Thursday, September 25, 2008

Headlines--- Classified Ads---Senior Management ######## surrounding the article denotes it is a “press release”

------------------------------------------------------------------ Please send Leasing News to a Colleague. Ask them to “bookmark” or join our email list. ------------------------------------------------------------------ Classified Ads---Senior Management

For a full listing of all “job wanted” ads, please go to: Leasing Recruiters: To place a free “job wanted” ad here, please go to:

-------------------------------------------------------------- GE shutting down outside leasing business?

This is perhaps one of the most important stories to come across, sent in by a reader. Unfortunately, Leasing News has been unable to "confirm or deny" its accuracy. None of our sources want to respond "on" or "off the record." From a reader: “GE appears to have stopped accepting credits and will not fund future deals for an indefinite period....have you heard anything? According to an article in the New York Times, "GE Capital Services, as the financial arm is called, holds the rest of the group’s top-notch businesses hostage...If there’s any lesson that Jeffrey R. Immelt, G.E.’s chief executive, might take away from the credit crisis, it’s that GE Capital’s financing needs could put the whole company at risk. “Not that G.E. is in trouble. Though the stock was hammered last week, GE Capital easily managed to finance itself in the commercial paper market. It would, however, have been irresponsible for G.E.’s board not to ask: “What if GE Capital ran into a funding crunch?” “At midyear, GE Capital had $695 billion of assets. A third of that was financed through short-term borrowing, including $100 billion in commercial paper. If that source shut down, G.E. would need to look elsewhere. In a real pinch, it might have to sell off assets — even industrial ones — at fire-sale prices… “One solution would be to spin off GE Capital to shareholders, perhaps even as a bank holding company — the corporate structure Goldman Sachs and Morgan Stanley are now embracing. This would be complicated, and an independent GE Capital might need more capital than it has now to maintain its credit rating. But it could gain access to new sources of financing, and G.E.’s other businesses would be positioned to thrive without taint from the financial sector.” New York Times Article -------------------------------------------------------------- Asset-Based Lenders Report 16.2 Percent Increase in New Credit Commitments 75 percent of reporting members experience increases in total credit commitments

NEW YORK, -- The Commercial Finance Association (CFA) released its "Quarterly Asset-Based Lending Index, Q2 2008," revealing a dramatic 16.2 percent increase in new credit commitments in the second quarter. Furthermore, 75 percent of reporting asset-based lenders saw an increase in total credit commitments. This, according to the CFA, is yet another example of the crucial role that asset-based lending plays in the global economy, as companies seek to secure financing to sustain and grow their operations. "Despite the negative headlines about the health of the current credit environment, we expect our members to continue to experience rapid rates of growth," said Andrej Suskavcevic, CEO, Commercial Finance Association. "Asset-based lending represents a uniquely stable and viable source of funding for businesses of all sizes and industries. This stability is even more apparent in tumultuous credit scenarios like our economy is facing today." The quarterly index comes on the heels of the CFA's "2007 Annual Asset-Based Lending Survey," which revealed an 11 percent increase in total credit commitments, bringing the industry's outstanding loan total to $545 billion. "In years past, we have alluded to asset-based lending's 'evolution' to a mainstream lending option," said Suskavcevic. "There is no question that it is time to remove the word 'evolution' when we speak about asset-based lending's place in the international commercial finance landscape. With consistent and significant growth -- even in this challenging credit environment -- it is clear that asset-based lenders are a critical part of the lending mainstream." The Quarterly Asset-Based Lending Index was conducted by R.S. Carmichael & Co, an independent market research firm, to measure business growth, credit commitment, credit line utilization and portfolio performance of the 20 largest CFA members engaged in asset-based lending. The survey was commissioned by the Commercial Finance Association. About CFA Founded in 1944, the Commercial Finance Association is the trade group of the asset-based financial services industry, with nearly 300 member organizations throughout the U.S., Canada and around the world. Members include the asset-based lending arms of domestic and foreign commercial banks, small and large independent finance companies, floor plan financing organizations, factoring organizations and financing subsidiaries of major industrial corporations.

-------------------------------------------------------------- ELFA Survey Reflects “Heard on the Street”

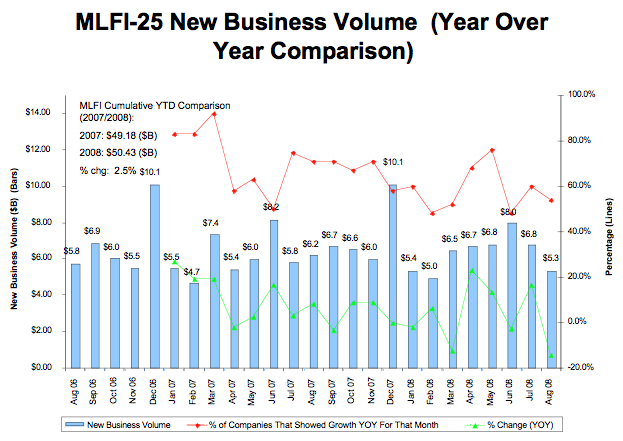

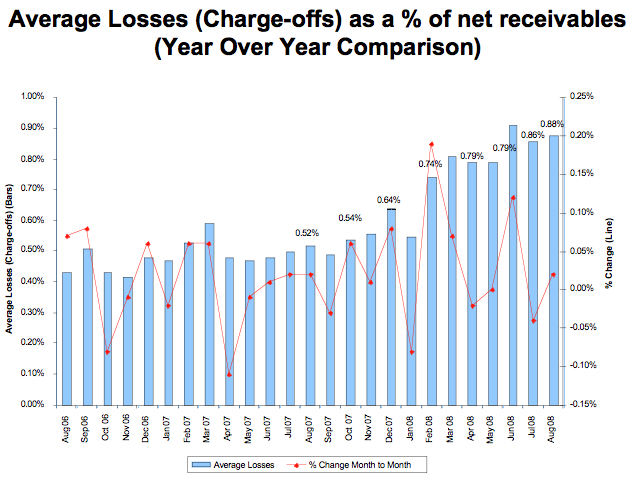

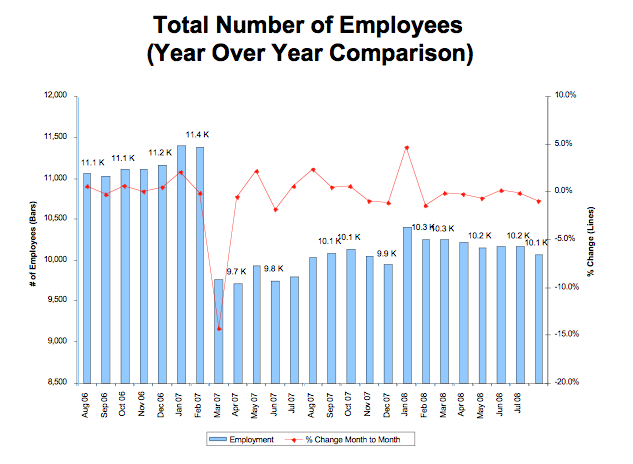

The Equipment Leasing and Finance Association (ELFA) Survey reflects the August down turn as experienced by many (but not all) leasing companies in their comments to “How’s Leasing Business?—‘Heard on the Street” II. “For nearly a year now, everyone has been watching for signs that the global credit crisis is spreading into the general economy,” said William (Bill) Verhelle, ELFA Chairman and CEO of First American Equipment Finance in Fairport, NY, and a participant in the monthly survey.

Specific equipment finance segments such as transportation, construction and some areas of the small-ticket market have experienced problems during the past several months. Until August, however, the broader equipment finance industry had yet to see a slowdown, “ he said. “This 14.5 percent August decline in equipment lease and loan originations (compared to the same month in 2007) may be the first objective data reflecting a broad capital equipment slowdown in the U.S.”

"“We don’t know whether [the expected decrease] is due to fewer businesses wanting to invest in capital goods, or if all the lenders are pulling back because they are capital-constrained and they are waiting to see the market stabilize before they put more money out,” the Hon. Ken Bentsen, Jr., President of the Equipment Leasing and Finance Association told "Financial Week" in its September 18th edition, as reported in Leasing News.

Mr. Bentsen basically told "Financial Week," it will be more difficult for equipment leasing and finance companies to fund the needs of corporate customers and expand business. “At the very least, this is probably going to compound some of the issues related to the larger financial institutions being capital-constrained and causing them to not expand their lending into our market,” he said. From “Financial Week:” "Mr. Bentsen said independent equipment finance companies that rely on bank syndications and commercial paper to operate would be most affected by the tightening credit environment. Smaller financial institutions that rely on deposits and insurance companies that are primarily funded through premiums will be less affected by the credit squeeze, he said. "Mr. Bentsen said that many banks “are awash with cash” but are pulling back on lending because they want to keep their balance sheets as liquid as possible, for fear they will be viewed as overleveraged. As cash hoarding increases, lending rates and Libor rates have gone through the roof this week, he said, a development that could slow the economy’s expansion over the long run. With finance companies being forced to pay higher borrowing rates—or seeing their access to credit cut back—corporate customers looking to finance equipment could be stymied. That’s particularly true for blue chip manufacturers, Mr. Bentsen said.

ELFA MLFI-25 Participants

ELFA Bentsen on equipment leasing: ”more difficult” -------------------------------------------------------------- Ken Bentsen on “Money Watch” Congress Bail Out

Copy and paste into your media player: If you have difficulty downloading, you can go to play: -------------------------------------------------------------- How’s Leasing Business? ---“Heard on the Street” II

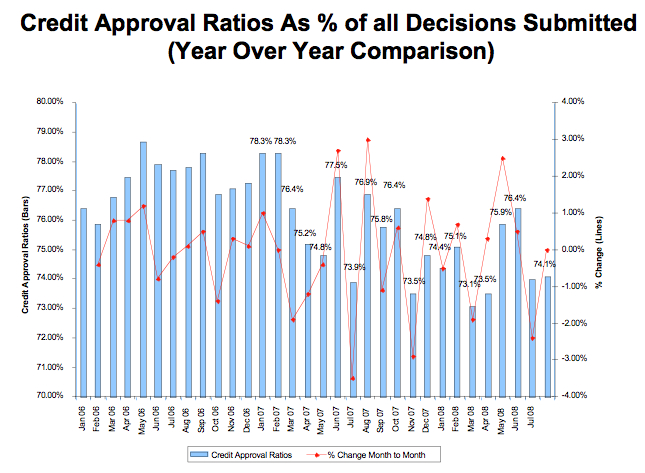

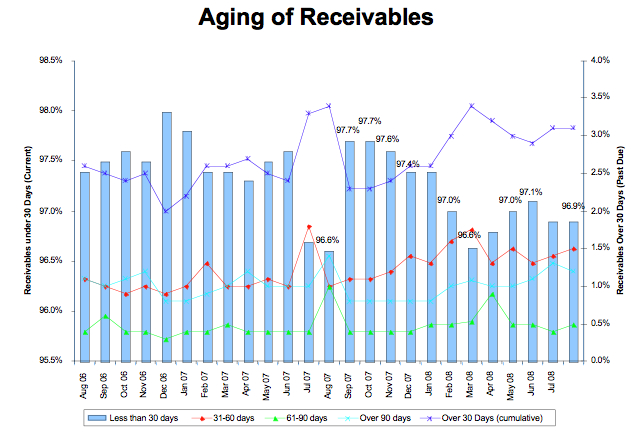

“We see significantly more opportunities now that we did a year ago. “Our general view of this situation is that the cause is two-fold: 1) the banks have retrenched from all but the very highest quality transactions, thus leaving a larger number of "non-bankable" transactions available for other lessors at acceptable rates, & 2) a number of the other lessors that traditionally financed the "non-bankable" deals have developed some liquidity constraints; thus inhibiting their ability to take full advantage of the available opportunities. “We do not see the 4th Quarter any different than the current market. Fortunately we were able to secure lines that enable us to take advantage of the current marketplace so our particular view of the balance of the year shows fairly strong deal flows & closings.” “We are having our best month ever and the pipeline looks good heading into the last quarter. With traditional lending institutions tightening their credit guidelines, companies are turning to leasing companies to fill that void. We are getting a number of deals in that 300K plus range because their banking institutions just cannot service them. “One thing that I cannot believe is the rise in fraudulent deals and applications we are seeing. I have been in the leasing business for over 10 years (which may not be that long for some) but this is the worst I have ever seen. I believe that I am logged onto Google maps for about 3 hours a day.” Naveen Sood “Madison is a 36 year vehicle and equipment lessor. Our vehicle business is way up. Banks and manufacturers shot themselves in the foot again on residuals. The manufacturers and banks keep doing the same thing over and over. The losses incurred and what is still coming will cure "chasing business with inflated residuals" for some years to come. “I have been in this business a long time and have never seen it quite like this. However, if one has some $$$$$$, the transactions and spreads are there. The bank "stuff" is not over and the days of consumers using their house as an ATM are also over. “If a funder, watch your apps. The frauds, as you know, in this environment are all around. “As I said, plenty business out there and good margins.” Happy Leasing. Allan Levine, Chief Operating Officer “Of course I have a different perspective, jaded litigious soul that I am. But I am seeing more senseless litigation (some of which has been commenced by companies known historically as "good guys"), more fraud suits, more battles over reps and warranties, and more disputes over advance fees. I guess in a tight economy there will naturally be plenty of willing customers. When it gets ugly, however it really gets ugly. “Be careful out there!” Kenneth C. Greene, Partner “We are optimistic heading into the 4th Quarter. At the same time, the recent stress in the financial markets makes the outlook very unpredictable. “ We are excited US Bank is our parent company and the strength they provide us.” Curt P Kovash “The first two quarters of 2008 saw new application count and funding at a slight increase over 2007 numbers. As we entered third quarter app count increased dramatically while at the same time approval ratios decreased dramatically indicating a weakness in credit quality. “We believe quality business is out there but must be underwritten and priced correctly in this challenging environment.” Don Myerson “From our perspective, the leasing industry is navigating one of the most “challenging” chapters in recent history. However, by staying focused and working hard, we’ve continue to find new business opportunities. In fact, our total originations are actually up slightly year-to-date. We don’t see much change in the upcoming quarter as the elections, credit markets, and real estate prices will all need to be resolved before anything can change materially. So, in short, we’re meeting the challenges of today’s market by working harder and staying committed to our employees. And most importantly, staying optimistic! “ Eric T. Sidebotham GeNESIS COMMERCIAL CAPITAL “Business has been strong, but delinquencies seem to be creeping up.” Brian Cornell “It’s tough out there but nothing we can’t get through with a little extra work.” Gary Saulter |President “(I still see) an entrepreneurial spirit underpinned with intelligence, creativity and a 'can-do' attitude that always finds a way to deliver capital to users of equipment. If there were no material challenges in that endeavor, there would be no need for the industry. I see the industry continuing to thrive on a secular upward trend.” Terry V. Waggoner, J.D. “Leasing is viewed as a reliable financing source in the current credit environment for companies that need operating equipment. “There are two key reasons why leases are attractive now: “1. Companies need to conserve cash and debt lines. “Depending on how leases are structured, transactions can provide for 10 – 17 % residuals that can further reduce payments because the user is only paying for part of the equipment’s useful life. “In reaction to tightening credit availability, manufacturers and distributors are cultivating their relationships with equipment leasing and financing firms to help sell equipment as both parties focus on what is mutually profitable. Private Equity firms have the liquidity to fare well while independents are selling portfolios to free up cash to enable more originations.” Michael J. Fleming, principal “The credit crunch is throwing a lot of business towards leasing. Many lessors I talk with have plenty of opportunities - it is just a matter of what you want to fund (or your credit people will let you fund). “All in all, things appear to pretty upbeat for the last quarter.” Shawn D. Halladay, Principal “Business for many of our clients is a mixed bag right now. Small ticket vendor has been holding up pretty well, for those that have funding. Rates are higher but so are spreads. Credit is tighter, but app flow is pretty good, and many are taking advantage of larger players that have either consolidated or left certain markets. Certain niche players doing well, certain niche players markets are being adversely effected by the economic slow down...rolling stock, automotive related markets...anything related to the fuel business diesel, or gas...or related to vehicle or truck aftermarket and equipment financed to dealerships. I've heard that B paper funders are doing well in new originations the last few months. There is weakness in almost everyone's back-end, as delinquencies are up, and many are spending allot of energy on collections activities and work outs. Randy Haug/ Sr. Vice President “The Leasing business has endured an increased slowing trend for the last 6 months and the business owners I talk to are all saying the same thing: "We are going to wait and see if the economy improves and then perhaps we will buy that piece of equipment". But what is different this time compared to the last 2 recessions, is that the customers that I have secured Approvals for, have cancelled the deal AFTER being delighted with the approval. They state it is because of their concerns over the economy. They express real worry about the ability to make future lease payments if the economy tanks even further. Broker lose deals from time to time, but generally it is because they found a cheaper rate somewhere, or they went to their bank and got a better deal, or they lost a contract for a job that initiated their request for a lease in the first place. But there is a real and absolute fear out there by small business America. I speak to so many brokers each week and they all say the same thing. “What do I see coming in the 4th quarter of this year? Let me tell you that in the last few weeks, more and more folks have called to get lease quotes. The activity is picking up, and I know many businesses wait until the 4th quarter to make Capital purchases. I have had my own lease brokerage for 20 years and I can peek back through time and see that the 4th quarter is always the BEST quarter, even in the prior 2 recessions. “Now that the Feds are bailing out Wall Street and the stock market is slowly recovering, people will go back to business as usual. Americans have short memories. I fully expect that many of the customers who backed out of their leases this summer will call up and ask me if I would re-activate their approvals. We are approaching a new Presidential election and there is always renewed hope in an election year. I don't believe I am being overly optimistic in my forecast. Rosanne Wilson, CLP, President

-------------------------------------------------------------- Classified Ads---Help Wanted Credit Professional

Vendor Sales Specialists

-------------------------------------------------------------- Fernando’s View

Out in Theaters: Ghost Town (DreamWorks Pictures): Ricky Gervais, the top-notch British comedian best known for his role in the English sitcom “The Office,” is finally introduced to American audiences in this likable romantic comedy. Gervais stars as Doctor Pincus, a cranky Manhattan dentist whose idea of fun is to stay away from other people. Unfortunately for him, after a brush with death in the middle of a surgery he realizes he’s now able to see the city’s many ghosts, who, in a comic twist on “The Sixth Sense,” won’t leave him alone. Director David Koepp doesn’t do anything original with the premise, but the cast (which includes Greg Kinnear and Tea Leoni) is appealing, and Gervais finds a unique note between sarcasm and grace. Flow: For Love of Water (Oscilloscope Pictures): Like last week’s “Trouble the Water,” Irena Salina’s film is an eye-opening documentary that reveals how close the human race often is to disaster. While “Trouble the Water” focused on New Orleans, however, “Flow” takes a global view (with visits to Bolivia and India, among other nations) of its subject, namely the ways in which the planet’s water supply is becoming endangered. Using graphics and interviews, the film paints an important portrait of a world neglecting to take care of its most essential fluid, and is not afraid to question the tactics of large corporations. Urgent but never hopeless, it’s an informative cinematic pamphlet about inconvenient truths. New on DVD: Mother of Tears (The Weinstein Company): Italian horror master Dario Argento is famous for such stylish thrillers as “Suspiria” and “Inferno,” both of which were part of an unfinished trilogy of supernatural terror. Fans have waited decades for the third entry, and they now can breath easy—“Mother of Tears” is a gory corker, a rich and fast-paced spectacle that finds Argento mining familiar territory with renewed energy. Asia Argento, the filmmaker’s daughter, stars as an art student involved with a coven of deadly witches, but the plot is really just a thin clothesline on which the director hangs his voluptuous set-pieces. Featuring underground conspiracies, killer animals, and a cameo by professional weirdo Udo Kier, it’s bloody good fun. Sex and the City: The Movie (New Line): In this big-screen adaptation of the beloved HBO series, the four New York City friends return for more fun, laughs and heartbreak. Carrie Bradshaw (Sarah Jessica Parker) is about to tie the knot with the man of her dreams, but things don’t go as planned. Meanwhile, Samantha (Kim Catrall), Charlotte (Kristin Davis) and Miranda (Cynthia Nixon) all have problems of their own. The story feels like three episodes stitched together, but the director, Michael Patrick King, knows how to keep things moving smoothly, and the cast is by now aces at combining sophistication and emotion. Fans will enjoy it, and some non-fans may be converted. L.A. Confidential (Warner Bros.): Considered by many one of the top movies of the 1990s, Curtin Hanson’s first-rate adaptation of James Ellroy’s novel hits DVDs in a spiffy 10-year anniversary edition. A mosaic of corruption in 1950s Los Angeles that has been compared to Roman Polanski’s masterful “Chinatown,” it follows three very different detectives (played by the splendid trio of Kevin Spacey, Russell Crowe and Guy Pearce) as the city’s glamorous veneer is lifted to reveal the rot underneath. As a Veronica Lake lookalike suspended between law and crime, Kim Basinger won a Best Supporting Actress Oscar. Don’t miss the DVD commentary by the great critic Andrew Sarris.

### Press Release ########################### Dee DiBenedictis Launches Lease Broker Assistant, LLC Dee DiBenedictis, a veteran of the equipment leasing industry, announces the launch of Lease Broker Assistant, LLC, (LBA) a company dedicated to helping independent brokers and lessors better manage their time and resources and grow their businesses without having to add employees. One of the biggest problems facing the new or smaller brokers is that their time is often stretched to its limit. They are constantly switching hats between marketing guru, salesperson, credit processor, documentation person, bookkeeper, receptionist, customer service rep, collector, data entry clerk and IT person. And the more hats they are wearing the less time they can devote to generating new revenue. New brokers to the industry face the same issues but have the added problems of not having the expertise to correctly package and submit credit applications and/or funding packages. They face the frustration of finally getting deals through the door but not getting them approved or worse yet, having approvals which are delayed at funding because of documentation errors. The only sensible solution to growth is to multiply manpower. Yet, brokers have a multitude of reasons preventing them from hiring an assistant, even though it's obvious they need one. In a perfect world, there would be an experienced leasing assistant that was always ready to work, but only when needed by the broker. Funding sources face the dilemma of wanting to work with new brokers but finding their staffs bogged down in the problems of beginners’ missteps. By referring their early stage brokers to LBA, they can send them to someone who can help them learn and learn it right. The broker benefits from the education and better approval ratios. The funder benefits by saving valuable resources and improving their firm’s approval/decline ratios and booked-to-submit ratios. There has long been a void in the marketplace that Lease Broker Assistant can fill with its menu of services and years of expertise. Said Dee DiBenedictis, “As a virtual lease broker assistant, we offer a creative labor force that provides practical solutions for small broker businesses all across the country.” If you would like more information about Lease Broker Assistant, please call or email Dee DiBenedictis at 407-328-8682 or dee@leasebrokerassistant.com Dee DiBenedictis ### Press Release ########################### Former IDS’ executives launch Seritus-CoS, Rosemount, MN/--Former IDS employees, Charles Lyles – President, Wade Sharp - Director of Global Product Development, Brad Back – Sr. Architect and Steve Shallman - Architect have partnered to launch Seritus-CoS. After evaluating the financial market place in regards to Credit Origination Systems, we concluded that there was a need for a solution which would leverage the latest technical advancement providing for a robust solution while lowering overall cost of ownership. Charles Lyles, partner with Seritus Solutions, LLC said “while I have been out of the leasing space for a few years, I kept up with the market through various contacts within the industry and concluded the market has not taken advantage of the integrated development tools that are readily available which enable systems to be built with greater functionality, scalability and lower overall costs. We believe that we have accomplished that with the release of Seritus-CoS”. The system has intelligent workflow processing to automate the flow of applications through your operation. Seritus-CoS seamlessly integrates with third party commercial and consumer credit sources to pull and store related bureau reports. It provides the capability for your business partners to initiate deals, monitor their progress and print financial documents remotely which were automatically generated from your standard forms. As deals are finalized, Seritus-CoS can seamlessly integrate with your back-end solution provider of choice. While working with Flagship Credit Services to enhance their own Credit Origination System, Seritus determined that there was a need for a system that was able to cost effectively provide the functionality for that segment of the market. While the system is architected to support all segments of the market, it can be installed as an out-of-the box solution allowing all segments to take advantage of the inherent tools to drive their business processes. Tom Payne, Managing Director of Flagship Credit Services said “the Seritus product suite has been key to significantly growing Flagship Credit Service's business while keeping our overall costs down. Our ability to effectively communicate with our vendors / dealers / brokers alike via the Seritus - CoS has been invaluable." Flagship Credit Services has moved from their internal developed system over to Seritus-CoS to ensure they continue to receive the same great support as well as continue to obtain future product enhancements. While Seritus Solutions is new to the market, the partners are not. They have a combined 61 years of technical experience and servicing of this market. Their commitment is to expand their partnerships with other leading companies within the commercial lease and loan market. (This ad is a “trade” for the writing of this column. Opinions ### Press Release ########################### Ed Gross awarded ELFA Distinguished Service Award

Washington, DC, ---The Equipment Leasing and Finance Association (ELFA) has selected Edward Gross, Shareholder, Vedder Price P.C. as the recipient of its Distinguished Service Award for 2008. “Ed Gross has tirelessly volunteered his legal, legislative and leadership expertise for the benefit of our members and the entire industry for nearly two decades,” said Kenneth E. Bentsen, Jr., ELFA President. “We are pleased to honor him for his outstanding efforts and achievements.” Gross has been an active participant in ELFA for almost 20 years, inspiring, educating and guiding the membership through his leadership. He has been elected to serve terms on the Board of Directors, the Government Affairs Council, the Industry Future Council, the Editorial Review Board, as chair of the Service Provider Business Council Steering Committee and the Legal Committee. Most recently, Gross served on the Board of Editors of the Equipment Leasing and Finance Foundation Journal of Equipment Lease Financing, (November of 2004 until the present) overseeing substantive content and direction, as well as authoring numerous articles for this scholarly publication. Since September 2007, Gross has assisted with the preparation of the ELFA Legal Update for the organization’s website, and he serves as an ELFA Legal Listserv monitor. He authored the core chapter (covering the lease agreement) in the ELFA Executive Guide to Lease Documentation published in April 2008. In addition to his many years of organizational leadership and countless speaking and editorial activities, Gross has spearheaded a number of ELFA advocacy projects. Since September 2007 he has chaired the ELFA Cape Town Convention Air and Rail Working Groups and the Air, Rail and Marine Finance Subcommittees where he is responsible for educating and strategizing with other industry leaders with respect to, among other things, the groundbreaking international convention which will have far ranging implications for transportation equipment financiers. He has also been an active participant since 2001 in ELFA’s Capitol Connections, this year meeting the staff of Congressional leaders and an Assistant Chief Counsel to the Department of Transportation to discuss and provide the industry’s point of view on the implications of proposed new FAA regulations. Gross assisted ELFA with its preparation and submission of a formal written response to these new proposed regulations. “Much of what I know about the industry or relevant issues I've learned by attending or participating in Association events,” said Gross. “I’m honored to have been able to give back when I’ve gotten so much out of participating. I look forward to what I hope will continue to be a very mutually beneficial relationship with the ELFA, its membership and staff,” said Gross. Gross has been active with ELFA conference programs, serving as a panelist or moderator at nearly all of the past 17 annual ELFA Legal Forums. In May 2008 at the Legal Forum, Gross was a panelist on the Legal Update panel and the moderator of the Business Air Finance panel. About the Equipment Leasing and Finance Association The Equipment Leasing and Finance Association is the trade association that represents companies in the $650 billion equipment finance sector which includes financial services companies and manufacturers engaged in financing the utilization and investment of and in capital goods. Its more than 700 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers. For more information, please visit www.elfaonline.org The ELFA is also the premier source for statistics and analyses covering the equipment finance sector. To access ELFA's comprehensive industry information, please visit ### Press Release ########################### Robert Krause Joins The Alta Group

LAKE TAHOE, --The Alta Group, a only global provider of specialized consulting services exclusively focused on equipment leasing and finance, announces the recruitment of Robert Krause, a leasing icon in the North American leasing industry, as its newest associate. Mr. Krause was formerly senior vice president of Sterling National Bank in New York City until his retirement from that company in June. It was a short-lived retirement, as Krause is now devoting his drive, knowledge, and industry connections to helping Alta clients. “Bob truly is an icon in the industry who brings an enormous amount of energy to his work,” said John C. Deane, managing principal of The Alta Group. “His work for Alta will focus on developing opportunities for independent companies through improved due diligence, operations reviews, access to funding sources, and other services.” Mr. Krause joins Alta at a critical time for the US economy. “Many companies are concerned about the credit crunch and gaining access to capital. I have spent years helping independent companies find funding, and this will be an important part of what I do for Alta clients,” Krause said. “I really enjoy meeting challenges and watching companies succeed in the industry.” He is a life-long New Yorker. He began his 45-year financial services career at Standard Financial Corporation, later worked for a Rothschild banking group affiliate, and then served as a founder and president of Northern Financial Corporation, which was purchased by Aetna in the 1970s and became Aetna Business Credit. He then held key positions for Todd Equipment Finance, and Granat Leasing. Krause’s career at Sterling began in 1993. Considred a tireless advocate for the leasing industry, Mr. Krause was an early board member of the Equipment Leasing and Finance Association (ELFA). He was founder and first president of the Eastern Association of Equipment Lessors (EAEL), which recently honored him with its Lifetime Achievement Award. Alison Pryor, executive director of EAEL, said Krause was recognized for his “years of leadership, ethical treatment of employees and customers, and significant contributions to the leasing industry and EAEL.” About Alta The Alta Group is a global consultancy serving equipment leasing and finance companies, investment professionals, manufacturers, banks, and government organizations. Founded in 1992, The Alta Group supports clients in North America; Latin America; Western, Central and Eastern Europe; Australia; and China. For more information, please visit http://www.thealtagroup.com. ### Press Release ###########################

News Briefs---- US existing home sales fall 2.2 pct in August Rates rise, mortgage applications fall Bill Heard closes its 14 auto dealerships; 2,700 lose jobs Could Warren Buffett Negotiate a Better Deal for Taxpayers? ---------------------------------------------------------------

You May have Missed--- Housing, dot-com bubbles show need for attitude change on risk ---------------------------------------------------------------

Sports Briefs---- Lions fire Millen ----------------------------------------------------------------

California Nuts Briefs--- UCLA report cites fallout from job losses far into '09 http://www.signonsandiego.com/news/business/20080924-9999-1b24econ.html ----------------------------------------------------------------

“Gimme that Wine” Wine Bloggers To Name Top Taster Blind Tasting Challenge At Bloggers Conference Santa Rosa, California Like vineyard terroir, oak terroir can be a wonderful thing British wine buffs return to claret Wineries of Wisconsin and Minnesota" A $200 Million Dollar Grape Harvest Underway On the CA Central Coast Putting Ventura on the Wine Map Wine Prices by vintage ----------------------------------------------------------------

Today's Top Event in History 1926- Henry Ford announces the 8 hour, 5-day work week. Ford was the first to grant a ten hour week, paid vacations, paid sick days, all before union organization. He worried about safety, boredom, and knew his “modernization” may eliminate jobs, even started company schools for employees. He was quite liberal for his day, a leader among inventors and scientists, and unfortunately most uninformed people remember him as an industrialist who took advantage of his workers---while he did have his prejudices and faults, he looked at his employees as part of his “family.” [headlines]

This Day in American History

-------------------------------------------------------------- Baseball Poem

-------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm -------------------------------------------------------------- Daily Puzzle How to play: Refresh for current date: --------------------------------------------------------------

http://www.gasbuddy.com/ -------------------------------------------------------------- Weather See USA map, click to specific area, no commercials -------------------------------------------------------------- Traffic Live--- Real Time Traffic Information You can save up to 20 different routes and check them out -------------------------------- |

|||||||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

|||||||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

Editorials (click here) |

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

|