Monday, May 5, 2008 Headlines--- Major Development at FTC-IFC Credit case ######## surrounding the article denotes it is a “press release”

------------------------------------------------------------------ Major Development at FTC-IFC Credit case Bench Trial postponed until July 14th Trebels on the record for the first time FTC makes some startling admissions In a major concession, and perhaps a turning point, particularly after the IFC Credit, Morton Grove, Illinois loss in Dallas, Texas on their appeal regarding SOS or Specialty Optical Systems, Inc. Northern District of Illinois, Eastern Division, United States Magistrate Judge Jeffrey Cole granted a second request by both parties for a continuance. Originally he said the bench trial would begin regardless on April 27th. This is a big surprise. Neither the FTC or IFC are talking about what is happening, but information now available in PACER indicates a major change in the FTC position, particularly admitting in a deposition with CEO Rudy Trebels that they do not believe IFC knowingly entered into fraudulent transactions with NorVergence or were part of a Ponzi scheme and that lessees were deceived that service was included in the contract. In making the motion to Reconsider the Court’s Partial Denial of IFC’s Motion to Dismiss and Supplemental Motion to Dismiss. Debra R. Devassy of Askounis & Darcy, representing IFC Credit Corporation includes this Exhibit 1. The Court: Well, was it—let me ask this. Was it the scheme by NorVergence? Mr. Schroder (FTC): Your Honor, I have never said it was a Ponzi---it The above comes in a submission by attorneys Debra Devassy, Alexa Darcy, Askounis & Darcy, Vincent Borst, Borst & Collins, Peter Deeb, Frey, Petrakis, Deeb, Blum & Briggs. Here are parts of the deposition by several attorneys of IFC Credit CEO Rudy Trebels as filed as Exhibit 1, where the FTC states its position that IFC was not part of any fraud: (Vincent Borst of Borst & Collins, representing IFC Credit, is asking the questions of Rudy Trebels, CFO in this part of the deposition:) Q. During this time period when you did this original Master Program Agreement, would that hold true, you didn’t have any indication that there was any fraudulent conduct going on? A. Our normal bad debt is about 1 percent a year. So there’s no reason in the world that we would possibly have entered into buying contracts and invest more than the full net worth of the company if we thought there were any issues like this. I mean it is just is unfathomable that us or nay of the other leasing companies would do that----I know you feel different, but it’s just--- Mr. Schroeder: Let me state on the record that FTC has never taken the position that IFC knew NorVergence was engaged in fraud when it bought the contracts. Just from Economics 101, I agree that we don’t think that that would have made financial sense. Why would you do that? That’s not our case. So we can stipulate to that. Mr. Borst: Okay By Mr. Borst:

Coda: Note in this news edition, there are three cases where leasing companies lost, one an appeal, and two instances of action by attorney generals in their state. -------------------------------------------------------------- FTC-IFC Settlement in the Offering by Christopher Menkin This is the first time IFC Credit CEO Rudy Trebels position has become public regarding the purchasing of NorVergence leasing contracts. It is something he should have done a long time ago, in this writer’s opinion. His attorneys obviously told him to speak only in court and not to the news media. The Pacer legal filings indicate the momentum has changed, almost as if watching a football game. IFC Credit is out of being backed into the one yard line where it was painted into before this Illinois trail began. The ball is now in Trebels hands as his team is moving forward toward the fifty yard line. It appears to me the only reason Judge Cole would delay the proceedings is that he sees a settlement in the offering. Judge Cole was quite adamant in starting the trial on April 27th. It appears the motions made and revelations by the FTC indicated to him that a compromise was available. Or to put it more bluntly, whether the legal aspects or other facts or opinions are yet to come, a meeting of the minds on position deserved a “time out.” A settlement would certainly resolve many legal questions, plus indicate further that despite “hold backs” and maneuvers during NorVergence bankruptcy that it was not until much later than IFC Credit became aware of the problems with NorVergence and its contract procedure. It appears IFC Credit was relying on NorVergence to provide services and became more away of NorVergence financial condition not far from when they filed bankruptcy (remember the Dun & Bradstreet reports right before the filing found no derogatory credit and it appeared the company was in very good financial condition. ) More importantly, what seems to have been proven in these proceedings brings the onus back to NorVergence for its deception and away from IFC Credit Corporation. How a settlement will be viewed by the attorney generals of Missouri and Texas, waiting in the wings, may be to IFC Credit’s advantage as well. It does certainly appear that Judge Cole is conservative We then are back to the original defense by all the leasing companies that the contract stands by a “hell and high water” position that the document be viewed under commercial law, not consumer Filed May 2, 2008: the transcript of the April 29 hearing is on 29 pages; the 114 page transcription is on 29 pages of this motion by Devasy and gives both parties side of their position before Judge. -------------------------------------------------------------- Slow Pay to Brokers

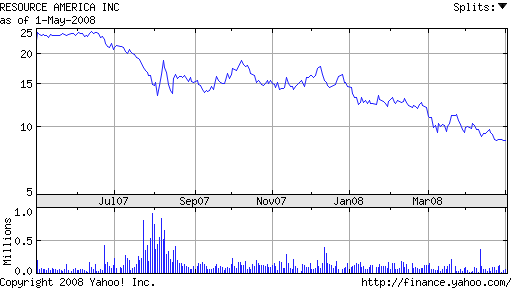

The main complaint about not being paid since February involved a leasing company not named. It has been settled, therefore the name will not be revealed. When Leasing News mentioned this complaint, it also brought up several regarding a major leasing company in Southern California. several readers thought it was LEAF as evidently there has been talk on the National Association of Equipment Leasing Association (NAELB) web forum about slow pay. Due the confidentiality, Leasing News will not quote emails on the NAELB forum. For the record, the company the complaints concerned were not LEAF, but another major company in Southern California, who’s president most likely is burned up because he was asked for a comment from Leasing News ( he never responded. editor) Any slowness in receiving commissions from any leasing company may be caused by a funding delay, a re-evaluation, incorrect certificate of insurance, hold up on a verbal by the signer, better due diligence of paperwork, and often just too much volume going through the pipe. A spokesman for LEAF said they pay brokers as fast as a deal is funded with a cut off time of 3pm; no delays except for normal administration processing in funding of a transaction. LEAF itself is in very good shape, $1.7 billion in assets under management as of December 31, 2007. The main operation also is in New Jersey. Again, the complaint is not against this company, although LEAF does have affiliates and offices in Southern California. Recently LEAF completed “Fund II, raising $120 million, stating this was down within 14 months, way ahead of schedule using a syndicate of more than 70 broker dealers. Fund I was for $17.1 Crit DeMent, Chairman and Chief Executive Officer of LEAF, stated, "We are very pleased by the confidence financial advisors and individual investors have shown in LEAF with their tremendous acceptance of our investment programs. LEAF's ability to raise substantial equity in the current dislocated capital markets allows us to continue to take advantage of this situation, and the lack of liquidity by other companies, on behalf of our investors." A large bridge facility ($380mm) was used to purchase the NetBank lease portfolio which is collateralized by the LEAF's assets. The bridge loan expires in November, 2008. In their most recent SEC filing, it appears FUND III is being used to cover this. Form 8-K for RESOURCE AMERICA INC “Item 8.01 Other Events. “In our current report on Form 8-K dated as of November 7, 2007, we described our indirect subsidiary's acquisition of a portfolio of leases from the Federal Deposit Insurance Corporation and originated by NetBank. We further stated our intention to sell that portfolio of leases to an investment partnership sponsored by LEAF Financial Corporation, one of our indirect subsidiaries. “On April 22, 2008, we completed the transfer of this portfolio of leases by transferring to LEAF Equipment Leasing Income Fund III, L.P., an investment partnership sponsored by LEAF Financial Corporation, membership interests of the entity that owns the special purpose entity that owns the portfolio of leases. This special purpose entity, that owns the portfolio of leases, now wholly owned by the investment partnership, remains the borrower on the Morgan Stanley Bank financing. As a result of the foregoing transaction, approximately $323 million of commercial finance assets were transferred by the regististrant to the investment partnership together with approximately $315 million of related debt financing.” Perhaps more will be explained this Wednesday, May 7, 2008, when Resource America will present the company’s First Quarter report at 8:30am, EDT; particularly why their stock is doing so well. -------------------------------------------------------------- Are Leasing Company stocks good investments? by Christopher Menkin (When a writer signs his name to an article, it then notes the opinions expressed are his, plus gives him the privilege to have a viewpoint.)

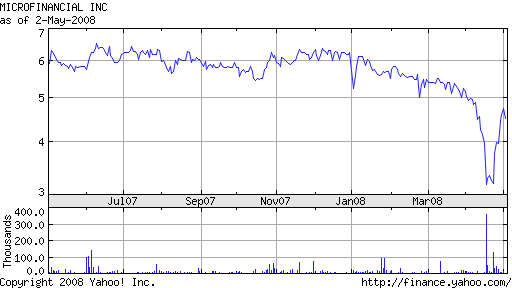

The question I have been asking friends who invest is have they ever considered leasing companies? They tell me they would never invest in leasing, not because of my personality, but simply put: “leasing companies stocks are poor investments as evidenced by their stock performance.” I specifically asked them why they thought the stocks were not performing well. Their ranges from: investors are holding their breath on risky investments: leasing companies are considered risky: The news also about SILO’s, FILO’s, NorVergence, and all the fraud involved also seem to scare those who are aware of these events. The Dow Jones was up on Friday, so perhaps the conclusion is what they told me in the first place: the performance of the stock alone is scary in itself:

Subprime mortgages and student loans are their problem. The commercial sector which made the company grow continues to perform, although sections are being sold off for cash flow. The

This company appears undervalued, even though many criticize its poor management and the loss of its key executives. Profits as well as performance is continuing to decline, business loans and factoring was abandoned ( actually never got off the ground), opening an industrial bank at this time in Utah was not viewed as a smart move, and now moving its efforts into vehicle leasing has many selling this company’s stock. May 9th Marlin will have a telephone conference on their earnings. This company may suddenly find itself out of leasing as Advanta leasing did,

A company in the micro-ticket marketplace. It has some problems in the past, but continues to perform, and in comparison, by percentages, the stock is not doing as badly as the other two publically held companies, but is also perhaps in the same indication. In looking at banks, many who have leasing divisions or own leasing companies, the leasing numbers are not available. Whether they should be viewed also as not doing as well in the stock market may These two companies have active leasing companies:

This bank has been more conservative and not suffered as the East Coast banks have. More importantly, the numbers in the last financial statement break apart the leasing segment, looking Since this is basically about leasing, my opinion is the Key Equipment Finance unit is a place to work; doing very well in this tough market place with sold leadership. Please note Paul A. Larkins, President and CEO, was Leasing News Person of the Year for 2006.

Resource America is a $1.7 billion company and LEAF Corporation is a small part in comparison ( see above story.) It does not have the subprime loan problems, but seems to fit in with the leasing

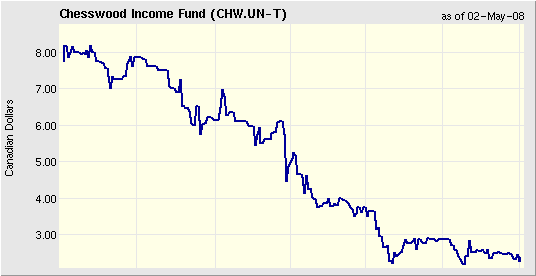

-------------------------------------------------------------- “B” Credits is how Chesswood sees Pawnee Leasing by Christopher Menkin

Pawnee is one of the three companies owned by the Chesswood out of Toronto, Canada. Although a US company, Pawnee is on the Canadian Stock Exchange. In a marketplace where this company The reality is brokers are independent, not tied to any one company, and when the broker can make more points, meaning a higher commission, and at the same time, offer their clients a lower lease rate, often with a faster turn around time, that’s where they are going to go---- especially when they have so many funding sources knocking at their door. It addition never in the leasing history have the leasing brokers been so well supported. The National Association of Equipment Leasing Brokers weekly On Line “Meet the Funder,” a list serve where member communicate about funding sources, plus Leasing Forum, which features a 'Looking For Funding' electronic bulletin board where members find homes for transactions of nearly every description. In addition a mentor program, service discounts, and even rebates from their $295 annual membership fee, too. Plus the association has excellent assets and a management service without equal for members only, controlled solely by brokers In the Chesswood Income Fund annual report, the filing states: “Direct financing lease income decreased by approximately $1.3 million year-over-year predominantly due to a $1.4 million decrease as a result of freight exchange. In US dollars, direct financing lease income actually increased by approximately $153,000 in a year. The average number of lease outstanding through 2007 remained virtually unchanged from 2006. Direct financing leasing income decreased by approximately $1.2 million ($161,000 decrease in US$) in the three-month period predominantly due to foreign exchange fluctuations compared to the prior year... “During the year-end December 31, 2007, the provision for credit losses increase by $3.8 million year-over-year due to the effect of higher charge-off levels on Pawnee’s allowance for doubtful accounts, as compared to the pro-forma figures for the prior years...” “During the three-month period ended December 31, 2007, the provision for credit losses increased by $869,000 in 2007 compared to the same figure last year. December 31, 2007 year-end financial statements show “direct leasing” The last quarter, three month ending in 2006 was 7,267 and 2007, 6,123. Chesswood is not aware of Pawnee’s subprime marketplace or reputation for subprime transactions, often called “story credits.” This marketplace has seen the growth of many smaller companies, just as when Pawnee started out and was micromanaged in leases for “risky” equipment and credits. Prior management had “hands on” 24/7 in the acceptance of leases. Today it is part of a Toronto company This lack of understanding is not an opinion, but comes directly from the Chesswood Annual Report where they explain: “BUSINESS OF PAWNEE “Pawnee is an equipment leasing company that provides lease financing on micro and small-ticket business equipment. Pawnee focuses on small businesses in the start-up and “B” credit segment of the U.S. Leasing market, servicing the lower 48 states through a network of approximately 550 independent brokers. As of December 31, 2007, Pawnee administered over 7,200 leases in the portfolio, with remaining scheduled lease payment so approximately US$107.2 million over the next five years...” “Pawnee’s business model is different from certain other leasing consumer sup-prime mortgage and finance companies in a number of important respects, including the following:

Chesswood Income Year-end: 76 pages (3.66mb download)

-------------------------------------------------------------- New school for brokers: Premier Lease Academy

Joining the school-training fray is Premier Leasing Academy out of Roswell, Georgia. $19,995 for five “intensive day training” in Atlanta, Georgia. They promise “back office support” for one year and access to over 20 “lenders.” The caveat also promises “2 full days of Sales and Marketing training to participants as part of the week long course” with Ms. Linda Kester. A press release states “She will also provide a full year of support via newsletters, email, and teleconferences. Linda has this to say about her decision to partner with Premier Leasing academy, “Jim, David & Randy have a superior level of integrity. Their complete knowledge of the industry and attention to detail makes them a dynamic team. I’m proud to be a part of that team.” Named as founders are James DuBois, David Hamilton and Randy Russell. Their background was not given. A telephone call to Premier Leasing Academy received voice mail that all academy “consultants” were on the other line talking to candidates and would get back within 24 hours time. Linda Kester told me that “ David Hamilton has been in the business for at least 18 years. They act as a Super Broker.” The web site states: “ You will be able to finance transactions with these lenders from $5,000 to $2,000,000 or more. You can get your deals approved in as little as a few hours with the right information. “1. TRANSACTION BASED FEES “In the industry we talk about points you can earn; 1 point = 1% of the total equipment cost. “• Equipment Leasing you can earn up to 15 points of the total cost. “You can clearly see if you only do 2-3 transactions a month how much you can make. You do not need to do a lot of transactions each month to be very successful. “2. ON GOING INCOME WITH VENDORS By developing a relationship with Vendors (suppliers of equipment) you are creating yourself a sales force with no overhead. As they sell their equipment and their customers need financing, they are sending you transactions. You become their in-house finance company and help them increase sales while increasing your own profits. “Vendors should be able to send in three to five transactions a month and in some cases more. So, you can see that if you work with your Vendors you will see the dollars add up quickly by answering the phone or reading a faxed application. “An example: a vendor sells $40,000 piece of equipment. You make 5% or $2,000. That same vendor sells 3-5 pieces of equipment each month. In your first year you should be able to open up 2 to 4 vendors....once again, you do the math!” www.leasingcareer.com Other Leasing schools/facilities:

-------------------------------------------------------------- Leasing Industry Help Wanted Collector

Document Processor

Leasing Sales Representative

Leasing Sales Representative

Special Assets Workout Officer

-------------------------------------------------------------- Top Stories --April 14-April 18

Here are the top ten stories most “opened” by readers last week: (1) Leasing Companies lose another big one (2) Archives-April 27, 2000--Paul Menzel,CLP (3) Marlin announces conference call (4) Archives--May 1, 2000 (5) Where in the World is Kit Menkin? (6) "Flowers..." “From Whom?" " Candygram." (7) Paul Weiss, back for a second time (8) Sales Make it Happen --- by Linda P. Kester (9) Leasing 102 by Mr. Terry Winders,CLP (10) Balboa Promotes Phil Silva to Exec. Vice -------------------------------------------------------------- Barry Dubin’s Daughter on Fox TV News

If you didn’t see Alyssa D. Gusenoff, daughter of well-known leasing attorney Barry Dubin of Cooper, White & Cooper LLP, on Fox TV News promoting her book “Margarita Mama”---here it is: Bonus:

-------------------------------------------------------------- Leasing 102 by Mr. Terry Winders, CLP

Holding Leases In an effort to maximize income or to get a better buy rate many Lessor’s have a line of credit at a local bank where they draw down the money required to fund a lease and take it off the street. Then when the opportunity presents itself they sell it off to a funding Lessor. This can also allow a Lessor time to bundle a series of transactions that create a larger dollar sale and lower funding rates. The question becomes how the legal and tax consequences are impacted by the purchase and sale of the goods. When you fund a True Lease and pay the vendor for the equipment you become its owner for both, Federal, and State income tax purposes and its legal owner for Uniform Commercial Code purposes. If you fund “a lease intended as a security” such as a “money over money” transaction or a “conditional sales lease” or any lease with a bargain purchase option then it is said that you are only holding the ownership in “trust” until the lease has been paid in full therefore what your are selling off is the right to collect the rents and a security interest in the equipment which requires you to assign the UCC-1 that you filed. In addition there is the State sales tax and other assed taxes that you become responsible for until you pass title or the security to the funding institution. Regardless of the type of lease when you fund the transaction you must have a sales tax permit from each state each piece of equipment resides in. Then the sales tax must be collected and remitted to the proper jurisdiction for any standard payments you receive. Then you must send the additional prepayments such as the last payment plus the sales tax to the funder. When you initially pay for the equipment it also requires you to provide a resale certificate number to avoid sales tax on the purchase price. You must send a resale certificate to each vendor of the equipment under lease. Then forms must be completed for sales tax receipts and sent to the State, in the beginning usually monthly and then later on in a quarterly time frame. When you proceed to sell off a bargain option transaction the difference between your outstanding balance and the purchase price will be your profit but it must be clearly recorded as to equipment cost and mark up. When selling a true lease the time you have held it determines its book value to you. If you have passed a quarterly Federal Income Tax reporting period then having taken the first part of the MACRS depreciation the purchase price will be effected by the tax consequences. Your sale may be the difference between the undepreciated value and the discounted rent price presenting you with both recovery of ordinary corporate income tax and a capital gains tax. In addition you will have to deal with your States income tax. You must always remember that to pass title or ownership for UCC purposes the new owner/lessor must obtain a “bill of sale” and take “possession”. Usually possession is handled in the original lease by making the Lessee the Lessor’s agent to accept the equipment from the vendor. When the new Lessor takes ownership the Lessee’s acknowledgement of the assignment should carry a statement that they are also acting as the new Lessor’s agent for possession purposes. Holding leases is a tricky business with a lot of costs and proper bookkeeping. Be sure you have separated each type of lease and know the consequences at the time of funding so you handle all the sales and income tax issues properly. Also if the funding occurs over the end of the year then property tax can also be a problem. Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666. Previous #102 Columns:

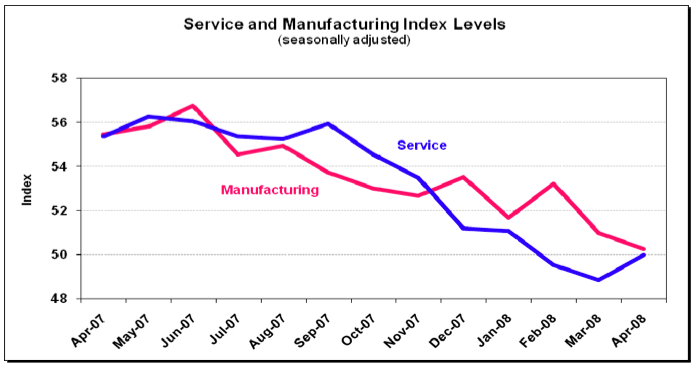

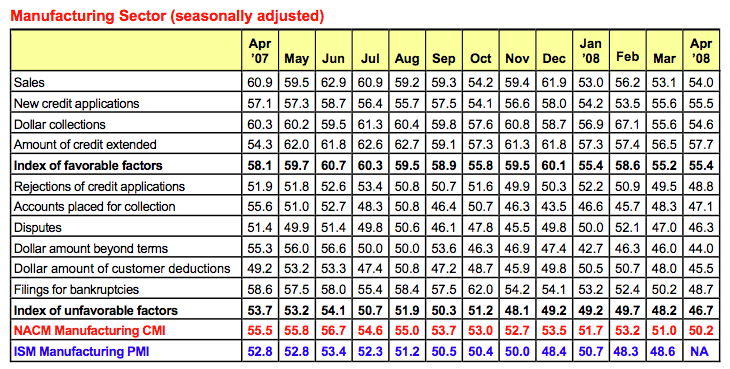

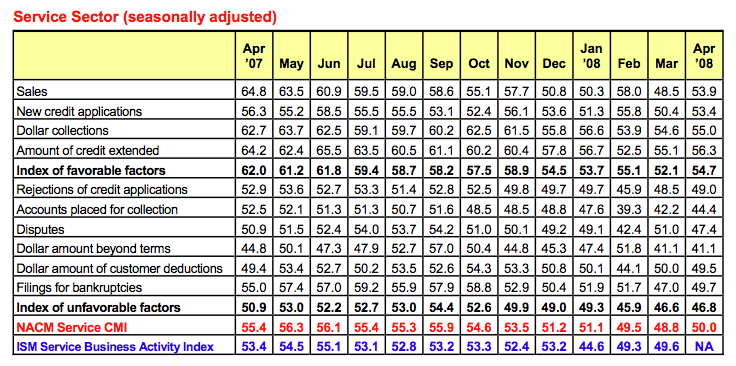

-------------------------------------------------------------- NACM Index continues to indicate contraction

National Association of Credit Manager’s Chart Daniel North, chief economist with credit insurer Euler Hermes ACI said that comments from participants for April from credit managers indicated an increase of slow paying customers and overall economic weakness, especially in businesses exposed to the housing industry. “... there was a significant increase in comments about the negative effects of higher input costs, especially fuel,” he said. “No doubt the Federal Reserve will cite these inflationary pressures as a concern when it signals to the financial markets that the cycle of monetary easing is about to end.” The seasonally adjusted manufacturing sector index fell for the second consecutive month as eight of its 10 components slid. Comments North provided from participants noted weak economic conditions: “laid off about quarter of our staff,” “sales very low,” “accounts finding more and more reasons not to pay within their times and are requesting extensions,” and “too much inventory.” In addition to comments about the weak economy, however, this month saw a distinct increase in participants’ notes about rising prices, North said. A manufacturer of plumbing fixtures said they “just increased prices” while a food processor stated, “We had a price increase.” An operator of a steel works gave a more thorough assessment highlighting the dangers of inflation: “We continue to increase prices as our raw materials prices have drastically increased….Many (of our customers) cannot pass along price increases.…if current economic conditions persist for the rest of 2008, then 2009 will be a much worse year as customers cannot hang on.” The seasonally adjusted service sector index rose 1.2%, the first increase in seven months, as seven of the 10 components rose. Comments from participants were mixed this month as some reported strength, others reported weakness and still others reported inflationary pressures, North noted. “Photographic and farm equipment, metals services and sporting goods industries all reported good business conditions,” he said. “Lumber, home furnishing and transportation industries reported increases in NSF checks, slow pay, weak sales and cancellations.” North pointed out that, as with the manufacturing sector, inflationary pressures came to the forefront. Trucking and transportation equipment suppliers reported that higher fuel prices are causing “significant trouble.” Other complaints reported were “cost of products sold has increased,” “raw material cost(s) are up 30% from last year” and, finally, an angry “It’s the fuel prices that (are) doing this!!” “On a seasonally adjusted basis over the past 12 months, a weakening trend is very clear,” said North. Nine of 10 components in both the manufacturing and service sectors fell (all 10 fell for the combined index). Manufacturing fell 5.3% while services declined 5.4%. “The data show without doubt a weakening economy over the past year, and the trends toward the critical 50 level bode poorly for the future,” he concluded. --- The National Association of Credit Management (NACM), headquartered in Columbia, Maryland supports more than 22,000 business credit and financial professionals worldwide with premier industry services, tools and information. NACM and its network of Affiliated Associations are the leading resource for credit and financial management information and education, delivering products and services which improve the management of business credit and accounts receivable. -------------------------------------------------------------- Dolphin Loses its Appeal on NorVergence leases in Missouri “Dolphin clearly chose to pursue the NorVergence customers, even in the face of immediate, numerous, and persistent complaints from the customers, when, under the MPA, it had clear recourse for recovery against NorVergence. This choice was evidently made early as Dolphin filed its first collection action under a NorVergence ERA as early as October of 2002. Fifty such suits were instituted between October 2002 and July 2004, when NorVergence filed for bankruptcy. “That NorVergence is now in bankruptcy and shielded from financial responsibility should not inure to Dolphin. The language of 52.04(b) speaks of equity and good conscience. Based on the nature of the agreements involved, the course of events, Dolphin's lack of diligence (by agreement with NorVergence), weigh heavily that the actions of Dolphin leave the court with the impression that the trial court's ruling was correct. NorVergence is an indispensable party in deciding this particular collection action. Generally, an original lender is not an indispensable party in a collection action. See Nachbar v. Duncan, 114 S.W.3d 421 (Mo. App. 2003). Here, however, the allegations of fraud, as well as the disturbing inferences arising from the actions of Dolphin and NorVergence clearly distinguish this case from a garden-variety collections action. That fact that NorVergence cannot be here should be Dolphin's responsibility rather than that of the defendant-respondents.” Since 2002, over two hundred collections actions have been instituted by Dolphin in the Circuit Court of Randolph County seeking to collect rents due under NorVergence leases. ### Press Release ########################### National City Commercial Capital to reduce debt for former SEATTLE – Six small businesses in Washington state that lost phone and Internet services when their telecommunications provider, NorVergence, Inc., went bankrupt in 2004 will not have to pay the full amount due on their rental contracts, the Washington State Attorney General’s Office announced today. National City Commercial Capital Company LLC agreed to issue refunds or reduce the debt of 381 former NorVergence customers nationwide as part of an agreement reached today with 22 states. NorVergence claimed its “Matrix” box would deliver unlimited broadband, landline and cell phone service with no per-minute charges. Customers who rented boxes typically agreed to pay $500 to $2,000 per month for a period of three to five years. The Federal Trade Commission contended that the boxes were actually standard integrated access devices or sometimes just firewalls that neither lived up to the claims nor saved customers money. NorVergence signed up more than 9,000 consumers nationwide then sold the rental agreements to approximately 40 different finance companies before being forced into bankruptcy by its creditors in June 2004. “The states that negotiated this settlement allege that the rental agreements were void to begin with,” said Assistant Attorney General David Huey. “National City Commercial Capital Company and the other finance companies who bought the agreements should have known about the fraud perpetrated by NorVergence.” National City denies any wrongdoing but has agreed to reduce the outstanding debt for customers who agree to the settlement offer and to correct any adverse credit information that resulted from customers not making payments. Nationwide, the company will forgive more than $7.2 million in lease payments. Huey said the settlement will put $151,590 back in the hands of Washington business owners, should they choose to participate. Most of this amount will be paid in the form of debt forgiveness, while some business owners may receive refunds. To participate, customers must pay all charges, late fees and taxes owed through July 15, 2004. National City will forgive 85 percent of the remaining contract balance thereafter, as well as any late fees or other penalties. The company will also forgive 80 percent of the remaining contract balance for customers who previously settled with the company. Settlement letters will be going out from National City to affected businesses within the next 30 days. The businesses will then have 35 days to respond. Besides Washington, the following states participated in the National City agreement: Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Illinois, Kansas, Louisiana, Massachusetts, Maryland, Michigan, Missouri, North Carolina, New Hampshire, Ohio, Pennsylvania, Rhode Island, Virginia and West Virginia. Fourteen finance companies have agreed to reimburse customers under agreements reached by the states. The Federal Trade Commission sued NorVergence, alleging that the former New Jersey-based company’s business practices violated consumer protection laws. The FTC settled charges against the company’s founders, Thomas N. Salzano and Peter J. Salzano, in June. The final court orders bar the Salzanos from engaging in all fraudulent and deceptive conduct alleged in the complaint, require them to make specific disclosures when pitching products in the future, and subject them each to $50 million judgments, which were mostly suspended. ### Press Release ########################### NorVergence Fraud-related Settlement Grants Relief to Georgia Businesses ATLANTA, GA – Joe Doyle, Administrator of the Governor’s Office of Consumer Affairs, announced a settlement with National City Commercial Capital Company, LLC, in connection with an alleged widespread telecommunications fraud involving NorVergence, Inc., a bankrupt New Jersey-based telephone equipment and service company. Under the settlement, National City Commercial Capital Company has agreed to refund or not collect $553,000 in rental payments from 38 Georgia companies. Mr. Doyle joined in the settlement with the Attorneys General of 22 other states. National City Commercial Capital Company is one of approximately 40 financing companies involved with the financing of telecommunication services through the rental of data routers that NorVergence called a “Matrix box.” NorVergence rented Matrix boxes (which purported to integrate and provide local telephone, long-distance telephone, wireless, and internet services) at a reduced rate to small businesses. NorVergence’s deceptive sales pitch was that the “Matrix box” would provide telephone and internet services while reducing telephone and internet service bills by 30%. The two types of “Matrix boxes” cost NorVergence between $500-$1500 and did not provide telephone or internet services. NorVergence had to obtain and pay for those services from other providers, which it had stopped doing before it went into bankruptcy. The rental agreement was typically for 3-5 years for $200-$4000 per month, depending upon the business’s previous telephone and internet bills. After securing contracts with businesses, NorVergence sold the rental agreements to different finance companies, including National City Commercial Capital Company. NorVergence had over 9,000 customer accounts nationwide. Most of these customers were small businesses, non-profit organizations, and local government entities. When NorVergence declared bankruptcy in June 2004, its customers were left without service but the finance companies, including National City Commercial Capital Company, maintained that the customers were still responsible for the five-year rental agreement payments. ### Press Release ###########################

News Briefs---- Is Jeffrey Peak the man to run CIT Buffett's thumbs down on dollar In Pellicano Case, Lessons in Wiretapping Skills ----------------------------------------------------------------

You May have Missed--- FASB on Subprime: "We Warned You" ---------------------------------------------------------------

Sports Briefs---- Celtics put Game 7 rout on ice, close out Hawks Spurs must slow West to even score with Hornets ----------------------------------------------------------------

“Gimme that Wine” Outspoken Mac McDonald of Vision Cellars bridges gap between African Americans and the wine industry Who Buys Wine Direct? AmericanWinery.com Places Winery Partners in Major Product Portals -- Wineries May Now Access Millions of New Consumers Online Understanding Red Wine’s Potential Benefit for Diabetes Private equity works the vineyard with $250 million fund targeting wineries Wine Prices by vintage ----------------------------------------------------------------

Calendar Events This Day Bonza Bottler Day Cartoonist Day Denmark: Observation of 1945 Liberation. Ethiopia: Patriots Victory Day Ireland: May Day Bank Holiday Japan: Children’s Day Melanoma Monday. Mexico: Battle of Puebla. Mexico: Cinco de Mayo. National Chocolate Custard Day National Hoagie Day Netherlands: Liberation Day Oyster Day South Korea: Children’s Day Thailand: Coronation Day. Totally Chipotle Day United Kingdom: May Day Bank Holiday. Saint feast Days http://www.123greetings.com/events/april2008.html http://www.catholic.org/saints/f_day/apr.php ----------------------------------------------------------------

Number 34 wrong:

----------------------------------------------------------------

Today's Top Event in History 1966-- Willie Mays hit home run number 512 of his career. The San Francisco Giants' superstar became the greatest home run hitter in the National League to that time. [headlines]

This Day in American History 1494-- Columbus discovered Jamaica in 1494, meeting the Arawak Indians, who reportedly celebrated the event with a rum drink. He would eventually enslave or kill all on the many islands by disease or violence. -------------------------------------------------------------- Baseball Poem The Base Stealer Poised between going on and back, pulled -------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm -------------------------------------------------------------- Daily Puzzle How to play: Refresh for current date: --------------------------------------------------------------

http://www.gasbuddy.com/ -------------------------------------------------------------- Provence, France-Vacation http://le-monastier.site.voila.fr/ -------------------------------------------------------------- News on Line---Internet Newspapers Pacific Palisades, California -------------------------------- |

||||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

||||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

||||||||||||||||||||||||

Cartoons |

||||||||||||||||||||||||

Editorials (click here) |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|