Tuesday, September 23, 2008

Headlines--- Classified Ads---Sales Manager ######## surrounding the article denotes it is a “press release” ------------------------------------------------------------------ Classified Ads---Sales Manager

For a full listing of all “job wanted” ads, please go to: Leasing Recruiters: To place a free “job wanted” ad here, please go to: -------------------------------------------------------------- How’s Leasing Business? ---“Heard on the Street”

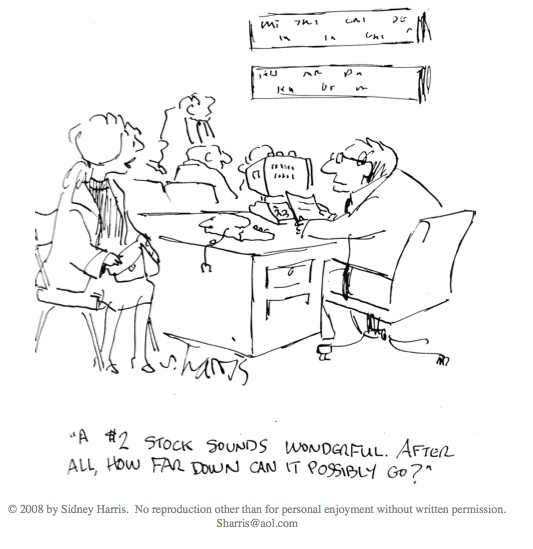

“New business activity has been strong across all of our business units this year; however, we are now seeing some decline in application only activity because small businesses are feeling the impact of the general economic slowdown. “We expect 4th quarter activity to remain steady versus the seasonal increase we normally experience as year end approaches.” Jerry Newell “Our business is up about 30% and I think the next three months should continue on the same trend. Bankers are having to turn away a lot of customers and they are sending them to us. “ Philip Dushey “Business was decent thru June, could have stayed home in July & August. Activity is definitely up for September. October thru December??????????????” Ron Mitchell, Vice President “From our perspective we will grow by a substantial amount in 2008, but remain below budget. August was a very slow month, and September looks better, but still below expectations. “We anticipate the fourth quarter to be month to month equal to or above forecast primarily because the industry shakeout has resulted in the unanticipated addition of several new vendor programs. However, pricing in this environment is extremely challenging as Libor widens out again against Treasuries, and lease rates remain flat. Those who benchmark against Treasuries as a COF measure are at a distinct advantage in the near term.” Donald A. Synborski “In 2008, we have experienced our best 1st Quarter and worst 2nd Quarter, respectively, post 9/11/01. That being said, the number of new applications is up slightly for Q3 compared to Q2, however, what we are noticing is a significant decrease in the quality of credits (Fair Isaac Scores) and an increasing number of working capital requests. What I make of this is that small business owners are scrambling to make ends meet both professionally and personally. “Each of the past 14 years the 4th Quarter has consistently been our best. To evaluate the prospects for the 4th Quarter, I would add the variables of the Election (with a new President) and the recent financial industry crisis (AIG, etc) and I would speculate that this may be a “flat” 4th quarter of which we haven’t seen in 7 years.” "Specializing in Equipment Financing" “New volume was very strong through June but fell off by almost 50% during July and August. Although volume has returned to or slightly exceeded the pace of earlier this year, I am very concerned at the apparent disappearance of willing buyers. It seems to me that the lending community has had, in many cases, a severe knee jerk reaction to the current economic uncertainty. Not to minimize the seriousness of the current crisis but without access to traditional channels to capital on some reasonable basis, I believe the remained of the year and perhaps through mid 2009 will be very challenging times for brokers and lessors as well as our customers.” Rick Wilbur “We are seeing weaker credits and story deals but we play the hand that's been dealt us. As for the future, no one could have predicted a month ago the extent of the crisis that the economy faces. So how can we predict the future? “I prefer to be optimistic and remember that fortunes were made during the depression. I was in leasing when the prime rate was 19% and it was the best year we ever had. "What's the rate?" will be replaced with ‘Can I get approved?’" “ Ken Glasgow “Getting approvals has been a challenge. Many more opportunities with Banks and many other traditional financial institutions now out of the equipment financing business. Banks may become our best referral business.” Always, “After very tough 1st & 2nd quarter, things have started to pick up, although volumes are still about 15-20% lighter than the same time last year. Our outlook is relatively positive with the upcoming election and seasoned businesses looking to lease vs. paying cash for upcoming equipment acquisitions. “This trend has really picked up from our end-user base over the past 30 days and we hope it continues. We’re hopeful that by this time next year, we’ll begin to see some reasonable growth, compatible to pre-mortgage debacle figures.” Rich Ehmke “During 36 years in this business, I can not remember ever hearing my customer base more concerned and cautious about the economy than during the past year. Most report that they are holding tight and limiting their exposure to any risk. There is not a lot of optimism and no one seems to see any relief in the short term. Fuel and housing issues continue to dominate the bad news.” M.L. Leonard “Like all businesses the leasing business is tough as well. Consumers are holding off on equipment purchases unless absolutely necessary. Lenders have tightened up while consumer credit in most cases has deteriorated. “Having said that, I believe there still exists plenty of opportunity out there for new business. The difference is that you just have to work harder to find it. That means making more marketing calls, asking for referral’s from existing customers and working with banks and accounting firms that need help with customers in need of capital. “Lastly, finding new ways to generate income such as expanding your products or services to include new programs or financial services. Overall, our business has seen a moderate decline but staying the course and creating new income streams has really helped our business thrive.” Sincerely, Anthony Sherwin “For companies with a tax appetite and funding ability the financial problems of the banks and other financial institutions has created a once in a generation opportunity to purchase and originate profitable high quality true leases. “Reduced competition from the banks and their desire to sell portfolios to raise cash is having a positive impact on risk and return. “ Dean Cash, President, “As a subsidiary of a Japanese conglomerate, Advantage Funding’s access to capital has not been impaired by the current economic downturn and our sales volume for 2008 has been increasing as a result of less competition. “Unfortunately, key indicators are pointing towards a slow down in volume for the fourth quarter and we anticipate a seasonal spike in delinquency and repossessions. “ Edward P. Kaye “As more vehicle lessors and lenders leave the market, competition for quality business has once again centered on core lease products like service and value as opposed to lower than low payments and outlandish residuals. Those free lunches appear to be over (for a few years anyway). “As an independent lessor, we still write sane, commercial and consumer vehicle leases with residuals that are forecast specifically for every lease. We are seeing a nice September surge in repeat business as well as big increase in referral, dealer and broker business. 4th quarter looks to be solid as the good deals continue to get done.” Dale R. Davis “What I’ve noticed is a flight to quality by my funders but not a drying up of funds. I see fourth quarter bookings higher due to several factors: - Bonus depreciation in the fourth quarter drives the cost to lessee down. - Funders have only had modest bookings to date in 2008. Thus, they will have to push in the fourth quarter to reach budget. Remember, bonuses get paid when you reach and/or exceed your boggy. - Finally, there is no doubt that the U.S. economy is in the midst of a persistent slowdown, yet the economic data and facts simply do not support the worst-case scenarios presented so often by the media. Interest rates remain moderate, inflation and inflation expectations are turning down and the economy has stubbornly resisted recession-like trends. Filtering through all the noise, I believe that the surprise will be to the upside with a stronger fourth quarter in bookings.” Cheers, D. Paul Nibarger, CLP Nibarger Associates is an investment banking firm that specializes in providing commercial borrowers with advice and services regarding project and equipment financing. Since its founding in 1983, Nibarger Associates has provided its clients with creative solutions for various traditional and difficult-to-finance projects. Using its broad base of experience in equipment leasing and debt markets, Nibarger Associates delivers the capital its clients need for profitable expansion. We are members of ELFA and NAELB with a CA Finance Lender/Broker license, # 603-8622 and serve on the boards of the CLP Foundation and NAELB. Nassau Asset Management: “Today I find the volume of collections, repossessions, and remarketing is going up and the quality of equipment involved is increasing as well. We still have no problem selling assets which is a good sign. If this downturn is anything like the last one it should be followed by tighter credit standards resulting in a lower volume of deals going bad. Of course that will be followed by a push for growth requiring higher risk that could result in another downturn years from now. 2015? “From my perspective we are forecasting October and November to be consistent with previous months. “I don't expect a major increase but maybe a slight decrease as we see every year in December.” Edward Castagna, President “Merger and Acquisition activity in equipment leasing has slowed, as both potential buyers and sellers are looking for an indication of where the economy and financial markets are headed before making long-term commitments. However, there are some buyers who think that now is a good time to buy because the competition for deals is less. “Thus leasing company acquisitions are still getting done when there are motivated buyers and sellers. We are experiencing a big increase in the number of companies seeking assistance in developing new sources of financing, and some of those companies are considering being acquired in order to have greater access to capital.” Kropschot Financial Services “Banks are having the time of their lives (in a negative way), equity is pretty frozen, rates cannot be determined from traditional comparables, and a few companies are paralyzed. “A large closely held company told me today their plans have changed 180 degrees this past week, without any understandable reason why (it was a cross border m&a ( merger and acquisition) deal, but they no longer want to do "m" nor "a"). “I think you will not see volumes recover this year. This generally foots with Bruce's comment (above,) inasmuch as there will be some changes and combination activity in the industry as a consequence of all this but many would report that, until that is all flushed out and the capital markets fully settle, there is no keg here for prospective equipment users to tap for now.” Paul Weiss “The negative news on Wall Street and recent bank failures for sure are sending all top level local-home town bank officials into panic board meetings to put new policies and procedures in place that will stop or heavily restrict any new commercial loans until the air has cleared. “History repeats itself and in times such as these, the leasing industry can do well if it focuses on the entrepreneur who still needs equipment to make a living and now will shy away from the bank as any new loan request for equipment will probably hit a brick wall. “Market heavily to the end user entrepreneur and tell them the gates are open for equipment financing.” Karl R. Probst kprobst@wffsp.com “Standing alone in the firestorm caused by changes in funding is creating uncertainty for most Independent Lessors. OWL’s coop members are less impacted as “Strength in Numbers” and our multiple sources, lessens this problem.” Ira Z. Romoff “The days of easy credit are over. While application volume remains consistent, our approval ratios are down significantly. With the monumental government bailout of financial institutions, there may be a brief stabilization for the remainder of 2008. However, I am extremely concerned with the long term impact on inflation and the dollar. By interfering in the market we are merely postponing our day of financial reckoning. “I do remain confident though that the strong, lessee and lessor alike, will weather the storm.” “Over the past year or so, we have seen business go from, ‘We want it, get it.’ to “’f we really need it, get it.’ to ‘If it is going to break down, go ahead and get it.’ and now, ‘What do you mean, it cannot be fixed? I guess we are going to have to go ahead and get it.’ “We still get some so called normal apps and we get plenty of junk. Things are slower and I think they will remain so until next spring.” David M. Rothenberg “Commerce National Bank's (CNB) leasing department is pretty new, but as I've been around forever and based on my own previous experience, I don't think that the leasing business, especially small ticket leasing, ever slows down that much. On the other hand, as a community bank, we are looking for quality and not looking to do hundreds of millions of dollars a year in new financings. I do see the overall approval process slowing as every lender is aware of many industry issues and will choose to either pass on, or look closer at, certain industries and certain single use collateral, that have or may be subject to extraordinary problems. We continue to see many "story" credits, and transactions where we may require additional financial information, more understanding of a business and reputation of the vendors, and more time to reach an informed decision. As a funder we always want to be selective when accepting the best business we can and hopefully only from experienced, ethical Lessors and Brokers, who know how to package and present transactions right, without much hand holding, and who aren't strictly focused on the lowest discount rate or maximum number of points that can be jammed into every deal. Bob Robichaud, CLP Tel: 714-882-7648 “Business for many of our clients is a mixed bag right now. Small ticket vendor has been holding up pretty well, for those that have funding. Rates are higher but so are spreads. Credit is tighter, but app flow is pretty good, and many are taking advantage of larger players that have either consolidated or left certain markets. Certain niche players doing well, certain niche players markets are being adversely effected by the economic slow down...rolling stock, automotive related markets...anything related to the fuel business diesel, or gas...or related to vehicle or truck aftermarket and equipment financed to dealerships. I've heard that B paper funders are doing well in new originations the last few months. There is weakness in almost everyone's back-end, as delinquencies are up, and many are spending allot of energy on collections activities and work outs. “Since we are in the midst of a financial tsunami I don’t think we have the history to hazard a guess. The upward and onward thinking of many in the financial sector has taken us to the top mountain only to find that the other side of the peak is a cliff. Many are free falling without any kind of a parachute and unable to think clearly about the sudden stop awaiting them. At this point maybe we should consider a new leasing company, USA, Inc. Admittedly frivolous thinking but perhaps only as frivolous as the thinking of financial powerhouses that suddenly have gone belly up. My feeling is things will be the same in the last quarter as now, companies being drawn and quartered and wondering how they got there in the first place, so fast did it occur.” Jerry Bernardy “Agility is seeing more quality opportunities than ever since we launched the business in 2004. Since our money is fairly expensive funding structured for early stage wireless companies, this is a good indication that there just aren't many alternatives available to this industry. We are being more cautious than ever in our underwriting and trying to be sure that we use our available funds to back the best companies in the market. “Hiring slowed down just a little this summer, although we were working retained (engaged, exclusive, priority) searches. The last 30 days have picked up considerably! “We found a new EVP of Credit for Pawnee (watch for an announcement soon) and we are being asked to find good credit/ funding/ syndication (sell side) talent. It seems that good credit people are in high demand right now. We are also getting bigger projects overseas Fred St Laurent Website: http://www./mribigcreek.com (Leasing News will print more “Heard on the Street” in its news edition. Editor) -------------------------------------------------------------- Hurricane Ike—Up-date

The Dallas Morning News writes that Beaumont, Houston evacuees are now returning home, and power has been restored to 35% of homes and businesses in the area. Most telephone lines are up and cellular sites are up and running. The rain and wind has been widespread, and the recovery out of the newspapers due to other news. It seems parts of Ohio were as affected as Houston. This report in from Dick Lightner, Dublin, Ohio, the Ohio Vehicle Leasing Association: “I and The OVLA have been without power, telephone, cable, and internet for 8 days as a result of the severe winds (reportedly winds were clocked at 75 mph in Greater Columbus) that went through Ohio Sunday, Sept. 14, afternoon as a result of Hurricane Ike. “So if you attempted to phone, email, etc., me or The OVLA and were unsuccessful, “AEP restored our power at 3:15 p.m. today, Sept. 22. “At the high, some 500,000 people and business were without power.” Dick Lightner

-------------------------------------------------------------- Classified Ads---Help Wanted Credit Professional

Vendor Sales Specialists

--------------------------------------------------------------

-------------------------------------------------------------- Top Stories --September 15--19

Here are the top ten stories most “opened” by readers last week: (1) Hurricane Ike hits Leasing businesses (2) Kit Menkin Heard it on the Grapevine (3) Merrill-Lynch sold to BofA (4) Lehman Bros.: Friend or Foe of Leasing? (5) NorVergence Leases back in the News (6) International Lease Finance Corp for sale? (7) Is Leasing Securitization Dead or Alive? (8) Tighter Credit Transforming the Economy (tie) (tie) (10) Leasing 102 by Mr. Terry Winders, CLP

-------------------------------------------------------------- UAEL promotes Merger with EAEL

Here is an e-mail to United Association of Equipment Leasing members from “I am pleased to present the attached Recommendation of UAEL – EAEL Merger for your review and consideration. Voting on the proposal will begin at our 2008 Fall Conference and Exposition in Denver. There will be a special session on Saturday the 27th by our task force members to present the proposal and answer any questions. For those of you unable to attend the Denver conference, ballots will be emailed shortly and voting will continue electronically until Friday October 10, 2008. “This proposal is the result of the hard work of many people, but we owe many thanks to our UAEL task force members: Brian Bjella – Grandview Financial and Steve Crane – Bank of the West. Particular thanks to our task force leader Brent Hall, who spent many of his hours volunteering for this effort…” The email encloses a formal proposal, basically stating, “Given the similar market positions of the UAEL and EAEL, both organizations stand to reap significant benefits from joining forces to better serve the small to mid-sized lessor and sophisticated broker niche.” Broker-Lessors membership fees go down for employees under three, except for funders, where the under $50MM is $500 less than present UAEL, but creates a over $50MM at $2,995, up $1,000. Service providers go up $200 for under six and $1500 for over six. The new name will be National Equipment Finance Association (NEFA). EAEL-UAEL Proposal: http://leasingnews.org/PDF/UAEL_EAEL_Merger.pdf

---------------------------------------------------------------- Leasing 102 by Mr. Terry Winders, CLP

“Early Buy Out Options” There is a new interest in Early Buy Out options (EBO) because some customers who cannot use the benefits from the economic stimulus package need to lease the equipment so the leasing company will utilize the tax benefits and give them reduced lease rates. However they do not want to give up the right to retain use of the equipment long range and are fearful of end of the lease options and therefore ask for an EBO. Usually about the 48th month of a 60 month lease and they sometimes request it be offered three or four times. To begin with, this is a federal income tax problem because to qualify as a “true lease” and pass the benefits on to the Lessee the Lessor must prove it was his “intent” to provide a lease and not a loan. Any early purchase options challenges this requirement. Therefore it must follow that any EBO must be for the fair market value. The question remains how do you compute the fair market value at an early stage and what tax rules must the Lessor follow? The internal revenue service feels that an EBO can be no more or less attractive than completing the lease and choosing to purchase the asset at that time at its then fair market value (FMV). Inasmuch that the EBO is computed at the start of the lease the FMV at lease termination must be determined and proof of that procedure with results placed in your lease folder for review upon audit. Next it would seem appropriate that after the lessee selects the point in time for the EBO that its FMV at that point in time be computed however the statement of “being no less attractive that continuing the lease” appears to rule out any requirement to do that. Once the lease payments have been computed the correct procedure to figure an EBO amount is to determine how many rent payments will remain after the EBO and discount them at the stream rate to the point of the EBO. Then take the computed FMV at lease termination and discount it by the number of months remaining in the lease after the EBO time frame at the Lessor’s implicit rate ( value of the rent and residual). Then add the two discounts together to get the EBO amount. This amount appears to be the discounted value of completing the lease therefore neutral in the eyes of the IRS. One note of clarification! The stipulated loss value or termination value does not usually deal with the fair value of the equipment at lease termination it usually only contains the residual value to make the Lessor “whole” in the case of equipment destruction or loss. Some Lessor’s believe that by adding one or two payments to the stipulated loss value they can create an EBO amount. This procedure will not stand the test of an IRS audit. You must always remember the basic premise that the Lessor has the burden of proof and has to prove “intent” and any advantages provided to the Lessee will destroy that intent. Any EBO’s offered in a lease like a “money over money” transaction that fails the tax and legal rules for any number of reasons can offer EBO’s by just computing a discount of the remaining payments plus any small residual booked. This happens on many leases with tax exempt customers such as 501C’s. I have not seen it on Municipals but there is no reason not to offer it. Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666. Previous #102 Columns:

(This ad is a “trade” for the writing of this column. Opinions -------------------------------------------------------------- Black Friday—1873 In last Friday’s “This Day in American History” it was the anniversary of “Black Friday.” 1873 -Black Friday: Jay Cooke & Co fails, causing a securities panic (This is a free “ad” for our good friends the Bateman’s, --------------------------------------------------------------- OTS Closes Ameribank and Appoints FDIC Receiver Washington, D.C. — The Office of Thrift Supervision (OTS) Ameribank’s troubles stemmed from excessive growth in construction rehabilitation loans, which provided financing for the rehabilitation of distressed properties, predominantly in low- to moderate-income housing markets. The quarter ending June 30, 2008, marked the fourth consecutive quarter of net losses and capital erosion for Ameribank. The OTS determined that Ameribank was “Critically Undercapitalized” and the institution was unable to develop a viable plan to restore capital to adequate levels. In May 2007, OTS issued a Supervisory Directive enforcement letter and began a continuous on-site presence at the institution. The enforcement letter restricted the bank’s rehabilitation lending activities and identified Ameribank as a troubled institution. In October 2007, OTS issued a Cease and Desist Order, a formal enforcement action, because Ameribank was not in full compliance with the Supervisory Directive. Ameribank became an OTS-regulated institution in May 1997 after converting from a state-chartered commercial bank to a federally chartered savings bank. The institution has 63 employees in its home office and seven retail branches in West Virginia and Ohio. Depositors’ accounts at Ameribank are insured by the FDIC’s Deposit Insurance Fund up to the statutory limits. Customer questions regarding the institution, including questions about federal deposit insurance coverage, should be directed to the FDIC at 1-877-894-4710 from 8:00 a.m. to 6:00 p.m. (Eastern Daylight Time). ( A unit of Pioneer Community Group Inc., Pioneer Community will assume the deposits associated with Ameribank's West Virginia branches and pay a 2% premium. Citizens Savings, a unit of United Bancorp Inc., will assume the deposits associated with the Ohio branches and pay a 1.14% premium. According to the FDIC, the cost of the transactions to the deposit insurance fund is estimated to be $42 million. The FDIC will retain Ameribank's remaining assets for later disposition. ) Full Press Release of FDIC take-over: http://files.ots.treas.gov/6800231.PDF )

### Press Release ########################### Leasing Partners Capital Inc. adds new Albany, New York Operation. WAYNE, NJ., , Leasing Partners Capital Inc (LPC), a leading equipment and technology leasing company announced the expansion of its operation with a new office location near Albany, New York. Gerald G. Oestreich will operate the new office for the firm. Gerry is a recognized leader in the equipment leasing business. He is a Charter Member, a Past President and Board Member of the National Association of Equipment Leasing Brokers (NAELB) and is currently serving on the Membership Committee. Gerry founded and operated Adirondack Leasing Associates Ltd for over 20 years before selling it to a bank in western NY. Gerry has served as an Officer and Board Member of several non-profit and civic organizations in the Albany, NY area. ”I’m pleased to have the opportunity to put my many years of equipment financing experience to work for LPC. I have been successful over the past 29 years in the finance business by providing consistent service to my clients. That service allowed me to help a local waste company grow from a one-man, one-truck operation, to a market leader with over 100 trucks operating in the area. The LPC model is a perfect fit for my talents and my clients.” says Oestreich. “I’m extremely pleased to have an individual of Gerry’s caliber join the team at Leasing Partners. His background, and relationships in the business, coupled with LPC’s outstanding responsiveness, is an unbeatable combination. Leasing Partners Capital Inc. has seen continued strong performance in finance applications and transactions so far in 2008. With key personnel additions like Gerry we expect this performance to continue.” Says Duane E. Rouba managing partner at Leasing Partners Capital’s Northern New Jersey Headquarters. About Leasing Partners Capital Inc. Leasing Partners Capital Inc. is a leading equipment and technology leasing company based in Northern New Jersey. The company operates 21 field offices throughout the United States. Leasing Partners Capital has been offering financial and operating lease products to businesses and vendors in the Commercial, and Government Market sectors for more than 20 years. The firm is known as a leader in the vendor leasing program arena as a result of excellent marketing execution, outstanding responsiveness and client service levels. ### Press Release ###########################

News Briefs---- ELFA Bentsen on equipment leasing: ”more difficult” G.E., a Giant of Lending, Is Dragged Down Along With Banks Fannie Shuts Door to More Small Lenders Bailout not much help for community banks What does the Treasury bailout mean for mortgages? WaMu loaned millions to California home flippers convicted in fraud scheme Microsoft to buy back $40 billion of stock Lehman employees go to work for new owners Global airline industry to lose more then USD5bn Airplane-leasing company borrows $6.5B ILFC's Udvar-Hazy, godfather of plane market ---------------------------------------------------------------

You May have Missed--- Paul Simon---Yankee Stadium http://www.nytimes.com/2008/09/21/sports/baseball/21simon.html?_r=1&oref=slogin ----------------------------------------------------------------

“Gimme that Wine” Winemaking in Washington State Manhattan City Winery Vintage 2008: Weather, lower yields put squeeze on No. Ca. wine grape growers "Bottleshock" brings more attention to Napa County Winegrowers Wine Prices by vintage ----------------------------------------------------------------

Today's Top Event in History 1815---The Great September Gale moved through New England on a path similar but just east of the Great 1938 Hurricane. The storm made landfall on Long Island and again at Old Saybrook, CT. Extensive structural damage was done. Providence, RI was flooded and 6 people were killed. This hurricane is rivaled only by the 1938 hurricane in New England History, which also brought economic disaster to the region [headlines]

This Day in American History

-------------------------------------------------------------- Baseball Poem

Mr. & Mrs. America by Wayne Lander You meet with customary pleasantries, in the caves of the heart. She wants to play People dream of homes they never find, or want. Mirages rise as frequently as suns. always do. In all, nothing fits as well fade like old clippings from The Sunday Times. America live in the .SportingNews, left to play. When the score is finalized is a silent game, the inside dying, from: (Printed with permission of the author) -------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm -------------------------------------------------------------- Daily Puzzle How to play: Refresh for current date: --------------------------------------------------------------

http://www.gasbuddy.com/ -------------------------------------------------------------- Weather See USA map, click to specific area, no commercials -------------------------------------------------------------- Traffic Live--- Real Time Traffic Information You can save up to 20 different routes and check them out -------------------------------- |

||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

||||||||||||||||||||||

|

||||||||||||||||||||||

Editorials (click here) |

||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

|