Monday, October 6, 2008

Headlines--- Classified Ads---Controller ######## surrounding the article denotes it is a “press release”

------------------------------------------------------------------- Classified Ads---Controller

For a full listing of all “job wanted” ads, please go to: To place a free “job wanted” Leasing News ad: ELFA Career Center: Job Seekers (free): -------------------------------------------------------------- Bailout Bill Details for Leasing

There did not appear to be an extension of 179 to expire the end of this year which increased depreciation to $250,000 with certain requirements, which includes: The extension appeared in one of the US Senate version, but evidently was eliminated. These two passed and were included in the “Bailout Bill:” Sec. 305. Extension of 15-year straight-line cost recovery for qualified leasehold improvements and qualified restaurant improvements; 15-year straight-line cost recovery for certain improvements to retail space. Sec. 505. Certain farming business machinery and equipment treated as 5-year property. This may also qualify to aid the leasing industry: Bailout bill gives tax break to Racetracks: A tax break for NASCAR racetracks and other motor-sports facilities is among the "sweeteners" tucked inside a 450-page financial-services bailout bill to make the package more palatable to lawmakers. The Senate-passed bill includes an array of so-called "tax extenders." One extends for two years a tax policy that had been allowed to expire in December that lets motor-sports facilities be treated the same as amusement parks and other entertainment complexes for tax purposes. That allowed them to write off their capital investments over a seven-year period. The motor sports industry feared that without a specific legal clarification, motor sports facilities would be required to depreciate their capital over 15 years or longer because of a recent Internal Revenue Service inquiry into the matter. That would make repaved tracks and new concession stands more expensive in the short term. It isn't a new tax break, rather the way tax law historically has been interpreted, said Lauri Wilks, the vice president of communications for Speedway Motorsports, which owns the NASCAR tracks in Fort Worth, Texas; Sonoma, Calif.; Concord, N.C.; and elsewhere. "It gives us incentive to go ahead and invest in our facilities," she said A press release notes two additional advantages for leasing companies: ### Press Release ### The Equipment Leasing and Finance Association (ELFA) applauds final congressional action on the EMERGENCY ECONOMIC STABILIZATION ACT OF 2008 (H.R. 1424). “We believe this critical legislation will help restore confidence in the capital markets and provide liquidity to the credit markets while providing adequate protection for U.S. taxpayers,” said Kenneth E. Bentsen, Jr., President of the Equipment Leasing and Finance Association. “We appreciate the efforts undertaken by the Congress which should help to restore order and the flow of capital in the markets, while providing sufficient oversight and protections for the taxpayers,” said Bentsen. ELFA also lauded several additional key measures in the bill including the extension of renewable tax credits for energy and a provision for active financial services income. Renewable Energy: The extension of the renewable solar, wind and geothermal energy tax credits will enhance the ability of the equipment finance industry to spur development and investment in this high growth arena. ELFA has advocated for a multi year extension of the renewable energy production tax credits and the renewable energy investment tax credits as a crucial federal commitment to these clean energy technologies. These federal tax incentives go directly to developers and owners of renewable energy projects including financing parties in certain cases. The equipment attributes of solar projects are particularly suitable for leasing so the multi year extension should be a major boon to the equipment finance industry. This legislation extends the 30% investment tax credit (ITC) for commercial solar for eight years until December 31, 2016 and extends the placed in service date for the production tax credits (PTCs) for solar and geothermal through December 31, 2010 and wind through December 31, 2009. These credits were scheduled to expire on December 31, 2008. Active Financing: The Equipment Leasing and Finance Association applauds congressional action extending for one year until December 31, 2009 the Subpart F provision for active financial services income. This rule addresses concerns about U.S. competitiveness and fairness by applying to our financial services companies the same general U.S. rule that defers current U.S. tax on other active trade or business income. Like their foreign-based competitors, our financial services firms –including manufacturers and leasing companies – will only pay a current tax in the country where their foreign operations are located. ### Press Release ##### Drudge Report on other bills added: Complete Bill: Section 179: -------------------------------------------------------------- Owens out at CIT—Is Peek Next?

Friday, October 3, 2008, CIT Group Inc. announced that Walter Owens resigned as President of Corporate Finance, effective immediately. The company will issue its financial results for the quarter ending September 30, 2008, before the market opens on Thursday, October 16, 2008. No comment on Owens resignation was made except for the SEC filing. The shake up continues which began with Rick Wolfert, resigned, and Thomas Hallman, retired was the cause, CIT said. In January, 2007, Owens then 46, was named President of CIT Corporate Finance. “In this newly created position he will work closely with CIT’s Corporate Finance business unit leaders to assess their current go-to-market models; develop an integrated distribution platform to serve a broad range of product offerings and customer segments, and improve operational efficiencies. He will report directly to Rick Wolfert, CIT Vice Chairman, Commercial Finance, and will continue to serve as a member of the Office of the Chair.”

In making the announcement Jeffrey M. Peek, CIT Chairman/CEO, said it, "...serves as a natural progression for Walter who drove the build-out of our sales force over the past 18 months" when he served as Executive Vice President and Chief Sales and Marketing Officer of CIT. Under his stewardship, he oversaw the expansion of the Company’s sales force by nearly 30%, established a sales technology infrastructure, embedded Chief Sales Officers (CSOs) in each business unit and built a proactive sales culture. As a result of these efforts, CIT’s expanded and strengthened sales force grew organic originations by more than 50% in 2006. In April this year on the announcement of 252 million first quarter loss, plus announced they had agreed to sell $4.6 billion of asset-based loan commitments and $770 million worth of aircraft, and that it was exploring the possibility of shedding its $4 billion rail-leasing business Walter J. Owens, President, CIT Corporate Finance received 106,292 restricted shares (shares at press time: $13.54/Stock value: $1,439,193; Friday it closed at $6.97 making it $740,855 today, if he had not exercised the stock before this day.) It should be noted that the Monitor Magazine has CIT as the third largest leasing company with $35.9 billion in 2007. Prior to joining CIT, Owens served as Chief Marketing Officer for GE Commercial Finance where he was responsible for executing growth strategies for existing and new products and markets. Other key positions held at GE included Managing Director and General Manager of GE Small Enterprise Services and Managing Director of Global Securitization for GE Capital Market Services. Owens also led the Heller integration into the GE Corporate Finance Services unit. Before GE, Owens served as Vice President at Citibank's Corporate Policy & Advisory Group from 1990 to 1992. He began his career in 1982 where he held a number of positions at Deloitte, Haskins and Sells in the Accounting and Auditing Services Division. Owens is a Certified Public Accountant. He received his BS from Villanova University and his MBA from New York University.

-------------------------------------------------------------- GE Capital in Limbo?

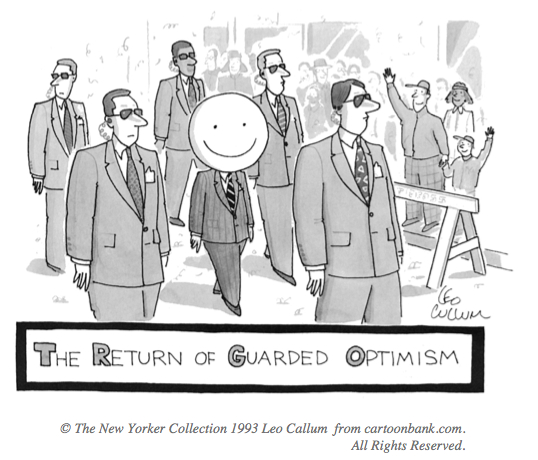

Last week GE told the media for ten months it has been unable to sell its $30 billion U.S. private-label credit portfolio. This news is very serious not only to GE, but to the leasing industry. On Friday, General Electric, the second-biggest U.S. company by market value and the largest leasing company, according to Monitor Magazine ($135.1 billion ), lost 15 percent to $21.57, the lowest since October 1997. GE sold shares on Oct. 2 for 9.2 percent less than the previous day's closing price. The company raised additional funds by selling $3 billion of preferred shares that pay a 10 percent annual dividend to Warren Buffett's Berkshire Hathaway Inc. As to the direction of GE Capital, there seemed to be several different interpretations, but it now appears they were all basically correct as the confusion appears within GE management itself: “I am an employee of GE Capital and our management has encouraged us to go after new business. However, things keep changing by the day at GE. The problem is that as the applications are coming in and being approved neither us or management know for sure what our pricing will be and when we will finally able to lock in price for our customers. Therefore GE Capital is somewhere in limbo. There seems to be some plans to work things out at a segment level and get temporary pricing for preferred referral source's only. But, management can't seem to commit to anything at the moment.” “With GE's money cost on the rise who knows what price they will come back with. It may be so outrageously high that we can't compete anyway. At a local level, GE management seems to be taking the ‘Keep you fingers crossed’ approach and has given no clear direction on how to manage the situation.” Add to this the cost to insure $10 million of GE debt for five years with credit-default swaps rose to $626, a year. The cost of annually insuring $10 million of GE Capital debt over a five-year period with credit default swaps rose to 626 basis points, $626,000 a year, up from 562 basis points late yesterday. That's nearly a five-fold increase over the past six months. By comparison, in April 2008 following the release of GE's first quarter earnings, five-year credit default swaps on GE Capital stood at 131 basis points, meaning it cost $131,000 a year to protect $10 million of GE debt. It is below a peak above $700,000 prior to the news of Buffett's purchase of $3 billion, including warrants and other “gimmes.” Costs are up; borrowing from banks is not what they expected to do. It also has been selling off several units, including GE Healthcare. Former GE CEO Jack Welch blames current CEO Jeffrey Immelt for not cutting back more when he saw the train coming. From a GE Capital employee: “While this is sad, it is not unexpected that GE management is flailing in this time of internal crisis. I blame the pervasive, ladder-climbing leadership culture that GE fosters. The GE culture is described perfectly in this blog:” http://theeverymanblog.wordpress.com/2008/04/11/the-trouble-with-ge/ Sign seen in the GE Leasing Service office:

-------------------------------------------------------------- M&T Credit (Bank) exits Leasing

“Effective October 1, 2008, M&T Credit Services, LLC (M&T Credit) will no longer offer equipment lease and finance services for business and professional banking customers. “M&T will honor approved applications up to 90 days after the approval date, and existing contracts will continue to be serviced through their expiration dates.” Alfred Luhr -- Last week Fitch Ratings has affirmed all ratings for the Buffalo, New York M&T Bank Corporation (MTB) and its principal bank subsidiaries, including the long-term Issuer Default Rating (IDR) of 'A-'. "Fitch expects continued stress in the housing market and on the consumer that will likely translate into ongoing elevated credit costs in the near term, thereby making the likelihood of a ratings upgrade extremely low. Although MTB's home equity and auto loan books exhibit good credit quality characteristics, loss rates have ticked up recently and are likely to increase further given economic conditions. While MTB's sizeable commercial real estate portfolio has demonstrated good performance through credit cycles, this book could also undergo further stress.” M&T is a bank holding company whose banking subsidiaries, M&T Bank and M&T Bank, National Association, operate branch offices in New York, Pennsylvania, Maryland, Virginia, West Virginia, Delaware, New Jersey, and the District of Columbia. M&T Bank Corporation ("M&T") (NYSE: MTB) plans to announce its third quarter 2008 earnings results in a press release that will be issued before the market opens on Tuesday, October 21, 2008 Copy of Alfred Luhr memo: -------------------------------------------------------------- Lakeland Bank out of Nationwide Leasing

Lakeland Bank, Montville, NJ, has let go its Equipment Leasing Division President Stephen Schachtel by “mutual agreement, “as per the SEC filing.

Mr. Schachtel joined Lakeland Bank in April 2000 as President, Lakeland Bank Equipment Leasing Division. Previously, he was the founder and President of NIA Leasing Co., a nationwide equipment leasing company. Under a separation agreement, Schachtel will continue to be paid his $200,000 annual base salary and benefits until the end of February, 2009, or until he finds another full-time job, according to the filing. The agreement excludes pay from commissions, bonuses, stock compensation and payments from severance plans. He can continue to use a company-owned automobile, the bank said. Schachtel was paid $1.2 million last year, including a $957,900 performance-based bonus ($2.16 million, plus) Former CEO Roger Bosma was paid $736,000 in salary, benefits and other compensation.

Chief Executive Officer Tom Shara said the replacement of Schachtel with the division’s number two man, Robert Ingram, is part of a plan to downsize the leasing business. “We want to go to a local leasing platform. We don’t want to do a national lease book of business,” said the former TD Banknorth executive who took over as CEO in April after former President & CEO Roger Bosma retired. The Leasing News Funder list shows 40 employees and the leasing division considered nationwide business from $2,000 to $15MM; "app. only" up to $150,000 In Lakeland Banks’s second quarter report they recorded a $6.3 potential loss, that they now have written off for one lessee in the trucking business. As of June 30, 2008, the Company had $46 million outstanding from this originator from approximately 1,400 leases of which approximately 75% is current or less than 30 days past due. A $6.7 million provision was recorded for the leasing division including a $6.3 million provision for the aforementioned originator." Mr. Shara said at the time, “Higher diesel fuel costs have impacted independent truckers and equipment lease originators, including one originator which can no longer fulfill all of its obligations under contractual recourse provisions.” It appears with the $6.3 million write-off, so did they do the same with Mr. Schachetl.

-------------------------------------------------------------- Goodbye Wachovia Leasing

The purchase of Wachovia by Wells Fargo has been heralded as a very good move by all bank and economic analysts. The situation appears the FDIC did not complete the due diligence, so just as in a mortgage escrow, it didn’t close, leaving Wells Fargo to acquire Wachovia and without government cost. Yesterday the state appeals court blocked a lower court ruling that had favored rival bidder Citigroup. It would have extended the time under which Wachovia and Citigroup had to complete their deal. Wells Fargo & Company issued the following statement yesterday evening regarding Citigroup’s claimed exclusivity agreement with Wachovia Corporation: "The appellate court has entered an order vacating Judge Ramos’s order of yesterday. We are pleased that the unfounded order entered yesterday has been vacated. Wells Fargo will continue working toward the completion of its firm, binding merger agreement with Wachovia Corporation.” In the meantime, what about the clients, employees and investors? On Friday, the bank stock slumped 38 percent to $6.21. As for leasing, there will be more unemployed put into the marketplace, either direction as the bank will be sold. History has shown that when Bank of America bought LaSalle Bank, its leasing division was basically broken up, although some employee moved to the BofA leasing divisions. Sovereign, among the many Wells Fargo Financial is doing very well and recently announced that Tim Reese, Wells Fargo Financial Capital Finance, will now lead WFF Leasing. Mark Merkel, who has been president of Wells Fargo Financial Leasing , is leaving the company. The announcement of the integration of the two business units has been made by Dave Kvamme, president and COO, Wells Fargo Financial, and Greg Janasko, senior vice president , commercial businesses. The changes are effective immediately. "By uniting our two leasing businesses we will strengthen Wells Fargo's presence in the commercial marketplace through the outstanding product mix and client-centered sales team that a larger organization can provide," Greg said. "We are excited about this opportunity and at the same time we want to thank Mark Merkel for his role over the years in building Wells Fargo Financial Leasing into a solid commercial business." In his new role, Tim will remain in Lincolnshire, Ill., where Capital Finance has been based, and will continue to report to Greg Janasko. Along with Tim's current direct reports, Daniel Dunn, Jack Haynes, Joe Willey, Brad Cronin and Art Meyers, will now report to him. WFF Capital Finance became part of Wells Fargo on October 1, 2007, with the company's acquisition of Greater Bay Bank, a California banking organization. Capital Finance provides financing through manufacturer-sponsored programs for a variety of equipment, including materials handling and compact utility equipment, copiers and fax systems, medical equipment and mailing technology. Wells Fargo Financial Leasing, founded in 1977, provides lease financing for office, medical, telecommunications and technology equipment to mid-market companies, medical practices and agricultural businesses throughout the U.S. Wells Fargo Financial Leasing now will have more than $2.4 billion in lease financing in force with over 180,000 active accounts and more than 5,000 vendor and manufacturer relationships.

-------------------------------------------------------------- Top Stories --September 29-Oct 3

Here are the top ten stories most “opened” by readers last week: (1) GE Capital not reversing directions? (2) Sonic “clarifies” GE pulling back Restaurants (3) (These two stories were the same, as the first one was corrected early on line, but run again in the next issue.) Gary Shiver’s New Company: Navitas (4) Jeff Taylor predicted today’s leasing market (5) Sales makes it Happen—by Steve Chriest (6) UAEL Conference by Bob Teichman, CLP (7) Leasing company stock Tuesday 4pm EDT (8) Loan costs soar as access tightens (9) Now What? –“So-Called” Wall Street Bail-Out (10) ELFA Introduces “New Career Center” Not Counted due to Technical Reasons: Extra: Extra: -------------------------------------------------------------- Classified Ads---Help Wanted Credit Professional

Vendor Sales Specialists

---------------------------------------------------------------- Leasing 102 by Mr. Terry Winders, CLP

Bad Times? It is interesting how our industry goes through a different financial crisis every so often and many in the press spell out our doom and yet each time we emerge after the crisis we are stronger and more excepted. At the current time funding is scarce and credit is tight. The accountants want to tighten up the GAAP rules and many are predicting the new rules will reduce interest in leasing because off balance sheet will be no more. However, because of the tight credit, companies are looking for new sources of money and financing and that may make it look like a major opportunity for you. It is a strange set of issues … business to be had and only a few places to fund it! I would counsel you not to panic and not to spread your wings to far from your home turf. It is time to consolidate your markets, not time to expand them. One of the things I have learned over the years is that new customer loyalty in a poor economy is a soft egg. Now is the time to contact existing customers to expand your involvement with their needs and help your existing vendors to make it through this credit crunch. Save your funding to protect existing markets and do not be attracted to new markets just because they are currently hungry. There is bound to be new markets that you would like to service and this looks like an excellent time to move in and take care of them hoping to retain the business when the economy rebounds. If you do this at the expense of your current markets even though they do not offer the rewards new markets appear to offer you will learn how fickle those markets are in the future. Stay where your customers know you and support their needs by expanding your product base and offer the ability to provide different financing alternatives on all kinds of equipment for them that you were unable to have in the past.. In Addition now is the time to improve the efficiency of your operation to cut costs and improve your ability to provide good turnaround time and increase your ability to react to changing times. Call your funding sources and offer to help with collections and press them for new funding. Get involved with the concerns of your funding sources and ask how you can improve the information you provide on potential transactions. Understand their fears and concerns and look to counteract them on a positive way. The more you support the transactions that you have sold to them the less chance that they may cut you off. Trying to obtain new funding sources at this point in time is a very difficult task. I would also suggest that you stay away from changing your compensation programs for your sales staff. There are enough changes going on without putting fear into the people who are between you and failure. Sales people are an emotional group and in times like these other industries may make the grass look greener over there. Try and take a business as usual approach and look at least six months into the future and decide how you are going to get there and keep your eye on the ball. This crisis will blow over just as all the rest have and how you handle it may make a big difference on how you come out on the other side. Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666. Previous #102 Columns:

(This ad is a “trade” for the writing of this column. Opinions -------------------------------------------------------------- Leasing listens to the Credit Managers by Christopher Menkin

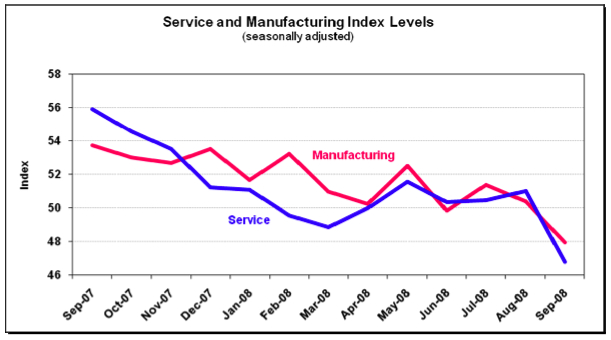

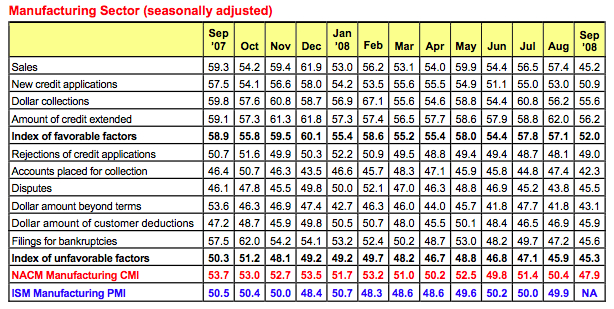

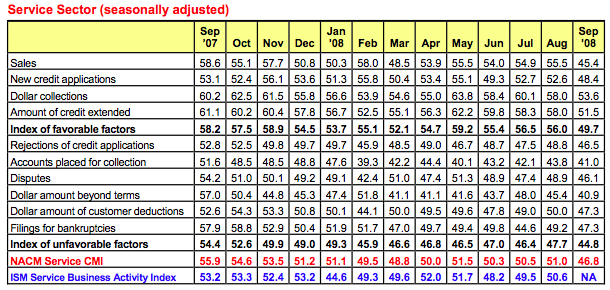

In the small to middle-size market, particularly with business direct from vendors, the rate increases can be passed on with sales finesse. The cost changes can be added on as in many other businesses that also have seen their costs increase. What does it affect? Perhaps the very rate sensitive large lease or finance transactions, but then again, when things are tightening up everywhere, especially in commercial real estate, businesses will pay the higher rate, particularly if they don’t have the time, ability, and also see rates rising everywhere. Credit tightening is not as important as getting the deal done. The market will absorb the costs, and again, pass it on. So here we go back to inflation, higher unemployment as city, counties, states, There will also be access to money, although the question will be what is the cost? Super Brokers become more important to those without more than one source of fund. In a more difficult situation are credit managers throughout the United States trying to keep their companies afloat. The National Association of Credit Management (NACM), headquartered in Columbia, Maryland, supports more than 19,000 business credit and financial professionals worldwide and issues monthly reports. Part of the reports are quotes from their members. Responses of note include a flooring business manager offering a real-life example of how the credit crunch is hurting the economy, stating that weakness in the construction market “is compounded by the fall of many lenders who supported the industry.” A manufacturer of telephone equipment said, “Times are tough both for ourselves and our customers. It's a tough economic climate for everyone.” And a manager in the building materials industry made the economic landscape starkly clear, noting simply that the “marketplace is brutal.” A respondent in the freight transportation arrangement business noted that there were “many more dispute(s), payment plans and slow payments.” And another in the same industry was a bit more blunt about the whole situation: “Bankruptcy reform forgot to include activating debtor prisons.”

When credit managers sent their responses in this month, they also sent along a message: “Welcome to the recession.” The seasonally adjusted Credit Manager’s Index (CMI) plummeted a record 3.3% to reach a historic low of 47.4, clearly indicating economic contraction. “While the economy has been deteriorating since the end of last year, its rate of decline is clearly increasing,” said Daniel North, chief economist for credit insurer Euler Hermes ACI, who analyzes the data and prepares the CMI report for the National Association of Credit Management. “The combined weight of high energy prices and a ruined housing market is now being compounded by the ever-worsening conditions in the credit markets,” he said. “In response, the Fed has cut interest rates and pumped hundreds of billions into the banking system, but no one will lend for fear that the financial system is on the verge of a meltdown. The credit markets need a big shot of confidence to be unclogged, or credit managers will become increasingly gloomy.”

This report and the CMI archives may be viewed at -------------------------------------------------------------- Fernando’s View Two Movies/Three DVD’s to Rent

In Theaters: A Girl Cut in Two (IFC Films): Claude Chabrol, the great French director who’s been making films since the late 1950s, continues to find new ways to dissect his favorite subject: The hypocrisy and venality of the decadent, moneyed social elite. Part Hitchcock thriller and part dark comedy, his new film focuses on an ambitious yet innocent TV weather girl (the terrific Ludivine Sagnier) and her affairs with an older, immoral novelist (François Berléand) and an unstable young heir (Benoît Magimel). As smooth as it is disturbing, Chabrol’s film reveals the rot hiding underneath high society’s polished surfaces without sacrificing its suave sense of humor. The Lucky Ones (Roadside Attractions): Compared to such coming-home films like “Stop-Loss,” “Grace Is Gone” and “Home of the Brave,” Neil Burger’s road-movie may be the most appealing of the recent Iraq War-themed movies. In fact, the war itself is never even mentioned—the focus instead is on the road-trip ventures of a trio of returning soldiers, a discharged veteran (Tim Robbins), a Las Vegas-bound specialist on leave (Michael Peña), and a free-spirit (Rachel McAdams) on a whimsical mission of her own. Better known for his fastidious period fantasy “The Illusionist,” Burger here keeps things mostly loose and light, zeroing in on the difficulties of military people adjusting to civilian life without resorting to chest-thumping clichés.

An Autumn Afternoon (Criterion): The final film of Yasujiro Ozu, this moving 1962 drama perfectly illustrates the Japanese master’s unmistakable take on life’s joys and foibles. The story of a widowed father (Chishu Ryu) and the daughter (Shima Iwashita) he thinks should get married should be familiar to Ozu fans, yet it is instilled with so much wisdom and feeling that it feels as if the director had left his private will on film. As with Ozu’s other films (“Tokyo Story,” “Late Spring”), the pace is gentle and the atmosphere of regret and acceptance is studded with small moments of humor. An invaluable work for fans of classic Japanese film. Iron Man (Paramount): In a year full of superhero movies straining to be “dark” and “meaningful,” this big-screen version of the Marvel Comics tin-man comes as a pleasant surprise, with flashes of breezy humor mixed with the metal-pounding action. Much of the credit goes to Robert Downey, Jr., who, playing industrialist-turned-flying-crusader Tony Stark, displays a master’s sense of irony even when covered with chunks of iron. The director, Jon Favreau, shows a deft touch with both explosions and romance, and the unusually good cast includes Gwyneth Paltrow, Jeff Bridges, and Terrence Howard. Make sure you comic-book aficionados stay until the very end of the credits. Taxi to the Dark Side (ThinkFilm): Alex Gibney won a Best Documentary Oscar for this sobering account of the knotted paths of justice in a post-9/11 world. Taking as a starting point the disturbing case of an Afghan taxi driver’s death in an American prison, the film details the (often illegal) extremes to which authorities will stoop in the war against terrorism. Interviewing former CIA operatives and victims of injustice, Gibney paints a startling picture of times in which the line between security and abuse has become indecently blurry. Definitely not for the squeamish, but essential. -------------------------------------------------------------- (Leasing News provides this ad “gratis” as a means to help support the growth of Lease Police)

News Briefs---- Asian markets plunge on fears crisis is spreading RBC acquires commercial leasing division of ABN Amro's Canada branch BNP Paribas to take majority stake in Fortis 600 dealerships might close or consolidate. Germany to Guarantee Private Bank Accounts New Chairman of Equipment Leasing Association of India ---------------------------------------------------------------

You May have Missed--- Trump Pockets Easy Money ----------------------------------------------------------------

California Nuts Briefs--- Will California Make Payroll? ----------------------------------------------------------------

“Gimme that Wine” Napa's Joseph Phelps Vineyards seeks review of order to pay $24 million Oregon Pinot Noir---2006 Exceptional Cheers: Wine and Liquor Keep Flowing Despite Sour Economy New Bordeaux appellation gets go-ahead Biking Colorado’s Wine Country (This is a free “ad” for our good friends the Bateman’s, Wine Prices by vintage ----------------------------------------------------------------

Today's Top Event in History 1905-Helen Wills Moody (Roark) birthday, tennis player born at Centerville, CA. Perhaps the greatest American tennis player, Wills Moody won 31 major titles, including Wimbledon eight times and the US championship seven times. From August, 1926, through 1935, she did not lose a Roark match nor even a single set. She led a reclusive life after retiring, but she painted and wrote mystery novels and her autobiography, Died at Carmel, CA, 1998. [headlines]

This Day in American History

-------------------------------------------------------------- Baseball Poem

Carl Erskine’s Last Pitch by Wayne Lanter It was a fastball over the top On loan to AAA to get work, that spring Anyway Erskine stared into right field, There was nothing anybody could do. An inning later he picked up another ball from: (Printed with permission of the author) -------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm -------------------------------------------------------------- Daily Puzzle How to play: Refresh for current date: --------------------------------------------------------------

http://www.gasbuddy.com/ -------------------------------------------------------------- Weather See USA map, click to specific area, no commercials -------------------------------------------------------------- Traffic Live--- Real Time Traffic Information You can save up to 20 different routes and check them out -------------------------------- |

||||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

||||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

Editorials (click here) |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|