subsidiary LEAF Financial Corporation ("LEAF"), was completed. LEAF II raised approximately $60 million and a syndicate of more than 60 broker dealers participated in the offering. This is LEAF's second fund; the first one, LEAF I, raised $17.1 million in gross offering proceeds.

LEAF II owns and manages a diversified portfolio of equipment leases and loans for credit-worthy American businesses. LEAF II's principal objective is to generate regular cash distributions to investors.

Crit DeMent, Chairman and Chief Executive Officer of LEAF, stated, "We are pleased and gratified by the tremendous response we've had to LEAF II. Clearly there was great interest among financial advisors and investors in LEAF II, and we look forward to our future growth and expansion."

LEAF is a commercial finance and equipment leasing company with over $540 million in assets under management as of June 30, 2006.

Resource America, Inc., a specialized asset management company with over $10.5 billion in assets under management as of June 30, 2006, uses industry specific expertise to generate and administer investment opportunities for its own account and for outside investors in the financial services, real estate and equipment leasing industries. For more information please visit our website at www.resourceamerica.com or contact Investor Relations at

pschreiber@resourceamerica.com .

[headlines]

### Press Release ###########################

CIT Declares Dividends for Third Quarter 2006

NEW YORK , -- CIT Group Inc. (NYSE: CIT),

a leading global provider of commercial and consumer finance solutions, announced that its Board of Directors has declared a regular quarterly cash dividend of $0.20 per share on its outstanding common stock. The common stock dividend is payable on November 30, 2006 to shareholders of record on November 15, 2006.

CIT also announced that its Board of Directors has declared quarterly cash dividends of $0.3968750 per share on the Company's Series A preferred stock and $1.2972500 per share on the Company's Series B preferred stock. The preferred stock dividends are payable on December 15, 2006 to holders of record on November 30, 2006.

About CIT

CIT Group Inc. (NYSE: CIT), a leading commercial and consumer finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has $68 billion in managed assets and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries worldwide. CIT, a Fortune 500 company and a member of the S&P 500 Index, holds leading positions in vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset-based lending.

With its global headquarters in New York City , CIT has more than 7,000 employees in locations throughout North America, Europe, Latin America , and Asia Pacific.

http://www.CIT.com .

[headlines]

### Press Release ###########################

CHP Consulting launches ALFA Systems 4.5

CHICAGO ,- CHP Consulting today announced the latest release of its ALFA Systems enterprise software platform for asset finance organizations.

Version 4.5 builds on ALFA's core strengths of end-to-end integration, flexible sales channel support and workflow automation, and demonstrates CHP Consulting's commitment to providing its clients with a long-term solution which stays at the forefront of technological innovation. This release represents more than 100 man-years of development and its many enhancements strengthen ALFA's position as the leading enterprise software platform on the market.

Key areas of functionality include:

Web portals for new business origination;

Improved user-productivity features;

Enhanced workflow and business-process management functionality;

Added support for international asset finance markets;

Further financial and value-added product capabilities; and,

Superior reporting and control.

ALFA Systems meets the requirements of companies operating in the leasing, asset finance, vehicle finance and consumer finance industries. Since Version 1.0, more than 30 companies in the United Kingdom , Europe, North America and Australia have selected ALFA as their core processing platform. ALFA covers the full business lifecycle, from web-based origination and pricing, through in-life processing and customer services, to end-of-agreement asset disposal - all in a single, robust, high-performance application. ALFA is used to finance more than five million assets worldwide, worth an estimated $100 billion.

“What's really exciting about ALFA Systems 4.5 is the range of additional capabilities that address the most important issues facing the industry”, said Andrew Denton, Chief Marketing Officer at CHP Consulting. “The asset finance sector has a global outlook, and our customers and prospects require a system to support their businesses on this scale. At the same time, the industry has an ever-increasing focus on the management of the asset and associated services - particularly in the vehicle sector - as well as strong growth for e-business channels and a growing compliance burden.

“All these issues demand more from a company's technology platform and, with this new release, we've delivered an improved platform already proven to do this on three continents.”

About CHP Consulting

CHP Consulting's ALFA Systems and consultancy services are used by top motor, asset and consumer finance organizations worldwide. ALFA is a fully scalable, enterprise- wide solution for the finance industry, providing end-to-end integration, flexible sales channel support and workflow automation. CHP's class-leading software and in-depth industry experience allow an exceptional delivery record. Key areas of expertise in clude equipment finance, motor finance, fleet management, vendor finance, asset management, consumer finance and structured finance. CHP was founded in 1990 and has offices in London , Chicago and Sydney , Australia . For more information on CHP, visit www.chpconsulting.com

[headlines]

### Press Release ###########################

The Alta Group's Latin American Leasing Conference

Attracts Finance Associations Throughout Region

4th Annual Event Set for Nov. 14-15, 2006

FT. LAUDERDALE, FL, -- The Alta Group's 4th Annual Latin American Leasing Conference will be held Nov. 14-15 at the Miami Marriott Biscayne Bay in Miami. The conference has become an important educational event and gathering for leasing executives and associations throughout Latin America . FELALEASE, the Federation of Latin-American leasing companies, will conduct its annual assembly during the meeting, says Ricardo Muñoz-Medina, conference organizer and a principal of The Alta Group.

The Alta Group is a global consultancy specializing in the leasing and finance industry. Its 4th Annual Latin American Leasing Conference, which will be conduced in Spanish, will feature sessions on:

Strategic Challenges, led by a representative of the Inter-American Development Bank;

The Current State of Leasing in Latin America, a panel discussion by representatives from leasing and finance associations in Argentina, Brazil, Chile, Colombia, Peru and Mexico;

The UNIDROIT Model Law on Leasing, led by Rafael Castillo-Triana, a principal with The Alta Group who is Latin America 's representative on the Model Law on Leasing Advisory Board, and a representative of the International Finance Corporation (IFC);

Cross-Border Syndications as a tool for funding and profitability, presented by Edmur Ribeiro, director of leasing for BLADEX in Panama City ;

Vehicle Leasing Development: Experiences Originating Leases, led by Andres De La Parra of BMW Financial Services in Mexico City ;

Lease Origination Challenges: Vendor Programs -- Myths versus Realities, led by Ubaldo Lopez, sales vice president for Latin America with Hewlett Packard Financial Services in Miami ;

Challenges of Funding with Available Tools of Liquidity in the Capital Markets, presented by Mario Ventura Verme of America Leasing in Lima , Peru ;

Attainable Resources in the ECAs (Export Credit Agencies) and Multinational Entities: The Export-Import Bank of the United States' Program of Guarantees and Credits, led by Wayne Gardella, vice president of the Ex-Im Bank in Washington, D.C., and Inter-American Investment Corporation's Experience with Bond Emissions for Credits, presented by an official of IIC in Washington, D.C.;

How to Take Advantage of Local Capital Markets: Experiences Using Fiduciary Bonds to Finance New Operations, led by Alberto Beunza, president of CGM Leasing in Buenos Aires, Argentina; and

The Challenge of Migrating from Financing Leases to Operating Leases, a panel discussion by Agustin Esguerra of Leasing de Occidente in Bogota, Colombia; Arnaldo Rodriguez of CSI Latina in Miami; and Jesus Dillon of Master Lease, a GMAC subsidiary in Monterrey, Mexico.

For more information or to register, please contact Bonnie Johnson at The Alta Group: Phone (801)322-4499, Fax (801)322-5454, or E-mail bjohnson@thealtagroup.com. Please visit www.thealtagroup.com to download the program in Spanish.

About The Alta Group

The Alta Group is a global consultancy serving equipment leasing and finance companies, investment professionals, manufacturers, banks and government organizations. Founded in 1992, The Alta Group supports clients in North America; Latin America; Western, Central and Eastern Europe; Australia and China . For more information, visit www.thealtagroup.com.

[headlines]

### Press Release ###########################

Bank of America Business Capital Provides $1.75 Million

In Acquisition Financing To Ashtead Group Plc

NEW YORK and LONDON - Bank of America Business Capital, one of the world's largest asset-based lenders, announced today that it was co-lead on a $1.75 billion credit facility to Ashtead Group plc (LSE:AHT.L) and its U.S. subsidiary Sunbelt Rentals, Inc. in connection with its $1 billion acquisition of competitor NationsRent Companies, Inc. The acquisition forms the third largest rental equipment company in the United States . The credit facility consists of an asset-based revolver and term loan. Banc of America Securities was co-lead on the syndication of the credit facility. Bank of America also continues to provide letters of credit as well as cash management products and services to Ashtead.

“We selected Bank of America Business Capital to lead this transaction because of its extensive experience in financing equipment rental companies and our long-standing relationship with Bank of America,” said Ashtead CFO Ian Robson. “Their ability to lend against foreign assets and to provide a total capital structure was very important to the success of this deal.”

“Leveraging our international resources, we provided the client with the financial flexibility to continue to implement its growth plans through acquisitions and organically,” said Joyce White, president of Bank of America Business Capital. “This financing continues to provide competitive borrowing costs and fewer, less restrictive covenants.”

Founded in 1947, Surrey, England-based Ashtead Group plc (www.ashtead-group.com) is the second largest rental equipment group in the world with more than 650 rental stores in the U.K. , U.S. , Canada and Asia . Ashtead provides rental equipment to more than 250,000 industrial, commerce and local government customers. The company's fleet of rental equipment extends from heavyweight equipment such as backhoes, excavators and forklift trucks, to smaller equipment such as power saws, ladders and small pumps.

Ashtead Group plc is comprised of Charlotte, North Carolina-based Sunbelt Rentals, A-Plant in the U.K. , and Ashtead Technology Rentals, which has offices in the U.K. , Singapore , the U.S. and Canada . Measured by rental revenues, A-Plant is the third largest equipment rental company in the U.K. and Sunbelt Rentals is the third largest rental equipment company in the U.S. Ashtead Technology is a world leader in the rental of electronic survey and inspection equipment to the offshore oil and gas industries in the North Sea, Asia and the Gulf of Mexico .

Bank of America Business Capital is one of the world's largest asset-based lenders, with 20 offices serving the United States , Canada and Europe . It provides companies with senior secured loans, cash management, interest rate and foreign exchange risk management, and a broad array of capital markets products. Capital markets and investment banking services are provided by Banc of America Securities LLC, member NYSE/NASD/SIPC, a subsidiary of Bank of America Corporation and an affiliate of Bank of America Business Capital. Visit www.bofa.com/businesscapitalnews for more information.

Bank of America (NYSE: BAC) is one of the world's largest financial institutions, serving individual consumers, small and middle market businesses and large corporations with a full range of banking, investing, asset management and other financial products and services. The company's Global Corporate and Investment Banking group (GCIB) focuses on companies with annual revenues of more than $2.5 million; middle-market and large corporations; institutional investors; financial institutions; and government entities. GCIB provides innovative services in M&A, equity and debt capital raising, lending, trading, risk management, treasury management and research. Bank of America serves clients in 175 countries and has relationships with 98 percent of the U.S. Fortune 500 companies and 79 percent of the Global Fortune 500. Many of the bank's services to corporate and institutional clients are provided through its U.S. and UK subsidiaries, Banc of America Securities LLC and Banc of America Securities Limited. For additional information, visit www.bankofamerica.com

[headlines]

### Press Release ###########################

Key Equipment Finance Names Pete J. Georgelas SVP & Director of Capital Markets

SUPERIOR, CO. - - Key Equipment Finance, one of the nation's largest bank-affiliated equipment financing companies and an affiliate of KeyCorp (NYSE: KEY), has named Pete J. Georgelas senior vice president and director of Capital Markets within Key Equipment Finance. Mr. Georgelas will manage all Capital Market activities and help the company meet its strategic goals related to trading desk objectives. Mr. Georgelas' office is based at the company's worldwide headquarters outside Boulder , Colorado .

"Pete has been with Key for more than 14 years and has over 25 years of experience in our industry," said Steve Dixon, managing director for Key Equipment Finance's Capital Markets and Lease Advisory Services group. "We are delighted to have him join our leadership team."

Prior to this promotion, Pete was vice president, Inside Sales, Packaging and Syndications for Key's global vendor leasing business. He was also sales manager for StorageTek Financial Services Corp., a privately labeled retail vendor program managed by Key. Within the direct sales organization, he has held positions as Northwest regional sales manager and national sales manager. Prior to Key, Mr. Georgelas worked in various sales and sales management positions for US Bancorp Equipment Finance, Inc., Chrysler Capital Corporation and E.F. Hutton Credit Corporation. Mr. Georgelas earned his bachelor of arts degree from the University of Utah at Salt Lake City .

Key Equipment Finance is an affiliate of KeyCorp (NYSE: KEY) and provides business-to-business equipment financing solutions to businesses of many types and sizes. They focus on four distinct markets: businesses of all sizes in the U.S. and Canada (from small business to large corporate);

. equipment manufacturers, distributors and value-added resellers worldwide;

. federal, provincial, state and local governments as well as other public sector organizations; and

. lease advisory services for manufacturers' captive leasing and finance companies.

Headquartered outside Boulder , Colorado , Key Equipment Finance manages a $12.6 billion equipment portfolio with annual originations of approximately $5.7 billion. The company has major management and operations bases in Toronto , Ontario ; Albany , New York ; Chicago , Illinois ; Houston , Texas ; London , England ; and Sydney , Australia . The company, which operates in 26 countries and employs 1,100 people worldwide, has been in the equipment financing business for more than 30 years. Additional information regarding Key Equipment Finance, its products and services can be obtained online at

KEFonline.com.

Cleveland-based KeyCorp is one of the nation's largest bank-based financial services companies, with assets of approximately $93 billion. Key companies provide investment management, retail and commercial banking, consumer finance, and investment banking products and services to individuals and companies throughout the United States and, for certain businesses,internationally.

[headlines]

### Press Release ###########################

CIT Rail Acquires Bombardier's Rail Car Leasing Business

NEW YORK –– CIT Rail, a unit of CIT Group Inc. (NYSE: CIT) a leading global provider of commercial and consumer finance solutions, today announced the acquisition of Bombardier's rail car leasing business assets. The acquisition was completed on October 2, 2006.

George Cashman, President of CIT Rail, said, “We are very pleased to be able to acquire a portfolio of this quality, both in terms of assets and lessees. This acquisition increases our serviced fleet by almost 15,000 cars, bringing our total portfolio to more than 102,000. The bolt-on nature of this acquisition further leverages our railcar operating lease platform, enabling us to readily integrate the portfolio and provide quality service to our customers.”

Stephen Z. Serepca, Senior Vice President of CIT Rail, said, “CIT continues to maintain one of the youngest and most modern rail fleets in North America with the acquired assets complementing our existing fleet in terms of both car type and age.”

The acquired portfolio adds almost 250 leases, among more than 100 companies, to CIT's existing portfolio. This acquisition not only grows CIT's fleet of rail cars, but also expands CIT's customer base throughout the country. It was structured as a seamless transaction for the companies that previously leased rail cars from Bombardier.

About CIT Rail

CIT Rail provides financial solutions to the bulk freight transportation market place. It supports the North American transportation system by working with freight shippers, receivers, carriers, intermediaries and facility operators across all modes to customize financial solutions for each customer's individual needs. As a full service lessor and owner of one of the youngest, most diversified fleets of rail assets in North America , CIT Rail brings unparalleled asset management expertise and commitment to the transportation sector.

About CIT

CIT Group Inc. (NYSE: CIT), a leading commercial and consumer finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has $68 billion in managed assets and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries worldwide. CIT, a Fortune 500 company and a member of the S&P 500 Index, holds leading positions in vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset-based lending. With its global headquarters in New York City , CIT has more than 7,000 employees in locations throughout North America, Europe, Latin America , and Asia Pacific. www.CIT.com

[headlines]

### Press Release ###########################

Bank Quarterly reports—see News Briefs below

[headlines]

### Press Release ###########################

--------------------------------------------------------------

News Briefs----

Wells Fargo profits rise in 3Q, others feel interest rate squeeze

http://www.signonsandiego.com/news/business/20061017-1328-earns-banks.html

KeyCorp Reports Third Quarter 2006 Earnings

http://biz.yahoo.com/prnews/061017/cltu003.html?.v=62

U.S. Bancorp Reports Record Net Income for the Third Quarter of 2006

http://biz.yahoo.com/bw/061017/20061017005286.html?.v=1

National Penn Bancshares, Inc. Reports Third Quarter Net Income

http://biz.yahoo.com/prnews/061017/phtu011.html?.v=75

Leesport Financial Corp. Reports 11.4% Growth in Quarterly Earnings Over 2005 and 8.7% Growth in Year to Date Earnings Over 2005 ... Surpasses One Billion in Assets

http://biz.yahoo.com/prnews/061017/phtu012.html?.v=73

Sandy Spring Bancorp Reports Third Quarter Results Highlighted by Continued Loan Growth

http://www.finanznachrichten.de/nachrichten-2006-10/artikel-7152363.asp

Sovereign execs emphasize improvements, not sale

http://www.snl.com/interactivex/article.aspx?CdId=A-4804916-11363

Sea Containers Files for Bankruptcy

http://www.kiplingerforecasts.com/apnews/XmlStoryResult.php?storyid=247943

Bernanke frets about bank regulations

http://www.mercurynews.com/mld/mercurynews/business/

financial_markets/15773270.htm

Wholesale prices, industrial production both down sharply

http://www.signonsandiego.com/news/business/20061017-1506-economy.html

President Bush Signs Bill Exempting CPAs for GLB Requirement

http://www.accountingweb.com/cgi-bin/item.cgi?id=102677

IBM Posts 5 Percent 3Q Revenue Gain $2.2 BB Quarterly Profit

http://www.chicagotribune.com/business/ats-ap_business12oct17,0,3654071.story?

coll=sns-business-headlines

Wal-Mart to buy Chinese chain for $1 billion

http://today.reuters.com/news/articlenews.aspx?type=businessNews&storyid=

2006-10-17T101601Z_01_N16394423_RTRUKOC_0_US-RETAIL-WALMART-C

HINA.xml&src=rss&rpc=23

What Customers Say And How They Say It

http://www.washingtonpost.com/wp-dyn/content/article/2006/

10/17/AR2006101701516.html

Confidence levels sag in Silicon Valley

http://www.siliconvalley.com/mld/siliconvalley/15779507.htm

Home prices fall, after 4 hot years

Median figure for Bay Area dips from $616,000 to $611,000

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2006/10/18/HOUSING.TMP

Home prices fall across entire region

http://www.sacbee.com/103/story/40883.html

110-Building Site in N.Y. Sold to Speyer for $5.4 Billion

http://www.nytimes.com/2006/10/17/nyregion/18stuycnd.html?ei=5065&en=

191ed9bdf9f7ccbb&ex=1161748800&partner=MYWAY&pagewanted=print

Lexus ES 350 is sweet treat indeed

http://www.usatoday.com/money/autos/reviews/2006-10-12-lexus-es350_x.htm

Steve Wynn Accidentally Punctures Picasso's Le Reve, worth $139 million...

http://www.reviewjournal.com/lvrj_home/2006/Oct-17-Tue-2006/news/10274785.html

Midwest Amtrak expansion hailed

http://www.chicagotribune.com/business/chi-ap-il-amtrakexpansion,0,3699137.

story?coll=chi-business-hed

Microsoft to spend $7.5 billion in FY 2007

Microsoft will spend about $7.5 billion in research and development in its 2007 fiscal year, Chief Executive Officer Steve Ballmer said Tuesday in Madrid.

"I would estimate off the top of my head approximately half a billion of that will be spent in Europe ," Ballmer said. The Redmond company's fiscal year ends in June.

www.seattletimes.com

[headlines]

---------------------------------------------------------------

You May have Missed---

Hardware Today: The Lease vs. Buy Dilemma?

http://www.serverwatch.com/hreviews/article.php/3638151

[headlines]

----------------------------------------------------------------

“Gimme that Wine”

Wine Spectator Online Celebrates 10 Years on the Web with 2 Weeks of Free Access

http://home.businesswire.com/portal/site/google/index.jsp?ndmViewId=

news_view&newsId=20061016005199&newsLang=en

Wine Enthusiast Magazine Announces the 2006 Wine Star Award Winners

http://www.winemag.com/ME2/dirmod.asp?sid=&nm=&type=Publishing&mod=

Publications%3A%3AArticle&mid=8F3A7027421841978F18BE895F87F791&tier=

4&id=9C34646EDB514EE3A3FB541366AA8102

Copia to lay off a third of its workers, sell land, refinance $68 million debt

http://www.napavalleyregister.com/articles/2006/10/17/news/local_top_story/

doc4534d0a0b6e07965874871.txt

Chardonnay hit by bunch rot

http://www1.pressdemocrat.com/apps/pbcs.dll/article?AID=/20061017/

NEWS/610170305/1033/NEWS01

Sonoma County Harvest Update

http://www.winebusiness.com/news/DailyNewsArticle.cfm?dataid=44997

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

The London International Vintners Exchange (Liv-ex)

is an electronic exchange for fine wine.

http://www.liv-ex.com/

[headlines]

----------------------------------------------------------------

Calendar Events This Day

Alaska Day

Anniversary of transfer of Alaska on October 18,1867 from Russia to the US . The transfer became official on Sitka ' Castle Hill. This is a holiday in Alaska , when it falls on a weekend it is observed on the following Monday.

Black Poetry Day

To recognize the contribution of black poets to American life and culture, and to honor Jupiter Hammon, first black in America to publish his own verse (born October 17, 1711)

http://www.aaregistry.com/african_american_history/405/Jupiter_Hammon_poet_pioneer

Canada : Persons Day

A day to commemorate the anniversary of the 1929 ruling that declared women to be persons in Canada .

China : Birthday of Confucius.

Chocolate Cupcake Day

Day of National Concern about Young People and Violence

Students across America are asked to voluntarily sign a “Student Pledge Against Gun Violence.”

www.pledge.org

Long Distance Day

Missouri Day

Observed by teachers and pupils of schools with appropriate exercises throughout state of Missouri.

National Support Your local Chamber of Commerce Day

If your company is a Chamber member, make a donation, upgrade your membership, recruit a new member or buy a sponsorship. Join your local chamber of commerce.

www.wkchamber.com

The Orphan Train Heritage Society of America Annual Reunion .

Between 1854 and 1929, more than 150,000 homeless children and poor families were transported out of New York City , Boston and Chicago aboard trains accompanied by “agents.” Agents for the New York Children's Aid Society arranged for Midwestern families to take the children under a contract agreement to “foster homes.”

http://www.nwaonline.net/pdfarchive/2000/October/14/10-14-00%20F5.pdf

http://www.janebuchanan.com/orphan_train.html

http://rainyskys.com/society.htm

Saint Luke: Feast Day

Patron saint of physicians and surgeons and artists, himself a physician and painter, authorship of the third Gospel and Acts of the Apostles is attributed to him. Died about AD68. Legend says that he painted portraits of Mary and Jesus.

http://www.catholic.org/saints/saint.php?saint_id=76

http://www.catholic-forum.com/saints/saintl06.htm

http://www.newadvent.org/cathen/09420a.htm

Watch A Squirrel Day

World Menopause Day

The World menopause Day challenged calls on every nation to make menopausal health a principal issue in their research, and public health agendas in order to help women prevent unpleasant symptoms that can affect productivity and qualify of life, as well as reduce rates of osteoporosis, heart disease, colon cancer and other aging and hormone-related diseases. www.imsociety.com

[headlines]

----------------------------------------------------------------

More than half of the coastline of the entire United States is in

Alaska .

[headlines]

----------------------------------------------------------------

Today's Top Event in History

1929 - The Judicial Committee of England's Privy Council ruled that women were to be considered as persons in Canada . Previously, under English common law, women were persons in matters of pains and penalties, but were not persons in matters of rights and privileges.

[headlines]

----------------------------------------------------------------

This Day in American History

1767 -Boundary between Maryland and Pennsylvania , the Mason Dixon line, agreed upon on this date, a major step in establishing “state” territories.

http://www.infoplease.com/ce6/us/A0832111.html

http://www.gamber.net/gamber/mason-dx.htm

http://news.nationalgeographic.com/news/2002/04/0410_020410_TVmasondixon.html

http://www.appalachiantales.com/masondixon.htm

1775- Falmouth , the original capital of Maine ( later to be called Portsmith) burned by British

http://www.mainehistory.org/facts/Falmouth_Fire.pdf

1776- Col John Glover and Marblehead regiment meet British Forces in Bronx , considered to be the first “Marines .” Glover and 750 soldiers, stationed at Pell's Point, fought to a standstill a British force of more than 4,000 regulars.

http://1-14th.com/GenGlover.htm

http://www.angelfire.com/ca4/gunnyg/vignettes22.html

http://www.speakeasy.org/~docschlk/glover.htm

http://www.marblehead.com/glovers/

http://www.amazon.com/exec/obidos/ASIN/0883890577/avsearch-bkasin-20/

103-9138784-6331807

1836-Birthday of Ellen Browning Scripps, who assisted her brother in numerous ways on his way to acquiring the Detroit Evening News and was a Jane-of-all-trades from proof to writing to make it a success; born, London , England . She then turned all of her energies and money to helping her brother Edward who was beginning a newspaper career in Cleveland . Through wise investments in newspapers as well as real estate, she became a multi-millionaire whose philanthropic works included the Scripps Institution of Oceanography and Scripps Memorial Hospital in La Jolla (both with Edward) and then singly endowed the Scripps College for Women in Claremont, CA., and helped establish the San Diego Zoo.

http://www.sandiegohistory.org/bio/scripps/ebscripps.htm

1889-Birthday of author Fannie Hurst, Hamilton , Oregon She published 17 novels, nine volumes of short stories, three plays, and hundreds of articles. She was a long-time friend of Eleanor Roosevelt and supported the New Deal.

http://search.eb.com/women/articles/Hurst_Fannie.html

http://www.jewishvirtuallibrary.org/jsource/biography/hurst.html

1842-The first telegraph cable was laid by Samuel Morse in New York Harbor between Battery and Governors Island .. The next day, the cable stopped working when a ship, in raising its anchor, had caught and wrecked 200 feet of it.. Another cable was laid the following year for commercial use by Samuel Colt. It was insulated with cotton yarn, beeswax, and asphaltum encased in a lead pipe, and connected New York City with both fire Island and Coney Island.

1863-Union General Daniel Sickles returns to visit his old command, the Third Corps of the Army of the Potomac . He was recovering from the loss of his leg at Gettysburg , and the visit turned sour when the army's commander, General George Meade, informed Sickles that he would not be allowed to resume command until he completely recovered from his injury at Gettysburg , Meade posted Sickles' troops at the left end of the Union line. The Army of the Potomac was arranged in a three-mile long, fishhook-shaped line on the top of Cemetery Ridge and Culp's Hill. On the morning of July 2, Sickles noticed that just in front of his position was a section of high ground. In his estimation, this rise could be used by the Confederates to shell the Union position. Sickles expressed confusion over his orders and three times Meade explained that Sickles was to hold the end of Cemetery Ridge. Sickles was unhappy with the explanation, failing to understand that Meade was fighting a defensive battle. He moved his corps forward anyway, and the move nearly cost the Union the battle. A furious Meade ordered Sickles to withdraw his troops, but the Confederates were already attacking. After heavy losses, the Third Corps moved back to Cemetery Ridge. Despite his wound, Sickles hurried back to Washington to conduct damage control. One of his first visitors was President Lincoln. Sickles was one of the few Democrats who welcomed Lincoln to Washington in 1861, and Lincoln remembered that gesture. Sickles gave his account of the battle and justified his move. He even claimed that his action prevented Meade from retreating and therefore prevented a Union defeat. This began a war of words between Meade and Sickles that lasted the rest of their lives. When the reports on the battle were filed that fall, Sickles did not fare well. Many, such as General Governor K. Warren and General-in-Chief Henry Halleck, blasted Sickles for his actions.

http://www.civilwarhome.com/sicklesbio.htm

1867- the American flag flew for the first time in Alaska , marking the formal transfer of this massive northern territory from Russia to the United States . Separated from the far eastern edge of the Russian empire by only the narrow Bering Strait, the Russians had been the first Europeans to significantly explore and develop Alaska . During the early 19th century, the state-sponsored Russian-American Company established the settlement of Sitka and began a lucrative fur trade with the Native Americans. However, Russian settlement in Alaska remained small, never exceeding more than a few hundred people. Seeing the giant Alaska territory as a chance to cheaply expand the size of the nation, William H. Seward, President Andrew Johnson's secretary of state, moved to arrange the purchase of Alaska . Agreeing to pay a mere $7 million for some 591,000 square miles of land-a territory twice the size of Texas and equal to nearly a fifth of the continental United States-Seward secured the purchase of Alaska at the ridiculously low rate of less than 2¢ an acre. He was seriously criticized for the purchase and it took Congress over a year to approve as people called the land “nothing but an ice box.” The museum in Juneau , Alaska has a full collection of historic events.

1870-Chew Tilghman of Philadelphia , PA., received a patent for his invention of a sandblasting process for cleaning, engraving, cutting and boring glass, stone, metal and other hard substances.

1873-Football rules were formulated at a meeting held in New York City and attended by delegates from Columbia , Princeton, Rutgers , and Yale universities.

1898-The United States flag was raised in Puerto Rico .

http://memory.loc.gov/ammem/today/oct18.html

1890 – John r. Owen, Jr. is first man to run 100 yard dash in under 10 seconds.

http://www.michtrack.org/HOF/hofowens.htm

1900-Birtdhay Lotte Lenya (born in Vienna as Karoline Wilhelmine Blamauer) , Austrian actress-singer; a star of the musical stage in pre- Hitler Berlin before fleeing to the United States . She popularized much of the music of her first husband's music, composer Kurt Weill. She starred in the stage version (1928) and then film (1931) of The Threepenny Opera. Following Weil's death and the increase of Hitler's anti-Jewish campaign, LL immigrated to the U.S. and led a revival of Weil's works including the Three Penny for which she won the 1956 Tony award. She appeared in Broadway production of Cabaret (1966), in such films as The Roman Spring of Mrs. Stone (1961) , but perhaps best known to American audiences as the Russian nurse Roas Klebb with a knife in her shoes in "From Russia with Love" (1964).

http://www.tvtome.com/images/people/271/8/53-32178.jpg

http://www.kwf.org/pages/ll/llbio.html

http://www.tvtome.com/tvtome/servlet/PersonDetail/personid-271853

1904-Birthday of A.J.Liebling, American journalist and author who said “Freedom of the press belongs to those who own one.” Abbott Joseph Liebling was born at New York , NY , and died there Dec 28, 1963.

1906 - A hurricane struck South Florida drowning 124 persons stranded in the Florida Keys .

1906-Birthday of James David Brooks, born at St. Louis , MO. , during the Depression Brooks worked as a muralist in the Federal Art Project of the works Progress Administration. His best-known work of that period was “Flight,” a mural on the rotunda of the Marine Air Terminal at La Guardia National Airport in New York . It was painted over during the 9150s, but resorted in 1980. Brooks served with the US Army from 1942 to 1945. When he returned to New York his interest shifted to abstract expressionism. His paintings were exhibited in the historical “Ninth Street Exhibition” as part of the Museum of Modern Arts exhibits “Twelve Americans” and “New American Painting,” among others. He died March 8, 1992 at Brookhaven , NY .

1908-Birthday of author/writer Marshall Winslow Stearns, Cambridge , MA

http://www.keough.net/category/us/0195012690.html

1918-Birthdayof pianist/songwriter Bobby Troup, Harrisburg, PA

http://www.emergencyfans.com/basement/articles/bio-troup.htm

http://www.emergencyfans.com/people/bobby_troup.htm

1919-Singer Anita O'Day born, Chicago , IL .

http://www.anitaoday.com/

http://www.geocities.com/BourbonStreet/Delta/3898/anitabio.html

1922-Robin Hood , starring Douglas Fairbanks, opened at Grauman's Egyptian Theater in Hollywood . Searchlights crossed the sky for the first time at a Hollywood premiere. As a publicity stunt two weeks before the premiere, Fairbanks had posed atop a New York hotel in costume, with bow and arrow, for photographers. He and several others shot arrows from the building and accidentally injured a man through an open window (the man agreed not to press charges).

Fairbanks was born in Denver , Colorado , in 1883 and began appearing onstage in 1901. He married in 1907 and had one son, Douglas Fairbanks, Jr., but the marriage ended in divorce. By 1915, he had switched to the fledgling film industry, where he was regularly cast as a swashbuckling hero. By 1918, he had appeared in more than 24 films. In 1919, Fairbanks teamed up with fellow stars Charlie Chaplin and Mary Pickford and director D.W. Griffith to launch the United Artists Corporation.

The following year, Fairbanks and Pickford married. As a wedding present for Pickford, Fairbanks bought an estate with 22 rooms on 18 acres, and Beverly Hills ' first swimming pool. The couple dubbed the property "Pickfair."

Meanwhile, Fairbanks continued to star in the United Artists' films, including The Three Musketeers (1921), Robin Hood (1922), and The Thief of Baghdad (1924). Unlike many other early stars, Fairbanks successfully made the transition to sound, but his career faded as he aged. In 1933, he and Pickford divorced, and in 1936 he married the former Lady Sylvia Ashley, a chorus girl who had married an English lord. He died in 1939. 1961-- the movie version of the Broadway musical West Side Story opened at New York 's Rivoli Theater. The musical, featuring music and lyrics by Leonard Bernstein and Stephen Sondheim, retold the story of Romeo and Juliet but set the action in contemporary New York . In the story, star-crossed lovers Maria and Tony are torn between their feuding cultures: Maria's brother leads a Puerto Rican gang that is at odds with Tony's Anglo gang. The movie won 10 Academy Awards, including Best Picture, Director, and Supporting Actor and Actress.

1926—Singer/guitarist/song writer Charles Edward Anderson “Chuck” Berry born St. Louis , MO

http://home.swipnet.se/~w-20401/chuck/berry.htm

http://www.chuckberry.com/

http://www.history-of-rock.com/berry.htm

http://www.crlf.de/ChuckBerry/bibliography.html

http://www.rocksite.info/r-berry-chuck.htm

1929 - The Judicial Committee of England's Privy Council ruled that women were to be considered as persons in Canada . Previously, under English common law, women were persons in matters of pains and penalties, but were not persons in matters of rights and privileges.

1930 -A big, early season lake effect snowstorm on the lee shores of Lake Erie and Ontario dumped 48 inches of snow just south of Buffalo , NY and 47 inches at Gouveneur , NY

1935- Tommy Dorsey cuts “ I'm Getting Sentimental Over You.”