Wednesday, June 25, 2008

Carly Simon, singer, songwriter, born June 15, 1945 New York, NY.

“You’re so Vain,” “Nobody does it Better,” “You belong to me.”

http://www.carlysimon.net/

Headlines---

Classified Ads---Sales Managers

Operation Lease Fleece Up-Date

Lease/Loan State License Requirements

Sales makes it Happen---by Linda P. Kester

Summer Sales---What to do

Classified Ads---Help Wanted

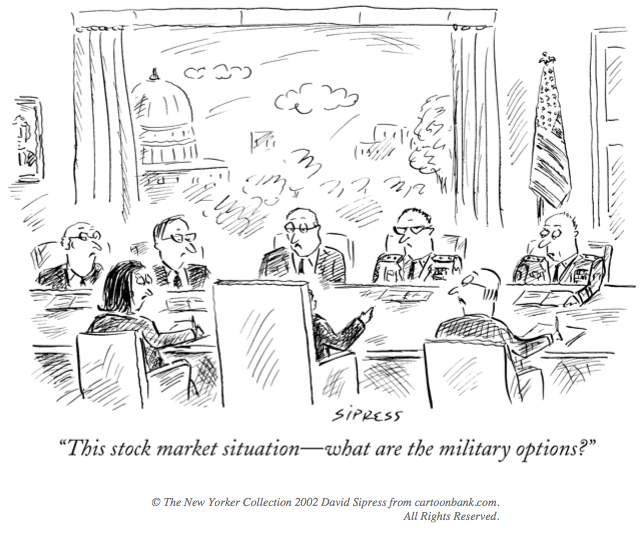

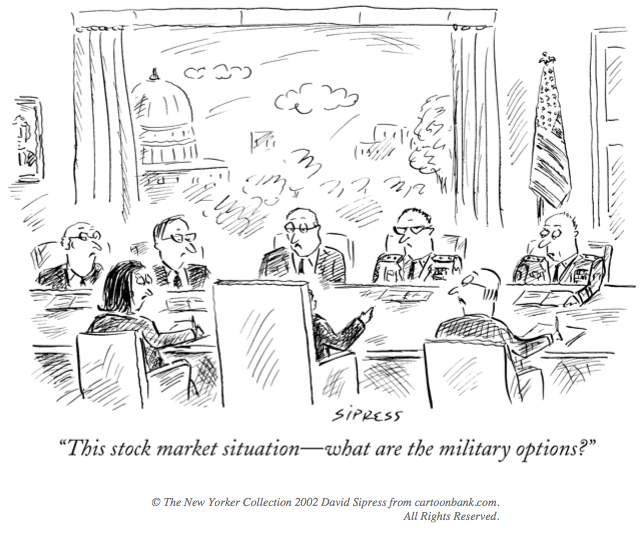

Cartoon—Stock Market

The Bank Loan Squeeze

Leasing Association Meetings open to all

Leasing News Banner Advertising

MLFI-25 May Leasing/Finance Index

Fed expected to leave key rate at 2%

Four years gains home prices wiped out

UPS stock falls to 5-year low

Illinois to Sue Countrywide

News Briefs---

You May have Missed---

World now has 10 million millionaires

"Gimme that Wine"

Calendar Events

Snapple Real Facts

Today's Top Event in History

This Day in American History

Baseball Poem

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

News on Line---Internet Newspapers

Monterey, California

######## surrounding the article denotes it is a “press release”

------------------------------------------------------------------

Classified Ads---Sales Managers

Atlanta, GA

Strong sales and leadership skills; demonstrated with sales training and sales performance. Lead team in both regional and national operations and developed marketing programs.

Email: mll1946@comcast.net

[Resume] |

Chicago, IL

Sales Executive or Senior Manager, with responsibility for leasing capital equipment in support of transactions based on current market values, market potential and economic trends.

tomvolk53@hotmail.com

Resume |

For a full listing of all “job wanted” ads, please go to:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

Leasing Recruiters:

http://www.leasingnews.org/Recruits/index.htm

To place a free “job wanted” ad here, please go to:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

[headlines]

--------------------------------------------------------------

Operation Lease Fleece Up-Date

In November, 2007 the FBI investigation dubbed “Operation Lease Fleece” charged 23 in their roles in a fraud scheme that allegedly caused more than $20 million in losses to several lending institutions that believed they were financing equipment leases.

According to several sources, the main “mover and shaker” behind the operation was Adam Zuckerman, as out lined by Leasing News. Perhaps more known to the industry were Jim Raeder and Mark McQuitty of CapitalWerks, Preferred Lease, SierraCities, Republic Leasing of Southern California.

Three of those named by the FBI and US Attorney court record could not be found. All but one are awaiting sentence and their plea agreement is sealed. Nohad Mousa, who appears to have worked for a vendor, has been sentenced and his plea agreement is now public

( and interesting reading: see the last one on the list.)

UNITED STATES DISTRICT COURT, CENTRAL DISTRICT OF CALIFORNIA

(Southern Division - Santa Ana)

CRIMINAL DOCKET FOR CASE #: 8:07-cr-00239-CJC All Defendants

Jennifer L Waier

AUSA - Office of US Attorney

411 West Fourth Street, Suite 8000

Santa Ana, CA 92701

714-338-3550

Email: USACAC.SACriminal@usdoj.gov

LEAD ATTORNEY

These are from public documents

(Those records found follow the original list from the US Attorney’s office:)

February 19 James Reader plead guilty 18:1343: Wire Fraud before Judge Cormac J. Carney. Sentencing set for 2/23/2009 10:00 AM before Judge Cormac J. Carney. Documents sealed.

May 20 Mark McQuitty plead guilty 18:1343: Wire Fraud before Judge Cormac J. Carney. Sentencing set for 5/18/2009 10:00 AM before Judge Cormac J. Carney. Documents sealed.

April 8 Anthony E. Watson plead guilty before Judge Cormac J. Carney. Sentencing set for 7/21/2008 10:00 AM before Judge Cormac J. Carney. Documents sealed.

June 1 Adam Zuckerman plead guilty with the jury trial date of July 8, 2008 at 8:30 a.m. as to this defendant only. Sentencing set for 7/13/2008 10:00 AM before Judge Cormac J. Carney.

Plea agreement as of December 7, 2007 is sealed.

January 31 Kirk A. McMahan plead guilty before Judge Cormac J. Carney. Sentencing set for 10/20/2008 09:00 AM before Judge Cormac J. Carney.

February 19 Paul Arnold plead guilty before Judge Cormac J. Carney. Sentencing set for 2/23/2009 10:00 AM before Judge Cormac J. Carney. Documents sealed

Geoffrey Silver to the charge of conspiracy to appear before Judge Cormac J. Carney June 30, 2008. Documents sealed

Brian Sime also known as Joe Turner also known as Tonga Title 18:1014 FALSE STATEMENT TO FINANCIAL INSTITUTION: 18: 2(b) CAUSING AN ACT TO BE DONE (1) Public Defender reassigned. Documents sealed.

May 20 Leo J Najera plead guilty before Judge Cormac J. Carney. Sentencing set for 11/10/2008 11:00 AM before Judge Cormac J. Carney. Documents sealed

March 13 Leigh Dorand plead guilty 18:1343: Wire Fraud before Judge Cormac J. Carney. Sentencing set for 2/9/2009 10:00 AM before Judge Cormac J. Carney. Document sealed

March 6 James H Breedlove plead guilty 18:1343: Wire Fraud before Judge Cormac J. Carney. Sentencing set for 7/21/2008 at 9:00 AM before Judge Cormac J. Carney. Documents sealed

Mark Castleman indicted for mail fraud Jury Trial continued to 12/2/2008 09:00 AM before Judge Cormac J. Carney. Jury Trial continued to 12/2/2008 09:00 AM before Judge Cormac J. Carney.

February 4 Les Spitzer also known as Guy Amsalem plead guilty before Judge Cormac J. Carney. Sentencing set for 12/15/2008 10:00 AM before Judge Cormac J. Carney. Documents sealed.

March 11 Jeffrey Greenough plead guilty to 18:1343: Wire Fraud(1) 18:2: Aiding and Abetting and Causing an Act to be Done

before Judge Cormac J. Carney. Sentencing hearing for defendant Jeffrey Greenough to 11/3/2008 09:00 AM before Judge Cormac J. Carney. Documents sealed.

March 11 Lourey McComber plead guilty to 18:1343: Wire Fraud(1) 18:2: Aiding and Abetting and Causing an Act to be Done

before Judge Cormac J. Carney. Stipulation to Continue 46 Sentencing hearing to 8/11/2008 11:00 AM before Judge Cormac J. Carney. Documents sealed.

March 7 Harold Gold plead guilty to 18:1343: Wire Fraud(1) before Judge Cormac J. Carney. Sentencing set for 7/14/2008 09:00 AM before Judge Cormac J. Carney. Documents sealed.

February 12 Nohad Mousa plead guilty to 18:1341 MAIL FRAUD before Judge Cormac J. Carney.

JUDGMENT AND COMMITMENT by Judge Cormac J. Carney as to Defendant Nohad Mousa (1), Count(s) 1, 6 months imprisonment, time served. Pay $100 special assessment. Pay total restitution of $94,775. Interest on restitution ordered waived. Defendant shall be held jointly and severally liable with co-participant George Simon (Docket No 8:07CR00246) for the amount of restitution ordered in this judgment. All fines are waived. 3 years supervised release under terms and conditions of US Probation Office and General Orders 318 and 01-05. Signed by Judge Cormac J. Carney.

Plea Agreement:

http://leasingnews.org/PDF/NohadMousa.pdf

Notably absent in court records is John J. Callaghan, 38, of Warminster, Pennsylvania, who worked at Citicapital. Allegedly there were three or four Citicapital bank officers named. According to a Citicapital press release three were dismissed. They are not named, nor allegations that the fraud was higher up in administration. Subprime and other large losses seem to have taken precedence. According to the US Attorney press release, complaints from Citibank started their investigation.

Here are those originally named by the FBI and US Attorney’s office:

James T. Raeder II, 42, of Mission Viejo, who worked at Capitalwerks/Preferred Lease

Mark McQuitty, 46, of Trabuco Canyon, who worked at Capitalwerks/Preferred Lease

Richard Norris, 60, of Los Angeles, who worked at Capitalwerks/Preferred Lease

Anthony E. Watson, 61, of San Clemente, who worked at Capitalwerks/Preferred Lease

Douglas Cox, 37, of Rancho Santa Margarita, who worked at Capitalwerks/Preferred Lease

Adam Zuckerman, 37, of Laguna Beach, who worked at Brickbanc

Kirk McMahan, 31, of Newport Beach, who worked at Brickbanc

Paul Arnold, 56, of Laguna Hills, who worked at Brickbanc

Geoff Silver, 35, of Calabasas, who worked at Silver Industries

Brian Sime, 29, of Irvine, who worked at Brickbanc

John J. Callaghan, 38, of Warminster, Pennsylvania, who worked at Citicapital

Leo Najera, 28, of Mission Viejo, who worked at ECCI

John Budge, 38, of Sartell, Minnesota, who worked at Bach Business Credit

Leigh Dorand, 42, of Phoenix, who worked at Tech Capital

James Breedlove, 51, of Newport Beach, who worked at Santa Fe Equipment

Mark Castleman, 47, of Chino Hills, who worked at Industrial Information Systems

Les Spitzer, 60, of Grenada Hills, who worked at Pyramid Infinite

George Simon, 38, of Redondo Beach, who worked at Advantage IT Solutions

Jeff Greenough, 48, of Laguna Beach, who worked at Peniche

Troy Worrell, 47, of Newport Beach, who worked at Peniche;

Lourey McComber, 53, of Prescott Valley, Arizona, who worked at Peniche

Harold Gold, 75, of Falmouth, Massachusetts, who worked at Leasing Services

Nohad Mousa, 40, of Anaheim, who worked at Saut Wa Soora, Inc.

Operation Lease Fleece

http://www.leasingnews.org/archives/February%202008/02-25-08.htm#p2

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Lease/Loan State License Requirements

by Kit Menkin

First, consult you local attorney experienced in finance and leasing, not just this list. Leasing News is not licensed to give legal advice anywhere. Any corrections, amendments, or comments regarding

this list is quite welcome.

My name is signed to this column as there are several personal opinions observed from personal experience. Most laws that are broken are not enforced unless by a specific complaint or they are large enough to be noticed, such as NorVergence. Even Operation Lease Fleece was not acted upon until a complaint was filed by Citibank.

The odds of not being caught are in the favor of those who are not licensed or following the laws. This should not be viewed as criticism, but as reality. The government agencies don’t have the staff. Perhaps an analogy can be made by noting only a very small percentage of those who exceed the speed limit, roll through a yellow-red light or stop sign, get caught.

Making the analogy to traffic laws has similarities, but the consequences of being caught may be more severe. Pay a find and/or going to traffic school is normally the first time consequence.

Not in California where the Department of Corporations can make an order to “cease and desist,” meaning you cannot conduct business, even during an appeal to a higher court. It means immediately, not tomorrow or next week, but “right now, “ when the order is handed down. A violation of this is quite serious. There are several pages of such orders. (1)

Violation of the “cease and desist” may result in not being able to obtain a license, meaning you can be shut down by the State of California.

In addition, the ruling can also apply to a license holder who is doing business with a non-license holder. Ignorance of the law is not a good excuse, especially concerning commercial law.

Most city and county clerks, city and county managers, plus other departments learn from each other at local, state and national meetings, share information, and with the aid of the internet, adopt laws and practices working elsewhere. The excuse that I have been doing this for ten years will not protect you, in fact, ignoring present laws only seems to attract new ones to make it more difficult to conduct business.

Kit Menkin, editor

Up-Date:

Nevada reportedly has a “personal property broker” requirement, but the information could not be officially confirmed.

Washington State has a new “loan originator” license, but it appears only to involve real estate transactions. There appears not to be any “commercial license” requirements, although there are consumer finance regulations on line.

Many states do not require that a leasing company or representative be licensed as are the following professions: attorney, certified public accountant, mortgage broker/company, real estate agent/broker/company. Many cities require a business license as well as states require “foreign corporations” and other entities to register or even post their financial statements and/or tax returns on line as does Nevada. This list does not address this.

It should be noted that many states do have laws regarding “advance payments” or “deposits” and all require a sales tax and/or use tax permit if you are paying a vendor for equipment in their state. This list includes such requirements.

There is a definite trend to meld consumer laws with commercial transactions, particularly if a personal guarantee is involved.

It should be pointed out that according to recent statistics, 84% of lease transactions are classified as “capital leases,” meaning they are “finance” transactions. Leases that sell the stream of payments or discount them also get treated as a “finance” and therefore arguments that the transactions are true leases or operating leases may be disqualified for meeting FASB and IRS requirements. It should also be noted from personal experience it is up to the judge to decide if it is an operating lease or capital lease; meaning in a bankruptcy matter or other dispute, the judge decides not a CPA or FASB or IRS agent. There is a “real life” difference between legal, tax, and accounting.

This is not a complete list, which is still in progress, but it has been up-dated as of June 25, 2008.

Arizona: All “advance fee loan brokers” must register annually with the state.

Arizona Revised Statutes, sec. 06-1303-1310 (1996)

Registration process: http://azdfi.gov/Licensing/AppPack/ALB_App.htm

Arkansas: All brokers of “a loan of money, a credit card or a line of credit” may not assess or collect an advance fee. In addition, all brokers must register with the Securities Commissioner, post a surety bond of $25.000 and have a net worth of $25,000.

Arkansas Code Annotate sec. 23-39-401 (1995)

California: "In addition to the lending authority provided by the law, the California Finance Lenders Law provides limited brokering authority. A "broker" is defined in the law as "any person engaged in the business of negotiating or performing any act as broker in connection with loans*made by a finance lender." Brokers licensed under this law may only broker loans to lenders that hold a California Finance Lenders license."

http://www.corp.ca.gov/FSD/lender.

(*any transaction that is not a true rent or meets the accounting and tax rules or is re-sold as a loan or discount or has a nominal purchase option is considered under this nomenclature. ) (2)

Connecticut: Brokers of “unsecured loans” may not assess or collect an advance fee. Connecticut General Statues, sec. 369-616 (1997)

Florida: Brokers of a “loan of money, a credit card, line of credit or related guarantee, enhancement or collateral of any nature” may not assess or collect an advance fee.

Florida Statues, Chapter 687.14 (1992)

Georgia: A broker of “loans of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature” may not assess or collect an advance fee unless such fee is for “actual services necessary to apply for the loan.” Official Code of Georgia Annotated, sec. 7- 7-1 (1992)

Idaho: No fee may be collected unless a loan is actually made.

Idaho Code, sec. 26-2501 (1992) Illinois: Code, 815 ILCS 175/15-5.03 Under the Act, a”loan broker” means any person who, in return for a fee from any person, promises to procure a loan for any person or assist any person in procuring a loan from any third party, or who promises to consider whether or not to make a loan to any person. 815ILCS 175/15-5- 15(a)

Specifically excluded from the application of the Act, however, are (1) any bank …regulated by any service loans for the Federal National Mortgage Association… (3) any insurance producer or company authorized to do business in [Illinois], (4) any person arranging financing for the sale of the person's product, (note that this exception does not apply to any person selling someone else's product and only applies to “the” person's product, implying the exception is for the owner of the product arranging for financing), (5) any person authorized to conduct business under the Residential Mortgage License Act of 1987 and (6) any person authorized to do business in [Illinois] and regulated by the Department of Financial Institutions or the Office of Banks and Real Estate.

“In the event that the Act is violated by the broker, the Secretary of State is empowered by the statute to make investigations and examinations, suspend or evoke the broker's approval, subpoena witnesses, compel the production of books and records, order depositions and obtain temporary restraining orders and injunctions against the broker. In the vent that a violate is found, the Secretary of State may impose a fine in the amount of $10,000 for each violation and the broker shall be liable to any person damaged in the amount of tactual damages plus attorneys fees.”

This appears as standard language on most states.

Iowa: A broker of loans of “money or property” may not assess or collect an advance fee except for a “bona fide third-party fee” and a broker must obtain a bond or establish a trust account and file required documents with the Commissioner or Insurance.

Iowa Code, sec. 535C (19920)

Kansas : Broker is not exempt. Discounter or Lessor is exempt: " ‘Creditor' means any person to whom a loan is initially payable on the face of the note or contract evidencing the loan” is exempt. Anyone who earns a fee or accept a deposit, except a bank, financial institution, discounter or lessor, must be registered.

http://www.securities.state.ks.us/rules/loan.rtf

Kentucky: Brokers of “a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature” may not assess or collect an advance fee.

Kentucky Revised Statutes Annotated, sec. 367.380 (1992)

Louisiana: A broker of loans of “money or property…whether such agreement is styled as a loan, a lease or otherwise” must obtain a surety bond or establish a trust account in the amount of $25,000. A broker may not collect an advance fee but may collect an “advance expense deposit for commercial loans” only for actual expenses incurred in obtaining the loan. Louisiana Revised Statutes Annotated, sec. 9:3574 (1993); Louisiana Revised Statutes Annotated, Sec. 51:1910 (1992)

Maine: No license required: "the regulation of commercial loan brokers does not fall under the jurisdiction of the Maine Bureau of Consumer Credit Protection. Transactions involving two businesses are legal/contractual in nature. Therefore, disputes involving a commercial loan between a business and commercial loan provider or broker must be settled in the court system."

http://www.maine.gov/pfr/consumercredit/faqs/loan_broker_faq.htm#j

Mississippi: A broker or loans of money may not assess or collect an advance fee and can be fined up to $5,000 for each violation. Mississippi Code Annotated, sec. 81-19-17 (1997)

Missouri: A broker of loans of “money or property” may not assess or collect an advance fee. Missouri Revised Statues, sec. 367 300 (19920

Nebraska: A broker of loans of money may not assess or collect an advance fee. Nebraska Revised Statutes, sec. 45-189 (1993)

New Jersey: Brokers of “loans of money” may not assess or collect an advance fee.

New Jersey Rev. Statutes, sec. 17:10B (1992)

New Mexico: New Mexico currently requires Brokers/Lessors to register for Licensing under the NM Mortgage loan Company or Loan Broker Act with the Financial Institutions Division of the State of New Mexico. Banks with Brick and Mortar within the State of New Mexico are exempt.

Prior to licensing applicants must submit the Following:

Articles of Incorporation

Listing of all principals (including management)

A full financial Package (to meet their minimum requirements of liquidity)

Personal financial statements on all principals

Disclosure of all current or past suits (civil or criminal)

Attach a corporate surety bond

Include a $400.00 registration fee renewable yearly

North Carolina: A broker of “loans of money or property…whether such agreement is styled as a loan, a lease or otherwise” must obtain a surety bond or establish a trust account in the amount of $25,000 and obtain a license. North Carolina General Statutes, sec. 66-106 (1992)

North Dakota: Brokers may not accept an advance fee unless the broker is licensed. North Dakota Century Code, 13-04. 1-09.1 (1993)Ohio: Department of Commerce, Division of Financial Institutions

(Certificate to engage in the business of a credit services organization in accordance with the provisions of Sections 4712.01 to 4712.14 of the revised code of Ohio, subject to all the provisions thereof and to the regulations of the division.) Ohio Department of Taxation requires a "Vendor's License" under provision 5739.17 of the Revised Code (...is hereby authorized to sell tangible personal property and selected services at the retail location specified below.) This also makes the lessor responsible for all taxes with penalties for not doing so.

South Carolina: A broker of “a loan of money, a credit card, a line of credit or related guarantee, enhancement or collateral of any kind or nature” may not assess or collect an advance fee. South Carolina Code Annotated, sec. 34-36-10 91992)

(1) California Cease and Desist Information:

http://www.corp.ca.gov/ENF/list/default.asp

(2). California Law

From Tom McCurnin, Attorney, Barton, Klugman & Oetting:

I'd like to clarify this:

1. First the definition of a "broker" under the Financial Lender's Law is not what you and I consider to be a broker. A broker in leasing often includes someone who writes the lease as a lessor and immediately assigns it to the real lender in a table funding deal. Under the Financial Lenders Law, a broker is only someone who negotiates it or assists in the financing, and who is not the actual lessor. If that "broker" was a lessor, he or she would have to be licensed as a Finance Lender. Indeed, if one was licensed as a broker and actually was a lessor, one wonders whether it would have to assign the lease only to a licensed lender. I advise lessor brokers to be licensed as a lender, not a broker.

2. Finance Lenders may assign to anyone, not merely other Financial Lenders. Servicers, for example, do not have to be licensed.

3. There is no definition in the Financial Lenders Law as to what a "true lease" is. Presumably, the Department of Corporations would have to use the Uniform Commercial Code 1-201(37) [e.g., no nominal consideration for residual and 10% put is not nominal] but nowhere is that defined.

(In a response to a question, Tom added :)

If the "broker" is not in the paper trail, e.g., not a lessor (and just negotiating the deal and not a lessor), than yes, the leasing company accepting the paper must be licensed.

If the "broker" is an actual lessor, and is licensed it can assign to anyone to service. e.g., any licensed finance lender can assign to another lender, who does not have to be licensed. The entity originating the deal must be licensed, others down stream do not have to be licensed, as long as the first in the chain is licensed.

California Court of Appeals Strikes Down Choice of Law Provision

Where Lender Was Not Licensed as a Financial Lender

Previously, many counsel for lenders opined that while an out of state lender's activities in the State of California might otherwise require the lender to be licensed under the California Lenders License Law, a choice of law provision in the loan documents (e.g., “This loan shall be governed by the laws of New York”) would make the loan subject to out of state law where no Lenders License is required.

Last week, the California Court of Appeals removed that argument from table ruling that a Nevada lender with a Nevada choice of law provision must nevertheless abide by the California Lenders Law in making loans in California because California had a greater economic interest in the provisions of the loan where the loans were made to California consumers. The Plaintiff alleged that the lender violated the California Lenders Law by failing to disclose a 34% interest rate and sought certification for Class Action status.

The lower court after trial held for the lender, ruling that notwithstanding the alleged violations, California law did not apply to the loans because of a choice of law provision in the loan documents. On appeal, the California Court of Appeal ruled that the California Courts have a greater interest in the California loans than Nevada does, because of the preamble to the Lenders Law, which requires the courts to interpret the provisions liberally, and because that California has a policy of protecting consumer. Calling the Lenders Law “fundamental, unwaivable, and integrated” the Court held that California law would apply and the lower court would determine the liability of the lender on remand.

The case, is Brack v. Omni Loan Company (California Court of Appeal 7-16-08).

Tom McCurnin

Barton, Klugman & Oetting

333 South Grand Ave.

Suite 3700

Los Angeles, CA 90071

Voice: (213) 621-4000

Direct (213) 617-6129

Fax: (213) 625-1832

[headlines]

--------------------------------------------------------------

Sales Make it Happen

Summer Sales---What to do

by Linda P. Kester

This time of year many sales people want to lay back and soak in the sun. However, leasing sales professionals know it's also the calm before the storm. The third and forth quarters of the year are a time of large potential volume. Summer is when we should turn our attention to ramping up application volume for fall sales success.

The following five tips are based on my experience of from selling copiers and equipment leasing services. I clearly remember my first summer working after college. I was shocked. I had to work? Full time? Over the summer? No hanging out at the pool? After a couple summers of poor performance I finally learned what it takes to be successful over the summer, enjoy the season, and meet my year end goals.

1. Desperation has an odor .

Barry J. Moltz writes in his book You Have To Be a Little Crazy ..."Desperation, like perspiration, has an odor". No one wants to do business with someone who is desperate.

If you are feeling frantic because you are not on track to reach your goals, turn that feeling into positive action. Learn to check your anxiety at the door.

During the summer months while you prospect, practice being relaxed, at peace with yourself, confident, emotionally neutral, loose, and free-floating. These are the keys to successful performance in almost everything you do.

2. Offer a joint marketing program with your best vendor.

Vendors are feeling the heat too. Approach your best vendor with a direct marketing plan that includes a monthly payment for a piece of equipment that they really want to move. Offer to split the expenses, or print up a direct mail piece, or offer to pay the postage.

The teamwork will turn into a winning situation for both of you.

(If you control the pricing build in an extra point into each deal to pay for the marketing piece.)

3. Seize the summer.

Have fun. This is equipment leasing not brain surgery! Summer can be a great time to run contest with your vendors and lessees. Give away water pistols, beach chairs, or picnic coolers.

These items are inexpensive and fun. Everyone loves to get them. I would run daily and monthly contests with my vendors and they would love when I came in the door bearing gifts.

Also, when you go on vacation this summer pick up a couple postcards from your destination and mail them to your top five accounts. Your goal is to let your account know that you are thinking of them, and you want to keep your name 'top of mind.'

You can write something like: "Enjoying my vacation here in Sea Isle City , came up with a couple new ideas that could help you sell some more equipment. Looking forward to speaking with you when I get back to the office."

4. Visualize Success

It won't matter that 500 doors may have been slammed in your face, because when door number 501 flies open, revealing a vendor who you develop a great relationship with, who sells to credit worthy lessees, whose average equipment cost is $35K, who has ten salespeople, and abundance flows to you, you'll completely forget about all the other doors.

5. Don't be concerned about "best times to call".

Many sales people use the summer months as an excuse to make less sales calls. They rationalize that everyone is on vacation, so it's a waste of time to prospect.

Sometimes vacation is the best time to make contact! The sales manager who has been putting you off may be away, so you finally get to speak with someone else in the organization who will tell you the real situation.

If you're not prospecting then you have NO chance of reaching anyone !

"No pessimist ever discovered the secrets of the stars, or sailed to an uncharted land, or opened a new heaven to the human spirit."

-- Helen Keller

Linda Kester helps leasing companies obtain more volume.

For more information please visit www.lindakester.com

Sales Makes it Happen articles:

http://www.leasingnews.org/Legacy/index.html

|

|

(This ad is a “trade” for the writing of this column.)

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Sales Representative

|

Sales Representative

We're a progressive leasing company with ambitious growth plans for 2008. If you're a proven sales rep in the small ticket arena and ready to join a winning team, contact us immediately. We offer a competitive comp plan, amazing work environment, and have strong relationships with the major funding sources.

E-mail: recruiter@gen-cap.com .

About the Company: Genesis Commercial Capital, LLC; Irvine, CA |

|

|

VENDOR SALES SPECIALISTS

LEASING SALES PROFESSIONALS

Like selling vendor programs and large transactions?

Enjoy international financing programs?

Prefer the advantages of a commission only environment with the security of health and welfare benefits?

CLICK HERE to find out how to have fun again. |

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

The Bank Loan Squeeze

Credit Today

www.creditToday.net

Small businesses can't fill out a one-page "express" application at Sun Bankcorp and get a $100,000 line of credit within 24 hours anymore. Nor can they take similar advantage of the Business Credit Express program at Bank of America.

"We'd wanted to give small businesses access to capital faster," explained Sun Bankcorp CEO Thomas Geisel ruefully. Then, in the first quarter the New Jersey bank sustained a $1.2 million loss from these loans, and the program was dropped. The much larger Bank of America has had to set aside $3.3 billion for bad loans.

Federal Reserve surveys show that the number of banks tightening their standards for loans to small business has risen from 30 percent in the first quarter to over 50 percent in May. "A lot of banks, especially larger one are really cutting back," notes Research Director Christine Barry of the Aite Group. "It's absolutely harder for small business to get credit today.

Trade creditors we've asked have not yet noticed severe payment delays from customers who may depend of bank credit lines for working capital. But they know it's coming.

"We're kind of bracing for it," Tony Warfield, director of credit services for D&H Distributors, told us. "We're looking at our sweet spot for bad debt—guys that have 50K to 300K credit lines. They fly below the radar of the big guys and above the radar of the real small guys. That kind of lack of lending would really affect their ability to conduct business."

Preparation for the impending storm includes getting plenty of current financial information and making sure there's ample credit insurance coverage in case "something bad happened" to any of them.

"We treat each customer and each relationship on its own merits," Warfield continues. "We're going to look closely at each one. We have the staff and the resources to do that. We're not going to run from them. We're going to see if we can help them through it.

"If it's been a long-term customer who has treated us well, we may be extending terms. We'd be a little more tolerant. If they used to pay us in 34 days and now they're paying in 42 days, we can tolerate that until this blows over."

What about interceding with a customer's bank? "We have conversations with banks from time to time, but generally it's to extol the virtues of our customer. At the customer's request, we'd step in and say we have faith in this guy."

copyright 2008 Credit Today, reprinted with permission:" www.CreditToday.net

Please send to a colleague. We do not spam. We do not add readers to our mailing list unless they request. Visit www.leasingnews.org or e-mail kitmenkin@leasingnews.org

with the subject: please subscribe.

[headlines]

--------------------------------------------------------------

Leasing Association Meetings open to all

Leasing Association Events-Meetings Open to All

Eastern Association of Equipment Lessors

Chapter Meeting Schedule for more information: www.eael.org

EAEL

Tel : 212 809-1602

Fax : 212-809-1650

62 William Street, 4th Floor

New York, NY 10005

| July 8 th |

Atlanta |

Chapter Meeting |

| July 21 |

EAEL Night |

Yankee Stadium |

| October 14 th |

Atlanta |

Chapter Meeting |

| November 4 th |

Buffalo |

Chapter Meeting |

| November 6 th |

Connecticut |

Chapter Meeting |

| November 12 th |

Philadelphia |

Chapter Meeting |

| November 13 th |

Long Island |

Chapter Meeting |

| November 18 th |

New Jersey |

Chapter Meeting |

| December 2 nd |

Boston |

Holiday Party |

| December 3 rd |

Buffalo |

Holiday Party |

| December 4 th |

Baltimore |

Holiday Party |

| December 8 th |

New York City |

Holiday Party |

| December 9 th |

Charlotte |

Holiday Party |

-----------------------------------------------------------------------

July 13,2008

5pm

Sam's Cafe Southwestern

6:40pm Arizona Diamondbacks

vrs. Chicago Cubs

Details: click here to view flyer

-----------------------------------------------------------------------

More information: www.naelb.org

September 5 & 6, 2008

Western Regional Meeeting

Hilton Orange County/Costa Mesa Costa Mesa, Ca.

November 14 & 15, 2008

Eastern Regional Meeting

Renaissance Concourse Hotel

Atlanta, GA

----------------------------------------------------------------------

To view Leasing Association Conferences in 2007, please click here. [headlines]

--------------------------------------------------------------

Leasing News Banner Advertising

The editor tries to place banner ads where they will be read by those the advertisers want to reach, rather than placed at random. News stories that will have an “ill” effect are avoided as best as possible. Often it is the position of the banner ad that attracts more response. This is at the sole discretion of the editor.

Banner ads may appear under the headlines at the choice of the editor, but are not guaranteed. An attempt is made to share them on a rotation basis with other banner advertisers.

Pricing Information |

Price |

Ad Size |

Pixels Size |

Term |

Per Day |

| $350.00 |

6.5W X 1.5 H |

468W X 180H |

21 days |

$14.29 |

| $550.00 |

6.5W X 2.5 H |

468W X 180H |

21 days |

$23.81 |

| $750.00 |

6.5W X 4" H |

468W X 288H |

21 days |

$35.71 |

21 Days on the Leasing News web site ( holidays not included.) They are placed by the editor in an appropriate position near a story that may be more compatible to their ad. They also appear under the headlines in each News Edition on a rotation basis instead of being placed by a news story.

Two month, three month, six month and one year contracts are available with a discount. Ads for employment should be placed in the classified ad section, where it is possible to also appear at the top of the headlines.

Email: Kitmenkin@leasingnews.org

[headlines]

---------------------------------------------------------------

### Press Release ###########################

"World Leasing News is a separate entity and not affiliated with Leasing News "

Equipment Leasing and Finance Association’s

Survey of Economic Activity: Monthly Leasing and Finance Index

MLFI-25 Data Show Year-Over-Year Originations Increased in May

Washington, DC, June 24, 2008— The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $650 billion equipment finance sector, showed overall new business volume for May increased 6.5 percent when compared to the same period 2007.

The MLFI-25 reflects levels of equipment financed and complements other relevant economic indices, including the monthly durable goods report produced by the U.S. Department of Commerce, which reflects new orders for manufactured durable goods and the Institute for Supply Management Index, which reports economic activity in the manufacturing sector. Along with the MLFI-25 these reports provide a complete picture that describes the use of productive assets in the U.S. economy: equipment produced, acquired and financed.

According to the May data, originations month-to-month remained flat, stabilizing at $7.2 billion.

Respondents’ portfolio performance improved: receivables in the less-than-30 day category were 97.0 percent in May, up slightly from the prior month. Charge-offs were almost flat when compared to the prior month, increasing one basis point to .78 percent.

Credit approval ratios (76.2 percent) increased 2.3 percent when compared to the prior month (73.9 percent). Total headcount has been relatively stable (showing only a slight decrease) since February 2008.

“Those expecting to see evidence of an overall slowdown in commercial equipment finance activity (or a significant decline in portfolio performance) as a result of the mortgage crisis, rising energy and food prices or a general economic slowdown may be surprised by this report,” said William Verhelle, Chief Executive Officer, First American Equipment Finance, Fairport, NY. “Only in specific segments such as trucking, real estate and among some small businesses is there evidence of significant increased delinquencies and reduced new equipment financing activity. There does not yet appear to be an overall slowdown in the pace at which businesses are financing new capital equipment, nor is there a material deterioration in the portfolio performance of existing capital equipment receivables due to commercial lenders," said Verhelle.

"It's possible that businesses are financing more capital equipment acquisitions to preserve cash, thereby accounting for the continued strong level of equipment loan originations. But many expected a more significant increase in charge-offs and over 30 day receivables," Verhelle said. Verhelle said. First American Equipment Finance is a participant in ELFA’s MLFI-25.

“Demand in the equipment finance sector appears to be picking up after an initial decline in the first quarter and credit quality shows little deterioration; business volume and portfolio quality are holding their own,” said Kenneth E. Bentsen, Jr., ELFA President. “So far, we seem to be weathering the storm,” said Bentsen.

MLFI-25 Methodology

ELFA produces the MLFI-25 report to help member organizations achieve competitive advantage by providing them with leading-edge research and benchmarking information which supports strategic business decision making. The report is also a barometer of the trends in U.S. capital equipment investment.

Five components are included in the MLFI-25 survey: new business volume (originations); aging of receivables; charge-offs; credit approval ratios (approved vs. submitted) and headcount for the equipment finance business.

The MLFI-25 provides metrics reflecting monthly commercial equipment lease and loan activity as reported by participating ELFA member equipment finance companies representing a cross section of the equipment finance sector including small ticket, middle market, large ticket, bank, captive and independent leasing and finance companies. Based on hard survey data, the responses mirror the economic activity of the broader equipment finance sector, which contributes to the representation of current business conditions nationally.

Results of each MLFI-25 are posted on the ELFA website and in ELT, the Magazine of Equipment Leasing and Finance. To access ELFA's comprehensive industry information, please visit

http://www.elfaonline.org/ind/research/

ELFA MLFI-25 Participants

ADP Credit Corporation

Bank of America

Bank of the West

Canon Financial Services

Caterpillar Financial Services Corporation

CIT

Citicapital

De Lage Landen Financial Services

Fifth Third Bank

First American Equipment Finance

GreatAmerica

Hitachi Credit America

HP Financial Services

Irwin Financial

John Deere Credit Corporation

Key Equipment Finance

Marlin Leasing Corporation

National City Commercial Corp.

RBS Asset Finance

Regions Equipment Finance

Siemens Financial Services

US Bancorp

US Express Leasing

Verizon Capital Corp

Volvo Financial Services

Wells Fargo Equipment Finance

About the Equipment Leasing and Finance Association (ELFA)

The Equipment Leasing and Finance Association is the trade association that represents companies in the $650 billion equipment finance sector, which includes financial services companies and manufacturers engaged in financing the utilization and investment of and in capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its over 700 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers.

For more information, please visit www.elfaonline.org ELFA is also the premier source for statistics and analyses covering the equipment finance sector. To access ELFA's comprehensive industry information, please visit http://www.elfaonline.org/ind/research/

[headlines]

### Press Release ###########################

--------------------------------------------------------------

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

News Briefs---- Federal Reserve expected to leave key rate at 2%

http://www.usatoday.com/money/economy/2008-06-23-fed-meeting_N.htm

Four years of gains in home prices wiped out

http://www.marketwatch.com/news/story/four-years-home-price-gains-wiped/story.aspx

?guid=%7BEB1B0595-37FA-4542-88A2-CE470ACAF101%7D&dist=msr_13

UPS stock falls to 5-year low

http://www.ajc.com/business/content/business/stories/2008/06/24/ups_earnings.html

Illinois to Sue Countrywide

http://www.nytimes.com/2008/06/25/business/25mortgage.html?_r=1&hp=&adxnnl=

1&oref=slogin&adxnnlx=1214370227-/SqJOihb4gEWqadWhfCnNw

[headlines]

----------------------------------------------------------------

You May have Missed--- World now has 10 million millionaires, report says

http://biz.yahoo.com/ap/080624/world_wealth.html?.v=1

[headlines]

----------------------------------------------------------------

“Gimme that Wine” Margaret Duckhorn of Duckhorn Wine Company Elected 2008-09 Wine Institute Chairman

http://biz.yahoo.com/prnews/080619/clth033.html?.v=101

"The Sipping Point" Demystifies Wine for Overwhelmed Wine Drinkers

http://www.prweb.com/releases/2008/6/prweb1029264.htm

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

The London International Vintners Exchange (Liv-ex) is an electronic exchange for fine wine.

http://www.liv-ex.com/

[headlines]

----------------------------------------------------------------

Calendar Events This Day Bhutan: National day.

National holiday observed

https://www.cia.gov/library/publications/the-world-factbook/geos/bt.html

Log Cabin Day

http://holidayinsights.com/moreholidays/June/logcabinday.htm

Mozambique: Independence Day

National holiday. Commemorates independence from Portugal in 1975.

https://www.cia.gov/library/publications/the-world-factbook/geos/mz.html

National Catfish Day

http://holidayinsights.com/moreholidays/June/catfishday.htm

National Strawberry Parfait Day

Slovenia: National day

Public holiday. Commemorates independence from the former Yugoslavia in 1991.

https://www.cia.gov/library/publications/the-world-factbook/geos/si.html

Virginia: Ratification Day.

10th state to ratify the constitution in 1788.

Saint feast Days

http://www.catholic.org/saints/f_day/jun.php

[headlines]

----------------------------------------------------------------

The first US Marines wore high leather collars to protect their necks from sabres, hence the name "leathernecks."

[headlines]

----------------------------------------------------------------

Today's Top Event in History 1959 - CBS journalist Edward R. Murrow interviewed his 500th -- and final -- guest on "Person to Person": actress Lee Remick. Just hours before this final broadcast, Murrow had presented his last news broadcast on the CBS radio network. CBS-TV had reportedly made $20 million from Murrow’s "Person to Person" series.

[headlines]

----------------------------------------------------------------

This Day in American History 1630—Governor Winthrop introduced the fork to American dining.

Prior to using a fork, the custom was to eat with your sharp knife or hands.

1788-Virginia became the 10th state to ratify the Constitution. Jamestown, was the first permanent English settlement in North America, The state, also known as Old Dominion, was named after the "Virgin Queen", Elizabeth I of England. Virginia and its capital, Richmond, have played major roles in American history. Like West Virginia, it names the cardinal as the state bird. The official state flower of Virginia is the flowering dogwood.

1844-President John Tyler married Julia Gardiner, daughter of a New York State Senator, at the Church of the Ascension, New York City. He became the first president to be married in the White House. His first wife, Letita Christian Polk, whom he had married on March 29,1813, had died on September 10,1842, in the White House.

1862-Earlier this month, at Fair Oaks, Virginia, Confederate forces under General Joseph E. Johnston stalled the Union advance toward Richmond in General George B. McClellan’s Peninsular campaign. Johnston was wounded at Fair Oaks and Robert E. Lee was then appointed commander of the Confederate Army of Northern Virginia. He then launched a series of engagements on this date that became known as the Seven Days Campaign. Battles at Oak Grove, Gaine’s Mill’s, Garnett’s Farm, Golding’s Farm, Savage’s Station, White Oak Swamp and finally Malvern Hill left more than 36,000 casualties on both sides. Despite losing the final assault at Malvern Hill, the Confederates under the leadership of General Lee succeeded in preventing the much larger Union army from taking Richmond.

1862-First day of the seven-day battle at Oak Grove

http://www2.cr.nps.gov/abpp/battles/va015.htm

1864-President Abraham Lincoln signs bill providing schools for Black children.

1864 -A TRIP TO THE CLIFF HOUSE by Mark Twain written for The San Francisco Daily Morning Call

If one tire of the drudgeries and scenes of the city, and would breathe the fresh air of the sea, let him take the cars and omnibuses, or, better still, a buggy and pleasant steed, and, ere the sea breeze sets in, glide out to the Cliff House. We tried it a day or two since. Out along the rail road track, by the pleasant homes of our citizens, where architecture begins to put off its swaddling clothes, and assume form and style, grace and beauty, by the neat gardens with their green shrubbery and laughing flowers, out where were once sand hills and sand-valleys, now streets and homesteads. If you would doubly enjoy pure air, first pass along by Mission Street Bridge, the Golgotha of Butcherville, and wind along through the alleys where stand the whiskey mills and grunt the piggeries of "Uncle Jim." Breathe and inhale deeply ere you reach this castle of Udolpho, and then hold your breath as long as possible, for Arabia is a long way thence, and the balm of a thousand flowers is not for sale in that locality. Then away you go over paved, or planked, or Macadamized roads, out to the cities of the dead, pass between Lone Mountain and Calvary, and make a straight due west course for the ocean. Along the way are many things to please and entertain, especially if an intelligent chaperon accompany you. Your eye will travel over in every direction the vast territory which Swain, Weaver & Co. desire to fence in, the little homesteads by the way, Dr. Rowell's arena castle, and Zeke Wilson's Bleak House in the sand. Splendid road, ocean air that swells the lungs and strengthens the limbs. Then there's the Cliff House, perched on the very brink of the ocean, like a castle by the Rhine, with countless sea-lions rolling their unwieldy bulks on the rocks within rifle-shot, or plunging into and sculling about in the foaming waters. Steamers and sailing craft are passing, wild fowl scream, and sea-lions growl and bark, the waves roll into breakers, foam and spray, for five miles along the beach, beautiful and grand, and one feels as if at sea with no rolling motion nor sea-sickness, and the appetite is whetted by the drive and the breeze, the ocean's presence wins you into a happy frame, and you can eat one of the best dinners with the hungry relish of an ostrich. Go to the Cliff House. Go ere the winds get too fresh, and if you like, you may come back by Mountain Lake and the Presidio, overlook the Fort, and bow to the Stars and Stripes as you pass.

1864-The Union Army facing mounds of pickets and bunkers decides to dig tunnels under this obstructions

1868-Congress authorized government laborers a workday of eight hours, which was signed into law by President Andrew Johnson this day, providing, among other things, that “eight hours shall constitute a day’s work for all laborers, workmen, and mechanics who may be employed by or on behalf of the Government of the Untied States.

1876-Lieutenant Colonel George Armstrong Custer, leading military forces of more than 200 men, attacked an encampment of Sioux Indians led by Chiefs Sitting Bull and Crazy Horse near Little Bighorn River, MT. Custer and 264 men of the Seventh Calvary were slaughtered in the brief battle (about two hours) of Little Bighorn. One horse, named Comanche, is said to have been the only survivor among Custer’s forces. This brought more repression by both the US Army and Federal Government to the American Indians in the next fifty years. It was common to “ Remember Custer’s Last Stand.” It was common for military commanders to attack the Indians out-numbered with firepower and from three directions. It is said one of his units halted in the three prong attack, and the other reacted by holding back and not proceeding with the long proved strategy, allowing the Indians to “divide and conquer.” He was considered an American hero. It was not until present time that he was considered an egoist trying to build his reputation in the military (very common in that day, and perhaps until recent times.) Military historians find no errors in the strategy of the attack, except for the execution (This is from accounts from interviews with the Indians, including scouts who were dismissed before the attack and watched the battle, plus papers and diaries from the soldiers. Other historians believe he should have waited for reinforcements from General Alfred H. Terry, who discovered the bodies)

http://memory.loc.gov/ammem/today/jun25.html

1886- birthday of Henry H. “Hap” Arnold, US general and commander of the Army Air Force in all theaters throughout WWII, Arnold was born at Gladwyne, PA. Although no funds were made available, as early as 1938 Arnold was persuading the US aviation industry to step up manufacturing of airplanes. Production grew from 6,000 to 262,000 per year from 1940—44. He supervised pilot training and by 1944 Air Force personnel strength had grown to two million from a prewar high of 21,000. Made a full general in 1944, he became the US Air Force’s first five-star general when the Air Force was made a separate military branch equal to the Army and Navy. Arnold died Jan 15, 1950, at Sonoma, CA.

1874-birthday of Rose O’Neill, born at Wilkes-Barre, PA. Her career included work as an illustrator, author and doll designer, the later gaining her commercial success with the Kewpie Doll. In 1910, “

The Ladies Homes Journal” devoted a full page to her Kewpie Doll designs, which were a marketing phenomenon for three decades. Died at Springfield, MO, April 6, 1944.

1881-Birthday of Crystal Eastman –said to be one of the most influential and “radical” U.S. women of her day. She was an attorney, feminist, labor reformer, peace advocate, birth control advocate, suffragist, and worker for women's financial equality in both the U.S. and England. She was active in the Political Equality League, Congressional Union for Woman Suffrage, Women's Peace Party, the Feminist Congress, and a member of the famed Heterodoxy Club of New York.

http://www.spartacus.schoolnet.co.uk/USAWeastman.htm

http://www.library.csi.cuny.edu/dept/history/lavender/386/ceastman.html

1908-birthday of African-American Beatrice Murphy, editor and author. http://www.addall.com/Browse/Detail/0836960335.html

1910- The Mann Act was passed by the US Congress. It prohibited the transportation of females across state or internationally lines for immoral purposes. It was said to be an attempt to curb the huge "white slave" and prostitution business in the U.S. and the world. At the time it was estimated that there were more than 600 recognized houses of prostitution in Chicago alone. New Orleans was "closed" to naval personnel because of the number of brothels. But the situation was nothing new With the change from rural to city living caused by the industrial revolution, more and more women were on their own without family to help support them. It was said that women were “imported” for prostitution, however, the custom had been going on since France brought in French prostitutes in the 17th century to marry French soldiers and settlers in Louisiana. The most famous prosecutions under the law were those of Charlie Chaplin in 1944 and Chuck Berry in 1962, who took unmarried women across state lines for "immoral purposes." Chaplin was acquitted but left the country under FBI director J. Edgar Hoover's threats. Berry was convicted and spent two years in the prime of his musical career in jail. After Berry's conviction, the Mann Act was enforced only sparingly and was finally removed from the books in 1986.

1918-Birthday of Marion Alice Orr, member of the Canadian Aviation Hall of Fame. MAO was one of the most noted pilots for the RCAF in England during World War II. She ferried military planes - some terribly shot up and dangerous to fly - from landing strips to repair locations and back. Her flights always subject to German fighter interception as well as the dangers from the planes disintegrating in air. The women also flew planes that had made their regular night sorties over Germany from air fields close to the channel to safer locations to the west of England and then returned them to the eastern air bases that evening. A number of women who ferried the planes died. In Canada, she was the first woman to fly and instruct helicopters. For further information on this remarkable woman and other Canadian flyers, see

1922-birthday of Bill Russo, jazz composer, arranger and trombonist, best known perhaps for playing with Stan Kenton. While I was going to Julliard School of Music, I studied privately with him in New York. He was teaching me fundamentals of big band arranging, starting with six and seven chord harmonies.

1925-birthday of accordion player Clifton Chewier, King of Zydeco, Opelousas,LA. Zydeco is the party music of the black Cajuns of Louisiana, and is a mixture of blues, French folk songs, country, R'n'B and rock 'n' roll. Chenier usually played an accordion and sang in a mixture of French and English. He often wore a jeweled crown on stage, and appeared at blues festivals and rock clubs all over North America. He was largely responsible for the popularity of zydeco outside his native Louisiana. Chenier, who was severely diabetic, died on December 12th, 1987, at the age of 62.

http://www.allmusic.com/cg/amg.dll?p=amg&sql=B485gtq0ztu43~C

http://www.coldbacon.com/music/clifton.html

http://www.allmusic.com/cg/amg.dll?p=amg&sql=Bxt1uakjk5m3z~C

1928 –Trombonist, composer, arranger Bill Russo birthday. I took private lessons from him in New York City 1958

1935-birthday of vocalist Eddie Floyd, Montgomery, Al

http://www.history-of-rock.com/eddie_floyd.htm

http://covers.wiw.org/artist/Eddie+Floyd

1941-Glenn Miller records Adios on Bluebird.

1941-Fair Employment practices Commission established.

1941 - Joe DiMaggio ran his hitting streak to 45 straight games, with a home run off Boston’s Heber Newsome. The ‘Yankee Clipper’ broke the record set by Wee Willie Keeler in 1897.

1942-- Major General Dwight D. Eisenhower takes command of U.S. forces in Europe. Although Eisenhower had never seen combat during his 27 years as an army officer, his knowledge of military strategy and talent for organization were such that Army Chief of Staff General George C. Marshall chose him over nearly 400 senior officers to lead U.S. forces in the war against Germany. After proving himself on the battlefields of North Africa and Italy in 1942 and 1943, Eisenhower was appointed supreme commander of Operation Overlord--the Allied invasion of northwestern Europe

1944---Top Hits

I’ll Be Seeing You - The Tommy Dorsey Orchestra (vocal: Frank Sinatra)

I’ll Get By - The Harry James Orchestra (vocal: Dick Haymes)

Swinging on a Star/Going My Way - Bing Crosby

Straighten Up and Fly Right - King Cole Trio

1944--*KELLY, JOHN D. Medal of Honor

Rank and organization: Technical Sergeant (then Corporal), U.S. Army, Company E, 314th Infantry, 79th Infantry Division. Place and date: Fort du Roule, Cherbourg, France, 25 June 1944. Entered service at: Cambridge Springs, Pa. Birth: Venango Township, Pa. G.O. No.: 6, 24 January 1945. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty. On 25 June 1944, in the vicinity of Fort du Roule, Cherbourg, France, when Cpl. Kelly's unit was pinned down by heavy enemy machinegun fire emanating from a deeply entrenched strongpoint on the slope leading up to the fort, Cpl. Kelly volunteered to attempt to neutralize the strongpoint. Arming himself with a pole charge about 10 feet long and with 15 pounds of explosive affixed, he climbed the slope under a withering blast of machinegun fire and placed the charge at the strongpoint's base. The subsequent blast was ineffective, and again, alone and unhesitatingly, he braved the slope to repeat the operation. This second blast blew off the ends of the enemy guns. Cpl. Kelly then climbed the slope a third time to place a pole charge at the strongpoint's rear entrance. When this had been blown open he hurled hand grenades inside the position, forcing survivors of the enemy guncrews to come out and surrender The gallantry, tenacity of purpose, and utter disregard for personal safety displayed by Cpl. Kelly were an incentive to his comrades and worthy of emulation by all.

1944--OGDEN, CARLOS C. Medal of Honor

Rank and organization: First Lieutenant, U.S. Army, Company K, 314th Infantry, 79th Infantry Division. Place and date: Near Fort du Roule, France, 25 June 1944. Entered service at: Fairmont, Ill. Born: 19 May 1917, Borton, Ill. G.O. No.: 49, 28 June 1945. Citation: On the morning of 25 June 1944, near Fort du Roule, guarding the approaches to Cherbourg, France, 1st Lt. Ogden's company was pinned down by fire from a German 88-mm. gun and 2 machineguns. Arming himself with an M-1 rifle, a grenade launcher, and a number of rifle and handgrenades, he left his company in position and advanced alone, under fire, up the slope toward the enemy emplacements. Struck on the head and knocked down by a glancing machinegun bullet, 1st Lt. Ogden, in spite of his painful wound and enemy fire from close range, continued up the hill. Reaching a vantage point, he silenced the 88mm. gun with a well-placed rifle grenade and then, with handgrenades, knocked out the 2 machineguns, again being painfully wounded. 1st Lt. Ogden's heroic leadership and indomitable courage in alone silencing these enemy weapons inspired his men to greater effort and cleared the way for the company to continue the advance and reach its objectives.

1945- singer Carly Simon was born in New York City, the daughter of publishing magnate Richard Simon of Simon and Schuster. She began singing with her sister Lucy when the two were in college. Simon began her solo career in 1969, and hit the top 10 two years later with "That's the Way I've Always Heard It Should Be." In 1972, her recording of "You're So Vain," featuring a guest appearance by Mick Jagger, hit number one. That year she married James Taylor, and the two combined in 1974 for the hit single "Mockingbird," a remake of a '60s R'n'B success by Inez and Charlie Foxx. Carly Simon suffers from stage fright and rarely appears in concert. In 1981, she filed for divorce from Taylor.

http://www.carlysimon.com/

http://www.carlysimon.net

1948-Boxer Joe Louis defended his heavyweight championship by knocking out Jersey Joe Walcott in the 11th round of a fight at Yankee Stadium. This was Louis’s last title defense after which he retired.

1950-Forces from northern Korea invaded southern Korea, beginning a civil war. US ground forces entered the conflict June 30. An armistice was signed at Panmunjom July 27,1953, formally dividing the country into two---North Korea and South Korea.

1949 - Entertainer Fred Allen closed out his amazing radio career. Allen was making the transition to TV. His final radio guest was his old pal, Jack Benny. order. Benny went on to become a television legend Allen’s caustic wit didn’t play well on TV and he found himself out of the medium in short time.

1950-The Korean War (1950-1953) began when North Korean forces launched an invasion across the 38th parallel into South Korea. The UN ordered an immediate cease-fire and withdrawal of invading forces.

1951-CBS broadcast the first color television program on June 25, 1951. The program was strictly experimental, as no viewers had color televisions at the time: The four- hour program could only be viewed on the forty color television sets at CBS. The first all-color station, WNBQ-TV in Chicago, began showing color programs on November 3, 1955, and switched to color entirely, even for local programs, by April 15, 1956.

1952---Top Hits

Kiss of Fire - Georgia Gibbs

I’m Yours - Don Cornell

Be Anything - Eddy Howard

The Wild Side of Life - Hank Thompson

1959 - CBS journalist Edward R. Murrow interviewed his 500th -- and final -- guest on "Person to Person": actress Lee Remick. Just hours before this final broadcast, Murrow had presented his last news broadcast on the CBS radio network. CBS-TV had reportedly made $20 million from Murrow’s "Person to Person" series.

1960---Top Hits

Cathy’s Clown - The Everly Brothers

Everybody’s Somebody’s Fool - Connie Francis

Swingin’ School - Bobby Rydell

Please Help Me, I’m Falling - Hank Locklin

1961 - Pat Boone spent this day at number one for one last time with "Moody River". Boone, a teen heart-throb in the 1950s, had previously walked his way up the music charts, wearing white buck shoes, of course, with these other hits: "Ain’t That a Shame", "I Almost Lost My Mind", "Don’t Forbid Me", "Love Letters in the Sand" and "April Love

1962- the U.S. Supreme Court ruled that a prayer read aloud in public schools violated the 1st Amendment’s separation of church and state. The court again struck down a law pertaining to the First Amendment when it disallowed an Alabama law that permitted a daily one-minute period of silent mediation or prayer in public schools in 1985. This decision has been seen by each new Supreme court and is considered a quite a controversy to this day.

1964 - "A Hard Day’s Night" was released by United Artists Records. The album featured all original material by The Beatles and became the top album in the country by July 25, 1964.

1965 - "Mr. Tambourine Man", by The Byrds, reached the number one spot on the pop music charts. The song was considered by many to be the first folk-rock hit. The tune was written by Bob Dylan, as were two other hits for the group: "All I Really Want to Do" and "My Back Pages". The group of James Roger McGinn, David Crosby, Gene Clark, Chris Hillman and Mike Clarke charted seven hits. The Byrds were inducted into the Rock and Roll Hall of Fame in 1991.

1967-the first worldwide live television program was “our World,” shown in 26 countries via four satellites. The two-hour production involved 10,000 technicians and 300 cameras in 14 countries on five continents. It opened with glimpses of births in Mexico, Canada, Denmark, and Japan. The rest of the program featured clips of Leonard Bernstein and Van Cliburn rehearsing a Rachmaninoff concerto at New York City’s Lincoln Center, the Beatles recording a song in London, a rehearsal of Lohengrin in Bayreuth, Germany, the making of a movie in Italy, and other presentations. The American outlet was the National Education Television network. The program cost about $5 million.

1968---Top Hits

This Guy’s in Love with You - Herb Alpert

MacArthur Park - Richard Harris

The Look of Love - Sergio Mendes & Brazil ’66

Honey - Bobby Goldsboro

1968---San Francisco Giant Bobby Bonds ( not Barry ) hits a grand slam in his firstmajor league game.

1969 - The Hollies record ``He Ain't Heavy, He's My Brother,'' with Elton John playing piano. The song reaches No. 7 on Billboard's singles chart.

1969-Pancho Gonzalez and Charlie Pasarell played the longest match in Wimbledon history. After 112 games and 5 hours, 12 minutes, Gonzales emerged triumphant.

1976---Top Hits

Silly Love Songs - Wings

Get Up and Boogie (That’s Right) - Silver Convention

Misty Blue - Dorthy Moore

El Paso City - Marty Robbins

1976 - The CN Tower opened in Toronto, Ontario, Canada. At 1,815 feet, 5 inches high, the tower is the world's tallest building and the tallest freestanding structure.

1979 - Muhammad Ali announced that he was retiring as world heavyweight boxing champion. The 37-year-old fighter said, “Everything gets old, and you can’t go on like years ago.” The “float like a butterfly, sting like a bee” act was no more.

1984---Top Hits

The Reflex - Duran Duran

Dancing in the Dark - Bruce Springsteen

Self Control - Laura Branigan

When We Make Love – Alabama

1987 - “Just the facts, ma’am. Thank you.” "Dragnet", starring Dan Aykroyd in the Jack Webb role of Sgt. Joe Friday; and Tom Hanks in the Harry Morgan role of detective Stribeck, opened around the U.S. The movie became the first Hollywood film to feature a "condom-conscious" bedroom scene ... just right for the social mores of the 1980s. "Dragnet" was a smash theatrical hit, as it had been on radio and TV in the 1940s and 1950s. “This is the city...”

1988---Top Hits

Dirty Diana- Michael Jackson

Foolish Beat- Debbie Gibson

The Flame- Cheap Trick

Make It Real- The Jets

1990 - "The Arizona Republic" reported it was 122 degrees in Phoenix, hot enough to cancel some flights at the airport.

1990-In the case of Cruzan v Missouri, the Supreme Court, in a 5-4 ruling, upheld the constitutional right of a person whose wishes are clearly known to refuse life-sustaining medical treatment.

1993- Bruce Springsteen was a surprise guest on David Letterman's final show as host of NBC's "Late Night." Letterman, after more than 11 years at NBC, began a similar show on CBS two months later. David Letterman was born in Indianapolis, Indiana, in 1947. From an early age, he aspired to host his own talk show. He became a stand-up comic and a wacky weatherman on a local TV station. After years on the stand-up comedy circuit, he made his first appearance on The Tonight Show in 1978 and served as the program's guest host 50 times. In 1980, Letterman had a short-lived morning variety show, The David Letterman Show, which won two Emmys.

He launched his popular late-night TV show in 1982. His offbeat humor and goofy stunts spoofed traditional talk shows. Antics like wearing a Velcro suit and throwing himself at a wall or tossing eggs into a giant electric fan, Letterman gained a large following, especially among college students. Regular features included his "Top Ten List," "Stupid Pet Tricks," and tours of the neighborhood. He also frequently wandered with his camera into other NBC shows in progress. Over more than 11 years, the show won five Emmys and 35 nominations.When Carson announced his retirement in 1992, Letterman and rival comic Jay Leno engaged in a heated battle for the coveted host slot. When Letterman was passed over, he left NBC for CBS, where his new program, Late Show, outperformed Leno's show almost every week in its first year. However, Leno pulled ahead the following year and maintained a strong lead. Letterman underwent emergency heart surgery in 2000 and was off the show for five weeks. He is back on, funny than ever, and that’s where we get “Will it Float or Will it Sink?”

1993—Top Hits

That s The Way Love Goes, Janet Jackson

Weak- SWV

Knockin Da Boots- H-Town

Freak Me- Silk

1993- John Dean begins testimony before Senate Watergate Committee, perhaps the turn in the hearings as “Deep Throat” begins to talk to two reporters at the Washington Post.

1996-A truck bomb exploded near Dhahran, Saudi Arabia, killing 19 American military personnel and wounding more than 300 people. Bombed was an apartment complex that housed about 2500 Americans. The CIA stated there were no solid clues about the identity of the perpetrators.

1996- American Airlines announced its Internet ticket purchasing system was ready for prime time. The airline also said it would introduce ticketless travel in September, “freeing its customers from worry about losing their airline tickets.” Eventually ticket agents would lose their minor commission, too, as the airlines learned they could oversell airplane seats easier via the computer.

1997-The National Hockey League announced that it had granted expansion franchises to four cities: Nashville(to begin play in 1998-99), Atlanta(1999-2000), Minneapollis-St. Paul and Columbus(both 2000-2001). The Nashville team chose the nickname Predators. Atlanta, the Thrashers, the Twin Cities as the Minnesota Wild and Columbus as the Blue Jackets. At the same time, the league’s Board of Governors approved the move of the Hartford Whalers to North Carolina where they became known as the Hurricanes.

1998—Top Hits

The Boy Is Mine- Brandy

You re Still The One- Shania Twain

Too Close- Next

My All- Mariah Carey

1998 - Windows 98 was released. Microsoft used the slogan, “Works better. Plays better.” The company said the new operating system would bring an “increased computer experience by providing a rich feature set for a wider variety of users than ever before.”

1999 - The San Antonio Spurs earned their first NBA (National Basketball Association) title in their 26-year history by beating the New York Knicks 78-to-77. That gave the Spurs the series 4 games to 1.

2002—Top Hits

Hot In Herre-Nelly

Without Me,-Eminem

Foolish- Ashanti

I Need A Girl (Part One)- P. Diddy Featuring Usher & Loon

[headlines]

--------------------------------------------------------------

Baseball Poem

Baseball Riddle

All professional

Leagues forbid its

Use.

Made to be

Indestructible.

Never cracks.

Unfilled inside the

Middle.

Baseball’s

Attempt to save

Trees.

Written by “ Dan Zamudio”

Printed in “Catcher in the Wry,”

Baseball Poem

McFarland and Company

[headlines]

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

[headlines]

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

[headlines]

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

[headlines]

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

http://www.weather.gov/

[headlines]

--------------------------------------------------------------

News on Line---Internet Newspapers Monterey, California

http://www.montereyherald.com/

--------------------------------

[headlines] |