Friday, October 17, 2008

"Cheers," Shelley Long, Ted Danson, George Wendt

Headlines--- Classified Ads---Syndicator --Special---- ######## surrounding the article denotes it is a “press release” ------------------------------------------------------------------------------- Classified Ads---Syndicator

For a full listing of all “job wanted” ads, please go to: To place a free “job wanted” Leasing News ad: ELFA Career Center : Job Seekers ( free ): ------------------------------------------------------------------------------

ELFA President Ken Bentsen on Fox News

See Equipment Leasing and Finance Association Kenneth Bentsen, Jr. interviewed on Fox, discussing the financial rescue plan, the markets, the economy and his views from the leasing industry viewpoint. This was sent in by a Leasing News reader: (Hit play )

------------------------------------------------------------------------

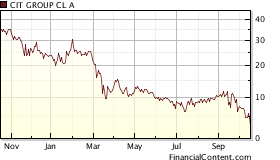

Peek calls CIT an “underdog” by Christopher Menkin

While the press releases to the media have been positive, trying to show liquidity, changes being made, the facts are the third quarter for the CIT Group (NYSE:CIT) New York was a $301.6 million loss, compared to a net loss of $46.3 million for the same period in 2007, second quarter $2.1 billion loss compared to a net loss of $135 million in the same period in 2007, and a first quarter loss of $257 million, compared to a profit of $271.4 million in 2007. CIT can't sell off units fast enough to turn the bottom line into a profit.

Hearing the news, the stock declined to its lowest in history to $2.92 on volume of 22,364,117, double its three month average of 10,839,300.

Jeffrey M. Peek, Current CIT Chairman and CEO “I think we have an underdog mentality here at CIT, “Peek said in the CIT telephone conference call: “For the last 50 if not 70 years we've been competing against the banks and the bigger banks. Cost of funds is part of the equation in terms of how you get business. Relationships, speed of turnaround, personal knowledge of people are also quite important. “Right now we're turning business away because we're one of the last people still in the market place. “If there were ever a time when just being bigger was going to dominate how you get business, it'd be in a time like this and as I said we have more business than we can write at this point based on liquidity.” http://seekingalpha.com/article/100286-cit-group-inc-q3-2008-earnings-call-transcript?source=wildcard&page=1 The CIT branding campaign began early March, 2007: “What is most important to realize is how CIT Financial recognizes the overall importance of lease financing: where it is not the balance sheet, but other properties, including cash flow and character that determine ‘capacity. It over rides traditional methods of equity as the means of granting credit. It is what the basics of all business really gets down to: know your customer. It fits today's rapid expansion into world wide markets, as well as your own home town. “As Jeffrey M. Peek, CIT Chairman and CEO, explains it, ‘The new campaign highlights CIT's unique go-to-the market strategy which goes beyond traditional financial analysis and places value on a customer's potential, ideas, and its people. The brand campaign was created by and launched through ‘Kirshenbaum bond' and partner (www.kb.com. editor).” http://www.leasingnews.org/archives/March%202007/03-05-07.htm#cit Since then, the subprime mortgage, student loans, and other aggressive tactics have taken their toll. Coincidental or not, it is noticeable how many executes are not any longer at CIT, such as Walter J. Owens, who left last Friday, Rick Wolfert, who left and then help start Tygris, plus US and the Global and US vendor program guru (Dell Computer) Thomas Hallman who allegedly retired. CIT Group Chairman Jeffrey Peek in discussing the third quarter loss said, "Vendor-finance returns were disappointing and we are undertaking a restructuring of that unit." If the vendor divisions are not doing well, also look for these people to "resign:" Ron Arrington, President, CIT Vendor Finance , U.S.

-------------------------------------------------------------------------------

Textron Cutting Back Its Finance Arm Stephen Taub - CFO.com | US

Textron Inc. is downsizing its commercial finance business to reflect "the sustained turmoil in world credit markets." In a regulatory filing, the company said, "In recent weeks, volatility and disruption in the capital and credit markets have reached unprecedented levels." The conglomerate, which has aircraft and defense businesses that include the Bell Helicopter and Cessna Aircraft brands, said that revenues companywide in the third quarter topped $3.5 billion, up 13.6 percent from $3.1 billion in 2007. A 15.6-percent growth in the manufacturing businesses offset a decline in revenues at the finance business, it said. Finance revenues decreased $30 million in the third quarter, due to lower market interest rates partially offset by the benefits of higher volume and interest rate floors. What's more, profits in the segment decreased $36 million due to an increase in the provision for loan losses and higher borrowing costs. Meanwhile, Textron said 60-day plus delinquencies increased to 1.06 percent of finance receivables from 0.61 percent at the end of the second quarter. Nonperforming assets increased to 2.67 percent of total finance assets from the second quarter level of 2.31 percent. "Strength in our aircraft and defense businesses offset weaker than expected performance in the finance business arising from the challenging economic environment," said Lewis B. Campbell, chairman, president, and CEO. "We remain committed to achieving strong performance results at our aircraft and defense businesses as we work through the issues facing us in our other segments." In response, Textron said that it will reduce the size of Textron Financial Corp., its commercial finance business, and the company will exit its Asset Based Lending and Structured Capital segments, along with several additional product lines, through an orderly liquidation over the next two to three years, as market conditions allow. The assets in the businesses to be liquidated represent approximately $2 billion in managed finance receivables within TFC's $11.4 billion portfolio, it said. TFC also said that it will limit new originations in its Distribution Finance, Golf, and Resort portfolios. Textron is one of a number of manufacturers — along with General Electric, the auto makers, Harley-Davidson Inc. and Caterpillar Inc — with finance operations designed ease the customer's way to buying goods. Reuters noted that some, such as Caterpillar and Harley, have remained focused, and have run into less trouble so far during the current period of credit-market turmoil than have Textron and GE, which ventured farther afield. Still, it's the rare financing business that has been spared the pain that resulted when the securitization markets they relied on for liquidity dried up, the wire service noted. Harley, for example, said on Thursday that operating profit fell 28 percent at its finance arm, which is involved with about half its motorcycle sales. As a result of the decision to downsize TFC, Textron said it expects to take a noncash impairment charge in the fourth quarter of up to $169 million, which represents the current goodwill balance at TFC. The company will also incur restructuring charges for headcount reductions and consolidations. "Going forward, we will continue to carefully evaluate the appropriate range of remaining lending activities at TFC in light of strategic fit and continuing developments in the capital markets, all in a manner that maximizes value for shareholders in any current or future financial market scenarios," Campbell said. Meanwhile, Textron said it has suspended its share repurchase program and is exploring a number of options to reduce a portion of its outstanding commercial paper funding. Magazine and email subscription is free:

-------------------------------------------------------------------------------

Office of Thrift Supervision Cost of Funds

http://leasingnews.org/PDF/OTS_Cost_of_Funds.pdf

-----------------------------------------------------------------------------

Balboa Capital says it has secured $100 MM

Balboa Capital, Irvine , California , issued a press release on Wednesday announcing that it had “secured $100MM in debt capital from its lending partners.” Phil Silva, President of Balboa Capital, stated, “In some of the tightest credit markets we've seen in recent times, our lenders have had the confidence to commit and provide $100MM in capital. This is a reinforcement of and testament to the confidence they have in our direction, track record of twenty years, leadership team, and our people. As capital becomes increasingly scarce, we need to be there for our customers - extending a hand of confidence, assurance and assistance with their equipment financing.” “Today and into the future, Balboa Capital has the financing available for our small and medium-sized business customers to acquire the equipment they need to fuel the growth of their respective businesses.” Leasing News tried to obtain answers from Chairman Pat Byrne, Phil Silva, President, as well as the communication officer who sent out the press release. Most press releases contain this information,and when they do not, Leasing News asks the party who sent the press release for the name or names. Leasing News requested the name or names of the lender(s), specifically not asking for their address or who to contact, just the corporate names of the debt capital lending partners. Also were these warehouse lines, nonrecourse and/or recourse lines (where you pay off the lease if it defaults or do you substitute another lease?) and are the open ended or a specific dollar amount for each lender? Or are they securitization sources where a company warehouses leases and then bundles them up and discounts the portfolio.” Generally, we do not verify these and leave it up to readers or the lender(s) named to contact us if not correct. Brokers who have worked with Balboa learn where the individual leases wind up, as well as Leasing News has learned from the Balboa Capital complaints received; the stream of payments were sent elsewhere, often to other leasing companies. Nothing illegal or wrong with this, but is the statement from Balboa Capital more “marketing” than naming the source(s) of the $100 million in debt capital “from its lending partners”? Corporate Information: Funder List Information:

------------------------------------------------------------------------------- Classified Ads—Help Wanted Vendor Sales Specialists

-------------------------------------------------------------------------------

New Hires---Promotions

Shawn Arnone appointed to senior vice president, business development for US Express Leasing (USXL), a Tygris Commercial Finance company, Parsippany , N.J. Prior to joining USXL, Arnone was senior vice president, global business development, for The CIT Group, from March 2005 through September 2008. During 2001-2005, he was vice president of global business development at Key Equipment Finance. Arnone also held key sales and management positions at Citicapital, Copelco Capital and Canon Financial Services. Before his career in financial services, Shawn co-founded and managed two successful businesses, including a magazine targeted toward teenagers and a well-known local dessert shop, Sweet Stuff, which he owned at the age of 19. He is an active member of the Equipment Leasing & Finance Association. Arnone currently serves on the Captive & Vendor Finance Business Council Steering Committee. Arnone attended St. Peter's College in Jersey City , N.J. , and received a Masters Degree in Business Administration from the Baruch College Zicklin School of Business in New York . Arnone resides in Harrington Park , N.J. Christopher M. Czaja has been named to the newly-created position of executive vice president of Insight Investments, Orange, CA. Mr. Czaja will be responsible for corporate finance including managing the privately-held company's banking relationships, treasury, credit and syndications, and will report to David Wang, Insight Investments chief financial officer. Previously, Mr. Czaja was vice president and treasurer of Relational Technology Solutions for six years where he was an active member of the senior management team overseeing all banking and credit functions, and structured and negotiated the company's domestic syndicated revolving credit facility representing over $200 million in commitments, a syndicated Canadian revolving credit facility, and asset-backed commercial paper program. Before that, he was vice president of the leasing department for European American Bank, now Citibank, where he was a founding member and manager of a de-novo lending team established to service leasing companies nationwide. He was responsible for new business development, account management and syndication activities for a multi-hundred million dollar portfolio. Prior to that, Mr. Czaja held management positions with National Westminster Bank (later Fleet and now Bank of America). Mr. Czaja holds a Bachelor of Science degree (Cum Laude) in Management and International Business as well as a Master of Business Administration degree (with Distinction) in Accounting and Finance from New York University 's Stern School of Business. Fred MacDonald has been appointed to Veterans Leasing & Finance, Inc. and Key Credit Corp sales and management team. The press release states “Fred brings with him over 30 years experience in the equipment leasing and finance industry, having held senior management positions at both Fleet Credit Corp., Denrich Leasing Division and Unicyn Funding Group, Inc. Most recently, Fred was Vice President of LEAF Third Party Funding, a subsidiary of LEAF Financial Corporation. “Veterans Leasing & Finance, Inc. (www.vlfinc.com) - specializes in the leasing and financing of a wide variety of equipment and is a backed by Key Credit Corp., a leader for more than 21 years in large volume vendor programs. Fred's working relationship with Key Credit Corp. dates back to 1986 when he was Vice President of Operations at Denrich Leasing.” Michael Zaman to lead syndications of equipment loan and lease transactions for Wells Fargo Equipment Finance's Regional, Business Banking, U.S. Corporate Banking and Corporate Aircraft groups. New to Wells Fargo, Zaman is a 15-year veteran in the syndications industry, and brings with him expertise gained from serving as syndications manager for a variety of banks, investment and independent equipment leasing companies. https://www.wellsfargo.com/com/bus_finance/wfefi/index -------------------------------------------------------------------------------

The average American credit score is 692

Here's a good chart that explains the impact of your score: * 720-850 - Excellent - This represents the best score range and best financing terms. * 700-719 - Very Good - Qualifies a person for favorable financing. * 675-699 - Average - A score in this range will usually qualify for most loans. * 620-674 - Sub-prime - May still qualify, but will pay higher interest. * 560-619 - Risky - Will have trouble obtaining a loan. * 500-559 - Very Risky - Need to work on improving your rating. Get Your Credit Score Now It's simple and doesn't require a SSN. (The company also advertises a “free trial.”) Visit this link:

(This ad is a “trade” for the writing of this column. Opinions contained in the column are those of Mr. Terry Winders, CLP) -------------------------------------------------------------------------------

-------------------------------------------------------------------------------

Fernando's View By Fernando F. Croce

Three movies/Three DVD's

Body of Lies (Warner Bros.): On the heels of the “Bourne” thrillers comes this complex, exciting action-drama about spy games in the Middle East , and the people caught in them. Director Ridley Scott teams up once more with his “Gladiator” star Russell Crowe, but Leonardo DiCaprio plays the film's shifting moral center, a U.S. intelligence agent determined to hang on to his idealism (and his life) in the middle of a series of dangerous secret missions in Iraq and Jordan. Though the two stars don't get enough time together, the film, made with Scott's trademark crispness and full of intrigue, is perfect for audiences who like sharp ideas along with their explosive action.

-----------------------------------------------------------------------------------

Beige Book: Worse than the last one

Reports indicated that economic activity weakened in September across all twelve Federal Reserve Districts. Several Districts also noted that their contacts had become more pessimistic about the economic outlook. Boston New York Philadelphia Cleveland Richmond Atlanta Chicago St. Louis Minneapolis Kansas City Dallas San Francisco

Full report

(Leasing News provides this ad “gratis” as a means to help support the growth of Lease Police -------------------------------------------------------------------------------

--Special---- “My Reaction to the Credit Crisis” by Gerry Egan, www.LearnLeasing.com

All I can do is what I can do and right now is a good time to do all that I can. I've been in the equipment leasing business in the US for almost thirty years and the owner of my own small company for almost eighteen of them. Equipment leasing is, essentially, an alternative form of financing for acquiring the business use of capital assets. Some parts of the industry are truly asset oriented, where most of the considerations surrounding any given transaction are based on the initial and the expected residual values of the equipment to be leased. Much of the industry, though, and the part of it I operate in, are far less focused on the value of the equipment to be leased than on the general creditworthiness of the company that will be leasing it; fundamentally it's a credit based business. Because any economic ‘bumps in the road' can directly affect the cost as well as the availability of business credit, one question I've been asked dozens of times over the years when we've hit those bumps is: How is the economy affecting my business? My favorite reply is to say that my business is way too small to be effected by anything as big as the national economy! That's partly my idea of being witty but it's also the only choice I have in looking at it. You see, as a small business owner, all I can really control about my business is what I do every day. If things in the economy-at-large are normal and I want to improve my business, I just need to work a little smarter. If things in the economy-at-large are really going gang-busters and I want to be sure to maximize the opportunity to improve my business, I just need to work a little smarter then, too. And if things in the economy-atlarge are going very poorly and I want to improve my business, can you guess what I need to do? That's right; I need to work a little smarter. So what do I think is the smart way for me to be working today? Well, this is a credit crisis, according to news reports. Nobody's going to be lending money they say. I'm not so sure, though. There's still money around and sitting still it isn't worth much, so I think it's more likely that money will still get lent, it will just get lent more carefully and to the best quality customers. In fact, I think much of it will go on a local basis to other small businesses, businesses who think like I do, that they can control how the economy affects them by controlling how smart they work every day. That's good news for me. A small business like mine has a better chance of effectively reaching the other small business owners around me than those ‘big guys' do. The other good news for me is that as the local banks that those small businesses around me are used to turning to for loans tighten up their policies and purse strings, those customers will be more open than ever before to looking at alternatives. Guess what business I'm in? I'm in the alternative to traditional bank financing business. I'll have the opportunity to get a foot in the door with many potential customers that never gave me a thought before. See what I mean? It's good news for me. Nobody likes to hear the same bad news over and over so a working-smart move for me is to create articles, press releases, and public talks that show small business owners that they still have credit avenues open to them through me. This will counter some of the negativity they're hearing and, more importantly, will identify me with them, as someone who's moving forward in spite of that negativity we're hearing. In times like this, I look for every possible opportunity to get in front of a group of local business owners to establish myself as a forward looking ‘expert'. My thirty years of experience has proven that to be a powerfully effective and smart way to invest my time and particularly in times when my competitors may be going into hunker-down mode. The kinds of businesses that still can get credit approval are successful businesses and successful businesses are used to having choices. They're used to having choices and they're successful because they understand how to evaluate choices and make good decisions. Having funding available for this market isn't the same as the easy days of selling into the sub-prime credit market, though. You don't have to be particularly good to sell into the sub-prime market; you just have to be willing. In the top credit tier market, though, the market that I need to be effective with to work my way through this credit crisis, I can't expect to do well with a take-it-or-leave-it sales approach. The credit that is available will be competing harder for this market now. This is the time for re-tooling my presentation skills and sales aids. I need to be sure I make a compelling case for why my ability to help them right now is an opportunity for them, not a limitation. People like to feel good about their decisions. Even if bank credit isn't available for a given prospect, if I take the time to develop professional sales tools that show why equipment leasing is a cost effective way of leaving available bank credit open for other things, I'm more likely to motivate a favorable decision than someone else presenting the same numbers in a ‘last chance, take it or leave it' proposal. I think that's working smarter. Just those two things will help insure me something else. It will help insure that I continue to have sources of funds. What we're suffering is largely the results of a veritable orgy of unsafe, unprotected lending. Those who still have money to lend will want to know far more about their borrowers now than they did before. That works in my favor. I meet my customers in my community. I know them. I get my information from them first hand and can verify it directly. I'm a much safer source of business for my funding sources than the mass-marketing mills who don't know much more about their customers than their phone or fax numbers. I think emphasizing marketing strategies that also help me insure my supplier lines is working smarter, too. I'm certain there are those who think I'm naïve, but I don't think I am. I'm actually quite aware of what's going on. I just don't have time to dwell endlessly on it because I'm busy. All I can do is what I can do, and now is a good time to do all that I can. Gerry Egan Gerry Egan has been arranging equipment leases in one capacity or another for over thirty years. He has been a vendor, a Lessor, a broker and a consultant and has handled transactions of all sizes, working with customers and funding sources both large and small, and both local and national. He's developed and presented programs for brokers, for vendors, for funding sources and for banks, both in person and via electronic media. Gerry's non-traditional but always customer-focused sales approaches get results. His willingness to think outside of the box and challenge the conventional ways of selling equipment leasing cut through the standard objections and actually create stronger, more productive —and more profitable— relationships. A Past-President of the National Association of Equipment Leasing Brokers, and one of the industry's most popular speakers, trainers and writers, Gerry's unique insights and ability to motivate have been a source of help and inspiration to many. Whether you're a funding source needing better results from your brokers, a bank wanting to capitalize on leasing opportunities, or a direct sales force ready to go to the next level, Gerry can craft a custom program to help you do it. ----------------------------------------------------------------- #### Press Release ####################### Zions Bancorporation Reports Earnings Salt Lake City -- Zions Bancorporation (Nasdaq: ZION - News; "Zions" or "the Company") yesterday reported third quarter net earnings applicable to common shareholders of $33.4 million. "This past quarter will be remembered as one that resulted in significant changes in the financial services industry, both in the United States and abroad," said Harris H. Simmons, chairman and chief executive officer. "While we are not immune to the problems of the industry, our core business remains remarkably strong and our balance sheet remains healthy. We strengthened our capital, built our loan loss reserves, and increased our liquidity during the quarter. We continue to be profitable and well-capitalized during a time when the industry has experienced severe financial stress." On-balance-sheet net loans and leases of $41.9 billion at September 30, 2008 were unchanged from the balance at June 30, 2008, and increased approximately $4.1 billion or 10.7% from $37.8 billion at September 30, 2007. The Company actively managed loan growth during the quarter in accordance with its stated desire to conserve capital and build capital ratios in the current uncertain economic environment. The growth of loan volumes in certain geographies, particularly Texas , was offset by declines in other markets. Net loan and lease charge-offs for the third quarter of 2008 were $95.3 million or 0.91% annualized of average loans. This compares with $67.8 million or 0.67% annualized of average loans for the second quarter of 2008 and $18.1 million or 0.19% annualized of average loans for the third quarter of 2007. The increase in charge-offs largely was driven by declining collateral values on residential acquisition, development, and construction loans in the Southwest and in Utah . The provision for loan losses was $156.6 million for the third quarter of 2008 compared to $114.2 million for the second quarter of 2008 and $55.4 million for the third quarter of 2007. The provision for the third quarter of 2008 was 1.49% annualized of average loans and was $61.3 million in excess of net loan and lease charge-offs. The allowance for loan losses as a percentage of net loans and leases was 1.45% at September 30, 2008, 1.31% at June 30, 2008, and 1.11% at September 30, 2007. The allowance of $609.4 million at September 30, 2008 provided a coverage of 1.6 years on an annualized basis of net loan and lease charge-offs for the third quarter of 2008. Full Press Release: http://biz.yahoo.com/prnews/081016/lath020.html?.v=101 ### Press Release ########################## California Foreclosures Decrease 57% in September, 2008

Mt. Pleasant , PA – Default Research, the premier provider of preforeclosure real estate data in Northern and Southern California, is reporting that Notice of Defaults and Notices of Trustee Sales in both regions fell 54 percent in Northern California and 58 percent in Southern California . According to Default Research, (http://www.defaultresearch.com), the significant decline is largely due to Senate Bill 1137 which was passed last July and went into effect on September 8, 2008. “While we hope to see these positive numbers continue in the future, they are not reflective of the still dismal foreclosure situation in California ,” said Serdar Bankaci, founder of Default Research. “Because the new law requires lenders to contact residence at least 30 days before filing a Notice of Default, the result it a lower number of recordings now. However, we expect to see the numbers increase again starting in November and December.” Bankaci cautions residents of California , the local media, and his clients to beware of the deceiving foreclosure statistics. In Northern California, the largest decreases were seen in Sonoma , Sacramento , and Solano counties. These drops were 64, 59 and 58 percent respectively from August 2008. In Southern California, the counties with the greatest declines from August to September were Ventura lead with 65 percent, San Diego at 60 percent, and Los Angeles fell to 59 percent. “Aside from the unavoidable lag in numbers, I think this is an excellent move on the part of the lawmakers in California ,” said Bankaci, whose foreclosure lists arrive two to three weeks ahead of the competition. “It is also very positive for our clients because now homeowners in distress will be well aware of the situation they face, and know their options before the brutal foreclosure process begins.” ### Press Release ############################

News Briefs---- Banks borrow record amount from Fed As Credit Tightens, Companies Curtail Spending, Expansion Merrill posts $5.2 bn Q3 losses Two Chicago law firms lay off attorneys, staff Ex-Tyco CEO & CFO lose appeals, years more jail time A.I.G. to Help Cuomo Recover Millions in Executive Pay Google's profit rises 26% ---------------------------------------------------------------

You May have Missed-- Playboy to lay off 55 employees, trim other costs ---------------------------------------------------------------------------

Sports Briefs---- Red Sox rally from huge deficit; sting Rays 8-7 in Game 5 Romo practices, could play with broken pinkie Six bad news for the Cowboys, one good one Mike Nolan and the 49ers --------------------------------------------------------------

California Nuts Briefs---

A Relieved California Finds Lenders in Credit Markets Guards' union drops Schwarzenegger recall effort ----------------------------------------------------------------

“Gimme that Wine” 'Parker's Wine Buyer's Guide No. 7' -- a departure from the past Wines of the Times: Paso Robles Zinfandels from California New Oregon Wine Explorer Features Interactive Trip Planner to Help Travelers Choose Wineries, UP AND DOWN THE Napa WINE ROADS with George Starke Wine Prices by vintage ----------------------------------------------------------------

Today's Top Event in History 1989--We experienced an earthquake of 7.1 in my hometown of Los Gatos at 2:04PM I was in my Chevrolet Suburban, not far from the office, near the University of Santa Clara , and a student on a bicycle in front of me suddenly fell down. At first I thought I hit him, and as he got up, I glanced over and saw two other bicyclists trying to stand and my car was violently rocking sideways as if the car had been silently blind sided. KCBS was on and announced they felt an earthquake, which later turned out in the Loma Prieta section of Los Gatos . The quake caused damage estimated at $10 billion and killed 67 people, many of who were caught in the collapse of the double-decked Interstate 80 in Oakland , California . We were without electricity and water for several days and sales for the month were the lowest they ever have been in our history as it took business many weeks to recover. As a sports note, the event is also known as the “World Series Earthquake. Minutes before the start of Game 3 of the World Series billed as the “ Battle of the Bay, “between the Oakland A's and the San Francisco Giants, Candlestick Park was rocked by the Loma Prieta earthquake. the game was postponed and the Series delayed for 11 days. The Oakland Athletics won games three and four for the first Series sweep in 13 years. [headlines]

This Day in American History 1492- Columbus sights isle of San Salvador (Watling Island, Bahamas) -------------------------------------------------------------- Baseball Poem

-------------------------------------------------------------- SuDoku The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler? http://leasingnews.org/Soduku/soduko-main.htm -------------------------------------------------------------- Daily Puzzle How to play: Refresh for current date: --------------------------------------------------------------

http://www.gasbuddy.com/ -------------------------------------------------------------- Weather See USA map, click to specific area, no commercials -------------------------------------------------------------- Traffic Live--- Real Time Traffic Information You can save up to 20 different routes and check them out -------------------------------------------------------------- News on Line---Internet Newspapers Georgia Newspaper (blocked by the Russians) *Other on line newspapers: -------------------------------- |

|||||||||||||||||||||||||||||||||||||||

Independent, unbiased and fair news about the Leasing Industry. |

|||||||||||||||||||||||||||||||||||||||

Ten Top Stories each week chosen by readers (click here) |

|||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||

Editorials (click here) |

|||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||

|