Friday, November 21, 2008

| Outfielder/first baseman Stanisław Franciszek Musiał, nicknamed "Stan the Man," born November 21, 1920 Donora, Pennsylvania. He played 22 seasons for the St. Louis Cardinals from 1941 to 1963. He is considered one of the greatest baseball players of all time. https://www.stan-the-man.com/index.php?main_page=page&id=15&chapter =0&zenid=cjr792dkiubfb95m1cb90hdgm4 |

Headlines---

Archives—November 21, 2000—The List

56 Leasing Companies Major Changes

Classified Ads---Controller

Key National Finance to cut 180 positions

by Christopher Menkin

Cartoon---Wants Chardonnay

Housing to return to “normal” in 2014

OTS: Persistent Housing Market Weakness

Classified Ads---Help Wanted

New Hires---Promotions

Classified Ads---Training

“Quantum of Solace”/” I’ve Loved You So Long”

“Encounters at the End of the World”

“Hellboy II: The Golden Army/ WALL-E”

Fernando’s View By Fernando F. Croce

Fitch Ratings: Drift Worsens 3rd Quarter

FDIC/IndyMac Loan Modification Model

GE Capital to Pare Jobs, Assets to Save $2B

Winners of Leasing Life Awards 2008

BofA's Lewis Sees U.S. `Drowning in Debt'

AP to cut 10 pct jobs in '09

WaMu cuts 1,600 S.F. Bay Area jobs

Ag in Trouble/Fields of Grain and Losses

News Briefs---

You May have Missed---

"Gimme that Wine"

Today's Top Event in History

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

|

------------------------------------------------------------------------------

Archives—November 21, 2000—The List

56 Leasing Companies Major Changes

Advanta Leasing (for sale, president now at eOriginals, others let go such as Kaye Lee)

Affinity Leasing, Washington (12/2000 to close)

American Business Leasing (gone)

Balboa Capital (Founder Byrne "...office available any time he wants to use it”).

The Bancorp Group, Inc. (Southfield, MI) (Not accepting news business. The BOD of the parent bank is assessing what to do with the leasing subsidiary.....currently servicing portfolio but not originating. no longer in business)

Bankvest (bankrupt)

Bombadier (reported having problems, not confirmed)

BSB Leasing (11/2000 closed to accepting new business)

Charter Financial (purchased by Wells Fargo 9/5/2000)

Colonial Pacific (11/98) purchased by GE Capital 5/2000 no more re-brokered applications, except from one or two sources, such as Steve Dunham's Leasing Associates)

Commerce Security (9/99 closed to leasing broker program) (11/99 last fundings)

Comstock Leasing (3/2000 Unicapital then Linc and discontinued operation this date)

Copelco (4/2000 sold to Citibank/10/2000 stock down rated/10/2000 ceases broker business, many complaints in manner turning off faucet)

Creative Capital" of Bloomfield Hills, MI. (shut-down 3/2000)

Dana (sold off, active as captive)

DVI Capital (out of broker)

El Camino Leasing, Woodland Hills, California (10/2000 No longer taking broker business)

eLease (June/July/2000 senior management changes)

FMA Finance (reportedly closed to brokers)

Fidelity (4/2000 acquired by EAB, a wholly owned subsidiary of ABN AMRO Bank N.V., headquartered in the Netherlands, raising funds)

Finova (out of market place ) ( 10/2000 Dow Jones headlines "Finova Stock Falls As Buyout Hopes Wane 10/2000 Dow Jones notes stock falling and problems at Finova 11/2000 Announces they will discontinue business, sell units 11/2000 Suspends Dividend 11/2000 Leucadia National to Invest $350 Million in Finova 11/2000 reports $274 million loss ))

First State Bancorp, Albuquerque, N.M (3/2000 sold leasing division-$64 million---)

Franklin Leasing, Des Moines, Iowa--owned by Liberty Bank-- (2/2000)-no longer writing leases (limited by regulations and leases are for sale ).

Franchise Mortgage Acceptance Corporation (FMAC) 11/1999 purchased by Bay View Commercial Corporation (Bay View Bank) 9/2000 discontinuing all franchise loan and lease production.

Golden Gate Funding (2/99 purchased by Westover Financial)

Heller Financials Commercial Services Unit (10/99 purchased by CIT)

Imperial Credit Industries (ICII) (sold portfolio)

Japan Leasing Credit claims (JLC --6/99 purchased by Orix) Lease Acceptance Corp--- (ceases broker business 7/26/2000)

Leasing Solutions (bankrupt)

Liberty Leasing (closed, California Company)

Linc Capital (out of vendor and broker business, NASDAQ halts stock sales, $13.4 loss last quarter, 10/2000 assets for sale

Lyon Credit Corporation (9/99 purchased by Hudson United Bancorp)

Manifest Group--(/1/2000 purchased by US Bancorp Leasing and Financial, "...a win for all the parties involved," Brian Bjella.

Matsco Financial (purchased by Greater Bay Bank)

Merit Leasing (gone)

Metwest Leasing, Spokane, Wa. (9/2000 advising brokers that they have run out of funds so they are unable to fund a transaction we have there for funding. 11/2000 Metwest Leasing Spokane, WA. is pulling the plug, confirmed by five sources.)

Metrolease--reports closing operation, John Blazek at Evergreen Leasing, Hathcock losing assets, will not confirm nor deny; many serious rumors of serious fraud floating around the marketplace, including debt to Textron Financial.)

NationsCredit, Business Leasing Group (1/29/99 sold to Textron**) *"The Business Leasing Group of Nations Credit was sold to Textron and we still do broker business," Jim Merrilees, very well respected individual in the leasing industry...

NIA National Leasing (3/2000 purchased by Lakeland Bancorp)

New England Capital (sold to Network Capital Alliance a division of Sovereign Bank. Sovereign did hire two people who will run a sales office in CT, doing basically the same deals with the same people as before. Little will change in that aspect.

Newcourt (sold off)

Onset Capital (Irwin buys 87% equity)

Orix 10/2000 "long-term Outlook has been revised from Stable to Negative" Credit Allianchat it has changed its name to ORIX Financial Services, 9/2000 Japanese Bank President Commits Suicide (Orix is a 14.7% shareholder in bank having problems ), ( 8/2000 closes small ticket vendor division in Portland, Oregon, "Business as usual (in New Jersey and with brokers)," says Steve Geller 11/8 New President at Orix appointed 11/10 First Six Month Profits up 14% at Orix! )

Phoenix (both divisions closed)

Republic Leasing, South Carolina 9/27/2000 (“The expected result will be a sale of Republic Leasing"---Dwight Galloway)

Resource Leasing, Herndon, Virginia (11/2000 MicroFinancial/Leasecomm acquires major portion of the assets.)

Rockford (sold to American Express)

Scripp Financial (6/29/2000 (purchased by US Bancorp)

Signature Leasing, Dublin, California (1/2000 no longer in small ticket marketplace)

SDI (closed to broker programs)

SFC Capital (9/15/2000 purchased by Trinity Capital)

SierraCities (11/2000 acquired by Vertical Net Credit

T&W, Washington (10/2000 filed Chapter 11. Creditors meeting on 12-4-00 Seattle. Case #00- 10868 US Bankruptcy Court Western District of Wash. 206-553-7545. Debtor Attorney-Marc Barreca 206-623-7580)

Transamerica (for sale, but no buyers, so taken off marketplace, no longer for sale)

Unicapital ( $11.4 million first quarter loss chairman, CEO, CFO resign, 38 employees cutback, BofA extends credit to November 20, as Unicapital closes down divisions, not accepting new business, winding down, reportedly to file bk Nov 15 ).

Varilease (11/2000 closed down)

USA Capital Leasing (gone-bk)

(Perhaps it is time for a new list to record the changes in the last six months. editor)

|

--------------------------------------------------------------

Classified Ads---Controller

|

Boca Raton, FL CPA w/ Sarbanes Oxley/ 15 years management exp. as CFO/ Controller/5 yrs w/ PWC Extensive exp providing accounting/ tax guidance for the equipment lease industry. Willing to relocate. Email: bltushin@hotmail.com |

| Chicago, IL experienced in lease accounting, operations, management, and Sarbanes-Oxley. Seeking position with equipment lessor. Would consider contract assignments or relocating. Email: leasecontroller@comcast.net |

|

Southeastern, MI Controller & Management experience w/ equip lessors &broker. MBA, CPA w/ extensive accounting, management, securitization experience with public and private companies. Willing to relocate. Email: Leasebusiness@aol.com |

For a full listing of all “job wanted” ads, please go to:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

To place a free “job wanted” Leasing News ad:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

ELFA Career Center: Job Seekers (free):

http://careers.elfaonline.org/search.cfm

--------------------------------------------------------------

Key National Finance to cut 180 positions

by Christopher Menkin

Paul A. Larkins, CEO of Key National Finance and Key Equipment Finance, Boulder, Colorado, Leasing News Person of the Year for 2006, confirmed that his operation is cutting back 180 positions. Following the news of Irwin Financial, Huntington Bank, Popular Bank, even GE Capital and Citicapital, it should be no surprise to find Key Equipment Finance and Key National Finance cutting back from their reported 1,100 employees, according to the Leasing News Funder list.

http://www.leasingnews.org/Funders_Only/Funders.htm#key

It appears much of the cut backs come from the expansion effort out of the United States, or in support of this global operation.

According to Larkins, 30 positions of the company's 352 person Boulder, Colorado headquarters are being let go or not replaced via attrition.

Larkins said Key National Finance and Key Equipment Finance are offering career transition services and separation benefits to the affected employees and also is exploring employment opportunities within other parts of KeyCorp.

He pointed out there were two entities involved. He did say he was

“disappointed by the economic considerations that forced these difficult personnel decisions.”

Investment in education, mentoring, training remains key at Key, Larkins told Leasing News. His goal was to improve employee performance, benefits, and give them a chance to grow through better opportunities. While it may appear that his goal has now changed, he said it has not: “I will tell you that Key remains fully committed to our internship, and employee development/training programs.”

One of the main reasons Larkins was named Leasing Person of the Year 2006 was his intern, mentor programs, plus emphasis on education at his own company as wells as other leasing companies, especially when he was serving as president of the Equipment Leasing and Finance Association. This was during the period of changing of name, thrust, retirement of long time president Mike Fleming (now a principal at The Alta Group,) and choice of former Democratic congressman Kenneth Bentsen, Jr. to get more involved in education, growth, and both more federal and state influence to the benefit of the leasing industry

October 21, 2008, Key Corp, Cleveland, Ohio, parent of Key National Finance and Key Equipment Finance, reported a $36 million loss for their third quarter, compared to a $224 million profit for the third quarter, 2007. Key Bank was not alone in the banking world, although perhaps more diverse and community oriented than many of the Eastern banks.

The leasing division numbers from the third quarter SEC filing were relatively pretty good:

Consolidated Average Balance Sheets From Continuing Operations

(dollars in millions)

Commercial Lease Financing

3rd Qtr 2nd Qtr 1st Qtr

$9,585 $9,798 $10,172

Nine Month/three quarter/totals Commercial Lease Financing

Average balance (dollars in millions)

2008 2007

$9,795 $10,121

Summary of Loan Loss Experience

(dollars in millions)

9/30/08 6/30/08 9/30/08

24 18 11

Nine Month Ending

9/30/08 9/30/07

$57 $33

Yes, the numbers definitely were better than most leasing companies were reporting during this period, but the writing has been on the wall since August as more and more leasing companies and financial institutions, especially banks, have been cutting back personnel. First it is through attrition, then a redirection of product development. Many leasing companies have left the indirect broker marketplace as well as getting out of equipment leasing altogether. The branding effort and move to Europe and elsewhere was next for many, including CIT, GE Capital, and now Key.

Paul A. Larkins

“The global financial crisis has created unprecedented challenges for our industry,” Larkins said in a memo to employees. “In response, we have implemented actions to enhance our revenue profile and rationalize expenses associated with our business operations and infrastructure.

"These changes will allow us to continue delivering capital to our relationship clients. Our expense-related actions include the difficult decision to reduce our global work force by approximately 180 positions, many through normal attrition.”

Monday Key Corp. Bank said it has raised $2.5 billion in capital through the U.S. Department of the Treasury’s Capital Purchase Program.

|

--------------------------------------------------------------

--------------------------------------------------------------

--------------------------------------------------------------

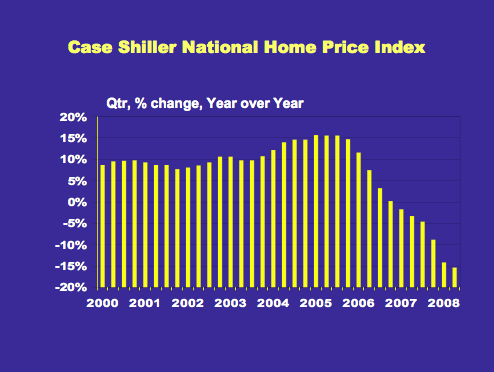

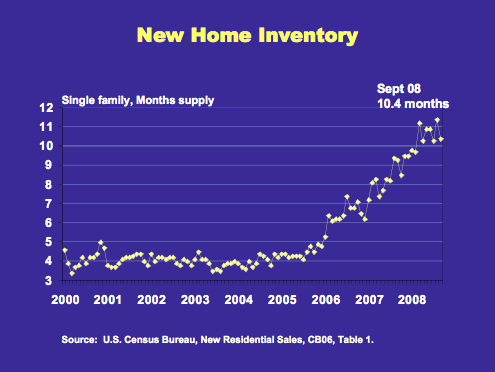

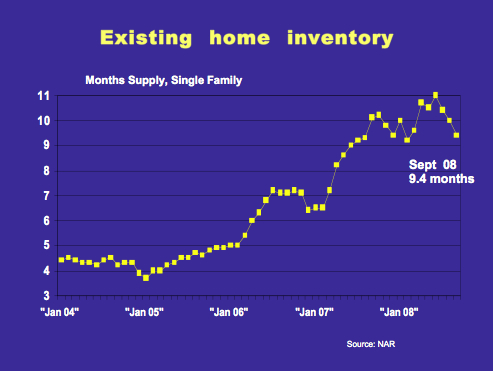

Housing to return to “normal” in 2014

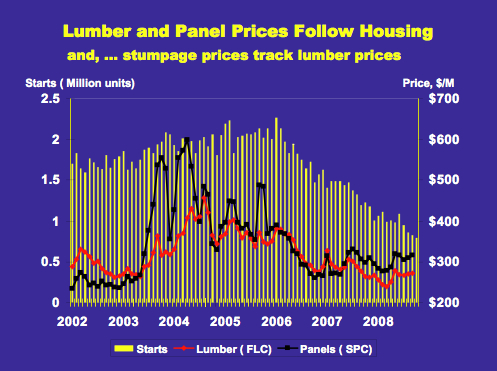

Housing continues to be a major financial problem and according to Al Schuler, USDA Forest Service, Analyst, who Leasing News has been quoting for the last six years, there does not seem to be much improvement in the future until 2011. The prediction then is three more years for housing to fully recover: 2014.

"Compounding the housing crises is the recession which is simply delaying the housing recovery,” Schuler points out. "The biggest problem remains foreclosures with the worsening job market, coupled with tight credit conditions, making matters worse.”

Florida, Nevada, Michigan, and California seem to be the hardest hit. Default Research, a major provider of preforeclosure real estate data in Southern California, is reporting that Notice of Defaults and Notice of Trustee Sales are up approximately 10.39 percent in October 2008 from the same time last year. The statistics also show that, from September 2008 to October 2008, the filings rose 24.04 percent.

“Senate Bill 1137 did ease the foreclosure problem in the Southern California region,” said Serdar Bankaci, founder of Default Research. “The bill, which went into effect in September, requires lenders to contact residents at least 30 days before filing a Notice of Default. By delaying the foreclosure process for families in the region, there was a relative decline in the number of Notices of Defaults and Notice of Trustee sales recorded last month.”

Even with the bill in effect, the hardest hit counties in Southern California are still Riverside and San Bernardino. Last month, Riverside had a staggering 12.12 percent of households in default while San Bernardino was second with 9.95% of households.

“Southern California is still struggling with approximately one in ten households entering foreclosure in Riverside and San Bernardino,” said Bankaci, whose daily foreclosure lists are e-mailed directly to real estate professionals in the region. “Market indicators continue to show declining inventories, but home prices continue to decline.”

Northern California is better off. The hardest hit counties in the region were Solano with 8.54 percent of households in default, followed by Sacramento at 7.98 percent, and Contra Costa at 7.72 percent. To put these numbers in perspective, those counties are over three times the national average of 2.5 percent which means one in every 12 households is in default.

The Default Research numbers show that in some of these regions home values have dropped over 25% since the peak of the real estate market. Rural areas such as Modesto and Stockton as well as

cities in Northern California also have higher than average unemployment rates, some above 10%.

Analyst Schuler points to general lack of confidence.

"Right now, people are understandably scared - their 401K's are down 30% or more this year; there have been almost 1.8 million net job losses to date; and the stock market is in panic mode, " he

said. "In this situation, people 'hunker down', and this unfortunately, makes matters worse. E.g., some pundits suggest that the 50% drop in oil prices translates to a big tax break, but, I would suggest that most people are saving the money that doesn't go into the gas tank. Consumer spending is 2/3rds or more of the economy, and when people cut back on spending, GDP has to come down, and this leads to more job losses.”

Deflation:

“Most wood product companies have been conserving cash by discontinuing dividends; cutting back on CAPEX expenditure; and reducing R&D expenditures.” Schuler says. “This, in addition to significant cut backs in production (both temporary and permanent) as they try to balance supply and demand. "

--------------------------------------------------------------

Persistent Housing Market Weakness Causes Thrift Industry Loss in Third Quarter of 2008

Washington, D.C. — Persistent weakness in the U.S. housing market continued to take a toll on the U.S. thrift industry in the third quarter of 2008, as the industry again set aside large reserves for loan losses, resulting in a $4 billion loss, the Office of Thrift Supervision (OTS) reported on Thursday.

Thrift institutions set aside $7.9 billion in loan loss provisions, prompted by a continuing downturn in the housing market that drove a further increase in troubled assets, mainly single family mortgages. In the most recent four quarters, the industry has added $23.4 billion to loan loss reserves.

“The housing sector is at the eye of the nation’s economic storm and the thrift industry, which focuses on home mortgages and other consumer retail lending, is feeling a strong impact,” OTS Director John Reich said. “This storm will pass, but we’ve already seen some damaging effects.”

Industry assets declined after the failure of three companies, including the country’s largest thrift, Washington Mutual.

Other highlights include:

At the end of the third quarter, there were 23 problem thrifts (institutions with composite examination ratings of 4 or 5), an increase from 17 thrifts in the previous quarter and 12 thrifts one year ago.

At the end of the third quarter, the OTS supervised 818 thrifts with assets of $1.18 trillion, as well as 469 holding company enterprises with approximately $8.1 trillion in U.S. domiciled consolidated assets.

Profitability, as measured by return on average assets (ROA), was a negative 1.35 percent in the third quarter, compared with negative 0.57 in the second quarter. One year ago, the industry ROA was a positive 0.20 percent.

More details, as well as charts and selected indicators, are available on the OTS website at

http://www.ots.treas.gov.

--------------------------------------------------------------

Leasing Industry Help Wanted

|

Burbank , California Credit Analyst Funding Manager Contact :Jason Downs: jdowns@capnetusa.com 877.980.0558 EXT. 125 |

www.capnetusa.com Recently named one of the “5 Best Places to Work” in Los Angeles . |

Sales

|

Like selling vendor programs and large transactions? CLICK HERE to find out how to have fun again. |

Please see our Job Wanted section for possible new employees.

-------------------------------------------------------------

New Hires---Promotions

JP Nicoletta named Chief Operating Officer for Graphic Savings Group, LLC., Brooklyn, New York. Nicoletta was formally with New World Equipment Funding, LLC, an independent funding source in Lake Success, New York, where he led the effort to develop their non-recourse third party program. He also performed various operations duties pertaining to risk management and servicing matters for New World’s +$200MM portfolio.

“This is a great opportunity for me,” Nicoletta said. “Graphic Savings Group is a perfect place for a young person to grow and get more involved in the leasing/finance business. New World is an excellent

company, but here was a chance for advancement in the industry.”

Prior to joining New World, Nicoletta was a Relationship Manager with Sovereign Bank’s Commercial Equipment and Vehicle Finance Division. He received a BA from Fordham University and is working to complete his MBA from Long Island University / C.W. Post College of Management.

--------------------------------------------------------------

Classified Ads---Training

Leasing Industry Outsourcing

(Providing Services and Products)

| Trainer: Atlanta, GA Able to provide training to dealers on financial merchandising as well as provide asset management service E-mail: kingcole@mindspring.com |

Trainer: Sausalito, CA Lease trainer and consultant. 38 years in equipment leasing. Expert in transaction analysis, financial statement analysis, credit, packaging, structuring. Presents highly popular classes and workshops. E-mail: BoTei@aol.com |

Please also visit:

http://www.leasingnews.org/Training/Financial_sales_trainer.htm

All "Outsourcing" Classified ads

(advertisers are both requested and responsible to keep their free ads up to date):

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

|

--------------------------------------------------------------

“Quantum of Solace”/” I’ve Loved You So Long”

“Encounters at the End of the World”

” Hellboy II: The Golden Army/ WALL-E”

Fernando’s View

By Fernando F. Croce

In Theaters:

Quantum of Solace (Columbia Pictures): After revitalizing the dried-up franchise in “Casino Royale,” Daniel Craig proves that his brutal, virile James Bond was no fluke in the secret agent’s newest adventure. As Bond seeks revenge for the death of his true love Vesper, he becomes part of an international intrigue involving bogus environmentalists and South American dictators, and meets a mysterious woman (Olga Kurylenko) with an agenda of her own. Director Marc Forster (“Monster’s Ball,” “The Kite Runner”) does better with the actors than with the over-edited action scenes, but Bond aficionados will enjoy the fast, elaborate thrills and the witty nods to the franchise’s most famous installments (including a particularly sharp reference to “Goldfinger”).

I’ve Loved You So Long (Sony Pictures Classics): Viewers interested in more subtle thrills will want to check out Philippe Claudel’s moody French drama. Kristin Scott Thomas (“The English Patient”) and Elsa Zylberstein play estranged sisters who meet after one of them returns after years in jail. The details of their relationship emerge slowly through an understated web of gestures and revelations that gradually goes from obscure to emotionally stirring. Unfolding like a book you can’t put down until you reach the end, the film is an intriguing look at anguish and identity boasting a stupendous performance by Thomas at its center.

New on DVD:

Encounters at the End of the World (Image): German filmmaker Werner Herzog (“Grizzly Man”) is still one of cinema’s great travelers, taking audiences along with him on journeys as arduous as they are fascinating. In his latest film, Herzog travels to Antarctica with a group of scientific explorers, and fantastic landscapes are matched by the unusual people making their way through them. You’d never think a documentary about researchers losing themselves in gigantic blocks of ice would make for very engaging viewing, yet Herzog’s eye for natural beauty and human idiosyncrasy ensures that every frame is imbued with visual splendor and a unique sense of humor.

Hellboy II: The Golden Army (Universal): Following his art-house success with “Pan’s Labyrinth,” Guillermo del Toro returns to giddy blockbuster territory with this eye-popping sequel to his 2004 hit. Adapted from Mike Mignola’s gorgeous graphic novels, the story finds devil-hero Hellboy (played with grouchy gusto by Ron Perlman) and his team of outsiders—including amphibian sidekick Abe (Doug Jones) and fire-shooting girlfriend Liz (Selma Blair)—battling a race of mythological beings bent on conquering the planet. Exciting, funny, and full of visually sumptuous creatures (a scene set in a monstrous marketplace has more imagination than all the “Star Wars” movies together), it’s a rare sequel that does the original justice.

WALL-E (Walt Disney): Continuing Pixar’s run of beguiling animated features, this exceptional tale goes beyond several of the limits of the standard cartoon and into something sad and beautiful. Set in a future in which the planet has become a deserted, cluttered garbage dump, the story follows WALL-E, a tiny waste-collecting robot with huge, melancholy eyes and dreams of finding a soul mate. Things take a drastic turn when another robot, Eve, takes WALL-E along back to its spaceship, where we discover what’s happened to Earth’s people. Director Andrew Stanton follows his previous family classic “Finding Nemo” with an equally impressive fable that’s sure to impress both children and adults.

---------------------------------------------------------------

### Press Release ###########################

Fitch Ratings: Global Corporate Negative Rating Drift Worsens in Third Quarter 2008

Fitch Ratings-New York-Fitch Ratings' global corporate rating actions in the third quarter of 2008 continued to reflect worsening credit and economic conditions with downgrades outnumbering upgrades 3.6 to 1, up from 1.8 to 1 in the second quarter and resulting in a year-to-date downgrade to upgrade ratio of 2.5 to 1.

Financial institutions shouldered the brunt of negative rating activity in the third quarter and year-to-date period with downgrades exceeding upgrades 5.3 to 1 in the third quarter and 3.2 to 1 on a year-to-date basis. Among industrials, downgrades led upgrades 1.8 to 1 in the third quarter and 1.7 to 1 year-to-date.

Emerging market corporate credits fared better than their developed market counterparts for the year-to-date period through September, registering a positive downgrade to upgrade ratio of 0.4 to 1, while developed markets recorded net negative rating movements for the same period of 4 to 1. However, emerging market Rating Outlook and Watch assignments have turned increasingly negative, indicating that credit quality is beginning to come under pressure in these previously robust markets. At the end of September, 13% of all emerging market issuers were assigned either a Negative Rating Outlook or Watch, compared with 7% at year-end 2007.

'Across Europe and North America, 21% of corporate issuers were assigned either a Negative Rating Outlook or Watch at the end of September compared with 13% at the beginning of the year,' said Charlotte Needham, Senior Director of Fitch Credit Market Research. 'The share of these issuers on Positive Rating Outlook or Watch declined to 7% from 9% at year end 2007.'

In addition to the more pronounced negative rating drift and increase in the share of global corporate entities on Negative Rating Outlook or Watch, the third quarter also recorded a meaningful increase in multi-notch downgrades.

'This year's rating activity clearly reflects the depth of the credit crisis and deteriorating prospects for global economic growth,' said Mariarosa Verde, Managing Director of Fitch Credit Market Research.

The new report 'Global Corporate Downgrades Accelerate in Third-Quarter 2008 - Rating Actions Exhibit Recessionary Patterns' dated Nov. 19, 2008, includes a detailed view of Fitch rating activity by industry sector and region and also provides insight into the distribution and direction of Fitch's global corporate rating outlooks.

If you have trouble viewing the report, please follow this link

http://www.fitchratings.com/corporate/reports/report_frame.cfm?rpt_id=415166

### Press Release ###########################

FDIC Announces Availability of IndyMac Loan Modification Model

"Mod in a Box" Road Map Now Available to Institutions

The Federal Deposit Insurance Corporation (FDIC) announces the availability of a comprehensive package of information to give servicers and financial institutions all of the tools necessary to implement a systematic and streamlined approach to modifying loans based on the FDIC Loan Modification Program initiated at IndyMac Federal Bank (IndyMac). The Program is designed to achieve affordable and sustainable mortgage payments for borrowers and increase the value of distressed mortgages by rehabilitating them into performing loans. Under the terms of the Program, borrowers receive a loan modification with a maximum 38% down to 31% housing-to-income ratio through the use of interest rate reduction, amortization term extension, and in some cases, principal deferment. This loan modification process improves the value of the troubled mortgages for investors while helping many borrowers experiencing financial difficulties remain in their homes.

The FDIC implemented this approach to loan modifications on August 20th after IndyMac Bank, FSB failed on July 11, 2008. As of November 20th, 2008 IndyMac has sent out more than 23,000 modification letters to eligible borrowers and has completed more than 5,300 modifications after verifying the borrowers' income. Thousands more are in the pipeline.

Although foreclosures are costly to lenders, borrowers and communities, the number of foreclosures continues to rise while the pace of modifications remains too slow. Currently, 1.6 million total loans are over 60 days delinquent. Through the end of 2009, the FDIC estimates that there will an additional 3.8 million new loans over 60 days past due. Today's release of the FDIC's "Mod in a Box" guide will provide the industry with the necessary tools to facilitate streamlined and systematic loan modifications to help stem foreclosures, halt the decline in home prices and provide needed stability to the broader economy.

FDIC Chairman Sheila C. Bair said, "The IndyMac loan modification framework is an effective loss mitigation strategy for both portfolio and securitized mortgages. I have long supported a systematic and streamlined approach to loan modifications to put borrowers into long-term, sustainable mortgages—achieving an improved return for bankers and investors compared to foreclosure. Implementing widespread loan modifications based on the Program used at IndyMac will strengthen local neighborhoods where foreclosures are driving down property values and will help stabilize the broader economy. I would encourage all industry participants to adopt the FDIC Loan Modification Program as the standard approach in dealing with the grave problems facing us with continued mounting foreclosures."

The FDIC Loan Modification Program guide is available at:

http://www.fdic.gov/consumers/loans/loanmod/loanmodguide.html

### Press Release ###########################

--------------------------------------------------------------

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

![]()

News Briefs----

GE Capital to Pare Jobs, Assets to Save $2 billion

http://www.bloomberg.com/apps/news?pid=20601103&sid=aJd9ubB_EQSA

VRL: Winners of Leasing Life Awards 2008 Announced

http://www.marketwatch.com/news/story/VRL-Winners-Leasing-Life-Awards/story.aspx

?guid=%7BD53ABA9C-D337-4762-A510-7F07DA452A65%7D

Bank of America's Lewis Sees U.S. `Drowning in Debt'

http://www.bloomberg.com/apps/news?pid=20601087&sid=aQSiUWDU0ng0&refer=home

Associated Press to cut 10 pct jobs in '09: sources

http://www.reuters.com/article/domesticNews/idUSTRE4AJ7V420081120?feedType=

RSS&feedName=domesticNews

WaMu cuts 1,600 S.F. Bay Area jobs

http://seattletimes.nwsource.com/html/businesstechnology/2008417607_webwamu20.html

Fields of Grain and Losses

http://www.nytimes.com/pages/business/index.html

---------------------------------------------------------------

You May have Missed---

Unsold Foreign Cars Hogging Space at a California Port

http://www.nytimes.com/2008/11/19/business/economy/19ports.html?

_r=1&ref=business&oref=slogin

----------------------------------------------------------------

![]()

“Gimme that Wine”

Can't-fail guide to Thanksgiving wines

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/11/20/WIDA1468EH.DTL

Vintage report: Châteauneuf-du-Pape 2004

http://www.decanter.com/archive/73037.html

Red wine may help ward off Alzheimer's

http://www.upi.com/Health_News/2008/11/19/Red_wine_may_help_ward_off_Alzheimers/

UPI-42781227129110/

Facebook Gets CorkSavvy: Share Your Wine Favorites with the Online Wine Journal

http://www.prweb.com/releases/corksavvy/facebook/prweb1579094.htm

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

The London International Vintners Exchange (Liv-ex) is an electronic exchange for fine wine.

http://www.liv-ex.com/

----------------------------------------------------------------

![]()

Today's Top Event in History

1835-Birthday of Henrietta Howland Robinson Green, better known as Hetty Green, reported to have been the richest woman in America, was born at New Bedford, MA. She inherited a large fortune from her father and invested it so shrewdly that she was considered the greatest woman financier in the world. She was an able financier who managed her own wealth, which was estimated to have been in excess of $185 million in today's money. At one point in time, Hetty Green held the mortgages on 60 churches. Died at New York, NY, July 3, 1916.

http://www.brfwitness.org/Bread/witchws.htm

http://www.scripophily.net/wesshorrrsto.html

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

| 1729-Birthday of Josiah Bartlett (also the name of the “president” in the TV series, “West Wing.” President of New Hampshire, Signer of the Declaration of Independence. http://www.josiahbartlett.com/ 1784 -- James Armistead is cited by French General Lafayette for his valuable service to the American forces in the Revolutionary War. Born into slavery 24 years earlier, had worked as a double agent for the Americans while employed as a servant of British General Cornwallis. http://staff.harrisonburg.k12.va.us/~paigner/gifted/James_Armistead_Lafayette/ JamesLafayette.html http://www.factmonster.com/ipka/A0886828.html http://russell.gresham.k12.or.us/Colonial_America/James_Armistead_.html 1785-Birthday of William Beaumont, US Army surgeon whose contribution to classic medical literature and world fame resulted from another man's shotgun wound. When Canadian fur trapper Alexis St. Martin received an apparently mortal wound June 6,1822---a nearly point-blank blast to the abdomen---Dr. Beaumont began observing his stomach and digestive processes through an opening in his abdominal wall. His findings were published in 1833 in” Experiments and Observations on the Gastric Juice and the Physiology of Digestion. St. Martin returned to Canada in 1834 and resisted Beaumont's efforts to have him return for further study. He outlived his doctor by 20 years and was buried at a depth of eight feet to discourage any attempt at posthumous examination. Beaumont, born at Lebanon, CT, died April 25, 1853 at St. Louis, Mo. 1789- North Carolina becomes the12th state to ratify the Constitution. http://memory.loc.gov/ammem/today/nov21.html 1800- Congress met at Philadelphia from 1790 to 1800, when the north wing of the new Capitol at Washington, DC, was completed. The House and the Senate had been scheduled to meet in the new building Nov 17, 1800, but a quorum wasn't achieved until Nov 21, 1800. Primary reason was the poor travel and highways became a priority with the new congress. 1800-formation of the Society of the Sacred Heart, a Roman Catholic religious order of women pledged to the education of girls. Founded by Madeleine Sophie Barat, it was brought to the U.S. at New Orleans in 1818 by Rose Philippine Duchesne. 1801 -- "Federal Bonfire Number Two", a mysterious fire swept the offices of the Department of Treasury, destroying books and papers, after Republicans demanded proof that the expenditures of Timothy Pickering, the recently replaced Federalist Secretary of War, could be properly accounted for. Most records in War Department custody were destroyed by fire, November 8, 1800. Many of the remaining Revolutionary War records were lost during the War of 1812. As a result there were, until 1873, few records for the period before 1789 in War Department custody. In 1873 Secretary of War William Belknap purchased for the Federal Government the papers of Timothy Pickering, who between 1777 and 1785 had been a member of the Board of War, Adjutant General of the Continental Army, and Quartermaster General; the papers of Samuel Hodgdon, Commissary General of Military Stores for several years during the war; miscellaneous contemporary papers; and some minor groups of records and single record items. http://www.cr.nps.gov/museum/exhibits/revwar/image_gal/indeimg/pickering.htm http://www.qmfound.com/COL_Timothy_Pickering.htm 1820 -- Thirteen-year-old Henry Wadsworth Longfellow's first poem, "The Battle of Lovell's Pond" is published in the Portland, Maine, Gazette. http://classicreader.com/author.php/aut.58/ 1824-The first Jewish congregation in the Reform movement was the Reform Society of Israe l ites, organized by dissident members of Congregation Beth Elohim of Charleston, SC, an Orthodox synagogue that had been founded by Sephardic Jews in 1750. The group was formed after the trustees of the synagogue refused a request to modernize the prayer service. Its leader was Isaac Harby, a teacher and journalist. The society disbanded in 1833, but many of its members rejoined the synagogue after the arrival of Rabbi Gustav Poznanski, who approved radical alterations in the service. 1835-Birthday of Henrietta Howland Robinson Green, better known as Hetty Green, reported to have been the richest woman in America, was born at New Bedford, MA. She inherited a large fortune from her father and invested it so shrewdly that she was considered the greatest woman financier in the world. She was an able financier who managed her own wealth, which was estimated to have been in excess of $185 million in today's money. At one point in time, Hetty Green held the mortgages on 60 churches. Died at New York, NY, July 3, 1916. http://www.brfwitness.org/Bread/witchws.htm http://www.scripophily.net/wesshorrrsto.html 1852- Union Institute was chartered by the Methodists in Randolph County, NC. Renamed Trinity College in 1859, the campus moved to Durham in 1892. Tobacco magnate James B. Duke endowed the school with $40 million in 1924, upon which its name was changed to Duke University. 1861-Confederate President Jefferson Davis names Judah Benjamin the secretary of war. A Sephardic Jew from South Carolina, Judah Benjamin was an exception to the rule in the Protestant South. As a young man, he moved to New Orleans and lived in a largely Jewish community. He married the daughter of a wealthy Catholic couple, but the marriage was distant--Natalie Benjamin moved to Paris soon after the birth of their daughter and the couple spent little of their fifty-plus-year marriage together. Benjamin practiced law and bought a sugar plantation near New Orleans. He became a representative in the Louisiana state legislature in 1842, and he was elected to the U.S. Senate in 1852. While there, he became a close friend of Jefferson Davis, who was then a Mississippi senator. Benjamin resigned during the secession crisis of 1860 and 1861, even before Louisiana officially left the Union. Davis selected Benjamin as the Confederacy's first attorney general, and he quickly became the president's most trusted advisor. After the Battle of First Bull Run, Secretary of War Leroy Walker resigned amid criticism that the Confederate army did not pursue the defeated Yankees. Davis appointed Benjamin to the position. Although Benjamin had no military experience, his appointment allowed Davis to dominate Confederate military affairs. Placing his trusted friend in the position of secretary of war ensured that Davis would not be challenged on important military decisions. Benjamin efficiently managed the day-to-day work of the war department, but he began to quarrel with some of the top generals who resented taking orders from a non-military bureaucrat. Benjamin also drew unfair criticism because of his religion--many openly questioned his loyalty because of his Jewish faith. When Roanoke Island fell to the Yankees in March 1862, criticism of Benjamin peaked. Many censured him for not sending men and supplies to the island's garrison. Furthermore, the war was going badly for the Confederates in the West. Davis recognized that the storm of complaints was crippling Benjamin's ability to perform his duty, so he appointed Benjamin secretary of state when Robert M. T. Hunter resigned that position. As the outlook for the Confederacy grew bleaker in 1863 and 1864, Benjamin floated the idea that the South could obtain foreign recognition only by promising emancipation. This radical concept fell on deaf ears until the last weeks of the war. When the Confederacy finally collapsed, Benjamin fled with the rest of the Confederate government to Danville, Virginia. When President Lincoln was assassinated, it was discovered that Benjamin had ties to the Surratt family, which was implicated in the conspiracy. Fearing capture and prosecution, Benjamin fled the country. He settled in England and practiced law there, often visiting his wife and daughter in Paris. During the rest of his life, Benjamin rarely spoke of his service to the Confederacy. He died in Paris in 1884. 1865-Shaw University founded, oldest black university in the South. http://www.shawuniversity.edu/profile.htm 1871 - The cigar lighter was patented by M.F. Gale of New York City. 1877- Thomas Edison announced his invention of the phonograph, Menlo Park, NJ. 1902- Phoebe Jane Fairgrave Omlie birthday, aviator, used an inheritance at age 17 to buy her own plane and then sold stunt flying to a movie studio to justify the expense. Her mother supported her endeavors. Her diminutive size handicapped her. She and her husband did barn-storming, which included walking on wings and other death-defying acts that were the mainstays of early aviation exhibitions. She was the first woman to get a federal pilot's license. With Amelia Earhart she painted markers on roofs throughout the country that guided pilots to the nearest airport (long before radar and plane-to-ground radios); headed and coordinated a project to train 5,000 airport ground personnel. She also opened a school for the training of women instructors after the Civilian Pilot Training schools fired all women instructors. http://www.anb.org/articles/20/20-00742.html 1904 --Coleman Hawkins Birthday http://www.redhotjazz.com/hawkins.html 1905- Frederick Charles (Freddie) Lindstrom, Baseball Hall of Fame third baseman and outfielder born at Chicago, IL. Lindstrom played for the New York Giants in the 1920s and 1930s. In the 1924 World Series, a ground ball hit a pebble and bounced over his head, allowing the run that gave the championship to the Washington Senators. Inducted into the Hall of Fame in 1976. Died at Chicago, Oct 4, 1981. 1908- birthday of Paul Rapier Richards, baseball player, manager and executive born at Waxahachie, TX. Richards was a catcher with marginal ability, but an innovative manager and executive. He invented the oversized catcher's mitt to handle knuckleball pitchers and the “Iron Mike” pitching machine. Died at Waxahachie, May 4,1986. 1920 – Birthday of Stan ‘The Man' (Stanley Frank) Musial (Baseball Hall of Famer, born Donora, PA.: SL Cardinals outfielder, first baseman [World Series: 1942, 1943, 1944, 1946/all-star: 1943, 1944, 1946-1963/Baseball Writers' Award: 1946, 1948]; topped .300 mark 18 times, won seven N.L. batting titles with his famed corkscrew stance and ringing line drives; 3-time MVP played in 24 All-Star games; nicknamed ‘The Man' by Dodger fans for the havoc he wrought at Ebbets Field) 1925-Birthday of guitarist Sal Salvador, born Monson, MA. 1934- The New York Yankees paid the San Francisco Seals $25,000 and four players for Joe DiMaggio. Despite DiMaggio's 61-game hitting streak in 1933 and his .341 batting average in 1934, the Yankees kept him with the Seals for 1935. He hit .398. 1934 - Cole Porter's "Anything Goes" opened at the Alvin Theatre in New York City. The show ran for 420 performances. 1934-The New York Yankees paid the San Francisco Seals $25,000 and four players for Joe DiMaggio. Despite DiMaggio's 61-game hitting streak in 1933 and his .3451 batting average in 1934, the Yankees kept him with the Seals for 1935. He hit .9398. 1940-Birthday of piano player Dr. John ( Malcom John Rebennack), New Orleans, LA ( also known as “The Night Tripper.”) http://www.jazzvalley.com/musician/dr.john http://www.frankspicks.com/reviews/doc.htm 1942—The Alcan Highway opens, Alaska ( lower half of: http://memory.loc.gov/ammem/today/nov21.html ) 1944---*MINICK, JOHN W. Medal of Honor Rank and organization: Staff Sergeant, U.S. Army, Company I, 121st Infantry, 8th Infantry Division. Place and date: Near Hurtgen, Germany, 21 November 1944. Entered service at: Carlisle, Pa. Birth: Wall, Pa. Citation: He displayed conspicuous gallantry and intrepidity at the risk of his own life, above and beyond the call of duty, in action involving actual conflict with the enemy on 21 November 1944, near Hurtgen, Germany. S/Sgt. Minick's battalion was halted in its advance by extensive minefields, exposing troops to heavy concentrations of enemy artillery and mortar fire. Further delay in the advance would result in numerous casualties and a movement through the minefield was essential. Voluntarily, S/Sgt. Minick led 4 men through hazardous barbed wire and debris, finally making his way through the minefield for a distance of 300 yards. When an enemy machinegun opened fire, he signaled his men to take covered positions, edged his way alone toward the flank of the weapon and opened fire, killing 2 members of the guncrew and capturing 3 others. Moving forward again, he encountered and engaged single-handedly an entire company killing 20 Germans and capturing 20, and enabling his platoon to capture the remainder of the hostile group. Again moving ahead and spearheading his battalion's advance, he again encountered machinegun fire. Crawling forward toward the weapon, he reached a point from which he knocked the weapon out of action. Still another minefield had to be crossed. Undeterred, S/Sgt. Minick advanced forward alone through constant enemy fire and while thus moving, detonated a mine and was instantly killed. 1944---Top Hits The Trolley Song - Judy Garland I'll Walk Alone - Dinah Shore Together - Helen Forrest & Dick Haymes Smoke on the Water - Red Foley 1948- The Sunday morning religious program "Lamp Unto My Feet" first aired over CBS television. It became one of TV's longest running network shows, and aired through January 1979. 1948-Birthday of drummer Alphonse Mouzon, Charleston, SC http://www.tenaciousrecords.com/bio.html http://www.drummerworld.com/drummers2/Alphonse_Mouzon.html http://www.amazon.com/exec/obidos/ASIN/B000003P0Q/inktomi-musicasin-20/ 104-6368463-9838304 http://www.angelfire.com/mac/keepitlive/drummers/Mouzen/mouzen.htm 1952---Top Hits You Belong to Me - Jo Stafford Glow Worm - The Mills Brothers Because You're Mine - Mario Lanza Jambalaya (On the Bayou) - Hank Williams 1953--- "Rags to Riches" by Tony Bennett topped the charts and stayed there for 8 weeks. 1955 - The first lady of the American stage, Helen Hayes, was honored for her many remarkable years in show business, as the Fulton Theatre in New York City was renamed the Helen Hayes Theatre 1956- Don Newcombe of the Brooklyn Dodgers won the first Cy Young award, given to the most outstanding pitcher in the major leagues. He added the National League Most Valuable Player Award to his trophy case as well 1959 - Following his firing from WABC Radio in New York the day before, Alan Freed refused “on principle” to sign a statement that he never received money or gifts (payola) for plugging records. Incidentally, few may remember, but Freed left WABC while he was on the air. He was replaced in mid-record by Fred Robbins, who later became a nationally-known entertainment reporter for Mutual Radio. 1960- "Stay" by Maurice Williams & the Zodiacs topped the charts and stayed there for a week. 1960---Top Hits Stay - Maurice Williams & The Zodiacs Are You Lonesome To-night? - Elvis Presley Last Date - Floyd Cramer Wings of a Dove - Ferlin Husky 1964 - The Verrazano Narrows Bridge opened. Actually, the upper deck was opened to traffic on this day. The bridge, linking Brooklyn and Staten Island, was the world's longest suspension bridge at 4,260 ft. 1980 - The largest TV audience ever, an estimated 82 million people, watched as Sue Ellen's sister, Kristin Shepard, shot J.R. Ewing on "Dallas". The jilted mistress was seen holding the smoking gun after a summer of viewers asking that haunting question, “Who Shot J.R.?” Eighty percent of all viewers watched the show. 1966-Birthday of Troy Kenneth Aikman , football player, star Dallas quarterback now sportscaster, West Covina, CA. 1967-Gen. William Westmoreland, commander of U.S. Military Assistance Command Vietnam, tells U.S. news reporters: "I am absolutely certain that whereas in 1965 the enemy was winning, today he is certainly losing." Having been reassured by the general, most Americans were stunned when the communists launched a massive offensive during the Vietnamese Tet New Year holiday on January 30, 1968. During this offensive, communist forces struck 36 of 44 provincial capitals, 5 of 6 autonomous cities, 64 of 242 district capitals and about 50 hamlets. At one point during the initial attack on Saigon, communist's troops actually penetrated the ground floor of the U.S. Embassy. 1968 -- A portrait of Frederick Douglass appears on the cover of Life magazine. The cover story, "Search for a Black Past," is the first in a four-part series of stories in which the magazine examines African-Americans, a review of 50 years of struggle, with interviews of Jesse Jackson, Julian Bond, Eldridge Cleaver, Dick Gregory, & others. http://www.life.com/Life/covers/1968/cv112268.html 1968---Top Hits Hey Jude - The Beatles Those Were the Days - Mary Hopkin Love Child - Diana Ross & The Supremes I Walk Alone - Marty Robbins 1969-The “internet” began when the first computer network was ARPANET, a data communications network developed by J.C.R. Lieklider, Robert Taylor, and other researchers for the Department of Defense's Advanced Research Projects Agency. The first ARPANET link was put into service on November 21, 1969. It connected a computer in the computer science department at the University of California at Los Angeles with a laboratory computer at the Stanford Research Institute, Stanford, CA. Over the next decade, ARPANET grew to include many government and university computers. In 1973, Dr. Vinton Cerf and Robert E. Kahn were commissioned by the federal government to create a national computer network for military, governmental, and institutional use. The network was based on ARPANET sites and employed packet-switching, flow-control, and fault-tolerance techniques developed by ARPANET. Historians consider this world wide network the origin of the Internet. 1970-Two months after launching their TV series, The Partridge Family reaches the top spot on the Billboard Hot 100 with "I Think I Love You". The only members of the cast who actually sang on the record were David Cassidy and his real-life step mother, Shirley Jones.. 1976---Top Hits Tonight's the Night (Gonna Be Alright) - Rod Stewart The Wreck of the Edmond Fitzgerald - Gordon Lightfoot Love So Right - Bee Gees Somebody Somewhere (Don't Know What He's Missin' Tonight) - Loretta Lynn 1981 - Olivia Newton-John started the first of 10 weeks at the top of the pop music charts when "Physical" became the music world's top tune. 1982- After a strike that commenced on September 23, the NFL resumed play with the seven intervening weeks of the season having been canceled. 1984---Top Hits Wake Me Up Before You Go-Go - Wham! Purple Rain - Prince & The Revolution I Feel for You - Chaka Khan Give Me One More Chance – Exile 1986-National Security Council member Oliver North and his secretary, Fawn Hall, begin shredding documents that would have exposed their participation in a range of illegal activities regarding the sale of arms to Iran and the diversion of the proceeds to a rebel Nicaraguan group. On November 25, North was fired but Hall continued to sneak documents to him by stuffing them in her skirt and boots. The Iran-Contra scandal, as it came to be known, became an embarrassment and a sticky legal problem for the Reagan administration.Only six years earlier, Iran had become an enemy of the United States after taking hostages at the U.S. embassy in Tehran. At the time, President Reagan had repeatedly insisted that the United States would never deal with terrorists. When the revelation surfaced that his top officials at the National Security Council had begun selling arms to Iran, it was a public relations disaster. During the televised Iran-Contra hearings, the public learned that the money received for the arms was sent to support the Contras in Nicaragua, despite Congress' Boland Amendment, which expressly prohibited U.S. assistance to the Contras. Though the communist Sandinistas had been legitimately elected in Nicaragua, the Reagan administration sought to oust them by supporting the Contras, an anti-Communist group. During the Iran-Contra hearings, North claimed that the entire Reagan administration had known about the illegal plan. After admitting that he had lied to Congress, he was convicted of shredding documents, obstruction of justice, and illegally receiving a security fence for his own residence. He received a light sentence of a fine and probation. A year later in July 1990, an appellate court voted 2-1 to overturn his conviction based on the possibility that some of the evidence may have come from testimony that Congress had immunized in their own hearings on the matter. President Reagan and Vice President George Bush maintained that they had no knowledge of the scheme. In fact, when Reagan was deposed, he claimed to have little memory of anything that happened in the White House in the mid-1980s. 1987 -- Cuban prisoners at a detention center in Oakdale, Louisiana riot & take control when the US announces reactivation of a 1984 agreement allowing Cuba to take back 2,000 "undesirables" in the U.S. A federal prison in Atlanta was commandeered two days later. The Oakdale standoff ended 29 November with release of hostages; the Atlanta crisis was resolved 4 December after the government agreed to grant a fair review of each Cuban's case. http://dwardmac.pitzer.edu/Anarchist_Archives/bright/dolgoff/cubanrevolution/toc.html 1987- "Mony Mony" by Billy Idol topped the charts and stayed there for a week. 1992- "I Will Always Love You" by Whitney Houston topped the charts and stayed there for 14 weeks. 1995 - The Beatles' "Anthology I" sold 450,000 copies in its first day of release. According to Capitol Records, it was the most single-day sales ever for an album. Yeah, yeah, yeah... 1995-The first entirely computer-animated movie “ Toy Story,” 81 minutes long, was released Walt Disney Pictures, Burbank, CA. It was produced at Pixar Corporation and directed by former Disney animator John Lasseter. The plot involves the adventures of two dolls, a cowboy and a space hero, who are rivals for the attention of a young boy. Toy Story was one of the year's top-grossing films, earning close to $300 million worldwide in its first 12 months of release. 1995- The Dow-Jones Index of 30 major industrial stocks topped the 5,000 mark for the first time. 1996- CompuServe announced it would shut down its family-oriented service, WOW!, just eight months after it was launched. The company had tried to enter the family market and enhance its computer presence earlier in the year, but it backed off after investing some $70 million in the high-profile launch. The service attracted only about 100,000 subscribers during its short life. 2002 -In an effort to appeal more to women and families, Major League Baseball announces a partnership with 5-year-old Women's Pro Softball League recently renamed National Pro Fastpitch. MLB will provide sponsorship support along with giving the softball players a presence at big league events. |

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out

with one click, or type in a new route to learn the traffic live.

Bank Beat

Cartoons

Computer Tips

Fernando's Review

Leasing 102

Online Newspapers

Placards

Sales Make it Happen

To Tell the Truth