|

Burbank , California Credit Analyst Funding Manager Contact :Jason Downs: jdowns@capnetusa.com 877.980.0558 EXT. 125 |

www.capnetusa.com Recently named one of the “5 Best Places to Work” in Los Angeles . |

Monday, November 24, 2008

| Composer, organist, pianist, singer Lee Michaels born 24 November 1945 Los Angeles, California. Best known for 1971 hit "Do You Know What I Mean." He was very popular during his day. He currently owns a chain of restaurants, named Killer Shrimp, around Southern California. http://www.answers.com/topic/lee-michaels http://music.yahoo.com/ar-257091---Lee-Michaels |

Headlines---

Classified Ads---Credit

While stocks up Friday, Leasing stocks down again

Bank Beat (includes Citibank Rescue plans)

by Christopher Menkin

Top Stories---November 17---November 21

Classified Ads---Help Wanted

Integron added to Leasing Software Companies List

Classified Ads---Web sites

Leasing 102 by Mr. Terry Winders, CLP

“Over Use—Return of Equipment”

Special Thanksgiving Edition: DVD’s to Rent

Planes, Trains & Automobiles/A Charlie Brown Thanksgiving

Scent of a Woman/ Addams Family Values/ What’s Cooking?

FDIC Board of Directors Approves TLGP Final Rule

AIG to sell plane lessor ILFC to investors

FDIC to guarantee as much as $1.4 trillion in bank debt

Bernanke says he erred in gauging mortgage fallout

China Financial Leasing Industry Report 2007

News Briefs---

You May have Missed---

"Gimme that Wine"

Today's Top Event in History

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

|

-------------------------------------------------------------------

Classified Ads---Credit

|

Seattle , WA |

| Santa Barbara, CA Former LEAF & Santa Barbara Bank & Trust employee with 5 years of credit and operations experience available to work remotely. Willing to occasionally travel. Email: sb.leasing@live.com |

For a full listing of all “job wanted” ads, please go to:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

To place a free “job wanted” Leasing News ad:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

ELFA Career Center: Job Seekers (free):

http://careers.elfaonline.org/search.cfm

--------------------------------------------------------------

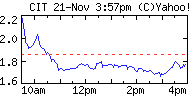

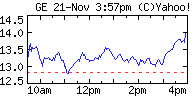

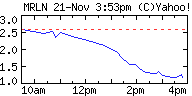

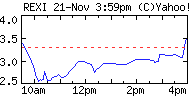

While stocks up Friday, Leasing stocks down again

Investors have unloaded CIT and Marlin stock with a solid “lack of confidence.” The government may be bailing CIT out, if they can print the money, and Marlin will get TARP money from the FDIC as a bank (not that much, by the way.) GE is in a similar possession, under performing, selling off assets, and REXI continues to not impress its former investors who believe the financials may be built with mirrors. If Dwight Galloway’s operation does not do very well, additional money for expansion will not be available, and further bank loans more difficult to obtain. To many, it looks more and more like NetBank all over again.

CIT $1.83

GE $14.03

Marlin $1.23

Rexi (LEAF) $3.62

|

--------------------------------------------------------------

--------------------------------------------------------------

Bank Beat (includes Citibank Rescue plans)

by Christopher Menkin

What is happening to Citibank stock appears to be similar to the fear of Y2K at the turning of the century. After all the fear and money spent, the century changed and little happened as the computer software had no serious failures as experts were all predicting. Fear had driven everyone to expert

the worse.

Sunday evening the FDIC released this press release:

###Press Release ##################

Joint Statement by Treasury, Federal Reserve and the FDIC on Citigroup

Washington, DC— The U.S. government is committed to supporting financial market stability, which is a prerequisite to restoring vigorous economic growth. In support of this commitment, the U.S. government on Sunday entered into an agreement with Citigroup to provide a package of guarantees, liquidity access and capital.

As part of the agreement, Treasury and the Federal Deposit Insurance Corporation will provide protection against the possibility of unusually large losses on an asset pool of approximately $306 billion of loans and securities backed by residential and commercial real estate and other such assets, which will remain on Citigroup's balance sheet. As a fee for this arrangement, Citigroup will issue preferred shares to the Treasury and FDIC. In addition and if necessary, the Federal Reserve stands ready to backstop residual risk in the asset pool through a non-recourse loan.

In addition, Treasury will invest $20 billion in Citigroup from the Troubled Asset Relief Program in exchange for preferred stock with an 8% dividend to the Treasury. Citigroup will comply with enhanced executive compensation restrictions and implement the FDIC's mortgage modification program.

With these transactions, the U.S. government is taking the actions necessary to strengthen the financial system and protect U.S. taxpayers and the U.S. economy.

- We will continue to use all of our resources to preserve the strength of our banking institutions and promote the process of repair and recovery and to manage risks. The following principles guide our efforts:

- We will work to support a healthy resumption of credit flows to households and businesses.

- We will exercise prudent stewardship of taxpayer resources.

- We will carefully circumscribe the involvement of government in the financial sector.

- We will bolster the efforts of financial institutions to attract private capital.

Attachment:

http://www.fdic.gov/news/news/press/2008/pr08125a.pdf

The Community Bank, Loganville, Georgia, was closed Friday by the Georgia Department of Banking and Finance, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Bank of Essex, to assume all of the deposits of The Community Bank.

As of October 17, 2008, The Community Bank had total assets of $681.0 million and total deposits of $611.4 million. Bank of Essex purchased approximately $84.4 million of The Community Bank's assets, and did pay the FDIC a premium of $3.2 million for the right to assume the failed bank's deposits. The FDIC will retain the remaining assets for later disposition.

The transaction is the least costly resolution option, and the FDIC estimates that the cost to its Deposit Insurance Fund will be between $200 million and $240 million. The Community Bank is the twentieth FDIC-insured institution to be closed nationwide, and the third in Georgia, this year.

Downey Savings and Loan Association, F.A., Newport Beach, California, were visited Friday morning, taken over by the FDIC, and had until the end of the day as Downey was sold to US Bank, Minneapolis, Minnesota. Downey Financial Corp., parent of Downey Savings, was co-founded in 1957 by developer Maurice McAlister, a bass fisherman and nickelodeon collector who built shopping centers with Downey branches as of September 30, 2008, Downey Savings had total assets of $12.8 billion and total deposits of $9.7 billion. PFF Bank had total assets of $3.7 billion and total deposits of $2.4 billion. Besides assuming all the deposits from the two California banks, U.S. Bank will purchase virtually all their assets. The FDIC will retain any remaining assets for later disposition.

Besides assuming all the deposits, U.S. Bank will purchase virtually all their assets. September 28, 2008, the bank had $198 million of outstanding senior notes and $14 million in cash. The FDIC will retain any remaining assets for later disposition.

The FDIC and U.S. Bank entered into a loss share transaction. U.S. Bank will assume the first $1.6 billion of losses on the asset pools covered under the loss share agreement, equal to the net asset position at close. The FDIC will then share in any further losses. Under the agreement, U.S. Bank will implement a loan modification program similar to the one the FDIC announced in August stemming from the failure of IndyMac Bank, F.S.B., Pasadena, CA.

The loss-sharing arrangement is expected to maximize returns on the assets covered by keeping them in the private sector. The agreement also is expected to minimize disruptions for loan customers as they will maintain a banking relationship.

U.S. Bank currently has 353 offices in California. Downey Savings has 170 branches in California and five in Arizona. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Downey Savings will be $1.4 billion

Downey lost $547.7 million in the first nine months of 2008, largely because of risky "option ARM" mortgages -- adjustable-rate loans that let borrowers pay so little each month that their loan balances rose.

http://leasingnews.org/PDF/Downey.pdf

PFF Bank & Trust, Pomona, California, received a visit in the morning also by the FDIC to let them know their banking operations were sold to US Bank, Minneapolis, Minnesota. PFF Bank had total assets of $3.7 billion and total deposits of $2.4 billion. Besides assuming all the deposits, U.S. Bank will purchase virtually all their assets. The FDIC will retain any remaining assets for later disposition.

The FDIC and U.S. Bank entered into a loss share transaction. U.S. Bank will assume the first $1.6 billion of losses on the asset pools covered under the loss share agreement, equal to the net asset position at close. The FDIC will then share in any further losses. Under the agreement, U.S. Bank will implement a loan modification program similar to the one the FDIC announced in August stemming from the failure of IndyMac Bank, F.S.B., Pasadena, CA.

Once a major provider of credit lines and warehouse loans to leasing companies in the "C" and "D" marketplace, it was a major loss with Creative Capital, where the bank did take over the real estate collateral, and commercial real estate development loans that primarily did them in, running up $289.5 million in losses in the January-September period. In 2008, PFF posted a loss of $246 million the first quarter, $217 million loss the second quarter, and $74 million the third quarter.

http://files.ots.treas.gov/680050.pdf

"The closing of these two thrifts once again demonstrates the tremendous impact of the housing market distress on the state of California," John Reich, director of the Office of Thrift Supervision, said in a statement announcing the seizure of the institutions.

US Bancorp agreed to shoulder the first $1.6 billion in losses on the two thrifts' loans.

The loss-sharing arrangement is expected to maximize returns on the assets covered by keeping them in the private sector. The agreement also is expected to minimize disruptions for loan customers as they will maintain a banking relationship.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $700 million for PFF Bank.

These were the twenty first and twenty second banks to fail in the nation this year, and the fourth and fifth banks to close in California. The last bank to be closed in the state was Security Pacific Bank, Los Angeles, on November 7, 2008 (List to be up-dated in the next edition

of Bank Beat. editor)

--

The list would be very long on the banks taking advantage of TARP.

The list is short, those going direct, such as Glacier Bancorp, Inc., Kalispell, Montana (Nasdaq: GBCI) who completed its public offering of 6,325,000 shares of common stock at a price of $15.50 per share, including the over-allotment of 825,000 shares exercised by the underwriters. The offering size was increased from 4,000,000 shares to 5,500,000 shares due to strong investor demand. The net proceeds to Glacier from the offering, after underwriting discounts and estimated transaction expenses, are anticipated to be approximately $94 million. Proceeds of the offering will be available to fund possible future acquisitions and for general corporate purposes.

"We are very pleased to have successfully completed this stock offering, and even increased the size of the offering, during a period of significant market turmoil," said Mick Blodnick, President and CEO. Blodnick noted that with the additional capital, Glacier's total risk-based capital ratio would increase to nearly 16%, making Glacier one of the most strongly capitalized banking companies in the country. "The proceeds of this offering will further strengthen our capital position, allowing us to pursue attractive strategic opportunities in our target markets."

http://www.snl.com/InteractiveX/file.aspx?Id=7005271&KeyFileFormat=XML

Another was United Bank, Martins Ferry, Ohio. Citing "positive" bank liquidity and capital adequacy, United Bancorp Inc. has decided not to take part in the U.S. Treasury's recently announced capital purchase program, the company's CEO, James Everson, said in a press release dated Nov. 20.

"With the known and yet to be determined conditions the U.S. Treasury will levy upon participants in this program, we do not feel it prudent to partake at this time," the company's CEO, James Eversonthe chief executive said in a press release.

Additionally, the company said its board approved the renewal of United Bancorp's stock repurchase program authorizing management to purchase up to $2 million of its common shares in the open market over the next two years.

http://www.snl.com/InteractiveX/file.aspx?Id=7008903&KeyFileFormat=XML

With a similar message, Palmetto Bank, Laurens, South Carolina, liquid and capitalized with strong asset quality and earnings. The Upstate-based bank, the fifth largest independent bank in S.C., is one of only a handful of banks that has turned a profit in 2008.

“We don’t need government funds because we are well capitalized,” said Leon Patterson, chairman and chief executive officer of Palmetto Bancshares, Inc., parent company for The Palmetto Bank. “Other banks may need government funds for capital. We don’t. We are still lending money and recently announced that our third quarter income rose by four percent from 2007. We’re as safe and reliable now as we were 102 years ago.”

In a press release: "So how has The Palmetto Bank been able to weather the financial storm that is blanketing the entire country?

“Simple, according to Patterson. “Sound, fiscal responsibility and a conservative business model,” Patterson said. “Our principle interests are within the Upstate communities we serve. Our commitment to safe, sound and secure banking practices has served us well for 102 years.” The Palmetto Bank is the fifth largest independent state-chartered commercial bank in South Carolina with 29 locations."

http://ofchq.snl.com/Cache/153A00BD547011417.PDF?O=PDF&CachePath=

\\dmzdoc1\webcache%24\&Y=&T=&D=

Other banks announcing they were not taking Tarp include: American National Bancshares, Danville, VA; Camden National, Camden, Maine; F&M Bancorp, Timberville, VA; New England Bancshares, Enfield, CT; North State Bancorp, Raleigh, NC: Bank of South Carolina, Charleston, SC.

Past editions of Bank Beat:

http://www.leasingnews.org/Conscious-Top%20Stories/Bank_Beat.htm

|

--------------------------------------------------------------

Top Stories---November 17---November 21

Here are the top ten stories most “opened” by readers last week:

(1) Archives—November 21, 2000—The List

56 Leasing Companies Major Changes

http://www.leasingnews.org/archives/November%202008/11-21-08.htm

(2) Former LEAF Third Party Funding Employees

http://www.leasingnews.org/archives/November%202008/11-17-08.htm#open

(3) Huntington to discontinue Vendor Finance Group

http://www.leasingnews.org/archives/November%202008/11-19-08.htm#hunt

(4) Lessor not responsible equipment liability

http://www.leasingnews.org/archives/November%202008/11-17-08.htm#less

(5) Leasing Stocks continue downward Trend

http://www.leasingnews.org/archives/November%202008/11-19-08.htm#stock

(6) Global Funding found Guilty in Clearwater

http://www.leasingnews.org/archives/November%202008/11-19-08.htm#global

(7) Key National Finance to cut 180 positions

by Christopher Menkin

http://www.leasingnews.org/archives/November%202008/11-21-08.htm#key

(8) VRL: Winners of Leasing Life Awards 2008 Announced

http://www.marketwatch.com/news/story/VRL-Winners-Leasing-Life-Awards/story.aspx?

guid=%7BD53ABA9C-D337-4762-A510-7F07DA452A65%7D

(9) GE Capital to Pare Jobs, Assets to Save $2 billion

http://www.bloomberg.com/apps/news?pid=20601103&sid=aJd9ubB_EQSA

(10) Karl Probst joins Harbor Financial Services

http://www.leasingnews.org/archives/November%202008/11-19-08.htm#hfs

|

--------------------------------------------------------------

Leasing Industry Help Wanted

|

Burbank , California Credit Analyst Funding Manager Contact :Jason Downs: jdowns@capnetusa.com 877.980.0558 EXT. 125 |

www.capnetusa.com Recently named one of the “5 Best Places to Work” in Los Angeles . |

Sales

|

Like selling vendor programs and large transactions? CLICK HERE to find out how to have fun again. |

Please see our Job Wanted section for possible new employees.

-------------------------------------------------------------

Integron added to Leasing Software Companies List

Leasing Software Companies Top eLeasing software companies, as ranked by employees.

(j) Integron Corporation additional services offered: |

The Integron Lease Termination Manager provides web-based, automated workflow processing for asset-based lease termination, reconciliation and settlement. The SaaS offering:

1. Reduces lease termination processing steps from 100 to about 20.

2. Eliminates lost/undocumented/un-reconciled equipment

3. Captures Continue-to Bill Revenue

4. Manages Consignment Vendors for peak performance

One of the great advantages is that the service coexists and interfaces with existing Lease Management/Portfolio Management systems.

Byran Lubel, President, Integron

“What this means is that a lessor need not throw out their investment in favor of another solution, “said Bryan Lubel, Integron’s President. “We simply plug into (with a little customization) what they already have and it allows them to reap the benefits of reduced cycle time, capture of missing and damaged equipment, and the management of unexpected returns.”

“It allows for the automation of lessor specific inspection processes, consignment vendor performance management, and the maximization of Return on Assets. This translates to an ROI of approximately 700%, and positive ROI can be realized in as little as two months”, he added. “We’ve done it and we have references in large financial institutions.”

http://www.leasingnews.org/Ag_leasing/software.htm

(Please see article that follows as it relates to what this software company currently provides. editor)

--------------------------------------------------------------

Classified Ads---Web sites

| Web Design & Marketing Why spend your time and money teaching some marketing firm how the leasing industry works? Leasing websites, secure applications & marketing. DFCO, LLC www.dfco.com/leasing Dana Freeman dana@dfco.com |

Leasing Industry Outsourcing

(Providing Services and Products)

All "Outsourcing" Classified ads

(advertisers are both requested and responsible to keep their free ads up to date):

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

“Over Use—Return of Equipment”

We have for years protected our residuals with proper return language. If the equipment was the type that was used constantly and was not measured by some standard then its return in “good working order” or “able to perform its function after return” was all we worried about and conservative residuals seem to be acceptable. The IRS has for many years wanted us to take “meaningful” residuals and evidence of that can be found in RR 2001-28. Then, as competition heated up bank lessors began to use up-grade options to offset the higher residuals of Captive leasing companies. Somewhere in the middle we began to actually look at the customers reported “use” and create rental structures that reflected that use. Return conditions became stricter and the 90 day notice requirements help prepare the Lessee for the possibility of repairs and extra maintenance prior to return.

Then some began to consider that the return conditions placed a burden on the Lessee and because of that burden it may be cheaper to purchase the equipment than prepare it for return. This was opposed by Article 2A of the UCC because if the return conditions or the remoteness of the return location placed an economic advantage to the lessee to purchase the lease equipment, rather than return it, then it was a forced sale and was considered an Article 9 loan in place of an Article 2A lease. It may even cause Federal Income tax problems because it could be argued that it was the “intent” of the Lessor to create a sale from the beginning.

No one wants to take a residual risk in these troubled times but no residual is not leasing and the new rules headed our way are going to put increased pressure on taking meaningful residual risk if you want to stay in commercial equipment leasing.

Two ways to solve your end of the lease residual problems comes from the question of “over use” and the equipment inspection rights found in your lease. For equipment that can be measured by some standard like hours of use, rotations, miles, shifts, etc. a reasonable use should be establish and placed in the lease as a standard. The rent should be expressed as a minimum payment each month with an annual or quarterly adjustment for additional or over use, after an inspection or copy of actual use is recorded and submitted. The extra rent could be use to adjust the residual downward. The inspection could be annual plus the adjustment could be quarterly. With the adjustment of rent you are truly in the leasing business and being compensated for the equipments actual use. Something that the rental car companies have been doing for years!

I have seen some additional methods that shorten the lease term instead of additional rent. Sometimes it is best to assume a residual based on a maximum term of use and let the term of the lease be determined by the actual use with a yearly minimum payment that would establish a full term at the beginning if the equipment is used as declared in your equipment description and use form. It is not hard to understand that over the term of a lease the actual use of the equipment will change.

This all assumes you have bookkeeping software that can handle whatever program you use. Software limitations have hampered Lessor’s’ for many years. This is why the annual adjustment or annual one time “over use” charge is assessed, and used to reduce the residual, instead of changing the rent requirement.

The evolution of leasing is pushing us into more structured deals to maintain the differences between leasing and lending. As the rule makers review the current set of requirements they see too much similarity between leases and conditional sales contracts and the push to clean up loans that disguise themselves as leases is going to get worse in the very near future. Move into true leasing that water is just fine if you understand how it works.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at leaseconsulting@msn.com or 502-327-8666.

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

--------------------------------------------------------------

Special Thanksgiving Edition: DVD’s to Rent

Planes, Trains & Automobiles/ A Charlie Brown Thanksgiving

Scent of a Woman/ Addams Family Values/ What’s Cooking?

Leasing News: Fernando’s View

By Fernando F. Croce

There may be no shortage of Christmastime classics, but when it comes to Thanksgiving, folks are often stumped when it’s time to watch a movie with the family. So here are some savory choices to go with the turkey gravy and pumpkin pie.

Planes, Trains & Automobiles (John Hughes, 1987): Steve Martin and John Candy make a splendid odd couple in this hilarious and ultimately poignant comedy from director John Hughes (“The Breakfast Club”). Smooth advertising exec Neal (Martin) and brash salesman Del (Candy) make unlikely traveling companions, but when their flight is grounded by snow, the two are stuck on a madcap road trip. Can they make it home in time for Thanksgiving—or, more to the point, before they kill each other? There are several memorable jokes and characters along the way, but what makes the film such an enduring treat is the expert chemistry between Martin and Candy.

A Charlie Brown Thanksgiving (Bill Melendez & Phil Roman, 1973): No holiday gathering is complete without a visit from the Peanuts gang. In this short but delightful animated TV special, Charles M. Schultz’s characters come to face such Turkey Day challenges as getting the family together and getting the right meals cooked. When Peppermint Patty and friends invite themselves over to Charlie Brown’s house, he must whip up a holiday special even though he’s supposed to be going to his grandmother’s house. Throw in lessons about what Thanksgiving really stands for and Snoopy and Woodstock in pilgrim costumes, and you have a tip-top Peanuts feature.

Scent of a Woman (Martin Brest, 1992): Al Pacino finally won a Best Actor Oscar for his portrayal of Lt. Col. Frank Slade, a crotchety and unpredictable blind man who teaches his young guide (Chris O’Donnell) about life while on a holiday trip. Many of the scenes, such as Frank’s tango session with a young woman and his climatic speech to a college of preppies, are often seen as modern classics. Equally memorable, however, is his tension-cracked Thanksgiving dinner with estranged relatives, a terrifically handled bit of familial hostility that’s sure to make audiences appreciate their own holiday gatherings.

Addams Family Values (Barry Sonnenfeld, 1993): A rare sequel that’s wittier than the original, this dark-humored jewel boasts what is possibly the funniest Thanksgiving pageant on record. While Gomez (Raul Julia) and Morticia (Anjelica Huston) deal with a conniving babysitter (Joan Cusack) back home, Wednesday (Christina Ricci) and Pugsley (Jimmy Workman) endure the horrors of a tacky summer camp. The film’s comic high point comes when the kids take part in the camp’s play about the first Thanksgiving (titled “A Turkey Named Brotherhood”) and turn traditions upside down. Without giving too much away, let’s just say you won’t look at pilgrims and Indians the same again.

What’s Cooking? (Gurinder Chadha, 2000): Set in Los Angeles’s ethnically diverse Fairfax district, this underrated comedy envisions Thanksgiving as a time that can bring people from different ages, nationalities and cultures together. At the center of a vast and colorful gallery of characters are Lizzy (Mercedes Ruehl), Audrey (Alfre Woodward), Trinh (Joan Chen) and Ruth (Lainie Kazan), women struggling to put together a feast that will bring their respective families home despite their difficulties. Despite the numerous plotlines, director Gurinder Chadha keeps a quick pace and warm tone, forging a tremendously appealing combination of laughs and tears.

---------------------------------------------------------------

### Press Release ###########################

FDIC Board of Directors Approves TLGP Final Rule

FDIC Board of Directors Approves TLGP Final Rule

Industry Funded Program Fully Backed by FDIC Guarantee; Will Promote Lending

The Board of Directors of the Federal Deposit Insurance Corporation (FDIC) today approved a final rule to strengthen the agency's Temporary Liquidity Guarantee Program (TLGP). The Program guarantees newly issued senior unsecured debt of banks, thrifts, and certain holding companies, and provides full coverage of non-interest bearing deposit transaction accounts.

The FDIC adopted the Temporary Liquidity Guarantee Program on October 13th because of disruptions in the credit market, particularly the interbank lending market, which reduced banks' liquidity and impaired their ability to lend. The goal of the TLGP is to decrease the cost of bank funding so that bank lending to consumers and businesses will normalize. The industry funded program does not rely on the taxpayer or the deposit insurance fund to achieve its goals.

"We are confident that the changes our Board approved today will create significant investor demand, and dramatically reduce funding costs for eligible banks and bank holding companies," said FDIC Chairman Sheila C. Bair. "I expect that the industry will take full advantage of this guarantee. I'm confident that the program—working in complement with the Treasury's Troubled Assets Relief Program and the Federal Reserve's Commercial Paper Funding Facility—will achieve its intended purpose to help insured banks increase lending—in a responsible way—to consumers and businesses."

The FDIC received more than 700 comments during the 15-day comment period. Based on those comments, the FDIC has made several significant changes to the interim rule, which was approved back on October 23.

Chief among the changes is that the debt guarantee will be triggered by payment default rather than bankruptcy or receivership. This change will add value to the guarantee and help entities obtain lower cost funding.

Another change is that short-term debt issued for one month or less will not be included in the TLGP, consistent with the objective of the program to facilitate longer term lending.

Finally, the fees to participate in the debt guarantee component of the TLGP have been changed. Originally the FDIC was going to charge eligible entities 75 basis points on an annualized basis for guaranteed debt. After reviewing the comments, the FDIC decided to impose a fee structure based on a sliding scale, depending on length of maturity. Shorter-term debt will have a lower fee structure and longer-term debt will have a higher fee. The range will be 50 basis points on debt of 180 days or less, and a maximum of 100 basis points for debt with maturities of one year or longer, on an annualized basis.

Eligible entities will have until December 5, 2008, to opt out of the TLGP. Once in the Program, an entity is in for the duration. Those that choose to opt out will not be able to participate at a later date. Any debt issued on or before June 30, 2009, will be fully protected through the earlier of the maturity of the debt instrument or June 30, 2012.

Under the transaction account guarantee program, a participating institution will be able to provide customers full coverage on non-interest bearing transaction accounts for an annual fee of 10 basis points. The coverage will be in effect for participating institutions until the end of 2009. After that date, these accounts will be subject to the basic insurance amount. The FDIC Board voted to include NOW accounts with interest rates of 0.5 percent or less and IOLTAs (lawyer trust accounts) in the transaction account program.

"We will implement this Program without relying on the taxpayer or the deposit insurance fund. Fees paid by participating entities should cover any losses associated with the guarantees," said Bair.

The final rule is attached:

http://leasingnews.org/PDF/FDIC_Temp_Liquidity.pdf

### Press Release ###########################

--------------------------------------------------------------

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

![]()

News Briefs----

AIG to sell plane lessor ILFC to investors

http://www.reuters.com/article/rbssFinancialServicesAndRealEstateNews/

idUSN2250674020081122

FDIC to guarantee as much as $1.4 trillion in bank debt

http://www.usatoday.com/money/industries/banking/2008-11-21-fdic-bank-

guarantees_N.htm?loc=interstitialskip

Bernanke says he erred in gauging mortgage fallout

http://apnews.myway.com/article/20081123/D94KRSM80.html

China Financial Leasing Industry Report 2007

http://www.live-pr.com/en/china-financial-leasing-industry-report-r1048231401.htm

Chris Brown wins 3 American Music Awards; Kanye West, Rihanna and Alicia Keys each take home 2

http://www.chicagotribune.com/news/sns-ap-music-american-music-awards

,0,7276093.story

---------------------------------------------------------------

You May have Missed---

LinkedIn CEO touts growth of network

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/11/23/BUAI141O97.DTL

----------------------------------------------------------------

![]()

“Gimme that Wine”

Make Thanksgiving a celebration of Pinot Noir

http://www.usatoday.com/life/lifestyle/2008-11-20-sips-thanksgiving_N.htm

JFK Airport's Terminal 5 has Sky-High Ambitions for Wine

http://www.winespectator.com/Wine/Features/0,1197,4727,00.html

Can't-fail guide to Thanksgiving wines

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/11/21/WIDA1468EH.DTL&hw

=wine&sn=001&sc=1000

Dan Aykroyd: One wild and crazy winemaker

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/11/20/WISB1441SR.DTL

(This is a free “ad” for our good friends the Bateman’s,

proprietors of Thunder Mountain Kona coffee)

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

The London International Vintners Exchange (Liv-ex) is an electronic exchange for fine wine.

http://www.liv-ex.com/

----------------------------------------------------------------

![]()

Today's Top Event in History

1963-The first murder to be shown on television took place at 12:20pm in the police headquarters at Dallas, Texas. While television news cameras were rolling, a Dallas police officer brought in Lee Harvey Oswald, the alleged assassin of President John Fitzgerald Kennedy. Oswald was in the process of being transferred to the county jail. A man in the crowd stepped forward and fired a concealed pistol at Oswald, killing him. The crime was witnessed by millions of people. The murdered was Jack Ruby ( Jacob L. Rubenstein), a Dallas nightclub owner.

http://memory.loc.gov/ammem/today/nov24.html

http://www.tsha.utexas.edu/handbook/online/articles/view/RR/fru3.html

http://www.jfk-online.com/rubydef.html

http://ourworld-top.cs.com/mikegriffith1/id153.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in American History

| 1713 -Birth of Father Junipero Serra, Spanish missionary to western America. From 1769, he established 9 of the first 21 Franciscan missions founded along the Pacific coast and baptized some 6,000 Indians before his death in 1784. In doing so, he erased the California Indian culture and way of life, often in a cruel manner, but he was on a “mission” and is part of elementary school projects to learn about the Catholic churches built in California. He is credited with helping to bring “civilization” to California coast, including vineyards. http://www.pbs.org/weta/thewest/people/s_z/serra.htm http://www.newadvent.org/cathen/13730b.htm 1784- Zachary Taylor's birthday, the soldier who became twelfth president of the US was born at Orange County, Virginia. Term of office, March 4, 1849-July 9, 1850. He was nominated at the Whig party convention in 1848, but, the story goes, he did not accept the letter notifying him of his nomination because it had postage due. He cast his first vote in 1846, when he was 62 years old. Becoming ill July 4, 1850, he died at the White House, July 9. His last words, " I am sorry that I am about to leave my friends." 1832- South Carolina passes Ordinance of Nullification to challenge Federal government rights over states, starting with tariff laws and other issues: historians view as the first sign of a succession from the United States. http://www.encyclopedia.com/html/n1/nullific.asp http://www.publicbookshelf.com/public_html/The_Great_Republic_By _the_Master_Historians_Vol_III/nullificat_bj.html http://www.yale.edu/lawweb/avalon/states/sc/ordnull.htm 1838- Canadian Sulpician missionary Franois Blanchet, 43, first arrived in the Oregon Territory. A native of Quebec, he spent 45 years planting churches in the American Northwest, and is remembered today as the "Apostle of Oregon." http://www.newadvent.org/cathen/02593a.htm 1859 -- Evolutionary theorist Charles Darwin's Origin of the Species is published. http://www.darwinfoundation.org/ 1863-“Lookout Mountain” Battle; part of a major three day major Civil War battle, after reinforcing the besieged Union army at Chattanooga, Tennessee, General Ulysses S. Grant launched the battle of Chattanooga.. Evidently falsely secure in the knowledge that his troops were in an impregnable position on Lookout Mountain, Confederate General Braxton Bragg and his army were overrun by the Union forces. Bragg himself barely escaped capture. The battle is very famous for the Union Army's spectacular advance up a heavily forced slope into the teeth of the enemy guns. Many historians claim this victory gave Grant the momentum of his campaign. Accordingly, pre-frontal clouds obscured the upper battle- field aiding a Union victory. http://ngeorgia.com/history/lookoutmountain.html http://www.publicbookshelf.com/public_html/The_Great_Republic_By _the_Master_Historians_Vol_III/civilwar_eh.html http://www.angelfire.com/rant/Tryp/rubyfalls.html http://ngeorgia.com/naturally/lookout_mountain.html http://www.chattanoogan.com/articles/article_34050.asp 1868 Scott Joplin Birthday, born Texarkana, Texas http://www.scottjoplin.org/biog.htm http://www.geocities.com/BourbonStreet/Bayou/9694/ http://www.ddc.com/~decoy/sjop.htm http://www.lsjunction.com/people/joplin.htm 1871-The National Rifle Association was organized and chartered in New York City with 35 members. Its first shooting meet was held on April 25,1873 at Creedmore, NY. The contestants included nine regiments of the New York National Guard, one regiment of the New Jersey National Guard, the U.S. Engineers, and a squad of regular servicemen from Governors Island. The first president of the association was General Ambrose Everett Burnside, who had commanded the Army of the Potomac during the Civil War. http://www.nra.org/ 1880 -In Montgomery, AL, more than 150 delegates from Baptist churches in 11 states met to form the Baptist Foreign Missions Convention of the United States. Liberian missionary William W. Colley was chief organizer, and the Rev. William H. McAlpine was elected the first president. 1887- Mary Ely Lyman birthday, Anglo-American theologian. Received her B.D. from Union Seminary in 1919 as the only woman in the class. Was not allowed to attend the commencement luncheon and had to sit in the balcony with faculty wives during the graduation ceremony even though she was the ranking scholar of her class. She attended two years at Cambridge on a fellowship and was refused a degree or a transcript because of her sex. She taught religion at Barnard College from 1919-1940 and taught at Union Seminary along with her husband. She was dean and professor of religion at Sweet Briar College. In 1950 became the first woman to hold a faculty chair at Union Seminary although a few years earlier she had been terminated because her husband (15 years her senior) had retired and it was "assumed" she would be retiring also. http://www.uts.columbia.edu/projects/AWTS/exhibit/lyman1.html http://www.uts.columbia.edu/projects/AWTS/exhibit/lyman2.html 1888-Birthday of Dale Carnegie, American inspirational lecturer and author. Dale Carnegie was born at Maryville, MO. His best known book, “ How to Win Friends and Influence People,” publish in 1936,sold nearly five million copies and was translated into 29 languages. Carnegie died at New York, NY Nov 1.1955. http://selfhelp.lifetimeinfo.com/gurus/dalecarnegie.htm http://www.westegg.com/unmaintained/carnegie/carnegie.html http://www.dale-carnegie.com/ 1896-The first absentee voting law was enacted by Vermont. According to its provisions, a voter could obtain a certificate declaring that he was qualified to vote in the state. He could then vote for state officers at any election booth in the state. 1896-Birthday of singer Rosa Henderson (born Rosa Deschamps), Henderson, KY http://www.redhotjazz.com/rosahenderson.html http://bluesland.net/thang/RosaHenderson.html http://music.mainseek.com/1912R46K0_Artists-A-Z-H-Rosa-Henderson.html 1918-Birthday of piano player/organist/arranger Bill “Wild” Davis, Glasgow, Mo. http://www.theiceberg.com/artist/28016/wild_davis.html 1919 -- The Oscar Mayer Company reopens a meat-packing plant on Madison's east side. The company searched for skilled workers in a recruiting frenzy that included a sweep of Milwaukee's Polish saloons during the Cudahy packing-plant strike. The Oscar Mayer plant had been operated by the Farmers' Cooperative Packing Company, which formed under a strongly worded state law encouraging cooperatives. Prior to the cooperative's opening two years ago, in 1917, Madison-area farmers had no choice but to sell their pigs and cattle to the Chicago beer trusts. Response to the cooperative was enthusiastic -- 5,000 area farmers bought nearly 600,000 dollars of stock in the new enterprise. The nation had only two other farm-owned cooperative packing plants, both in Wisconsin. But faced with mounting wages and operating losses, and no real prospect of new capital, the cooperative was forced to sell the plant to the Chicago firm, Oscar F. Mayer & Brother. 1922-pianist Teddy Wilson born Austin, Texas. http://www.pbs.org/jazz/biography/artist_id_wilson_teddy.htm http://www.audioroots.com/musique/new-york-chicago_612.htm http://www.pianolagoon.com/1702553.html 1923-birthday of baritone sax player Serge Chaloff, Boston, MA http://www.theiceberg.com/artist/27266/serge_chaloff.html http://www.allaboutjazz.com/reviews/r1201_015.htm 1923-Birthday of harmonica player Earl Payton, Pine Bluff, AR 1924-The first “Corn-husking championship” was held on a farm near Alleman, Polk County, IA. there were six contestants. The winner was Fred Staek of Webster County, IA, who husked 1,1891 pounds in 90 minutes. 1925-Birthday of sax player Al Cohn sax ,Brooklyn NY http://www.vh1.com/artists/az/cohn_al/bio.jhtml http://www.52ndstreet.com/reviews/reissues/cohnovertones.reissues.html (one of the “Four Brothers:” Serge Chaloff, Stan Getz, Zoot Sims and Herbie Stewart. Al Cohn replaced Herbie Stewart. Jimmy Giuffre, you would also be right, and he did replace Zoot Sims on Tenor sax (Guiffre is known as a great clarinet player. But what is best known beside the sound, is the tune arranged by Jim Guiffre with Serge Chaloff on baritone sax and Stan Getz, Zoot Sims, and Al Cohn on tenor sax. What makes this so unique is not the four together, but the arrangement with the lead in the trombone section? A jazz classic. http://www.gerrymulligan.info/m_4-again.html http://www.mymusic.ca/product.asp?myptr=theiceberg&muzenbr= 192717&last_page=http%3A%2F%2Fwww%2Etheiceberg%2Ecom %2Fartist%2Ehtml%3Fartist%5Fid%3D4639 http://www.blacksaint.com/bios/jgiuffre.html 1933-Singer Bessie Smith, 38, cuts last record, “ I'm Down in the Dumps.” http://physics.lunet.edu/blues/Bessie_Smith.html http://www.redhotjazz.com/bessie.html http://alt.venus.co.uk/weed/bessie/ 1937-The Andrews Sisters record Bei Mir Bist Du Schoen (Decca). We had dinner last year next to the two surviving sisters and their husbands at the Bellagio in Las Vegas, Nevada. They still looked great and appeared to be very gracious people. http://www.cmgww.com/music/andrews/ http://www.bigbands.net/andrewsbio.htm 1941-Birthday of bass player Donald “Duck” Dunn, Memphis, TN, perhaps best known for playing himself in “The Blues Brothers.” A Saturday night studio musician who is one of the architects of the Stax / Volt sound. http://www.ericclaptonfaq.com/questions/Donald_Duck_Dunn.htm http://us.imdb.com/name/nm0242551/ 1941-Birthday of drummer Pete Best, Madras India, known for being the original “Beatles” drummer, and for setting the beat sound; fans were “outraged” when he was replaced by Ringo Starr. http://www.beatlesagain.com/bpete.html http://www.pete-best.com/ http://www.petebest.com/1988.asp http://petebestdiscography.com/ 1941-Donald "Duck" Dunn of Booker T., ”The Blues Brothers,” & the MG's is born. 1944--Birthday of Rita Mae Brown, novelist and poet. Gained fame with her rollicking Rubyfruit Jungle about growing up a lesbian in South Florida when she became friends with actor Alexis Smith. Later she had an affair with tennis player Martina Navritalova and wrote a controversial "revenge" book about women's tennis. 1947 -John Steinbeck's novel "The Pearl" published http://www.gradesaver.com/ClassicNotes/Titles/pearl/about.html 1950 - Frank Loesser's musical comedy, "Guys and Dolls", opened at the 46th Street Theatre in New York City. The show ran for 1,200 performances. 1950 - The temperature at Chicago, IL, dipped to 2 below zero to equal their record for the month established on the 29th in 1872. On the first of the month that year Chicago established a record high for November with a reading of 81 degrees. 1955---Top Hits Sixteen Tons - Tennessee Ernie Ford Autumn Leaves - Roger Williams Love and Marriage - Frank Sinatra Love, Love, Love - Webb Pierce 1958 - Jackie Wilson's "Lonely Teardrops" was released, as was a Richie Valens' album featuring "Donna" on one side and "La Bamba" on the other. 1957 -- Cleveland rookie Jim Brown rushes for an NFL record 237 yards and four touchdowns to lead the Browns to a 45-31 victory over the Los Angeles Rams. http://images.nfl.com/history/images/1124.jpg 1957-Harry Belafonte was at #1 on the UK chart with "Mary's Boy Child", the first single to sell over 1 million copies in the UK. It stayed at the top for seven weeks. 1958-The Kingston Trio became the very first group to ever have an album reach the top of the US chart. Before them, only solo artists had hit number one. They would go on to record a total of fourteen Top Ten albums and an additional five would enter the top 25. 1958 - Harold Jenkins, who became Conway Twitty, got his first #1 hit with "It's Only Make Believe", which was the United States' most popular song for one week. 1961 - The Lion Sleeps Tonight became the first African song to hit the Number 1 spot on the American pop chart. The American version, recorded by the Tokens, was a translation of a South African folk song known variously as "Mbube" or "Wimoweh". 1963-The first murder to be shown on television took place at 12:20pm in the police headquarters at Dallas, Texas. While television news cameras were rolling, a Dallas police officer brought in Lee Harvey Oswald, the alleged assassin of President John Fitzgerald Kennedy. Oswald was in the process of being transferred to the county jail. A man in the crowd stepped forward and fired a concealed pistol at Oswald, killing him. The crime was witnessed by millions of people. The murdered was Jack Ruby ( Jacob L. Rubenstein), a Dallas nightclub owner. http://memory.loc.gov/ammem/today/nov24.html http://www.tsha.utexas.edu/handbook/online/articles/view/RR/fru3.html http://www.jfk-online.com/rubydef.html http://ourworld-top.cs.com/mikegriffith1/id153.htm 1963---Top Hits I'm Leaving It Up to You - Dale & Grace Washington Square - The Village Stompers She's a Fool - Lesley Gore Love's Gonna Live Here - Buck Owens 1966--The Beatles begin recording sessions for the "Sgt. Pepper's Lonely Hearts Club Band" LP by laying down tracks for "Strawberry Fields Forever". The song however, doesn't make the 1967 album, but would appear the following year on "Magical Mystery Tour". 1969 - United States Army Lieutenant William L. Calley, charged with the massacre of over 100 civilians in the Vietnamese village of My Lai in March 1968, was ordered to stand trial by court martial. 1969 - Apollo 12 returned to Earth after its moon landing. 1970 - The United State's outstanding collegiate football player of the year was awarded the Heisman Memorial Trophy. The winner was Jim Plunkett, quarterback for the Stanford Cardinal, who later went on to a sterling career in the NFL. 1971---Top Hits Theme from Shaft - Isaac Hayes Baby I'm-A Want You - Bread Have You Seen Her - Chi-Lites Daddy Frank (The Guitar Man) - Merle Haggard 1971-D.B.Cooper Hijacking. A middle-aged man whose plane ticket was made out to "D.B. Cooper" parachuted from a Northwest Airlines 727 jetliner on Nov 25, 1971, carrying $200,000 which he had collected from the airline as ransom for the plane and passengers as a result of threats made during his Nov 24 flight from Portland, OR, to Seattle, WA. He parachuted near Woodland, WA, into a raging thunderstorm with winds up to 200 miles per hour and the temperature at seven degrees below zero, wearing only a light business suit. He left the plane with 10,000 $20 bills. He was never found, and it is believed that he was killed. Several thousand dollars of the marked ransom money turned up in February 1980, along the Columbia River, near Vancouver, WA. http://www.super70s.com/Super70s/News/1971/November/24-DB_Cooper.asp http://www.aero.com/publications/parachutes/9602/pc0296.htm 1973 - After more than two years of retirement, Frank Sinatra returned with a NBC television special titled, "Ol' Blue Eyes is Back". Despite finishing third in the ratings, in a three-show race, one critic called the program, "the best popular music special of the year." 1973-After cracking Billboard's Top Ten with "It Don't Come Easy" (#4) and "Back Off Boogaloo" (#9), Ringo Starr reaches number one with "Photograph", a song he co-wrote with George Harrison. 1979-A pair of Pop music divas, Donna Summer and Barbra Streisand combined their voices to produce the top tune in the US, "No More Tears (Enough Is Enough)". It's Summer's third number one single and Streisand's fourth. 1979---Top Hits No More Tears (Enough is Enough) - Barbra Streisand/Donna Summer Babe - Styx Please Don't Go - K.C. & The Sunshine Band Come with Me - Waylon Jennings 1981-“Simon and Simon” premieres on television. This popular crime show about private eye brothers starred Jameson Parker as smooth, educated A.J. Simon and Gerald McRaney as brother Rick, a Vietnam vet. Other featured actors included Mary Carver as Cecilia Simon, their mother; Eddie Barth as rival detective Myron Fowler; Jeannie Wilson as Myron's daughter Janet, a district attorney; Tim Reid as undercover policeman Downtown Brown and Joan McMurtrey as Lieutenant Abby Marsh. The series was based on a 1980 made-for-TV movie called "Pirate's Key," with the series locale shifted from Florida to San Diego. http://www.geocities.com/Hollywood/Bungalow/7691/simonnsimon.html http://timstvshowcase.com/ 1982 - Hurricane Iwa lashed the Hawaiian Islands of Niihau, Kauai, and Oahu with high winds and surf. Winds gusting to 120 mph caused extensive shoreline damage. Damage totaled 150 million dollars on Kauai, and fifty million dollars on Oahu. The peak storm surge on the south shore was six to eight feet. It marked the first time in 25 years that Hawaii had been affected by a hurricane 1987---Top Hits Mony Mony "Live" - Billy Idol (I've Had) The Time of My Life - Bill Medley & Jennifer Warnes Heaven is a Place on Earth - Belinda Carlisle I Won't Need You Anymore (Always and Forever) - Randy Travis 1988 - Low pressure brought heavy snow and high winds to the Northern and Central Rockies. Snowfall totals in Colorado ranged up to 40 inches at Wolf Creek Pass, with 27 inches falling in 24 hours. Telluride CO received 32 inches of snow, and winds atop Mines Peak gusted to 95 mph. 1990-The first telescope of importance with a compound objective mirror was the William M. Keck I telescope on Mauna Kea, Hawaii. It had a 394-inch main objective mirror of 36 hexagonal segments that could be precisely positioned by computer. An interferometer combined the light from the 36 segments into a single focused image. The first astronomical image from the Keck was produced this day when nine of the segments were in place. 1991- In week 13, after going 12-0 Washington loses to Dallas 24-21. Washington ends their season 14-2 and beats the Buffalo Bills in the Super Bowl 37-24, Joe Gibbs coach of the Redskins and Marv Levy coach of the Bills. In 1991, the Bills appeared in their first of four consecutive Super Bowls. In this game, Bills kicker Scott Norwood missed a field goal “wide right”, in the games final seconds to seal the victory for the Giants. The team would lose the next three Super Bowls by a combined score of 119- 54. However, the team was one of the most dominant in the 90s, recording 100 victories in the decade and winning the AFC Championship four times." They are still “Meet the Press” Tim Russert's favorite team. 1992-The US Military leaves the Philippines. The Philippines became a US colony at the turn of the century when it was taken over from Spain after the Spanish-American War. Through President Franklin D. Roosevelt signed a bill Mach 24,1934 granting the Philippines independence to be effective July 4, 1946., before that date Manila and Washington singed a treaty allowing the US to lease military bases on the island. In 1991, the Philippine Senate voted to reject a renewal of that lease, and this day, after almost 100 years of military presence on the island, the last contingent of US marines left the Subic base. 1992- a major winter storm across the Texas panhandle, western Oklahoma and western Kansas produced near blizzard conditions which contributed to a massive 200 car pile-up on interstate 40 in Amarillo, TX. All traffic was brought to a virtual standstill in the Texas and Oklahoma panhandles. 19 inches of snow with drifts over 6 feet at Lavern, OK. Drifts reached 15 feet near Hugoton, KS. 17 inches fell at Liberal, 16 at Garden City and 14 inches at Dodge City in Kansas. 1994 - The film comedy "Junior," starring Arnold Schwarzenegger, Danny DeVito, and Emma Thompson, opened in United States theaters. Schwarzenegger and Thompson were later both nominated for Golden Globe acting awards. 1996 - Following its United States opening weekend, Star Trek: First Contact brought in $30.7 million at the box office. 1998 - The Spice Girls' "Live at Wembley" video was released by Virgin Music Video, and the following year was certified platinum. 1998---Top Hits Lately- Divine Doo Wop (That Thing)- Lauryn Hill Nobody s Supposed To Be Here- Deborah Cox One Week- Barenaked Ladies |

--------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out

with one click, or type in a new route to learn the traffic live.

Bank Beat

Cartoons

Computer Tips

Fernando's Review

Leasing 102

Online Newspapers

Placards

Sales Make it Happen

To Tell the Truth