Tuesday, May 2, 2006 Teacher's Day

(see other calendar events ) Headlines--- Award at Dana Point Conference ######## surrounding the article denotes it is a “press release”

-------------------------------------------------------------------------------

To be presented this Friday at the noon luncheon of the United Association of Equipment Leasing Conference in Dana Point, California by Christopher “Kit” Menkin, editor/publisher Leasing News. ------------------------------------------------------------------------------- Classified Ads---Credit

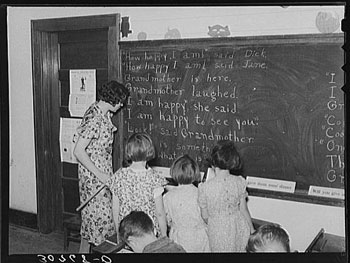

1937---Rural schoolchildren and teacher. Williams County, North Dakota. Atlanta, GA. Boston Ma. Corona, CA. Fort Lee NJ. Irvine, CA. Los Angeles, CA. New Jersey, N.J. New York, NY. Sausalito, CA. Orange, CA. Senior Credit Officer For a full listing of all “job wanted” ads, please go to: To place a free “job wanted” ad, please go to: ------------------------------------------------------------------------------

Archives from the Past---May 2, 2000 #1—Kropschot Announcement Good News!!!!! See Bruce at the UAEL S.F. Conference This Weekend ! ! ! BRUCE KROPSCHOT RE-ESTABLISHES KROPSCHOT FINANCIAL SERVICES Bruce Kropschot announced today that he has re-established Kropschot Financial Services, which he founded in 1986 as a merger and acquisition advisory firm for the equipment leasing and financing industry. Mr. Kropschot left the firm in late 1997 to become Vice Chairman - Mergers and Acquisitions of UniCapital Corporation, which he helped acquire 17 equipment casing businesses. and go public in May 1998 in the largest roll-up initial public offering ever Effective April 1.2000, Mr. Kropschot retired from UniCapital Corporation, where he was also President of UniCapital Business Credit Group. Under Mr. Kropschot's leadership. Kropschot Financial Services arranged over 125 acquisitions of equipment leasing and specialty finance businesses from 1986 through 1997 and was ranked as the leading provider of merger and acquisition advisory services in this sector, Mr. Kropschot stated, "I am pleased to be devoting again all of my attention to M&A activities. “There is a need for an advisory firm that understands the opportunities and the challenges unique to the equipment leasing market. When representing owners in the sale of their businesses. Kropschot Financial Services will riot only be looking to maximize the sale price but also to find a buyer under whom the business and its employees can achieve their potential. When representing acquisition searches for buyers, we will utilize our vast knowledge of the leasing industry and its many participants to locate those companies that best fit the defined acquisition parameters. The firm will also arrange financing for equipment leasing and specialty finance companies and perform business valuations. Mr. Kropschot indicated that Kropschot Financial Services would soon be making an announcement regaining other key executives who will be joining the firm. Bruce Kropschot has been in the equipment leasing industry for nearly 30 years. Prior to founding Kropschot Financial Services, he was Executive VP of HBE Leasing Corporation and President and an owner of Master Lease Corporation (now known as De Lage Landen Financial Services). He is a CPA and holds BBA and MBA degrees in accounting and finance from the University of Michigan. He has served on the Board of Directors of the Equipment Leasing Association of America, United Association of Equipment Leasing and Eastern Association of Equipment Lessors and is a founding member of International Merger & Acquisition Professionals, an organization of leading M&A intermediaries located throughout North America and Europe Mr. Kropschot can be reached in his Stuart, FL. office at (772-228-9808) or through e-mail at bkropschot@aol.com. See Bruce at the UAEL S.F. Conference This Weekend ! ! ! (Unfortunately Bruce will not be at the Dana Point Conference: “Kit--Sorry I won't be able to attend the UAEL convention. It conflicts with the reunion of my college baseball team. (We won the College World Series in 1962 by beating your local Santa Clara team in a 15 inning thriller.)” Bruce Kropschot -- #2 -- Bennett 30 Year Sentence (Six years ago a larger scandal than NorVergence with a total of $700 million, 12,000 scammed ) Bennett Receives 30-Year Prison Sentence Patrick Bennett, the accused mastermind of one of the biggest Ponzi schemes in U.S. history, was sentenced Friday (4/28/00) to 30 years in prison. Bennett was chief financial officer of the family-owned Bennett Funding Group, a Syracuse, NY, firm that allegedly bilked some 12,000 people out of $700 million. U.S. District Judge John S. Martin postponed sentencing several times to allow Bennett and his wife, Gwen, more time to turn over assets to a trustee for the investors. Last month, the judge offered to sentence Bennett to 20 years on the condition he turn over additional assets, such as the sprawling upstate New York horse farm registered in his wife's name. But Judge Martin said in Manhattan federal court that Bennett had failed to turn over assets and that "damage was done, and continues to be done, to people who lost life savings while [Gwen Bennett] lives in luxury." Before the sentencing, Bennett called the judge's handling of the case "illegal, unethical and un-American" and continued to maintain his innocence. Bennett was convicted in June on 42 counts of fraud and money-laundering, although the jury deadlocked on 11 counts, including the securities-fraud charge related to the pyramid scheme. He was ordered to forfeit $109 million, the amount of money he was found guilty of laundering. His attorney, Michael D. Pinnisi, said Bennett would appeal the conviction and sentence. Because he wasn't convicted on the most serious charges, Bennett should only have received a sentence of a few years, Pinnisi said. Prosecutors said Bennett used his company to sell securities based on phony office-equipment leases. Bennett Funding filed for bankruptcy protection in 1996. ----------------------------------------------------------------------- NorVergence Scandal Getting “Warmer” by Christopher Menkin Arizona Attorney General Terry Goddard sent out a press release letting his constituents know his staff made a settlement with Popular Leasing USA Inc. “…that could result in more than $200,000 in debt forgiveness to nine Arizona customers regarding NorVergence leases.” Illinois received 48.2% and New York 67% or 467 accepted the settlement by their AGs' offices. Popular, IFC Credit, Partner's Equity, and Sterling Bank, among others, did not reach a settlement. Perhaps Arizona will be different as Popular has over 300 in Missouri they are taking to court on the same matter. How Popular can settle here, but not there, is perhaps a business decision and not one of ethics? Now before some of the readers say this column is anti-leasing company, remember CIT, Wells Fargo, US Bancorp, and others who took the high road, made the better business and ethical decision. There were some other smaller companies who did the same. In the State of Washington one major leasing company turned down the second NorVergence lease application, after their operation department question the same piece of equipment in the second lease costing almost double. When the telephone service was cut off on the first lease, after NorVergence filed bankruptcy, the Washington State leasing company told Leasing News they settled the lease contract amicably. Now that we mentioned IFC Credit, remember their attorney Vincent Borst, principal at Askounis & Borst, P.C.. Chicago, Illinois, wrote Leasing News, ““More to the point, IFC considers those assertions to be sanctionable against counsel, and slanderous against IFC. If you assist in slandering IFC's reputation by publishing these wholly unsubstantiated assertions, IFC will take all available legal steps against you to recoup the undoubted damage to its reputation your article will cause, including suit against you in a Court of appropriate jurisdiction.” Well, Superior Judge Sally Montgomery who already ruled on the case against IFC Credit, appears to be reviewing what IFC Credit didn't like us reporting: charges of perjury---centered around previous testimony on money owed, hold backs, and other legal opinions. Leasing News was informed by two reliable sources that Patrick A. Witowski, Executive Vice President of Operations, was “ordered” to appear before Judge Montgomery regarding specific accounting questions, particularly in connection with previous testimony in her court.

Judge Sally Montgomery Judge Montgomery ruled earlier for the NorVergence lessee “.... properly cancelled the Lease with NorVergence. IFC takes nothing on it's counterclaim. SOS shall recover court costs and reasonable attorney fees in the amount of $45,000.00 for trial, $30K for appeal, and $15 K for a petition for review to the Supreme Court of Texas, and $15K for responding to any unsuccessful appeal by IFC to the Supreme Court of Texas in the event the petition for discretionary review is granted per the parties stipulation.” Leasing News has attempted to obtain comments from IFC Credit instead of “warnings” from their attorney. We certainly want to air the facts and all sides to the story fairly. Remember the game with your eyes closed and you have to find something that is hidden, and you get “warmer” or “colder.” As you get further away, you are told “colder.” As you get closer, it is you are “warm” and then “warmer” or “colder,” depending on how close you are to what is hidden. The Federal Trade Commission Civil Investigative Demand (CID) issued to IFC Credit Corporation, Morton Grove, Illinois, is about to get real hot, according to a well informed source. The material sought reportedly is going from “warmer” to “hotter.“ Speaking of the law profession, certainly many ears should been burning from what is being discussed at the ELA legal forum in its third day at The Palace Hotel in San Francisco, California. This is a gathering of the top professional leasing attorneys employed by the top companies. One of the defense attorneys told Leasing News, in a confidential manner, that he believes the officers at IFC Credit should have their own private counsel, not corporate counsel. Texas Law: (1) is made during or in connection with an official proceeding; and (2) is material. (b) An offense under this section is a felony of the third degree. http://www.capitol.state.tx.us/statutes/pe.toc.htm THE PUNISHMENT? (b) In addition to imprisonment, an individual adjudged guilty of a felony of the third degree may be punished by a fine not to exceed $10,000. Acts 1973, 63rd Leg., p. 883, ch. 399, § 1, eff. Jan. 1, 1974. ----------------------------------------------------------------

Luke Sentenced to prison for bank fraud

Paul B. Luke, CPA 50, of Omaha, Nebraska, was sentenced to one year in prison, three years of supervised release and $1.2 million in restitution on Friday, April 29 th , in U.S. District Court in Tacoma for Bank Fraud. Luke was Director of Finance, and later Marketing Director, at T&W Leasing, a Tacoma corporation in the business of leasing commercial equipment to businesses. He had been very active in several equipment leasing associations at one time. According to records in U.S. District Court in Tacoma, Luke created a fraudulent lease agreement in order to draw more than $1 million from a line of credit T&W had with Bank of America. The money was used to pay T&W's employees, and the company later defaulted on the $1.2 million loan and went out of business. “ T&W, Tacoma, Washington ( 8/2001) Mike Price, formerly of T&W Leasing, Resigns from Westar Financial. (7/2001) T&W Mike Price charged with evading taxes on $3.2 million yacht. (10/2000) filed Chapter 11. Creditors meeting on 12-4-00 Seattle. Case # 00-10868 US Bankruptcy Court Western District of Wash. 206-553-7545. Debtor Attorney-Marc Barreca 206-623-7580.” Price paid $442,661 in restitution and penalties after he pleaded guilty in attempting to evade about $280,000 in state taxes on a 73-foot yacht, the state Department of Revenue said. He also was sentenced to 30 days of community service by King County Superior Court Judge Charles Mertel. Price was charged with submitting paperwork to the Department of Licensing stating he had paid $53,820 in sales tax on the lesser amount when in fact no sales tax was ever paid. The falsified paperwork enabled Price to dodge more than $280,000 in sales and watercraft excise taxes, prosecutors charged in papers filed July 5. Price resigned in January 2000 as chairman and CEO of publicly traded T&W Financial, an equipment leasing company that subsequently went out of business. Prosecutors said Price falsified paperwork to show that he had purchased the boat from a T&W Leasing Co., which they said was fictitious. In fact, he had contracted with Tacoma and Anacortes firms to build the boat for him, according to the charges. Leasing News List ### Press Release#### UNITED STATES ATTORNEY'S OFFICE Western District of Washington According to court records, in November 1999, LUKE created a sham lease agreement in order to draw more than a million dollars from a line of credit T&W had with Bank of America. The agreement called for an affiliated company, Signature Automotive Group, to sell it's assets to T&W for $10 and then lease those assets back from T&W for more than $223,000 per month. This sham lease had no economic value but was used to allow T&W to draw funds from its line of credit. The money was then used to pay T&W's employees. The company later defaulted on the $1.2 million loan. In 2000, T & W declared bankruptcy and went out of business. In asking for the prison term, prosecutors acknowledged that LUKE “did not personally pocket” the money fraudulently taken from Bank of America. “However, given that he owned approximately one-percent of T&W's stock...(he) did stand to benefit by keeping the business afloat,” Assistant United States Attorney Arlen Storm wrote to the court. The case was investigated by the Federal Bureau of Investigation. Assistant United States Attorney Arlen Storm prosecuted the case. For additional information please contact Emily Langlie, Public Affairs Officer for the United States Attorney's Office, Western District of Washington at (206) 553-4110. ### Press Release ############################ --------------------------------------------------------------------------- Classified Ads---Help Wanted

----------------------------------------------------------------------------

Top Stories--April 24-28

Here are the top ten stories most "opened" by readers last week. (1) Orix Closing U.S. Mid-Market Leasing Department? (2) Commonwealth Capital Founder passes away (3) Bank of New York gets “warning” from the Feds (4) Woodring Jumps Ship to Join Dakota Financial (5) Getting Wise to Lies on Resumes (6) Pictures from the Past--2002 "Top Gun” Richard Baccaro (7) Sales Makes it Happen--by Bob Teichman, CLP (8) Last Call: Bernie Boettigheimer Retirement Party (9) Citi Commercial Business Group realignment (10) Selling Up by Steve Chriest (10) Why I Became a CLP "What the Designation Means” (This is our first "tie" since doing the ten top stories. editor)

------------------------------------------------------------------------------- MachineryLink New Facility MachineryLink Inc.'s new facility in Sioux City, Iowa has predicted it will create 100 jobs over the next three years. The company, started in 2000, claims to have the largest private combine fleet in North America, serving a 33-state network. The new facility will begin operations in August as a center for field service, sales, and training support. MachineryLink expects to begin operations in August. Repo growth ignites ABSnet The $1 trillion ABCP market shows no signs of slowing down, with its low cost of financing and short-term flexibility. Still, professionals in the sector wonder if the surging repurchase agreement market, also known as repos, might one day take a significant bite out of commercial paper business. For the past couple of years, dealers used commercial paper to fund the super senior tranches of certain asset-backed deals. More recently, however, repos appear to be taking the place of asset-backed commercial paper to fund those securities and CDOs, market sources said. “A lot of repo money is available, to the extent that repo money could supplant commercial paper,” said one person familiar with the market. Case in point: Credit Suisse brought the $332 million Duke Funding High Grade II to market in January, funding at least part of the deal with repos. “This is bad for the ABCP dealer community. Repo counter parties are dealing directly with asset sellers and providing funding through that mechanism,” said a commercial paper market professional. True enough; the cost of repos has gotten cheaper in the past two years, said James Croke, a partner in the capital markets department at Cadwalader, Wickersham & Taft. Repo spreads tightened substantially from about Libor plus 20 basis points about two years ago to the single-digit range over that benchmark today, Croke estimated. Further, the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 broadened the types of securities that can qualify as collateral in repo agreements. Currently, eligible securities include mortgage loans, mortgage-related securities and certain bankers' acceptances, along with the old standard, government securities. While some ABS experts acknowledge that the use of repurchase agreements has grown substantially over the last couple of years, they say it poses no substantial foreseeable threat to the asset-backed commercial paper market. “The commercial paper market has always been an important source of funding for the warehousing of assets, but repurchase agreements were also always an alternative,” said Andrew Jones, a managing director at Dominion Bond Rating Service. He added that repurchase agreements used to be the primary sources of funding mortgage collateral before the development of the ABCP market. Commercial paper conduits became a popular source of warehouse funding in the late 1990s, particularly after the liquidity crunch of 1998, which caused sellers to recognize the benefits of having diverse sources of funding, he said. Broker dealers, who often provide warehouse funding, typically prefer to pull their credit lines in a liquidity crunch, instead of riding it out. In those situations — and others wherein liquidity dries up — asset-backed commercial paper is an even more important as an alternative funding source, said Jones. And while spreads on repos have been tightening, commercial paper is historically cheap, and sometimes prices at about six basis points below the benchmark, said Croke. Repos are more likely to be used by dealers that do not have access to liquidity needed to fund deals with commercial paper, said Devansh Patel, a director in Barclays Capital's CDO structured funds group. “It's another tool in the toolkit,” said Patel. Funding certain high-grade deals with commercial paper has brought a new investor base to the CDO product that traditionally had no access to it, further shoring up commercial paper position as a competitive funding source, he said. As Croke sees it, the two techniques are compatible, especially because some dealers have figured out that they can use the asset-backed commercial paper markets to fund repo transactions. “They have figured out ways to enable people to earn a positive spread through refinancing, issuing ABCP,” Croke said. “It is a kind of merging of those technologies.” — DM -------------------------------------------------------------------------- Quartucio Named Sr. VP, Marketing for Tokyo Leasing (U.S.A.) ELTnews Tokyo Leasing (U.S.A.) Inc., Purchase, N.Y. names George Quartucio to Sr. Vice President of Marketing. In this role he will be responsible for new business development for the newly created small ticket vendor program. ------------------------------------------------------------------------------- More Pain Expected For Lower-Rated CMBS ABSnet Lower-rated U.S. commercial mortgage-backed securities transactions are expected to take more hits in the future, according to a study from Wachovia Securities. The CMBS Default and Loss Study 1995-2005 said BB- and BBB-rated bonds are at risk because the rating agencies have over time reduced credit enhancement on CMBS because of strong loan performance. While AAA bonds have continued to perform well, cumulative losses over the past 10 years have been around 2.91%, mainly in the BB and BBB area, said Brian Lancaster, senior analyst. "A few years ago these tranches may have had a subordination of 6%, but now that rests between 2-3%," Lancaster said. "The AAAs on the other hand continue to do well because they are the most scrutinized by the rating agencies, investors and underwriters." The comprehensive study looks at 63,000 loans in 424 CMBS fixed-rate conduit and fusion transactions completed between 1995 and 2005. The study also found that while the largest markets showed the best performance over time, property type is also an important factor. Indeed, delinquencies for offices in secondary markets were almost double those in primary markets. But delinquencies for multifamily properties differ little from primary to secondary markets. ------------------------------------------------------------------------------ ### Press Release ############################# Pitney Bowes Sells Oce Imagistics Lease Portfolio

STAMFORD, Conn., -- Pitney Bowes Inc. (NYSE: PBI) today announced the sale of its Oce Imagistics, Inc. lease portfolio for approximately $288 million to De Lage Landen, a subsidiary of the Rabobank Group, that specializes in international asset financing and vendor finance programs. The portfolio consists of leases for document imaging solutions, facsimile systems, copiers and multi-functional systems marketed by Oce Imagistics, a division of Oce N.V. (NASDAQ: OCENY). The company expects to realize about $210 million of after-tax cash proceeds from the transaction and to recognize an after-tax gain of about $10 million. The sale of the Oce Imagistics lease portfolio is part of the company's strategy to reduce its exposure to the Capital Services external financing business. The company is currently exploring a range of asset and business disposition alternatives for Capital Services including a spin-off, a sale of the business or a sale of all or a portion of the assets. Pitney Bowes engineers the flow of communication. The company is a $5.6 billion global leader of mailstream solutions headquartered in Stamford, Connecticut. For more information about the company, its products, services and solutions, visit http://www.pitneybowes.com/. #### Press Release ########################### Chuck Lemar and Lee Taylor Join Main Street Bank

KINGWOOD, TEXAS, – Main Street Bank, Kingwood, Texas, announced the appointment of Chuck Lemar as Senior Vice President and Lee Taylor as Vice President of the Health and Fitness Division. Lemar, whose career spans over 30 years in commercial banking and financial services attended the University of Maryland. Lemar previously served in executive management positions at Orix Credit Alliance, Textron Vendor Financial Services, Transamerica Vendor Finance and Cybex Corporation. His experience includes direct leadership and participation in overall business development with manufacturers, franchises, and end user Affinity groups. Taylor has worked for 15 years in financial services with leadership positions at Pitney Bowes and IBM Credit. She graduated from Fairfield University with an MBA degree, and holds a BA in Economics from the University of Connecticut. Tom Depping, Chairman of Main Street Bank stated: “Chuck and Lee are nationally recognized leaders in the health and fitness industry. They make a powerful team committed to providing world class financing programs to this growing industry. We are excited about having them on our team.” Lemar said: “Main Street Bank is committed to serving the financing needs of the health and fitness industry. Getting fit is a way of life for millions of American's. Lee and I are very excited about being part of a bank committed to the success of this very important industry.” Main Street Bank, established in 1984, maintains retail-banking offices in the Houston, Texas market and is a national leader in commercial equipment lease financing. Chuck and Lee can be contacted at clemar@msnbank.com and ltaylor@msnbank.com. ### Press Release ########################## Represents CIT's Commitment to Providing Integrated Financial Solutions to the Global Aerospace and Defense Industry NEW YORK,/ -- CIT Group Inc. , a leading provider of commercial and consumer finance solutions, announced the launch of its Aerospace and Defense Finance Group to provide integrated financial solutions, ranging from traditional balance sheet recapitalizations, leasing and project financings to growth capital and acquisition financing to the global aerospace and defense industry. The Group, led by Patrick Henry Dowling, Managing Director and General Manager, will be responsible for originating corporate finance and advisory services with companies operating worldwide in the aerospace, defense and homeland security industries. The Group will be located in CIT's new global headquarters at 505 Fifth Avenue in New York City. "Under Pat's leadership, CIT now has an experienced team in place that offers a diverse range of products and services to the aerospace and defense industry," said Jeffrey Knittel, President of CIT Aerospace. "Since joining CIT in late 2005, Pat has expanded the reach of the CIT Aerospace and Defense Finance Group in providing financing solutions which has enabled us to capitalize on our industry relationships and find emerging opportunities in the global aerospace and defense market." "CIT has a unique, integrated platform and unparalleled industry expertise to provide creative solutions to the aerospace and defense industry," said Pat Dowling, Managing Director and General Manager of CIT Aerospace and Defense. "We are building a global team with offices in North America and London. I am very pleased to most recently welcome aboard Robert Jones and John Donohue, who bring extensive investment banking and financial expertise to our team. They will play a key role in developing advanced financial solutions to meet the strategic objectives of our clients and promote CIT's capabilities throughout the aerospace and defense industry." As part of the launch of its Aerospace and Defense Group, CIT will host its inaugural Aerospace and Defense Customer Forum on Thursday, May 4th in New York City. FAA Administrator Marion Blakey, General Tommy Franks and The Honorable Jack Kemp, Founder and Chairman, Kemp Partners will keynote the event, while Edward S. Beyer, Executive Advisor to the President of Pratt & Whitney, Carolyn Corvi, Vice President and General Manager, Airplane Production, Boeing Commercial Airplanes, and Barry Eccleston, President & CEO of Airbus North America will lead an industry panel discussion on "Transformation: Opportunities in an Evolving Industry." In addition, Wilson Leach from Aviation International News and Bob Dilenschneider of The Dilenschneider Group will also speak. Mr. Dowling previously served as Managing Director and Industry Leader, Aerospace and Defense, for GE Commercial and Industrial Finance before joining CIT. Since 1984, he held various positions with GE Commercial Finance focused on serving the aviation industry. Prior to joining GE, Mr. Dowling was employed at The Continental Group and Price Waterhouse. He is a certified public accountant and holds a Bachelor of Science in Accounting from Fordham University and a Juris Doctorate from Pace University School of Law. Mr. Jones was a Director in the Aerospace & Defense Group at Wachovia Securities prior to joining CIT. He previously held a similar position at CIBC World Markets and brings over 10 years of investment banking experience focused on aerospace and defense. Mr. Jones is a Chartered Financial Analyst, a Series 7 & 63 license holder and a graduate of the University of Western Ontario. Mr. Donohue was an Associate at GE Commercial Finance before joining CIT where he graduated from the Risk Management Leadership Program and most recently focused on leveraged transactions for private equity sponsors. Prior to this he held several finance roles at American Express before receiving his Masters of Business Administration from Indiana University's Kelley School of Business. Mr. Donohue also holds a Bachelor of Science from Miami University. About CIT Aerospace CIT Aerospace provides financing solutions to a broad spectrum of the global aerospace value chain ranging from operators of commercial and business aircraft to manufacturers, suppliers and service providers in the aerospace and defense industries as well as financial institutions. CIT Aerospace manages a fleet of over 300 commercial and business aircraft leased and financed to over 100 airlines around the world. About CIT CIT Group Inc. , a leading commercial and consumer finance company, provides clients with financing and leasing products and advisory services. Founded in 1908, CIT has over $65 billion in assets under management and possesses the financial resources, industry expertise and product knowledge to serve the needs of clients across approximately 30 industries worldwide. CIT, a Fortune 500 company and a component of the S&P 500 Index, holds leading positions in vendor financing, factoring, equipment and transportation financing, Small Business Administration loans, and asset- based lending. With its Global Headquarters in New York City, CIT has approximately 6,600 employees in locations throughout North America, Europe, Latin and South America, and the Pacific Rim. For more information, visit http://www.cit.com/ . ### Press Release ############################

News Briefs---- From coast to coast, immigrants say 'we need to be heard' Dollar Declines On Trade Deficit Currency Hits 7-Month Low Against Yen Fed Switches to Lower CP Measure Microsoft and Google Set to Wage Arms Race Wal-Mart says April sales rose 6.8 percent Disney Parks Welcome 2-Billionth Guest Today A theater critic looks at the current casts of evening news shows -------------------------------------------------------------------------------

You May have Missed--- John Daly says he has lost between $50 million and $60 million during 12 years of heavy gambling

Sports Briefs---- Titans, Ravens talk McNair deal Jet's Deal for Leinart fell short Flutie reportedly set to call it quits: Legend eyes broadcasting

“Gimme that Wine” Vintner Bobby Fetzer drowns rafting in Mendocino $25 fee to visit/Coppola Gets Serious about Winemaking Bordeaux opposition fails to damp Paris Tasting Wine Prices by vintage US/International Wine Events Winery Atlas Leasing News Wine & Spirits Page Calendar Day

Brothers and Sisters Day Robert's Rules Day Teacher Day ------------------------------------------------------------------------------

Today's Top Event in History 1863-General Stonewall Jackson, leading a large part of Gen. Lee's army, delivered a devastating blow on Gen. Hooker's right flank. Reconnoitering with his staff at day's end, Jackson and his group were mistaken for Union soldiers and fired on by their own forces. Jackson's shattered left arm had to be amputated. While he was hospitalized pneumonia set in; his death came on May 10. http://norfacad.pvt.k12.va.us/project/sjackson/sjackson.htm http://www.waysideofva.com/stonewalljackson/

This Day in American History 1837-birthday of our Sue Robert's relative, Henry M. Robert (General, US Army), author of Robert's Rules of Order, today the standard parliamentary guide. Stanley Cup Champions This Date • Toronto Maple Leafs

Spring Poem To My Brother Miguel in memoriam Translated by Robert Bly Brother, today I sit on the brick bench outside the house, Miguel, you hid yourself Listen, brother, don't be too late

|

||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

||||||||||||||||||||||

Top Stories chosen by editor Kit Menkin (chronological order) |

||||||||||||||||||||||

- Bank of New York get "warning" from the Feds |

||||||||||||||||||||||

|